CareCloud Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

CareCloud operates within a dynamic healthcare IT landscape, facing pressures from rivals and the evolving needs of its customers. Understanding these forces is crucial for strategic planning and identifying competitive advantages.

The complete report reveals the real forces shaping CareCloud’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CareCloud's reliance on a handful of major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform significantly amplifies supplier bargaining power. These giants dominate the market, meaning CareCloud has limited alternatives for the critical infrastructure powering its cloud-based solutions.

The concentration of these providers means they can dictate terms and pricing, directly impacting CareCloud's operational expenses. For instance, in 2024, the global cloud computing market was valued at over $600 billion, with these three providers holding a substantial majority of the market share, underscoring their leverage.

The demand for specialized AI and healthcare IT professionals is soaring, creating a seller's market. This scarcity means recruitment agencies and educational providers offering these skills wield significant influence. For companies like CareCloud, this translates directly into higher recruitment expenses and increased salary expectations for essential talent, particularly as they build out AI capabilities.

CareCloud's reliance on proprietary software and data tool licensing presents a potential avenue for supplier bargaining power. If the company depends on unique, difficult-to-replicate software components or advanced data analytics tools from a limited number of vendors to power its integrated platforms, those vendors gain leverage. This dependency can impact CareCloud's operational costs and its ability to innovate.

For instance, a critical data analytics tool that significantly enhances CareCloud's revenue cycle management capabilities, if licensed from a single provider with no readily available alternatives, could see its licensing fees increase. In 2023, the global market for healthcare analytics software was valued at approximately $15.5 billion, with growth driven by demand for AI and machine learning capabilities. Should CareCloud's chosen vendor be a key player in this high-growth segment, their pricing power would be amplified.

Cybersecurity and Compliance Solution Vendors

Cybersecurity and compliance solution vendors wield considerable influence over CareCloud. The healthcare sector's strict regulations, particularly HIPAA, necessitate robust data protection. Vendors offering specialized cybersecurity and compliance tools are crucial, as failures can lead to severe financial penalties and reputational damage.

The increasing frequency and sophistication of cyberattacks in the healthcare industry amplify this bargaining power. For instance, the average cost of a healthcare data breach reached $10.10 million in 2023, according to IBM's Cost of a Data Breach Report. This high cost underscores the critical need for effective solutions, giving vendors leverage in negotiations.

- High Switching Costs: Implementing new cybersecurity and compliance systems often involves significant integration efforts and retraining, making it costly and disruptive for CareCloud to switch vendors.

- Specialized Expertise: The niche and evolving nature of cybersecurity threats means that vendors possess specialized knowledge that is difficult for CareCloud to replicate internally.

- Regulatory Dependence: Vendors offering solutions that ensure adherence to HIPAA and other healthcare regulations are indispensable, as non-compliance carries substantial legal and financial risks.

- Market Concentration: In certain specialized areas of healthcare cybersecurity, the market may be dominated by a few key players, further concentrating bargaining power with suppliers.

Switching Costs for Core Technology Partnerships

CareCloud's reliance on core technology partners and software development frameworks significantly influences supplier bargaining power. While CareCloud provides an integrated platform, the underlying technologies are often developed by third parties. Switching these foundational elements can be exceptionally costly, involving not just monetary expenses but also considerable time and potential operational disruptions. For instance, a major shift in a cloud infrastructure provider or a core data analytics engine could necessitate extensive re-engineering and recertification processes.

The high switching costs associated with core technology partnerships directly empower these suppliers. This means that companies like CareCloud, which depend on these specialized technologies, have limited leverage to negotiate better terms or demand significant changes from their suppliers. The investment already made in integrating these technologies creates a lock-in effect, making it economically unfeasible to move to an alternative provider without incurring substantial financial penalties and operational setbacks.

