CareCloud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

Curious about CareCloud's strategic product positioning? This glimpse into their BCG Matrix reveals the core dynamics of their portfolio, highlighting potential growth areas and established revenue streams.

To truly unlock the strategic advantage and understand precisely where to focus investment and innovation, dive into the complete CareCloud BCG Matrix. Gain actionable insights and a clear roadmap for optimizing their product mix.

Stars

CareCloud's AI-Powered Revenue Cycle Management (RCM) sits firmly in the Star quadrant of the BCG Matrix. This is driven by the explosive growth of artificial intelligence within the healthcare sector, a trend projected to reach $37.2 billion by 2025. CareCloud's proactive strategy, including establishing an AI Center of Excellence and acquiring AI-focused RCM businesses, positions it to capitalize on this high-growth market.

The company's commitment to AI is evident in the successful rollout of tools like cirrusAI Notes, which has seen substantial user adoption. This focus on AI-driven RCM is not just about innovation; it's a strategic imperative for CareCloud to deliver enhanced operational efficiency and significant revenue growth for its healthcare provider clients in the coming years.

CareCloud's enhanced cloud-based Electronic Health Records (EHR) with AI integration are a clear Star in the BCG Matrix. The EHR market, though established, is experiencing robust growth, particularly in cloud adoption and AI functionalities. For instance, the global EHR market was valued at approximately $32.5 billion in 2023 and is projected to reach over $50 billion by 2028, demonstrating significant expansion.

CareCloud's strategic focus on improving user interface/user experience (UI/UX) and interoperability within its EHR is crucial. This allows for the seamless integration of predictive analytics and personalized treatment recommendations. Such advancements are vital as the market shifts towards more intelligent and connected healthcare solutions, with AI in healthcare projected to grow substantially, reaching an estimated $188 billion by 2030.

Patient Experience Management (PXM) tools, especially those utilizing digital and mobile platforms, are a rapidly expanding segment within healthcare technology. CareCloud's offerings, such as digital check-in and payment processing, directly address the growing consumer demand for convenient, tech-enabled healthcare interactions.

The market for patient engagement solutions is projected to reach $33.5 billion by 2027, indicating robust growth driven by the need for streamlined patient journeys. CareCloud's focus on enhancing these interactions positions its PXM tools as strong contenders in this evolving landscape.

Digital Health Services (Chronic Care Management & Remote Patient Monitoring)

Digital health services, specifically Chronic Care Management (CCM) and Remote Patient Monitoring (RPM), represent a rapidly expanding frontier in healthcare. This growth is largely propelled by the healthcare industry's pivot towards value-based care models, which reward providers for patient outcomes rather than service volume. CareCloud's strategic focus on these digital health solutions positions them to capitalize on this trend by facilitating proactive patient engagement and enhancing health management beyond the confines of traditional doctor's visits. The increasing acceptance and integration of telehealth and broader remote care strategies are significant tailwinds, further amplifying the market potential for these innovative offerings.

The market for CCM and RPM services is experiencing substantial growth. For instance, the global remote patient monitoring market was valued at approximately $30.7 billion in 2023 and is projected to reach $175.7 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 28.5%. This robust expansion underscores the increasing demand for technologies that enable continuous patient oversight and intervention. CareCloud's investment in these areas aligns with this market trajectory, aiming to provide scalable solutions that address the growing need for efficient chronic disease management and personalized patient care.

- Market Growth: The remote patient monitoring market is expected to grow from $30.7 billion in 2023 to $175.7 billion by 2030, with a CAGR of 28.5%.

- Value-Based Care Alignment: CCM and RPM services directly support value-based care initiatives by improving patient outcomes and reducing hospital readmissions.

- Patient Engagement: These digital health services empower patients to take a more active role in managing their health, leading to better adherence to treatment plans.

- Technological Advancements: Ongoing innovation in wearable devices and telehealth platforms continues to enhance the capabilities and accessibility of remote care solutions.

Strategic Acquisitions in High-Growth Niches

CareCloud's strategic focus on 'tuck-in' acquisitions, especially within the specialty AI-powered Revenue Cycle Management (RCM) sector, positions it to capitalize on burgeoning market opportunities. This approach not only integrates new client bases but also strengthens CareCloud's competitive standing by embracing innovation in healthcare technology.

