Cathay Pacific Airways PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Pacific Airways Bundle

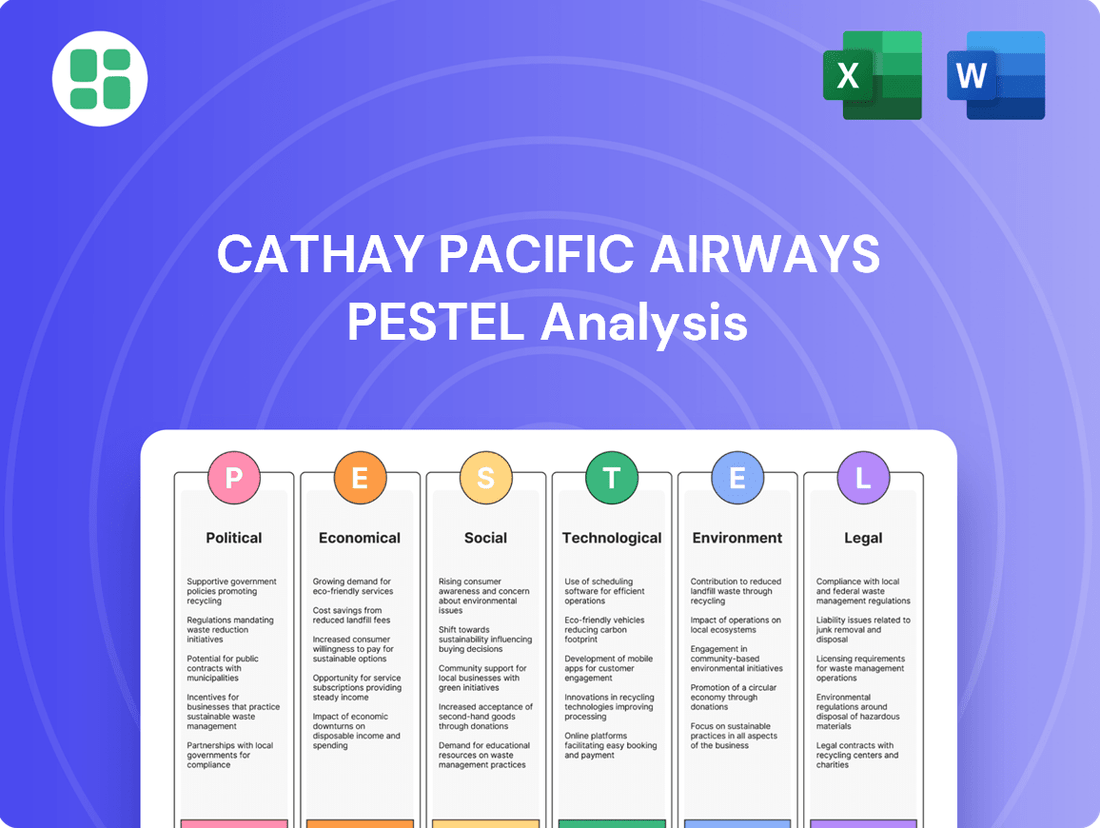

Navigate the complex external environment impacting Cathay Pacific Airways with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, environmental regulations, and legal frameworks are shaping the airline's future. Gain actionable intelligence to inform your strategic decisions and competitive positioning.

Unlock a deeper understanding of the forces at play for Cathay Pacific Airways. Our expertly crafted PESTLE analysis provides crucial insights into the external landscape, empowering you to anticipate challenges and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

Cathay Pacific's success is closely linked to the Hong Kong SAR Government's strategic vision to maintain Hong Kong International Airport (HKIA) as a premier global aviation hub. Government support, including significant infrastructure investments, directly benefits Cathay's operational capabilities and network expansion potential.

The completion of HKIA's Three-Runway System in November 2024 is a prime example of this support, significantly enhancing air traffic capacity. This expansion, coupled with ongoing Airport City development plans, is designed to foster greater connectivity and create a more robust aviation ecosystem, which Cathay Pacific is poised to leverage.

Cathay Pacific's operations are significantly influenced by geopolitical tensions, especially concerning Hong Kong's ties with mainland China and global trade dynamics. For instance, the ongoing trade friction between the US and China directly impacts air cargo volumes, a crucial segment for Cathay Pacific. In 2023, air cargo accounted for approximately 25% of Cathay Pacific's total revenue, highlighting its sensitivity to these international trade policies.

