CareDx Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareDx Bundle

Uncover the strategic brilliance behind CareDx's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve into their innovative product offerings, astute pricing strategies, targeted distribution channels, and impactful promotional campaigns, revealing the core elements of their success.

Ready to elevate your own marketing acumen? Gain instant access to this expertly crafted, editable analysis and discover actionable insights you can apply to your business or studies. Don't miss out on this opportunity to learn from a market leader!

Product

CareDx's product offering centers on innovative genomics-based diagnostic tests like AlloSure Kidney and AlloMap Heart, crucial for non-invasive monitoring of transplanted organs. These tests offer clinicians vital insights, enabling early detection of rejection and improved patient care strategies. For instance, AlloSure Kidney demonstrated a 93% accuracy in detecting active kidney transplant rejection in a study, a significant advancement in transplant management.

The company's commitment to product development is evident in advancements like the AI-driven AlloSure Plus platform, which aims to further refine organ health assessment. This continuous innovation ensures CareDx remains at the forefront of transplant diagnostics, providing cutting-edge solutions to a critical medical need. In 2023, CareDx reported revenue growth driven by its transplant diagnostic solutions, highlighting the market's increasing adoption of these advanced tests.

Digital Transplant Solutions are a crucial component of CareDx's marketing mix, extending beyond their core diagnostic offerings. These digital tools, including patient management platforms like AlloCare and AlloHome, aim to support patients throughout their transplant journey. For instance, AlloHome, which focuses on remote patient monitoring, saw significant adoption, with CareDx reporting over 10,000 patients enrolled by the end of 2023, demonstrating a tangible impact on patient engagement and care delivery.

Furthermore, CareDx integrates these digital solutions with Electronic Medical Records (EMR) systems, facilitating seamless data flow and improving clinical workflows. Operational support platforms like Ottr Organ for organ procurement and XynQAPI for quality improvement are also key. In 2024, CareDx continued to expand its digital footprint, with EMR integrations reaching over 50 major healthcare systems, enhancing data accessibility and operational efficiency for transplant centers.

CareDx's product strategy includes specialized transplant lab offerings, such as HLA typing solutions like AlloSeq Tx, QTYPE, and Olerup SSP. These are critical for organ compatibility assessment and ongoing patient monitoring post-transplant, equipping transplant facilities with vital diagnostic capabilities.

The company further supports labs with services like HLA Typing Service and the innovative AlloSeq cfDNA Service. This dual approach of product and service delivery underpins CareDx's commitment to advancing transplant care through comprehensive laboratory solutions.

Integrated Multi-Modality Solutions

CareDx emphasizes integrated multi-modality solutions, exemplified by its HeartCare offering. This combines AlloSure Heart donor-derived cell-free DNA (dd-cfDNA) with AlloMap Heart gene-expression profiling (GEP) for a holistic assessment of heart transplant patient health. This approach aims to provide a more complete picture of organ status, enhancing the detection of rejection risk and potentially minimizing the reliance on invasive procedures.

The clinical utility of these combined technologies is a key focus for CareDx, with ongoing efforts to build supporting evidence. For instance, data presented in 2024 continued to highlight the complementary nature of dd-cfDNA and GEP in managing heart transplant patients. This integrated strategy positions CareDx to offer more sophisticated diagnostic tools.

- HeartCare Integration: Combines AlloSure Heart (dd-cfDNA) and AlloMap Heart (GEP) for comprehensive organ assessment.

- Clinical Utility Focus: Ongoing evidence generation supports the combined diagnostic power of these modalities.

- Reduced Invasiveness: Aims to improve rejection risk assessment, potentially decreasing the need for biopsies.

Focus on Transplant Patient Care Pathway

CareDx’s product strategy is laser-focused on enhancing the long-term health and financial well-being of transplant patients and their support networks. Their comprehensive suite of solutions addresses needs across the entire transplant journey, from before the procedure to long after, ensuring critical data is available to optimize patient care.

