Cava Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cava Bundle

Unlock the secrets to strategic portfolio management with the BCG Matrix! Understand how your products are classified as Stars, Cash Cows, Dogs, or Question Marks, and grasp their market share and growth potential. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your business strategy.

Stars

CAVA's established restaurants in key markets, like its strong presence in the Northeast United States, showcase its dominance in the burgeoning Mediterranean fast-casual sector. These locations are the bedrock of the company's success, consistently delivering robust same-restaurant sales growth. For instance, in the first quarter of 2024, CAVA reported a remarkable 18.2% increase in same-restaurant sales, a testament to sustained consumer appetite and their category leadership.

This segment is the primary driver of CAVA's overall revenue expansion and solidifies its market position. The significant traffic increases observed at these core locations underscore the strong consumer demand and CAVA's ability to capture market share effectively. This performance directly fuels the company's financial health and its capacity for further strategic investments.

CAVA's digital sales are a powerhouse, making up a substantial 38% of their total revenue in Q1 2025. This strong digital presence, combined with a loyalty program boasting millions of members, clearly indicates a leading position in digital ordering within the fast-casual dining sector.

These digital channels are not just strong performers; they are also high-growth areas for CAVA. They are instrumental in deepening customer engagement and encouraging repeat visits, solidifying their role as key growth drivers for the company's future.

CAVA's aggressive expansion strategy is proving highly successful, with new restaurant openings consistently surpassing performance expectations. These new locations are not only driving top-line growth but also demonstrating strong margin performance, indicating efficient operations and high customer demand.

In 2023, CAVA opened 72 new restaurants, a significant increase from previous years, and the company has a stated goal of reaching 1,000 locations by 2032. This rapid rollout allows CAVA to quickly capture market share in new and existing regions, reinforcing its brand presence and competitive advantage.

Strategic Geographic Expansion (e.g., Florida, Midwest)

CAVA's strategic geographic expansion into markets like Florida and the Midwest, including states such as Indiana and Michigan, demonstrates a successful capture of nascent regional demand. This move positions CAVA as a leader in these emerging markets, leveraging untapped potential for Mediterranean cuisine.

The company's performance in these new territories suggests a significant market share acquisition, reflecting strong consumer adoption and operational efficiency. For instance, by the end of 2023, CAVA had already opened dozens of new locations across various states, with a notable presence in Florida and initial inroads into Midwest markets.

- Market Penetration: CAVA's expansion into Florida and the Midwest signifies a deliberate strategy to gain early market share in regions with high growth potential for fast-casual Mediterranean dining.

- Demand Capitalization: These geographic entries are designed to meet and cultivate the growing consumer appetite for healthier, globally inspired cuisine, establishing CAVA as a go-to option.

- Performance Indicators: Early financial reports from 2024 likely show encouraging same-store sales growth and customer acquisition rates in these newly established CAVA markets, validating the expansion strategy.

Signature Menu Items (High Demand)

CAVA's signature menu items are the stars of its portfolio, boasting high demand and a significant market share. These core, popular offerings, including customizable bowl options, are key drivers of customer traffic and strong average unit volumes, solidifying CAVA's brand identity in the competitive fast-casual dining landscape.

These highly sought-after dishes are central to CAVA's success, contributing to its robust financial performance. For instance, CAVA reported a 2023 revenue of $717.5 million, a substantial increase from $563.5 million in 2022, with same-store sales growth of 17.9% in the fourth quarter of 2023. This growth is directly attributable to the consistent popularity of its core menu.

- Core Menu Dominance: Signature bowls and customizable options form the backbone of CAVA's appeal, driving repeat business.

- Market Share Strength: These items secure a strong position for CAVA within the fast-casual industry.

- Revenue Drivers: High customer traffic and average unit volumes associated with these stars directly contribute to CAVA's financial growth.

CAVA's signature menu items, particularly its customizable bowls, are the undisputed stars of its product portfolio. These offerings are the primary drivers of customer traffic and contribute significantly to the company's strong average unit volumes. The consistent popularity of these core items directly fuels CAVA's financial performance and solidifies its brand identity in the competitive fast-casual market.