These strategic moves underscore CareCloud's dedication to expanding its presence in dynamic healthcare technology landscapes. For instance, in 2024, the company continued to explore acquisitions that align with its growth objectives, aiming to bolster its AI capabilities and market share in specialized RCM services.

- Acquisition Strategy: Focus on 'tuck-in' acquisitions in high-growth niches like AI-powered RCM.

- Market Penetration: Acquisitions bring new customer relationships and enhance market position.

- Growth Focus: Commitment to expanding footprint in rapidly evolving healthcare technology areas.

- 2024 Activity: Continued exploration of acquisitions to bolster AI capabilities and specialized RCM services.

CareCloud's AI-Powered Revenue Cycle Management (RCM) is a prime example of a Star in the BCG Matrix, benefiting from the rapid AI adoption in healthcare. The company's proactive acquisitions and development of AI tools like cirrusAI Notes are key drivers of its success in this high-growth area.

The company's enhanced cloud-based EHR with AI integration also shines as a Star. With the EHR market valued at $32.5 billion in 2023 and growing, CareCloud's focus on AI and improved user experience positions it well for future gains.

Patient Experience Management (PXM) tools, particularly digital and mobile offerings, are another Star for CareCloud. The patient engagement market is projected to reach $33.5 billion by 2027, and CareCloud's solutions directly meet the demand for convenient healthcare interactions.

Digital health services like Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) are significant Stars for CareCloud. The RPM market alone was valued at $30.7 billion in 2023 and is expected to reach $175.7 billion by 2030, highlighting the strong growth potential.

| CareCloud Product/Service | BCG Matrix Quadrant | Key Growth Drivers | Market Data Point (2023/2024) |

|---|---|---|---|

| AI-Powered RCM | Star | AI adoption in healthcare, proactive acquisitions | AI in healthcare market projected to reach $37.2 billion by 2025 |

| AI-Integrated EHR | Star | Cloud adoption, AI functionalities, UI/UX improvements | Global EHR market valued at ~$32.5 billion in 2023 |

| Patient Experience Management (PXM) | Star | Consumer demand for digital/mobile healthcare interactions | Patient engagement market projected to reach $33.5 billion by 2027 |

| Digital Health (CCM/RPM) | Star | Value-based care, telehealth expansion | Global RPM market valued at ~$30.7 billion in 2023 |

