Cathay Pacific Airways Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Pacific Airways Bundle

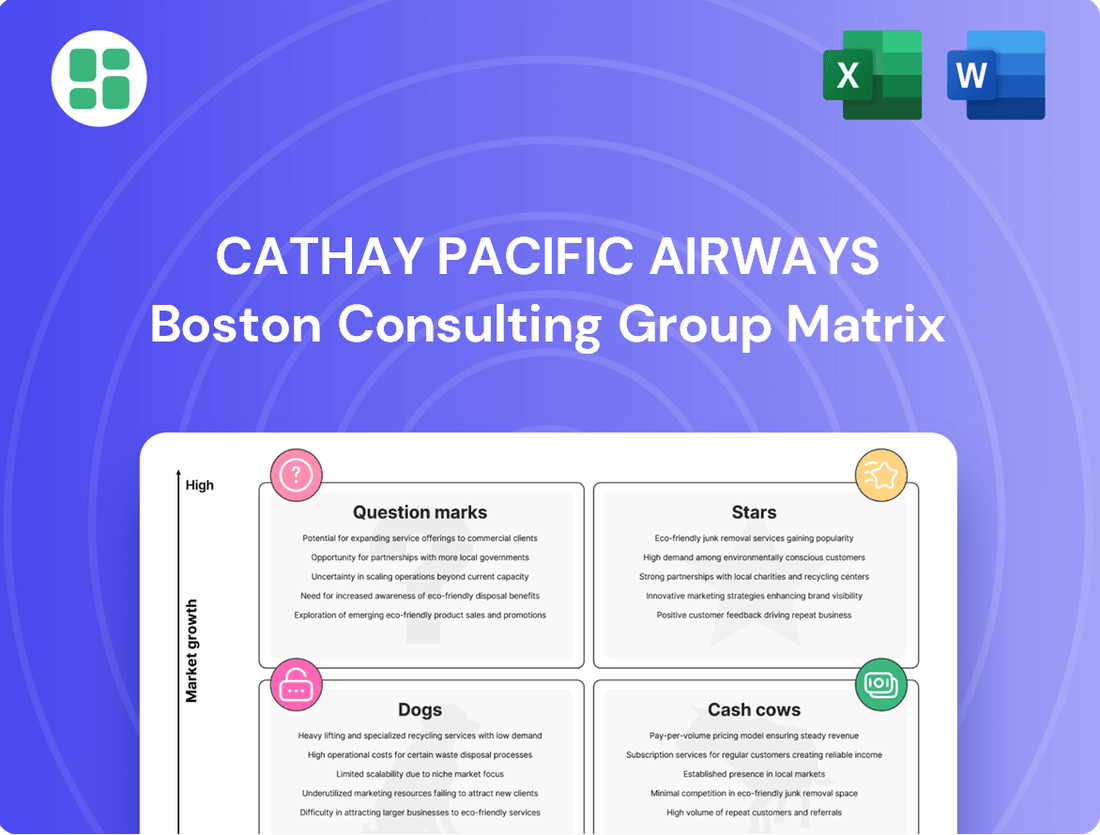

Curious about Cathay Pacific Airways' strategic positioning? Our BCG Matrix analysis offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, revealing critical insights into their product portfolio. Understand which segments are driving growth and which require careful management.

Don't miss out on the full strategic picture! Purchase the complete Cathay Pacific Airways BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing their airline services and investments.

Stars

Cathay Pacific's premium cabins are performing exceptionally well, fueled by a resurgence in business travel and major events hosted in Hong Kong. This segment is a star performer, boasting a strong market share within the premium travel niche, signifying substantial growth and investment opportunities.

The airline experienced a significant surge in premium cabin passengers in October 2024, marking the highest figure since the pandemic's onset. This recovery underscores Cathay Pacific's leadership in the high-yield premium segment.

Cathay Pacific is aggressively rebuilding its long-haul passenger network, aiming to restore 100% of its pre-pandemic flight capacity by the first quarter of 2025. This expansion is supported by year-on-year passenger growth, indicating a strong recovery in international travel demand.

