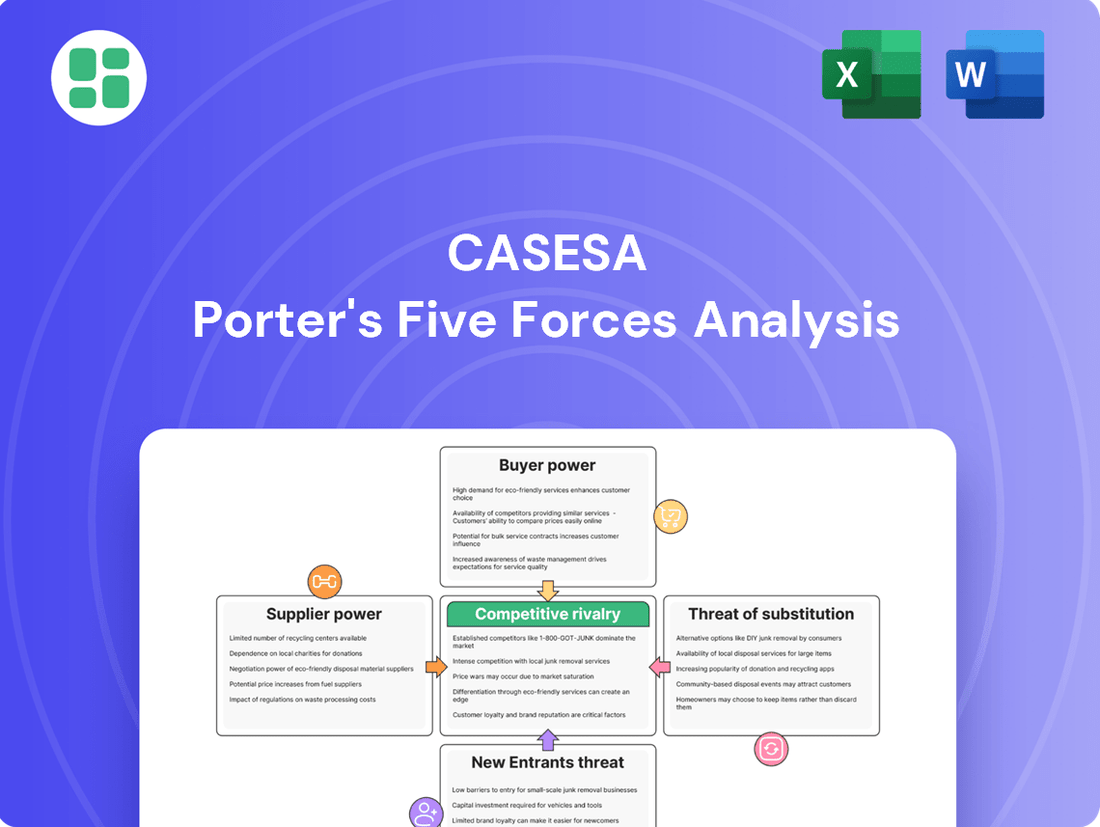

Casesa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

Casesa's competitive landscape is shaped by the interplay of five key forces, influencing profitability and strategic decisions. Understanding these dynamics is crucial for navigating its market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Casesa’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Casesa's reliance on specialized security equipment, like advanced cameras and alarm monitoring technology, places it at the mercy of its suppliers. The market for these high-tech components is often concentrated, meaning a few key players dominate. This limited competition grants these suppliers considerable leverage over pricing and contract terms.

The projected growth of the high-tech security component market to $30 billion by 2025 further amplifies supplier power. With increasing demand, suppliers of unique and critical components have even less incentive to negotiate favorable terms for buyers like Casesa, potentially leading to higher costs and limited flexibility in sourcing.

Casesa's increasing reliance on specialized technology providers for AI surveillance and smart monitoring systems significantly amplifies supplier bargaining power. Major players in integrated security systems, such as ADT and Honeywell, hold substantial sway. For instance, Honeywell's security segment reported revenues of $11.1 billion in 2023, indicating its market strength and ability to influence terms.