Consider the implications for a health IT company like CareCloud. If their Electronic Health Record (EHR) system relies on a specific database technology or a proprietary middleware, changing that component could impact the entire system's functionality and compliance. For example, in 2024, many healthcare organizations faced challenges in migrating legacy EHR systems, highlighting the deep integration and associated switching costs. This dependence grants suppliers a stronger position to dictate pricing and terms.

- High Integration Costs: Replacing core software development frameworks or cloud infrastructure can involve millions in re-development and testing.

- Operational Disruption Risk: Switching foundational technology partners can lead to service interruptions and data integrity concerns, impacting patient care.

- Specialized Expertise Required: The need for specialized skills to manage and migrate complex technological stacks further entrenches reliance on existing suppliers.

- Regulatory Compliance Hurdles: Healthcare technology must meet stringent regulatory standards, making technology changes complex and time-consuming, reinforcing supplier power.

CareCloud's reliance on a few dominant cloud infrastructure providers grants them significant bargaining power. These providers, holding a large share of the over $600 billion global cloud market in 2024, can dictate terms due to limited alternatives for CareCloud's critical operations.

The scarcity of specialized AI and healthcare IT professionals in 2024 empowers recruitment agencies and educational providers. This seller's market drives up recruitment expenses and salary expectations for CareCloud, especially as they expand AI capabilities.

Vendors of proprietary software and data tools, particularly in the $15.5 billion healthcare analytics market (2023), wield leverage if their solutions are unique and difficult to replace. This dependency can escalate CareCloud's operational costs and hinder innovation.

Suppliers of cybersecurity and compliance solutions hold considerable influence due to the critical need for HIPAA adherence and the high cost of healthcare data breaches, which averaged $10.10 million in 2023. This makes switching vendors difficult and costly for CareCloud.