Routes connecting to North America and Europe are experiencing a notable uptick in frequencies and passenger numbers, fueled by demand from returning students and robust summer travel bookings. This segment is crucial for Cathay Pacific’s global presence.

The airline's strategic acquisition of new long-haul aircraft, such as the Boeing 777-9s slated for delivery starting in 2027, underscores its dedication to strengthening its position in these vital, high-demand markets.

Cathay Pacific is a frontrunner in Sustainable Aviation Fuel (SAF) adoption, actively cultivating a local SAF ecosystem and broadening its global utilization. This commitment positions SAF as a stars category, reflecting its significant growth potential and Cathay's leadership role.

The airline's SAF usage saw a remarkable 22-fold increase from 2022 to 2023, with ambitious goals set for 2025, underscoring its rapid expansion. This surge in SAF adoption not only addresses environmental imperatives but also grants Cathay a distinct competitive advantage in a dynamic and increasingly eco-conscious aviation landscape.

Digital Transformation in Engineering Operations

Cathay Pacific’s engineering division is undergoing a significant digital overhaul, integrating sophisticated software to streamline operations. This modernization drive is crucial for boosting productivity and fostering innovation, aiming to solidify Cathay Pacific’s standing as a frontrunner in digital aviation services.

The airline's commitment to real-time, data-driven maintenance signifies a strategic focus on an area poised for substantial growth in operational efficiency and competitive edge. This investment is expected to yield tangible benefits in how the airline manages its fleet maintenance.

- Digital Transformation Investment: Cathay Pacific is investing heavily in digital tools for its engineering operations.

- Efficiency Gains: The goal is to improve coordination and productivity within the engineering department.

- Data-Driven Maintenance: Real-time data analytics are being implemented for predictive maintenance, enhancing fleet reliability.

- Industry Leadership: This initiative positions Cathay Pacific to lead in digital innovation within the aviation engineering sector.

Expansion into New Passenger Destinations

Cathay Pacific is aggressively expanding its global network, with a goal to surpass 100 passenger destinations by mid-2025. This includes the addition of new routes such as Dallas and Urumqi, signaling a strong growth strategy. This expansion is designed to capture new passenger traffic and bolster its international footprint.

These new routes directly contribute to an increase in available seat kilometers (ASKs) and overall passenger volume. For instance, the introduction of new services often leads to a significant uplift in the airline's capacity. In 2024, Cathay Pacific added several new routes, contributing to its network growth.

- Network Expansion: Aiming for over 100 destinations by H1 2025.

- New Routes: Examples include Dallas and Urumqi.

- Strategic Goal: Capture new passenger flows and enhance global presence.

- Impact: Increased available seat kilometers and passenger volume.

Cathay Pacific's premium cabins are a clear star performer, driven by the strong rebound in business travel and key events in Hong Kong. The airline saw a significant increase in premium passengers in October 2024, reaching its highest point since the pandemic began. This segment represents a high-growth area with substantial investment potential.

The airline's aggressive rebuilding of its long-haul network, targeting 100% pre-pandemic capacity by Q1 2025, is another star. Routes to North America and Europe are seeing increased frequencies and passenger numbers, supported by strategic aircraft acquisitions like the Boeing 777-9s. This expansion is crucial for its global standing.

Cathay Pacific's leadership in Sustainable Aviation Fuel (SAF) adoption also positions it as a star. SAF usage surged dramatically, showing a 22-fold increase from 2022 to 2023, with ambitious targets for 2025. This commitment not only addresses environmental concerns but also offers a competitive edge in an eco-conscious market.

The engineering division's digital transformation, focusing on streamlined operations and data-driven maintenance, is a star initiative. This investment aims to boost productivity and fleet reliability, reinforcing Cathay Pacific's position as an innovator in aviation services.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Premium Cabins | High | High | Star |

| Long-Haul Network Expansion | High | High | Star |

| Sustainable Aviation Fuel (SAF) | High | High | Star |

| Digital Engineering Operations | High | High | Star |

What is included in the product

This BCG Matrix overview details Cathay Pacific's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A clear Cathay Pacific BCG Matrix overview quickly identifies underperforming routes and cash cows, easing the pain of resource allocation decisions.

