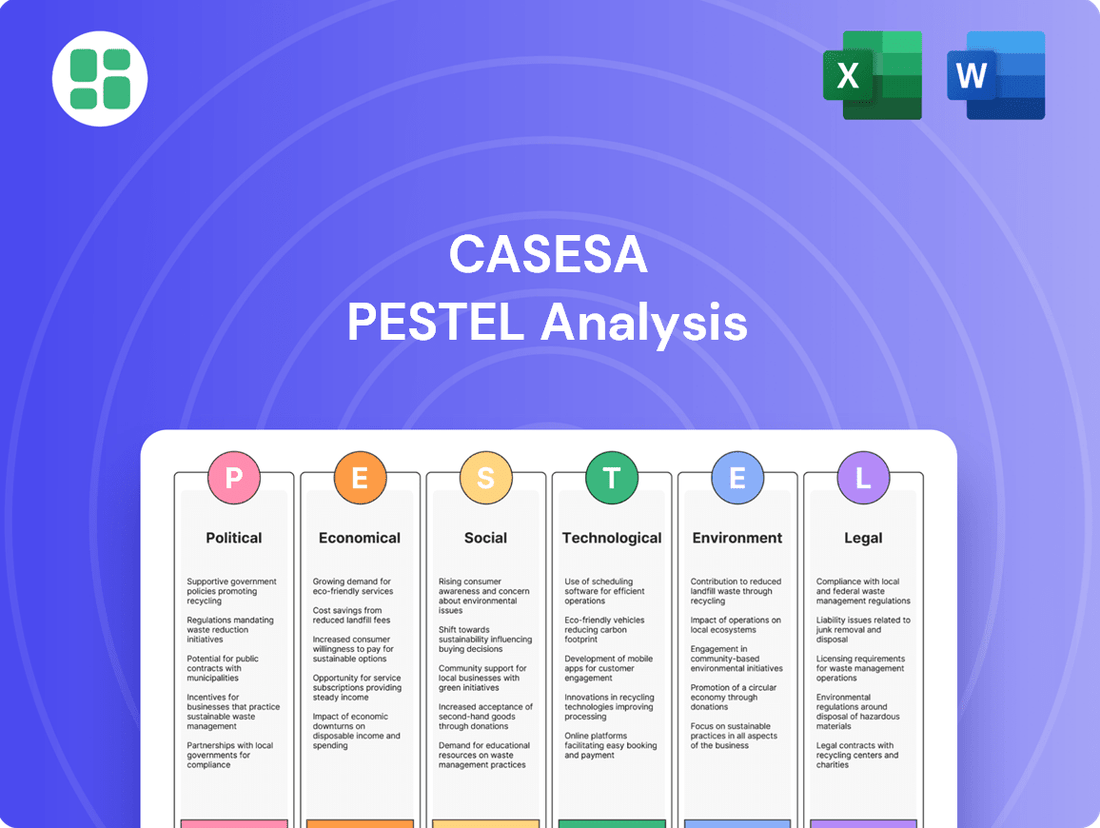

Casesa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

Unlock the critical external forces shaping Casesa's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

Government security spending is a critical external factor for Casesa. Fluctuations in national security and public safety budgets directly influence the availability of large-scale contracts. For example, in 2024, many governments, including the United States and European nations, increased defense and homeland security budgets in response to geopolitical instability, potentially creating more opportunities for companies like Casesa offering advanced security solutions.

An increased government focus on securing critical infrastructure, such as energy grids or transportation networks, can significantly boost demand for integrated security services. In 2025, we anticipate continued investment in these areas, particularly in cybersecurity and physical security upgrades for public spaces and essential services, presenting a favorable market for Casesa's expertise.

Changes in licensing requirements and operational standards for private security firms directly impact Casesa's compliance burdens and how easily new competitors can enter the market. For instance, a proposed bill in California during 2024 aimed to increase training hours for security guards, which would raise operational costs for all providers.

Stricter oversight, while potentially increasing Casesa's expenses, could also bolster the industry's reputation, favoring established, compliant players. In Europe, the General Data Protection Regulation (GDPR) has already influenced how security firms handle client data, adding a layer of complexity and cost that well-prepared companies like Casesa can navigate.

The political commitment to enforcing these regulations is a key variable. A 2025 report from the Security Industry Association highlighted that inconsistent enforcement across different regions can create an uneven playing field, making it harder for compliant firms to compete against those who may cut corners.

