Cathay Pacific Airways SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Pacific Airways Bundle

Cathay Pacific Airways boasts a strong brand reputation and a strategic hub in Hong Kong, but faces intense competition and fluctuating fuel costs. Understanding these internal capabilities and external market forces is crucial for navigating the dynamic aviation industry.

Want the full story behind Cathay Pacific's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cathay Pacific consistently ranks high in global airline awards, a testament to its premium brand. In 2025, it was recognized for its exceptional economy class and in-flight entertainment, reinforcing its reputation for quality and attracting discerning travelers.

This strong brand equity allows Cathay Pacific to command premium pricing and foster customer loyalty, especially in lucrative long-haul markets. The airline's commitment to an elevated customer experience is evident in ongoing investments like the new Aria Suite for Business Class, set to launch on Boeing 777-9 aircraft in 2025.

Cathay Pacific benefits immensely from its strategic position at Hong Kong International Airport (HKIA), a pivotal global aviation nexus. This deep integration with its home base offers a substantial competitive edge, facilitating seamless operations and network expansion.

The recent completion of HKIA's Three-Runway System, a significant infrastructure upgrade, directly bolsters Cathay's capacity. This enhancement allows for greater operational flexibility and the potential to grow its route network, reinforcing Hong Kong's status as a premier international aviation hub.

This prime location at HKIA enables Cathay Pacific to offer extensive global connectivity for both its passenger and cargo services, a critical factor in its ability to serve a diverse international customer base.

Cathay Cargo has shown impressive resilience and growth, with a significant uptick in tonnage and revenue throughout 2024. This surge is largely fueled by the booming global e-commerce sector, especially the strong flow of goods between mainland China and key markets such as North America.

The cargo division benefits immensely from Cathay Pacific's expanding passenger network, allowing it to utilize more belly cargo space. This synergy, combined with a strategic focus on high-value, time-sensitive shipments like pharmaceuticals and fresh produce, bolsters the group's financial performance.

As the dominant carrier at Hong Kong International Airport, the world's busiest international air cargo hub, Cathay Cargo is uniquely positioned to capitalize on global trade flows, reinforcing its strength in the air freight industry.

Comprehensive Global Network and Recovery Progress

Cathay Pacific Group has successfully navigated its recovery, achieving 100% of its pre-pandemic flight capacity by January 2025. This robust network expansion is further bolstered by its dual-brand strategy, incorporating HK Express, which collectively aims to serve 100 global destinations within 2025.

The airline boasts extensive connectivity, particularly to major cities worldwide and a strong foothold in the Chinese Mainland. This comprehensive reach, covering both point-to-point and transit passengers, is a significant asset as they continue to add new routes.

- Network Restoration: 100% of pre-pandemic flight capacity restored by January 2025.

- Destination Goal: Targeting 100 destinations served globally within 2025.

- Strategic Expansion: Dual-brand strategy (Cathay Pacific & HK Express) enhances global reach.

- Key Markets: Significant presence in Chinese Mainland and major international cities.

Fleet Modernization and Sustainability Initiatives

Cathay Pacific is actively modernizing its fleet, with plans to introduce over 100 new passenger and freighter aircraft. This significant investment includes orders for Airbus A330neo and ongoing evaluations for Boeing 787 Dreamliner and 777X series aircraft, enhancing operational efficiency.

These fleet upgrades are central to Cathay Pacific's ambitious sustainability goals, aiming for net-zero carbon emissions by 2050. The airline is also prioritizing the increased use of Sustainable Aviation Fuel (SAF) to further reduce its environmental impact.

Beyond aircraft, Cathay Pacific has established new sustainability targets for 2025 and beyond. These initiatives focus on tangible reductions in waste, such as cutting down on single-use plastics and minimizing cabin waste across its operations.

- Fleet Expansion: Over 100 new passenger and freighter aircraft planned, including A330neo orders.