Casesa's reliance on skilled security personnel for its manned guarding services directly impacts the bargaining power of labor suppliers. These suppliers, often agencies or individual contractors, can leverage the demand for qualified guards to negotiate higher wages and improved benefits.

Regulations like Employment Regulation Orders (EROs) in many regions establish minimum pay and working conditions for security staff, setting a baseline that labor suppliers must meet. In 2024, the average hourly wage for security guards in many developed economies saw an upward trend, reflecting increased demand and a tightening labor market.

The growing urbanization and persistent concerns about crime rates in 2024 continue to fuel the demand for professional guarding solutions. This heightened demand strengthens the position of labor suppliers, enabling them to push for better compensation and terms, thereby increasing Casesa's labor costs.

Switching Costs for Proprietary Systems

When Casesa commits to a supplier's proprietary security software or hardware, the cost of switching becomes a significant hurdle. This includes expenses for staff retraining, integrating new systems, and the potential for operational disruptions. These substantial switching costs inherently limit Casesa's leverage and bolster the supplier's bargaining power.

For complex, integrated security systems, these switching costs can be particularly prohibitive. For instance, a 2024 survey of IT decision-makers indicated that over 60% consider the integration of new security solutions with existing infrastructure a major challenge, often leading to extended implementation timelines and increased upfront investment.

- High Integration Costs: Replacing a deeply embedded proprietary security system can necessitate costly overhauls of related IT infrastructure.

- Training and Skill Gaps: New systems often require specialized knowledge, leading to significant investment in employee training or hiring new talent.

- Data Migration Complexity: Transferring sensitive security data to a new platform presents technical challenges and potential security risks during the transition.

- Vendor Lock-in: Proprietary systems are designed to make it difficult and expensive to move to a competitor, effectively locking customers into the current supplier.

Impact of Global Supply Chain Disruptions

The global supply chain for security equipment is vulnerable to disruptions, directly impacting Casesa. These disruptions can result in higher costs and extended lead times for essential components. For example, data from 2024 suggests around 40% of businesses experienced delays in acquiring critical materials, prompting suppliers to raise prices due to increased production and shipping expenses.

These supply chain issues translate into tangible financial consequences for Casesa. Increased operational expenditures stemming from these delays and price hikes can erode profit margins. Furthermore, compromised service delivery timelines due to material shortages can negatively affect customer satisfaction and potentially lead to lost business opportunities.

- Increased Costs: Suppliers passing on higher production and shipping expenses.

- Delivery Delays: Approximately 40% of companies faced delays in obtaining critical materials in 2024.

- Operational Impact: Higher operational expenditures for Casesa.

- Service Disruption: Potential negative impact on service delivery timelines and customer satisfaction.

Casesa faces significant supplier bargaining power due to the concentration of specialized security equipment markets and the increasing demand for advanced technology. This leverage allows suppliers to dictate terms and pricing, impacting Casesa's costs and operational flexibility.

The high cost of switching proprietary security systems, coupled with vendor lock-in, further strengthens supplier positions. Additionally, the labor market for security personnel, influenced by regulations and rising demand in 2024, grants labor suppliers considerable influence over wages and benefits.

Supply chain disruptions, which affected approximately 40% of businesses in 2024, also empower suppliers by enabling them to pass on increased production and shipping costs, directly impacting Casesa's operational expenditures and service delivery.

| Factor | Impact on Casesa | Supporting Data/Trend |

| Supplier Concentration (Tech) | Limited negotiation leverage, higher prices | Few dominant players in high-tech security components |

| Switching Costs (Proprietary Systems) | Increased dependence, reduced flexibility | Over 60% of IT decision-makers cite integration challenges (2024) |

| Labor Market Demand | Higher labor costs, potential wage pressure | Upward trend in security guard wages (2024) |

| Supply Chain Disruptions | Increased operational costs, delivery delays | ~40% of businesses faced material delays (2024) |

What is included in the product

This analysis dissects the competitive forces impacting Casesa, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

The security services industry is highly competitive, presenting customers with a wide array of choices for integrated security solutions. This abundance of options means Casesa's clients, from small businesses to large corporations and individual homeowners, can readily switch to alternative providers if they aren't satisfied with pricing, service quality, or the breadth of services offered.