Cathay Pacific operates within a stringent regulatory framework, encompassing international aviation standards and specific national laws. For instance, compliance with airworthiness directives from agencies like the European Union Aviation Safety Agency (EASA) is paramount, often requiring significant investment in maintenance and upgrades. In 2024, the International Air Transport Association (IATA) continued to emphasize enhanced safety protocols, pushing airlines like Cathay Pacific to invest in advanced monitoring and reporting systems, potentially impacting operational costs.

Cross-Border Travel Policies

Cross-border travel policies are a huge driver for airlines like Cathay Pacific. Changes in these rules, especially concerning travel between Hong Kong, mainland China, and other Asian nations, directly impact how many people can fly. This means more passengers or fewer, which directly affects Cathay Pacific's revenue. For example, in early 2024, Hong Kong saw a significant increase in inbound tourism, partly due to eased travel restrictions and promotional efforts, boosting passenger numbers for local carriers.

The Hong Kong SAR Government's focus on improving air links is a real game-changer. By making it easier to connect with mainland China and countries involved in the Belt and Road Initiative, they're opening up new opportunities. This strategy allows Cathay Pacific to expand its routes and attract more travelers, strengthening its position in the region. In 2023, Cathay Pacific reported carrying over 24 million passengers, a substantial increase from the previous year, reflecting improved travel demand and supportive policies.

- Policy Impact: Easing of travel restrictions, particularly with mainland China, directly correlates with increased passenger traffic for Cathay Pacific.

- Connectivity Growth: Government initiatives to boost air connectivity with Belt and Road countries offer strategic advantages for route expansion.

- Passenger Volume: In the first half of 2024, Cathay Pacific saw a notable surge in passenger numbers, exceeding 12 million, driven by relaxed travel protocols and increased demand.

Government Scrutiny and Public Image

As Hong Kong's flag carrier, Cathay Pacific faces significant government scrutiny, particularly concerning its post-pandemic recovery. This oversight directly influences its public perception and can create pressure to adjust operations to meet governmental objectives, such as increasing connectivity with mainland China. For instance, in early 2024, Cathay Pacific announced plans to expand its mainland China network, adding routes to cities like Xi'an and Fuzhou, aligning with broader economic integration goals.

The airline's public image is a critical political factor. Following the challenges of the COVID-19 pandemic, Cathay Pacific has been under the spotlight to demonstrate resilience and commitment to Hong Kong's status as an international hub. This scrutiny can translate into policy considerations that might favor or constrain the airline's strategic decisions. For example, government support for aviation infrastructure development, while beneficial, often comes with expectations of service provision that align with national or regional priorities.

Recent data highlights the ongoing focus on Cathay Pacific's operational performance and its role in regional connectivity. As of the first quarter of 2024, passenger traffic figures showed a strong rebound, with Cathay Pacific reporting a 65% increase in passenger numbers compared to the same period in 2023, reaching over 7 million passengers. This recovery is closely monitored by government bodies to assess the health of Hong Kong's aviation sector and its contribution to the local economy.

Key considerations for Cathay Pacific regarding government scrutiny include:

- Alignment with Hong Kong Government's Aviation Strategy: Ensuring operational plans support Hong Kong's role as a global and regional aviation hub.

- Mainland China Connectivity: Responding to government directives or incentives to increase flight frequencies and destinations within mainland China.

- Public Perception Management: Proactively addressing public concerns and maintaining a positive image through transparent communication and service excellence.

- Regulatory Compliance: Adhering to evolving aviation regulations and safety standards set by both Hong Kong and international authorities.

Government policies directly shape Cathay Pacific's operating environment, from infrastructure development at Hong Kong International Airport to international travel agreements. The Hong Kong SAR Government's commitment to bolstering HKIA's status as a global hub, evidenced by the Three-Runway System's completion in late 2024, provides a significant operational advantage.

Geopolitical considerations and trade relations, particularly between China and the West, influence cargo volumes, a key revenue stream for Cathay Pacific. In 2023, air cargo represented about 25% of the airline's revenue, underscoring its sensitivity to these international dynamics.

Regulatory compliance with international aviation standards and national laws is paramount, with agencies like EASA setting safety benchmarks. The International Air Transport Association's continued emphasis on safety protocols in 2024 necessitates ongoing investment in advanced systems.