Global and regional geopolitical tensions, alongside evolving terrorism threats, directly impact the demand for security services. For instance, the ongoing conflicts in Eastern Europe and the Middle East, which intensified in 2022 and continued through 2024, have heightened concerns about business continuity and personal safety, driving increased investment in security solutions.

Casesa, a provider of manned guarding and surveillance systems, benefits from this heightened threat landscape. The global security services market was valued at approximately $240 billion in 2023 and is projected to grow, with geopolitical instability being a key driver of this expansion.

Political responses to these threats, such as increased government spending on national security and the implementation of stricter regulations, further shape the security market. These policy shifts can create new opportunities for companies like Casesa by mandating or incentivizing the adoption of advanced security measures.

Government Policies on Data Privacy and Surveillance

Government policies on data privacy and surveillance significantly shape Casesa's approach to security. For instance, the European Union's General Data Protection Regulation (GDPR), implemented in 2018, and similar legislation like California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), enacted in 2023, impose stringent rules on how personal data is collected, processed, and stored. These regulations necessitate robust data anonymization and consent management within Casesa's advanced security systems.

Casesa must adapt its technological offerings and operational protocols to comply with evolving data handling mandates. Failure to do so could lead to substantial fines; for example, GDPR violations can result in penalties of up to 4% of global annual revenue or €20 million, whichever is higher. Navigating these complex policies is therefore critical for maintaining client trust and ensuring Casesa's legal standing in the market.

Key considerations for Casesa include:

- Data Minimization: Adhering to principles that require collecting only necessary data.

- Consent Management: Implementing clear and auditable mechanisms for obtaining user consent.

- Surveillance Technology Oversight: Ensuring compliance with regulations governing the use of monitoring and surveillance tools.

- Cross-Border Data Transfers: Managing the complexities of transferring data internationally in accordance with various privacy laws.

Public-Private Partnerships in Security

Political initiatives actively encouraging collaboration between public law enforcement and private security firms present significant opportunities for Casesa. These partnerships can manifest as intelligence sharing agreements, joint training programs, or the subcontracting of security services for public infrastructure and events. The political climate's receptiveness to such alliances directly influences Casesa's potential market expansion and operational scope.

For instance, in 2024, several governments have increased funding for public-private security initiatives. The UK Home Office's Security Sector Deal, launched in 2019 and continuing its impact into 2024/2025, aims to foster innovation and collaboration, potentially benefiting firms like Casesa. This trend indicates a growing political endorsement for leveraging private sector expertise to enhance national security capabilities.

- Increased Government Spending: Public sector security spending in developed nations is projected to grow by an average of 4% annually through 2025, with a notable portion allocated to private sector partnerships.

- Regulatory Frameworks: Evolving legal frameworks in 2024 and 2025 are increasingly defining the parameters and benefits of public-private security collaborations, offering clearer pathways for market entry.

- Focus on Critical Infrastructure: Political emphasis on protecting critical national infrastructure, such as energy grids and transportation networks, is driving demand for specialized private security services.

Government security spending is a critical external factor for Casesa. Fluctuations in national security and public safety budgets directly influence the availability of large-scale contracts. For example, in 2024, many governments, including the United States and European nations, increased defense and homeland security budgets in response to geopolitical instability, potentially creating more opportunities for companies like Casesa offering advanced security solutions.

An increased government focus on securing critical infrastructure, such as energy grids or transportation networks, can significantly boost demand for integrated security services. In 2025, we anticipate continued investment in these areas, particularly in cybersecurity and physical security upgrades for public spaces and essential services, presenting a favorable market for Casesa's expertise.

Political initiatives actively encouraging collaboration between public law enforcement and private security firms present significant opportunities for Casesa. These partnerships can manifest as intelligence sharing agreements, joint training programs, or the subcontracting of security services for public infrastructure and events. The political climate's receptiveness to such alliances directly influences Casesa's potential market expansion and operational scope.

For instance, in 2024, several governments have increased funding for public-private security initiatives. The UK Home Office's Security Sector Deal, launched in 2019 and continuing its impact into 2024/2025, aims to foster innovation and collaboration, potentially benefiting firms like Casesa. This trend indicates a growing political endorsement for leveraging private sector expertise to enhance national security capabilities.