- Sustainability Commitment: Targeting net-zero carbon emissions by 2050 and increasing SAF usage.

- Waste Reduction: New 2025 targets to decrease single-use plastics and cabin waste.

Cathay Pacific's premium brand, consistently recognized in global awards, attracts discerning travelers and allows for premium pricing. Its commitment to an elevated customer experience, including new premium cabin products, reinforces its market position.

The airline's strategic advantage at Hong Kong International Airport (HKIA), a major global aviation hub, provides unparalleled connectivity and operational flexibility. The recent expansion of HKIA's infrastructure directly benefits Cathay Pacific's capacity and network growth.

Cathay Cargo demonstrates strong performance, driven by e-commerce growth and its integration with the passenger network, leveraging belly cargo capacity for high-value shipments. Its position as the dominant carrier at the world's busiest international air cargo hub is a significant strength.

The restoration of pre-pandemic flight capacity by January 2025 and the goal to serve 100 global destinations within 2025, supported by a dual-brand strategy with HK Express, highlights its robust network expansion and market reach.

Cathay Pacific's significant fleet modernization, with over 100 new aircraft planned, enhances operational efficiency and supports its ambitious sustainability goals, including net-zero emissions by 2050 and increased use of Sustainable Aviation Fuel.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Premium Brand Reputation | Consistently recognized for high-quality service, attracting premium customers. | Awarded for exceptional economy class and in-flight entertainment in 2025. |

| Strategic Hub Location | Dominant presence at Hong Kong International Airport (HKIA), a global nexus. | HKIA's Three-Runway System completion enhances operational capacity. |

| Strong Cargo Operations | Resilient cargo division fueled by e-commerce and network synergy. | Cathay Cargo benefits from increased belly cargo space and high-value shipments. |

| Network Expansion | Restored 100% pre-pandemic capacity by Jan 2025, targeting 100 destinations in 2025. | Dual-brand strategy with HK Express broadens global reach. |

| Fleet Modernization & Sustainability | Investing in over 100 new aircraft and committed to net-zero emissions by 2050. | Orders for Airbus A330neo and increased use of Sustainable Aviation Fuel (SAF). |

