Casesa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

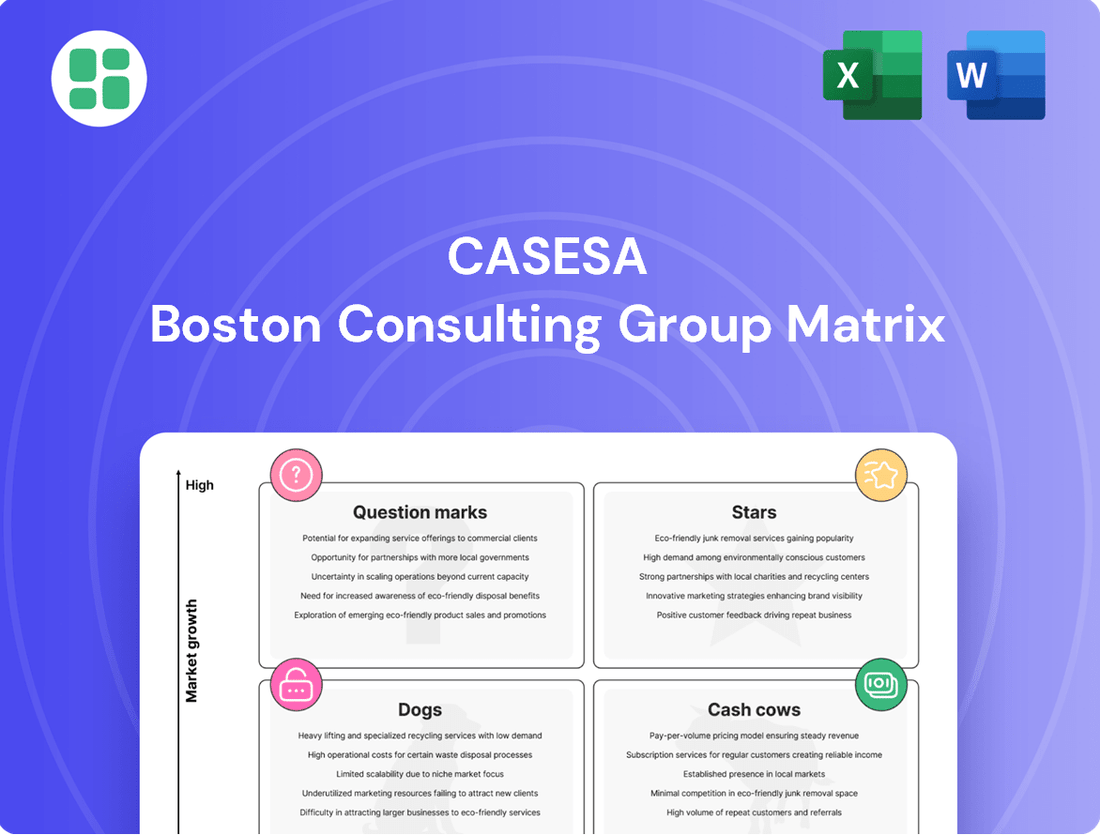

Unlock the secrets to this company's strategic product portfolio with a glimpse into its BCG Matrix. See how its offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, offering a foundational understanding of its market position. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment decisions.

Stars

Casesa's AI-Powered Integrated Security Solutions are firmly positioned as a Star in the BCG matrix. These solutions leverage advanced AI for video analytics, predictive threat detection, and automated responses, offering a sophisticated and proactive approach to security.

The market for AI in security is booming, with a projected growth to USD 71.69 billion by 2030, exhibiting a robust CAGR of 19.02% from 2025. This rapid expansion indicates significant demand and opportunity.

As a leader in tailored security strategies, Casesa is well-equipped to capitalize on this high-growth sector. By providing superior intelligence and operational efficiency, Casesa can attract and retain high-value clients who demand state-of-the-art protection, solidifying its Star status.

Cyber-Physical Security Convergence Consulting represents a significant growth opportunity for Casesa, aligning perfectly with the Star quadrant of the BCG matrix. Businesses are increasingly recognizing the interconnectedness of their digital and physical assets, demanding integrated security solutions. For instance, the global market for converged security solutions was projected to reach over $110 billion by 2024, highlighting the substantial demand.