Changes in cross-border travel policies, especially between Hong Kong and mainland China, directly impact passenger numbers. The first half of 2024 saw Cathay Pacific carry over 12 million passengers, a surge attributed to eased travel restrictions and increased demand.

| Political Factor | Impact on Cathay Pacific | 2023/2024 Data/Trend |

|---|---|---|

| Government Aviation Strategy | Supports HKIA as a hub, enabling network expansion. | HKIA Three-Runway System completion (Nov 2024). |

| Geopolitical Tensions/Trade Policy | Affects air cargo volumes. | Air cargo was ~25% of revenue in 2023. |

| Travel Policies | Drives passenger traffic. | Over 12 million passengers in H1 2024, up significantly. |

| Regulatory Environment | Requires investment in safety and compliance. | IATA pushing enhanced safety protocols in 2024. |

| Government Scrutiny/Support | Influences operational decisions and public perception. | Expansion of mainland China routes announced early 2024. |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Cathay Pacific Airways, offering insights into market dynamics and strategic considerations.

A concise Cathay Pacific PESTLE analysis, presented in a clear, summarized format, acts as a pain point reliever by enabling quick referencing and discussion during strategic planning and stakeholder meetings.

Economic factors

Cathay Pacific's financial health is intrinsically linked to the global economic recovery. The airline saw a significant rebound in both passenger and cargo operations, a clear signal of resurgent travel demand. This positive trend was underscored by Cathay Pacific's 2024 annual results, which reported a substantial increase in both revenue and profit, mirroring the broader industry's recovery path.

Fluctuations in global fuel prices are a major economic factor for airlines like Cathay Pacific. These price swings directly impact operating costs, a significant portion of an airline's expenses. For example, Cathay Pacific has noted that lower fuel prices can boost financial performance, contributing to positive outlooks, such as their anticipation of stronger results in the latter half of 2024.

However, this volatility presents a persistent economic risk. When fuel prices surge, it can quickly erode profitability, forcing airlines to consider fare increases or cost-cutting measures. The International Air Transport Association (IATA) has consistently highlighted fuel costs as a primary driver of airline profitability, with even small shifts having a substantial effect on the bottom line.

As a global carrier, Cathay Pacific's financial performance is directly impacted by fluctuations in exchange rates, as its revenue and operating expenses are denominated in numerous foreign currencies. For instance, a strengthening Hong Kong Dollar (HKD) against key trading currencies could reduce the value of overseas earnings when repatriated, while a weakening HKD could increase the cost of imported goods and services, such as aircraft fuel and maintenance.

While Cathay Pacific employs hedging strategies to mitigate these risks, the effectiveness of these instruments can vary. For example, in 2023, the airline reported that its hedging activities helped to reduce the impact of currency volatility on its fuel costs, but significant unhedged exposures can still emerge. These unhedged positions can lead to unexpected gains or losses, impacting the airline's profitability and overall financial stability.

Competition in the Aviation Market

The aviation sector is notoriously competitive, particularly in regional markets, often leading to normalized yields and squeezing profit margins. This economic reality directly impacts airlines like Cathay Pacific, forcing them to constantly adapt their strategies to maintain profitability.

Cathay Pacific's approach includes a dual-brand strategy, leveraging Cathay Pacific for premium services and HK Express for the budget-conscious segment. This aims to capture a broader market share, but the intense competition across all segments remains a significant economic challenge.

- Intensified Competition: The Asia-Pacific region, a key market for Cathay Pacific, saw a significant increase in low-cost carriers and expanded networks from major international airlines throughout 2024, intensifying price wars.

- Yield Pressure: In 2024, average yields for carriers operating similar routes to Cathay Pacific experienced a downward trend, with some reports indicating a 5-8% decrease year-on-year due to overcapacity on popular Asian routes.

- Strategic Response: Cathay Pacific's integration of HK Express in 2023 aimed to counter this by offering a more competitive price point, but it also meant managing two distinct operational and marketing strategies in a challenging economic environment.

Consumer Spending Power and Tourism Trends

Consumer spending power and shifting tourism trends are fundamental drivers for Cathay Pacific's passenger volume and the demand within its premium cabins. As economies recover and discretionary income rises, more individuals are inclined to travel, both for leisure and business purposes. This directly translates to increased ticket sales and a greater appetite for higher-yield services.

The airline's revenue growth is heavily reliant on robust demand from key markets. For instance, in 2024, Cathay Pacific has seen a significant rebound in travel from Japan and South Korea, with passenger numbers approaching pre-pandemic levels. Similarly, Southeast Asia and Australia continue to be vital sources of both leisure and corporate travelers, contributing substantially to the airline's top line.

Several factors are shaping these trends:

- Increased Disposable Income: In many of Cathay Pacific's key markets, wage growth and a strong job market in 2024 are boosting household disposable income, enabling more spending on travel.

