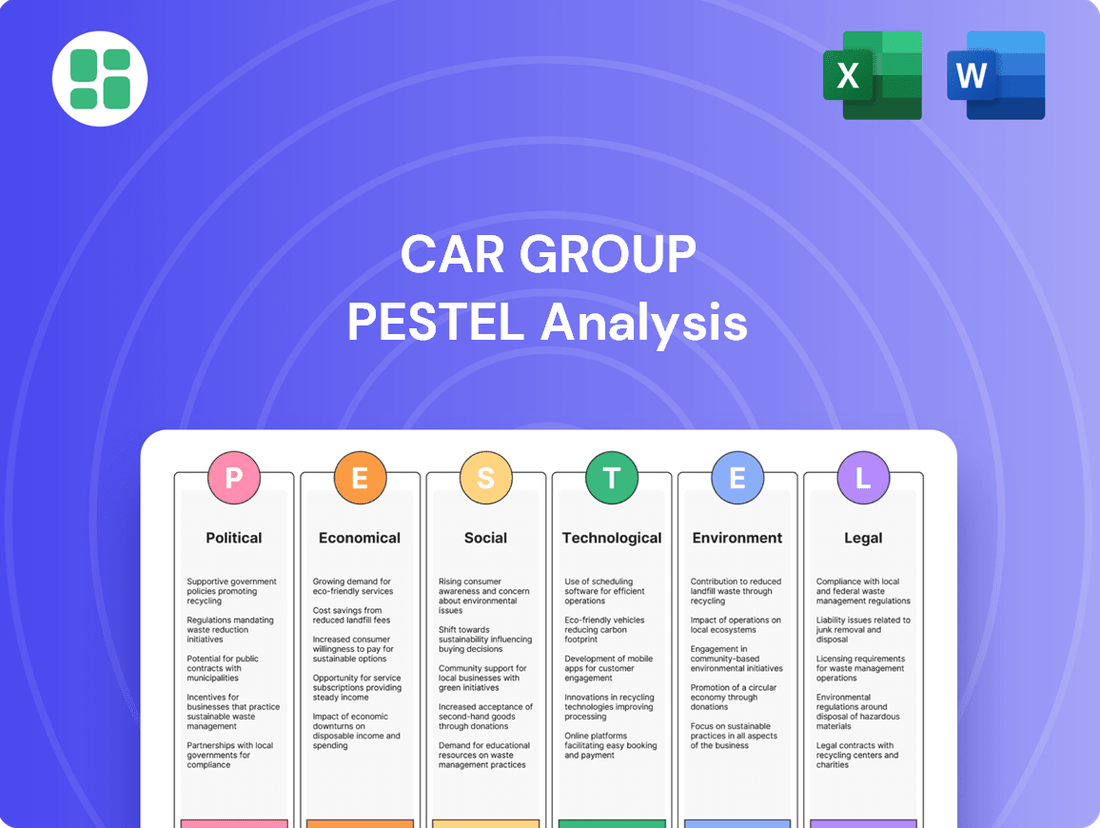

CAR Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAR Group Bundle

Understand the critical political, economic, social, technological, legal, and environmental factors shaping CAR Group's future. Our expert-crafted PESTLE analysis provides the actionable intelligence you need to navigate these complex forces. Gain a competitive edge and make informed strategic decisions. Download the full version now for immediate insights.

Political factors

Governments in CAR Group's key markets, including Australia, Brazil, and South Korea, are increasingly scrutinizing online marketplaces. For instance, Australia's Competition and Consumer Act 2010, particularly Schedule 2 (Australian Consumer Law), sets stringent standards for consumer protection, which can directly impact how CAR Group manages vehicle listings and seller conduct. New regulations could mandate stricter advertising standards or enhanced consumer protection measures for online vehicle sales, potentially requiring CAR Group to adapt its platform operations and verification processes.

CAR Group's operations are significantly shaped by international trade policies and tariffs. For instance, the European Union's Common External Tariff, which generally stands at 10% for imported vehicles, influences the cost of vehicles entering the EU market. Similarly, the United States' tariffs on steel and aluminum, implemented in 2018 and largely maintained through 2024, impact manufacturing costs for automakers, which can trickle down to vehicle prices and thus affect the listings on platforms like CAR Group.

