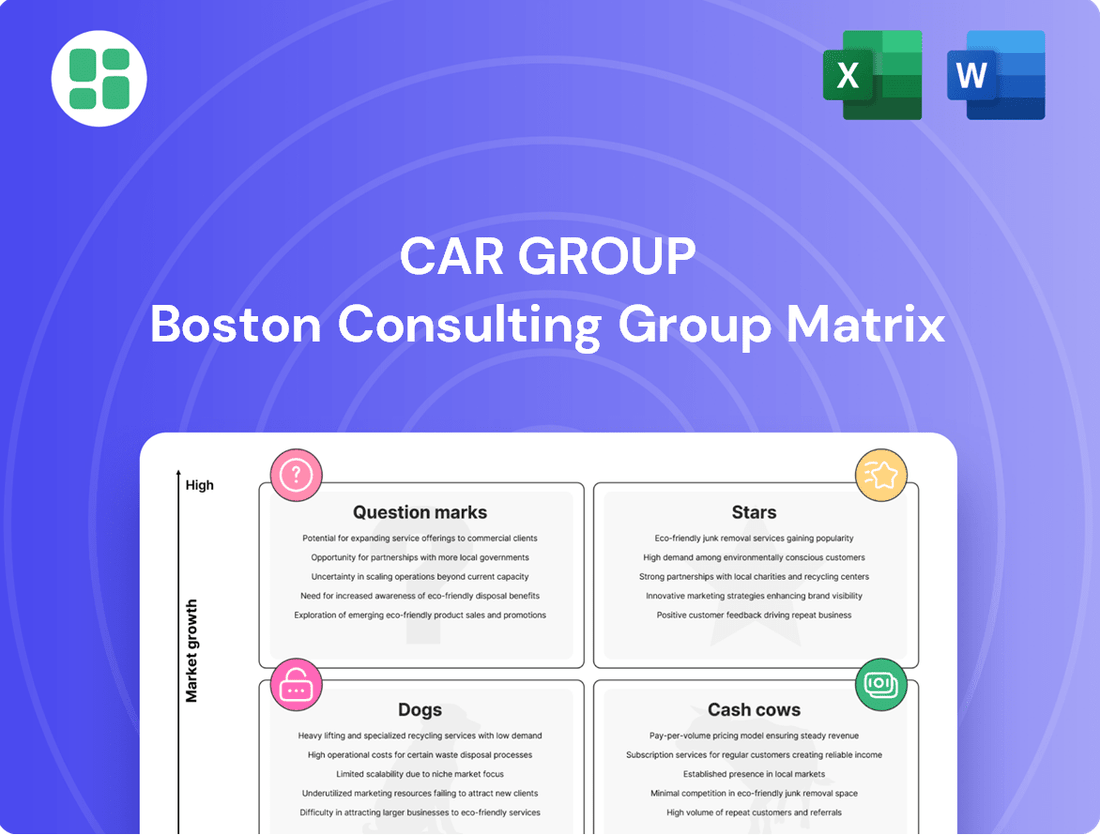

CAR Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAR Group Bundle

Understand how this company's product portfolio stacks up using the BCG Matrix – identifying Stars, Cash Cows, Dogs, and Question Marks. This essential framework reveals where to invest and where to divest for optimal growth and profitability.

Ready to transform your strategic planning? Purchase the full BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for maximizing your company's potential and outmaneuvering competitors.

Stars

Trader Interactive (US) is positioned as a Star within CAR Group's BCG Matrix, driven by its substantial growth prospects in the North American specialized vehicle and equipment classifieds sector. Its strong performance is a key contributor to CAR Group's overall expansion.

CAR Group's half-year report for FY25 underscored this, revealing robust revenue increases and positive EBITDA from its North American ventures, signaling Trader Interactive's increasing market share and successful integration.

Webmotors, a key player in CAR Group's portfolio, is experiencing robust growth in Brazil. This expansion is fueled by its nationwide reach, the introduction of innovative products, and a significant increase in finance-related transactions. In 2024, Brazil's automotive sector has seen a notable uptick in sales, creating a favorable environment for Webmotors to further solidify its market position.