This ease of switching significantly empowers customers, giving them considerable bargaining power. They can leverage this to demand more competitive pricing and more favorable contract terms from Casesa and its competitors. For instance, in 2024, the global security services market was valued at approximately $250 billion, with numerous players vying for market share, further intensifying customer leverage.

Customers are increasingly looking for security plans that are specifically designed for their individual situations, which is exactly what Casesa strives to offer. This desire for personalized approaches gives customers more sway because they can clearly state what they need and expect companies like Casesa to deliver it.

The fact that customers can pinpoint their exact security requirements means they have a stronger negotiating position. They can shop around for providers who can meet these specific demands, putting pressure on Casesa to be flexible and competitive.

The market for customized security services is expanding globally. Projections indicate continued growth, meaning customers will have even more options and thus greater bargaining power in the future.

Customers, particularly businesses, are often mindful of their budgets, even when security is paramount. This price sensitivity means they'll actively compare offerings from various providers to find the best value. For instance, in 2024, many IT security service providers saw increased customer inquiries focused on cost-saving measures, with some reports indicating a 15% average increase in price-based comparisons for managed security services compared to the previous year.

The sheer number of security solution providers available means customers have a wide array of choices. This competitive landscape empowers them to negotiate better terms or switch to a more affordable alternative if Casesa's pricing isn't perceived as competitive. The cybersecurity market in 2024 was estimated to have over 4,000 vendors globally, creating a highly fragmented and customer-friendly environment for price-conscious buyers.

Consequently, Casesa faces pressure to maintain competitive pricing to secure and keep its clientele. This can directly affect the company's profitability, as aggressive pricing strategies may be necessary to win deals, potentially squeezing profit margins in order to remain attractive in a crowded market.

Access to Information and Online Reviews

Customers today wield significant power due to unprecedented access to information. Online platforms, review sites, and comparison tools allow them to thoroughly research security service providers, scrutinizing everything from service quality to pricing. This transparency means companies with a history of poor performance or negative customer experiences are easily identified, directly impacting their ability to attract and retain clients.

The proliferation of online reviews and ratings directly influences purchasing decisions. For instance, a study in 2024 indicated that over 85% of consumers consider online reviews as important as personal recommendations when choosing a service provider. This heightened awareness empowers customers to demand better service and more competitive pricing, as they can readily switch to alternatives with superior reputations.

- Informed Decision-Making: Customers can easily compare features, pricing, and service level agreements across multiple security providers.

- Reputation Management: Negative online sentiment can rapidly erode a company's customer base, making reputation a critical asset.

- Price Sensitivity: Increased transparency often leads to greater price sensitivity among customers who can easily find lower-cost alternatives.

- Demand for Quality: Customers are more likely to demand high-quality service and responsiveness when they have easy access to information about competitors.

Threat of Backward Integration by Large Clients

Large corporate clients, particularly those with significant security expenditures, may explore developing their own security infrastructure rather than relying solely on external providers like Casesa. This could involve building internal security teams or investing in proprietary technology, a move that, while substantial in cost, signals a willingness to control critical functions.

This threat of backward integration by major clients acts as a powerful lever. For instance, if a large enterprise annually spends upwards of $50 million on security services, the potential to internalize even a portion of that spending could be a significant motivator for them to negotiate harder with current vendors.

- Client Leverage: Large clients can use the threat of in-house security development to negotiate better pricing and service level agreements with Casesa.

- Cost of Integration: Developing in-house security capabilities requires substantial upfront investment in personnel, technology, and training, which can be a deterrent.

- Strategic Importance: For some clients, security might be deemed a core competency, making backward integration a strategic imperative rather than just a cost-saving measure.

Customers in the security services sector possess significant bargaining power due to the abundant availability of providers and the ease with which they can switch. This allows them to demand competitive pricing and favorable contract terms, especially given the market's fragmentation. For example, in 2024, the global security services market, valued at approximately $250 billion, featured thousands of vendors, amplifying customer leverage.