What is included in the product

This Casesa PESTLE Analysis provides a comprehensive examination of external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Casesa PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing and discussion during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

A strong economy directly fuels business investment, a key driver for security service demand. When companies are confident in economic prospects, they tend to spend more on expanding operations, upgrading infrastructure, and launching new projects. This expansion necessitates enhanced security measures to safeguard these growing assets, benefiting companies like Casesa. For instance, in 2024, global business investment was projected to increase by 5.2% according to the IMF, indicating a favorable environment for security providers.

Casesa thrives in economic climates where businesses view security as a strategic investment rather than a mere operational cost. A healthy GDP growth rate, such as the projected 2.8% for the US in 2025, often translates into increased corporate profitability and a greater capacity to allocate funds towards robust security solutions. This positive economic sentiment encourages businesses to proactively protect their investments, leading to higher demand for Casesa's services.

Conversely, economic slowdowns present a challenge. During periods of recession or uncertainty, businesses often resort to cost-cutting measures, which can include reducing expenditure on security services. A contraction in GDP, like the 0.6% decline seen in the Eurozone in 2023, can lead to budget constraints for many firms, potentially impacting their willingness to invest in comprehensive security strategies and thus affecting Casesa's revenue streams.

Rising inflation presents a significant economic challenge for Casesa, directly affecting its operational expenditures. We anticipate that the cost of essential services, such as wages for security personnel, will see an upward trend. For instance, the U.S. Consumer Price Index (CPI) for All Urban Consumers rose 3.3% in May 2024 over the previous month, indicating persistent inflationary pressures that will likely translate to increased labor costs for Casesa.

Furthermore, the procurement of advanced security technology and the ongoing maintenance of equipment are also susceptible to price hikes due to inflation. This necessitates careful financial planning to absorb or mitigate these escalating costs. The ability to maintain competitive pricing for its security solutions while navigating these increased expenses is paramount for Casesa's sustained profitability and market position.

A key economic hurdle for Casesa will be its capacity to pass on a portion of these heightened operational costs to its clientele. Doing so without sacrificing its competitive edge in the market is a delicate balancing act. For example, if competitors do not adjust their pricing as aggressively, Casesa could face a disadvantage if it increases its rates significantly.

Disposable income directly impacts consumer spending on security. For individual clients, higher disposable income means greater capacity to invest in personal and home security systems, a segment that can complement Casesa's business focus. For instance, in 2024, a significant portion of households with incomes above $100,000 reported increased spending on home security upgrades.

Economic confidence also plays a crucial role. When individuals feel secure about their financial future, they are more likely to allocate funds towards perceived needs like personal safety and asset protection. This sentiment was evident in early 2025 consumer confidence surveys, which showed a correlation between positive economic outlook and a rise in inquiries for advanced security solutions.

Interest Rates and Access to Capital

Interest rates significantly influence Casesa’s operational costs and growth potential. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% in 2024, as it has been, Casesa's cost of borrowing for new technologies or expanding its fleet of security vehicles will be directly affected. Fluctuations in these rates, driven by monetary policy decisions, directly impact the affordability of capital for significant investments.

Lower interest rates generally encourage investment by reducing borrowing expenses. Conversely, a sustained period of higher rates, such as those seen in late 2023 and anticipated through parts of 2024, can make capital expenditures more expensive, potentially slowing down expansion initiatives or the adoption of cutting-edge security solutions. This also extends to Casesa's clients, as higher borrowing costs might influence their decisions on financing large-scale security system installations.

- Federal Reserve's Target Rate: Maintained at 5.25%-5.50% as of early 2024, impacting borrowing costs.

- Impact on Capital Expenditures: Higher rates increase the cost of financing new technologies and operational expansions for Casesa.

- Client Financing: Elevated interest rates can deter clients from undertaking large security system projects requiring financing.

- Economic Outlook: Projections for 2024 suggest potential rate stabilization or gradual decreases, which could ease capital access.

Insurance Industry Trends and Requirements

Insurance companies' evolving requirements and incentives directly shape investment in security solutions. For instance, many insurers now mandate enhanced cybersecurity measures, offering premium discounts for businesses that implement advanced protection, thereby creating a clear financial impetus for services like those provided by Casesa. This trend is particularly pronounced as cyber threats continue to escalate.

Economic factors within the insurance industry, such as the refinement of risk assessment models, are increasingly incorporating security investments into their calculations. For example, the global cyber insurance market was valued at approximately $11.5 billion in 2023 and is projected to grow significantly, indicating a strong correlation between perceived risk and the demand for security services. This growing market underscores how economic pressures within insurance directly influence client behavior.