Casesa's expertise in bridging IT and OT (Operational Technology) security, a key aspect of this convergence, allows it to address a critical market need. This specialization is vital as critical infrastructure and industrial control systems become more digitized, creating new vulnerabilities. A recent survey indicated that 75% of organizations experienced at least one cyber-physical security incident in the past year, underscoring the urgency for such consulting services.

Specialized smart city and critical infrastructure security solutions are a rapidly expanding market. The increasing global urbanization, with projections suggesting over 68% of the world’s population will live in urban areas by 2050, drives demand for robust protection of essential services like power grids, water systems, and transportation networks. Casesa's focus on this sector, particularly with offerings leveraging IoT integration and advanced analytics, positions them well to capture significant market share.

If Casesa has secured substantial contracts in this specialized area, it signifies a strong competitive advantage. For instance, the global smart city market was valued at approximately $400 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030, indicating immense potential. Their expertise in securing interconnected systems is crucial, as cyber threats to critical infrastructure are escalating, with the average cost of a data breach in the industrial sector reaching millions of dollars.

Advanced Biometric Access Control Systems

Advanced biometric access control systems, such as facial and iris recognition, are experiencing robust market growth. This surge is fueled by heightened security needs and the increasing preference for touchless, mobile-integrated access. In 2024, the global biometric market was projected to reach over $100 billion, with access control being a significant contributor.

Casesa's advanced biometric solutions, particularly those leveraging AI for improved accuracy and adaptability, position them favorably within the market. These systems offer superior security and user-friendliness, attracting businesses aiming to modernize their physical security infrastructure. The demand for AI-powered biometrics is expected to grow at a compound annual growth rate (CAGR) exceeding 20% through 2028.

- Market Growth: The global biometric market is expanding rapidly, with access control systems being a key driver.

- AI Integration: Casesa's AI-enhanced biometrics offer superior accuracy and adaptability.

- Demand Drivers: Increased security needs and the shift to touchless, mobile solutions are propelling market expansion.

- Future Outlook: The segment is poised for continued strong growth, with significant investment in AI-driven technologies.

Cloud-Based Video Surveillance and Monitoring (VSaaS)

Cloud-based Video Surveillance as a Service (VSaaS) is a dynamic sector, characterized by rapid expansion and increasing adoption. Its appeal lies in offering clients flexibility, the ability to scale services easily, and the convenience of managing systems remotely. This makes it a prime candidate for growth within the VSaaS market.

Casesa's current 24/7 alarm monitoring, if strategically moved to a sophisticated cloud-based platform enhanced with advanced video analytics, would position it firmly as a Star in the BCG matrix. This strategic shift leverages the inherent strengths of VSaaS, making it a compelling offering.

- High Growth Potential: The global VSaaS market was projected to reach approximately $10.5 billion in 2024, with a compound annual growth rate (CAGR) of over 16% expected through 2030.

- Recurring Revenue: This segment benefits from a subscription-based model, providing predictable and consistent revenue streams for Casesa.

- Customer Acquisition: Lower upfront costs for clients compared to traditional on-premise solutions are a significant driver for market penetration and customer acquisition.

- Technological Advancement: Integration of AI-powered video analytics, such as object detection and facial recognition, further enhances the value proposition and market demand.

Casesa's AI-Powered Integrated Security Solutions are a prime example of a Star in the BCG matrix. This segment benefits from a rapidly expanding market, with AI in security projected to reach $71.69 billion by 2030, growing at a CAGR of 19.02% from 2025. Casesa's ability to offer advanced analytics and predictive threat detection positions it to capture significant market share in this high-growth area.

Cyber-Physical Security Convergence Consulting also shines as a Star. The global market for converged security solutions was over $110 billion in 2024, demonstrating substantial demand. Casesa's expertise in bridging IT and OT security addresses critical vulnerabilities, especially as 75% of organizations reported cyber-physical incidents in the past year.

Advanced biometric access control systems, like facial recognition, are another Star. The global biometric market was projected to exceed $100 billion in 2024, with AI-powered biometrics showing a CAGR over 20% through 2028. Casesa's AI-enhanced solutions offer improved accuracy and user-friendliness, meeting the demand for modernized physical security.

