Cava Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cava Bundle

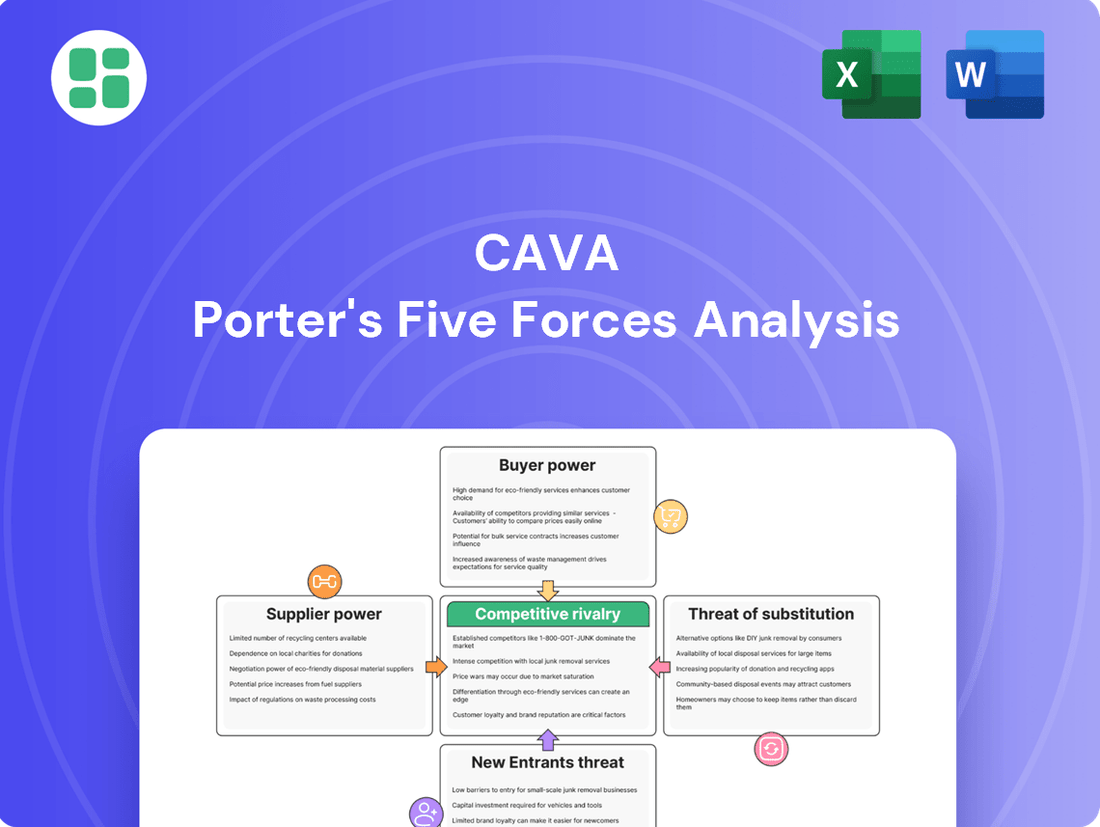

Cava's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for anyone looking to navigate or invest in the sparkling wine market.

The complete report reveals the real forces shaping Cava’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for CAVA's essential ingredients, such as fresh produce, unique Mediterranean spices, and specialized oils, significantly impacts their bargaining power. When a limited number of suppliers can consistently meet CAVA's stringent quality and volume requirements, these suppliers gain leverage, potentially resulting in increased ingredient costs or less favorable contract terms.

For instance, CAVA's strategic decision to introduce grilled steak nationwide in 2024 likely intensified discussions and negotiations with its protein suppliers. The success of such a rollout hinges on securing reliable and cost-effective sourcing, which can shift the balance of power towards suppliers if they are few and in high demand.

The bargaining power of suppliers for CAVA is influenced by the switching costs associated with sourcing ingredients and services. If CAVA faces significant expenses or disruptions when changing suppliers, perhaps due to specialized ingredient requirements or deeply integrated logistics, then suppliers gain more leverage. This means suppliers can potentially dictate terms or raise prices more easily.