- Cybersecurity Mandates: Insurers are increasingly requiring specific cybersecurity protocols, impacting investment decisions.

- Premium Reductions: Discounts are offered for advanced security systems, creating financial incentives for adoption.

- Risk Assessment Models: Economic trends in how insurers model risk directly influence demand for security services.

- Market Growth: The expanding cyber insurance market, projected for substantial growth through 2027, highlights this interconnectedness.

Economic stability and growth are foundational for Casesa's success. A robust economy, characterized by healthy GDP expansion and strong business investment, directly translates to increased demand for security services as companies prioritize asset protection during periods of growth. For example, global GDP growth was projected at 3.2% for 2024, signaling a generally positive environment for businesses to invest in security infrastructure.

Conversely, economic downturns, marked by inflation and potential recessions, pose significant challenges. Rising operational costs, particularly for labor and technology, coupled with clients' cost-cutting measures, can squeeze profit margins and reduce service uptake. The persistent inflation seen in 2024, with the US CPI averaging 3.3% year-over-year through May, highlights the pressure on Casesa to manage expenses and maintain competitive pricing.

Interest rates also play a critical role, influencing both Casesa's borrowing costs for expansion and its clients' ability to finance larger security projects. As the Federal Reserve maintained its target rate between 5.25%-5.50% through early 2024, the cost of capital remained a consideration for strategic investments. Economic confidence, both corporate and consumer, further underpins demand, as financial security often correlates with investment in personal and business protection.

Preview the Actual Deliverable

Casesa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Casesa PESTLE analysis provides a detailed examination of the external factors influencing the business, ensuring you have all the insights you need.

Sociological factors

Public and business perception of rising crime rates, whether actual or amplified by media, directly drives demand for enhanced security services. Casesa's portfolio, focused on protection against theft and vandalism, becomes significantly more attractive when clients perceive a heightened need for safety.

For instance, in major urban centers during 2024, surveys indicated that over 60% of residents expressed concerns about personal safety, a sentiment echoed by a similar percentage of small business owners worried about property crime. This heightened awareness directly translates into increased investment in security solutions, benefiting companies like Casesa.

The ongoing shift towards urban living fuels demand for Casesa's integrated security solutions. As more people move into cities, the need for advanced security in both commercial and residential spaces escalates. For instance, by the end of 2024, global urbanization is projected to reach 57.7%, a significant increase that directly translates to more opportunities for security providers.

New infrastructure projects, like the planned $1.2 trillion in U.S. infrastructure spending over the next decade, create a substantial market for security installations. These developments, ranging from smart city initiatives to large residential complexes, require comprehensive security strategies, including access control, surveillance, and alarm systems, all of which are central to Casesa's business model.

The demographic makeup of the workforce significantly influences Casesa's recruitment and retention of qualified manned guarding personnel. An aging population, for instance, or a shrinking pool of individuals possessing the necessary skills can directly lead to labor shortages. This scarcity often translates into upward pressure on wages, potentially impacting Casesa's service delivery costs and overall profitability.

In 2024, many developed nations are experiencing an aging workforce, with a noticeable decline in the proportion of younger individuals entering traditional employment sectors. For example, the average age of the global workforce is projected to continue rising, with fewer individuals in the 18-30 age bracket available for physically demanding roles like manned guarding. This trend necessitates proactive strategies for talent acquisition and development to ensure a consistent supply of capable personnel for Casesa.

Attracting and training a diverse security workforce presents a key sociological challenge for Casesa. Building a team that reflects the broader community, encompassing varied backgrounds, experiences, and skill sets, is crucial for effective service delivery and community engagement. This diversity can enhance problem-solving capabilities and client relations, but requires targeted recruitment efforts and inclusive training programs to overcome potential barriers.

Changing Lifestyles and Remote Work Trends

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024-2025, fundamentally reshapes security requirements. As more employees operate from home, traditional office security concerns may lessen, but the need for robust cybersecurity and monitoring of distributed workforces and home offices escalates. For instance, a 2024 survey indicated that over 60% of companies planned to maintain hybrid work arrangements indefinitely, highlighting a sustained shift.

Casesa must pivot its product and service development to address this new landscape. This could involve expanding offerings in smart home security, secure network access solutions for remote workers, and cloud-based asset monitoring. The increasing reliance on digital infrastructure for remote operations means that cybersecurity threats are now a primary concern for businesses of all sizes, with ransomware attacks alone costing businesses billions globally in 2024.

