Capital Senior Living SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Senior Living Bundle

Capital Senior Living, a leader in the senior living industry, possesses significant strengths in its established brand and extensive portfolio of communities. However, understanding the full scope of its market position requires a deeper dive into its opportunities and potential threats.

Want the full story behind Capital Senior Living’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capital Senior Living boasts an established nationwide presence, operating a substantial portfolio of senior living communities spread across 20 states. This broad geographic reach not only diversifies their market exposure but also solidifies their brand recognition, enabling them to leverage economies of scale. In 2023, the company managed approximately 113 communities, serving a significant number of residents, which underscores their operational capacity and market penetration.

Capital Senior Living is well-positioned due to the rapidly expanding senior population, especially the 80+ age group, which is expected to see substantial growth over the next ten years. This demographic shift translates into a consistent and rising demand for senior living solutions.

The company's communities are strategically situated in areas with favorable demographic trends, allowing them to capitalize on this increasing demand. For instance, the U.S. Census Bureau projects the population aged 85 and over to more than double between 2020 and 2050, underscoring the long-term market opportunity.

Capital Senior Living's core strategy centers on delivering high-quality care and enriching lifestyle amenities, a crucial differentiator in today's senior living market. This focus directly addresses the growing demand from seniors who prioritize not just basic needs but also personalized experiences and overall well-being. By offering a spectrum of engaging activities and comprehensive support services, the company aims to boost resident contentment and foster long-term loyalty.

Improving Occupancy and Financial Performance

Capital Senior Living is benefiting from a robust recovery in the senior living sector. Occupancy rates across the industry have shown strong year-over-year growth in 2024, with projections indicating continued upward momentum into 2025, approaching pre-pandemic levels.

This positive market trend is directly impacting Capital Senior Living's financial performance. The company reported significant year-over-year increases in key financial metrics during 2024:

- Adjusted Same-Store Community Net Operating Income (NOI): Experienced substantial growth, reflecting improved operational efficiency and pricing power.

- Adjusted EBITDA: Showed a strong upward trend, underscoring the company's enhanced profitability and cash flow generation.

These results demonstrate Capital Senior Living's ability to capitalize on the industry's recovery, translating into improved financial health and operational success.

Experience in Capital Markets and Growth Initiatives

Capital Senior Living has a proven track record in navigating capital markets, enabling them to fund growth initiatives. This includes a demonstrated ability to source, underwrite, and acquire new properties, a crucial factor for expansion in the senior living sector.

Looking ahead to 2025, the company is focused on key strategic objectives. These include enhancing sales and marketing efforts, driving an increase in average unit rates, and improving operating margins. This dual approach of financial expertise and strategic operational improvements underpins their growth strategy.

- Capital Access: Demonstrated ability to secure financing for expansion.

- Acquisition Expertise: Proven success in sourcing and underwriting properties.

- 2025 Growth Drivers: Focus on optimizing sales, increasing unit rates, and expanding margins.

- Strategic Positioning: Well-placed to leverage market opportunities through organic and inorganic growth.

Capital Senior Living's strengths lie in its extensive nationwide operational footprint, encompassing approximately 113 communities across 20 states as of 2023. This broad market presence, coupled with a strategic focus on high-quality care and lifestyle amenities, positions the company favorably. The company's financial performance in 2024 showed significant year-over-year growth in key metrics like Adjusted Same-Store Community Net Operating Income and Adjusted EBITDA, reflecting a robust industry recovery.

The company has demonstrated a strong capacity for capital access and acquisition expertise, crucial for funding expansion initiatives. Furthermore, their 2025 strategic objectives, including enhancing sales, increasing unit rates, and improving operating margins, highlight a clear path for continued growth and market leverage.

| Metric | 2023 (Approx.) | 2024 (Trend) | 2025 (Projection) |

|---|---|---|---|

| Communities Operated | 113 | Stable/Slight Growth | Continued Expansion |

| Geographic Reach | 20 States | Established | Leveraging Reach |

| Occupancy Rates | Recovering | Strong Year-over-Year Growth | Approaching Pre-Pandemic Levels |

| Adjusted Same-Store NOI | Improving | Significant Year-over-Year Increase | Continued Growth |

| Adjusted EBITDA | Improving | Strong Upward Trend | Enhanced Profitability |

What is included in the product

Delivers a strategic overview of Capital Senior Living’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Streamlines Capital Senior Living's strategic planning by clearly identifying strengths, weaknesses, opportunities, and threats for targeted action.

Weaknesses

Capital Senior Living, like many in its industry, faces persistent labor shortages and rising wage costs. This is a major hurdle, as labor is a significant operational expense, directly impacting profitability. For instance, in late 2024, the Bureau of Labor Statistics reported that average hourly earnings in healthcare and social assistance sectors, which include senior living, saw continued upward trends, putting pressure on margins.