Encar, a wholly-owned subsidiary of CAR Group in South Korea, is a standout performer. Its revenue has seen substantial growth, fueled by a strategic push into premium products and an increase in the yield per transaction. The company's home delivery service is also experiencing a significant uptick in usage.

The South Korean automotive market is robust, with domestic sales showing a healthy upward trend. A notable aspect of this market is the growing consumer interest in eco-friendly vehicles, which presents a prime opportunity for Encar to expand its value-added services and capitalize on this evolving demand.

Data & Insights Solutions

CAR Group's data and insights solutions are a significant growth driver, capitalizing on the extensive data generated across its automotive marketplaces. These offerings provide critical analytics and advertising tools tailored for the automotive sector.

The increasing reliance of the automotive industry on data for advertising, inventory optimization, and market intelligence positions these solutions for substantial growth. For example, in 2024, the automotive advertising market is projected to reach over $40 billion globally, underscoring the demand for data-driven insights.

- Data Monetization: CAR Group transforms raw marketplace data into actionable insights for manufacturers, dealers, and other industry stakeholders.

- Targeted Advertising: Leveraging deep consumer behavior data, CAR Group enables highly targeted advertising campaigns, improving ROI for automotive clients.

- Market Intelligence: The solutions offer comprehensive market trends, pricing analysis, and inventory insights, empowering strategic decision-making.

- Growth Potential: With the automotive digital advertising spend expected to grow by 10-15% annually through 2025, CAR Group's data solutions are well-positioned to capture this expansion.

New Digital Retail and Transactional Services

CAR Group is actively investing in new digital retail products and transactional services. Their goal is to build seamless experiences for individuals buying and selling vehicles privately. This strategic move is designed to capture greater value from each transaction.

These enhanced offerings include deeper product functionalities and streamlined consumer-to-consumer (C2C) payment processes. The market for online vehicle purchases is experiencing rapid growth as consumer preferences continue to shift towards digital channels.

- Digital Retail Expansion: CAR Group is focused on building out its digital retail capabilities to cater to the evolving needs of private car buyers and sellers.

- Transactional Service Enhancement: Investments are being made to improve transactional services, including C2C payment systems, to boost efficiency and value capture.

- High-Growth Market: The push into digital retail and transactional services aligns with the increasing consumer trend towards online vehicle purchasing, a segment showing significant growth potential.

Stars in CAR Group's BCG Matrix represent high-growth, high-market-share businesses. Trader Interactive (US), Webmotors (Brazil), and Encar (South Korea) are prime examples within CAR Group's portfolio, demonstrating significant expansion and market leadership. These entities are crucial for the group's overall growth trajectory.

CAR Group's data and insights solutions also fit the Star category, leveraging vast marketplace data for analytics and advertising. The global automotive advertising market, projected to exceed $40 billion in 2024, highlights the immense potential for these data-driven offerings.

The company's investment in digital retail and transactional services further solidifies its Star positioning. This strategic expansion into seamless private vehicle transactions taps into a rapidly growing online purchasing trend.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Trader Interactive (US) | High | High | Star |

| Webmotors (Brazil) | High | High | Star |

| Encar (South Korea) | High | High | Star |

| Data & Insights Solutions | High | High | Star |

What is included in the product

The CAR Group BCG Matrix analyzes product/business unit performance based on market share and growth, guiding investment decisions.

Quickly identify underperforming "Dogs" and resource-draining "Cash Cows" to optimize portfolio allocation.

Cash Cows

carsales.com.au's core Australian classifieds business is a prime example of a Cash Cow within the CAR Group's BCG Matrix. It commands a dominant market share in a mature yet steady Australian automotive classifieds sector.

This segment consistently generates significant cash flow, requiring minimal additional investment for promotion thanks to its strong brand and high user engagement. In the fiscal year 2023, carsales.com.au reported revenue of approximately AUD 630 million, showcasing its robust financial contribution.

The substantial cash generated by carsales.com.au is crucial for funding CAR Group's strategic initiatives, including international market expansion and the development of new digital products and services.