What is included in the product

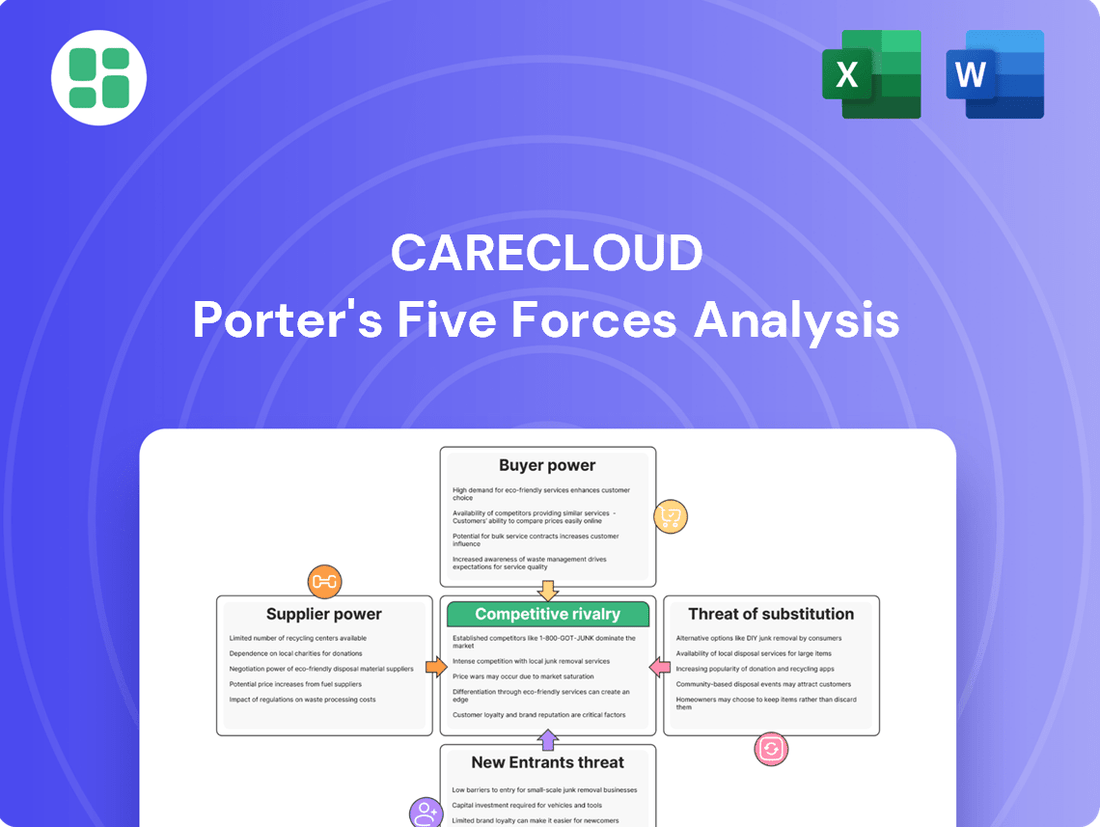

CareCloud's Porter's Five Forces Analysis dissects the competitive intensity within the healthcare IT sector, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces dashboard, eliminating the need for manual data compilation and analysis.

Customers Bargaining Power

Healthcare providers often face substantial costs when considering a switch from their current Electronic Health Record (EHR) or practice management systems. These costs encompass the intricate process of data migration, the necessity for comprehensive staff retraining, and the potential for significant disruptions to both clinical operations and administrative workflows. For instance, a survey by Black Book Research in 2023 indicated that the average cost for a mid-sized practice to switch EHR vendors could range from $50,000 to $150,000, not including lost productivity.

These high switching costs effectively diminish the bargaining power of individual medical practices. Once a provider is deeply integrated with a platform like CareCloud, the financial and operational hurdles to change become a strong deterrent, making them less likely to demand concessions or seek alternative solutions due to the significant investment already made.

CareCloud caters to a diverse clientele, from solo medical practitioners to expansive multi-specialty clinics. This wide range of customer types, each with unique operational needs and scales, inherently creates a fragmented demand for their services.

While larger healthcare organizations might possess more individual leverage due to their volume, the sheer number of smaller practices means that no single customer or small group can dictate terms. For instance, in 2024, the healthcare IT market saw continued growth, with many smaller practices adopting cloud-based solutions to improve efficiency, further diversifying CareCloud's customer base and diluting any concentrated bargaining power.

CareCloud's core offerings, such as Electronic Health Records (EHR), practice management, and revenue cycle management, are fundamental to the smooth functioning and financial stability of healthcare organizations. These services are not merely supplementary; they are critical for daily operations, making it difficult for customers to simply switch or operate without them.

Because healthcare providers rely heavily on these essential services, their power to negotiate substantial price reductions or dictate unfavorable terms is significantly diminished. For instance, in 2023, the healthcare IT market saw continued investment, with companies prioritizing solutions that streamline operations and ensure compliance, underscoring the critical nature of these platforms.

Availability of Competing Solutions

Even with significant switching costs in healthcare technology, CareCloud faces a reality where customers can choose from a variety of integrated platforms and specialized solutions. This availability of alternatives means customers hold a degree of power, compelling CareCloud to consistently prove its worth and offer competitive pricing to win and keep business.

The competitive landscape in healthcare IT, as of 2024, features numerous vendors offering diverse functionalities. For instance, the Electronic Health Record (EHR) market alone saw significant activity, with companies like Epic and Cerner continuing to dominate, but also with newer cloud-based solutions gaining traction, offering clients more flexibility. This broad market means that a client dissatisfied with CareCloud's offerings, or seeking a specific feature not readily available, can often find a suitable replacement.

- Customer Choice: The healthcare technology sector in 2024 provided a wide array of EHR, practice management, and revenue cycle management solutions, giving clients numerous alternatives to CareCloud.

- Value Proposition: CareCloud must continually differentiate itself by showcasing superior features, user experience, and cost-effectiveness to counter the bargaining power derived from readily available competing solutions.

- Market Dynamics: The presence of both large, established players and agile, niche providers ensures that customer options remain robust, thereby limiting the pricing power of any single vendor like CareCloud.

