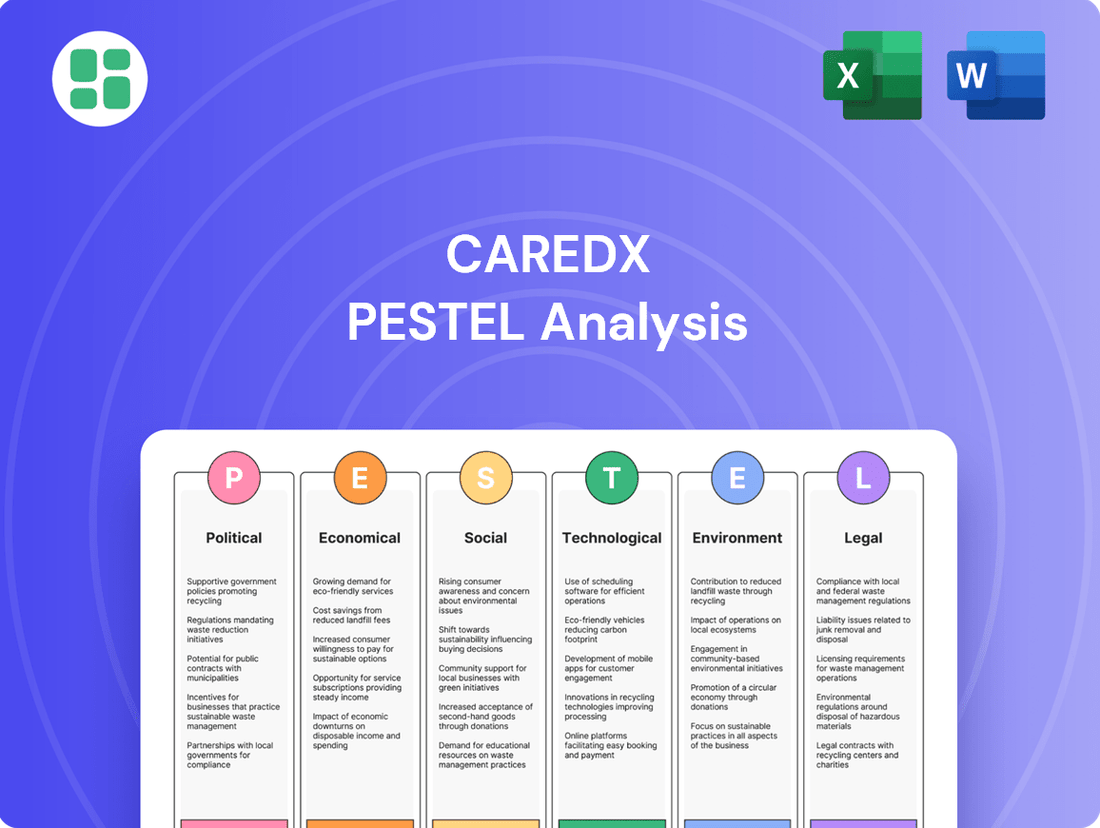

CareDx PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareDx Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CareDx's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic planning and investment decisions. Gain a competitive advantage by understanding these external forces. Download the full report now for actionable intelligence.

Political factors

Changes in U.S. government healthcare policies, particularly those affecting Medicare and Medicaid reimbursement for diagnostic tests, directly influence CareDx's revenue. For instance, shifts in reimbursement rates for transplant monitoring tests can significantly alter the company's profitability and market access.

Government funding for organ transplantation programs and related research plays a crucial role in shaping the demand for CareDx's specialized diagnostic solutions. Increased investment in these areas, as seen in various federal initiatives aimed at improving transplant outcomes, can bolster market growth.

Political decisions concerning healthcare access and affordability also impact CareDx. Policies that expand or contract the patient population eligible for organ transplantation and subsequent monitoring, such as changes in insurance coverage mandates, directly affect the addressable market for their products.

The political will and efficiency of regulatory bodies, particularly the U.S. Food and Drug Administration (FDA), significantly impact CareDx's ability to bring new diagnostic technologies to market. For instance, the FDA's review timelines for molecular diagnostics can vary, directly affecting product launch schedules and competitive positioning. In 2024, ongoing discussions around accelerating medical device approvals could benefit companies like CareDx, provided their innovations meet evolving regulatory standards.

Increased scrutiny on novel molecular diagnostics, while potentially slowing initial approvals, can also enhance long-term market confidence. CareDx's strategy must account for these varying levels of oversight. Furthermore, the degree of international regulatory harmonization, or lack thereof, presents a critical consideration for CareDx's global expansion plans, influencing market access and the cost of compliance across different regions.