Australian Dealer Advertising Solutions, a cornerstone of CAR Group's portfolio, are true cash cows. Their market leadership in Australia, bolstered by deep, long-standing relationships with dealerships, ensures a consistent and robust revenue stream. This segment is characterized by a high proportion of recurring revenue, making it a predictable and reliable generator of cash for the company.

In 2024, CAR Group's Australian Dealer Advertising Solutions continued to demonstrate impressive financial performance. The segment reported strong revenue growth, driven by the sticky nature of its advertising contracts and the increasing digital spend by Australian automotive dealers. Adjusted EBITDA for these solutions also saw significant expansion, reflecting efficient operations and the mature, high-margin nature of the business.

Red Book, a prominent Australian vehicle valuation service acquired by CAR Group in 2007, stands as a mature and authoritative entity within the automotive industry. It reliably supplies critical valuation data to a broad spectrum of market participants, from dealerships to insurance companies.

This established position, coupled with the perpetual demand for precise vehicle data, translates into a consistent, high-margin revenue stream. Red Book requires minimal investment for growth, effectively functioning as a stable cash generator for CAR Group.

In 2024, the Australian used car market continued to see significant activity, with valuation services like Red Book playing a crucial role. While specific revenue figures for Red Book are not publicly disclosed, the broader automotive data and analytics sector in Australia is robust, indicating sustained demand for such services.

Australian Motorcycle and Marine Marketplaces

The Australian motorcycle and marine online marketplaces, while smaller than the automotive segment, represent mature businesses for CAR Group. These platforms have secured established market shares within their respective niches.

Leveraging the same core technology and operational efficiencies as the broader carsales platform, these marketplaces generate consistent, albeit low-growth, cash flow. This stability is driven by their dedicated and loyal user bases.

- Market Maturity: The motorcycle and marine segments are mature, indicating stable demand and established competition.

- Synergistic Benefits: Operational and technological efficiencies are shared with the larger automotive business, enhancing profitability.

- Consistent Cash Flow: These businesses contribute reliably to CAR Group's overall financial performance due to their niche but loyal customer segments.

- Limited Growth Potential: While stable, these segments are not expected to exhibit significant growth, characteristic of mature markets.

Established Subscription-Based Dealer Services

Established subscription-based dealer services within CAR Group's portfolio are prime examples of Cash Cows. These services, a staple for dealerships across Australia, generate consistent and predictable revenue. Their essential nature for dealership operations translates into robust customer loyalty and minimal need for significant capital expenditure, primarily requiring upkeep and minor enhancements.

The stability of these offerings is underscored by their long-term customer relationships. For instance, CAR Group's dealer services have consistently demonstrated high renewal rates, reflecting their integral role in dealer business operations. In 2023, CAR Group reported that its dealer services segment continued to be a significant contributor to overall revenue, with a substantial portion of this revenue being recurring.

- Predictable Revenue: The subscription model ensures a steady inflow of cash, making financial forecasting more reliable.

- High Retention: Dealers rely on these tools, leading to low churn and sustained income.

- Low Investment Needs: Minimal capital is required for growth, freeing up resources for other ventures.

- Stable Cash Generation: These services consistently produce surplus cash, a hallmark of a Cash Cow.

CAR Group's Australian Dealer Advertising Solutions are quintessential Cash Cows. Their market dominance in Australia, built on deep dealer relationships, ensures a consistent revenue stream with a high proportion of recurring income. In 2024, this segment showed strong revenue growth, fueled by sticky advertising contracts and increased digital ad spend by dealers.

Red Book, a long-standing vehicle valuation service, also operates as a Cash Cow. Its authoritative data is in constant demand across the automotive sector, generating a stable, high-margin income with minimal reinvestment needs. The Australian used car market's continued activity in 2024 underscores the enduring demand for Red Book's services.

The Australian motorcycle and marine online marketplaces, while smaller, function as mature Cash Cows for CAR Group. They hold established niche market shares and benefit from shared operational efficiencies, providing consistent, low-growth cash flow from loyal user bases.