Cloud-based Video Surveillance as a Service (VSaaS) represents a Star for Casesa. The VSaaS market was estimated at $10.5 billion in 2024, with a projected CAGR of over 16% through 2030. By shifting its monitoring services to a cloud platform with AI analytics, Casesa can leverage this high-growth segment for recurring revenue and broader customer acquisition.

| Product/Service | BCG Quadrant | Market Growth | Market Share | Key Drivers |

| AI-Powered Integrated Security Solutions | Star | High (19.02% CAGR from 2025) | Strong | Demand for advanced analytics, predictive threat detection |

| Cyber-Physical Security Convergence Consulting | Star | High (>$110 billion market in 2024) | Strong | Increasing IT/OT integration, rising cyber-physical incidents |

| Advanced Biometric Access Control | Star | High (>$100 billion market in 2024, 20%+ CAGR for AI biometrics) | Strong | Heightened security needs, preference for touchless/mobile solutions |

| Cloud-based VSaaS | Star | High (>$10.5 billion market in 2024, 16%+ CAGR) | Strong | Flexibility, scalability, recurring revenue model, AI integration |

What is included in the product

The Casesa BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Effortlessly identifies underperforming "Dogs" and resource-draining "Cash Cows" for strategic divestment or optimization.

Cash Cows

Traditional manned guarding services for commercial clients are a classic Cash Cow for Casesa. This mature market, projected to grow from USD 28.56 billion in 2025 to USD 41.55 billion by 2033, provides a substantial and dependable revenue stream. Casesa's existing contracts in this sector, where it likely possesses a solid market position, are key to this status.

These established services demand minimal new investment in marketing or expansion once contracts are in place. This translates into consistent, predictable cash flow, which is crucial for funding other, potentially higher-growth areas within Casesa's portfolio. The stability of these earnings allows for strategic allocation of resources across the company.

Standard access control system installation and ongoing maintenance for existing clients are a clear Cash Cow for Casesa. This segment benefits from a mature market where demand for reliable, conventional solutions like key card and basic biometric systems remains strong. Casesa's established client base and efficient service model in this area translate into robust profit margins and consistent cash flow, as significant new investment in research and development isn't a primary driver here.

Casesa's foundational 24/7 alarm monitoring service, a bedrock offering distinct from newer AI-driven analytics, likely commands a significant and stable customer base. This mature service, characterized by predictable demand and minimal additional costs for each new subscriber, firmly positions it as a Cash Cow within the BCG matrix. Its substantial market share in the critical security sector ensures a steady stream of operational cash flow, a vital resource that can be strategically channeled into fostering growth in other, more dynamic segments of Casesa's business.

Routine Video Surveillance System Installation and Upgrades

Routine video surveillance system installation and upgrades for existing clients are a prime example of a Cash Cow for Casesa. This business line, while not seeing rapid expansion, consistently generates revenue. The ongoing demand for fundamental security keeps this segment stable.

Casesa's established expertise and strong client relationships in this area translate to efficient project completion and high customer loyalty. This reliability ensures a predictable income stream, a hallmark of a Cash Cow.

For instance, in 2024, the demand for basic CCTV installations and maintenance remained robust, with reports indicating a global market value of approximately $48.5 billion for the overall video surveillance market, a segment where Casesa holds a steady position.

- Steady Revenue: Consistent demand for non-AI surveillance ensures predictable income.

- High Client Retention: Casesa's reputation fosters repeat business and upgrades.

- Efficient Operations: Established processes lead to profitable, low-overhead projects.

- Market Stability: The basic security segment offers a reliable, albeit slow-growing, market share.

Integrated Security Solutions for Small to Medium Enterprises (SMEs)

Integrated Security Solutions for Small to Medium Enterprises (SMEs) represent Casesa's cash cows. These offerings focus on customized, integrated security strategies for SMEs, leveraging mature technologies such as basic access control, standard video surveillance, and alarm monitoring. This segment thrives on repeat business and referrals within a stable market, reflecting a consistent demand for reliable security infrastructure.

Casesa's strength lies in its capacity to deliver comprehensive yet standardized security packages to a broad SME client base. This approach generates dependable revenue streams with moderate investment requirements, as the implemented solutions are proven and widely accepted in the market. For instance, in 2024, the SME security market in North America alone was valued at approximately $15 billion, with integrated systems accounting for a significant portion, demonstrating the substantial and consistent demand.

- Stable Market Demand: SMEs consistently require foundational security measures, ensuring a predictable revenue base.

- Repeat Business & Referrals: Customer satisfaction with reliable, integrated solutions drives ongoing contracts and new client acquisition.

- Mature Technology Utilization: Leveraging established technologies reduces R&D costs and accelerates deployment for clients.

- Dependable Revenue Generation: Standardized packages offer predictable income with manageable operational overhead.