However, the broader restaurant industry, including CAVA, is actively working to reduce these dependencies. A key strategy is diversifying the supplier base. For instance, as of late 2023 and into 2024, many restaurant chains have been exploring multiple sourcing options for everything from produce to proteins to packaging, aiming to spread risk and enhance negotiation power. This move towards diversification inherently lessens the bargaining power of any single supplier.

The uniqueness of ingredients significantly influences CAVA's supplier bargaining power. If suppliers provide proprietary or hard-to-source components crucial for CAVA's signature Mediterranean taste, they can command higher prices. For instance, a specific type of olive or a unique spice blend that defines CAVA's popular bowls would give that supplier considerable leverage.

Threat of Forward Integration by Suppliers

While forward integration by suppliers is a less common threat in the restaurant industry, it could significantly boost their bargaining power if realized. Imagine a major food supplier, like a large produce distributor, deciding to open its own chain of fast-casual restaurants. This would directly compete with existing players like Cava.

However, the significant capital outlay and intricate operational knowledge required to successfully manage a restaurant chain, especially a multi-unit one, generally make this a low probability threat. For instance, establishing a single new restaurant location can cost hundreds of thousands of dollars, and scaling that to a chain involves immense logistical and management challenges. In 2024, the fast-casual sector, while growing, still presents substantial barriers to entry for companies primarily focused on supply chain management.

The threat of forward integration by suppliers for a company like Cava is therefore minimal due to these high barriers.

- High Capital Investment: Opening even a single restaurant can cost upwards of $250,000 to $1 million, making it a significant hurdle for suppliers.

- Operational Complexity: Managing inventory, staffing, customer service, and marketing for a restaurant chain requires different expertise than pure supply.

- Brand Building Challenges: Suppliers would need to build a new brand identity and customer loyalty from scratch to compete effectively.

- Focus on Core Competencies: Most suppliers are likely to remain focused on their primary business of production and distribution rather than diversifying into a highly competitive retail food service market.

Importance of CAVA to Suppliers

CAVA's significant growth and expansion, including its reported revenue of $711.6 million for the fiscal year 2023, positions it as a crucial client for many of its suppliers. This substantial business volume can diminish a supplier's leverage, as their own revenue streams become increasingly dependent on maintaining a strong relationship with CAVA. The chain's high average unit volumes (AUV) further solidify its importance to suppliers, making CAVA a highly sought-after and valuable customer.

CAVA's bargaining power with suppliers is generally moderate, influenced by its growing scale and diversification efforts. While CAVA's significant purchasing volume, as evidenced by its $711.6 million revenue in 2023, makes it a valuable client, the company actively works to mitigate supplier leverage by diversifying its sourcing and reducing switching costs. The threat of suppliers integrating forward into restaurant operations remains low due to high capital and operational barriers.

| Factor | Impact on CAVA's Supplier Bargaining Power | 2023/2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration of key ingredient suppliers increases their power. | Nationwide steak rollout in 2024 increased demand for protein suppliers. |

| Switching Costs | High switching costs for specialized ingredients or logistics empower suppliers. | CAVA aims to diversify suppliers to reduce dependency and associated costs. |

| Ingredient Uniqueness | Proprietary or hard-to-source ingredients give suppliers significant leverage. | Signature Mediterranean spices and specific oils are critical to CAVA's brand. |

| CAVA's Scale | CAVA's large purchasing volume ($711.6M revenue in 2023) reduces supplier leverage. | High average unit volumes (AUV) make CAVA a key customer for many suppliers. |

| Forward Integration Threat | Low threat due to high capital and operational barriers for suppliers. | Establishing a restaurant chain requires significant investment beyond a supplier's core competency. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cava's sparkling wine market position.

Effortlessly identify and address competitive threats by visualizing the intensity of each Porter's Five Force on a single, intuitive dashboard.

Customers Bargaining Power

In the current economic climate, marked by persistent inflation, customers in the fast-casual dining sector, including CAVA's market, exhibit significant price sensitivity. This means they are highly attuned to price changes and actively seek out the best value for their money.