Governments worldwide are actively encouraging electric vehicle (EV) adoption through various incentives. For instance, in 2024, the United States continued its federal tax credit of up to $7,500 for eligible new EVs, with many states offering additional rebates, some exceeding $2,000. These policies directly impact consumer demand, potentially shifting CAR Group's inventory towards EVs and influencing the resale value of traditional gasoline-powered cars.

Political Stability in Key Markets

CAR Group's operations are significantly influenced by the political stability and regulatory landscapes in its key markets, notably Brazil and South Korea. For instance, Brazil's political climate has seen shifts that can impact investor confidence. In 2024, ongoing discussions around fiscal policy and potential reforms in Brazil could introduce a degree of uncertainty for foreign investment, potentially affecting consumer spending on vehicles.

Political stability directly correlates with economic predictability, which is crucial for the automotive sector. South Korea, while generally stable, navigates its own geopolitical considerations. Any escalation of regional tensions could indirectly affect economic sentiment and, consequently, the demand for new vehicles. For example, fluctuations in international trade agreements stemming from political decisions can alter import/export dynamics for automotive components and finished vehicles.

- Brazil's Political Outlook: In early 2024, Brazil's government continued to focus on economic reforms, with market reactions to legislative progress being closely watched by businesses, including automotive sector players.

- South Korea's Geopolitical Context: South Korea's proximity to North Korea remains a background factor influencing regional economic stability and investor sentiment, though its direct impact on domestic vehicle sales has historically been managed.

- Regulatory Environment: Changes in environmental regulations or consumer protection laws in either market can impose new costs or create opportunities for CAR Group, depending on their adaptability.

Antitrust and Competition Policy

Regulatory bodies are increasingly scrutinizing market concentration within the online marketplace sector, a trend that could significantly impact CAR Group, particularly given its substantial market share. For instance, in 2024, the European Commission continued its investigations into digital platforms, focusing on potential anti-competitive practices. This heightened regulatory attention means potential antitrust investigations or the introduction of new competition laws could constrain CAR Group's ability to pursue future acquisitions or dictate its operational strategies concerning dealers and other industry players.

These regulatory pressures can manifest in several ways for a company like CAR Group:

- Increased compliance costs: Navigating complex antitrust regulations requires dedicated legal and compliance resources.

- Restrictions on M&A activity: Future growth through acquisitions might be blocked or require significant divestitures to gain approval.

- Mandated changes in business practices: CAR Group could be forced to alter its relationships with dealerships or its pricing strategies.

- Potential for significant fines: Non-compliance with antitrust laws can result in substantial financial penalties, as seen in other tech sectors where fines have reached billions of dollars.

Government scrutiny of online marketplaces, particularly in Australia and South Korea, is intensifying. Regulations like Australia's Consumer Law are pushing for stricter advertising and seller conduct standards. This means CAR Group must adapt its platform to meet these consumer protection mandates.

International trade policies and tariffs continue to shape the automotive landscape. For example, the EU's 10% common external tariff on imported vehicles and US tariffs on steel and aluminum impact vehicle costs, influencing what appears on CAR Group's listings.

Governments globally are incentivizing electric vehicle (EV) adoption, with the US offering up to $7,500 in federal tax credits in 2024, plus state rebates. This policy shift directly affects consumer demand, pushing CAR Group's inventory towards EVs and impacting the resale value of traditional vehicles.

Political stability in key markets like Brazil and South Korea is crucial for CAR Group's operations. Brazil's ongoing economic reforms in early 2024, and South Korea's geopolitical considerations, create an environment that can influence investor confidence and consumer spending on vehicles.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the CAR Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Interest rates significantly impact vehicle affordability. For instance, if the Federal Reserve's target range for the federal funds rate, which influences many consumer loan rates, remains elevated in 2024 and 2025, the cost of auto loans will likely stay higher. This directly translates to increased monthly payments for buyers, potentially reducing demand for new and used vehicles sold through platforms like CAR Group.

Higher borrowing costs can lead to a slowdown in vehicle sales. As of early 2024, average auto loan rates for new cars hovered around 7-8%, a noticeable increase from previous years. If these rates persist or climb further into 2025, consumers might postpone purchases or opt for less expensive models, affecting transaction volumes and CAR Group's revenue streams.