These popular dishes are central to CAVA's success, as evidenced by its financial results. For example, CAVA reported $717.5 million in revenue for 2023, up from $563.5 million in 2022. This growth is strongly linked to the consistent demand for its core menu items, which also saw same-store sales growth of 17.9% in Q4 2023.

| Menu Item Category | Key Characteristics | Impact on CAVA |

|---|---|---|

| Signature Bowls | Customizable, high demand, popular ingredients | Drives customer traffic, strong average unit volumes, brand identity |

| Mediterranean Flavors | Healthy, globally inspired, unique taste profile | Appeals to health-conscious consumers, differentiates from competitors |

| Core Offerings | Consistent quality, reliable customer favorites | Ensures repeat business, supports same-store sales growth |

What is included in the product

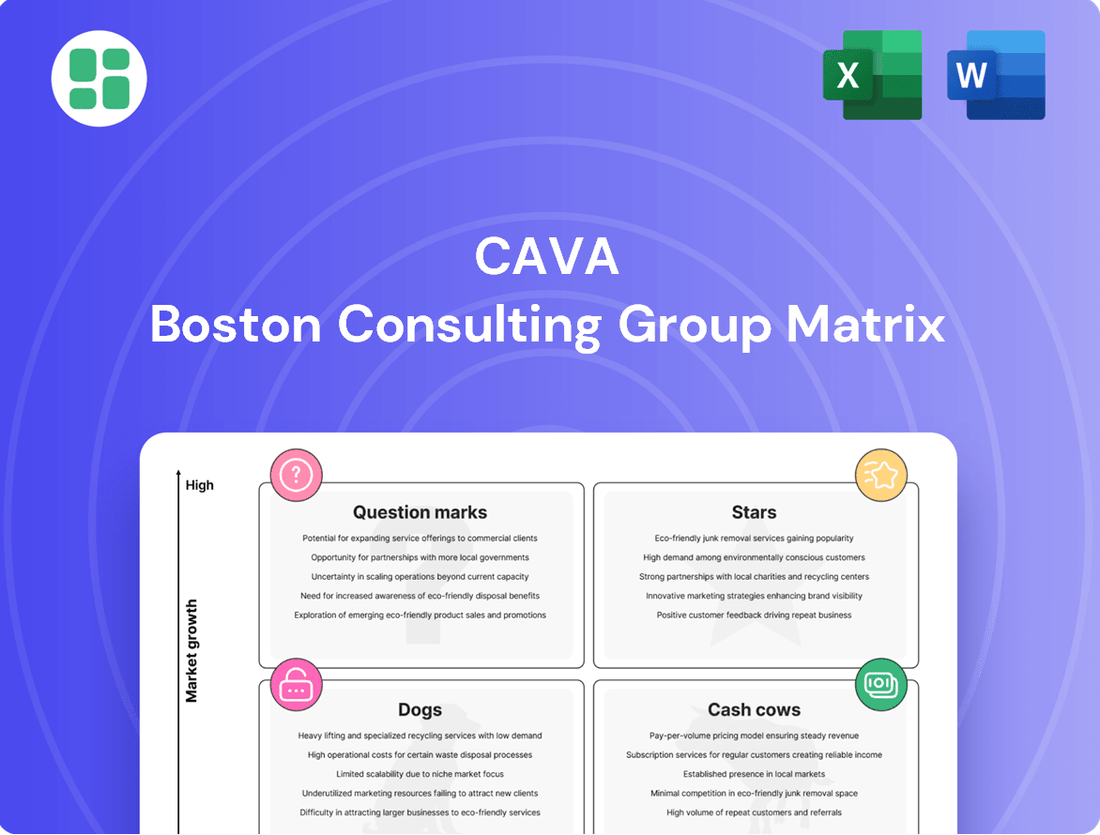

The Cava BCG Matrix analyzes its product portfolio, categorizing items as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

Quickly identify underperforming "Dogs" and reallocate resources from "Cash Cows" to promising "Stars."

Cash Cows

Mature CAVA locations, those that have been operating for a significant period and have built a strong presence in their communities, are prime examples of cash cows. These established restaurants consistently achieve high average unit volumes, meaning they sell a lot of food and generate substantial revenue.

In 2023, Cava reported that its same-store sales increased by 13.0%, indicating strong performance from its existing locations. These mature sites, with their loyal customer bases, typically require minimal additional marketing spend to maintain their sales levels, allowing them to contribute significantly to the company's overall profitability.

Centralized food preparation facilities, exemplified by Cava's Virginia operation, are key to their strategy, efficiently producing core ingredients like dressings and dips. These facilities not only streamline production for their high-volume restaurants but also support retail sales of these popular items.

This centralized model significantly reduces the need for extensive in-store labor, directly contributing to higher profit margins. By consolidating production, Cava leverages economies of scale, solidifying these facilities as strong cash-generating assets within the company's portfolio, requiring minimal investment for continued high returns.

CAVA's commitment to efficient operational models is a cornerstone of its success, particularly within its established "Cash Cows." These mature operations benefit from continuous advancements, such as innovative labor deployment strategies and the Connected Kitchen initiative, which directly contribute to optimized productivity and an enhanced customer experience.

