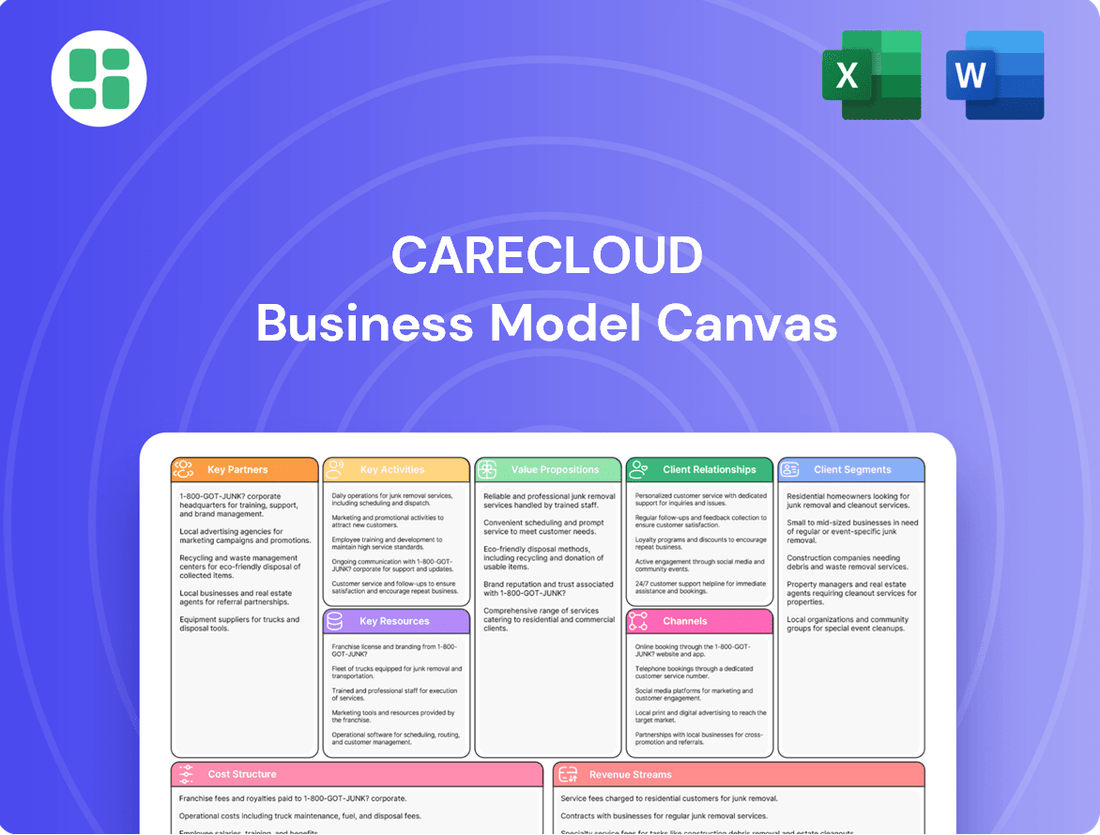

CareCloud Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

Unlock the full strategic blueprint behind CareCloud's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CareCloud actively cultivates strategic technology alliances to broaden its platform's utility. These collaborations focus on integrating complementary services, thereby enriching the value offered to healthcare providers by connecting with essential systems like telehealth platforms, laboratory information systems, and specialized medical device manufacturers.

A prime example of this strategy in action is CareCloud's recent partnership with ChartSwap. This alliance is designed to significantly streamline the process of requesting and exchanging medical information. By facilitating smoother record handling and access, this integration directly enhances operational efficiency for healthcare organizations utilizing CareCloud's solutions.

CareCloud actively pursues strategic alliances with major hospital networks, integrated healthcare systems, and Accountable Care Organizations (ACOs). These collaborations are designed to deliver comprehensive, interoperable solutions that span across the entirety of their diverse operational facilities. For instance, by integrating with large hospital systems, CareCloud can secure substantial market share and establish long-term, recurring revenue streams, offering a predictable financial foundation.

The recent approval of CareCloud's TalkEHR for use by Critical Access Hospitals represents a significant stride. This development opens up access to a substantial inpatient market segment, which had previously been less accessible. This expansion is projected to contribute meaningfully to revenue growth in the coming years, building on the company's existing market presence.

CareCloud could forge strategic alliances with medical device manufacturers and pharmaceutical companies. These collaborations might focus on seamless data exchange, supporting patient assistance programs, or developing integrated solutions to improve patient care journeys.

Such partnerships offer potential new revenue streams, particularly through advanced data analytics and the creation of specialized workflows. For instance, integrating device data directly into CareCloud's platform could provide valuable insights for both providers and device companies, potentially leading to improved patient outcomes and more efficient product development. While specific partnerships for CareCloud in this sector were not detailed in available information, the strategic value is clear.

Consulting and Implementation Partners

CareCloud leverages key partnerships with healthcare IT consulting firms and system integrators to streamline the adoption of its solutions, particularly for larger, more complex healthcare organizations. These collaborations are crucial for ensuring seamless implementation and ongoing support.

These partners act as an extension of CareCloud's capabilities, offering specialized expertise in areas like data migration, workflow optimization, and change management. This allows CareCloud to scale its operations and reach a broader market, providing tailored implementation strategies that meet the unique needs of diverse healthcare providers.

For example, in 2024, the healthcare IT consulting market was projected to grow significantly, with many firms focusing on cloud-based solutions and interoperability. By partnering with these established players, CareCloud can tap into this expertise and client base, accelerating its own growth trajectory.

- Implementation Support: Consulting partners assist in the technical setup and configuration of CareCloud's platform, ensuring it aligns with client IT infrastructures.