- Pent-up Demand: Following years of travel restrictions, there's a notable release of pent-up demand, particularly for experiential travel and visiting family and friends.

- Business Travel Recovery: While leisure travel has rebounded strongly, business travel is also showing a consistent recovery in 2024, with companies resuming in-person meetings and conferences.

- Premium Segment Growth: Anecdotal evidence and booking data from early 2025 suggest a continued strong preference for premium cabin experiences among discerning travelers, indicating a willingness to pay for enhanced comfort and services.

Cathay Pacific's financial performance is closely tied to global economic health, with 2024 showing a strong rebound in passenger and cargo operations, reflecting increased travel demand. For instance, the airline reported a significant profit increase in its 2024 results, aligning with industry-wide recovery trends.

Fuel costs remain a critical economic factor, directly impacting Cathay Pacific's operating expenses. The airline anticipates stronger financial results in the latter half of 2024, partly due to favorable fuel price movements, though volatility poses a persistent risk.

Exchange rate fluctuations also significantly affect Cathay Pacific, as revenues and expenses span multiple currencies. While hedging strategies are employed, unhedged exposures can still lead to financial volatility, as seen in past reporting periods.

| Economic Factor | Impact on Cathay Pacific | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Recovery | Increased travel demand, higher revenue potential | Strong rebound in passenger and cargo, profit growth reported for 2024. |

| Fuel Prices | Direct impact on operating costs and profitability | Anticipated positive impact from lower prices in H2 2024; volatility remains a risk. |

| Exchange Rates | Affects repatriated earnings and cost of imports | Ongoing management of currency exposures through hedging strategies. |

| Competition & Yields | Pressure on profit margins, need for strategic adaptation | Intensified competition in Asia-Pacific; yields saw an estimated 5-8% decrease on some routes in 2024. |

| Consumer Spending & Tourism | Drives passenger volume and premium cabin demand | Robust recovery in key markets like Japan and South Korea; increased disposable income supports travel. |

Full Version Awaits

Cathay Pacific Airways PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cathay Pacific Airways PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline's operations and strategic planning.

Sociological factors

Post-pandemic travel patterns show a clear shift, with a notable resurgence in demand for long-haul journeys and a preference for specific leisure hotspots. This trend directly impacts airline strategies, necessitating adjustments in route networks and service portfolios to cater to these evolving passenger desires.

Cathay Pacific, for instance, is actively monitoring and responding to these evolving preferences. The airline has noted a significant increase in inbound student traffic, particularly during academic start and end periods. Furthermore, demand spikes during major holiday seasons continue to be a critical factor in their operational planning and capacity allocation.

Cathay Pacific's operational strength hinges on its skilled workforce, especially pilots and cabin crew. The airline has been actively recruiting, aiming to restore its pre-pandemic capacity by 2025. This strategic hiring push is crucial for meeting the resurgent demand in air travel.

Public perception of health and safety in air travel remains a critical factor for Cathay Pacific. Following global health events, passenger confidence is directly tied to an airline's demonstrated commitment to safety. For instance, in 2023, IATA reported that 86% of travelers felt that air travel safety had improved over the past decade, a positive trend Cathay Pacific aims to leverage.

Cathay Pacific must continue to implement and clearly communicate robust health protocols to maintain and enhance passenger trust. This includes measures like enhanced cabin cleaning, air filtration systems, and flexible booking options. The airline's proactive communication regarding these measures directly impacts its ability to attract and retain customers in a competitive market.

Community Engagement and Social Responsibility

Cathay Pacific places significant importance on its connection to Hong Kong, actively participating in community initiatives. The airline supports programs focused on youth development and contributes to the local arts and culture scene, aiming to create a positive social impact. This commitment helps solidify its brand reputation within its primary market.

In 2023, Cathay Pacific continued its efforts in community engagement, including its long-standing partnership with the Hong Kong Arts Festival. The airline also focused on its sustainability goals, which often have a social component, by aiming to reduce its environmental footprint, a key concern for many stakeholders.

- Youth Development: Cathay Pacific's initiatives often target young people, aiming to provide opportunities and foster talent within Hong Kong.

- Arts and Culture Support: The airline is a notable patron of the arts, contributing to the vibrancy of Hong Kong's cultural landscape.

- Brand Image: These social responsibility efforts enhance Cathay Pacific's standing and goodwill among the Hong Kong public and international observers.