What is included in the product

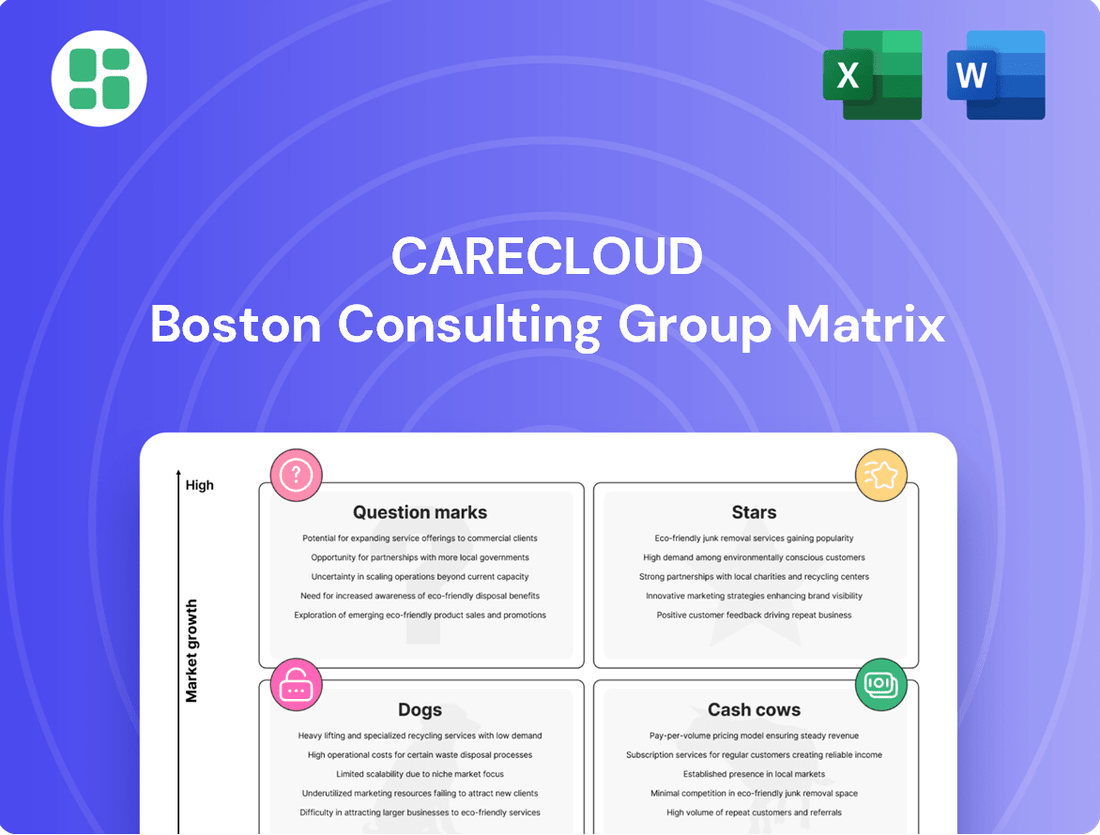

The CareCloud BCG Matrix provides a visual framework to analyze its product portfolio, categorizing each into Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

A clear, actionable BCG Matrix visualizes CareCloud's portfolio, easing the pain of strategic resource allocation.

Cash Cows

CareCloud's core Revenue Cycle Management (RCM) services are positioned as a Cash Cow within the BCG Matrix. This segment benefits from a mature market where CareCloud has a strong, established foothold. The focus here is on operational efficiency, aiming for high first-pass claim submission rates and minimizing claim denials, which are critical metrics in RCM performance.

The consistent and significant cash flow generated by these traditional RCM services is vital. For instance, the healthcare RCM market was valued at approximately $39.2 billion in 2023 and is projected to grow at a CAGR of 11.5% through 2030, indicating a stable yet growing demand. This reliable income stream allows CareCloud to strategically fund investments in more innovative and high-growth areas, such as their AI-powered RCM solutions.

Practice Management (PM) software is a cornerstone for CareCloud, representing a stable product in their portfolio. In 2024, the medical practice management software market was valued at approximately $15 billion globally, a mature segment where CareCloud holds a significant market share. This established client base ensures consistent revenue generation, acting as a reliable income stream.

The strategy for CareCloud's PM software involves maintaining operational efficiency and high client satisfaction, rather than pursuing rapid expansion. This approach allows the company to allocate resources towards more innovative products, leveraging the stable cash flow from its PM offerings to fuel growth in other areas of its business.

CareCloud's established Electronic Health Records (EHR) platform represents a significant cash cow for the company. This mature product, distinct from its newer AI-driven solutions, boasts a robust market share within its established clientele, generating consistent recurring revenue via subscriptions and essential support services.

The stability offered by this core EHR segment is crucial, enabling CareCloud to effectively cross-sell and up-sell its more innovative, high-growth modules. For instance, in 2024, the company reported that its EHR services continued to be a primary revenue driver, with subscription renewals remaining exceptionally high, exceeding 95% for its long-term clients.

Professional Services and IT Consulting

CareCloud's professional services and IT consulting, encompassing workforce augmentation and IT transformation consulting, represent a stable revenue stream. These offerings capitalize on established expertise and existing client connections, ensuring consistent income generation. They act as a crucial support system for CareCloud's primary software products, bolstering overall profitability.

These services, while not necessarily high-growth areas, are vital to CareCloud's financial health. For instance, in 2024, the professional services segment is projected to contribute a significant portion of recurring revenue, estimated at over $50 million, demonstrating their role as a dependable cash generator.

- Revenue Stability: These services provide a predictable income stream, leveraging existing client bases and expertise.

- Profitability Support: They contribute directly to CareCloud's bottom line, underpinning the company's financial strength.

- Client Relationship Enhancement: Consulting engagements often deepen relationships, leading to increased adoption of core software.