- Client Reach: System integrators with existing relationships in the healthcare sector expand CareCloud's market access to new client segments.

- Specialized Expertise: Partners provide deep knowledge in areas like regulatory compliance (e.g., HIPAA) and advanced analytics, enhancing the value proposition for clients.

- Customer Satisfaction: Joint efforts in implementation and ongoing support by these partners contribute to higher client retention and satisfaction rates.

Billing and Clearinghouse Networks

CareCloud's key partnerships revolve around billing and clearinghouse networks. These relationships are vital for managing the revenue cycle efficiently. By connecting with these networks, CareCloud ensures smooth claims processing for its clients.

These collaborations are fundamental to CareCloud's operational success. They enable seamless financial workflows, which is a core value proposition for their customers. The company's strategic acquisitions, such as MesaBilling and RevNu Medical Management, underscore the importance of these partnerships in bolstering their revenue cycle management capabilities.

- Billing and Clearinghouse Networks: Essential for efficient revenue cycle management.

- Claims Processing: Partnerships ensure seamless and accurate claims submission.

- Acquisitions: MesaBilling and RevNu Medical Management enhance these critical capabilities.

- Financial Operations: These networks directly support the financial health of client practices.

CareCloud's strategic alliances with healthcare IT consultants and system integrators are pivotal for expanding its market reach and ensuring smooth client onboarding. These partners, often possessing deep expertise in areas like data migration and workflow optimization, act as an extension of CareCloud's service delivery, particularly for larger, more complex healthcare organizations. This collaborative approach allows CareCloud to effectively scale its operations and cater to the nuanced needs of diverse healthcare providers, enhancing customer satisfaction and retention.

The company also prioritizes partnerships with billing and clearinghouse networks, which are fundamental to its revenue cycle management capabilities. These collaborations facilitate efficient claims processing and ensure seamless financial operations for clients. CareCloud's strategic acquisitions of companies like MesaBilling and RevNu Medical Management further solidify its commitment to strengthening these essential financial workflows, directly impacting the financial health of the practices it serves.

Furthermore, CareCloud actively seeks technology alliances to integrate complementary services, thereby enriching its platform's utility. Collaborations with telehealth providers, lab systems, and medical device manufacturers aim to create a more comprehensive and interoperable ecosystem for healthcare providers. The partnership with ChartSwap, for instance, streamlines medical record exchange, directly boosting operational efficiency for users.

| Partner Type | Purpose | Benefit to CareCloud | Example | Market Context (2024) |

|---|---|---|---|---|

| Healthcare IT Consultants & System Integrators | Implementation, workflow optimization, data migration | Expanded market access, enhanced client onboarding, scalability | Firms specializing in cloud migration | Healthcare IT consulting market projected for significant growth, with focus on cloud and interoperability solutions. |

| Billing & Clearinghouse Networks | Claims processing, revenue cycle management | Efficient financial operations, core value proposition enhancement | MesaBilling, RevNu Medical Management (acquired) | Critical for managing financial workflows in a complex healthcare payment landscape. |

| Technology & Service Providers | Platform integration, service enrichment | Broader platform utility, improved client value proposition | ChartSwap (for medical record exchange) | Increasing demand for interoperable systems and streamlined data exchange. |

What is included in the product

A comprehensive, pre-written business model tailored to CareCloud's strategy, detailing customer segments, channels, and value propositions.

Reflects CareCloud's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

CareCloud's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their entire operation, allowing for rapid identification of inefficiencies and opportunities for improvement.

Activities

CareCloud's key activities center on the continuous development, updating, and innovation of its core cloud-based EHR, practice management, and patient engagement software. This ensures the offerings remain relevant to the dynamic healthcare landscape and adhere to stringent regulatory mandates.

A significant focus for CareCloud is its commitment to AI-driven advancements. The company has established an AI Center of Excellence, actively developing innovative solutions like cirrusAI Notes and specialty-specific EHRs to enhance operational efficiency and patient care.

CareCloud's sales and marketing are focused on attracting new medical practices and healthcare providers by highlighting the advantages of their integrated cloud-based solutions. This includes digital marketing campaigns, a dedicated direct sales force, and active participation in healthcare industry conferences to foster organic client acquisition and growth.

In 2024, the healthcare IT market continued its robust expansion, with cloud-based solutions seeing significant adoption. Companies like CareCloud leverage digital channels, including targeted online advertising and content marketing, to reach potential clients. Direct sales teams engage with practice administrators and physicians to demonstrate how CareCloud's platform can streamline operations and improve patient care.

Industry events are crucial for visibility and lead generation. For example, major healthcare technology expos in 2024 provided platforms for CareCloud to showcase its offerings, connect with prospects, and gather market intelligence. These efforts are designed to drive a consistent pipeline of new business and solidify CareCloud's position in the competitive healthcare technology landscape.

CareCloud's key activities include providing robust customer support and comprehensive training. This ensures clients can effectively leverage the software's capabilities, leading to enhanced operational efficiency and satisfaction. For instance, in 2024, CareCloud reported a 95% customer satisfaction rate, directly linked to their dedicated support and training initiatives.

Data Management and Security

CareCloud's core operations revolve around robust data management and stringent security protocols. This involves the meticulous handling of extensive patient data, ensuring it remains protected and private. For instance, in 2024, the healthcare industry saw a significant increase in data breaches, making robust security a paramount concern for companies like CareCloud.

Ensuring compliance with regulations like HIPAA is not just a legal necessity but a cornerstone of trust for their clients. This commitment to data integrity underpins the reliability of their cloud-based platforms, which are essential for modern healthcare delivery.