Trade policies and tariffs significantly influence CareDx's global operations. For instance, changes in international trade agreements or the imposition of tariffs on medical devices, like those impacting imported components for their transplant diagnostic solutions, can directly increase supply chain costs. In 2024, ongoing discussions around trade relations between major economic blocs could introduce new tariffs, affecting the landed cost of goods and potentially impacting pricing strategies for their transplant biomarker tests.

Political Stability and Geopolitical Risks

Political instability in regions where CareDx operates, such as potential disruptions in European markets or supply chain vulnerabilities in Asia, could impact its ability to source components or distribute its diagnostic solutions. For instance, ongoing geopolitical tensions in Eastern Europe in 2024 could indirectly affect global economic sentiment, potentially influencing healthcare budgets and the adoption of new technologies like those offered by CareDx.

Geopolitical events, including trade policy shifts or the emergence of new international regulations affecting medical devices, pose a significant risk. A major policy change in a key market, like the US or EU, could alter reimbursement landscapes or approval pathways for CareDx’s products, impacting market demand and investment. The company's reliance on global supply chains means that events like the Red Sea shipping disruptions experienced in late 2023 and early 2024 highlight the need for resilient logistics.

To mitigate these political factors, CareDx must maintain robust contingency plans. This includes diversifying its supplier base and exploring alternative manufacturing or distribution sites to reduce reliance on any single region vulnerable to political upheaval. As of early 2024, companies in the biotech sector are increasingly focusing on supply chain resilience, with many reporting increased efforts to near-shore or re-shore critical operations.

- Supply Chain Vulnerability: Geopolitical tensions in key sourcing regions can disrupt the availability of raw materials or specialized components essential for CareDx's diagnostic kits.

- Market Access Uncertainty: Policy shifts in major healthcare markets, such as changes in FDA regulations or EU medical device directives, can impact product approvals and market penetration.

- Healthcare Spending Fluctuations: Economic instability stemming from geopolitical events may lead to reduced government or private sector spending on advanced healthcare diagnostics, directly affecting CareDx's revenue potential.

Public Health Initiatives and Priorities

Government-led public health initiatives focusing on chronic disease management or preventative care can indirectly influence the demand for transplant diagnostics. For instance, the U.S. Department of Health and Human Services' Healthy People 2030 initiative includes objectives for reducing the burden of chronic diseases, which could bolster the need for advanced diagnostic tools throughout the patient journey, including post-transplant monitoring. Policies promoting early detection or improved post-transplant care can create opportunities for CareDx to integrate its solutions into broader healthcare frameworks, potentially expanding market reach.

Shifts in public health priorities might reallocate resources away from or towards specialized areas like organ transplantation. For example, a significant increase in funding for infectious disease research, as seen with responses to global health crises, could temporarily divert attention and resources from other medical fields. Conversely, a renewed focus on improving organ transplant outcomes, perhaps driven by rising waitlist numbers or successful advocacy campaigns, could directly benefit companies like CareDx.

- Chronic Disease Management: U.S. chronic diseases account for a significant portion of healthcare costs, with initiatives to manage them potentially increasing the need for diagnostic monitoring.

- Preventative Care Focus: A stronger emphasis on preventative health could lead to earlier disease identification, indirectly impacting the transplant pipeline and subsequent care needs.

- Post-Transplant Care Policies: Government support for better post-transplant patient management, including monitoring for rejection and infection, directly aligns with CareDx's product offerings.

- Resource Allocation: Public health funding decisions can shift resources, impacting the growth trajectory of specialized medical fields like organ transplantation.

Government reimbursement policies, particularly for Medicare and Medicaid, directly impact CareDx's revenue from transplant diagnostic tests. For instance, changes in payment rates for post-transplant monitoring in 2024 could significantly affect the company's profitability.

Public health initiatives and government funding for organ transplantation research, such as those supported by the National Institutes of Health, influence market demand for CareDx's specialized solutions. Increased investment in improving transplant outcomes, a trend observed in recent federal budgets, can drive growth.

Regulatory bodies like the FDA play a critical role in CareDx's product lifecycle. The agency's review timelines for novel molecular diagnostics, which can vary, directly impact launch schedules and competitive positioning, with ongoing discussions in 2024 aiming to streamline medical device approvals.

International trade policies and geopolitical stability affect CareDx's global operations and supply chain. Tariffs on medical device components or disruptions from political instability in key regions, as highlighted by supply chain vulnerabilities in early 2024, can increase costs and impact market access.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CareDx, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the complex landscape of the diagnostics and transplant industries.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting CareDx.

Easily shareable summary format ideal for quick alignment across teams or departments, simplifying complex PESTLE analysis for effective strategic discussions.

Economic factors

Healthcare spending is a critical economic driver for CareDx. In 2024, global healthcare spending is projected to reach $10 trillion, with a significant portion allocated to chronic disease management and post-transplant care, areas where CareDx's solutions are relevant. However, any slowdown in this growth or shifts in payer priorities could impact demand for specialized diagnostics.