Cash Cows

Cathay Cargo Operations is a prime example of a Cash Cow for Cathay Pacific Airways. In the second half of 2024, the cargo division saw impressive year-on-year growth in tonnage, bolstered significantly by the surging demand for e-commerce. This strong performance also translated into increased yields, highlighting the unit's profitability.

Leveraging its position in Hong Kong, a premier global air cargo hub, Cathay Cargo commands a substantial market share within a mature but reliably profitable sector. The consistent and substantial cash flow generated by these operations is crucial, providing vital financial support to other segments of Cathay Pacific's broader business activities.

Cathay Pacific's established regional passenger routes, like Hong Kong to Japan, China, and India, are clear Cash Cows. They command impressive market shares: 51% for Hong Kong-Japan, 49% for Hong Kong-China, and a dominant 84% for Hong Kong-India. These routes consistently bring in substantial revenue and passenger numbers, with high load factors indicating their maturity and reliable cash generation.

The Cathay Pacific brand is synonymous with premium travel, leveraging its status as Hong Kong's flagship carrier to maintain a strong market position. This premium perception translates into customer loyalty and a willingness to pay for the associated experience.

The Cathay loyalty program acts as a significant driver of recurring revenue and customer retention within a mature aviation market. In 2023, Cathay Pacific reported a net profit of HK$9.79 billion (approximately US$1.25 billion), a stark turnaround from previous losses, indicating the strength of its established customer base and brand appeal.

This combination of strong brand equity and a robust loyalty program creates a stable foundation for consistent cash flow generation and profitability. The airline's ability to attract and retain premium passengers, even in a competitive landscape, underscores its cash cow status.

Aircraft Catering and Ground-Handling Services

Cathay Pacific's catering, laundry, and ground-handling services are firmly positioned as Cash Cows within the BCG matrix. These ancillary businesses operate in a mature, stable market, benefiting from the airline's significant operational scale and consistent demand.

Their role is crucial, providing essential, high-utilization support to Cathay Pacific's core flight operations. This captive market, coupled with high operational efficiency, ensures a reliable and steady generation of cash flow for the group. For instance, in 2023, Cathay Pacific handled over 32 million passengers, directly translating into substantial demand for these support services.

- Mature Market Operations: These services cater to a well-established industry with predictable demand, driven by airline activity.

- High Utilization & Captive Market: Cathay Pacific's extensive flight network ensures high utilization rates for its catering, laundry, and ground-handling units, creating a built-in customer base.

- Steady Cash Flow Generation: The efficiency and consistent demand allow these businesses to generate stable profits, contributing significantly to the group's overall financial health.

Strategic Investments in Associates (e.g., Air China Cargo)

Cathay Pacific Airways maintains strategic equity interests in key associates, such as Air China Cargo, a prominent player in the Chinese Mainland's air cargo sector. This investment underscores Cathay Pacific's presence in a stable, mature market, leveraging its position for consistent returns.

In 2024, these strategic investments, including Air China Cargo, generated a substantial profit of HK$288 million. This contribution highlights the value of diversified income streams, providing a reliable return on investment for the group.

- Strategic Equity: Cathay Pacific holds significant stakes in associates like Air China Cargo.

- Market Position: Air China Cargo is a leading air cargo provider in the Chinese Mainland.

- Financial Contribution (2024): The investment yielded HK$288 million in profit.

- Market Dynamics: Operates within a stable, mature market, ensuring consistent returns.

Cathay Pacific's established regional passenger routes, like Hong Kong to Japan, China, and India, are clear Cash Cows. They command impressive market shares: 51% for Hong Kong-Japan, 49% for Hong Kong-China, and a dominant 84% for Hong Kong-India. These routes consistently bring in substantial revenue and passenger numbers, with high load factors indicating their maturity and reliable cash generation.

The Cathay Pacific brand is synonymous with premium travel, leveraging its status as Hong Kong's flagship carrier to maintain a strong market position. This premium perception translates into customer loyalty and a willingness to pay for the associated experience.