Customers are increasingly informed and price-sensitive, readily comparing offerings and leveraging online reviews to find the best value. This transparency pressures companies like Casesa to maintain competitive pricing and high service quality to retain clients, as demonstrated by a 2024 trend showing a 15% average increase in price-based comparisons for managed security services.

The potential for large clients to develop in-house security capabilities also serves as a powerful negotiation tactic, particularly for those with substantial security budgets. This threat of backward integration, especially for enterprises spending tens of millions annually on security, compels providers to offer more attractive terms.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High | Over 4,000 global cybersecurity vendors |

| Switching Costs | Low | Clients can readily switch providers |

| Customer Information Access | High | 85% of consumers consider online reviews crucial |

| Price Sensitivity | High | 15% increase in price comparisons for managed security services |

| Threat of Backward Integration | Moderate to High (for large clients) | Potential for enterprises with $50M+ security spend to internalize functions |

Full Version Awaits

Casesa Porter's Five Forces Analysis

This preview showcases the complete Casesa Porter's Five Forces Analysis, ensuring that the document you receive after purchase is identical to what you see here. You'll gain immediate access to this professionally formatted and ready-to-use analysis, providing a comprehensive understanding of the competitive landscape. No placeholders or mockups are used; what you preview is precisely the final deliverable you'll download.

Rivalry Among Competitors

The security services industry, where Casesa operates, is notably fragmented. This means there are many companies vying for business, ranging from global giants to smaller, local operations. In 2023, the global security services market was valued at approximately $245 billion, illustrating the sheer scale and the number of participants.

Casesa encounters a broad spectrum of competitors offering everything from on-site personnel to advanced technological solutions like surveillance systems and alarm monitoring. This diverse competitive landscape often drives down prices as companies try to win contracts, making differentiation through service quality and innovation crucial for survival and growth.

Competitors, including Casesa, are increasingly differentiating themselves through highly customized security strategies and integrated solutions. This focus on tailored offerings, such as combining physical security with advanced technological surveillance, is a major area of competition.

The security industry saw significant growth in demand for integrated solutions in 2024, with many firms reporting a 15-20% increase in clients seeking bundled services. This trend necessitates continuous investment in research and development, as well as specialized training for personnel to adapt to these evolving client requirements and maintain a competitive edge.

The security industry is experiencing a fierce battle driven by rapid technological evolution, especially in AI. Companies are racing to integrate AI for smarter surveillance, advanced video analysis, and predictive monitoring, aiming to boost threat detection and operational efficiency. For instance, the global AI in security market was projected to reach $34.9 billion by 2027, highlighting the significant investment and competitive pressure in this area.

Casesa faces intense rivalry as competitors deploy AI to offer more sophisticated risk identification and response capabilities. Staying ahead means constantly upgrading technology, as AI is fundamentally reshaping how security threats are managed. Failing to keep pace with these AI-driven innovations could leave Casesa at a significant disadvantage.

Regulatory Compliance and Licensing Requirements

The security industry faces significant competitive rivalry stemming from stringent regulatory compliance and licensing. These requirements act as substantial barriers to entry, influencing operational costs and demanding continuous adaptation from existing players. For instance, in 2024, many jurisdictions updated their private security licensing requirements, necessitating re-certification for guards and companies alike, thereby increasing overheads and potentially reducing the number of smaller, less capitalized competitors.

Adherence to evolving standards in areas such as labor practices, equipment certification, and data privacy is paramount. In 2024, new Employment Regulation Orders in several countries mandated higher minimum wages and improved working conditions for security personnel, directly impacting labor costs for all firms. Furthermore, the increasing focus on data security means that companies handling sensitive client information must invest in robust data protection measures, adding another layer of operational expense and compliance burden.

- Increased operational costs due to licensing and compliance mandates.

- Barriers to entry are raised, potentially limiting new competitors.

- Ongoing need for investment in training and certification to meet regulatory updates.

- Data privacy regulations require significant investment in secure systems and protocols.

Mergers and Acquisitions for Market Consolidation

The industry is actively consolidating through mergers and acquisitions. This trend is driven by larger companies aiming to achieve greater economies of scale, broaden their service offerings, and capture more market share. For instance, in 2024, the global M&A market saw significant activity in sectors ripe for consolidation, with deal values reaching hundreds of billions of dollars across various industries.