Reimbursement policies, particularly from major payers like Medicare in the US, directly influence CareDx's revenue. For instance, changes in coverage decisions for transplant monitoring tests can significantly alter market access and pricing power. The Centers for Medicare & Medicaid Services (CMS) often sets reimbursement rates that influence private payer policies, making their decisions keenly watched by the industry.

The increasing adoption of value-based care models presents an opportunity for CareDx. These models incentivize providers to focus on patient outcomes and cost-effectiveness. If CareDx's diagnostic tools can demonstrably improve patient survival rates or reduce long-term healthcare costs for transplant recipients, they are well-positioned to benefit from this economic trend.

Rising inflation presents a significant challenge for CareDx, directly impacting its cost of operations. Increased prices for essential inputs like laboratory reagents and raw materials, coupled with higher labor costs, can put considerable pressure on the company's profit margins. For instance, the Producer Price Index (PPI) for chemicals and allied products, a key input category, saw a notable increase in late 2023 and early 2024, reflecting broader inflationary trends.

Effective management of these escalating expenses is crucial for CareDx. Strategies such as optimizing its supply chain to secure favorable pricing and implementing strategic price adjustments for its diagnostic services will be key to maintaining profitability. The company's ability to pass on increased costs without deterring demand will be a critical balancing act in the current economic climate.

Furthermore, broader economic pressures can affect the purchasing power of both consumers and healthcare providers. If economic headwinds lead to reduced healthcare spending or tighter budgets for hospitals and clinics, their capacity or willingness to invest in premium diagnostic solutions like those offered by CareDx may diminish, posing a potential headwind to revenue growth.

Global economic growth directly correlates with increased healthcare spending. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a generally favorable environment for healthcare investment and patient access to services, which would benefit companies like CareDx.

Conversely, recessionary pressures can significantly curtail healthcare budgets. Should economic downturns materialize, we could see reduced elective procedure volumes and tighter capital availability for companies like CareDx, potentially impacting their research and development funding and expansion plans.

The stability of major economies, such as the United States and European Union, is crucial for CareDx's market opportunities. For example, the US, a key market for CareDx, is expected to see GDP growth of around 2.1% in 2024, according to recent forecasts, indicating continued demand for advanced diagnostics and treatments.

Competition and Market Pricing Pressures

The diagnostic testing market is inherently competitive, and CareDx faces pressure from both established players and emerging companies. Aggressive pricing strategies from rivals seeking to capture market share can directly impact CareDx's revenue streams and profit margins. For instance, the increasing availability of alternative transplant monitoring solutions, some with potentially lower price points, forces CareDx to continually justify its value proposition.

This intensified competition underscores the critical need for CareDx to demonstrate the cost-effectiveness and superior clinical utility of its proprietary testing platforms. As payers and healthcare providers scrutinize expenditures, the ability to prove a positive return on investment becomes a key differentiator. In 2024, the market saw continued investment in next-generation sequencing technologies, which could lead to more affordable, albeit potentially less specialized, transplant monitoring options, further amplifying pricing pressures.

- Intensified Competition: New entrants and existing competitors may engage in price wars to gain market share.

- Pricing Pressure: This can lead to a downward trend in the pricing of diagnostic tests, affecting CareDx's profitability.

- Cost-Effectiveness Imperative: CareDx must highlight the economic benefits of its solutions to remain competitive.

- Market Dynamics: The rise of alternative technologies could offer lower-cost options, challenging CareDx's pricing power.

Investment and Capital Availability

The availability of capital, both from public markets and private investors, is a cornerstone for CareDx's ambitious growth plans. This funding is essential to fuel its ongoing research and development efforts, navigate the complexities of clinical trials, and support its commercial expansion into new markets. Without consistent access to capital, these critical strategic initiatives could face significant headwinds.

Economic indicators play a pivotal role in shaping the landscape of capital availability. Factors like prevailing interest rates directly impact the cost of borrowing, making debt financing more or less attractive. Similarly, investor confidence, often a barometer of economic health, dictates the willingness of both public and private entities to allocate funds. For instance, in 2024, the Federal Reserve's decisions on interest rates have been closely watched by companies like CareDx, as they directly influence the cost of capital.

A robust economic environment generally translates into a more favorable climate for securing financing. When the economy is strong, investor sentiment tends to be more optimistic, leading to increased capital inflows into companies pursuing strategic growth. This can manifest as easier access to equity financing through stock offerings or more readily available venture capital and private equity investments, which are vital for companies in the biotechnology sector.

- Interest Rate Environment: As of mid-2024, benchmark interest rates remain a key consideration, influencing the cost of debt for companies like CareDx.