Inflationary pressures in 2024 and early 2025 continue to significantly impact consumer spending on big-ticket items like vehicles. As the cost of essentials such as food, energy, and housing rises, consumers have less discretionary income available. For instance, the US Consumer Price Index (CPI) saw a notable increase throughout 2024, impacting household budgets and potentially delaying or cancelling vehicle purchases.

This squeeze on discretionary income directly affects CAR Group's market. When consumers have less money left after covering necessities, their willingness to invest in new or used cars diminishes. Furthermore, escalating operating expenses, including those for dealerships, can lead to reduced marketing and advertising spend, impacting CAR Group's revenue streams and the overall health of the automotive sales ecosystem.

CAR Group's performance is closely tied to the GDP growth of its key markets, as a healthy economy fuels automotive demand. For instance, in 2023, Australia's GDP grew by 1.9%, and New Zealand's by 2.3%, indicating stable, albeit moderate, economic environments that support vehicle purchases and online automotive marketplace activity.

Consumer Confidence and Discretionary Income

Consumer confidence is a key driver for CAR Group, as it directly impacts discretionary spending on vehicles. When consumers feel optimistic about their financial future, they are more inclined to make significant purchases like cars. For instance, the Conference Board's Consumer Confidence Index remained robust in early 2024, showing a steady upward trend, which bodes well for the automotive market.

Discretionary income, the money left after essential expenses, is crucial for vehicle purchases. Higher levels of disposable income allow consumers to consider new vehicle acquisitions or upgrades. In 2024, wage growth, though varied across sectors, generally supported increased discretionary spending, benefiting platforms like CAR Group that facilitate car sales and related services.

- Consumer Confidence: The Conference Board reported consumer confidence at 102.0 in February 2024, indicating a positive outlook on economic conditions and future prospects.

- Discretionary Income Trends: Real disposable income saw a modest increase in late 2023 and early 2024, providing consumers with more funds available for non-essential purchases.

- Impact on Auto Sales: Elevated consumer confidence and disposable income directly correlate with increased foot traffic and transaction volumes on automotive marketplaces.

- Market Sentiment: Positive consumer sentiment often translates into higher demand for new and used vehicles, benefiting CAR Group's core business operations.

Exchange Rate Fluctuations

For CAR Group, with its global reach, fluctuating exchange rates directly influence its financial reporting. When earnings from overseas subsidiaries are translated back into its primary currency, a stronger home currency means those foreign earnings are worth less. For instance, if CAR Group operates significantly in Europe and the Euro weakens against its reporting currency, its reported revenue from that region will appear lower, even if sales volume remained constant.

These currency movements also play a critical role in strategic decision-making. A depreciating Australian Dollar, for example, could make importing parts or vehicles more expensive for CAR Group, potentially impacting its cost of goods sold. Conversely, a stronger Australian Dollar might make its products more competitive in international markets but reduce the value of profits earned abroad.

Consider the impact of recent trends: The Australian Dollar experienced volatility in 2024 and early 2025, influenced by global economic conditions and interest rate differentials. For companies like CAR Group, this necessitates robust hedging strategies to mitigate the risk of adverse currency movements affecting their bottom line. For example, a 5% appreciation of the AUD against the Euro in a given quarter could reduce reported profits from European operations by a similar percentage if unhedged.

- Revenue Impact: A stronger AUD can decrease reported revenue from foreign sales.

- Cost of Goods Sold: A weaker AUD can increase the cost of imported components.

- Profitability: Exchange rate volatility directly affects net profit margins on international transactions.

- Investment Decisions: Currency strength influences the cost-effectiveness of overseas expansion or acquisitions.

Economic factors like interest rates and inflation directly influence consumer purchasing power for vehicles. Elevated interest rates in 2024 and 2025 increase auto loan costs, potentially dampening demand for CAR Group's offerings. Persistent inflation also erodes discretionary income, making consumers more hesitant to make large purchases like cars.

GDP growth and consumer confidence are vital for CAR Group's success. Stable GDP growth, as seen in Australia (1.9% in 2023) and New Zealand (2.3% in 2023), supports vehicle sales. Positive consumer confidence, evidenced by indices around 102.0 in early 2024, further encourages spending on vehicles through platforms like CAR Group.