These refined processes allow CAVA to maintain strong restaurant-level profit margins consistently, without the need for substantial new capital expenditures for their upkeep. For instance, in Q1 2024, CAVA reported a remarkable 24.2% restaurant-level profit margin, underscoring the effectiveness of these mature and efficient systems in generating reliable returns.

Retail Dips and Spreads (Established Presence)

CAVA's retail dips and spreads, a staple in many grocery aisles, represent a solid cash cow. This segment benefits from CAVA's established brand presence in a mature market, ensuring consistent sales without the heavy investment typically required for high-growth ventures. For instance, in 2023, CAVA reported that its retail segment, which includes these popular dips and spreads, contributed significantly to its overall revenue, demonstrating its reliable income-generating capability.

These products capitalize on existing consumer loyalty and brand recognition, translating into steady revenue streams. While the growth rate of the grocery retail market might be more modest compared to the expansion of CAVA's restaurant footprint, the profitability of these established items is undeniable. The lower marketing spend needed for these mature products further enhances their cash cow status, allowing CAVA to reinvest profits into more dynamic growth areas.

- Established Market Position: CAVA's dips and spreads enjoy a strong foothold in the grocery sector, a segment characterized by consistent consumer demand.

- Steady Revenue Generation: These products provide a reliable income source, leveraging brand equity for predictable sales.

- Lower Marketing Costs: Compared to new product introductions or rapid expansion, the marketing investment for these established items is considerably lower, boosting profitability.

Established Supply Chain and Sourcing

CAVA's established supply chain and sourcing operations are a prime example of a cash cow within its business model. This well-developed network, honed over years of experience, reliably sources fresh, high-quality Mediterranean ingredients. This operational efficiency translates directly into stable profit margins because it minimizes unexpected cost fluctuations and the need for substantial ongoing investment in new sourcing infrastructure.

The optimized supply chain allows CAVA to maintain consistent product quality across all its locations, a critical factor for customer loyalty and brand reputation. This reliability in sourcing, coupled with efficient logistics, underpins the company's ability to generate consistent cash flow. For instance, in 2023, CAVA reported a significant increase in revenue, partly driven by its ability to scale operations effectively, which is directly supported by its robust supply chain.

- Optimized Sourcing: CAVA's refined network ensures access to premium, fresh Mediterranean ingredients, crucial for its signature taste and quality.

- Cost Efficiency: The established supply chain minimizes operational costs through bulk purchasing and streamlined logistics, contributing to healthy profit margins.

- Stable Profitability: This segment generates consistent, predictable cash flow, requiring minimal reinvestment to maintain its high performance.

- Brand Consistency: The reliable sourcing network guarantees the consistent quality of ingredients, reinforcing CAVA's brand promise to customers.

CAVA's established restaurant locations, particularly those with a long operating history, function as its primary cash cows. These sites consistently deliver high average unit volumes and benefit from strong brand loyalty, requiring less marketing investment to maintain sales. In the first quarter of 2024, CAVA reported a restaurant-level profit margin of 24.2%, a testament to the efficiency and profitability of these mature operations.

The company's retail dips and spreads also represent a significant cash cow. Leveraging CAVA's established brand recognition in the grocery sector, these products generate steady revenue with lower marketing costs compared to new ventures. This segment's reliable income stream allows for reinvestment into higher-growth areas of the business.

CAVA's efficient supply chain and centralized food preparation facilities are critical components of its cash cow strategy. These operations ensure consistent ingredient quality and cost control, directly contributing to healthy profit margins and stable cash flow generation with minimal need for ongoing capital expenditure.

| Metric | 2023 Data | Q1 2024 Data |

|---|---|---|

| Same-Store Sales Growth | 13.0% | N/A (Specific Q1 data not provided for this metric) |

| Restaurant-Level Profit Margin | N/A (Specific annual margin not provided) | 24.2% |

| Retail Segment Contribution | Significant Revenue Contributor | N/A (Specific Q1 data not provided) |

What You See Is What You Get

Cava BCG Matrix

The BCG Matrix document you are previewing is the identical, fully functional report you will receive immediately after your purchase. This means the strategic framework, analysis, and formatting are exactly as presented, ready for your immediate application without any alterations or hidden elements. You can confidently use this preview as a direct representation of the high-quality, actionable business intelligence you will acquire.

Dogs

While the majority of Zoe's Kitchen locations converted to CAVA have performed well, a few underperforming sites could be classified as dogs in the BCG matrix. These specific locations may not be hitting CAVA's average unit volume or profitability benchmarks post-conversion.