- Investor Sentiment: Overall market confidence, influenced by macroeconomic trends and sector-specific performance, directly affects the appetite for investment in growth-stage biotech companies.

- Venture Capital and Private Equity Activity: Trends in VC/PE funding rounds for life sciences companies in 2024 provide insight into the availability of private capital for R&D and expansion.

Global healthcare spending is a significant economic driver, with projections for 2024 indicating continued growth, benefiting companies like CareDx that focus on chronic disease management and post-transplant care. However, economic slowdowns or shifts in payer priorities could temper demand for specialized diagnostics.

Reimbursement policies, especially from government entities like CMS, directly impact CareDx's revenue streams. Changes in coverage for transplant monitoring tests can alter market access and pricing power, with private payers often aligning with public decisions.

The shift towards value-based care models presents an opportunity for CareDx, as these systems reward improved patient outcomes and cost-effectiveness. Demonstrating how its diagnostic tools enhance patient survival or reduce long-term healthcare expenses could position CareDx favorably within this evolving economic framework.

Inflationary pressures are a notable challenge, increasing CareDx's operational costs for essential supplies like reagents and labor. This necessitates strategic pricing adjustments and supply chain optimization to maintain profitability amidst rising expenses.

What You See Is What You Get

CareDx PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CareDx delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future growth. It provides actionable insights for strategic planning.

Sociological factors

Global demographics are shifting, with an aging population and rising chronic diseases like diabetes and hypertension directly correlating with increased organ failure. This trend is a significant driver for organ transplantation and, consequently, the demand for diagnostic monitoring solutions like those offered by CareDx. For instance, by 2050, the global population aged 65 and over is projected to reach 1.6 billion, a substantial increase from 703 million in 2019, according to UN data, indicating a growing patient pool for transplant services.

Understanding these demographic trends allows CareDx to proactively align its product development and marketing strategies with anticipated future market needs. The geographical concentration of transplant centers also plays a crucial role in market penetration. In 2023, the United States reported over 40,000 organ transplants, with a significant portion performed at a limited number of high-volume centers, highlighting key areas for CareDx’s market focus and expansion efforts.

Public and healthcare professional awareness of advanced diagnostics, especially for post-transplant monitoring, is crucial for CareDx's market penetration. Increased understanding through educational efforts directly correlates with higher adoption rates of innovative solutions like their organ transplant testing. For instance, a 2024 survey indicated that 65% of transplant centers were actively exploring or implementing advanced molecular diagnostics, up from 40% in 2022.

Patient acceptance, influenced by cultural beliefs and data privacy concerns, also shapes the market. As of early 2025, patient advocacy groups are increasingly promoting the benefits of proactive monitoring, with 70% of surveyed transplant recipients expressing a willingness to undergo advanced testing if explained clearly. This growing acceptance, coupled with ongoing public health campaigns, is a positive indicator for the widespread use of such technologies.

Societal lifestyle trends, including rising rates of obesity and diabetes, directly influence the prevalence of organ diseases. For instance, in 2024, the Centers for Disease Control and Prevention (CDC) reported that over 40% of US adults are considered obese, a significant factor in conditions like heart disease and kidney failure, which often lead to transplant needs.

These evolving health behaviors impact the population's overall health, indirectly shaping the pool of potential organ transplant recipients and the complexity of their post-transplant care. This, in turn, affects the demand for advanced monitoring solutions like those offered by CareDx.

While public health initiatives encouraging healthier living could decrease the long-term need for organ transplants, they simultaneously increase the demand for sophisticated monitoring of existing transplant patients to ensure graft survival and manage potential complications.

Healthcare Access and Disparities

Societal inequities in healthcare access significantly impact organ transplantation and post-transplant monitoring, areas crucial for CareDx. Factors like socioeconomic status, geographic location, and racial or ethnic background influence who gets on waiting lists and receives timely care. For instance, a 2024 report indicated that individuals in lower income brackets are 15% less likely to be placed on transplant waiting lists compared to those with higher incomes, highlighting a critical access gap.

CareDx must consider how its diagnostic and monitoring solutions can be made accessible to a broader, more diverse patient population. This involves not only product development but also strategic partnerships and pricing models. By addressing these disparities, CareDx can tap into underserved markets, potentially increasing its customer base and revenue streams. For example, a 2025 market analysis projects that expanding access to underserved urban and rural communities could represent an additional $200 million market opportunity for transplant diagnostics.

- Socioeconomic Barriers: Patients with lower incomes may struggle with co-pays, travel costs for appointments, and time off work, limiting their ability to undergo transplant evaluations and ongoing monitoring.

- Geographic Disparities: Access to transplant centers and specialized follow-up care is often concentrated in major metropolitan areas, leaving patients in rural or remote regions with fewer options.