Cultural Influences on Travel

Cultural events and holidays are major drivers of travel demand for Cathay Pacific. For instance, the Cathay/HSBC Hong Kong Sevens is a significant event that draws international visitors, boosting bookings. Similarly, Golden Week in mainland China and Japan, observed in early May and late April/early May respectively, sees a surge in travel, which Cathay Pacific actively capitalizes on by adjusting its flight schedules and promotions to meet this increased demand.

Cathay Pacific strategically aligns its operations with these cultural calendars. In 2024, anticipating the rebound in travel post-pandemic, the airline increased capacity on routes serving key holiday destinations during peak periods like Lunar New Year and summer holidays. This proactive approach aims to maximize passenger numbers and revenue by catering to heightened travel desires during culturally significant times.

- Hong Kong Sevens Impact: The Cathay/HSBC Hong Kong Sevens is a prime example of a cultural event driving tourism, with significant passenger uplift for Cathay Pacific.

- Golden Week Demand: Golden Week holidays in China and Japan consistently generate substantial travel demand, which Cathay Pacific leverages through network optimization.

- 2024 Capacity Adjustments: Cathay Pacific increased flight frequencies during key holiday periods in 2024 to capture the recovering travel market.

- Cultural Tourism Growth: The airline benefits from the broader trend of cultural tourism, where people travel specifically to experience local festivals and traditions.

Sociological factors significantly shape Cathay Pacific's operational landscape, influencing everything from passenger confidence to workforce dynamics. The airline's commitment to community engagement, particularly in youth development and arts patronage in Hong Kong, bolsters its brand image and social license to operate.

The airline's strategic focus on restoring pre-pandemic capacity by 2025 underscores the importance of its workforce, with ongoing recruitment efforts for pilots and cabin crew. Public perception of health and safety remains paramount, with Cathay Pacific actively communicating its robust protocols to rebuild passenger trust, a sentiment echoed by IATA's 2023 report indicating 86% of travelers felt air travel safety had improved over the last decade.

Cathay Pacific leverages cultural events and holidays as key demand drivers, evident in the passenger uplift from events like the Cathay/HSBC Hong Kong Sevens and the consistent demand during Golden Week in China and Japan. In 2024, the airline proactively adjusted capacity to capitalize on these periods, reflecting a strategic alignment with cultural calendars to meet heightened travel desires.

Technological factors

Cathay Pacific is heavily invested in digital transformation, aiming to streamline operations and enhance customer service through technologies like cloud computing. This initiative is crucial for managing its extensive global network efficiently. For instance, in 2023, Cathay Pacific reported a significant increase in passenger numbers, carrying 24.3 million passengers, up 46% from 2022, highlighting the need for robust digital infrastructure to manage this growth.

The airline's adoption of cloud applications is central to achieving greater scalability and operational agility. This move supports a vision for a more paperless environment, reducing administrative overhead and improving data accessibility across departments. Such technological advancements are vital for Cathay Pacific to remain competitive in the rapidly evolving aviation industry, where digital capabilities directly impact customer satisfaction and operational costs.

Cathay Pacific is actively pushing for Sustainable Aviation Fuel (SAF) development, particularly within Asia. This strategic focus is vital for the airline to meet its ambitious decarbonization goals. For instance, in 2023, Cathay Pacific aimed to increase its SAF usage to 2% of its total fuel consumption, a significant step towards its 2030 target of 10%.

The airline's commitment extends to building a robust local SAF ecosystem. This includes expanding its Corporate SAF Programme, which allows corporate clients to contribute to SAF usage, thereby reducing their own carbon footprints. This program saw substantial growth in 2024, with an increasing number of companies signing up, demonstrating a growing market demand for sustainable travel options.

Cathay Pacific is actively modernizing its fleet, a crucial technological move to enhance efficiency and sustainability. A prime example is the integration of fuel-efficient aircraft like the Airbus A350, which significantly lowers carbon emissions and operational expenses. This strategic upgrade is central to their long-term cost management and environmental responsibility goals.

The airline has ambitious plans for fleet expansion and renewal, aiming to add over 100 new passenger and freighter aircraft in the coming years. This substantial investment in advanced aviation technology underscores their commitment to maintaining a competitive edge and meeting evolving market demands. By incorporating the latest in aircraft design and engine technology, Cathay Pacific is positioning itself for greater operational performance.

In-house Digital Innovation and Commercialization

Cathay Pacific is actively pursuing in-house digital innovation and commercialization through Cathay Technologies, aiming to become a leader in the aviation sector. This strategic move allows them to monetize proprietary digital solutions, such as the Electronic Flight Folder (EFF), which enhances operational efficiency and flight safety. For instance, the EFF system has been designed to reduce paper usage and streamline pre-flight information delivery to flight crews, contributing to a more sustainable and efficient operation.