What is included in the product

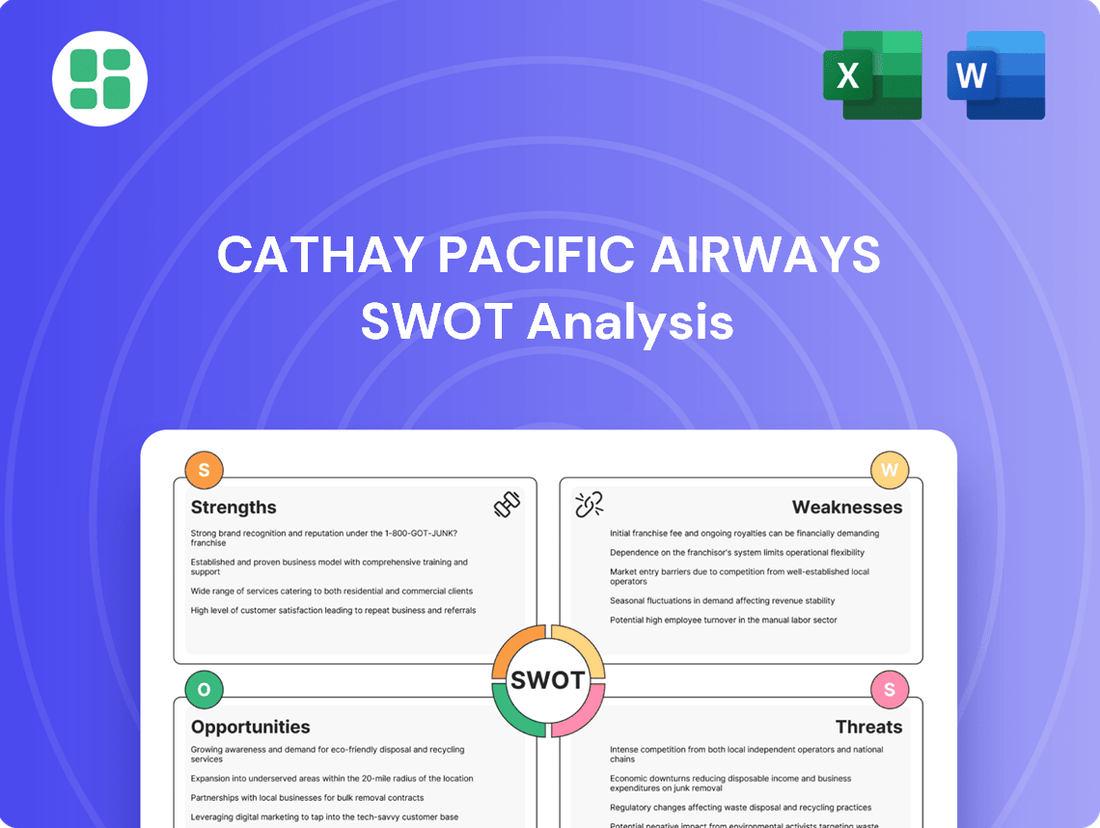

This SWOT analysis provides a comprehensive overview of Cathay Pacific Airways's internal capabilities and external market dynamics, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear view of Cathay Pacific's competitive landscape to pinpoint areas for improvement and capitalize on opportunities.

Weaknesses

Cathay Pacific's significant reliance on its Hong Kong hub, while a strategic advantage, also exposes it to considerable risks. For instance, the social unrest experienced in Hong Kong in 2019 led to widespread flight cancellations and a notable drop in passenger numbers, directly impacting the airline's revenue. This dependence means that any geopolitical instability or localized disruptions in Hong Kong can have an outsized negative effect on Cathay Pacific's operational capacity and financial health.

Cathay Pacific faces formidable competition from established full-service airlines like Singapore Airlines and Emirates, as well as aggressive low-cost carriers such as AirAsia. This rivalry, especially on popular Asian routes, has put significant pressure on ticket prices.

In 2024, despite seeing higher passenger numbers, the average revenue per passenger, known as yield, experienced a decline. For instance, Cathay Pacific reported a 2.7% drop in passenger yield for the first half of 2024 compared to the same period in 2023, illustrating the impact of this intense market dynamic.

Despite proactive recruitment drives throughout 2024 and ambitious hiring targets for 2025, Cathay Pacific continues to grapple with manpower deficits. Pilot shortages, in particular, were a significant factor, leading to operational disruptions and flight cancellations in late 2024, underscoring the persistent challenge of aligning staffing levels with operational demands.

The airline's pilot headcount in 2024 remained notably below its pre-COVID-19 pandemic figures. While Cathay Pacific expresses confidence in its ongoing recruitment strategies, the critical need to secure sufficient personnel to fully support its planned capacity restoration and ambitious growth trajectory for 2025 and beyond presents an enduring operational hurdle.

Vulnerability to Fuel Price Fluctuations

Cathay Pacific's profitability is significantly tied to the volatile nature of jet fuel prices. Even with hedging in place, which aims to mitigate some of this risk, substantial spikes in crude oil prices can quickly impact operational costs and squeeze profit margins. For instance, while Cathay Pacific reported a substantial profit in 2024, largely aided by favorable fuel costs, a reversal of this trend in 2025 or beyond could present a considerable challenge.

The airline industry, by its very nature, faces this ongoing vulnerability. Global events, geopolitical tensions, and supply and demand dynamics for oil are external factors that Cathay Pacific cannot directly control, yet they have a profound effect on its bottom line. This reliance on a commodity with such unpredictable pricing represents a persistent financial risk that management must continually navigate.

- High Sensitivity to Jet Fuel Costs: Operational expenses are directly impacted by global oil price volatility.