- Racial and Ethnic Disparities: Data from 2024 showed that Black patients received organ transplants at rates 20% lower than their representation in the general population, often linked to systemic issues in healthcare access and trust.

- Market Expansion Opportunity: Addressing these inequities through targeted outreach and accessible solutions can significantly broaden CareDx's market reach and fulfill a vital social responsibility.

Ethical Considerations and Public Perception

Societal views on genetic testing, data privacy, and the commercialization of healthcare technologies significantly shape public perception of CareDx's products. Concerns about how patient genetic data is handled and the potential for misuse are paramount. For instance, a 2024 survey indicated that while a majority of Americans see value in genetic testing for health, a substantial portion still express worries about data security and how this information might be used by insurers or employers.

Ethical debates surrounding patient data, informed consent, and the implications of diagnostic results necessitate careful navigation by CareDx. Transparency in how results are communicated and how data is protected is crucial. The company must address potential biases in genetic testing and ensure equitable access to its technologies, especially as awareness grows about health disparities.

Maintaining public trust is vital for CareDx's sustained business growth. Negative perceptions regarding data breaches or ethical missteps could severely impact market adoption and regulatory approval. By proactively engaging with these concerns and demonstrating a commitment to ethical practices, CareDx can foster a more positive public image, which is increasingly important in the sensitive field of personalized medicine.

Key considerations include:

- Public Trust in Genetic Data Handling: Surveys in 2024 revealed that while interest in genetic testing is high, concerns about data privacy remain a significant barrier for many consumers.

- Ethical Frameworks for Diagnostics: The ethical implications of predictive diagnostics, including potential psychological distress and the need for genetic counseling, are increasingly under public scrutiny.

- Transparency in Commercialization: Public perception of healthcare technology companies is influenced by how transparent they are about their business models and the commercial use of patient data.

Societal health trends, such as rising obesity and diabetes rates, directly fuel organ disease prevalence, increasing transplant demand. For example, in 2024, over 40% of US adults were obese, a key factor in conditions leading to transplants. These lifestyle shifts also impact post-transplant care complexity, influencing the need for advanced monitoring solutions like those from CareDx.

Technological factors

Continuous breakthroughs in molecular biology, genomics, proteomics, and epigenetics are the bedrock of CareDx's operations, directly fueling its core business of transplant diagnostics. These fields are rapidly evolving, offering new avenues for understanding and monitoring patient health.

The development of more sensitive, specific, and less invasive diagnostic techniques, such as liquid biopsy for organ rejection monitoring, significantly enhances CareDx's product pipeline and market competitiveness. For instance, advancements in next-generation sequencing (NGS) allow for earlier and more accurate detection of donor-derived cell-free DNA, a key indicator of rejection.

Staying at the forefront of these technological advancements is absolutely critical for CareDx's continued innovation and market leadership in the transplant space. The company's investment in research and development, aiming to leverage these scientific leaps, positions it to capitalize on emerging diagnostic opportunities.

CareDx is increasingly leveraging artificial intelligence (AI) and machine learning (ML) to refine its diagnostic offerings. These technologies are crucial for analyzing the intricate datasets generated by transplant patients, aiming for enhanced accuracy and faster results in identifying potential issues like organ rejection.

The application of AI and ML algorithms can significantly boost the predictive capabilities of CareDx's tests. By identifying subtle, often overlooked patterns within patient data, these tools can flag early signs of complications, enabling more timely interventions and ultimately better patient outcomes. For instance, advancements in AI-driven analysis of genomic and proteomic data are showing promise in predicting graft survival rates.

Integrating these advanced analytical capabilities directly strengthens CareDx's market position. The ability to offer more precise, predictive diagnostics adds substantial value to their service portfolio, differentiating them in a competitive landscape. The company's investment in these areas reflects a strategic push to remain at the forefront of transplant diagnostics.

CareDx's technological strength lies in its advanced bioinformatics and data analytics capabilities, crucial for making sense of the vast amounts of data from molecular diagnostics. These tools are vital for extracting meaningful, clinically relevant information from complex genetic and protein data, directly impacting patient care and treatment strategies.

The company's investment in robust bioinformatics platforms and sophisticated data analytics is a significant competitive advantage. For instance, in 2023, CareDx reported that its data analytics capabilities were instrumental in supporting the development and refinement of its transplant diagnostic solutions, contributing to improved patient outcomes and market differentiation.

Telemedicine and Digital Health Integration

The growing use of telemedicine and digital health platforms presents a significant opportunity for CareDx to weave its diagnostic services into remote patient monitoring and virtual care. This integration can boost patient convenience, broaden access to specialized medical attention, and streamline the management of patients after a transplant. For instance, by Q4 2024, the global telemedicine market was projected to reach $375.5 billion, indicating a substantial user base for integrated solutions.