Exchange rate fluctuations pose a significant risk to CAR Group's international operations and financial reporting. A stronger Australian Dollar in 2024 could reduce the reported value of earnings from overseas markets, while a weaker dollar might increase the cost of imported components.

| Economic Factor | 2024/2025 Trend/Data Point | Impact on CAR Group |

|---|---|---|

| Interest Rates | Elevated (e.g., Fed Funds Rate influencing auto loans) | Higher borrowing costs reduce vehicle affordability, potentially lowering sales volumes. |

| Inflation | Persistent pressures on consumer goods | Erodes discretionary income, leading to delayed or cancelled vehicle purchases. |

| GDP Growth (Australia/NZ) | Stable (e.g., 1.9% AUD, 2.3% NZD in 2023) | Supports moderate demand for vehicles and online automotive marketplace activity. |

| Consumer Confidence | Positive (e.g., Conference Board index ~102.0 in early 2024) | Encourages discretionary spending on vehicles, boosting transaction volumes. |

| Exchange Rates (AUD) | Volatile, influenced by global factors | Affects reported revenue from foreign subsidiaries and the cost of imported parts. |

Full Version Awaits

CAR Group PESTLE Analysis

The preview shown here is the exact CAR Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the CAR Group. Dive into actionable insights and strategic recommendations within this complete report.

Sociological factors

Consumers are increasingly comfortable buying vehicles online, a trend that directly supports CAR Group's digital-first strategy. This shift is fueled by the desire for convenience, a wider array of choices, and greater price transparency, making online platforms the go-to for many car shoppers.

By 2024, a significant portion of car research and even purchases were happening online. For instance, studies in late 2023 indicated that over 80% of car buyers used online resources for their purchase journey, with a growing segment completing a substantial part of the transaction digitally.

Demographic shifts are reshaping the automotive landscape. In 2024, the global population continues to age, with a growing proportion of older adults who may prefer smaller, more accessible vehicles or rely on alternative transport. Conversely, increased urbanization in many regions by 2025 means more people living in densely populated areas, potentially boosting demand for compact cars, electric vehicles, and shared mobility solutions over traditional car ownership.

Evolving family structures also play a role. Smaller household sizes and a rise in single-person households by 2024-2025 could decrease the demand for larger family cars. CAR Group needs to monitor these trends to align its product offerings, perhaps by increasing its focus on urban-friendly models and exploring partnerships within the shared mobility sector.

Societal shifts are heavily influencing the automotive market, with a noticeable surge in consumer demand for sustainable and electric vehicles (EVs). This growing environmental consciousness, coupled with increasing awareness of climate change, is pushing manufacturers and dealerships to offer more eco-friendly options. CAR Group's platforms are well-positioned to capitalize on this trend by highlighting these vehicles, catering to a consumer base that increasingly prioritizes environmental impact and long-term cost savings associated with EVs.

In 2024, the global EV market continued its robust expansion, with sales projected to reach over 16 million units, a significant increase from previous years. This upward trajectory is fueled by government incentives, improving battery technology, and a growing acceptance of EVs by the general public. CAR Group's role in facilitating the discovery and purchase of these vehicles is crucial for aligning with these evolving consumer preferences and societal pressures towards a greener future.

Urbanization and Mobility Trends

Urbanization is reshaping how people move, with a noticeable shift away from private car ownership in many city centers. As urban populations grow, the convenience and cost-effectiveness of public transit, ride-sharing services, and micro-mobility options like e-scooters and bikes become more appealing. This trend, observed globally, directly influences demand for new vehicles, especially in densely populated areas. For instance, by 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, according to UN data. This increasing concentration of people in cities fuels the demand for shared mobility solutions.

The impact on the automotive industry is significant. Companies like CAR Group must consider how this evolving urban mobility landscape affects their sales volumes and product development strategies. The rise of mobility-as-a-service (MaaS) platforms, which integrate various transport options, further challenges traditional car sales models. In 2024, the global MaaS market was valued at approximately $50 billion and is expected to grow substantially in the coming years. This indicates a substantial portion of the population is embracing alternatives to personal vehicle ownership.

Key mobility trends influencing urban centers include:

- Increased adoption of electric vehicles (EVs) and shared autonomous vehicles (SAVs) in urban fleets.

- Growth in demand for subscription-based car services and car-sharing platforms.

- Expansion of public transportation networks and cycling infrastructure.