- Hedging Limitations: While hedging strategies are employed, they do not eliminate all risks associated with fuel price surges.

- External Control: Fuel price fluctuations are largely beyond Cathay Pacific's direct influence, creating an inherent financial vulnerability.

- Impact on Profitability: Significant increases in oil prices can rapidly erode the profit margins achieved during periods of lower fuel costs.

High Capital Expenditure for Fleet Modernization

Cathay Pacific's ambitious fleet modernization and expansion, a key driver for future competitiveness and environmental performance, necessitates substantial capital outlays. These investments, projected to exceed HK$100 billion, are a significant financial commitment. This large expenditure naturally leads to an increase in the airline's net borrowings and overall financial leverage in the near to medium term, posing a potential risk if market conditions are not favorable.

The successful realization of the benefits from this extensive fleet upgrade is intrinsically linked to external factors. Favorable market conditions, such as sustained passenger demand and manageable fuel prices, are critical. Equally important is the airline's ability to execute these complex modernization plans efficiently and on schedule. Any delays or cost overruns could further strain its financial position.

- Significant Capital Outlay: Over HK$100 billion committed to fleet modernization and expansion.

- Increased Financial Leverage: Higher net borrowings and financial leverage in the short to medium term.

- Dependence on Market Conditions: Success hinges on favorable passenger demand and economic stability.

- Execution Risk: Realizing benefits depends on efficient and timely implementation of modernization plans.

The airline's heavy reliance on the Hong Kong hub makes it susceptible to localized disruptions. Geopolitical events or political instability in Hong Kong can significantly impact operations and revenue, as seen during the 2019 social unrest. This concentration risk means that challenges specific to Hong Kong can disproportionately affect Cathay Pacific's overall performance.

Intense competition from both full-service carriers and low-cost airlines continues to pressure ticket prices. This dynamic was evident in the first half of 2024, where Cathay Pacific reported a 2.7% decrease in passenger yield despite increased passenger numbers. Navigating this competitive landscape requires constant strategic adjustments to maintain profitability.

Manpower shortages, particularly among pilots, remained a challenge throughout 2024, leading to operational disruptions and flight cancellations. Despite recruitment efforts, the airline's pilot headcount in 2024 was still below pre-pandemic levels, highlighting an ongoing hurdle in matching staffing to operational demands for 2025 and beyond.

What You See Is What You Get

Cathay Pacific Airways SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Cathay Pacific Airways' Strengths, Weaknesses, Opportunities, and Threats. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global resurgence in international travel, especially across the Asia-Pacific and to and from mainland China, offers Cathay Pacific a prime chance to boost passenger numbers and return to profitability. This trend is supported by significant passenger growth observed throughout 2024 and into early 2025.

Cathay Pacific is strategically enhancing its network and capacity to capitalize on this demand. The airline is introducing new direct routes and has set an ambitious target to operate to 100 destinations worldwide by 2025, directly addressing the recovering travel market.

The surge in global e-commerce is a significant tailwind for air cargo, and Cathay Pacific Cargo is well-positioned to benefit. In 2024, e-commerce sales are projected to reach over $7 trillion worldwide, a figure that underscores the immense demand for efficient air freight solutions.

Cathay Cargo's expertise in handling specialized cargo, such as temperature-sensitive pharmaceuticals and high-value automotive parts, provides a competitive edge. The airline's growing belly capacity, stemming from the recovery of its passenger network, further enhances its ability to transport these lucrative goods. For instance, Cathay Pacific aims to increase its freighter fleet utilization alongside passenger flight recovery, supporting this growth.

By concentrating on these high-yield segments, Cathay Cargo can optimize its revenue streams. The increasing demand for express delivery services, a direct result of e-commerce expansion, means that speed and reliability are paramount, areas where Cathay Cargo can excel.