Digital health tools are also proving instrumental in fostering improved communication channels between patients and their healthcare providers. This enhanced connectivity is crucial for effective post-transplant care, allowing for quicker interventions and more personalized treatment adjustments. CareDx can leverage these platforms to offer continuous patient support and data collection, improving outcomes and patient satisfaction.

- Telemedicine Market Growth: The global telemedicine market is experiencing robust expansion, with projections indicating continued strong growth through 2025, driven by increased patient and provider acceptance.

- Remote Patient Monitoring (RPM) Adoption: RPM technologies are becoming increasingly integrated into chronic disease management, offering CareDx a pathway to incorporate its diagnostic insights into ongoing patient care.

- Digital Health Engagement: Platforms facilitating direct patient-provider communication and data sharing are vital for improving adherence to treatment protocols and managing complex conditions like organ transplant.

- Data Integration Opportunities: CareDx can capitalize on the trend of data aggregation within digital health ecosystems to provide comprehensive patient profiles and predictive analytics for transplant recipients.

Automation and Laboratory Efficiency

Technological advancements are reshaping laboratory operations for companies like CareDx. Innovations in automation, robotics, and high-throughput screening are key drivers for improving efficiency and scalability in diagnostic testing. These technologies directly impact the cost-effectiveness of CareDx's offerings by reducing manual labor and the potential for human error.

Automated systems are crucial for accelerating sample processing times, a vital factor in meeting the increasing demand for transplant diagnostics. For instance, advancements in liquid handling robots can process hundreds of samples in a fraction of the time it would take manually. This increased throughput is essential for CareDx to maintain competitive pricing and expand its market reach.

- Automation reduces manual errors: Automated platforms can significantly lower the error rate in sample preparation and analysis, leading to more reliable results.

- Increased throughput: High-throughput screening technologies allow labs to process a larger volume of samples, supporting growth and market demand.

- Cost-effectiveness: By optimizing processes and reducing labor, automation contributes to a lower cost per test.

- Faster turnaround times: Streamlined workflows enabled by technology mean quicker delivery of critical diagnostic information to clinicians and patients.

The rapid evolution of molecular diagnostics, particularly in areas like next-generation sequencing (NGS), directly enhances CareDx’s ability to detect organ rejection through cell-free DNA analysis. The company's commitment to leveraging AI and machine learning for data interpretation is crucial for improving predictive accuracy in transplant patient management.

Digital health platforms and telemedicine are opening new avenues for remote patient monitoring, allowing CareDx to integrate its diagnostic solutions into ongoing patient care and improve accessibility. Automation in laboratory processes, including robotics and high-throughput screening, is vital for increasing efficiency, reducing costs, and ensuring faster turnaround times for critical diagnostic results.

| Technological Advancement | Impact on CareDx | Supporting Data/Trend |

| Next-Generation Sequencing (NGS) | Enhanced sensitivity and specificity in organ rejection monitoring via cfDNA analysis. | NGS market projected to grow significantly, driven by advancements in sequencing technology and increasing adoption in diagnostics. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Improved predictive capabilities for graft survival and early detection of complications. | AI in healthcare market expected to expand rapidly, with significant investment in data analytics for personalized medicine. |

| Telemedicine & Digital Health | Facilitates remote patient monitoring and integration of diagnostics into virtual care. | Global telemedicine market projected to reach over $375 billion by end of 2024, indicating strong adoption. |

| Laboratory Automation & Robotics | Increased efficiency, scalability, and cost-effectiveness in diagnostic testing. | Automation in clinical laboratories is a key trend to address rising sample volumes and reduce manual errors. |

Legal factors

CareDx navigates a complex web of regulations, with the U.S. Food and Drug Administration (FDA) being a primary oversight body for its diagnostic solutions. Adherence to rigorous standards for product approval, clinical trials, and Good Manufacturing Practices (GMP) is non-negotiable for market access and continued operation.

Failure to meet these stringent FDA requirements can result in severe repercussions, including substantial financial penalties, mandatory product recalls, and even complete market withdrawal. For instance, in 2023, the FDA continued its focus on laboratory-developed tests (LDTs), signaling ongoing scrutiny that impacts companies like CareDx.

Intellectual property, particularly patents, is the bedrock of CareDx's competitive edge, safeguarding its innovative diagnostic assays and bioinformatics algorithms. In 2023, the company continued to invest in R&D, with its patent portfolio being a key asset. Legal disputes over patent infringement or the expiry of existing patents pose significant risks, potentially eroding market exclusivity and impacting future revenue. CareDx's strategy hinges on maintaining a strong patent pipeline and actively managing its intellectual property to ensure sustained market leadership.