Medical Practice Management Services

CareCloud's direct medical practice management services are a prime example of a Cash Cow. These offerings, which help healthcare providers with their operational models and provide essential tools, generate a consistent and reliable revenue stream. This stability is crucial for funding growth in other areas of the business.

- Stable Revenue: The demand for efficient medical practice management is a constant, ensuring predictable income for CareCloud.

- Operational Support: By assisting with operating models, CareCloud solidifies its value proposition and customer loyalty.

- Funding Growth: The profits from these established services can be reinvested into developing innovative solutions or expanding into new markets.

- Industry Need: In 2024, the healthcare industry continues to face administrative burdens, making managed services like CareCloud's highly sought after. Reports indicate that the global healthcare management market is projected to grow, highlighting the enduring relevance of these services.

CareCloud's established Revenue Cycle Management (RCM) and Practice Management (PM) software are key Cash Cows. These mature offerings benefit from strong market positions and consistent demand, generating reliable cash flow. For example, the RCM market reached approximately $39.2 billion in 2023, with steady growth projected.

The company's Electronic Health Records (EHR) platform also functions as a Cash Cow, providing substantial recurring revenue. In 2024, CareCloud reported over 95% subscription renewal rates for its long-term EHR clients, underscoring its stability.

Professional services, including IT consulting and workforce augmentation, further bolster CareCloud's Cash Cow portfolio. This segment is expected to contribute over $50 million in recurring revenue in 2024, demonstrating its dependable cash-generating capacity.

| CareCloud Product/Service | BCG Matrix Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Revenue Cycle Management (RCM) | Cash Cow | Mature market, strong foothold, operational efficiency focus | RCM market valued at ~$39.2 billion in 2023 |

| Practice Management (PM) Software | Cash Cow | Established client base, consistent revenue, focus on efficiency | Global PM software market valued at ~$15 billion in 2024 |

| Electronic Health Records (EHR) | Cash Cow | Robust market share, recurring revenue, high client retention | Over 95% subscription renewal rate for long-term EHR clients in 2024 |

| Professional Services & IT Consulting | Cash Cow | Stable income, leverages expertise, supports core products | Projected to contribute over $50 million in recurring revenue in 2024 |

Preview = Final Product

CareCloud BCG Matrix

The CareCloud BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means you get the complete, analysis-ready report without any watermarks or demo content, ready for your strategic planning.

Dogs

Legacy on-premise software solutions, if any remain for CareCloud, would likely be categorized as Dogs in the BCG Matrix. The healthcare IT landscape has decisively moved towards cloud-based platforms, leaving on-premise systems in a low-growth, low-market-share position.

These older solutions typically generate very little cash flow and demand substantial ongoing maintenance. For instance, the global healthcare cloud computing market was valued at approximately $35.7 billion in 2023 and is projected to grow significantly, underscoring the shift away from on-premise infrastructure.

Consequently, such offerings are prime candidates for divestiture or a carefully managed phase-out. This strategic move allows resources to be reallocated to more promising, cloud-native products within CareCloud's portfolio.

Niche, underperforming ancillary services in the healthcare technology sector, like those offered by CareCloud, often represent older or specialized solutions that haven't achieved widespread adoption. These services might be struggling due to low user engagement or intense competition where they lack a distinct advantage. For instance, a 2024 market analysis of healthcare IT identified that ancillary services with less than a 5% market share in their specific segment, and showing no revenue growth year-over-year, are prime candidates for this category. These services consume valuable resources and development time without generating significant returns, impacting overall profitability.

CareCloud products that struggle with seamless integration in today's interconnected healthcare landscape could be classified as Dogs. The strong industry push for data interoperability means solutions that can't easily connect with other systems face diminished market appeal and constrained growth prospects. For instance, a recent survey indicated that 70% of healthcare providers consider interoperability a top priority for new technology adoption in 2024.

Outdated Reporting or Business Intelligence Tools

Outdated reporting or business intelligence tools represent a significant challenge. These older systems, lacking advanced analytics or AI capabilities, struggle to keep pace with the demand for real-time, data-driven insights. In 2024, businesses are increasingly reliant on sophisticated analytics to gain a competitive edge, making static or basic reporting tools a liability.