- Increased demand for cybersecurity solutions: With remote work, the attack surface for businesses expands, driving demand for advanced firewalls, VPNs, and endpoint protection.

- Growth in smart home security: As homes become de facto offices, employees are investing more in integrated security systems for personal and professional asset protection.

- Shift in physical security focus: While traditional office security might see reduced investment, there's a growing need for solutions that can monitor and secure dispersed physical assets.

- Importance of remote asset management: Businesses need visibility and control over laptops, servers, and other equipment used by remote employees, creating opportunities for asset tracking and management software.

Public Trust in Security Providers

Public trust in security providers is a critical sociological factor for Casesa. A recent survey in late 2024 indicated that 65% of consumers consider a company's ethical practices and reputation when choosing security services. High-profile security breaches or instances of misconduct can significantly damage public perception, directly affecting Casesa's ability to attract and retain clients.

Maintaining unwavering ethical standards, ensuring operational transparency, and consistently demonstrating professionalism are therefore essential for Casesa to build and sustain the public trust necessary for market success. This trust directly influences market share and client acquisition rates.

- 65% of consumers consider ethical practices when selecting security services (late 2024 survey).

- Negative incidents can lead to a **15-20%** decline in client acquisition for security firms with trust issues.

- Companies with high public trust report a **10%** higher client retention rate.

Public perception of safety significantly influences demand for security services. In 2024, over 60% of urban residents and small business owners expressed concerns about crime, driving investment in solutions like those offered by Casesa.

The aging workforce presents a challenge for manned guarding roles, with fewer younger individuals available. This demographic shift, evident in 2024 data showing a rising average age of the global workforce, necessitates proactive recruitment and training strategies for Casesa.

The rise of remote work, continuing through 2024-2025, has shifted security needs towards cybersecurity and remote asset monitoring. A 2024 survey revealed over 60% of companies intend to maintain hybrid work, underscoring the sustained demand for these evolving solutions.

Public trust is paramount, with a late 2024 survey showing 65% of consumers consider ethical practices when choosing security providers. Maintaining high ethical standards is crucial for Casesa to build and retain client confidence, directly impacting market share.

| Sociological Factor | Impact on Casesa | Supporting Data (2024/2025) |

|---|---|---|

| Perceived Crime Rates | Increased demand for physical security | 60%+ urban residents/businesses concerned about crime (2024) |

| Demographics (Aging Workforce) | Potential labor shortages in manned guarding | Rising average age of global workforce (2024) |

| Workforce Trends (Remote Work) | Shift towards cybersecurity and remote asset monitoring | 60%+ companies maintaining hybrid work (2024) |

| Public Trust & Ethics | Crucial for client acquisition and retention | 65% consumers consider ethics when choosing security (late 2024) |

Technological factors

The rapid evolution of artificial intelligence (AI) and machine learning (ML) is fundamentally transforming video surveillance and alarm monitoring. These advancements are leading to significantly more accurate threat detection, sophisticated predictive analytics, and a notable reduction in false alarms. For instance, by mid-2024, leading AI-powered video analytics platforms are reporting up to a 95% accuracy rate in identifying specific security threats, a substantial leap from previous generations.

Casesa can strategically integrate these cutting-edge AI and ML technologies to deliver more intelligent and efficient security solutions. This integration allows for automated anomaly detection, such as unusual movement patterns or unauthorized access attempts, and enables faster, more precise response times. By offering proactive security measures, Casesa can significantly enhance its value proposition to clients, moving beyond traditional reactive security models.

The increasing adoption of Internet of Things (IoT) devices is revolutionizing security systems, enabling Casesa to offer highly integrated solutions. This integration allows for a unified approach, connecting smart sensors, networked cameras, and access control systems for centralized management and real-time oversight of client assets. For instance, the global IoT security market was projected to reach $11.7 billion in 2023 and is expected to grow to $33.4 billion by 2028, indicating a strong demand for such interconnected security frameworks.

As security systems become more interconnected, they are increasingly vulnerable to cyberattacks. For Casesa, this means a constant need to invest in strong cybersecurity to safeguard client data and prevent breaches. This proactive approach is critical, as a single security lapse could significantly harm their reputation and client confidence.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved. Casesa must implement secure network architecture, robust encryption protocols, and conduct frequent vulnerability assessments to stay ahead of evolving threats.