Established subscription-based dealer services are also strong Cash Cows, offering predictable revenue due to high dealer retention and minimal capital expenditure requirements. These services are integral to dealer operations, ensuring sustained income and a reliable surplus cash generation.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue (Approx.) | 2024 Outlook |

| carsales.com.au (Australia) | Cash Cow | Dominant market share, mature market, low investment needs, high user engagement. | AUD 630 million | Continued strong cash generation, funding group initiatives. |

| Australian Dealer Advertising Solutions | Cash Cow | Market leadership, recurring revenue, strong dealer relationships, high margins. | Not explicitly broken out, but significant contributor. | Strong revenue and Adjusted EBITDA growth. |

| Red Book (Australia) | Cash Cow | Authoritative valuation data, perpetual demand, stable high-margin revenue, minimal growth investment. | Not publicly disclosed, but robust sector. | Sustained demand in active used car market. |

| Motorcycle & Marine Marketplaces (Australia) | Cash Cow | Established niche share, loyal user base, operational synergies, consistent low-growth cash flow. | Not publicly disclosed, but stable contributors. | Reliable cash generation from dedicated segments. |

| Subscription-based Dealer Services (Australia) | Cash Cow | Predictable subscription revenue, high retention, essential for dealers, low investment needs. | Significant contributor, high recurring revenue portion. | Continued stable cash flow and high renewal rates. |

Full Transparency, Always

CAR Group BCG Matrix

The CAR Group BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted by strategy professionals, offers actionable insights into your business portfolio's strategic positioning, ready for immediate implementation without any hidden watermarks or demo content.

Dogs

Underperforming legacy products or features, often found in the Dogs quadrant of the CAR Group BCG Matrix, represent offerings with low market share and low growth potential. These might be outdated advertising formats or clunky functionalities that have been surpassed by newer, more user-friendly alternatives. For instance, a platform might still offer banner ads, a format that saw its effectiveness decline significantly, with digital ad spending in formats like video and social media dominating in 2024.

These legacy items typically consume valuable resources, such as maintenance and support staff time, without generating substantial revenue or user engagement. In 2024, many companies are actively divesting or sunsetting such products to reallocate capital towards more innovative and profitable ventures. For example, a company might have a legacy CRM system that is costly to maintain and offers fewer features than modern cloud-based solutions, leading to a decision to phase it out.

Small, Non-Core International Ventures with Limited Scale represent those CAR Group operations in less significant international markets where market share and growth have stalled. These ventures often consume valuable resources without a clear path to becoming dominant players or delivering substantial profits.

For instance, if CAR Group's venture in a particular Southeast Asian market generated only $5 million in revenue in 2024, with a projected growth rate of 2% for the next three years, and holds a mere 1% market share in a fragmented industry, it would fit this category. Such operations might be candidates for divestiture or a strategic pivot to avoid continued resource drain.

Highly niche, low-demand classifieds represent segments within the automotive, motorcycle, or marine sectors that attract very little buyer or seller interest. These are often specialized parts, obscure vehicle models, or unique services with a tiny customer base. For example, classifieds for vintage marine engine parts or rare classic motorcycle accessories might fall into this category.

These segments typically exhibit minimal market share and little to no growth prospects, making them candidates for divestment or discontinuation. In 2024, platforms focusing on these areas might see transaction volumes in the hundreds rather than thousands, with average listing durations extending to several months due to the scarcity of interested parties. The return on investment for maintaining and marketing these specific classifieds is often negligible.

Divested Australian Tyres Business

The divested Australian Tyres business unit within CAR Group serves as a prime example of a 'Dog' in the BCG Matrix. This segment, excluded from proforma financial reporting, likely exhibited low growth and a small market share before its divestment. Such characteristics are hallmarks of a 'Dog' – a business that consumes resources without generating significant returns and is not central to the group's future strategic direction.

Prior to its divestment, the Australian Tyres business likely faced challenges in a competitive market, leading to its classification as a 'Dog'.

- Low Market Share: The business struggled to gain significant traction against established competitors in the Australian tyre market.

- Low Growth Prospects: The overall market for tyres in Australia may have been mature or experiencing slow growth, limiting the unit's potential.