This strategic alignment is underscored by their 2024 divestiture of non-core lab services, a move that sharpens their dedication to essential diagnostics for the transplant community. This allows for greater investment in innovation that directly impacts patient outcomes.

- Focus on Patient Outcomes: CareDx aims to improve long-term survival rates and quality of life for transplant recipients.

- Cost Management: Their products are designed to help manage healthcare expenditures associated with transplantation.

- End-to-End Care Pathway: Solutions cover both pre-transplant evaluation and post-transplant monitoring.

- Diagnostic Specialization: Divestiture of non-core assets in 2024 reinforces their commitment to transplant-specific diagnostics.

CareDx's product portfolio is anchored by its pioneering genomics-based diagnostic tests, notably AlloSure Kidney and AlloMap Heart. These non-invasive tools are indispensable for monitoring transplanted organs, offering clinicians critical insights for early rejection detection and optimized patient care strategies. For instance, AlloSure Kidney has shown impressive accuracy, with a study reporting 93% effectiveness in identifying active kidney transplant rejection, a significant leap in managing transplant patient health.

The company's commitment to product advancement is evident in developments like the AI-enhanced AlloSure Plus platform, designed to further refine organ health assessments. This ongoing innovation solidifies CareDx's position at the vanguard of transplant diagnostics, delivering advanced solutions to a vital medical domain. The market's increasing embrace of these sophisticated tests contributed to CareDx's revenue growth in 2023, driven by its transplant diagnostic solutions.

CareDx's product strategy also encompasses integrated multi-modality solutions, such as its HeartCare offering. This combines AlloSure Heart donor-derived cell-free DNA (dd-cfDNA) with AlloMap Heart gene-expression profiling (GEP) to provide a holistic view of heart transplant patient health. This integrated approach aims to deliver a more complete organ status assessment, potentially reducing the need for invasive procedures by improving rejection risk detection.

| Product Category | Key Products | Primary Function | 2023/2024 Data Point |

|---|---|---|---|

| Transplant Diagnostics | AlloSure Kidney, AlloMap Heart | Non-invasive organ rejection monitoring | AlloSure Kidney 93% accuracy in rejection detection (study); Over 10,000 patients enrolled in AlloHome by end of 2023. |

| Digital Transplant Solutions | AlloCare, AlloHome | Patient management and remote monitoring | EMR integrations reached over 50 major healthcare systems in 2024. |

| Laboratory Solutions | AlloSeq Tx, QTYPE, Olerup SSP | HLA typing for compatibility assessment | Continued expansion of specialized lab services. |

| Integrated Solutions | HeartCare (AlloSure Heart + AlloMap Heart) | Holistic heart transplant assessment | Focus on demonstrating complementary clinical utility of dd-cfDNA and GEP in 2024 data. |

What is included in the product

This analysis offers a comprehensive examination of CareDx's marketing strategies, delving into their Product offerings, Pricing models, Place (distribution) channels, and Promotion activities.

It provides a deep dive into how CareDx positions itself in the market, utilizing real-world practices and competitive context for actionable insights.

Provides a clear, concise overview of CareDx's marketing strategy, simplifying complex data for efficient decision-making.

Streamlines understanding of CareDx's product, price, place, and promotion to address market uncertainties and drive growth.

Place

CareDx leans heavily on its direct sales force to connect with its primary audience: transplant centers and specialized physicians like nephrologists and cardiologists. This approach is vital for effectively communicating the technical intricacies of their diagnostic solutions and fostering strong relationships with healthcare professionals who make purchasing decisions.

CareDx boasts an extensive healthcare institution network, directly serving over 1,200 hospitals and transplant centers throughout the United States. This broad reach is crucial for its transplant diagnostics business. The company’s distribution spans 47 U.S. states, strategically covering key healthcare networks and specialized medical facilities.