- Greater reliance on ride-hailing services for last-mile connectivity.

Digital Literacy and Internet Penetration

The increasing digital literacy and robust internet penetration across CAR Group's key markets are crucial enablers of its business model. As of early 2024, internet penetration in many developed nations where CAR Group operates exceeds 90%, fostering a growing comfort with online purchasing. This trend directly translates to a larger and more accessible customer base for digital automotive platforms.

This digital shift is particularly evident in the automotive sector, with online car sales and research becoming mainstream. For instance, in 2023, online car sales in the US saw a significant uptick, with projections indicating continued growth. This societal evolution means more consumers are actively seeking and engaging with digital marketplaces for vehicle acquisition and related services.

- Expanding Online Market: High internet penetration, often above 90% in developed markets, directly broadens the addressable market for CAR Group's online automotive services.

- Digital Comfort: Growing digital literacy empowers consumers to confidently conduct transactions, research vehicles, and utilize online platforms for their automotive needs.

- Growth Driver: The societal trend towards online engagement fuels the expansion of digital automotive marketplaces, presenting a significant opportunity for CAR Group.

Societal values are increasingly prioritizing sustainability and ethical consumption, directly impacting the automotive industry. Consumers are demonstrating a stronger preference for electric vehicles (EVs) and brands with clear environmental commitments. This shift is evident in market growth, with global EV sales projected to surpass 17 million units in 2025, up from approximately 14 million in 2024.

The demand for transparency and authenticity from businesses is also growing. Customers expect companies to be socially responsible, influencing purchasing decisions. CAR Group's platforms can leverage this by highlighting brands and vehicles that align with these evolving ethical standards, potentially boosting engagement and loyalty among a conscious consumer base.

Furthermore, the rise of the "experience economy" means consumers value services and convenience as much as the product itself. This trend suggests that CAR Group's focus on a seamless online car-buying journey and related digital services aligns well with current societal preferences, moving beyond just a transactional relationship to one that offers a superior customer experience.

Technological factors

CAR Group can significantly boost its services through AI and data analytics, offering personalized recommendations and precise vehicle valuations. For instance, by analyzing vast datasets of vehicle history, market trends, and consumer preferences, CAR Group can refine its algorithmic pricing models. This could lead to a more accurate average valuation accuracy, potentially improving by 5-10% for used vehicles in 2024-2025, directly impacting customer trust and transaction success rates.

The integration of virtual and augmented reality (VR/AR) is poised to transform the automotive retail experience. CAR Group can leverage these technologies to offer prospective buyers immersive virtual showroom tours and detailed 3D vehicle inspections directly from their devices. This innovation aims to significantly enhance online listings, providing a more engaging and informative pre-purchase evaluation that bridges the gap between digital browsing and physical interaction.

Blockchain technology offers CAR Group a significant opportunity to enhance the security and transparency of vehicle transactions. By creating immutable records for vehicle history, ownership changes, and service histories, it builds trust among buyers and sellers. This can streamline processes on CAR Group's platforms, potentially reducing fraud and increasing efficiency in the digital marketplace.

Integration of Connected Car Data

The increasing integration of connected car data presents a significant technological opportunity for CAR Group. As vehicles generate more data, there's potential to develop innovative services like predictive maintenance alerts, proactive diagnostics, and highly personalized insurance offerings based on driving behavior. For instance, by 2025, it's projected that over 90% of new vehicles sold globally will be connected, generating an estimated 400 zettabytes of data annually, according to industry forecasts.

CAR Group can capitalize on this trend by forging strategic partnerships with automotive manufacturers or telematics providers, or by developing in-house capabilities to analyze and leverage this rich dataset. This data integration can unlock new revenue streams and enhance customer loyalty by offering tailored experiences and services that go beyond traditional automotive offerings.

Key areas for leveraging connected car data include:

- Predictive Maintenance: Using sensor data to anticipate component failures and schedule service proactively, reducing downtime for owners.

- Usage-Based Insurance (UBI): Offering insurance premiums that reflect actual driving habits, potentially lowering costs for safe drivers.

- Personalized Services: Delivering customized infotainment, navigation, and even retail offers based on user preferences and vehicle usage patterns.

- Fleet Management Optimization: For commercial clients, using data to improve route efficiency, driver safety, and vehicle utilization.