This initiative positions Cathay Pacific to offer valuable digital tools to other airlines, potentially creating new revenue streams and solidifying its reputation for technological advancement. By commercializing innovations like the EFF, Cathay Pacific demonstrates a commitment to digital transformation that extends beyond its own operations, seeking to influence broader industry standards for safety and efficiency.

The company's investment in developing and commercializing these digital assets reflects a forward-thinking approach to leveraging technology for competitive advantage. This strategy is particularly relevant in the current aviation climate, where digital solutions are increasingly critical for cost management and service improvement.

Cybersecurity and Data Analytics

Cathay Pacific's increased digitalization makes robust cybersecurity paramount. Protecting sensitive passenger and operational data from breaches is critical, especially with the growing threat landscape. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, highlighting the immense financial and reputational risk for airlines.

Leveraging data analytics offers significant advantages for Cathay Pacific. Insights into customer preferences can drive personalized marketing and service offerings, while optimizing routes based on real-time data can improve fuel efficiency and punctuality. For instance, airlines are increasingly using AI-powered analytics to predict maintenance needs, reducing downtime and operational costs.

- Cybersecurity Investment: Airlines are increasing spending on advanced threat detection and prevention systems to safeguard customer data.

- Data-Driven Operations: Utilizing big data analytics to optimize flight paths, fuel consumption, and passenger load factors.

- Personalized Customer Experience: Employing analytics to understand passenger behavior and tailor services, enhancing loyalty.

- Regulatory Compliance: Adhering to stringent data privacy regulations like GDPR and CCPA, which necessitate strong data protection measures.

Cathay Pacific's embrace of digital transformation, including cloud computing and data analytics, is vital for managing its growing operations. In 2023, the airline carried 24.3 million passengers, a 46% increase from the previous year, underscoring the need for scalable digital infrastructure. This digital push aims to enhance customer service and operational efficiency, with innovations like the Electronic Flight Folder (EFF) contributing to a more paperless and streamlined environment.

The airline is also prioritizing fleet modernization with fuel-efficient aircraft like the Airbus A350 to reduce emissions and costs. Cathay Pacific plans to add over 100 new aircraft, integrating advanced aviation technology to maintain a competitive edge. Furthermore, their commitment to Sustainable Aviation Fuel (SAF) saw them aim for 2% SAF usage in 2023, with expansion of their Corporate SAF Programme in 2024 to meet decarbonization goals.

| Technological Factor | Description | Impact on Cathay Pacific | Key Data/Initiative |

| Digital Transformation | Adoption of cloud computing, data analytics, and digital tools. | Improved operational efficiency, enhanced customer experience, scalability. | 24.3 million passengers carried in 2023 (46% increase YoY); development of Electronic Flight Folder (EFF). |

| Fleet Modernization | Integration of fuel-efficient aircraft and new aircraft acquisitions. | Reduced operational costs, lower carbon emissions, improved performance. | Integration of Airbus A350; plan to add over 100 new passenger and freighter aircraft. |

| Sustainable Aviation Fuel (SAF) | Investment and promotion of SAF development and usage. | Progress towards decarbonization goals, meeting environmental regulations, attracting eco-conscious customers. | Targeted 2% SAF usage in 2023; expansion of Corporate SAF Programme in 2024. |

| Cybersecurity | Investment in advanced threat detection and prevention systems. | Protection of sensitive passenger and operational data, mitigation of financial and reputational risks. | Global cybercrime costs projected at $10.5 trillion annually in 2024. |

Legal factors

Cathay Pacific, operating globally, must adhere to stringent international aviation regulations. These are established by organizations like the International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA), dictating safety, security, and operational procedures.

Compliance with these global standards is non-negotiable for maintaining Cathay Pacific's operating licenses and its extensive international route network. For instance, ICAO's Annex 19 on Safety Management Systems is a cornerstone for all member states, impacting airline operations worldwide.

Cathay Pacific must strictly adhere to Hong Kong's labor laws, including those governing minimum wage, working hours, and employee benefits, to maintain smooth operations. In 2023, Hong Kong's statutory minimum wage remained at HK$37.5 per hour, a key compliance point for all employers, including Cathay Pacific.

Navigating the complexities of international labor regulations is paramount for Cathay Pacific's global workforce, impacting everything from recruitment to termination processes across various countries.