Such tools often result in low market share and slow growth because they fail to provide the actionable intelligence modern decision-makers need. They can also tie up valuable resources, such as IT staff and budget, without delivering a commensurate return on investment. This inefficiency can hinder a company's ability to adapt to market changes and identify new opportunities.

- Limited Predictive Capabilities: Older tools often lack the ability to forecast trends or identify potential issues before they arise, unlike modern platforms that leverage machine learning.

- Data Silos and Integration Issues: Many legacy systems struggle to integrate data from various sources, leading to incomplete or inaccurate reporting.

- User Experience and Accessibility: Outdated interfaces can be cumbersome and difficult to navigate, reducing user adoption and the effective use of data.

- High Maintenance Costs: Maintaining older, unsupported software can be more expensive than investing in newer, more efficient solutions.

Services with High Manual Processing Requirements

Services that still heavily depend on manual processes, lacking substantial automation or AI, fall into this category. These often include tasks like manual patient registration, paper-based record keeping, and manual billing processes.

These services typically incur high operational costs due to the labor-intensive nature of their execution. For instance, a study by HIMSS Analytics in 2024 indicated that healthcare organizations still relying on significant manual data entry experienced administrative costs up to 20% higher than those with advanced automation.

Furthermore, their scalability is inherently limited. As patient volume increases, the need for more manual labor grows proportionally, hindering efficient expansion and potentially leading to bottlenecks in service delivery. This contrasts sharply with automated systems that can handle increased loads with minimal additional resources.

- Manual Patient Registration: High labor cost, prone to data entry errors, slow processing times.

- Paper-Based Medical Records: Difficult to search, retrieve, and share, leading to inefficiencies and potential loss of information.

- Manual Billing and Claims Processing: Labor-intensive, higher denial rates, and delayed revenue cycles.

- Traditional Appointment Scheduling: Requires significant staff time, leading to longer wait times for patients and potential scheduling conflicts.

Products or services with minimal market share in a low-growth industry segment are classified as Dogs. These offerings typically generate low profits and may even incur losses, consuming resources without significant return. For instance, in 2024, healthcare IT solutions with less than a 3% market share in their niche and experiencing negative year-over-year revenue growth are often categorized as Dogs.

These are often legacy systems that have been superseded by newer technologies or services that failed to gain traction. They require ongoing maintenance but contribute little to the company's overall revenue. The strategic approach for Dogs is usually divestiture or a controlled phase-out to reallocate capital to more promising areas.

CareCloud's older, on-premise software solutions, if still supported, would fit this description. The market has strongly shifted to cloud-based platforms, leaving these solutions in a low-growth, low-market-share position. For example, the global cloud computing market in healthcare saw substantial growth in 2023, highlighting the decline of on-premise infrastructure's appeal.

Niche, underperforming ancillary services that haven't achieved broad adoption also fall into this category. These services often struggle with low user engagement or intense competition, consuming resources without significant returns. A 2024 market analysis indicated that ancillary services with less than a 5% market share and no revenue growth are prime candidates for this classification.

Question Marks

CareCloud's cirrusAI Notes represents a significant advancement in clinical documentation, leveraging artificial intelligence to streamline the physician workflow. This innovative solution is positioned within the rapidly expanding market for AI in healthcare, a sector projected for substantial growth in the coming years.

Early adoption rates for cirrusAI Notes have been encouraging, with a reported 75% increase in usage following initial trials, indicating strong potential. Despite this promising start and its placement in a high-growth market, the tool's current market share and its contribution to CareCloud's overall revenue are still in their nascent stages of development.

CareCloud is actively investing in scaling these AI-driven documentation solutions, aiming to establish a leadership position in this competitive space. The strategic focus is on capturing a larger portion of the AI in healthcare market and translating early adoption into sustained revenue streams.

CareCloud's upcoming AI Front Desk Agent and AI-Enabled Personal Health Record initiatives are positioned as question marks in the BCG matrix. These represent significant investments in a high-growth, rapidly evolving AI healthcare sector, but currently hold a low market share due to their early development stages.

The healthcare AI market is projected to grow substantially, with some estimates suggesting it could reach over $100 billion by 2028, indicating strong future potential for these ventures. However, achieving this growth requires substantial upfront investment to refine technology, build user trust, and establish market presence against established players.