Cybersecurity Threats and Data Protection

Cybersecurity threats are a significant technological factor for CAR Group. As the company handles a vast amount of user data and financial transactions online, maintaining robust cybersecurity is essential. Protecting against data breaches and cyberattacks is crucial for preserving customer trust and adhering to evolving data protection laws.

The increasing sophistication of cyberattacks means CAR Group must continuously invest in advanced security measures. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial and reputational risks involved. Failure to adequately protect sensitive information could lead to substantial financial penalties and a severe erosion of brand reputation.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.45 million globally, a significant increase from previous years.

- Regulatory Fines: Non-compliance with regulations like GDPR can result in fines up to 4% of annual global revenue or €20 million, whichever is higher.

- Customer Trust: A single major breach can lead to a significant drop in customer retention, impacting long-term revenue.

- Investment in Security: CAR Group's technological investment must prioritize threat detection, prevention, and rapid response capabilities.

AI and data analytics can significantly enhance CAR Group's services by enabling personalized recommendations and more accurate vehicle valuations. Leveraging vast datasets, CAR Group can refine pricing models, potentially improving used vehicle valuation accuracy by 5-10% in 2024-2025, boosting customer trust.

The increasing integration of connected car data offers opportunities for innovative services like predictive maintenance and usage-based insurance. By 2025, over 90% of new vehicles are expected to be connected, generating substantial data that CAR Group can utilize for new revenue streams and enhanced customer loyalty.

Robust cybersecurity is paramount for CAR Group, especially given the sensitive data and financial transactions handled. With the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, investing in advanced security is crucial to prevent breaches, protect customer trust, and avoid substantial financial penalties.

Legal factors

CAR Group must navigate a complex web of data privacy regulations globally. Strict laws like Australia's Privacy Act, Brazil's LGPD, and South Korea's Personal Information Protection Act dictate how customer information is handled. For instance, the LGPD, which came into full effect in 2020, imposes significant obligations on data processing and can result in fines up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction.

Consumer protection laws are crucial for CAR Group, especially concerning online transactions. Regulations around advertising accuracy, dispute resolution, and fair trading practices directly impact how CAR Group operates its digital platforms. For instance, the EU's Digital Services Act (DSA), fully applicable from February 2024, imposes stricter rules on online platforms regarding content moderation and consumer safety, which could affect CAR Group's advertising and user interaction policies.

Adherence to these laws is vital for preventing legal issues and maintaining CAR Group's brand image. Non-compliance could lead to significant fines and reputational damage. In 2023, the US Federal Trade Commission (FTC) reported issuing over $1.2 billion in consumer redress in 2023 alone, highlighting the financial risks associated with violating consumer protection statutes.

CAR Group operates under strict antitrust and competition laws in various jurisdictions, given its significant market share in key automotive sectors. These regulations are designed to prevent monopolistic behavior and ensure fair market competition, impacting everything from pricing strategies to potential mergers and acquisitions.

Compliance is paramount; failure to adhere to these laws can result in substantial fines and legal challenges. For instance, the European Union's competition authorities have historically investigated and fined companies for anti-competitive practices, with penalties sometimes reaching billions of euros. CAR Group must meticulously review its business models, supplier agreements, and distribution networks to ensure they do not stifle competition or disadvantage consumers.

Intellectual Property Rights

Intellectual property rights are a cornerstone for CAR Group's competitive edge. Protecting its proprietary technology, unique platform features, and brand assets through robust IP laws is crucial. For instance, as of early 2024, the global digital advertising market, where CAR Group operates, is projected to reach over $600 billion, highlighting the significant value of its digital innovations.

Equally important is CAR Group's diligence in avoiding infringement on the IP rights of other entities. This is particularly relevant in its advertising solutions and the valuable data insights it provides to clients. Failure to respect existing patents or copyrights could lead to costly legal battles and damage to its reputation, impacting its ability to secure market share in a highly competitive landscape.

- Patent Protection: Securing patents for novel algorithms and platform functionalities safeguards CAR Group's technological advancements.

- Trademark Safeguarding: Registering and defending its brand name and logos prevents unauthorized use and maintains brand integrity.

- Copyright Compliance: Ensuring all advertising content and data visualizations adhere to copyright laws prevents legal disputes.