Casesa's provision of managed network security services for established enterprise clients functions as a significant Cash Cow. This segment benefits from the ongoing need for robust cybersecurity in a market that, while evolving, still relies heavily on established protocols and consistent oversight. The predictable revenue generated from long-term contracts in this area is a cornerstone of Casesa's financial stability.

These services typically require less incremental investment compared to cutting-edge solutions, focusing instead on efficient delivery and client retention. This translates into high profit margins and a consistent cash flow that can be reinvested into more innovative ventures. For example, the global managed security services market was projected to reach over $60 billion in 2024, with a substantial portion attributed to enterprise-level contracts for ongoing protection.

Casesa's expertise in providing routine compliance and auditing services for businesses in regulated industries also represents a Cash Cow. This mature market segment demands consistent, albeit predictable, adherence to established standards, ensuring a steady stream of recurring revenue. The relatively low innovation cost and high client stickiness in this area contribute to its cash-generating capabilities.

The demand for these services is driven by ongoing regulatory requirements, making it a stable and reliable income source. Casesa's established track record and deep understanding of these compliance frameworks allow for efficient service delivery and strong client relationships, further solidifying its Cash Cow status. In 2024, the cybersecurity compliance market alone was estimated to be worth over $25 billion globally.

| Service Area | Market Status | Cash Flow Contribution | Investment Needs |

|---|---|---|---|

| Managed Network Security (Enterprise) | Mature, Stable | High, Predictable | Low to Moderate |

| Routine Compliance & Auditing | Mature, Consistent | High, Recurring | Low |

Preview = Final Product

Casesa BCG Matrix

The Casesa BCG Matrix document you are currently previewing is the exact, fully polished version you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool for your business planning.

Dogs

Maintaining outdated analog surveillance systems for clients resistant to upgrades firmly places this service in the Dog quadrant of the BCG matrix. The market for analog technology is shrinking, with minimal future growth potential.

This segment likely demands significant resources, such as scarce specialized parts and ongoing training for technicians on older equipment, while generating low returns. For instance, in 2024, the global market for analog CCTV equipment saw a decline of approximately 8% compared to the previous year, according to industry reports.

Casesa should strategically reduce investment in this area, focusing instead on guiding these clients toward adopting contemporary digital surveillance solutions, which offer enhanced security and operational efficiency.

Generic, undifferentiated security consulting without a clear link to Casesa's broader integrated solutions or long-term contracts often falls into the Dog category. This type of offering typically struggles with low market share due to a lack of unique value proposition.

Such services can consume valuable expert resources without generating the profitable, recurring revenue needed for growth. For instance, if a significant portion of consulting engagements in 2024 resulted in one-off projects with less than a 5% follow-on contract rate, it would signal a Dog status.

Casesa should consider either revamping these generic offerings to highlight specific differentiators and integrate them into a service continuum, or strategically phase them out to reallocate resources to more promising areas.

Offering purely manual patrol services in tech-saturated urban areas, where advanced surveillance and remote monitoring are common, positions these operations as Dogs in the BCG matrix. The market share for such labor-intensive services is declining, with many urban centers seeing a significant shift towards technological security solutions.

In 2024, the global security services market is projected to reach over $250 billion, but the growth in traditional manned guarding in highly urbanized, tech-forward cities is significantly slower than in other segments. For instance, a recent industry report indicated that while the overall security market grew by an estimated 5-7% in 2023, the segment focused solely on manual patrols in advanced urban environments saw growth closer to 1-2%, often impacted by labor shortages and rising wages.

Casesa's manual patrol services in these environments face low margins due to intense competition and the increasing cost of labor. The strategic fit is questionable as clients in these areas are increasingly demanding integrated security solutions that combine technology with human oversight, rather than purely manual efforts.

Basic Intrusion Detection Systems Without Monitoring Contracts

Selling and installing basic intrusion detection systems without ongoing monitoring contracts often places these offerings in the Dogs category of the BCG Matrix. While initial hardware sales might provide a revenue stream, the absence of recurring service fees and the highly competitive market for standalone security hardware limit long-term profitability and market share. This lack of ongoing value can make them cash traps.

The market for basic, unmonitored security systems is highly commoditized. In 2024, the global market for home security systems, excluding professional monitoring, is expected to see growth but with increasingly thin margins on hardware alone. For instance, companies focusing solely on DIY hardware sales without service packages often struggle to differentiate and maintain significant market share against larger, integrated providers. This often results in low return on investment for the capital tied up in inventory and installation.