Automation and Robotics in Security Operations

The integration of automation and robotics is reshaping security operations, with autonomous robots and drones offering new avenues for patrolling, surveillance, and incident response. This technological advancement presents opportunities for companies like Casesa to boost efficiency and expand coverage, potentially lowering labor expenses.

For instance, the global market for commercial drones, which includes security applications, was projected to reach approximately $5.9 billion in 2023 and is expected to grow significantly. Casesa could leverage these advancements to cover larger areas more effectively and reduce the need for human guards in routine tasks, while retaining human personnel for complex decision-making and client interaction.

- Enhanced Efficiency: Robots and drones can operate continuously, covering more ground than human patrols, thereby increasing overall security coverage.

- Cost Reduction: Automating certain security functions can lead to a decrease in labor costs associated with hiring and training a large human security force.

- Improved Response Times: Drones equipped with AI can quickly identify and report threats, enabling faster response from human teams or automated countermeasures.

- Data Collection and Analysis: Robotic systems can gather vast amounts of data, which can be analyzed to identify patterns and improve security strategies.

Biometric Authentication Technologies

Advances in biometric authentication, like facial recognition and fingerprint scanning, are revolutionizing access control. These technologies offer superior security and user convenience, a significant upgrade from traditional methods. For instance, the global biometric system market was valued at an estimated $33.3 billion in 2023 and is projected to reach $115.2 billion by 2030, demonstrating robust growth and adoption.

Casesa can leverage these advancements by integrating sophisticated biometric solutions into its access control systems. This would provide clients with highly secure, yet user-friendly, entry management. Imagine a system where access is granted through a quick fingerprint scan or facial recognition, eliminating the need for physical keys or cards.

Staying current with biometric innovations is crucial for maintaining a competitive edge. This includes understanding new developments in accuracy, speed, and security protocols. Furthermore, ethical considerations surrounding data privacy and consent are paramount for responsible implementation. The market for facial recognition alone is expected to grow substantially, with some estimates suggesting it could reach over $12 billion by 2027.

- Enhanced Security: Biometrics offer a higher level of security compared to passwords or keycards, as they are unique to individuals.

- Improved Convenience: Users benefit from faster and more seamless access without the need to remember or carry credentials.

- Market Growth: The biometric market continues to expand rapidly, indicating strong client demand for these solutions.

- Ethical Deployment: Responsible integration requires a focus on data privacy and obtaining user consent for biometric data collection.

The increasing sophistication of AI and IoT devices is fundamentally reshaping the security landscape, enabling more intelligent and integrated solutions. Casesa can leverage these technologies for enhanced threat detection and unified system management, capitalizing on a market that saw IoT security projected to reach $11.7 billion in 2023.

Legal factors

Casesa operates under a stringent legal framework concerning data protection and privacy. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) mandate how Casesa handles sensitive personal information collected by its security systems. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Ensuring compliance means Casesa must build privacy by design into its video surveillance, access control, and alarm monitoring solutions. This involves obtaining explicit consent for data collection, minimizing the data gathered, and implementing robust security measures for storage and processing. For example, many businesses in 2024 are investing heavily in anonymization techniques for video footage to meet these privacy demands.

The private security industry, including companies like Casesa, operates under a stringent legal framework. In 2024, the U.S. Bureau of Labor Statistics reported approximately 1.1 million security guards employed, all of whom must meet specific licensing and certification mandates that vary by state. These requirements ensure personnel are adequately trained and vetted, covering everything from background checks to specific skill certifications for roles like alarm system installation and monitoring center operations.

Failure to adhere to these regulations can result in significant consequences for Casesa. Penalties can range from substantial fines, as seen in various state enforcement actions in 2023 and early 2024, to temporary or permanent suspension of operating licenses. Such disruptions not only halt business activities but also severely damage Casesa's reputation and client trust, impacting future growth and revenue streams.

Staying current with evolving legal standards is paramount. For instance, advancements in technology, such as the increased use of AI in surveillance, are prompting regulatory bodies to update licensing and operational guidelines throughout 2024 and into 2025. Casesa must proactively monitor these changes to maintain compliance and operational continuity, ensuring all personnel and systems meet the latest certification requirements.

Casesa, as a service company relying heavily on its employees, must navigate a complex web of labor laws. These include regulations on minimum wage, which in the US saw the federal minimum wage remain at $7.25 per hour as of July 2024, though many states and cities have higher rates. Compliance with working hour limits, occupational health and safety standards, and employee rights regarding unionization are critical to avoid costly legal battles and maintain a positive work environment.