Impact of Regulatory Mandates and Incentives

Government regulations and incentives, such as those promoting Electronic Health Record (EHR) adoption, directly influence the demand for CareCloud's services. For instance, the HITECH Act in the United States provided significant financial incentives for healthcare providers to adopt certified EHR technology, boosting the market for companies like CareCloud.

However, these mandates can also empower customers. Healthcare providers facing stringent compliance deadlines may leverage these requirements to negotiate better terms, demand specific functionalities, or seek assurances on vendor support to meet regulatory obligations. This can increase the bargaining power of customers, especially larger healthcare systems with significant purchasing volume.

- Regulatory Push: Government mandates like Meaningful Use (now Promoting Interoperability) incentivized EHR adoption, creating a market for CareCloud.

- Customer Leverage: Compliance requirements allow customers to demand specific features, pricing, and support from vendors.

- Market Shaping: Regulations can dictate market standards, influencing product development and vendor competition.

- 2024 Impact: Ongoing shifts in healthcare policy and data privacy regulations (e.g., HIPAA updates) continue to shape customer expectations and vendor offerings in 2024.

The bargaining power of customers for CareCloud is influenced by several factors, including high switching costs, a fragmented customer base, and the essential nature of its services. While these elements generally limit customer power, the availability of alternatives and regulatory influences introduce nuances.

Despite high switching costs, customers retain some leverage due to the competitive healthcare IT market. In 2024, the market continued to offer a wide array of solutions, allowing providers to seek out better features or pricing. This competitive pressure compels CareCloud to remain adaptable and customer-focused to maintain its market position.

The essential nature of CareCloud's offerings, such as EHR and revenue cycle management, means providers are heavily reliant on these systems. However, regulatory mandates can paradoxically empower customers, enabling them to negotiate terms that align with compliance needs, particularly for larger healthcare systems.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (as of 2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power due to financial and operational hurdles. | Mid-sized practice EHR switch costs estimated $50k-$150k (2023), excluding productivity loss. |

| Customer Fragmentation | Lowers bargaining power as no single customer dominates. | CareCloud serves diverse clients from solo practitioners to large clinics; 2024 saw continued growth in smaller practice adoption of cloud solutions. |

| Essential Services | Lowers bargaining power as services are critical for operations. | EHR, practice management, and RCM are fundamental; 2023 saw continued investment in operational streamlining solutions. |

| Availability of Alternatives | Increases bargaining power by providing options. | The EHR market in 2024 features major players (Epic, Cerner) and emerging cloud vendors, offering clients flexibility. |

| Regulatory Influence | Can increase bargaining power by creating specific demands. | Government mandates (e.g., Promoting Interoperability) require specific functionalities, allowing customers to negotiate terms. Ongoing 2024 policy shifts impact customer expectations. |

Preview Before You Purchase

CareCloud Porter's Five Forces Analysis

This preview showcases the identical CareCloud Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of industry competitiveness. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare technology sector. This exact document, fully formatted and ready for immediate use, will equip you with strategic understanding.

Rivalry Among Competitors

The healthcare technology landscape is fiercely competitive, with giants like Epic and Cerner dominating the market alongside a multitude of specialized niche players. CareCloud navigates this intense rivalry across its core offerings in Electronic Health Records (EHR), practice management, and revenue cycle management (RCM). This necessitates constant innovation and a clear strategy to stand out.

The healthcare technology sector, including companies like CareCloud, is seeing a significant surge in investment and integration of Artificial Intelligence (AI) and generative AI. This push aims to boost operational efficiency and improve patient care. For instance, in 2024, venture capital funding for AI in healthcare reached record highs, with significant portions directed towards companies developing AI-driven clinical decision support and administrative automation tools.

This intense focus on AI innovation directly fuels competitive rivalry. Companies are locked in a race to develop and deploy the most sophisticated and impactful AI-powered solutions, creating a dynamic environment where technological leadership is a key differentiator. Early adopters and innovators in AI are likely to gain market share, putting pressure on less advanced competitors to catch up or risk falling behind.