The airline faces ongoing challenges in managing industrial relations and collective bargaining agreements with its diverse employee unions, which can influence operational stability and costs.

Cathay Pacific faces evolving legal landscapes concerning data privacy and consumer protection. Stricter regulations, mirroring the EU's General Data Protection Regulation (GDPR), are increasingly impacting how airlines collect, store, and process passenger information. Failure to comply can result in significant fines; for instance, the GDPR can levy penalties up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk for non-adherence.

Anti-Trust and Competition Laws

Cathay Pacific operates in a highly competitive global aviation market, making adherence to anti-trust and competition laws crucial to prevent monopolistic behavior and ensure fair market practices. These regulations govern everything from route allocation to pricing, impacting how the airline can structure its operations and partnerships.

Strategic alliances, such as those with other airlines, and pricing decisions are under constant scrutiny to ensure they do not stifle competition or lead to unfair advantages. For example, in 2024, the European Union continued its focus on airline competition, investigating potential collusion among carriers on certain routes, which could affect Cathay Pacific's alliance strategies.

Failure to comply can result in significant penalties. For instance, in 2023, several airlines faced substantial fines for price-fixing activities, underscoring the financial risks associated with anti-competitive practices. Cathay Pacific must therefore navigate these legal frameworks diligently.

- Regulatory Scrutiny: Airlines are subject to ongoing review by competition authorities globally to prevent anti-competitive practices.

- Alliance Compliance: Strategic partnerships must be structured to meet merger control and competition law requirements in all relevant jurisdictions.

- Pricing Integrity: Pricing strategies are monitored to ensure they are not predatory or collusive, with significant fines for violations.

- Market Dominance: Laws aim to prevent any single airline from gaining undue market dominance, impacting route planning and expansion.

Environmental Regulations and Carbon Emissions Policies

Cathay Pacific operates within an environment of increasingly stringent environmental regulations, especially concerning carbon emissions and noise pollution. These legal frameworks directly impact the airline's operational requirements and financial planning, necessitating compliance with evolving standards. For instance, the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) mandates emissions reductions for international flights, affecting Cathay Pacific's global operations.

The airline's strategic push towards sustainability, including its investment in Sustainable Aviation Fuel (SAF) and fleet modernization, is significantly influenced by these regulatory pressures. By 2024, Cathay Pacific aimed to use SAF for 5% of its total fuel consumption, a target directly linked to meeting both current and anticipated environmental legislation. This commitment is crucial for maintaining its license to operate and for avoiding potential penalties associated with non-compliance.

- Regulatory Compliance: Cathay Pacific must adhere to international and national environmental laws, including those governing carbon emissions and noise levels at airports.

- SAF Mandates: Growing pressure from regulatory bodies and governments to increase the use of Sustainable Aviation Fuel is a key driver for Cathay Pacific's fuel procurement strategies.

- Emissions Trading Schemes: Participation in emissions trading schemes, such as the EU Emissions Trading System (EU ETS) for flights within Europe, imposes direct financial obligations based on carbon output.

- Future Legislation: Anticipation of stricter future regulations, including potential carbon taxes or enhanced emissions reduction targets, necessitates proactive investment in greener technologies and operational efficiencies.

Cathay Pacific must navigate a complex web of international and national aviation laws, including those set by ICAO and IATA, to ensure safety and security. Compliance with Hong Kong's labor laws, such as the HK$37.5 minimum wage per hour, is also essential for its workforce. The airline must also contend with evolving data privacy regulations, with penalties mirroring GDPR's potential 4% of global revenue for breaches.

Environmental factors

Climate change is a major focus for Cathay Pacific, with a commitment to reaching net-zero carbon emissions by 2050. To support this, the airline aims to reduce its carbon intensity by 12% by 2030, a goal that necessitates substantial investment in sustainable aviation fuel (SAF) and upgrading its aircraft fleet.

These decarbonization targets are driving significant capital allocation, with Cathay Pacific actively exploring and investing in SAF production and adoption. The airline is also prioritizing the acquisition of newer, more fuel-efficient aircraft to lower its environmental footprint.

The availability and cost of Sustainable Aviation Fuel (SAF) are paramount environmental considerations for Cathay Pacific. The airline is committed to boosting SAF adoption and fostering the growth of its supply chain across Asia, viewing it as the most impactful strategy for long-term emissions reduction.

Cathay Pacific aims to increase its SAF usage significantly, targeting 10% of its total fuel consumption by 2030. This ambitious goal is supported by investments and partnerships aimed at scaling SAF production, particularly in the Asian market where supply remains a key challenge.