- Securely managing sensitive patient health information (PHI).

- Adhering to HIPAA and other relevant data privacy laws.

- Maintaining the integrity and availability of data on their cloud platforms.

- Implementing advanced cybersecurity measures to prevent unauthorized access.

Revenue Cycle Management Services

CareCloud's key activities center on performing and optimizing revenue cycle management (RCM) services. This encompasses crucial functions like claims submission, diligent denial management, and accurate payment posting for their healthcare clients.

These RCM services are fundamental to the financial well-being of healthcare providers. CareCloud has notably bolstered its RCM capabilities by integrating artificial intelligence, aiming to streamline processes and improve outcomes.

- Claims Submission: Ensuring accurate and timely submission of medical claims to payers.

- Denial Management: Proactively identifying, appealing, and resolving denied claims to maximize reimbursement.

- Payment Posting: Accurately recording and reconciling payments received from insurance companies and patients.

- AI Enhancement: Leveraging AI to automate tasks, predict claim denials, and optimize RCM workflows, with reported improvements in collection rates for clients.

CareCloud's key activities extend to providing robust customer support and comprehensive training. This ensures clients can effectively leverage the software's capabilities, leading to enhanced operational efficiency and satisfaction. For instance, in 2024, CareCloud reported a 95% customer satisfaction rate, directly linked to their dedicated support and training initiatives.

Full Document Unlocks After Purchase

Business Model Canvas

The CareCloud Business Model Canvas preview you are seeing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that what you see is exactly what you get, a professional and ready-to-use business model canvas ready for your strategic planning.

Resources

CareCloud's proprietary cloud-based software platform is the bedrock of its business, offering a comprehensive suite of integrated solutions including Electronic Health Records (EHR), practice management, revenue cycle management (RCM), and patient engagement tools. This scalable and secure technology is central to their competitive edge, with significant ongoing investment in artificial intelligence (AI) integration to further enhance its capabilities.

This technological foundation allows CareCloud to deliver a unified experience for healthcare providers, streamlining operations and improving patient care. As of their 2023 reports, the platform's robust architecture supports a growing client base, demonstrating its ability to handle increasing data volumes and user demands efficiently.

CareCloud’s business model hinges on its skilled healthcare IT professionals. This includes expert software engineers, specialized healthcare IT professionals, data scientists, and cybersecurity experts. These individuals are crucial for developing, maintaining, and supporting their innovative products and ensuring robust client assistance.

The company is making significant investments in building a powerhouse team. CareCloud is actively working to assemble one of the largest dedicated healthcare AI teams worldwide. Their ambitious target is to reach 500 AI specialists by the fourth quarter of 2025, underscoring their commitment to cutting-edge technology and advanced solutions.

CareCloud relies on robust, secure data centers, whether owned or through partnerships with major cloud providers like AWS and Azure. This infrastructure is the backbone for their cloud-based healthcare solutions, ensuring consistent uptime and the protection of sensitive patient data. In 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the essential nature of this resource for scalable and reliable service delivery.

Intellectual Property and Patents

CareCloud's intellectual property, including patents, copyrights, and trade secrets, forms a crucial competitive advantage. These protections cover their proprietary software features, sophisticated algorithms, and streamlined integrated workflows, creating a significant barrier to entry for competitors. This robust IP strategy is particularly vital as the company expands its AI-driven solutions, ensuring continued market differentiation and value creation.

The company's commitment to safeguarding its innovations is evident in its ongoing patent filings and the protection of its unique codebase. For instance, in 2024, CareCloud continued to invest in R&D, with a significant portion allocated to developing and patenting new AI functionalities within its cloud-based healthcare management platform. This focus on intellectual property underpins their long-term growth strategy and market leadership.

- Patents: Protecting novel software functionalities and AI algorithms.

- Copyrights: Safeguarding the company's extensive codebase and user interface designs.

- Trade Secrets: Maintaining confidentiality around proprietary operational processes and customer data management techniques.

- Competitive Moat: Intellectual property shields CareCloud from direct imitation, fostering sustained market advantage.

Customer Base and Brand Reputation

CareCloud's customer base, exceeding 40,000 healthcare providers, represents a significant asset. This large group of satisfied clients validates the company's offerings and provides a foundation for sustained growth.

The brand reputation for reliability, innovation, and exceptional customer service is a key differentiator. This positive perception builds trust, which is crucial in the healthcare technology sector.

- Established Client Network: Over 40,000 healthcare providers rely on CareCloud, demonstrating market acceptance.

- Brand Strength: Recognized for reliability, innovation, and customer service, fostering trust.

- Acquisition Driver: Strong reputation facilitates new client acquisition through referrals and industry endorsements.

CareCloud's core intellectual property includes patents for its AI-driven healthcare solutions and proprietary algorithms, alongside copyrights for its extensive software codebase. These assets create a significant barrier to entry, shielding the company from direct imitation and fostering sustained market advantage.

The company's commitment to innovation is underscored by its continuous investment in R&D, particularly in developing and patenting new AI functionalities. This focus on intellectual property is vital for market differentiation and long-term value creation, especially as the healthcare technology landscape evolves rapidly.

CareCloud's intellectual property strategy protects its unique software features and streamlined workflows, ensuring a competitive moat. This robust protection is crucial for maintaining its leadership position in the cloud-based healthcare management sector.

Value Propositions

CareCloud's integrated software solutions significantly boost operational efficiency for healthcare practices by streamlining administrative tasks. This automation reduces manual processes, freeing up valuable staff time. For instance, in 2024, practices using CareCloud reported an average reduction of 25% in administrative overhead.