As electronic health record (EHR) and practice management software features become increasingly similar, the risk of commoditization looms large. This standardization can make customers more sensitive to price, forcing companies like CareCloud to compete on cost. For instance, in 2024, the average annual contract value for basic EHR systems saw a slight decrease as more vendors offered similar core functionalities.

This intense pricing pressure can squeeze profit margins if CareCloud cannot differentiate its offerings. To combat this, the company must focus on unique value-added services, superior customer support, or advanced analytics that go beyond the standard features. Failing to do so could lead to a race to the bottom, where profitability is sacrificed for market share.

Active Merger and Acquisition (M&A) Landscape

The healthcare IT sector is experiencing a significant wave of consolidation. This trend is driven by companies looking to broaden their service offerings and client bases, leading to fewer, but larger, competitors. For instance, in 2024, the healthcare IT M&A market saw continued activity, with deals aimed at integrating disparate technologies and creating end-to-end solutions.

CareCloud's renewed focus on acquisitions underscores this dynamic. By actively pursuing M&A opportunities, CareCloud aims to bolster its market position and enhance its technological capabilities. This strategic move signals that the competitive landscape is evolving rapidly, with companies prioritizing growth through integration.

- Increased Consolidation: The healthcare IT industry is seeing a rise in mergers and acquisitions, creating larger, more integrated players.

- CareCloud's Strategy: CareCloud has revived its acquisition strategy, actively seeking deals to expand its market share and capabilities.

- Market Dynamics: This M&A activity highlights a competitive environment where strategic partnerships and acquisitions are key to growth and staying relevant.

Emphasis on Operational Efficiency and Customer Experience

Competitive rivalry within the healthcare technology sector is intensifying, with firms like CareCloud facing pressure to optimize operations and elevate customer interactions. Competitors are heavily investing in streamlining clinical workflows and improving both client and patient experiences, making these aspects critical differentiators.

CareCloud's ability to leverage its technology for superior service delivery is paramount in this crowded market. Customer satisfaction and retention are key metrics, and companies are vying for market share by offering more intuitive platforms and responsive support. For instance, in 2024, many healthcare IT providers reported increased customer churn rates when user experience was not a primary focus.

- Focus on Workflow Automation: Competitors are integrating AI and automation to reduce administrative burdens for healthcare providers, directly impacting operational efficiency.

- Enhanced Patient Portals: Investments in user-friendly patient portals are a major trend, aiming to boost patient engagement and satisfaction.

- Data Analytics for Service Improvement: Companies are using data analytics to identify pain points in the customer journey and implement targeted improvements.

- Service-Level Agreement (SLA) Competition: Stricter SLAs around uptime and support response times are becoming a competitive battleground, highlighting the importance of reliable service delivery.

The competitive rivalry in healthcare technology is intense, driven by rapid innovation, particularly in AI, and increasing commoditization of core services like EHRs. Companies like CareCloud face pressure to differentiate through value-added services and superior customer experience to avoid price wars and maintain profitability.

Consolidation trends mean larger, more integrated competitors are emerging, pushing companies like CareCloud to pursue strategic acquisitions to bolster their market position and technological capabilities. This dynamic environment necessitates continuous adaptation and a focus on unique selling propositions.

| Competitive Factor | 2024 Trend/Data | Impact on CareCloud |

|---|---|---|

| AI Integration | Record VC funding for AI in healthcare, focus on clinical support & admin automation. | Drives innovation race; requires investment to stay competitive. |

| EHR/Practice Management Commoditization | Slight decrease in average annual EHR contract value due to similar core features. | Increases price sensitivity; necessitates focus on unique value-adds. |

| Industry Consolidation | Continued M&A activity to broaden service offerings and client bases. | Creates larger competitors; necessitates strategic M&A for CareCloud. |

| Customer Experience | Increased customer churn reported by providers neglecting user experience. | Requires focus on intuitive platforms and responsive support for retention. |

SSubstitutes Threaten

Despite widespread digital adoption, a persistent threat of substitutes exists for CareCloud in the form of manual, paper-based processes. Many smaller or more traditional medical practices continue to rely on these legacy systems for critical functions like patient records, billing, and appointment scheduling. These methods, while inefficient and prone to errors, represent a lower upfront cost alternative that CareCloud's comprehensive digital solutions must overcome.