The Cathay loyalty program acts as a significant driver of recurring revenue and customer retention within a mature aviation market. In 2023, Cathay Pacific reported a net profit of HK$9.79 billion (approximately US$1.25 billion), a stark turnaround from previous losses, indicating the strength of its established customer base and brand appeal.

This combination of strong brand equity and a robust loyalty program creates a stable foundation for consistent cash flow generation and profitability. The airline's ability to attract and retain premium passengers, even in a competitive landscape, underscores its cash cow status.

What You’re Viewing Is Included

Cathay Pacific Airways BCG Matrix

The Cathay Pacific Airways BCG Matrix you are previewing is the identical, fully formatted report you will receive upon purchase, offering a comprehensive strategic overview without any watermarks or demo content.

What you see is the actual, analysis-ready Cathay Pacific Airways BCG Matrix document that will be instantly downloadable after your purchase, providing you with a professionally designed file for immediate business planning.

This preview accurately represents the final Cathay Pacific Airways BCG Matrix report you will acquire, ensuring you receive a market-backed analysis crafted for strategic clarity and professional application.

The Cathay Pacific Airways BCG Matrix presented here is the exact document you will possess after completing your purchase, ready for editing, printing, or direct presentation to stakeholders.

Dogs

Older fleet aircraft, such as certain Airbus A330-300s within Cathay Pacific's operations, are transitioning out as the airline modernizes its fleet. These aircraft are being systematically retired and replaced by newer, more fuel-efficient models, reflecting a strategic shift towards operational efficiency and sustainability.

The operational economics of these older A330-300s present challenges, often incurring higher maintenance expenses and demonstrating reduced fuel efficiency compared to their modern counterparts. This disparity in operating costs can lead to lower profitability margins for these specific assets in the current competitive landscape.

In the context of Cathay Pacific's fleet strategy, these older A330-300s are categorized as 'Dogs' in the BCG Matrix. Their declining relevance and the ongoing replacement process indicate a low market growth and a diminishing market share for these particular aircraft types within the airline's overall capacity.

Cathay Pacific's underperforming long-haul routes, like Hong Kong to Los Angeles and San Francisco, are currently classified as 'dogs' in its BCG Matrix. These routes have seen a decline in market share, even with overall passenger numbers increasing, indicating intense competition. For instance, in 2024, while the broader Asia-North America travel market experienced a rebound, these specific Cathay Pacific routes struggled to maintain their competitive edge against rivals offering more attractive pricing or service bundles.

The Hong Kong-Paris route also falls into this 'dog' category, facing similar challenges of diminishing market share. This suggests that these particular long-haul segments may not be contributing to profitability as effectively as other parts of Cathay Pacific's network. A strategic reassessment is crucial to determine if these routes can be revitalized or if resources should be reallocated to more promising markets within the airline's portfolio.

Cathay Pacific's ongoing digital transformation in engineering is commendable, but any lingering legacy, paper-based, or inefficient operational processes that haven't been modernized can be classified as 'dogs' within its operational framework. These processes, often characterized by manual workflows and outdated systems, can significantly hinder efficiency and increase costs. For instance, if a substantial portion of maintenance records or flight planning still relies on physical documents, it directly impacts turnaround times and increases the risk of errors.

These 'dog' processes consume valuable resources without generating commensurate returns in terms of speed, accuracy, or cost savings. Their low growth in operational efficiency and a weak competitive advantage in the digital age firmly place them in the 'dog' category. In 2023, airlines globally saw a renewed focus on operational efficiency, with companies investing heavily in digital solutions to streamline maintenance and ground operations. Cathay Pacific's success in this area hinges on identifying and migrating these legacy systems to modern, digitized platforms to avoid falling behind industry benchmarks.

Certain Less Popular Regional Routes

Certain less popular regional routes within Cathay Pacific's network can be classified as 'dogs' in the BCG Matrix. While Cathay Pacific generally holds a strong position in regional travel, specific routes may face challenges such as softer demand or heightened competition. This can result in reduced load factors or lower yields for those particular flight paths.

For example, if a specific route, like one to Japan from Hong Kong, experiences a sustained downturn in demand, as was observed in March 2025, and consistently shows a low market share coupled with minimal growth, it would fit the 'dog' category. These underperforming routes necessitate close observation and strategic review.