For CAVA, maintaining its perceived value while effectively managing its operational costs is paramount to customer retention. For instance, in the first quarter of 2024, CAVA reported a 21.1% increase in total revenue to $227.6 million, indicating strong demand, but the company also needs to balance this growth with pricing strategies that resonate with cost-conscious consumers.

The availability of numerous substitutes for Cava, such as Chipotle, Panera, and even traditional fast-food chains and grocery store prepared meals, significantly amplifies customer bargaining power. This wide selection means customers can easily switch if prices rise or satisfaction dips.

In 2024, the fast-casual dining sector continued to see robust competition, with many players offering similar Mediterranean-inspired or customizable bowl concepts. This competitive landscape directly translates to consumers having more leverage, as switching costs between these establishments are minimal.

Customer switching costs for Cava are notably low. Essentially, a customer can switch to a competitor simply by choosing a different restaurant for their next meal. This ease of transition means customers have significant leverage, readily comparing Cava against other Mediterranean or fast-casual options based on factors like price, menu variety, or location. For instance, a customer might easily opt for a local deli or another fast-casual chain if Cava's pricing increases or a competitor offers a more appealing daily special.

Customer Information and Transparency

Customers today are more informed than ever, readily accessing nutritional details, ingredient lists, and even a company's sustainability efforts through various digital channels. This heightened awareness means they can make more discerning choices, directly impacting a company's success.

CAVA's commitment to transparency regarding its menu offerings and ingredient sourcing plays a crucial role in shaping customer preferences and fostering loyalty. For instance, in 2023, CAVA reported that 55% of its customers cited healthy options as a primary reason for choosing the brand, underscoring the value of clear nutritional communication.

- Informed Consumer Base: Customers actively seek and utilize information about food quality and sourcing.

- Digital Influence: Online platforms and social media are key drivers of customer awareness regarding ingredients and sustainability.

- CAVA's Transparency: Open communication about menu items and sourcing practices can significantly influence purchasing decisions and build brand trust.

- Impact on Loyalty: Transparent practices can lead to increased customer retention and a stronger brand connection, as evidenced by customer feedback highlighting health as a key driver.

Brand Loyalty and Differentiation

CAVA works to cultivate customer loyalty by positioning itself as a leader in the Mediterranean fast-casual sector. The brand highlights its commitment to health, vibrant flavors, and a highly personalized dining experience. This focus on a unique and appealing brand identity helps to lessen the inherent power customers possess due to numerous dining choices.

By emphasizing its distinctiveness, CAVA aims to reduce price sensitivity among its customer base. For instance, in the first quarter of 2024, CAVA reported a 22.1% increase in same-store sales, indicating strong customer demand and a degree of brand stickiness. This growth suggests that customers are willing to choose CAVA even with other fast-casual options available.

- Brand Positioning: CAVA differentiates itself as a 'category-defining Mediterranean fast-casual' brand.

- Customer Appeal: Focuses on health, bold flavors, and customization to build loyalty.

- Mitigating Customer Power: A strong, unique brand can reduce the impact of customer bargaining power.

- Sales Performance: Q1 2024 saw a 22.1% rise in same-store sales, reflecting customer preference.

The bargaining power of customers in the fast-casual dining sector, particularly for brands like CAVA, is substantial due to a highly informed consumer base and the ease of switching between numerous competitors. Customers in 2024 are adept at comparing prices, ingredient quality, and nutritional information across various platforms, making them less susceptible to price increases without a perceived increase in value.

CAVA's strategy to counter this involves emphasizing its unique Mediterranean positioning, commitment to health, and personalized customer experience. For example, CAVA reported that 55% of its customers in 2023 cited healthy options as a primary reason for choosing the brand, highlighting the effectiveness of clear communication about product benefits.