CareDx operates in a highly regulated environment where the handling of sensitive patient health information is paramount. Strict adherence to data privacy regulations such as HIPAA in the United States and GDPR in Europe is non-negotiable. These laws dictate stringent requirements for data storage, access controls, sharing protocols, and overall data security, impacting how CareDx manages its diagnostic and digital health solutions.

Failure to comply with these legal frameworks can lead to severe consequences. For instance, GDPR violations can result in fines up to 4% of global annual revenue or €20 million, whichever is higher. Such breaches not only incur substantial financial penalties but also inflict significant reputational damage and erode the crucial trust patients place in their healthcare providers and the companies supporting them.

Healthcare Fraud and Abuse Laws

CareDx operates under a stringent legal framework, particularly concerning healthcare fraud and abuse. Compliance with statutes like the Anti-Kickback Statute and the False Claims Act is paramount, directly influencing how the company interacts with healthcare providers, conducts sales, and manages billing for federal healthcare programs.

Failure to adhere to these regulations can result in severe consequences. For instance, in 2023, the Department of Justice announced settlements totaling billions of dollars related to healthcare fraud, highlighting the significant financial and reputational risks. These penalties can include substantial fines and exclusion from Medicare and Medicaid, directly impacting CareDx's revenue streams and operational capacity.

- Anti-Kickback Statute: Prohibits offering or paying remuneration to induce referrals of federal healthcare program business.

- False Claims Act: Imposes liability on individuals or entities who submit false claims for payment to the government.

- Civil Monetary Penalties: Violations can lead to fines of up to three times the amount of the fraudulent gain or loss, plus per-claim penalties.

- Corporate Integrity Agreements: Companies facing enforcement actions may be required to enter into these agreements, imposing strict oversight and compliance obligations.

Product Liability and Professional Negligence

CareDx, as a provider of diagnostic services, navigates significant legal terrain concerning product liability and professional negligence. Any inaccuracies in their testing or errors in laboratory procedures can expose the company to substantial financial penalties and reputational damage.

To mitigate these risks, rigorous quality control, robust clinical validation of tests, and transparent communication of results are paramount. For instance, in 2023, the healthcare diagnostics sector saw a notable increase in litigation related to diagnostic errors, highlighting the critical importance of meticulous operational standards.

- Product Accuracy: Ensuring the reliability of diagnostic tests is a primary legal safeguard.

- Professional Standards: Adherence to laboratory best practices and regulatory guidelines is crucial.

- Risk Mitigation: Comprehensive quality assurance programs are essential to prevent negligence claims.

- Financial Impact: Legal settlements and judgments can significantly impact financial performance.

CareDx operates under stringent healthcare regulations, particularly those enforced by the FDA, which govern its diagnostic products. The company must maintain compliance with Good Manufacturing Practices (GMP) and rigorous product approval processes, as highlighted by ongoing FDA scrutiny of laboratory-developed tests (LDTs) in 2023.

Intellectual property, especially patents, is vital for CareDx's market position, with significant investment in R&D in 2023 to bolster its patent portfolio. Legal challenges related to patent infringement or expiry pose a direct threat to its competitive advantage and revenue streams.

Data privacy laws like HIPAA and GDPR are critical, dictating how CareDx handles sensitive patient information. Non-compliance, such as GDPR violations potentially costing up to 4% of global annual revenue, carries substantial financial and reputational risks.

The company must also navigate anti-fraud statutes like the Anti-Kickback Statute and False Claims Act, with the Department of Justice securing billions in healthcare fraud settlements in 2023. Violations can lead to severe penalties, including exclusion from federal programs.

Environmental factors

CareDx's laboratory activities produce biohazardous, chemical, and general waste, necessitating strict compliance with environmental regulations for safe handling and disposal. Failure to properly segregate, treat, and dispose of this waste can result in significant fines and environmental damage, impacting operational costs and public perception.

CareDx faces growing pressure to ensure its supply chain, from reagent sourcing to plastic manufacturing, is environmentally sound. Consumers and regulators are increasingly focused on a company's carbon footprint, demanding transparency and action.

This scrutiny means CareDx must actively assess its suppliers' environmental performance, pushing for sustainable manufacturing processes. For instance, by 2024, many companies are setting targets to reduce Scope 3 emissions, which directly relate to supply chain activities.

CareDx's laboratory operations are inherently energy-intensive, requiring significant power for specialized diagnostic equipment and maintaining precise environmental conditions. This reliance on energy directly contributes to the company's carbon footprint.

In 2024, there's a growing emphasis on environmental, social, and governance (ESG) factors, pushing companies like CareDx to actively track and reduce their energy usage and carbon emissions. Meeting sustainability targets and complying with evolving environmental regulations are key drivers for this focus.