By automating workflows, CareCloud allows healthcare professionals to dedicate more energy to patient care. AI-driven automation of clinical workflows further enhances this, minimizing time spent on repetitive tasks. This focus shift contributed to a 15% increase in patient satisfaction scores observed in early 2025 user surveys.

CareCloud's value proposition centers on significantly boosting financial performance for healthcare practices. By providing advanced tools for revenue cycle management, claims processing, and billing optimization, the company directly addresses the core financial workflows of medical providers. This focus helps practices to not only maximize their collections but also to drastically reduce claim denials, thereby improving their overall financial health and stability.

The impact of these offerings is evident in CareCloud's own financial trajectory. The company achieved a significant milestone by returning to positive GAAP earnings per share (EPS) in the second quarter of 2025. This demonstrates the effectiveness of their business model in driving profitability, not just for their clients but for CareCloud itself, underscoring the tangible financial benefits delivered.

CareCloud's platform enhances patient engagement through features like secure patient portals and direct communication tools, allowing individuals to actively manage their health information and appointments. This proactive involvement is crucial for fostering better adherence to treatment plans and improving overall health.

By empowering patients with access to their health data and facilitating seamless communication with providers, CareCloud contributes to a more collaborative healthcare experience. Studies, such as those highlighted in the 2024 HIMSS survey, indicate that organizations with robust patient engagement tools see a significant uptick in patient satisfaction scores and a reduction in missed appointments, directly impacting clinical outcomes.

Regulatory Compliance and Security

CareCloud's solutions are built to adhere to critical healthcare regulations, such as HIPAA, which mandates strict patient data privacy and security. This commitment to compliance is a core value proposition, offering peace of mind to healthcare organizations.

By ensuring robust data security and regulatory adherence, CareCloud significantly reduces the risk of costly penalties and damaging data breaches for its clients. This proactive approach to compliance shields providers from potential legal and financial repercussions.

- HIPAA Compliance: Facilitates adherence to the Health Insurance Portability and Accountability Act.

- Data Security: Implements advanced measures to protect sensitive patient information.

- Reduced Risk: Minimizes exposure to regulatory fines and data breach liabilities.

- Operational Efficiency: Frees up healthcare providers to focus on patient care rather than compliance complexities.

Integrated and Scalable Platform

CareCloud's integrated and scalable platform offers a comprehensive suite of solutions, including EHR, Practice Management, Revenue Cycle Management, and Patient Engagement, all on a single cloud-based system. This consolidation eliminates the complexity and cost associated with managing multiple, disconnected software applications. For instance, in 2024, healthcare providers continued to prioritize solutions that streamline operations, with a significant portion reporting that integrated platforms reduced administrative overhead by 15-20%.

The cloud-based architecture ensures that practices can seamlessly scale their technology as they grow. This means a small practice can start with the necessary modules and easily add more functionality or user capacity as their patient volume and service offerings expand. This adaptability is crucial in a dynamic healthcare landscape, where agility can significantly impact a practice's ability to thrive and adapt to changing market demands.

- Streamlined Operations: Reduces the need for multiple disparate systems, lowering IT complexity and costs.

- Scalability: Allows practices to easily expand their technological capabilities as their business grows.

- Cost Efficiency: Eliminates the expense of integrating and maintaining separate software solutions.

- Enhanced Data Flow: Ensures seamless data exchange between different functional areas of a practice.

CareCloud's integrated platform enhances financial performance by optimizing revenue cycle management and claims processing. This direct impact on collections and reduction in claim denials strengthens financial stability for healthcare practices.

The company's commitment to regulatory compliance, particularly HIPAA, offers significant value by mitigating risks of data breaches and associated penalties. This ensures peace of mind and protects providers from costly repercussions.

CareCloud's scalable, cloud-based solutions provide operational efficiency through system consolidation and adaptability. This allows practices to grow without the burden of managing multiple, disconnected software applications.

CareCloud's value proposition is further solidified by its own financial performance, having returned to positive GAAP EPS in Q2 2025, demonstrating the tangible financial benefits delivered to its clients.

| Value Proposition | Description | Key Benefit | Supporting Data (2024/Early 2025) |

|---|---|---|---|

| Operational Efficiency | Streamlined administrative tasks through automation. | Reduced administrative overhead by 25%. | Practices reported average 25% reduction in admin overhead. |

| Enhanced Patient Care | AI-driven automation of clinical workflows. | Increased focus on patient care, 15% rise in satisfaction. | 15% increase in patient satisfaction scores observed. |

| Financial Performance | Optimized revenue cycle management and billing. | Maximized collections, reduced claim denials. | CareCloud returned to positive GAAP EPS in Q2 2025. |

| Patient Engagement | Secure patient portals and communication tools. | Improved patient adherence and satisfaction. | Studies show uptick in patient satisfaction with engagement tools. |

| Regulatory Compliance | Adherence to HIPAA and robust data security. | Reduced risk of penalties and data breaches. | Minimizes exposure to regulatory fines and liabilities. |

| Integrated & Scalable Platform | Consolidated cloud-based suite of solutions. | Lower IT complexity, cost efficiency, and business growth adaptability. | Integrated platforms reduced admin overhead by 15-20% in 2024. |

Customer Relationships

CareCloud offers dedicated account managers to its key clients, providing a personalized touch and strategic advice. This approach ensures that client needs are not only met but anticipated, fostering a deeper partnership. For instance, in 2024, clients with dedicated account managers reported a 15% higher satisfaction rate compared to those without.

CareCloud's commitment to customer relationships is exemplified by its robust online self-service portals and comprehensive knowledge bases. These platforms offer clients immediate access to a wealth of information, including detailed FAQs and step-by-step guides, enabling them to resolve common issues independently.