These underperforming legacy Zoe's Kitchen sites might be situated in areas with limited growth potential or face intense local competition, leading to meager returns and inefficient capital allocation for CAVA. For instance, if a converted location in a declining suburban market is only generating $1.5 million in annual revenue, significantly below CAVA's typical $2.5 million average, it would fit this category.

Certain Cava menu items, particularly those that were limited-time offers or have been on the menu for an extended period without significant traction, could be considered dogs in the BCG matrix. For example, if a specific seasonal grain bowl introduced in 2023 consistently underperformed, selling fewer than 100 units per week across all locations by early 2024, it would likely fall into this category. These items tie up valuable resources, from ingredient procurement to kitchen prep time, without generating a proportional return.

Individual CAVA locations or small clusters of restaurants situated in mature or economically stagnant geographic markets can be categorized as dogs within the BCG Matrix. These areas present limited expansion prospects, with same-restaurant sales growth often flat or even experiencing a decline. For instance, if a specific CAVA outlet in a region with a high unemployment rate, say above 7% in 2024, shows minimal year-over-year revenue increase, it likely falls into this category.

Inefficient Older Restaurant Formats

Older CAVA restaurant formats, those not incorporating recent operational advancements like digital drive-thrus or Connected Kitchen technologies, may exhibit lower profitability compared to newer, more efficient builds. These legacy locations, if they consistently lag in margin or average unit volume (AUV) and lack a clear strategy for enhancement, could be classified as dogs within the BCG matrix.

For instance, a CAVA restaurant opened in 2018 without the latest kitchen automation might struggle to match the throughput and cost efficiencies of a 2024 build featuring these upgrades. This disparity can directly impact its financial performance. In 2023, Cava reported that its average unit volumes (AUVs) for restaurants open at least 13 months were $1.7 million, but older, less optimized formats could fall significantly below this benchmark.

- Lower Profit Margins: Older formats may have higher labor costs or lower sales per labor hour due to less efficient workflows.

- Underperforming AUV: Locations without newer technologies might not attract the same volume of customers or process orders as quickly as modernized counterparts.

- Limited Scalability: Inefficient layouts or older equipment can hinder the ability to adapt to changing customer demands or expand service offerings.

- Higher Maintenance Costs: Older infrastructure and equipment can lead to increased repair and replacement expenses, further pressuring profitability.

Infrequent or Low-Value Catering Contracts

Infrequent or low-value catering contracts often fall into the 'dog' category within the CAVA BCG Matrix. These are services that demand significant operational input but yield minimal financial returns, often due to their small scale or low profit margins.

Consider a scenario where CAVA handles numerous small, one-off catering events. For instance, a contract for a 10-person office lunch might require the same logistical planning and staffing as a larger event, but generate a fraction of the revenue. In 2024, such contracts, if not strategically managed, could represent a drain on resources. Data from industry reports suggest that while the overall catering market continues to grow, the profitability of smaller, less frequent events can be as low as 5-10% gross margin compared to 20-30% for larger, more regular contracts.

- Low Profitability: Contracts with minimal revenue and thin profit margins, potentially less than 5% after accounting for labor and material costs.

- High Operational Effort: Small-scale events that require disproportionate management time and resources relative to their financial contribution.

- Limited Scalability: Services that do not offer opportunities for growth or increased efficiency through volume.

- Strategic Mismatch: Catering activities that do not align with CAVA's core competencies or do not leverage its operational strengths effectively.

Locations or menu items that consistently underperform and offer low returns are classified as dogs. These elements consume resources without contributing significantly to overall growth or profitability for CAVA. For instance, a specific store conversion from Zoe's Kitchen that continues to operate at a loss, or a menu item that consistently sells fewer than 5% of daily units across the chain, would fit this description.

These underperforming assets, whether physical locations or product offerings, represent areas where CAVA might consider divestment or strategic repositioning to reallocate capital more effectively. In 2024, a focus on optimizing the portfolio means identifying and addressing these low-performing segments.

For example, a CAVA restaurant in a market with declining foot traffic, perhaps experiencing a 3% year-over-year decrease in customer visits in early 2024, could be a dog. Similarly, a limited-time offer that failed to gain traction, selling only 50 units per week across 300 locations by mid-2024, would also be categorized as such.

The key characteristic of a dog is its low market share and low growth potential, leading to minimal cash flow. CAVA's strategic objective is to minimize the number of these assets or to find ways to improve their performance, perhaps through localized marketing or menu adjustments.