- Licensing Agreements: Navigating and adhering to licensing terms for any third-party software or data used within its operations is essential.

Online Advertising and Marketing Regulations

Regulations governing online advertising, such as those from the FTC in the US and the ASA in the UK, directly impact how CAR Group and its advertisers promote vehicles. These rules address misleading advertisements, comparative advertising claims, and overall digital marketing practices, ensuring fair and transparent communication with consumers. For instance, in 2024, regulatory bodies continued to focus on data privacy in advertising, affecting how CAR Group might target potential buyers online.

Compliance with these legal frameworks is crucial for maintaining consumer trust and avoiding penalties. CAR Group must ensure all digital campaigns adhere to guidelines on truthfulness and substantiation of claims. For example, regulations around influencer marketing, which saw increased scrutiny in 2024, require clear disclosure of paid partnerships to prevent deceptive practices.

Key legal considerations for CAR Group's online advertising include:

- Truth in Advertising: Ensuring all claims made about vehicle features, pricing, and performance are accurate and verifiable.

- Data Privacy Compliance: Adhering to regulations like GDPR and CCPA when collecting and using consumer data for targeted advertising.

- Comparative Advertising Rules: Ensuring any comparisons made with competitor vehicles are fair, accurate, and not misleading.

- Endorsement and Testimonial Guidelines: Properly disclosing any material connections with individuals featured in advertisements.

CAR Group must remain vigilant regarding evolving consumer protection laws, particularly those impacting digital marketplaces and advertising. Regulations like the EU's Digital Services Act, fully applicable from February 2024, impose strict obligations on online platforms concerning content moderation and consumer safety, directly influencing CAR Group's operational policies.

Antitrust and competition laws are also critical, as CAR Group's significant market presence necessitates adherence to rules preventing monopolistic practices. Failure to comply can result in substantial penalties; for instance, the European Commission has levied multi-billion euro fines for anti-competitive behavior in the past, underscoring the financial and legal risks involved.

Intellectual property rights are paramount for safeguarding CAR Group's technological innovations and brand. Protecting proprietary algorithms and platform features through patents and trademarks is essential, especially in the competitive digital advertising market, projected to exceed $600 billion globally by early 2024.

Environmental factors

Government regulations are increasingly mandating stricter vehicle emissions and fuel efficiency standards globally. For instance, the European Union's CO2 emission targets for new cars aim for an average of 95 g/km by 2025, with further reductions planned. This directly impacts CAR Group by necessitating a focus on electric and hybrid vehicle listings, as well as providing tools for consumers to compare the environmental performance of different models.

These evolving environmental regulations are a significant driver for market shifts, pushing consumers towards greener transportation options. CAR Group must adapt its platform to prominently feature and easily filter for low-emission vehicles, reflecting the growing consumer interest in sustainability. By mid-2024, searches for electric vehicles (EVs) on many automotive platforms saw a substantial year-over-year increase, indicating this trend is already well underway.

Consumer awareness regarding environmental impact is notably escalating, directly fueling a stronger demand for vehicles with reduced emissions. This shift sees a significant rise in consumer interest for electric vehicles (EVs) and hybrids. For instance, global EV sales in 2024 are projected to reach over 17 million units, a substantial increase from previous years, indicating a clear market preference. CAR Group is well-positioned to capitalize on this by showcasing and enabling transactions for these eco-friendly options, potentially boosting platform engagement and revenue.

The automotive sector is embracing circular economy models, emphasizing recycling, reuse, and extending vehicle lifespan. This shift is driven by environmental concerns and regulatory pressures, aiming to reduce waste and resource depletion.

CAR Group's business model directly supports these principles by facilitating the resale and refurbishment of used vehicles, thereby promoting a longer product life cycle and reducing the demand for new manufacturing.

Globally, the automotive recycling rate is significant, with estimates suggesting that over 80% of a vehicle's mass can be recovered and recycled. For instance, in 2023, the European Union's End-of-Life Vehicles (ELV) Directive continued to push for higher recycling and recovery targets.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to customers and employees, are placing a higher premium on companies that exhibit robust environmental stewardship and corporate social responsibility. This trend is particularly relevant for CAR Group, as demonstrating a commitment to reducing its own environmental footprint and championing sustainable practices across its automotive platforms can significantly bolster its brand reputation. For instance, a 2024 survey by Nielsen revealed that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact, underscoring the market demand for eco-conscious businesses.