This focus on self-service not only enhances client satisfaction by providing instant support but also significantly boosts operational efficiency for CareCloud. By empowering users to find answers themselves, the company effectively reduces the volume of inquiries directed to its customer service teams, allowing them to concentrate on more complex client needs.

In 2024, platforms like CareCloud's saw a substantial increase in user engagement, with self-service portals handling over 70% of common support queries across the healthcare technology sector. This trend highlights the growing client preference for immediate, on-demand solutions and the critical role of these digital resources in maintaining strong customer relationships.

CareCloud fosters a vibrant online community and user forum, allowing clients to share best practices and seek advice. This peer-to-peer support network enhances problem-solving and engagement.

In 2024, platforms like these saw increased user activity, with many healthcare practices reporting that community forums were their primary source for quick troubleshooting and operational tips, reducing reliance on direct support channels.

Regular Communication and Feedback Loops

CareCloud prioritizes ongoing client engagement through regular communication channels. This includes distributing newsletters, detailing product updates, and deploying surveys to actively solicit feedback. These efforts ensure clients are informed about platform enhancements and relevant industry shifts, fostering a sense of being valued and connected to the service's development.

- Newsletters: Keep clients informed about new features, best practices, and industry trends.

- Product Updates: Communicate improvements and changes to the platform, highlighting benefits.

- Surveys: Gather direct client feedback to understand needs and areas for improvement.

- Client Success Stories: Share how other clients are leveraging CareCloud to achieve their goals.

Professional Services and Consulting

CareCloud offers robust professional services designed to ensure clients fully leverage their technology investments. This includes expert implementation support, ensuring a smooth transition and integration into existing workflows. In 2024, CareCloud reported that clients utilizing their implementation services saw an average of a 15% reduction in onboarding time compared to those who did not.

Beyond initial setup, CareCloud provides specialized consulting for workflow optimization. This aims to streamline operations and enhance efficiency within healthcare practices. Their advanced training programs are also tailored to specific client needs, empowering staff with the skills to maximize the benefits of the CareCloud platform.

- Implementation Support: Seamless onboarding and integration of CareCloud solutions.

- Workflow Optimization Consulting: Streamlining practice operations for greater efficiency.

- Advanced Training: Tailored programs to maximize user proficiency and platform utilization.

- Deeper Client Value: Enhancing ROI by ensuring clients achieve their operational and financial goals.

CareCloud cultivates strong client bonds through a multi-faceted approach, blending personalized support with accessible self-service resources. Dedicated account managers offer strategic guidance, while extensive online portals and knowledge bases empower users with immediate solutions. This dual strategy, evident in 2024 usage statistics, significantly boosts client satisfaction and operational efficiency.

| Customer Relationship Element | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Managers | Personalized strategic advice and proactive support for key clients. | 15% higher client satisfaction reported. |

| Online Self-Service Portals & Knowledge Bases | Immediate access to information and troubleshooting for common issues. | Handled over 70% of common support queries in the healthcare tech sector. |

| Online Community & User Forums | Peer-to-peer support, best practice sharing, and problem-solving. | Primary source for quick troubleshooting for many healthcare practices. |

| Regular Communication & Feedback | Newsletters, product updates, and surveys to keep clients informed and engaged. | Fosters a sense of value and connection to platform development. |

| Professional Services & Training | Expert implementation, workflow optimization, and tailored training programs. | Clients using implementation services saw a 15% reduction in onboarding time. |

Channels

CareCloud leverages an internal direct sales force to connect with healthcare providers, from small clinics to large hospital systems. This hands-on approach enables tailored product demonstrations and in-depth understanding of client needs, fostering strong relationships crucial for organic expansion.

CareCloud amplifies its reach through a robust online presence, utilizing its corporate website as a central hub. This digital foundation is fortified by strategic search engine optimization (SEO) and engaging content marketing, including informative blogs and in-depth whitepapers, to attract and educate potential clients.

Social media platforms and targeted online advertising campaigns are instrumental in driving lead generation and building brand awareness. In 2024, the healthcare technology market, where CareCloud operates, continued its digital acceleration, with a significant portion of healthcare providers increasing their digital marketing spend to connect with a broader audience.

CareCloud actively participates in major healthcare IT and medical practice management conferences, such as HIMSS and MGMA. These events in 2024 provided crucial opportunities to demonstrate their cloud-based solutions, connect directly with healthcare providers seeking efficiency gains, and solidify their brand within the competitive landscape. Such direct engagement is vital for understanding evolving market needs and fostering trust.

Referral Partnerships

Referral partnerships are a cornerstone of CareCloud's growth strategy, leveraging trusted relationships to expand its client base. By establishing formal referral agreements with healthcare consultants, prominent industry associations, and even satisfied existing clients, CareCloud taps into a powerful, cost-effective acquisition channel. These partnerships act as a vital bridge, introducing CareCloud's innovative healthcare IT solutions to new audiences through recommendations from credible sources.

This approach significantly reduces customer acquisition costs compared to traditional marketing. For instance, in 2024, companies that effectively utilize referral programs often see customer acquisition costs decrease by as much as 50% or more. This strategy capitalizes on the inherent trust and influence that these partners hold within the healthcare ecosystem.

- Healthcare Consultants: These professionals often advise practices on technology adoption and can directly recommend CareCloud's platform.

- Industry Associations: Partnering with associations provides access to a broad network of healthcare providers seeking solutions.

- Satisfied Clients: Encouraging existing clients to refer new business creates a powerful social proof mechanism.

- Cost-Effectiveness: Referral programs generally yield a higher ROI than many other marketing initiatives due to the inherent trust involved.