CareDx heavily relies on its digital infrastructure, including its main website and specialized portals like AlloSeq and AlloSure, to streamline test ordering and result delivery. These platforms are crucial for managing interactions with a substantial base of registered medical professionals, offering them a user-friendly gateway to the company's diagnostic solutions.

Strategic Partnerships and Collaborations

CareDx actively cultivates strategic partnerships with a wide array of entities, including clinical laboratories, integrated healthcare systems, and prominent medical research institutions. These alliances are crucial for broadening their market penetration and ensuring the seamless integration of their specialized diagnostic solutions across the healthcare landscape. For instance, collaborations with major hospital networks can accelerate the adoption of their organ transplant monitoring tools, directly impacting patient care pathways.

These collaborations are designed to significantly bolster CareDx's distribution channels, allowing their innovative diagnostic products to reach a wider patient and clinician base. Furthermore, these partnerships are instrumental in facilitating the integration of cutting-edge research findings into their product development pipeline, ensuring their offerings remain at the forefront of transplant medicine. By embedding their diagnostic tools within the established workflows of these key players, CareDx solidifies its position within the transplant ecosystem.

- Partnerships with over 1,000 clinical laboratories globally, as reported in their 2023 investor relations materials, underscore their extensive reach.

- Collaborations with leading transplant centers aim to integrate AlloSure and AlloMap testing into standard of care protocols, driving increased utilization.

- Research collaborations with institutions like the National Institutes of Health (NIH) contribute to the validation and expansion of their biomarker discovery efforts.

- Agreements with electronic health record (EHR) vendors are in progress to streamline data flow and improve accessibility of test results for clinicians.

Global and EMR Integration

CareDx is actively expanding its global footprint, currently serving markets in North America and Europe. Market penetration varies by region, reflecting different adoption rates for its transplant diagnostics. By the end of Q1 2024, CareDx reported approximately 70% of its revenue originated from North America, with Europe contributing the remaining 30%, showing significant growth potential in international markets.

A key aspect of CareDx's strategy involves seamless Electronic Medical Record (EMR) integration. This includes ensuring compatibility with major EMR systems such as EPIC AURA. This integration is designed to streamline clinical workflows, making diagnostic insights more readily accessible to healthcare providers at the point of care. In 2023, CareDx announced partnerships with over 50 hospital systems that utilize EMRs, facilitating faster data flow and improved patient management.

- Global Reach: Operations primarily in North America and Europe, with ongoing expansion efforts.

- EMR Integration: Focus on compatibility with leading EMR systems like EPIC AURA to enhance clinical workflow.

- Market Penetration: Varies across regions, indicating opportunities for deeper market penetration.

- Data Accessibility: Streamlining access to diagnostic insights for healthcare providers.

CareDx's place strategy is deeply rooted in its direct engagement with transplant centers and key medical specialists, utilizing a dedicated sales force to convey complex diagnostic information. This direct approach is complemented by an extensive network, serving over 1,200 hospitals and transplant centers across 47 U.S. states by the end of 2023, ensuring broad market coverage.

Digital platforms, including their website and specialized portals, are central to streamlining test ordering and result delivery for a large base of medical professionals. Furthermore, strategic alliances with clinical laboratories, healthcare systems, and research institutions are crucial for expanding market reach and integrating their diagnostic solutions across the healthcare ecosystem.

| Geographic Presence (End of 2023) | Key Distribution Channels | Digital Engagement |

|---|---|---|

| North America (approx. 70% revenue) | Direct Sales Force | Company Website & Portals |

| Europe (approx. 30% revenue) | 1,200+ Hospitals/Transplant Centers | EMR Integration (e.g., EPIC AURA) |

| Expansion in progress | 47 U.S. States Covered | Streamlined Ordering & Results |