The inefficiency of paper-based systems is well-documented; for instance, studies have shown that administrative tasks in healthcare can consume up to 20% of a physician's time. CareCloud's integrated platform directly addresses this by streamlining workflows, improving data accuracy, and enhancing compliance, offering a clear value proposition over the tangible but ultimately costlier manual approach.

Larger healthcare organizations with substantial IT budgets, such as those with over 500 physicians, may choose to build their own Electronic Health Record (EHR) or practice management systems. This internal development, while demanding significant upfront investment and ongoing maintenance, can be a direct substitute for purchasing external solutions. For instance, a large hospital system might dedicate millions annually to its IT infrastructure, allowing for custom-built software that perfectly aligns with its unique workflows, thereby reducing reliance on third-party vendors like CareCloud.

The rise of fragmented 'best-of-breed' software combinations poses a significant threat of substitution for integrated healthcare IT platforms. Providers may opt for specialized solutions for billing, scheduling, or electronic health records, assembling a system tailored to their specific needs rather than adopting a single, comprehensive platform. This approach allows for greater flexibility and potentially better performance in niche areas, directly competing with the all-encompassing offerings of larger vendors.

Outsourcing of Administrative and Revenue Cycle Functions

Healthcare providers increasingly turn to specialized third-party vendors for administrative and revenue cycle management (RCM) functions, presenting a significant threat of substitution to companies like CareCloud. These outsourcing services directly compete with CareCloud's software solutions for tasks such as medical billing, claims processing, and patient collections. For instance, the global healthcare BPO market, which includes RCM services, was valued at approximately $30.5 billion in 2023 and is projected to grow significantly, indicating a robust demand for these outsourced alternatives.

This trend means that healthcare organizations can opt for comprehensive outsourced RCM solutions instead of investing in and managing their own software and internal processes. This can be particularly attractive for smaller practices or those looking to reduce overhead and improve efficiency without direct software investment. The availability of these specialized service providers offers a viable alternative pathway for achieving RCM goals.

The threat is amplified as outsourcing providers often offer end-to-end solutions, encompassing technology, expertise, and labor. This comprehensive approach can be more appealing than a software-only solution, especially if the healthcare provider lacks internal RCM expertise.

- Market Growth: The global healthcare outsourcing market is expanding, with RCM services being a key segment, indicating a strong availability of substitute services.

- Cost-Effectiveness: Outsourcing can offer predictable costs and potentially lower operational expenses compared to in-house management using software.

- Expertise Access: Third-party providers bring specialized knowledge and experience in navigating complex billing and coding regulations.

- Focus on Core Competencies: By outsourcing administrative tasks, healthcare providers can redirect resources and focus on patient care.

General Business Software Adaptations

For very small or budget-constrained medical practices, general business software can act as a substitute for specialized healthcare solutions. Think of using spreadsheets for patient scheduling or basic CRM tools for contact management. While these tools don't have healthcare-specific functionalities, they offer a low-cost way to handle some administrative tasks.

For instance, a small clinic might leverage QuickBooks for billing and patient record keeping if they are not yet ready for a full EHR system. This approach can be particularly appealing when considering the average cost of an EHR system, which can range from $500 to $700 per month for smaller practices, according to some industry reports from 2024. The perceived savings, even if the functionality is limited, makes these general tools a viable, albeit basic, alternative.

- Limited Functionality: General business software lacks crucial healthcare-specific features like HIPAA compliance, integrated telehealth, or specialized medical billing codes.