The competitive landscape in 2024, featuring many similar customizable bowl concepts, means switching costs remain minimal. CAVA's Q1 2024 revenue of $227.6 million, a 21.1% increase, indicates strong demand, but continued success hinges on balancing this growth with pricing that acknowledges customer price sensitivity.

| Factor | Impact on CAVA | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | High; customers seek value | Persistent inflation influences purchasing decisions. |

| Availability of Substitutes | Amplifies customer power | Numerous competitors (Chipotle, Panera, etc.) offer similar concepts. |

| Switching Costs | Low; easy to choose alternatives | Customers can easily switch based on price, menu, or location. |

| Informed Consumer | Enables discerning choices | Digital access to nutrition, sourcing, and sustainability information. |

| Brand Loyalty Drivers | Health, flavor, personalization | 55% of customers in 2023 cited healthy options as a key driver. |

Same Document Delivered

Cava Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Cava Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the Cava wine industry. What you're previewing is precisely the same professionally formatted and insightful analysis that will be available to you instantly after completing your purchase, ensuring no surprises and immediate value.

Rivalry Among Competitors

The fast-casual dining sector, particularly for Mediterranean-inspired concepts like Cava, is a crowded marketplace. Major players such as Chipotle Mexican Grill and Sweetgreen, alongside a multitude of smaller regional chains and independent eateries, all vie for consumer attention and dollars. This sheer volume and variety of competitors significantly intensifies the rivalry within the industry.

The fast-casual dining sector is booming, with projections suggesting continued robust expansion. This growth is a significant factor, as it can temper the intensity of competitive rivalry by creating ample space for various businesses to thrive and capture market share. For instance, the U.S. fast-casual market was valued at approximately $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2030.

Furthermore, the specific niche of Mediterranean cuisine is also on an upward trajectory. As consumer interest in healthier, diverse flavor profiles increases, the demand for Mediterranean options is set to rise. This dual growth in the broader fast-casual market and the specialized Mediterranean segment means that even with numerous competitors, the overall market expansion can support multiple players without necessarily intensifying head-to-head competition to unsustainable levels.

CAVA carves out a distinct niche by championing Mediterranean-inspired cuisine, a strategy that sets it apart in the crowded fast-casual market. Its core offering revolves around highly customizable bowls, salads, and pitas, allowing customers to tailor their meals precisely to their preferences. This focus aims to position Mediterranean flavors as the next significant cultural cuisine category in the dining landscape.

Exit Barriers

High fixed costs are a major factor in Cava's competitive landscape, acting as significant exit barriers. These costs, including substantial investments in restaurant leases, kitchen equipment, and ongoing staffing, mean that exiting the market is often financially punitive. For instance, many restaurant leases have long-term commitments, making it difficult and expensive to break them early.

When businesses face these high exit barriers, they may continue operating even when unprofitable, simply to cover ongoing expenses rather than incur further losses from closure. This dynamic intensifies competitive rivalry within the fast-casual dining sector, as underperforming establishments remain in the market, vying for customers and putting downward pressure on prices and margins for all players, including Cava.

Consider the implications for the industry: In 2023, the US restaurant industry saw a net unit growth of 0.3%, indicating a cautious expansion. However, the underlying fixed costs remain a constant challenge. For a company like Cava, which operates numerous physical locations, managing these operational costs is crucial for maintaining flexibility and profitability in a competitive environment.

- High Fixed Costs: Restaurant leases, specialized kitchen equipment, and a consistent workforce represent substantial upfront and ongoing investments for Cava and its competitors.

- Lease Commitments: Many restaurant leases are multi-year contracts, creating a financial obligation that is difficult and costly to escape prematurely.

- Continued Operation Despite Losses: The desire to recoup investments and cover fixed costs can lead struggling restaurants to remain operational, increasing market saturation and competitive intensity.

- Impact on Rivalry: This situation forces all players, including Cava, to compete more aggressively on price, service, and innovation to attract and retain customers in a crowded marketplace.

Aggressiveness of Competitors

Competitors in the fast-casual dining sector are locked in a fierce battle for market share, constantly rolling out new menu items and enhancing their digital capabilities. This intense rivalry is evident in the rapid adoption of technologies like AI-powered ordering systems and sophisticated loyalty programs, all designed to capture and keep customer attention.

For instance, in 2024, many fast-casual chains significantly invested in their digital infrastructure. Starbucks, a major player, continued to refine its mobile order and pay system, which accounted for a substantial portion of its U.S. transactions. Chipotle, another key competitor, has been investing in its digital platform and delivery services, aiming to increase convenience and accessibility for its customers.