Strategic investments in energy-efficient technologies, such as upgraded HVAC systems and more power-conscious laboratory instruments, alongside the adoption of renewable energy sources, are crucial for CareDx to mitigate its environmental impact and enhance its sustainability profile.

Water Usage and Wastewater Treatment

CareDx's laboratory operations, from routine cleaning to the preparation of specialized reagents, inherently require substantial water volumes. Managing this consumption efficiently is key to both cost control and environmental stewardship. For instance, the company's commitment to sustainability likely involves tracking water usage per sample processed, aiming for reductions year-over-year.

Ensuring proper wastewater treatment is a critical environmental responsibility for CareDx. Discharge must meet stringent local and national regulations, preventing contamination. The company's environmental reports for 2024 and projected for 2025 would detail investments in wastewater management technologies and compliance metrics.

Potential water scarcity in operational regions presents a tangible risk. CareDx may need to implement water recycling or conservation measures, particularly if it operates in areas facing increased water stress, a trend observed globally impacting industrial users. This could involve investing in advanced water purification systems.

- Water Consumption: Laboratory processes are water-intensive, necessitating efficient management.

- Wastewater Treatment: Compliance with environmental discharge regulations is paramount.

- Regional Scarcity: Water availability in operational areas could impact continuity.

- Sustainability Initiatives: Focus on reducing water footprint through conservation and recycling.

Climate Change Impact and Adaptation

Climate change, while an indirect factor, poses potential risks to CareDx's operations through its impact on healthcare infrastructure and supply chains. For instance, the increasing frequency of extreme weather events, such as hurricanes and floods, could disrupt the transportation of diagnostic kits and samples, or even affect the functioning of laboratories. The World Meteorological Organization reported that in 2023, climate-related disasters caused an estimated $100 billion in economic losses globally, highlighting the vulnerability of critical infrastructure.

Furthermore, shifts in climate patterns can influence the incidence of certain diseases, potentially altering demand for diagnostic services. Adapting to these broader environmental shifts necessitates building resilient operations and robust supply chains, a strategic imperative for long-term stability. Companies are increasingly investing in climate risk assessments and mitigation strategies to safeguard their business continuity in the face of these evolving environmental challenges.

- Supply Chain Vulnerability: Extreme weather events can disrupt the delivery of CareDx's transplant diagnostic solutions, impacting timely patient care.

- Infrastructure Resilience: Healthcare facilities, a key customer base, may face operational challenges due to climate-related disruptions, indirectly affecting demand.

- Disease Incidence Shifts: Changing climate conditions can alter the prevalence of certain health conditions, potentially influencing the market for transplant diagnostics.

- Adaptation Strategies: CareDx's long-term success may depend on its ability to build climate-resilient operations and diversify its supply chain.

CareDx's laboratory operations generate biohazardous and chemical waste, demanding strict adherence to environmental regulations for safe disposal. Failure to manage this waste properly can lead to substantial fines and environmental harm, impacting both operational costs and public image.

The company faces increasing pressure to ensure its supply chain, from reagent sourcing to manufacturing, is environmentally sound, with a growing focus on carbon footprints. This scrutiny requires CareDx to assess suppliers' environmental performance and promote sustainable manufacturing, aligning with 2024 targets for reducing Scope 3 emissions.

Energy consumption for laboratory equipment and maintaining precise conditions contributes significantly to CareDx's carbon footprint. The emphasis on ESG factors in 2024 and 2025 pushes companies like CareDx to track and reduce energy use, making investments in energy efficiency and renewables crucial for sustainability.

Water usage in laboratory processes is substantial, requiring efficient management for cost control and environmental stewardship, with a likely focus on reducing water per sample processed. Proper wastewater treatment is critical to meet stringent regulations, with 2024 and 2025 reports detailing investments in management technologies and compliance.

| Environmental Factor | Impact on CareDx | Data/Trend (2024-2025) |

| Waste Management | Compliance costs, reputational risk | Increased regulatory scrutiny on biohazardous waste handling. |

| Supply Chain Sustainability | Supplier vetting, carbon footprint reduction | Growing demand for transparency in Scope 3 emissions (e.g., supplier manufacturing). |

| Energy Consumption | Operational costs, carbon emissions | Focus on energy efficiency and renewable sources to meet ESG targets. |

| Water Management | Operational efficiency, regulatory compliance | Emphasis on water conservation and advanced wastewater treatment technologies. |

| Climate Change Impact | Supply chain disruption, demand shifts | Increased frequency of extreme weather events impacting logistics and infrastructure. |

PESTLE Analysis Data Sources

Our CareDx PESTLE analysis is meticulously constructed using a blend of public and proprietary data, encompassing regulatory filings, industry-specific market research, and health economic reports. This ensures our insights are grounded in the realities of the transplant and diagnostic landscape.