- Cost Savings: For practices with very tight budgets, using existing or low-cost general software can significantly reduce upfront and ongoing technology expenses compared to dedicated healthcare IT.

- Scalability Issues: As a practice grows, these general tools often become insufficient, requiring a more robust and specialized system to manage increasing patient volumes and complex data requirements.

- Data Security Risks: Without built-in healthcare compliance features, using generic software for patient data can expose practices to significant security vulnerabilities and potential data breaches.

The threat of substitutes for CareCloud is multifaceted, encompassing both traditional manual methods and increasingly sophisticated alternative solutions. Manual, paper-based processes remain a viable substitute for smaller or more traditional practices due to their lower initial cost, despite their inherent inefficiencies. For example, administrative tasks in healthcare can consume up to 20% of a physician's time, a burden CareCloud's digital solutions aim to alleviate.

Larger organizations may develop in-house EHR systems, representing a significant investment but offering tailored functionality. Furthermore, the market for specialized third-party vendors providing outsourced revenue cycle management (RCM) services is robust, valued at approximately $30.5 billion in 2023, offering an end-to-end alternative to software-only solutions.

Even general business software, like spreadsheets for scheduling or basic CRM tools for patient management, can serve as a low-cost substitute for practices with very limited budgets. These tools, while lacking healthcare-specific features and posing potential data security risks, offer a perceived cost saving, especially when compared to the $500-$700 monthly cost of EHR systems for smaller practices in 2024.

Entrants Threaten

Entering the healthcare technology sector, particularly for comprehensive cloud-based solutions akin to CareCloud's offerings, necessitates significant initial capital. This includes substantial investments in research and development, robust IT infrastructure, and attracting specialized talent. For instance, in 2024, the average cost for developing a sophisticated healthcare SaaS platform can easily range from $500,000 to over $2 million, a considerable hurdle for many aspiring competitors.

The healthcare sector, including companies like CareCloud, is a minefield of regulations. Laws such as HIPAA and HITECH demand stringent data security and patient privacy measures. New companies entering this space must invest heavily in legal counsel and continuous compliance efforts, making it a formidable barrier.

Healthcare providers are inherently risk-averse, placing a high premium on trust and a proven track record when choosing technology partners for their critical operations and sensitive patient data. This cautious approach creates a significant barrier for new entrants. For instance, in 2024, healthcare IT spending reached an estimated $150 billion, with a substantial portion allocated to established vendors with strong security and compliance certifications, a hurdle new players must overcome.

New entrants often struggle to gain traction because they lack the established reputation and positive client testimonials that companies like CareCloud have cultivated over years of service. Acquiring customers becomes a much more arduous and expensive process when potential clients cannot rely on a history of successful implementations and dependable support, directly impacting market penetration rates for emerging businesses.

Challenges in Data Interoperability and Ecosystem Integration

The threat of new entrants in the healthcare IT sector, particularly for platforms like CareCloud, is significantly influenced by the substantial hurdles in data interoperability and ecosystem integration. New players must navigate the intricate web of existing healthcare systems, including disparate Electronic Health Records (EHRs), laboratory information systems, and pharmacy networks. Failure to achieve seamless data exchange can render a new solution ineffective and hinder its adoption by providers already invested in established workflows.

The technical complexities involved in connecting with legacy systems are immense. New entrants often require extensive partnerships and significant investment in middleware or APIs to ensure their platforms can communicate effectively within the fragmented healthcare ecosystem. For instance, the Health Insurance Portability and Accountability Act (HIPAA) mandates strict data security and privacy, adding another layer of complexity for any new entrant aiming to integrate with existing patient data repositories. By 2024, the push for greater interoperability, driven by regulations like the 21st Century Cures Act, means that solutions not built with open standards and robust integration capabilities will struggle to gain traction.