Preview the Actual Deliverable

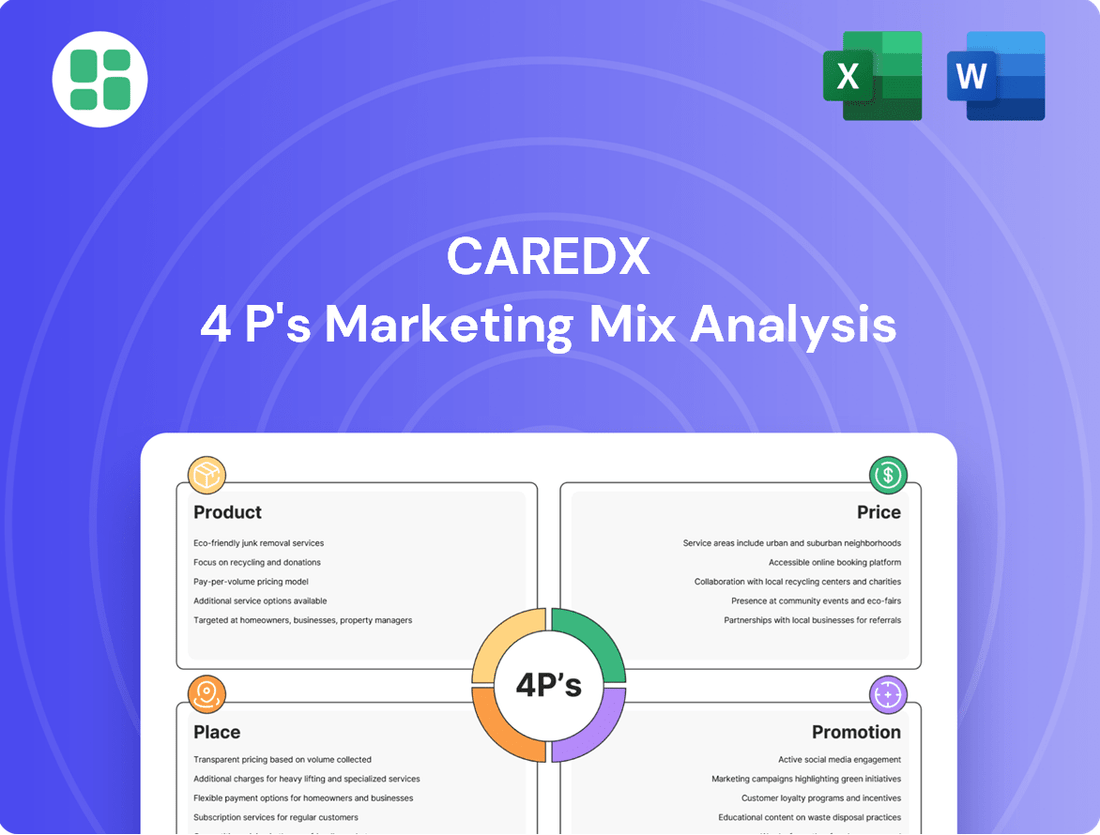

CareDx 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CareDx 4P's Marketing Mix Analysis is fully complete and ready for your strategic use.

Promotion

CareDx's targeted clinical and professional marketing directly engages transplant specialists and key healthcare professionals. This approach utilizes a dedicated sales force and specialized communication platforms to educate the transplant community on their diagnostic solutions.

In 2024, CareDx continued to focus on building awareness and driving adoption of its offerings like AlloSure and AlloMap. Their strategy emphasizes reaching decision-makers within transplant centers, aiming to integrate their diagnostics into routine patient management protocols.

CareDx heavily relies on scientific publications and conference presentations to promote its offerings, showcasing clinical study results and data in respected medical journals and at key industry events. This approach is crucial for building credibility and demonstrating the value of their diagnostic solutions.

Their robust presence at events like the 2025 World Transplant Congress highlights this commitment. For instance, in 2023, CareDx presented data from over 20 clinical studies at major transplant and cardiology conferences, underscoring their dedication to advancing the field through evidence-based communication.

CareDx leverages its extensive website as a core digital marketing platform, providing in-depth product details, clinical trial outcomes, and educational materials for both medical practitioners and patients. This digital approach is vital for sharing information and generating leads in the niche field of transplant diagnostics.