- Menu Innovation: Competitors are frequently introducing limited-time offers and seasonal specials to drive traffic and create buzz.

- Technological Advancements: Investment in digital ordering, AI for personalized recommendations, and efficient kitchen automation is a common strategy.

- Loyalty Programs: Enhanced rewards, tiered benefits, and personalized offers are crucial for customer retention in this crowded market.

- Aggressive Expansion: Many brands are pursuing aggressive growth strategies, opening new locations to increase their physical presence and reach.

The competitive rivalry within the fast-casual sector, particularly for Mediterranean-inspired brands like Cava, is highly intense. Numerous established players and emerging concepts are vying for consumer preference, leading to aggressive strategies in pricing, marketing, and innovation. This dynamic is further fueled by the sector's growth, which attracts new entrants and encourages existing ones to expand.

In 2024, the fast-casual market continued its robust expansion, with many brands focusing on digital integration and personalized customer experiences to stand out. For example, Chipotle's digital sales represented a significant portion of its overall revenue, showcasing the importance of technology in this competitive space. Cava itself has been actively expanding its footprint, opening new locations to capture a larger share of this growing market.

| Competitor Example | Key Competitive Strategy | 2024 Focus Area |

|---|---|---|

| Chipotle Mexican Grill | Digital ordering, supply chain efficiency | AI integration, new menu items |

| Sweetgreen | Health-focused, sustainable sourcing | Plant-based options, community engagement |

| Panera Bread | Loyalty programs, digital convenience | Subscription services, expanded delivery |

SSubstitutes Threaten

Consumers have a wide array of dining options beyond fast-casual Mediterranean, including traditional fast food chains, casual dining establishments, and full-service restaurants. These alternatives cater to similar needs for convenient and satisfying meals but at varying price points and offering distinct dining experiences.

For instance, a consumer seeking a quick lunch might opt for a burger from McDonald's, a pizza from Domino's, or a sit-down meal at Olive Garden, all of which represent substitutes for Cava. The accessibility and familiarity of these established segments provide a constant competitive pressure.

Home cooking and meal preparation, encompassing everything from traditional home-cooked meals to convenient ready-to-eat options from supermarkets and the growing meal kit delivery market, represent a potent threat of substitutes for many businesses, particularly in the food service industry.

Consumers are increasingly seeking value and convenience, and home-based meal solutions often deliver on both fronts. For instance, the global meal kit delivery service market was valued at approximately $15.2 billion in 2023 and is projected to grow, indicating a strong consumer preference for these alternatives.

The ability for individuals to prepare meals at home, often at a lower cost per serving than dining out or ordering prepared meals, directly impacts the demand for restaurant and prepared food services. This trend is further amplified by the rising popularity of grocery stores offering a wider array of pre-prepped ingredients and ready-to-heat meals, making home dining more accessible and appealing.

Grocery stores and convenience stores are significant threats, offering prepared meals, deli items, and ingredients for quick home-cooked options. The increasing consumer demand for health-conscious and convenient food solutions fuels the appeal of these alternative channels. In 2024, the prepared foods segment within US grocery stores continued to see robust growth, with many chains expanding their offerings to compete directly with fast-casual concepts.

Cost-Effectiveness of Substitutes

The threat of substitutes is amplified when economic conditions tighten. For instance, during inflationary periods, consumers actively seek out more affordable alternatives to their usual purchases. This trend was particularly evident in 2023, where persistent inflation pushed many households to re-evaluate their spending habits.

Grocery stores have become significant players in offering these substitutes. They often provide private-label brands or bulk options that present a more budget-friendly choice compared to established brands. This strategic positioning makes them a direct threat to companies whose products might be perceived as premium or less essential.

- Inflationary Pressures: In 2023, the US inflation rate averaged 4.12%, impacting consumer purchasing power and driving demand for lower-cost alternatives.

- Grocery Store Dominance: Major grocery chains have expanded their private-label offerings, which can be 20-30% cheaper than national brands, presenting a compelling substitute.