- Strategic Non-Core: CAR Group's decision to divest indicates the business was not aligned with the company's core competencies or future growth strategy.

Outdated Technology Platforms Not Integrated with Core Business

Outdated technology platforms not integrated with CAR Group's core business represent a significant challenge. These legacy systems, often costly to maintain and inefficient, offer minimal returns and act as a drag on operational efficiency. Their lack of integration hinders seamless data flow and process automation, preventing CAR Group from fully leveraging its modern, unified platform for strategic growth.

Maintaining these disparate systems can incur substantial costs. For instance, in 2024, many companies reported spending upwards of 15-20% of their IT budget on maintaining legacy systems, a figure that could be significantly reduced by consolidation. This financial drain diverts resources that could otherwise be invested in innovation and growth initiatives.

- High Maintenance Costs: Legacy systems often require specialized, costly support and are prone to frequent breakdowns, leading to unplanned expenditures.

- Operational Inefficiencies: Lack of integration creates data silos and manual workarounds, slowing down processes and increasing the risk of errors.

- Limited Scalability: Outdated platforms struggle to adapt to evolving business needs and market demands, hindering CAR Group's ability to scale effectively.

- Security Vulnerabilities: Older systems are often more susceptible to cyber threats, posing significant risks to data integrity and business continuity.

Dogs in the CAR Group BCG Matrix represent business units or products with a low market share and low growth potential. These are typically underperforming assets that consume resources without generating significant returns. For example, a niche classifieds section with minimal user engagement and few transactions in 2024 would be considered a Dog.

Companies often consider divesting or discontinuing these 'Dog' segments to reallocate capital towards more promising ventures. The Australian Tyres business unit, divested by CAR Group, exemplifies this category, indicating it was not a strategic fit and offered limited future prospects.

These offerings often include outdated technology platforms that are costly to maintain and hinder operational efficiency. In 2024, such legacy systems can represent a substantial portion of IT budgets, diverting funds from innovation.

The strategic decision to exit or minimize investment in these 'Dog' areas is crucial for optimizing resource allocation and focusing on growth drivers.

Question Marks

Chileautos, along with other smaller international market entries, represents the Question Marks in CAR Group's BCG Matrix. These ventures are in developing digital classifieds markets, offering potential for growth, but currently hold a modest market share.

Significant investment is needed for these operations to gain traction and build brand awareness. For instance, in 2024, CAR Group continued to invest in expanding its presence in emerging markets, with a focus on digital innovation to compete effectively.

The future success of these smaller international markets remains uncertain, requiring careful strategic decisions regarding further investment or potential divestment. Their classification as Question Marks highlights the need for ongoing evaluation of their growth potential versus the resources required to achieve it.

CAR Group is heavily investing in advanced AI and machine learning to create sophisticated data products. These innovations aim to significantly improve the experience for both consumers browsing vehicles and advertisers looking to reach them. For instance, AI-powered personalization engines can tailor vehicle recommendations, potentially increasing engagement rates by up to 20% based on early testing in similar digital platforms.

While the potential for AI and machine learning in the automotive digital space is immense, their widespread market adoption and direct impact on market share are still in the early stages of development. This dynamic positions these advanced features as question marks within the CAR Group's BCG matrix, signifying high potential but also considerable uncertainty regarding their immediate strategic impact and competitive advantage.

CAR Group's expansion into EV-specific marketplaces positions them in a high-growth segment, aligning with the global EV boom. For instance, by mid-2024, EV sales in many key markets continued their upward trajectory, with some regions reporting EV market shares exceeding 15% of new vehicle registrations. This strategic move allows CAR Group to tap into a dedicated customer base actively seeking electric vehicles and related services, potentially capturing early market share in this rapidly developing sector.

New Consumer-to-Consumer (C2C) Payment Solutions

CAR Group's exploration into new consumer-to-consumer (C2C) payment solutions is positioned as a potential question mark within its BCG Matrix. The company is actively developing these services to streamline private transactions, aiming to attract a greater volume of peer-to-peer sales. However, the actual market penetration and revenue generation capabilities of these C2C payment offerings remain uncertain, requiring further validation.