- Data Interoperability Challenges: New entrants must overcome the technical difficulties of integrating with a wide array of existing healthcare IT systems, many of which are based on older technologies and lack standardized data formats.

- Ecosystem Integration Needs: Success hinges on the ability to connect with essential partners like labs, pharmacies, and other healthcare providers, requiring significant effort in establishing data-sharing agreements and technical interfaces.

- Regulatory Compliance: Adhering to stringent regulations such as HIPAA and the 21st Century Cures Act adds a critical layer of complexity and cost for new market entrants seeking to handle sensitive patient data.

- Market Acceptance Hurdles: Without proven interoperability and seamless integration, new solutions face resistance from healthcare organizations hesitant to disrupt existing workflows or invest in systems that cannot easily exchange information.

Long Sales Cycles and High Customer Acquisition Costs

The healthcare IT sector is characterized by lengthy sales cycles, often stretching over 12-18 months, as new solutions must navigate complex approval processes involving multiple stakeholders within a healthcare organization. This extended timeline, coupled with high customer acquisition costs that can exceed $50,000 per client, presents a substantial barrier for new entrants aiming to establish a foothold.

New companies must invest heavily in sales, marketing, and implementation support to overcome the inertia and established relationships of incumbent providers. The financial strain of these upfront investments, before significant revenue is generated, makes sustained entry particularly challenging for those without substantial capital backing.

- Long Sales Cycles: Healthcare IT sales can take over a year due to complex decision-making.

- High Customer Acquisition Costs: Acquiring a new healthcare client can cost upwards of $50,000.

- Financial Demands: Significant upfront investment is required, delaying profitability.

The threat of new entrants into the healthcare technology market, particularly for comprehensive cloud-based solutions like those offered by CareCloud, is considerably low due to several formidable barriers. These include the immense capital required for development and infrastructure, the complex regulatory landscape, and the inherent risk aversion of healthcare providers who prioritize established, trusted vendors. For instance, in 2024, the average cost for developing a sophisticated healthcare SaaS platform can easily range from $500,000 to over $2 million, a significant hurdle for many aspiring competitors.

Furthermore, achieving seamless data interoperability with existing, often legacy, healthcare systems presents a substantial technical challenge. New entrants must navigate intricate integration requirements and comply with stringent data security and privacy regulations like HIPAA and HITECH, adding layers of complexity and cost. By 2024, the push for greater interoperability, driven by regulations like the 21st Century Cures Act, means that solutions not built with open standards and robust integration capabilities will struggle to gain traction.

The lengthy sales cycles, often exceeding 12-18 months, and high customer acquisition costs, which can reach over $50,000 per client in 2024, also deter new market participants. These factors, combined with the need for significant upfront investment in sales, marketing, and implementation support before generating substantial revenue, create a financially demanding environment that favors established players with deep financial reserves.

| Barrier | Description | 2024 Impact/Cost |

|---|---|---|

| Capital Requirements | Developing robust healthcare SaaS platforms requires substantial investment in R&D, IT infrastructure, and talent. | $500,000 - $2 million+ for platform development. |

| Regulatory Compliance | Adherence to HIPAA, HITECH, and other healthcare-specific regulations demands significant legal and compliance resources. | Ongoing investment in legal counsel and continuous compliance efforts. |

| Interoperability & Integration | Connecting with diverse legacy systems (EHRs, labs) and ensuring data exchange is technically complex. | Requires middleware, APIs, and partnerships; non-compliance can hinder adoption. |

| Sales Cycles & Acquisition Costs | Long sales processes (12-18 months) and high customer acquisition costs make market entry financially taxing. | Customer acquisition costs can exceed $50,000 per client. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CareCloud is built upon a robust foundation of data, incorporating financial reports from publicly traded competitors, industry-specific market research from firms like KLAS Research, and regulatory filings from healthcare bodies.

We leverage a combination of primary and secondary data, including direct competitor financial statements, industry association reports, and expert interviews with healthcare IT professionals, to thoroughly assess the competitive landscape.