- Consumer Behavior Shift: Surveys in late 2023 indicated that over 60% of consumers were actively seeking deals and switching to cheaper brands due to cost concerns.

Changing Consumer Preferences

The growing consumer focus on health and sustainability significantly expands the threat of substitutes for Cava. As consumers increasingly seek out healthier and environmentally friendly food choices, a broader array of products and services can now serve as alternatives. For instance, the surge in plant-based diets means that numerous vegan and vegetarian restaurants, meal kit services, and even grocery store items offering plant-based alternatives directly compete with Cava's Mediterranean-inspired bowls.

This shift is not merely a trend; it's a fundamental change in consumer behavior. By early 2024, the global plant-based food market was projected to reach hundreds of billions of dollars, indicating a substantial and growing demand for these alternatives. This means that if Cava does not continue to adapt its offerings to align with these evolving preferences, it risks losing market share to competitors who cater more directly to these demands.

- Health-Conscious Consumers: Demand for lower-calorie, nutrient-dense options drives consumers towards salads, grain bowls from other fast-casual chains, and even home-cooked meals emphasizing fresh ingredients.

- Plant-Based Movement: The proliferation of vegan and vegetarian eateries, as well as mainstream restaurants expanding their plant-based menus, provides readily available substitutes for Cava's core offerings.

- Sustainability Focus: Consumers concerned about environmental impact may opt for locally sourced food, or businesses with transparent and sustainable supply chains, which could include smaller, independent eateries or farmers' markets.

- Convenience Alternatives: While Cava offers convenience, other fast-casual concepts, meal delivery services, and even prepared foods from grocery stores also compete on speed and ease of access.

The threat of substitutes for Cava is significant, stemming from a wide range of alternatives that satisfy similar consumer needs for convenient and flavorful meals. These substitutes range from traditional fast food and casual dining restaurants to the growing market of home-cooked meals and meal kits.

Grocery stores, in particular, have become formidable competitors by expanding their prepared foods sections and offering a variety of convenient, often healthier, options. This trend was highlighted in 2024 as many grocery chains continued to enhance their ready-to-eat selections to capture market share from fast-casual dining.

Economic factors, such as inflation, further bolster the threat of substitutes. Consumers facing tighter budgets actively seek more affordable meal solutions, often turning to home preparation or lower-cost grocery store options. In 2023, persistent inflation drove many consumers to trade down, with over 60% actively seeking deals and switching to cheaper brands.

The increasing consumer focus on health and sustainability also broadens the substitute landscape. Plant-based diets and ethically sourced foods are gaining traction, leading consumers to explore a wider array of vegan/vegetarian restaurants, specialized meal services, and even farmers' markets.

| Substitute Category | Example | Key Driver | 2023/2024 Relevance |

|---|---|---|---|

| Traditional Fast Food | McDonald's, Burger King | Convenience, Price | Consistent competitive pressure |

| Casual Dining | Olive Garden, Chili's | Sit-down experience, Variety | Offers a different dining occasion |

| Home Cooking/Meal Kits | HelloFresh, Blue Apron | Cost-effectiveness, Customization | Global meal kit market valued at ~$15.2B in 2023 |

| Grocery Prepared Foods | Supermarket deli, ready-to-heat meals | Convenience, Perceived Healthiness | Robust growth in US grocery prepared foods segment in 2024 |

| Plant-Based Options | Vegan restaurants, plant-based alternatives | Health, Sustainability | Global plant-based food market projected to reach hundreds of billions by early 2024 |

Entrants Threaten

Launching a new fast-casual restaurant chain, especially one aiming for national or regional scale like CAVA, demands significant upfront capital. This includes securing prime real estate, the costs associated with building out and equipping multiple locations, and the initial working capital needed to cover inventory, staffing, and marketing before profitability is achieved. For instance, in 2024, the average cost to open a single fast-casual restaurant can range from $300,000 to over $1 million, depending on size and location, creating a formidable financial hurdle for potential new competitors.

Established players like CAVA leverage significant economies of scale, which creates a substantial barrier for new entrants. For instance, in 2023, CAVA reported a revenue of $714 million, indicating a large operational footprint. This scale allows them to negotiate lower prices for ingredients, optimize marketing spend across numerous locations, and streamline distribution networks, leading to a lower cost per unit than a new competitor could initially achieve.