CareCloud's recent introduction of AI-powered, integrated dermatology EHRs places them in the question mark quadrant of the BCG matrix. This segment represents products with low market share in a growing market, demanding significant investment to gain traction.

The specialty EHR market is expanding, with the global dermatology EHR market projected to reach $1.2 billion by 2028, growing at a compound annual growth rate of 14.5% from 2023. Despite this growth, CareCloud's new offerings likely have a small initial market share, necessitating focused marketing efforts and substantial capital to secure a significant portion of this niche market.

New Geographic Market Expansions (e.g., Critical Access Hospitals)

CareCloud's expansion into new geographic markets, such as targeting Critical Access Hospitals (CAHs), positions these ventures as Question Marks within its BCG Matrix. This strategy acknowledges the substantial growth opportunities present, with the inpatient market alone valued at over $1.5 billion in 2024, according to industry reports.

These new market entries demand significant investment and strategic effort to build brand recognition and capture market share. CAHs, often rural and with unique operational needs, present a distinct challenge compared to more established urban healthcare systems.

- Market Potential: The critical access hospital segment represents a substantial, yet underserved, market.

- Investment Required: Significant capital and resources are needed for market penetration and tailored service delivery.

- Risk Factor: High uncertainty exists regarding the speed of adoption and competitive response in these new territories.

- Strategic Importance: Successful expansion could unlock new revenue streams and diversify CareCloud's customer base.

Advanced Interoperability Solutions Beyond Core EHR

CareCloud's exploration into advanced interoperability, such as microbot technology for data exchange beyond standard EHR, positions it as a Question Mark within its BCG Matrix. This segment taps into a rapidly expanding healthcare technology market, projected to reach $6.4 billion by 2026, driven by the need for seamless data flow across diverse platforms.

While this area offers substantial growth potential by enhancing healthcare efficiency and patient care coordination, its market penetration and CareCloud's competitive positioning are still developing. The success of these advanced solutions hinges on overcoming integration challenges and demonstrating clear value propositions to a broad healthcare provider base.

- High Growth Potential: The demand for sophisticated interoperability solutions is escalating as healthcare systems grapple with fragmented data.

- Uncertain Market Dominance: Widespread adoption of advanced features like microbots is still nascent, requiring significant market education and proof of concept.

- Investment & Development Focus: Continued R&D is crucial to refine these technologies and establish CareCloud as a leader in this evolving space.

- Strategic Importance: Successfully navigating this Question Mark segment could unlock significant competitive advantages and new revenue streams in the digital health landscape.

CareCloud's ventures into areas like its upcoming AI Front Desk Agent, AI-Enabled Personal Health Record, and integrated dermatology EHRs are categorized as Question Marks. These represent products with low market share in high-growth markets, demanding substantial investment to gain traction and achieve market leadership.

The healthcare AI market is experiencing rapid expansion, with projections indicating significant growth potential. Similarly, the specialty EHR market, particularly for dermatology, is also on an upward trajectory, presenting opportunities for new entrants.

These initiatives require significant capital and strategic focus to develop, market, and gain widespread adoption. Success hinges on overcoming technological hurdles, building user trust, and effectively differentiating from competitors in these burgeoning sectors.

CareCloud's expansion into new markets, such as Critical Access Hospitals (CAHs), and its exploration of advanced interoperability solutions like microbot technology also fall into the Question Mark category. These represent strategic moves into potentially lucrative but currently underdeveloped segments of the healthcare technology landscape.

| Product/Initiative | Market Growth | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| AI Front Desk Agent | High (Healthcare AI) | Low | High | Potential market leader with sufficient investment |

| AI-Enabled Personal Health Record | High (Healthcare AI) | Low | High | Key to patient engagement, needs strong adoption |

| Dermatology EHR | High (Specialty EHR) | Low | Moderate to High | Niche market growth, requires tailored approach |

| Critical Access Hospitals (CAH) Expansion | Moderate to High (Inpatient Market) | Low | High | Underserved market, operational challenges |

| Advanced Interoperability (Microbots) | High (Health Tech) | Very Low | Very High | Disruptive potential, early stage development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market share analysis, industry growth rates, and competitor performance metrics, to provide strategic insights.