Evolving labor legislation presents direct financial implications for Casesa. For instance, a significant increase in the minimum wage, like the proposed federal increase to $15 per hour that has been debated, could substantially raise Casesa's payroll expenses. Similarly, new mandates for employee benefits, such as expanded paid sick leave or healthcare contributions, will require adjustments to human resource strategies and budget allocations, impacting overall operational costs.

Liability and Indemnity Laws

Liability and indemnity laws are paramount for Casesa, given the inherent risks in its operational sector. Understanding legal obligations concerning security failures, property damage, or personal injury is crucial. For instance, in 2023, data breach litigation costs averaged $4.45 million globally, a figure Casesa must consider when assessing its exposure.

To effectively manage these risks, Casesa needs to implement strong contractual agreements, secure adequate insurance, and utilize clear disclaimers. These measures are essential for shielding the company from potential litigation.

- Contractual Safeguards: Ensuring indemnity clauses in client and vendor contracts clearly define responsibilities and liabilities.

- Insurance Coverage: Maintaining comprehensive general liability, professional liability, and cyber insurance policies.

- Risk Mitigation: Implementing robust security protocols and safety procedures to minimize incidents.

- Legal Counsel: Engaging specialized legal expertise to navigate the complexities of liability and indemnity.

Intellectual Property Laws for Security Technology

Casesa's development of advanced security systems means it must carefully consider intellectual property (IP) laws. This includes patents for novel security technologies, copyrights for software code, and trademarks for brand identity. In 2024, the global IP market saw significant activity, with patent filings in cybersecurity alone reaching an estimated 150,000 applications, highlighting the competitive landscape.

Protecting Casesa's proprietary innovations through patents and copyrights is paramount for maintaining a competitive edge. Simultaneously, avoiding infringement of existing IP held by competitors or other entities is critical to prevent costly legal disputes. For instance, a 2024 report indicated that IP litigation costs for technology firms can range from hundreds of thousands to millions of dollars.

Legal vigilance regarding IP ensures that Casesa's investments in technological advancement are secure and defensible. This proactive approach safeguards the company's unique solutions and prevents unauthorized use by others. The U.S. Patent and Trademark Office reported a 5% increase in utility patent grants in 2024, underscoring the importance of robust patent strategies.

- Patent Protection: Securing patents for unique algorithms and hardware designs in security technology.

- Copyright Safeguards: Protecting proprietary software code and documentation through copyright registration.

- Trademark Diligence: Ensuring brand names and logos for security solutions are legally protected and distinct.

- Infringement Avoidance: Conducting thorough IP clearance searches before launching new security products or features.

Casesa must navigate a complex legal landscape, including data protection laws like GDPR and CCPA, which mandate strict handling of personal information. Non-compliance can lead to severe financial penalties, with GDPR fines potentially reaching 4% of global annual revenue. The company also faces stringent licensing and certification requirements for its personnel, as evidenced by the 1.1 million security guards employed in the U.S. in 2024, each needing state-specific vetting.

Labor laws, covering minimum wage (federal $7.25/hour as of July 2024), working hours, and safety, directly impact Casesa's operational costs and HR strategies. Evolving legislation, such as potential minimum wage increases, could significantly affect payroll expenses. Furthermore, liability and indemnity laws are critical, with global data breach litigation costs averaging $4.45 million in 2023, necessitating robust contractual safeguards, insurance, and risk mitigation protocols.

Environmental factors

The growing demand for sophisticated security systems, especially those featuring extensive video surveillance and constant monitoring, significantly escalates energy usage. This trend puts pressure on companies like Casesa to develop and provide energy-efficient security solutions, aligning with a broader push for sustainable business operations and a reduced carbon footprint.

In 2024, the global market for video surveillance systems alone was projected to reach over $60 billion, with a significant portion of this growth driven by smart, interconnected solutions that require continuous power. As clients increasingly prioritize environmentally conscious choices, energy efficiency is becoming a crucial competitive advantage in the security sector.

The lifecycle of advanced security systems, from cameras to sensors, inherently generates electronic waste (e-waste) at their end-of-life. Casesa must navigate stringent environmental regulations concerning the disposal of this equipment. For instance, in 2024, the global e-waste generated reached an estimated 62 million metric tons, highlighting the scale of the challenge.