Cathay Pacific is actively pursuing waste reduction, targeting a 30% decrease in cabin waste and a 50% cut in single-use plastics by 2025. This aligns with broader circular economy principles, influencing everything from product sourcing to end-of-life management.

The airline is integrating circular economy concepts into its operations, focusing on durable product design and enhancing recycling infrastructure at key airports like Hong Kong International Airport. This strategic shift aims to minimize environmental impact and promote resource efficiency.

Noise Pollution and Local Environmental Impact

Cathay Pacific's operations, like all airlines, contribute to noise pollution in areas surrounding airports, a key environmental concern for residents. The company is actively working to reduce this impact. For instance, by the end of 2023, Cathay Pacific had introduced 12 new aircraft, with a focus on newer, quieter models as part of its fleet renewal program. This initiative aims to lessen the local environmental footprint associated with its flights.

Efforts to mitigate noise include optimizing flight paths and implementing quieter operational procedures. Cathay Pacific has invested in modernizing its fleet, with a significant portion now comprising fuel-efficient and quieter aircraft types, such as the Airbus A350 and Boeing 777X, which are designed to meet stricter noise regulations. These advancements are crucial for improving the quality of life for communities near their operational hubs.

Key initiatives and their impact include:

- Fleet Modernization: Introduction of newer aircraft models designed for reduced noise emissions. By early 2024, over 60% of Cathay Pacific's long-haul fleet consisted of A350 aircraft, known for their quieter operation.

- Operational Improvements: Implementing optimized flight procedures and continuous descent approaches to minimize noise during landing and takeoff phases.

- Community Engagement: Working with airport authorities and local communities to address noise concerns and share data on noise reduction efforts.

Biodiversity and Ecosystem Protection

While Cathay Pacific's direct operations don't always immediately appear linked to biodiversity, the airline's broader environmental footprint, particularly carbon emissions, can indirectly impact ecosystems. For instance, the aviation sector's contribution to climate change exacerbates issues like coral bleaching and habitat loss, which are critical for biodiversity.

Cathay Pacific's commitment to sustainability, including its fleet modernization and investment in Sustainable Aviation Fuels (SAFs), plays a role in mitigating these indirect effects. By reducing its overall environmental impact, the airline contributes to a healthier planet, which in turn supports biodiversity and ecosystem protection.

As of early 2025, Cathay Pacific continues to invest in SAF, aiming for 10% of its total fuel consumption to be SAF by 2030. This aligns with global efforts to decarbonize aviation, indirectly benefiting environmental conservation.

- Fleet Modernization: Cathay Pacific operates a young fleet, with aircraft like the Airbus A350 and Boeing 777-9 (expected to join in 2025) offering significant fuel efficiency improvements over older models, reducing overall emissions.

- Sustainable Aviation Fuel (SAF): The airline is actively increasing its use of SAF, a key strategy for reducing aviation's carbon intensity and its indirect impact on climate-sensitive ecosystems.

- Operational Efficiencies: Implementing optimized flight paths and ground operations further reduces fuel burn, contributing to a lower environmental impact.

Cathay Pacific is actively addressing climate change, targeting net-zero carbon emissions by 2050 and a 12% reduction in carbon intensity by 2030. This requires significant investment in Sustainable Aviation Fuel (SAF), with a goal of SAF comprising 10% of its total fuel consumption by 2030.

The airline is also focusing on waste reduction, aiming to cut cabin waste by 30% and single-use plastics by 50% by 2025, integrating circular economy principles into its operations.

Noise pollution reduction is another key environmental factor, addressed through fleet modernization, with over 60% of its long-haul fleet being A350 aircraft by early 2024, known for quieter operations.

The airline's efforts to reduce its carbon footprint indirectly support biodiversity by mitigating climate change impacts on ecosystems.

| Environmental Goal | Target Year | Current Status/Progress |

| Net-zero Carbon Emissions | 2050 | Ongoing initiatives |

| Carbon Intensity Reduction | 2030 | Target: 12% |

| Sustainable Aviation Fuel (SAF) Usage | 2030 | Target: 10% of total fuel |

| Cabin Waste Reduction | 2025 | Target: 30% |

| Single-Use Plastics Reduction | 2025 | Target: 50% |

PESTLE Analysis Data Sources

Our Cathay Pacific PESTLE analysis is meticulously constructed using a comprehensive blend of official airline industry reports, government aviation regulations, and economic indicators from reputable international organizations. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental forces shaping the airline's operating landscape.