This wave of M&A activity intensifies competitive rivalry. Consolidated entities emerge with enhanced resources and expanded capabilities, creating a more challenging environment for smaller or less integrated players. The increased market concentration means that fewer, larger companies wield more influence over pricing and market dynamics.

- Increased Market Concentration: As companies merge, the number of major players in the industry decreases, leading to a more concentrated market.

- Economies of Scale: Mergers allow companies to reduce per-unit costs by increasing production volume and optimizing operations.

- Expanded Service Portfolios: Acquirers often integrate the services of acquired companies, offering a more comprehensive suite to customers.

- Heightened Competitive Pressure: Larger, consolidated firms can leverage their increased resources and market power to outcompete rivals.

Competitive rivalry within the security services industry is intense, driven by a fragmented market and a wide array of service offerings. Companies like Casesa must differentiate through innovation and tailored solutions to stand out. The global security services market, valued at approximately $245 billion in 2023, underscores the scale of this competition.

The rapid integration of Artificial Intelligence (AI) is a key battleground, with firms investing heavily to enhance surveillance and threat detection capabilities. For instance, the AI in security market was projected to reach $34.9 billion by 2027, indicating significant competitive pressure in this domain.

Furthermore, stringent regulatory compliance and evolving labor standards, such as updated licensing requirements and increased minimum wages observed in 2024, add to operational costs and complexity. Consolidation through mergers and acquisitions also heightens rivalry, as larger entities gain economies of scale and broader service portfolios, increasing pressure on smaller players.

| Key Competitive Factor | Impact on Rivalry | 2023/2024 Data Point |

| Market Fragmentation | High number of players leads to intense competition. | Global security services market valued at ~$245 billion (2023). |

| Technological Advancements (AI) | Race to integrate AI for enhanced services. | AI in security market projected to reach $34.9 billion by 2027. |

| Regulatory Compliance & Labor Costs | Increased operational costs and barriers to entry. | 2024 saw updated licensing and higher minimum wages impacting firms. |

| Industry Consolidation (M&A) | Larger firms gain market share and resources. | Significant M&A activity in 2024 across various industries. |

SSubstitutes Threaten

Many larger corporations, including those that might consider using services like Casesa, often opt to build their own in-house security departments. This internal approach acts as a direct substitute, allowing them to manage manned guarding, system monitoring, and overall security protocols directly. For example, a 2024 report indicated that over 60% of Fortune 500 companies maintain dedicated internal security teams, citing perceived cost efficiencies and enhanced control over sensitive operations.

The rise of accessible DIY security systems and smart home technology poses a substantial threat to Casesa. These solutions, often featuring user-friendly interfaces and lower upfront costs, allow consumers and small businesses to manage their own security, directly bypassing the need for professional installation and monitoring services. For instance, the market for smart home security devices, including video doorbells and indoor cameras, has seen explosive growth, with many households adopting these technologies for their convenience and perceived cost-effectiveness.

Public law enforcement and emergency services, like police and fire departments, act as a baseline security for everyone. While they don't replace specialized private security, some businesses or individuals might lean on these public services for basic needs like alarm response, potentially lowering their demand for more extensive private security measures.

Insurance and Risk Management Solutions

The threat of substitutes for direct security services is significant, as businesses can opt for financial mitigation through insurance. For instance, comprehensive cyber insurance policies can cover losses from data breaches, acting as a financial buffer instead of investing in advanced cybersecurity software. In 2024, the global cyber insurance market was valued at approximately $12.7 billion and is projected to grow, indicating a strong reliance on this substitute.

Similarly, physical security risks like theft or vandalism can be addressed through property insurance. Companies might allocate budget towards robust insurance coverage rather than extensive physical security measures like guards or advanced surveillance systems. This financial protection serves as a viable alternative, especially when the perceived likelihood or impact of a security event is deemed manageable through compensation.

The cost-effectiveness of insurance compared to continuous investment in security infrastructure is a key driver. Businesses, particularly small to medium-sized enterprises, may find insurance premiums a more predictable and manageable expense than the upfront and ongoing costs of cutting-edge security technology or personnel. This economic consideration makes insurance a powerful substitute.