CAVA has cultivated significant brand recognition and a deeply loyal customer following, establishing itself as a leader in the Mediterranean fast-casual dining sector. This strong brand equity makes it difficult for new competitors to gain traction.

New entrants must overcome the substantial hurdle of building comparable trust and loyalty in a market already saturated with dining options. For instance, CAVA's revenue grew by 54% in 2023, reaching $715.7 million, demonstrating its market strength.

Access to Distribution Channels and Prime Locations

Securing desirable real estate locations and establishing efficient supply chains are critical for restaurant success, acting as significant barriers to entry. Prime locations often come with high costs and limited availability, making it difficult for newcomers to compete with established players who have already secured these valuable spots.

Existing restaurant chains frequently possess preferential access or deeply entrenched relationships with suppliers and distributors, which can translate into better pricing and more reliable delivery. This can create a significant cost disadvantage for new entrants who are just beginning to build their networks.

- Prime Real Estate Scarcity: In 2024, the demand for prime retail and restaurant locations remained exceptionally high in major urban centers, with vacancy rates for desirable storefronts often below 5%.

- Supply Chain Leverage: Established chains can negotiate bulk discounts and favorable terms with food suppliers, a benefit not readily available to new, smaller operations.

- Distribution Network Barriers: Building a robust and cost-effective distribution network for fresh ingredients and supplies can take years and substantial investment, a hurdle new restaurants must overcome.

Regulatory Hurdles and Food Safety Standards

The restaurant industry faces significant regulatory burdens that act as a barrier to entry. New businesses must meticulously adhere to a complex web of health codes, food safety standards, and stringent traceability requirements. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced food safety practices, requiring businesses to implement robust systems for tracking ingredients from source to table.

Navigating these regulations demands substantial investment in time, training, and infrastructure. Compliance often necessitates specialized equipment, rigorous staff training programs, and ongoing audits, all of which represent considerable upfront costs for any aspiring restaurateur. Failure to comply can result in hefty fines, operational shutdowns, and severe damage to brand reputation, making the regulatory landscape a formidable hurdle.

- Health and Safety Compliance: Restaurants must meet local, state, and federal health department regulations, including proper food storage, preparation, and sanitation.

- Food Traceability: Regulations require businesses to track the origin of food products, enabling swift recalls in case of contamination.

- Licensing and Permits: Obtaining necessary operating licenses, liquor licenses, and building permits can be a lengthy and expensive process.

- Labor Laws: Compliance with minimum wage, overtime, and workplace safety regulations adds to operational costs and complexity.

The threat of new entrants for a chain like CAVA is moderate, primarily due to high capital requirements and established brand loyalty. While the fast-casual market is attractive, the costs associated with real estate, build-out, and initial operations, estimated between $300,000 to over $1 million per location in 2024, present a significant financial barrier.

Economies of scale enjoyed by CAVA, evidenced by its $715.7 million revenue in 2023, allow for better pricing on ingredients and marketing. This scale creates a cost disadvantage for newcomers. Furthermore, CAVA's strong brand recognition and customer loyalty, demonstrated by its 54% revenue growth in 2023, makes it challenging for new players to capture market share.

| Barrier | Description | 2024/2023 Data Point |

|---|---|---|

| Capital Requirements | High costs for real estate, build-out, and initial operations. | $300,000 - $1M+ per location (2024 estimate) |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | $715.7 million revenue (2023) |

| Brand Loyalty | Established customer base and brand recognition. | 54% revenue growth (2023) |

| Real Estate Access | Difficulty securing prime locations. | Sub-5% vacancy for prime retail (2024) |

| Regulatory Compliance | Adherence to health, safety, and licensing standards. | Emphasis on enhanced food safety practices (2024) |

Porter's Five Forces Analysis Data Sources

Our Cava Porter's Five Forces analysis is built upon a foundation of robust data, including company financial reports, industry-specific market research from firms like IBISWorld, and consumer trend data from platforms such as Statista.