- Low Profitability: Without recurring monitoring fees, the profit margins on standalone hardware sales are typically very low, often in the single digits.

- High Competition: The market for basic DIY security hardware is crowded, with numerous players offering similar products, driving down prices and profitability.

- Limited Growth Potential: The lack of an ongoing service component restricts the ability to build customer loyalty and expand revenue streams beyond the initial sale.

- Cash Trap Risk: Investments in inventory, marketing, and installation for these products may not generate sufficient returns to justify the capital expenditure, leading to a cash drain.

Legacy On-Premise Security Software Support

Supporting legacy on-premise security software presents a classic Dogs quadrant scenario within the BCG Matrix. These solutions, often requiring extensive manual intervention for updates and problem-solving, struggle to compete as the industry increasingly embraces cloud-native strategies. The market for such systems is contracting, indicating low future growth potential.

The financial implications are stark. High ongoing support costs, coupled with minimal revenue generation due to the shrinking market, make this segment a drain on resources. For instance, a significant portion of IT budgets in 2024 was still allocated to maintaining legacy systems, with some estimates suggesting up to 70% of IT spend going towards keeping existing infrastructure running rather than innovation.

Casesa's strategic imperative is clear: phase out support for these aging on-premise solutions. The focus should be on migrating existing clients to more efficient, cloud-managed platforms. This transition not only reduces operational overhead but also unlocks opportunities for enhanced service delivery and greater client satisfaction.

- Low Market Growth: The demand for on-premise security software is declining as cloud adoption accelerates.

- High Support Costs: Manual maintenance and troubleshooting for legacy systems incur significant operational expenses.

- Client Migration Strategy: Casesa should prioritize moving clients to modern, cloud-based security solutions.

- Operational Efficiency: Transitioning to cloud platforms aims to streamline support and reduce overall costs.

Dogs represent offerings with low market share and low market growth, consuming more resources than they generate. These are typically products or services that are outdated, highly competitive, or lack a clear value proposition. Casesa's analog surveillance systems, generic consulting, and manual patrol services in tech-heavy areas are prime examples.

These segments often require significant investment in maintenance and support while yielding minimal returns, making them cash drains. For instance, in 2024, the market for analog CCTV saw an approximate 8% decline, and the growth in purely manual security patrols in advanced urban environments was estimated at only 1-2%.

Casesa should strategically divest from or minimize investment in these Dog offerings. The focus should be on transitioning clients to more modern, profitable solutions or phasing out these services to reallocate resources effectively.

Selling basic intrusion detection systems without ongoing monitoring also falls into the Dog category. The market for standalone security hardware is commoditized, with low margins and limited growth potential without a recurring service component. This lack of differentiation and ongoing revenue makes them cash traps, as capital invested in inventory and installation struggles to generate adequate returns.

Question Marks

Drone-based surveillance and inspection services represent a classic Question Mark in the BCG matrix for Casesa. This sector is experiencing rapid technological advancement and growing demand, particularly for perimeter security and large-scale monitoring, indicating high future growth potential. However, Casesa's current market share is likely low, reflecting its nascent stage in this emerging field.

Significant investment in research and development, along with pilot programs, is essential for Casesa to gain traction and build market share in drone surveillance. This strategic imperative means the business unit is a cash consumer, with uncertain immediate returns. The company must carefully evaluate the cost of entry and the pace of market adoption to determine if continued investment is warranted or if an exit strategy is more prudent.

Developing AI-driven behavioral analytics for niche markets like specialized retail loss prevention or sensitive data centers positions Casesa's offerings as Question Marks. These areas offer substantial growth prospects, but Casesa's current limited presence necessitates considerable investment to build market share and leadership.

The potential for high returns in these emerging verticals is significant, yet the initial investment required to penetrate and establish a strong foothold means these ventures carry higher risk. For instance, a 2024 report indicated that AI adoption in specialized security sectors, while growing at an estimated 25% CAGR, still has a relatively low penetration rate of under 15% for advanced behavioral analytics solutions.

Casesa's foray into predictive maintenance for security systems, powered by IoT integration, represents a classic BCG Matrix Question Mark. This burgeoning sector is projected to reach $12.2 billion globally by 2028, according to a recent market analysis, driven by the increasing adoption of smart security solutions and the demand for proactive issue resolution.