- Insurance as a Financial Safety Net: Companies can choose to cover potential losses from security breaches through insurance policies, rather than solely relying on preventative measures.

- Cost-Benefit Analysis: Insurance premiums are often seen as a more predictable and manageable expense compared to the substantial investment required for advanced security systems and personnel.

- Market Trends: The growing global cyber insurance market, valued around $12.7 billion in 2024, highlights the increasing adoption of insurance as a primary risk mitigation strategy.

Cybersecurity Solutions for Digital Assets

The threat of substitutes for Casesa's physical security systems is growing as digital assets become paramount. As businesses digitize, cybersecurity solutions are increasingly seen as an alternative to traditional physical security, especially when budgets are constrained. For instance, in 2024, global spending on cybersecurity solutions was projected to reach over $200 billion, reflecting a significant shift in security priorities.

Companies may divert funds from physical security to bolster their digital defenses. This means that while Casesa provides advanced physical security, the escalating cyber threat landscape presents a substantial substitute. A report from Gartner in late 2023 indicated that over 60% of organizations planned to increase their cybersecurity spending in 2024.

- Cybersecurity as a Substitute: Digital defenses are increasingly replacing or augmenting physical security needs for protecting valuable information and intellectual property.

- Resource Allocation: Limited budgets force businesses to choose between enhancing physical security or investing in cybersecurity, with the latter often taking precedence due to evolving threats.

- Market Trends: The global cybersecurity market is experiencing robust growth, with projections indicating continued expansion driven by rising cyberattack incidents.

- Impact on Casesa: Casesa must consider how the growing effectiveness and perceived necessity of cybersecurity solutions impact the demand for its traditional physical security offerings.

The threat of substitutes for Casesa's offerings is multifaceted. Businesses can choose to build their own internal security teams, a trend supported by data showing over 60% of Fortune 500 companies having dedicated internal security in 2024. Furthermore, the proliferation of DIY smart home security systems provides a cost-effective alternative for individuals and smaller businesses, bypassing the need for professional services. Public law enforcement also serves as a baseline security, potentially reducing reliance on private sector solutions for certain needs.

| Substitute Category | Description | Example/Data Point |

|---|---|---|

| In-house Security Teams | Companies managing their own security personnel and systems. | Over 60% of Fortune 500 companies maintain internal security teams (2024). |

| DIY Smart Home Security | Consumer-grade, user-friendly security devices. | Significant market growth in video doorbells and indoor cameras. |

| Public Law Enforcement | Basic security and emergency response services. | Acts as a baseline security for all, potentially reducing demand for specialized private services. |

| Insurance (Cyber & Property) | Financial mitigation for security-related losses. | Global cyber insurance market valued at $12.7 billion in 2024. |

| Cybersecurity Solutions | Digital defense mechanisms to protect data and assets. | Global cybersecurity spending projected to exceed $200 billion in 2024. |

Entrants Threaten

New companies looking to challenge Casesa in the integrated security services market face a steep uphill battle due to the immense capital needed. Think about the investment in cutting-edge surveillance technology, sophisticated monitoring hubs, and a fleet of vehicles for rapid response. These aren't small expenses; they represent a significant barrier to entry.

Beyond technology, building a robust operational infrastructure demands substantial funding. This includes establishing and maintaining advanced monitoring centers and equipping a fleet for mobile patrols. These essential components require considerable upfront financial commitment, making it difficult for smaller players to get a foothold.

Furthermore, the human element is a major cost factor. Casesa's integrated model relies on a large, well-trained workforce for manned guarding services. Recruiting, vetting, and continuously training this personnel base represents a significant ongoing capital outlay, further deterring potential new entrants who may lack the financial muscle to support such a workforce.

The security industry presents significant regulatory hurdles that act as a formidable barrier to new entrants. Companies, especially those involved in manned guarding or alarm monitoring, must secure various licenses and certifications for both the organization and its personnel. For instance, in the UK, the Security Industry Authority (SIA) licenses individuals working in specific sectors, a process that involves background checks and training. This complex web of regulations, including data protection laws like GDPR, can be both time-consuming and expensive to navigate, deterring potential new competitors.