Cathay Pacific is strategically growing its global footprint. In 2024, the airline announced new routes to destinations like Riyadh and Penang, alongside increased frequencies to popular European cities such as Amsterdam and Zurich. This expansion is designed to capitalize on the resurgence of international travel and solidify its position as a premier carrier.

Strengthening alliances is a core part of this strategy. By deepening relationships with partners like Alaska Airlines and British Airways, Cathay Pacific offers passengers more connected journeys and unlocks revenue-sharing opportunities. These collaborations are crucial for leveraging its Hong Kong hub, aiming to capture a larger share of the lucrative transit passenger market.

Digital Transformation and Enhanced Customer Experience

Cathay Pacific is investing heavily in digital transformation to elevate its customer experience. This includes upgrading booking platforms, in-flight entertainment systems, and connectivity options, aiming to attract and retain tech-savvy travelers. For instance, the airline has been rolling out new cabin products and enhancing its premium economy offerings, underscoring its dedication to a premium service model.

These digital and product enhancements are crucial for differentiating Cathay Pacific in the highly competitive aviation sector.

- Digital Investment: Cathay Pacific's commitment to digital transformation aims to streamline customer journeys from booking to post-flight engagement.

- Customer Experience Focus: Investments in new cabin products and upgraded premium economy seating are designed to enhance passenger comfort and satisfaction.

- Competitive Advantage: These improvements are key to attracting and retaining a discerning customer base, particularly those who value advanced technology and premium services.

Leadership in Sustainable Aviation

Cathay Pacific's significant investments in Sustainable Aviation Fuel (SAF) and its commitment to achieving net-zero emissions by 2050 position it to lead in sustainable aviation. By mid-2024, the airline had already flown over 400 flights utilizing SAF, demonstrating a tangible commitment to reducing its environmental footprint. This proactive stance not only enhances its brand image among increasingly eco-conscious travelers but also positions it to capitalize on potential future regulatory advantages and incentives for green aviation initiatives.

The airline's ongoing efforts to reduce single-use plastics and cabin waste further underscore its dedication to environmental responsibility. These initiatives are crucial for attracting and retaining customers who prioritize sustainability in their travel choices. For instance, Cathay Pacific aims to eliminate single-use plastics from its catering operations by the end of 2025, a move that aligns with growing consumer demand for environmentally friendly practices.

This leadership in sustainability can translate into a competitive advantage, potentially attracting new customer segments and fostering stronger loyalty among existing ones. The airline's investment in SAF, for example, not only addresses current emissions but also prepares it for a future where SAF mandates may become more prevalent, offering a strategic hedge against evolving industry regulations.

The airline's strategic network expansion, including new routes announced in 2024 to Riyadh and Penang and increased frequencies to European hubs like Amsterdam and Zurich, directly targets the recovering global travel demand. These moves aim to solidify Cathay Pacific's position as a premier carrier in key markets.

Deepening alliances with partners such as Alaska Airlines and British Airways enhances Cathay Pacific's reach and revenue potential. These collaborations are vital for leveraging its Hong Kong hub to capture a larger share of the transit passenger market, offering seamless connections for a growing international clientele.

Cathay Pacific's significant investment in digital transformation, including platform upgrades and enhanced in-flight connectivity, addresses the evolving preferences of tech-savvy travelers. The rollout of new cabin products and improved premium economy seating further differentiates its service offering in a competitive landscape.

Cathay Pacific's commitment to sustainability, evidenced by over 400 flights using Sustainable Aviation Fuel (SAF) by mid-2024 and a goal to eliminate single-use plastics by the end of 2025, positions it favorably with eco-conscious consumers and potentially future regulatory advantages.

Threats

Geopolitical instability, including ongoing trade conflicts, poses a significant threat to Cathay Pacific. These tensions can dampen global travel demand and reduce cargo volumes, directly impacting the airline's revenue streams. For instance, the CEO has specifically highlighted trade conflicts as a concern for Cathay Cargo.