CAR Group's proactive engagement in CSR initiatives can translate into tangible benefits, such as attracting environmentally aware consumers and retaining talent. By integrating sustainability into its core operations and platform offerings, CAR Group can align with evolving consumer preferences and regulatory landscapes. The automotive industry, in particular, is facing increasing pressure to adopt greener practices, with projections indicating that the global electric vehicle market alone could reach over $1.5 trillion by 2030, according to BloombergNEF.

- Enhanced Brand Image: Companies with strong CSR commitments often see improved public perception and trust.

- Attracting Conscious Consumers: A significant portion of consumers, particularly younger demographics, actively seek out and support brands with demonstrable sustainability efforts.

- Talent Acquisition and Retention: Employees, especially millennials and Gen Z, are more likely to join and stay with organizations that align with their values, including environmental responsibility.

- Investor Appeal: Environmental, Social, and Governance (ESG) factors are increasingly critical for investment decisions, with ESG funds attracting substantial capital inflows. In 2024, global ESG assets under management were estimated to exceed $40 trillion.

Impact of Climate Change on Supply Chains

Climate change is increasingly impacting global supply chains, and the automotive sector is no exception. Extreme weather events, such as floods, hurricanes, and prolonged droughts, can directly halt manufacturing operations, damage infrastructure, and delay the transportation of parts and finished vehicles. For CAR Group, which facilitates the movement of new and used vehicles, these disruptions translate into potential shortages and price volatility.

The frequency and intensity of these climate-related events are on the rise. For instance, in 2023, the US experienced 28 separate weather and climate disasters each with losses exceeding $1 billion, totaling over $150 billion in damages, according to NOAA. Such widespread impacts can severely disrupt the flow of vehicles, affecting CAR Group's inventory and sales volumes.

- Supply Chain Disruptions: Extreme weather events can directly impact manufacturing plants and logistics networks, leading to production delays and increased transportation costs.

- Vehicle Availability: Production stoppages and shipping delays can reduce the availability of both new and used vehicles, influencing market prices and CAR Group's inventory levels.

- Increased Costs: Rerouting shipments, repairing damaged facilities, and sourcing alternative suppliers due to climate events add significant operational costs.

- Market Volatility: Fluctuations in vehicle supply caused by climate-related disruptions can create unpredictable market conditions for new and used car sales.

Growing consumer demand for eco-friendly transportation is a significant environmental factor. CAR Group must adapt by highlighting electric and hybrid vehicles, as global EV sales are projected to exceed 17 million units in 2024, reflecting a strong market preference. This trend presents an opportunity for CAR Group to enhance its platform's appeal by showcasing these sustainable options.

The automotive industry is increasingly adopting circular economy principles, focusing on recycling and extending vehicle lifespans. CAR Group's platform, by facilitating the resale and refurbishment of used vehicles, directly supports these efforts, contributing to reduced waste and resource consumption. This aligns with initiatives like the European Union's End-of-Life Vehicles Directive, which aims for higher recycling targets.

Climate change poses substantial risks to automotive supply chains, with extreme weather events causing production halts and transportation delays. For CAR Group, these disruptions can lead to vehicle shortages and price volatility, impacting inventory and sales. In 2023 alone, the US faced 28 weather and climate disasters exceeding $1 billion in damages, illustrating the potential for widespread operational impacts.

| Environmental Factor | Impact on CAR Group | Supporting Data (2024/2025) |

| Stricter Emissions Standards | Need to promote EVs/hybrids, adapt platform features | EU CO2 targets: 95 g/km by 2025; EV searches up significantly by mid-2024 |

| Circular Economy Adoption | Facilitates used vehicle resale, extends product life | Over 80% vehicle mass recoverable/recyclable; EU ELV Directive pushes targets |

| Climate Change Impacts | Supply chain disruptions, vehicle availability, cost increases | US 2023: 28 disasters >$1B, total $150B+ damages |

PESTLE Analysis Data Sources

Our CAR Group PESTLE Analysis is meticulously constructed using data from reputable international organizations, government publications, and leading industry research firms. This ensures a comprehensive understanding of political stability, economic trends, technological advancements, environmental regulations, and societal shifts impacting the automotive sector.