Casesa enjoys a significant advantage due to its robust brand reputation and deeply ingrained client trust, critical factors in the security sector where reliability is non-negotiable. Newcomers face a steep uphill battle in replicating this established credibility, as customers are hesitant to switch from providers with a proven history of safeguarding their safety and assets.

Economies of Scale and Cost Advantages

Established security firms often leverage significant economies of scale, particularly in purchasing security equipment and technology. For instance, a large firm might secure bulk discounts on surveillance systems, access control hardware, and communication devices, driving down their per-unit cost considerably.

These scale advantages translate into cost advantages for incumbents. A security company operating across numerous high-profile contracts in 2024, for example, can spread its fixed costs, such as central management and administrative overhead, over a much larger revenue base. This makes it difficult for new entrants, who must build their infrastructure and client base from scratch, to match the pricing or profit margins of established players.

- Economies of Scale: Large security providers benefit from lower per-unit costs due to bulk purchasing of equipment and technology.

- Cost Advantages: Incumbents can spread fixed operational costs over a wider revenue base, enabling more competitive pricing.

- Barriers to Entry: New entrants struggle to achieve similar cost efficiencies without the established volume of business.

- Pricing Pressure: This cost disparity can force new firms to either accept lower margins or charge higher prices, hindering their market penetration.

Access to Specialized Technology and Skilled Labor

The threat of new entrants for Casesa, particularly concerning specialized technology and skilled labor, is moderately low. Casesa's reliance on advanced security systems, including AI-powered solutions, requires significant upfront investment in research and development, as well as ongoing access to cutting-edge hardware and software. For instance, the global AI in security market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, indicating a competitive landscape for technological talent and resources.

New companies entering this space would face substantial hurdles in replicating Casesa's technological infrastructure and expertise. Acquiring or developing the necessary specialized technological know-how, particularly in areas like machine learning for threat detection and sophisticated data analytics, is a time-consuming and capital-intensive process. Furthermore, the demand for cybersecurity professionals, especially those with expertise in AI and advanced systems integration, remains exceptionally high. In 2024, the cybersecurity skills gap continues to be a major concern, with millions of unfilled positions globally, making it difficult for new entrants to attract and retain the required talent pool.

- High R&D Investment: Developing and maintaining AI-powered security systems requires substantial ongoing investment in research and development, a barrier for new, less capitalized entrants.

- Skilled Labor Scarcity: The global cybersecurity workforce shortage, estimated to be over 3.4 million professionals in 2024, makes it challenging for new companies to recruit experienced personnel for installation, maintenance, and monitoring of advanced systems.

- Proprietary Technology: Casesa may possess proprietary algorithms or patented technologies that are difficult and costly for new entrants to replicate.

- Industry Experience: Established players like Casesa benefit from years of operational experience and accumulated knowledge in the security sector, which new entrants lack.

The threat of new entrants for Casesa is generally low due to high capital requirements for technology and infrastructure, coupled with significant regulatory compliance costs. Furthermore, Casesa's established brand reputation and economies of scale create substantial barriers, making it difficult for newcomers to compete on cost and trust.

| Barrier Type | Description | Impact on New Entrants | Example for Casesa |

|---|---|---|---|

| Capital Requirements | Significant investment needed for advanced technology, monitoring centers, and response fleets. | High deterrent for undercapitalized firms. | Estimated $10.5 billion global AI in security market (2023) requires substantial R&D. |

| Regulatory Hurdles | Obtaining licenses and certifications for operations and personnel. | Time-consuming and costly compliance. | SIA licensing in the UK for manned guarding personnel. |

| Brand Reputation & Trust | Established credibility in a sector where reliability is paramount. | New entrants struggle to gain customer confidence. | Clients are hesitant to switch from proven security providers. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and spreading fixed costs. | New entrants cannot match incumbent pricing or margins. | Bulk discounts on surveillance systems and access control hardware. |

Porter's Five Forces Analysis Data Sources

Our Casesa Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, competitor financial statements, and trade association publications to provide a robust understanding of the competitive landscape.