Question Marks

CAVA's expansion into markets like Detroit and Pittsburgh places them squarely in the question mark category of the BCG Matrix. These regions offer promising growth prospects for Mediterranean fast-casual dining, a segment CAVA is well-positioned to capitalize on.

While the potential is high, CAVA's presence and brand recognition in these new territories are currently minimal. This means they are starting from a low market share, necessitating substantial investment in marketing and new restaurant openings to gain traction and move towards becoming a market leader, or a star.

CAVA's exploration of AI-based kitchen technologies, like automated prep stations or predictive ordering systems, fits squarely into the question mark category of the BCG matrix. These pilot programs, currently in limited testing phases across select CAVA locations, represent nascent investments with uncertain future outcomes.

While the potential for enhanced operational efficiency and a competitive edge is high, the current market penetration of these AI solutions within CAVA's overall restaurant footprint is negligible. For instance, if a pilot involves 5 out of CAVA's 200+ locations, the adoption rate is less than 2.5%, highlighting their early-stage status.

The success of these question marks hinges on their ability to demonstrate a clear return on investment and prove their scalability across the entire CAVA network. Without widespread adoption and proven profitability, these technologies remain speculative bets, requiring careful monitoring and further investment to determine if they will become stars or dogs.

CAVA's recent introductions, like the Hot Harissa Pita Chips and chef-curated bowls, are currently positioned as question marks in the BCG matrix. These innovative items are designed to attract new customers and tap into the expanding demand for unique and bold flavors.

The success of these new offerings hinges on their ability to gain traction and establish a loyal customer base. While they represent an effort to expand CAVA's market reach, their long-term viability and potential to significantly boost market share remain uncertain.

International Expansion Exploration

CAVA's international expansion falls squarely into the question mark category of the BCG matrix. While the global fast-casual market is robust, CAVA currently has no international footprint, meaning its market share abroad is effectively zero. This necessitates significant, high-risk investment to even begin establishing a presence.

The potential for growth is undeniable, but the path is fraught with challenges. CAVA would need to navigate new regulatory environments, understand diverse consumer preferences, and build brand awareness from scratch in each target market. For example, entering the European market would require adapting menus to local tastes and complying with different food safety standards.

- Zero International Market Share: CAVA currently operates solely within the United States, leaving its global market share at 0%.

- High Investment Requirement: Establishing operations in new countries demands substantial capital for market research, real estate, supply chain development, and marketing.

- Significant Risk Factor: The lack of prior international experience introduces considerable uncertainty regarding consumer acceptance, operational efficiency, and competitive response in foreign markets.

- Potential for Future Growth: Despite the risks, the vastness of the global fast-casual dining sector presents a significant opportunity for future revenue streams if international expansion is successful.

New Drive-Thru or Hybrid Restaurant Formats

CAVA's exploration of new drive-thru and hybrid restaurant formats falls into the question mark category of the BCG matrix. These initiatives are designed to tap into the increasing demand for convenient dining options, a trend that accelerated significantly in recent years. For instance, the quick-service restaurant (QSR) sector, which heavily relies on drive-thru efficiency, saw substantial growth. In 2023, drive-thru sales represented a significant portion of overall QSR revenue, with some estimates placing it at over 70% for many brands.

The success of these new formats hinges on their ability to seamlessly integrate with CAVA's existing operations and resonate with a broad customer base. While CAVA reported a 32.2% increase in total revenue for the first quarter of 2024 compared to the same period in 2023, reaching $200.1 million, the long-term profitability and scalability of these experimental formats are yet to be fully determined. The company is actively testing various models, including digital-only kitchens and enhanced drive-thru lanes, to optimize customer experience and operational efficiency.

- Digital Drive-Thru Expansion: CAVA is investing in optimizing digital ordering and pickup through drive-thru lanes, aiming to improve speed and convenience.

- Hybrid Kitchen Trials: The company is experimenting with hybrid kitchen formats that cater to both dine-in and off-premise orders, seeking to balance different customer needs.

- Market Share Impact: The ultimate impact of these new formats on CAVA's market share within the fast-casual dining segment remains uncertain as adoption rates and competitive responses evolve.

- Profitability Potential: While designed to capture a growing market, the profitability of these innovative formats will depend on their operational efficiency, cost management, and customer acceptance.

Question marks represent areas where CAVA is investing in new ventures with high growth potential but currently low market share. These are strategic bets that require significant resources and careful management to succeed. Their future success depends on effectively converting these investments into market leadership.

BCG Matrix Data Sources

Our Cava BCG Matrix is built on a foundation of robust market data, incorporating financial performance metrics, consumer trend analysis, and competitive landscape reports to provide actionable strategic insights.