- Underperforming Routes: Specific regional routes with consistently low demand and high competition.

- Example Scenario: Softening demand on Japan routes from Hong Kong in March 2025, potentially indicating a 'dog' status for certain segments.

- Strategic Action: Routes categorized as 'dogs' require careful monitoring for potential optimization strategies or eventual divestment to reallocate resources effectively.

Grounding Issues for HK Express A320neo Fleet

HK Express, a subsidiary of Cathay Pacific Airways, faced significant operational hurdles in 2024. A notable portion of its Airbus A320neo fleet was grounded due to widespread engine issues affecting the aviation industry. This directly impacted the airline's performance, contributing to a reported loss for the year.

This grounding situation positions HK Express's affected A320neo capacity within the BCG Matrix as a 'dog'. The segment exhibits low operational efficiency and profitability, primarily driven by external, uncontrollable factors like engine supply chain problems. This translates to a low market share for the grounded aircraft and limited growth potential until these technical issues are resolved and the fleet can operate at full capacity.

- HK Express reported a loss in 2024.

- Grounding of A320neo aircraft due to engine issues impacted operations.

- This situation signifies low operational efficiency and profitability for the affected segment.

- The grounding results in low market share and limited growth potential for the grounded capacity.

Certain older Airbus A330-300 aircraft in Cathay Pacific's fleet are considered 'dogs' due to their declining operational efficiency and higher maintenance costs compared to newer models. These aircraft are being phased out as part of a fleet modernization strategy, reflecting a low market share and minimal growth prospects for these specific assets within the airline's evolving network.

Underperforming long-haul routes, such as Hong Kong to Los Angeles and San Francisco, also fall into the 'dog' category. Despite a broader market rebound in 2024, these routes struggled against competitors, indicating a diminishing market share and a need for strategic review to either revitalize or reallocate resources.

Legacy, paper-based operational processes within Cathay Pacific's engineering division, if not fully digitized, represent 'dogs.' These inefficient systems hinder turnaround times and increase costs, placing them in a low-growth, low-competitive advantage position in the current digital landscape.

HK Express, a Cathay Pacific subsidiary, experienced significant operational challenges in 2024, with a portion of its A320neo fleet grounded due to engine issues. This situation led to a reported loss for the year, classifying the affected capacity as a 'dog' due to low efficiency, profitability, and limited growth potential until the technical problems are resolved.

Question Marks

Cathay Pacific is actively expanding its global reach by introducing new routes to emerging destinations. For instance, in 2024, the airline launched services to Hyderabad, Dallas, Urumqi, Rome, and Munich, tapping into markets identified for their growth potential.

These newly established routes represent Cathay Pacific's 'Question Marks' in the BCG matrix. While these destinations hold significant promise for future passenger traffic and revenue, the airline currently possesses a low market share in these regions. This is a natural consequence of their recent introduction, as they are still building brand awareness and passenger loyalty.

Significant investment is therefore crucial for these 'Question Mark' routes. Cathay Pacific will need to allocate substantial resources towards marketing campaigns and operational infrastructure to effectively cultivate demand, increase passenger adoption, and ultimately grow market share in these promising, yet nascent, markets.

Cathay Pacific's commitment to developing a Sustainable Aviation Fuel (SAF) ecosystem in Hong Kong positions this venture as a Star in the BCG matrix. The airline is a co-founder of the Hong Kong Sustainable Aviation Fuel Coalition (HKSAFC), actively working to facilitate SAF use at Hong Kong International Airport (HKIA).

This strategic move targets a high-growth future market for aviation, yet currently experiences low adoption and supply. Significant investment is required to build this crucial infrastructure, but the potential for substantial returns as SAF becomes mainstream is considerable.

The integration of new digital customer experience platforms at Cathay Pacific, such as AI-powered chatbots for customer service and advanced personalized travel apps, would likely be categorized as Question Marks in the BCG Matrix. These initiatives are designed for significant future growth in customer engagement and operational efficiency, reflecting a high potential market.