Investor Relations and Public Relations

CareDx prioritizes transparent communication with its investors through various channels. This includes regular investor presentations, quarterly earnings calls, and annual shareholder meetings designed to clearly articulate the company's financial health and future strategic direction. For example, in their Q1 2024 earnings call, management highlighted progress in key product areas and provided updated financial guidance for the year.

Public relations efforts are equally robust, with press releases serving as a primary tool to disseminate important company news. These announcements cover critical developments such as new product introductions, significant clinical study results, and other key business achievements, ensuring a wide reach to both the financial community and the general public. In early 2024, CareDx issued a press release detailing the positive outcomes of a pivotal clinical trial for a new diagnostic test.

- Investor Presentations: Regular updates on financial performance and strategic initiatives.

- Earnings Calls: Quarterly discussions on financial results and outlook.

- Press Releases: Announcements of new products, study findings, and business milestones.

- Shareholder Meetings: Annual engagement with investors to review company progress.

Educational and Clinical Support Programs

CareDx's commitment to education and clinical support is a cornerstone of their 'Promotion' strategy. They offer comprehensive programs designed to equip healthcare professionals with the knowledge to effectively utilize their diagnostic tools. This focus ensures optimal patient care and reinforces the value of CareDx's innovative solutions.

These initiatives include:

- Training Sessions: Hands-on training to familiarize clinicians with the practical application of CareDx's diagnostics.

- Webinars: Regular online sessions covering the latest advancements, case studies, and best practices.

- Resource Hubs: Providing accessible materials that detail the benefits and scientific backing of their offerings.

By investing in these educational and clinical support programs, CareDx aims to foster deeper understanding and adoption of their technologies, ultimately contributing to improved patient outcomes in transplant medicine. For instance, in 2023, CareDx reported a significant increase in engagement with their digital learning platforms, indicating strong demand for such resources from the medical community.

CareDx's promotion strategy centers on educating and engaging the transplant community, emphasizing scientific validation and clinical utility. They leverage a multi-channel approach, from direct engagement with specialists to broad dissemination of research findings.

In 2024, CareDx continued to highlight its diagnostic solutions like AlloSure and AlloMap through scientific publications and presentations at key industry events. Their 2023 performance saw continued investment in these promotional activities, with over 20 clinical studies presented at major conferences, reinforcing their commitment to evidence-based marketing.

The company also actively communicates with investors, detailing financial performance and strategic direction through earnings calls and press releases. For example, their Q1 2024 earnings call provided insights into product development and market penetration strategies.

| Promotional Activity | Focus Area | Key Data/Examples |

|---|---|---|

| Scientific Publications & Conferences | Clinical validation, data dissemination | Presented data from 20+ clinical studies at major transplant/cardiology conferences in 2023. |

| Digital Marketing & Resource Hubs | Product information, clinical trial outcomes | Extensive website with educational materials for practitioners and patients. Reported increased engagement with digital learning platforms in 2023. |

| Investor Relations | Financial health, strategic direction | Regular investor presentations, quarterly earnings calls (e.g., Q1 2024), press releases on milestones. |

Price

CareDx's pricing strategy is fundamentally a reimbursement-based model, relying on public and private insurance payers. This means the company's revenue is directly tied to whether its diagnostic tests are covered and at what rate by entities like Medicare and commercial insurers. Securing favorable coverage decisions and reimbursement rates is paramount for ensuring patients can access these vital tests and for the company's financial viability.

Established Medicare reimbursement rates are a cornerstone for CareDx's key products, directly impacting their market access and revenue generation. AlloSure Kidney, for instance, benefits from a reimbursement rate of $2,841, while AlloMap Heart is reimbursed at $3,240.

Further solidifying market acceptance, AlloSure Heart, when used alongside AlloMap Heart, secures a reimbursement of $2,753. These figures highlight the critical pathway for revenue and demonstrate the established value proposition within the Medicare system for these vital diagnostic tools.