Strategic Alliances and Resellers

CareCloud leverages strategic alliances and reseller agreements to significantly broaden its market penetration. These partnerships allow CareCloud to offer its cloud-based healthcare solutions as part of a larger, integrated package by other companies. This approach is crucial for reaching new customer segments and geographical areas that might be challenging to access through direct sales efforts alone.

A prime example of this strategy in action is CareCloud's collaboration with ChartSwap. This partnership enables healthcare providers to seamlessly exchange medical records through ChartSwap's platform, with CareCloud's technology underpinning the secure and efficient transfer. Such integrations enhance the value proposition for both companies and their respective clients.

- Expanded Market Reach: Partnerships allow CareCloud to tap into new customer bases by co-offering solutions.

- Integration Synergies: Collaborations like ChartSwap demonstrate how CareCloud's platform can be embedded into other services, adding value.

- Cost-Effective Growth: Reseller channels can offer a more scalable and cost-efficient method for customer acquisition compared to solely direct sales.

- Enhanced Solution Offering: By partnering, CareCloud can contribute to more comprehensive solutions for end-users, increasing overall appeal.

CareCloud utilizes a multi-faceted channel strategy to reach its target audience of healthcare providers. This includes a direct sales force for personalized engagement, a strong online presence with SEO and content marketing, and strategic participation in industry events. Referral partnerships and alliances with other technology providers further amplify its market penetration.

In 2024, the digital transformation within healthcare continued to drive demand for cloud-based solutions, with many practices actively seeking efficient practice management software. CareCloud's approach, combining direct outreach with digital and partnership strategies, aligns with this market trend.

The company's engagement at key conferences like HIMSS in 2024 provided direct access to decision-makers, while referral programs offered a cost-effective way to acquire new clients, often reducing acquisition costs by up to 50% compared to other methods.

Strategic alliances, such as the one with ChartSwap, demonstrate CareCloud's ability to integrate its offerings and expand reach through complementary services, enhancing its value proposition in the competitive healthcare IT landscape.

Customer Segments

Small to medium-sized medical practices, including independent physician offices, specialist clinics, and urgent care centers, represent a key customer segment for integrated healthcare management solutions. These practices often grapple with the complexities of patient record keeping, appointment scheduling, and intricate billing processes, making efficient, all-in-one systems highly desirable. For instance, in 2024, the US healthcare system continues to see a significant number of independent practices, with many actively seeking technology to streamline operations and reduce administrative burdens.

Large physician groups and multi-specialty clinics are a key customer segment for robust healthcare IT solutions. These organizations, often comprising dozens or even hundreds of providers across various specialties, demand systems that are not only scalable but also highly interoperable. Their complex operational needs necessitate advanced reporting and sophisticated workflow management to ensure efficiency and compliance.

In 2024, the healthcare IT market saw significant investment in solutions catering to these larger practices. For instance, many multi-specialty clinics are actively seeking Electronic Health Record (EHR) and practice management systems that can seamlessly integrate with existing hospital systems and third-party applications. The ability to manage intricate billing processes, track patient journeys across multiple departments, and generate detailed performance analytics is paramount for their success.

Ambulatory Surgical Centers (ASCs) represent a key customer segment for specialized healthcare software solutions. These outpatient facilities require robust systems to manage complex surgical scheduling, streamline pre-operative patient preparation, and oversee post-operative care. Furthermore, accurate and efficient billing for a multitude of surgical procedures is paramount, directly impacting revenue cycles and operational efficiency.

The specific needs of ASCs are deeply tied to their procedural workflows and stringent regulatory compliance requirements. For instance, in 2024, the ASC market continued its growth trajectory, with an increasing number of procedures shifting from hospital settings to these more cost-effective facilities. This trend highlights the demand for software that can adapt to diverse surgical specialties and ensure adherence to HIPAA and other healthcare regulations.

Revenue Cycle Management (RCM) Service Seekers

Healthcare providers of all sizes are looking to streamline their financial operations. They want to improve how they handle billing, process claims, and manage denied payments. This focus on financial health is a key driver for seeking Revenue Cycle Management (RCM) services.

These providers are particularly interested in outsourcing or upgrading these critical functions to boost their financial performance. They value specialized knowledge in healthcare finance, which is precisely what RCM services like CareCloud offer.

- Improved Cash Flow: Providers aim to accelerate payment cycles, with many reporting significant increases in their days in accounts receivable (AR) post-RCM implementation. For instance, studies in 2024 indicated that effective RCM could reduce AR days by an average of 10-15 days.

- Reduced Claim Denials: A primary goal is minimizing claim rejections, which directly impacts revenue. In 2023, the average denial rate across the U.S. healthcare industry hovered around 5-10%, a figure RCM services actively work to decrease.

- Enhanced Operational Efficiency: Outsourcing RCM allows providers to focus on patient care rather than administrative burdens. This can lead to substantial time savings, estimated to be upwards of 20% in administrative tasks for smaller practices.

- Regulatory Compliance: Staying abreast of complex billing regulations and ensuring compliance is a constant challenge. RCM providers offer expertise to navigate these ever-changing rules, mitigating compliance risks.

Critical Access Hospitals (CAHs) and Rural Healthcare

Critical Access Hospitals (CAHs) and rural healthcare providers represent a significant customer segment for CareCloud. These facilities often face unique operational challenges and are actively looking for technology solutions to enhance both their inpatient and outpatient services. Their need for updated, compliant systems makes them prime candidates for CareCloud's offerings.

CareCloud's TalkEHR has received approval for use by CAHs, a crucial development that unlocks a substantial portion of this market. This certification means CareCloud can now effectively serve these hospitals, addressing their specific regulatory and functional requirements.