However, their current market penetration is low, indicating they are still in the early stages of adoption. Cathay Pacific's investment in these nascent technologies, aiming to capture a future share of the digital travel market, requires substantial capital for development, testing, and widespread market rollout. For instance, in 2024, airlines globally are investing heavily in AI and personalization, with a significant portion of IT budgets allocated to customer-facing digital solutions, underscoring the high cost and uncertain payoff of these ventures.

Expansion of HK Express Network to New Asian Destinations

HK Express, Cathay Pacific's low-cost carrier, is actively pursuing network expansion, adding new routes to destinations such as Cheongju, Daegu, Miyako (Shimojishima), Guiyang, Kuala Lumpur (Subang), and Kota Kinabalu. These strategic additions target high-growth regional markets, aiming to establish a stronger foothold for the airline.

While HK Express is experiencing rapid overall growth, these specific new routes are considered 'Question Marks' within the BCG matrix framework. This classification stems from their presence in promising, high-growth markets where HK Express currently holds a relatively low market share. Significant investment will be necessary to cultivate demand and build a substantial market presence on these new services.

- Network Expansion: HK Express has launched new routes to Cheongju, Daegu, Miyako (Shimojishima), Guiyang, Kuala Lumpur (Subang), and Kota Kinabalu.

- Market Position: These routes are in high-growth Asian markets but represent low current market share for HK Express.

- Strategic Investment: The airline will need to invest heavily to build brand awareness and passenger demand in these nascent markets.

- BCG Classification: These new routes are categorized as 'Question Marks' due to their high growth potential coupled with low current market share.

Investment in Next-Generation Widebody Aircraft (Boeing 777-9, A350 Freighter)

Cathay Pacific’s substantial orders for next-generation widebody aircraft, including the Boeing 777-9 and Airbus A350 Freighter, position these as potential future Stars or Cash Cows within its BCG Matrix. These aircraft, with deliveries slated from 2027, represent significant capital expenditures aimed at capturing high-growth capacity in the coming years. Currently, their market share is effectively zero as they are not yet operational.

- Strategic Investment: The acquisition of Boeing 777-9s and A350 Freighters signifies Cathay Pacific's commitment to modernizing its fleet and securing future market leadership.

- High Capital Outlay: These orders involve substantial upfront capital, reflecting the long-term nature of aircraft investments and their impact on the company's financial resources.

- Future Growth Potential: Upon entering service, these aircraft are expected to drive capacity expansion and revenue growth, aligning with Cathay Pacific's long-term strategic objectives.

- Zero Current Market Share: As these aircraft are not yet operational, their current contribution to Cathay Pacific's market share is nil, characteristic of a nascent or question mark category before market entry.

Cathay Pacific's new routes, like those launched in 2024 to Hyderabad and Dallas, are classified as Question Marks. These represent high-growth markets where the airline is still establishing its presence and market share. Significant investment in marketing and operations is needed to nurture these routes into Stars.

Similarly, HK Express's recent route additions to cities like Cheongju and Guiyang are also Question Marks. Despite operating in high-growth regions, HK Express holds a low market share on these specific routes, necessitating substantial investment to build demand and competitive advantage.

The airline's investment in digital customer experience platforms, such as AI chatbots, also falls into the Question Mark category. These are future-oriented initiatives with high growth potential but currently low adoption, requiring significant capital for development and rollout.

Cathay Pacific's ambitious fleet modernization, including orders for Boeing 777-9s and A350 Freighters, also starts as a Question Mark before operational entry. These large capital expenditures aim to capture future market growth, but their current market share is zero.

| Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| New Routes (e.g., Hyderabad, Dallas) | Question Mark | High | Low | High |

| HK Express New Routes (e.g., Cheongju, Guiyang) | Question Mark | High | Low | High |

| Digital Customer Experience Platforms (AI Chatbots) | Question Mark | High | Low | High |

| Next-Gen Aircraft Orders (777-9, A350 Freighter) | Question Mark (Pre-Operational) | High (Projected) | Zero (Pre-Operational) | Very High |

BCG Matrix Data Sources

Our Cathay Pacific Airways BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.