The success of these C2C payment solutions hinges on several factors:

- Market Adoption: While CAR Group aims to simplify private sales, the willingness of consumers to adopt new payment platforms for C2C transactions is not guaranteed.

- Profitability Potential: The revenue models for these C2C payment services are still being tested, and their long-term profitability is yet to be established.

- Competitive Landscape: Existing payment providers and emerging fintech solutions present a crowded market, making it challenging for CAR Group to carve out a significant niche.

- Regulatory Environment: Changes in financial regulations could impact the development and deployment of these new payment technologies.

Exploration of Adjacent Automotive Ecosystem Services

Adjacent automotive ecosystem services represent a significant growth frontier for CAR Group, moving beyond traditional vehicle listings. These services, such as integrated vehicle financing and insurance offerings, tap into the entire car ownership lifecycle. For instance, by facilitating financing directly through its platform, CAR Group can capture a share of the lucrative automotive finance market, which in 2024 saw substantial activity with new car loan originations reaching billions globally.

Expanding into post-purchase services, like maintenance scheduling, warranty management, or even connected car data monetization, further diversifies CAR Group's revenue streams. These areas offer high growth potential by extending the company's value chain. In 2024, the automotive aftermarket services sector alone was valued in the hundreds of billions of dollars, indicating a vast opportunity for platforms that can effectively connect consumers with service providers.

- Vehicle Financing Integration: CAR Group can partner with financial institutions or develop its own financing solutions, capturing a portion of the loan origination fees and interest income.

- Insurance Partnerships: Offering bundled insurance policies at the point of sale or for existing vehicle owners creates a recurring revenue stream and enhances customer loyalty.

- Post-Purchase Services: Developing a network for maintenance, repairs, and parts, potentially leveraging data from connected vehicles, opens up a significant aftermarket revenue channel.

- Data Monetization: With user consent, anonymized data on vehicle usage, maintenance needs, and purchasing habits can be valuable for market research and targeted advertising.

Question Marks in CAR Group's portfolio represent areas with high growth potential but low market share, demanding significant investment to capture market position. These include emerging international markets and new technology ventures like AI-driven personalization and EV-specific marketplaces.

The strategic challenge lies in determining which of these Question Marks warrant further investment to become Stars, and which should be divested if they fail to gain traction. For instance, CAR Group's investment in AI aims to boost engagement by an estimated 20% on digital platforms, a key metric for these uncertain ventures.

The success of these initiatives, such as the development of C2C payment solutions, is contingent on market adoption, profitability, and navigating a competitive landscape. By mid-2024, the global EV market share continued to grow, offering a promising, yet still uncertain, avenue for CAR Group's specialized marketplaces.

CAR Group's expansion into adjacent automotive ecosystem services, like integrated financing and insurance, also falls into the Question Mark category. While the automotive finance market saw billions in new loan originations in 2024, and the aftermarket services sector is valued in the hundreds of billions, CAR Group's specific penetration into these areas is still developing.

| Category | CAR Group Initiative | Market Potential | Current Share | Strategic Consideration |

|---|---|---|---|---|

| Emerging Markets | Chileautos & Smaller International Entries | High (Developing Digital Classifieds) | Modest | Requires significant investment for growth and brand building. |

| Technology | AI & Machine Learning Data Products | Very High (Enhanced User Experience) | Early Stage / Unproven Market Impact | High potential but uncertain immediate strategic impact. |

| New Segments | EV-Specific Marketplaces | Very High (Global EV Boom) | Developing / Capturing Early Share | Leveraging rapid EV adoption trends. |

| Financial Services | C2C Payment Solutions | Moderate to High (Streamlining Private Sales) | Uncertain Market Penetration | Hinges on adoption, profitability, and competition. |

| Ecosystem Services | Vehicle Financing & Insurance Integration | High (Lucrative Automotive Finance Market) | Developing / Capturing Share | Potential for recurring revenue and customer loyalty. |

BCG Matrix Data Sources

Our CAR Group BCG Matrix leverages comprehensive data, including financial performance, market share analysis, industry growth rates, and competitor intelligence, to provide a strategic overview.