CareDx acknowledges the significant financial strain patients face, particularly with specialized medical services. To address this, they offer robust patient financial assistance programs designed to alleviate out-of-pocket expenses for eligible individuals. These programs are a crucial component of their 'Price' strategy, ensuring broader access to their diagnostic solutions.

Further enhancing price transparency and patient empowerment, CareDx provides Good Faith Estimates. This initiative, in line with the No Surprises Act, offers uninsured or self-pay patients a clear understanding of anticipated costs. For instance, in 2024, the average cost for a transplant-related diagnostic test can range from $500 to $2,000, making such estimates invaluable for patient budgeting.

Value-Based Pricing Justification

CareDx employs value-based pricing, highlighting the significant clinical benefits of its transplant solutions. This strategy emphasizes improved patient outcomes and potential long-term cost savings within the healthcare system, particularly concerning transplant management.

The company's approach aims to demonstrate that its diagnostic tests are not merely expenses but crucial tools for optimizing patient care and reducing the overall burden of post-transplant complications. This value proposition is central to their reimbursement strategies.

- Clinical Utility: CareDx's tests provide actionable insights that directly influence patient management decisions, leading to better outcomes.

- Cost-Effectiveness: By enabling early detection of rejection or complications, their solutions can prevent more expensive interventions and hospitalizations.

- Reimbursement Support: The demonstrable clinical and economic value strengthens CareDx's position in securing favorable reimbursement from payers.

Strategic Revenue Cycle Management

CareDx is actively refining its revenue cycle management to boost average selling prices (ASPs) and streamline collections. This includes restructuring their dedicated RCM team to improve efficiency. For instance, in Q1 2024, CareDx reported total revenue of $77.4 million, a slight increase from $76.1 million in Q1 2023, indicating a focus on optimizing existing revenue streams.

A key strategy involves broadening payer coverage and advocating for specific billing codes for their diagnostic tests. This move aims to secure more predictable revenue and enhance pricing stability in the long term. By securing dedicated codes, CareDx can simplify the reimbursement process and potentially command better pricing for its innovative offerings.

- Revenue Cycle Management Optimization: Restructuring the RCM team to enhance billing and collection processes.

- Average Selling Price (ASP) Growth: Initiatives focused on increasing the ASP for CareDx's diagnostic solutions.

- Payer Coverage Expansion: Efforts to secure broader acceptance and reimbursement from insurance providers.

- Dedicated Billing Codes: Strategic push for unique billing codes to improve revenue predictability and pricing power.

CareDx's pricing is deeply intertwined with reimbursement, focusing on securing coverage from Medicare and private insurers. This approach is critical for patient access and company revenue, with established rates like $2,841 for AlloSure Kidney and $3,240 for AlloMap Heart demonstrating this reliance.

To manage patient costs, CareDx offers financial assistance and Good Faith Estimates, aiming for transparency. For example, transplant-related diagnostic tests in 2024 could range from $500 to $2,000, making these patient-focused pricing elements vital.

The company is also actively optimizing its revenue cycle management, with Q1 2024 revenue reaching $77.4 million, up from $76.1 million in Q1 2023. This includes efforts to increase Average Selling Prices (ASPs) and secure dedicated billing codes for improved revenue predictability.

| Product | Medicare Reimbursement Rate | Notes |

|---|---|---|

| AlloSure Kidney | $2,841 | Key diagnostic for kidney transplant monitoring. |

| AlloMap Heart | $3,240 | Established diagnostic for heart transplant monitoring. |

| AlloSure Heart (with AlloMap) | $2,753 | Combined use for enhanced heart transplant assessment. |

4P's Marketing Mix Analysis Data Sources

Our CareDx 4P's analysis leverages a comprehensive blend of public company disclosures, including SEC filings and investor presentations, alongside proprietary market intelligence. We also incorporate data from industry reports and competitive intelligence platforms to ensure a thorough understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.