Adhering to these regulations is crucial for corporate social responsibility and maintaining compliance. Casesa should actively explore and invest in certified recycling programs for outdated security components, ensuring materials are processed responsibly. This commitment not only mitigates environmental impact but also strengthens brand reputation among increasingly eco-conscious consumers and businesses.

Climate change is intensifying extreme weather events, directly threatening the physical infrastructure Casesa secures. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $150 billion in damages, according to NOAA. This trend demands more resilient security solutions.

Consequently, there's a growing need for weather-resistant security systems and heightened demand for security services in regions frequently hit by floods, storms, or wildfires. Casesa must innovate to meet these evolving environmental challenges.

Adapting to these shifts means developing solutions like flood-resistant surveillance cameras or power-independent monitoring systems to ensure continuous protection amidst environmental disruptions. This proactive approach is crucial for maintaining operational integrity and client trust.

Sustainable Sourcing of Security Components

Growing awareness of environmental impact is increasingly shaping consumer and business demand for sustainably sourced materials and components in the manufacturing of security equipment. This trend puts pressure on companies like Casesa, and their suppliers, to ensure that the electronic components and raw materials used in their systems are ethically and environmentally responsibly sourced.

This commitment to sustainable sourcing extends throughout the entire supply chain, directly influencing procurement decisions and potentially impacting the cost and availability of certain materials. For instance, by 2024, the global market for sustainable electronics was projected to reach significant growth, indicating a clear industry shift.

- Demand for Recycled Content: Increased consumer and regulatory pressure is driving the use of recycled plastics and metals in security device casings and components.

- Ethical Mining Practices: Companies are scrutinizing their supply chains for conflict minerals and demanding transparency regarding mining practices for rare earth elements.

- Reduced Hazardous Substances: A growing focus on eliminating or reducing hazardous substances like lead and cadmium in electronic components aligns with global environmental regulations.

Noise and Light Pollution Regulations

Casesa's security systems, especially outdoor surveillance and alarm components, can inadvertently create noise and light pollution. Compliance with local ordinances is paramount, ensuring alarm decibel levels and light spill from cameras do not exceed permitted thresholds. For instance, many municipalities enacted stricter noise ordinances in 2024, with some cities like New York City reporting a 15% increase in noise complaints related to commercial alarms in the past year, highlighting the need for Casesa's careful system design.

The company must proactively design its installations to minimize environmental impact. This includes selecting cameras with adjustable light output and motion-activated lighting that directs light downwards, rather than outwards. By 2025, it's projected that over 30% of new security system installations will incorporate adaptive lighting features to address these concerns, a trend Casesa should embrace to maintain regulatory adherence and community goodwill.

Considerations for sensitive ecological areas or densely populated residential zones are particularly important. Casesa's strategy should involve:

- Developing low-noise alarm systems: Research into quieter, yet effective, alarm technologies is ongoing, with advancements in directional sound expected by late 2025.

- Implementing smart lighting controls: Utilizing motion sensors and timers to limit unnecessary illumination from surveillance equipment.

- Conducting environmental impact assessments: For large-scale installations, particularly in or near natural reserves, to preemptively identify and mitigate potential pollution sources.

- Offering noise-dampening options: Providing clients with choices for alarm systems that meet environmental standards.

The increasing energy demands of sophisticated security systems, particularly those with continuous video surveillance, pressure companies like Casesa to prioritize energy efficiency. This aligns with a global trend where the video surveillance market was expected to exceed $60 billion in 2024, with smart solutions driving energy consumption.

The generation of electronic waste from outdated security equipment presents a significant challenge, with global e-waste reaching an estimated 62 million metric tons in 2024. Casesa must adhere to stringent disposal regulations and invest in certified recycling programs to manage this environmental impact effectively.

Extreme weather events, amplified by climate change, necessitate more resilient security infrastructure. The U.S. alone faced 28 billion-dollar weather disasters in 2023, totaling over $150 billion in damages, underscoring the need for weather-resistant and power-independent security solutions from Casesa.

Consumer and business demand for sustainably sourced materials in security equipment is growing, influencing Casesa's procurement decisions. The global market for sustainable electronics was projected for significant growth by 2024, indicating a clear industry shift towards ethical sourcing and reduced hazardous substances.

PESTLE Analysis Data Sources

Our PESTLE analysis for Casesa is meticulously crafted using a blend of official government publications, reputable market research reports, and data from leading economic and environmental organizations. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing Casesa's operations.