Potential economic downturns, whether globally or within key markets like mainland China, also present a substantial risk. Such downturns can lead to decreased consumer spending on discretionary items like air travel and a slowdown in international trade, both of which are crucial for Cathay Pacific's financial performance.

The Asian aviation market is incredibly competitive, with both established full-service airlines and nimble low-cost carriers vying for passengers. This often leads to aggressive pricing strategies, or price wars, which can significantly squeeze profit margins for carriers like Cathay Pacific.

As airlines worldwide, including those in Asia, continue to bring back flights and increase capacity following the pandemic, the sheer volume of available seats rises. This increased supply can naturally lead to lower ticket prices, putting further pressure on Cathay Pacific's ability to maintain healthy profit margins, even if passenger numbers themselves are growing.

The aviation sector is still grappling with persistent supply chain disruptions. This directly impacts the timely delivery of new aircraft and essential spare parts, posing a significant risk to Cathay Pacific's fleet modernization and expansion strategies. For instance, the ongoing delays with the Boeing 777X program could hinder Cathay Pacific's ability to enhance its operational efficiency and maintain its competitive edge in key markets.

Furthermore, issues with aircraft engines have led to certain subsidiary aircraft being temporarily grounded. This situation underscores the vulnerability of airline operations to external supply chain shocks and component reliability, directly affecting fleet availability and service continuity.

Regulatory Changes and Environmental Pressures

Increasing global regulatory pressures, particularly concerning environmental sustainability, pose a significant threat. Potential carbon taxes or more stringent emission standards could directly increase Cathay Pacific's operating expenses. For instance, the European Union's Emissions Trading System (ETS) already impacts airlines flying within its airspace, and similar initiatives are expanding globally.

While Cathay Pacific is actively investing in Sustainable Aviation Fuel (SAF) and modernizing its fleet, the pace and stringency of future regulations could still present substantial financial challenges. A rapid escalation in compliance costs, without sufficient lead time for adaptation, might strain the company's financial resources. For example, if carbon pricing mechanisms are introduced or significantly tightened in key markets like Asia or North America in 2024 or 2025, it could necessitate substantial, unplanned capital outlays.

- Increased Operating Costs: Potential carbon taxes and stricter emission standards directly raise operational expenses.

- Financial Burden of Compliance: Rapid or stringent regulatory shifts could impose significant financial strain if preparation is insufficient.

- Impact on SAF and Fleet Modernization: While investments are being made, the pace of regulatory change may outstrip the benefits of current strategies.

Resurgence of Health Crises or Pandemics

The aviation sector remains highly susceptible to global health emergencies, as evidenced by recent events. A renewed outbreak or the appearance of novel pathogens could trigger renewed travel bans and a sharp decline in passenger numbers, directly impacting Cathay Pacific's operations and financial stability.

For instance, during the peak of the COVID-19 pandemic, Cathay Pacific experienced a dramatic reduction in passenger traffic. In 2020, the airline carried only 4.6 million passengers, a staggering 86.7% decrease from the 33.9 million carried in 2019. This highlights the severe financial consequences that health crises can inflict.

- Lingering effects of past pandemics: Continued traveler apprehension and potential for localized outbreaks could still suppress demand.

- New infectious disease emergence: A novel virus could necessitate immediate and widespread travel restrictions, mirroring the impact of COVID-19.

- Economic strain on consumers: Health crises often coincide with economic downturns, reducing discretionary spending on travel.

Intensified competition from both established carriers and low-cost airlines in the Asian market poses a significant threat, potentially leading to price wars that erode profit margins. Furthermore, a global economic slowdown or downturns in key markets like mainland China could reduce travel demand and cargo volumes, directly impacting Cathay Pacific's revenue. The airline also faces the risk of increased operating costs due to evolving environmental regulations, such as potential carbon taxes, which could necessitate substantial, unplanned capital outlays if not managed proactively.

SWOT Analysis Data Sources

This Cathay Pacific Airways SWOT analysis is built upon a robust foundation of data, drawing from official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.