While the potential is substantial, Casesa's current market share in this specialized area is likely modest. Establishing the necessary IoT sensor networks, robust data analytics platforms, and acquiring the specialized talent for predictive modeling requires significant upfront investment, typical for Question Mark ventures.

The strategic imperative for Casesa is clear: invest in developing a competitive technological edge and fostering wider market adoption. This could involve strategic partnerships or acquisitions to accelerate capability development, aiming to transform this Question Mark into a future Star within the IoT security landscape.

Specialized Security Training and Consultancy (High-End)

Specialized Security Training and Consultancy (High-End) fits the Question Mark category in the BCG Matrix for Casesa. This segment targets advanced threats like counter-espionage and sophisticated executive protection planning, a market experiencing rapid growth. For example, the global corporate security market was valued at approximately $120 billion in 2023 and is projected to grow at a CAGR of 7.5% through 2030, driven by increasing cyber and physical threat sophistication.

Casesa might currently hold a low market share in this premium niche if its offerings haven't been specifically tailored or heavily marketed to this high-end clientele. To succeed, substantial investment is required in recruiting top-tier security experts and developing targeted marketing campaigns to build brand recognition and trust within this discerning market. The potential for high returns exists if Casesa can effectively capture even a small portion of this expanding, high-value segment.

- Market Growth: The demand for specialized security solutions is escalating due to evolving global threats.

- Investment Needs: Significant capital is necessary for expert personnel and targeted marketing.

- Market Share: Casesa likely has a nascent or low market share in this specialized, premium segment.

- Strategic Focus: Future success hinges on strategic investment to gain traction and build a strong reputation.

Security as a Service (SaaS) Model for SMBs

Transitioning traditional security offerings to a Security-as-a-Service (SaaS) model for Small and Medium Businesses (SMBs) positions this strategy as a Question Mark for Casesa. The SMB market is rapidly adopting cloud-based solutions, with the global cybersecurity market for SMBs projected to reach $137.1 billion by 2027, growing at a CAGR of 14.5%.

While the SaaS model offers compelling advantages like scalability and predictable recurring revenue, Casesa's current market share within the SMB segment might be low if its primary focus has been on enterprise clients or on-premises solutions. This shift demands substantial investment in developing a user-friendly platform, building a dedicated sales force, and executing targeted marketing campaigns to capture this new customer base.

- Market Potential: The SMB cybersecurity market is experiencing robust growth, driven by increasing cyber threats and the need for cost-effective, scalable solutions.

- Investment Needs: Significant capital is required for platform development, cloud infrastructure, customer support, and specialized sales and marketing efforts tailored to SMBs.

- Competitive Landscape: Casesa will face established SaaS security providers and new entrants, necessitating a strong value proposition and competitive pricing.

- Revenue Model: The SaaS model shifts revenue from one-time project fees to recurring subscriptions, impacting cash flow and requiring careful financial planning.

Casesa's investment in developing advanced AI for threat detection in critical infrastructure represents a significant Question Mark. This sector is experiencing high growth, with the global cybersecurity market for critical infrastructure projected to reach $40.5 billion by 2029, growing at a CAGR of 10.2%.

However, Casesa's current market share is likely minimal, requiring substantial investment in R&D, specialized talent, and market penetration strategies to build a competitive position. The company must carefully manage these expenditures against the uncertain timeline for widespread AI adoption in this highly regulated sector.

| Business Unit | BCG Category | Market Growth | Casesa Market Share | Investment Needs | Strategic Imperative |

|---|---|---|---|---|---|

| Drone Surveillance | Question Mark | High | Low | High (R&D, Pilot Programs) | Invest to gain traction or consider exit |

| AI Behavioral Analytics (Niche) | Question Mark | High | Low | High (Market Penetration) | Build leadership and market share |

| Predictive Maintenance (IoT Security) | Question Mark | High | Modest | High (IoT Networks, Data Platforms) | Invest in tech edge, partnerships/acquisitions |

| Specialized Security Training | Question Mark | High | Low | High (Expert Recruitment, Marketing) | Build brand recognition and trust |

| SaaS for SMBs | Question Mark | High | Low | High (Platform Dev, Sales Force) | Capture new customer base, develop value proposition |

| AI for Critical Infrastructure | Question Mark | High | Minimal | High (R&D, Talent, Penetration) | Manage expenditures against uncertain adoption |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.