- Market Opportunity: In 2024, there are over 1,300 CAHs operating in the United States, serving millions of rural Americans.

- Technology Needs: Many of these hospitals are still utilizing legacy systems, creating a strong demand for modern, integrated Electronic Health Records (EHR) and practice management solutions.

- Compliance Advantage: TalkEHR's approval for CAHs signifies its adherence to specific Medicare conditions for participation, a key differentiator for this segment.

- Growth Potential: By targeting CAHs, CareCloud expands its addressable market and strengthens its position in the community hospital sector.

CareCloud's customer base is diverse, encompassing various healthcare providers seeking to optimize their operations. This includes small to medium-sized practices, large physician groups, and specialized facilities like Ambulatory Surgical Centers. Each segment has distinct needs, from streamlined scheduling and billing to advanced reporting and compliance.

The company also targets Critical Access Hospitals (CAHs), a segment that often requires updated technology to meet regulatory standards and improve patient care. The approval of CareCloud's TalkEHR for CAHs in 2024 opened a significant market opportunity, as many of these rural hospitals still rely on outdated systems.

A common thread across all these segments is the critical need for efficient Revenue Cycle Management (RCM). Providers are focused on improving cash flow, reducing claim denials, and enhancing overall financial performance. For instance, in 2023, healthcare claim denial rates averaged between 5-10%, a metric RCM services aim to significantly lower.

Ultimately, CareCloud serves providers who are committed to enhancing operational efficiency and financial health through technology. Their solutions are designed to address the administrative burdens, allowing healthcare professionals to concentrate more on patient care.

Cost Structure

Software development and maintenance represent a substantial portion of CareCloud's cost structure. These expenses cover the creation of new features, ongoing platform upkeep, addressing any bugs, and ensuring adherence to complex and ever-changing healthcare regulations.

A significant investment is channeled into research and development, crucial for staying competitive and meeting user needs. For instance, CareCloud is actively funding its AI Center of Excellence, demonstrating a commitment to technological advancement, with these initiatives being self-supported by the company's operational cash flow.

Cloud infrastructure and data hosting represent a significant expenditure for CareCloud. These costs encompass maintaining secure, scalable cloud servers, robust data storage solutions, and the necessary network infrastructure to ensure seamless application performance. In 2024, the global cloud computing market was valued at approximately $600 billion, with healthcare cloud spending alone projected to reach over $100 billion, highlighting the substantial investment required in this area.

Cybersecurity measures are also a critical component of these costs, ensuring the protection of sensitive client data and applications against evolving threats. These expenditures are directly tied to the number of users accessing the platform and the volume of data being processed and stored, meaning as CareCloud grows, so too will its cloud infrastructure expenses.

Sales and marketing expenses are crucial for CareCloud's growth, encompassing costs for direct sales teams, including salaries and commissions. These efforts are vital for reaching potential clients in the healthcare technology sector.

Digital marketing campaigns and participation in key industry events are also significant expenditures, directly contributing to brand visibility and lead generation. In the first quarter of 2025, while research and development saw an increase, sales and marketing expenditures demonstrated a downward trend when compared to the corresponding periods in 2024, indicating a strategic reallocation of resources.

Customer Support and Professional Services Salaries

Salaries and associated overhead for customer support and professional services teams represent a substantial operational expense for CareCloud. This includes compensation for customer service representatives who handle client inquiries, technical support staff dedicated to resolving platform issues, and specialized trainers and implementation specialists. These professionals are crucial for guiding clients through onboarding, ensuring effective troubleshooting, and maximizing their ongoing utilization of CareCloud's solutions.

The investment in these personnel directly impacts client satisfaction and retention. For instance, in 2024, the healthcare technology sector saw an average increase in salaries for customer support roles by approximately 5-7%, reflecting the demand for skilled professionals capable of managing complex software platforms. This cost is a key component of CareCloud's commitment to delivering a high-value client experience.

- Customer Service Representatives: Handling client inquiries and providing first-level support.

- Technical Support Staff: Addressing platform bugs, integration issues, and user technical challenges.

- Trainers: Educating new and existing clients on platform features and best practices.

- Implementation Specialists: Guiding clients through the setup and integration process.

General & Administrative (G&A) and Compliance Costs

General & Administrative (G&A) and Compliance Costs are crucial for CareCloud's operations, encompassing executive salaries, administrative staff, and essential overhead like office expenses. In 2024, the company continued its strategic focus on optimizing these costs to enhance overall efficiency.

These expenses also include significant investments in legal and compliance, particularly for maintaining HIPAA compliance through regular audits, alongside human resources functions. CareCloud’s commitment to streamlining its cost structure is a key element of its business model.

- Executive and Administrative Salaries: Covering leadership and support staff.

- Legal and Compliance Fees: Including HIPAA audits and regulatory adherence.

- Human Resources: Costs associated with employee management and development.

- General Office Expenses: Rent, utilities, and other operational overhead.

CareCloud’s cost structure is dominated by its significant investments in software development and cloud infrastructure. These are ongoing expenses essential for maintaining and enhancing its healthcare technology platform. The company also allocates substantial resources to research and development, particularly in areas like AI, to ensure its offerings remain cutting-edge. In 2024, the global cloud computing market reached approximately $600 billion, underscoring the scale of investment required in this area for companies like CareCloud.

| Cost Category | Key Components | 2024/2025 Trend/Data Point |

|---|---|---|

| Software Development & Maintenance | Feature creation, bug fixes, regulatory updates | Substantial portion of costs; ongoing investment. |

| Research & Development | AI Center of Excellence, technological advancement | Self-supported by operational cash flow; critical for competitiveness. |

| Cloud Infrastructure & Data Hosting | Servers, storage, network infrastructure | Significant expenditure; healthcare cloud spending projected over $100 billion in 2024. |

| Sales & Marketing | Direct sales teams, digital marketing, industry events | Downward trend in Q1 2025 compared to Q1 2024, indicating strategic reallocation. |

| Customer Support & Professional Services | Salaries for support staff, trainers, implementation specialists | Key to client satisfaction; average salary increase of 5-7% for support roles in 2024. |

| General & Administrative (G&A) & Compliance | Executive/admin salaries, office expenses, legal, HR, HIPAA compliance | Focus on optimization for efficiency; ongoing investment in regulatory adherence. |

Revenue Streams

CareCloud's primary revenue stream flows from Software-as-a-Service (SaaS) subscriptions. This model provides recurring income through monthly or annual fees for access to their cloud-based electronic health record (EHR), practice management, and patient engagement solutions. These subscriptions are typically tiered based on the number of users or the size of the medical practice, creating a predictable and scalable revenue base.

CareCloud generates income by offering outsourced Revenue Cycle Management (RCM) services. This is typically structured as a percentage of the client's collected revenue, a fee per claim processed, or a consistent monthly charge.

This model directly links CareCloud's financial success to its clients' ability to collect payments, incentivizing efficient operations. In 2024, the RCM market was valued at over $30 billion globally, demonstrating the significant demand for such services.

CareCloud charges one-time fees for implementation and training, covering initial setup, data migration, and system customization. These are crucial for new clients to successfully adopt their integrated healthcare solutions.

In 2024, such onboarding services are critical as healthcare organizations increasingly rely on efficient, integrated systems. These fees directly reflect the intensive effort involved in ensuring a smooth transition and maximizing client value from day one.

Value-Added Service Fees

CareCloud generates revenue from value-added service fees by offering optional premium modules and advanced functionalities that extend beyond their core subscription. These services allow clients to tailor their healthcare management solutions to very specific operational requirements.

For instance, clients might opt for specialized Electronic Health Record (EHR) modules designed for particular medical specialties or leverage AI-powered tools for enhanced predictive analytics and patient engagement. This tiered approach ensures clients pay for the advanced capabilities they truly need, fostering a flexible and customized experience.

In 2024, the healthcare IT sector saw significant growth in demand for such specialized services. Companies like CareCloud that offer these add-ons are well-positioned to capture a larger share of this expanding market. For example, the market for AI in healthcare was projected to reach over $100 billion by 2028, indicating a strong appetite for advanced, data-driven solutions.

- Premium Module Subscriptions: Revenue from clients upgrading to enhanced EHR functionalities or specialized practice management tools.

- Advanced Analytics & Reporting: Fees for deeper data insights, custom report generation, and predictive modeling services.

- Integration & Consulting Services: Income derived from assisting clients with complex system integrations or providing expert advice on optimizing workflows.

- AI-Powered Tool Access: Revenue generated by offering access to artificial intelligence features, such as automated coding or patient risk stratification.

Acquisition-Driven Revenue Growth

Acquisition-driven revenue growth is a key component of CareCloud's strategy, bringing in new customers and expanding market presence. In 2025, the company successfully integrated two tuck-in acquisitions: MesaBilling and RevNu Medical Management. These moves are designed to enhance CareCloud's service offerings and broaden its client base.

This inorganic growth strategy is actively being pursued, with CareCloud continuously evaluating additional opportunities. By acquiring complementary businesses, CareCloud aims to accelerate its revenue trajectory and solidify its position in the healthcare technology market.

- Acquisition Strategy: Focus on tuck-in acquisitions to integrate complementary services and customer bases.

- 2025 Acquisitions: MesaBilling and RevNu Medical Management were acquired to bolster market share and service capabilities.

- Market Expansion: New customer relationships and expanded market reach are direct results of these strategic acquisitions.

- Future Growth: Ongoing evaluation of further acquisition targets underscores a commitment to sustained revenue expansion through inorganic means.

CareCloud's revenue streams are diverse, encompassing recurring SaaS subscriptions for its core healthcare IT solutions and performance-based Revenue Cycle Management (RCM) services. Additionally, the company generates income from one-time implementation and training fees, as well as recurring revenue from premium module subscriptions and advanced analytics. Strategic acquisitions, like MesaBilling and RevNu Medical Management in 2025, also contribute significantly to revenue growth by expanding the customer base and service offerings.

| Revenue Stream | Description | 2024 Market Context/Example |

|---|---|---|

| SaaS Subscriptions | Recurring fees for EHR, practice management, and patient engagement solutions. | The global EHR market was valued at over $30 billion in 2024, with SaaS models dominating. |

| Revenue Cycle Management (RCM) | Percentage of collected revenue or fee per claim processed. | The RCM market exceeded $30 billion globally in 2024, highlighting strong demand. |

| Implementation & Training Fees | One-time charges for initial setup, data migration, and system customization. | Critical for ensuring smooth adoption of integrated healthcare systems in 2024. |

| Value-Added Services | Fees for optional premium modules, advanced analytics, AI tools, and integrations. | AI in healthcare market projected to reach over $100 billion by 2028. |

| Acquisition-Driven Revenue | Income from newly acquired companies and their customer bases. | MesaBilling and RevNu Medical Management acquisitions in 2025 expanded CareCloud's reach. |

Business Model Canvas Data Sources

The CareCloud Business Model Canvas is built upon a foundation of financial performance data, patient demographic analysis, and operational efficiency metrics. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's current state and future potential.