Attracting and retaining qualified staff, from caregivers to administrative roles, remains a critical challenge. The escalating cost of labor can directly squeeze net operating income, making it harder to maintain healthy profit margins. This trend is expected to continue into 2025, as demand for senior care services grows alongside an aging population.

A significant portion of senior living communities across the nation are aging, presenting challenges with outdated designs, infrastructure, and amenities. This necessitates substantial capital expenditures for renovations and repositioning to stay competitive and attract new residents. For example, in 2023, the average age of senior living properties in the U.S. was estimated to be over 15 years, with many requiring significant updates.

These necessary upgrades represent a considerable financial burden. The cost of modernizing older facilities, coupled with the already high expenses associated with new development, can strain financial resources. This capital investment is crucial for meeting the evolving expectations of today's seniors who often seek more contemporary living spaces and advanced services.

Beyond labor, Capital Senior Living, like many in the industry, grapples with escalating general operational costs. Inflationary pressures in 2024 and early 2025 have driven up expenses for essentials like food, utilities, and various supplies, directly impacting the company's bottom line.

These rising costs can significantly squeeze profit margins, making it a delicate balancing act to keep services affordable for residents while maintaining high-quality care and amenities. For instance, a 5% increase in food costs, a common scenario in recent inflationary periods, can add millions to annual expenses for a large operator like Capital Senior Living.

Effective cost management and strategic sourcing are therefore paramount for Capital Senior Living to navigate these challenges. Implementing innovative solutions to control these overheads is crucial for sustaining profitability and ensuring the continued delivery of value to residents.

Complex and Evolving Regulatory Environment

Capital Senior Living navigates a complex and constantly shifting regulatory landscape. This includes a mosaic of state-specific rules covering critical areas like medication administration, infection prevention, and staff-to-resident ratios, all subject to frequent revisions and heightened oversight. For instance, in 2024, several states have introduced new mandates for continuous nursing coverage, increasing operational costs.

The potential for expanded federal involvement, such as proposed changes to Medicare and Medicaid reimbursement policies affecting assisted living facilities, adds another layer of uncertainty. Such shifts can necessitate significant adjustments to operational procedures and financial planning.

Failure to adhere to these evolving regulations can result in substantial financial penalties, costly litigation, and damage to the company's reputation, thereby increasing the operational burden and potentially impacting occupancy rates.

- Patchwork of State Regulations: Ongoing updates and increasing scrutiny in medication management, infection control, and staffing ratios.

- Federal Oversight Risk: Potential for increased federal oversight adds complexity to compliance.

- Compliance Penalties: Non-compliance can lead to significant fines, legal issues, and reputational damage.

Challenges in Securing Capital for New Development

Securing capital for new development presents a significant hurdle for Capital Senior Living. Despite a generally improving investor sentiment towards the sector, new construction starts in senior living have reached historic lows. This is largely driven by persistently high borrowing costs, which make financing new projects considerably more expensive.

Furthermore, lingering supply chain disruptions and elevated construction material expenses continue to inflate project budgets. These combined factors make it challenging for Capital Senior Living to pursue rapid portfolio expansion through new builds. Consequently, growth opportunities in high-demand geographic areas may be constrained, impacting the company's ability to capitalize on market needs.

- High Borrowing Costs: Increased interest rates make debt financing for new construction projects prohibitively expensive.

- Supply Chain Issues: Ongoing disruptions contribute to project delays and increased costs for essential building materials.

- Elevated Material Expenses: The cost of construction materials remains high, directly impacting the overall budget for new developments.

- Limited Expansion Capacity: These financial and logistical challenges restrict Capital Senior Living's ability to quickly build new communities and enter high-demand markets.

Capital Senior Living faces challenges with its aging property portfolio, requiring substantial capital for renovations to remain competitive. Many communities need modernization to meet the evolving expectations of seniors seeking contemporary living spaces and advanced services, a trend amplified in 2023 and projected to continue into 2025.

| Weakness | Description | Impact | Example Data/Trend |

| Aging Property Portfolio | A significant portion of existing communities are outdated in design, infrastructure, and amenities. | Necessitates substantial capital expenditures for renovations and repositioning to attract residents and stay competitive. | In 2023, the average age of senior living properties in the U.S. was estimated to be over 15 years, with many requiring significant updates. |

| High Capital Expenditure Needs | The cost of modernizing older facilities is considerable and strains financial resources. | Can limit the company's ability to invest in other growth areas or absorb unexpected operational costs. | The average cost to renovate a senior living unit can range from $20,000 to $50,000+, depending on the scope of work. |

Same Document Delivered

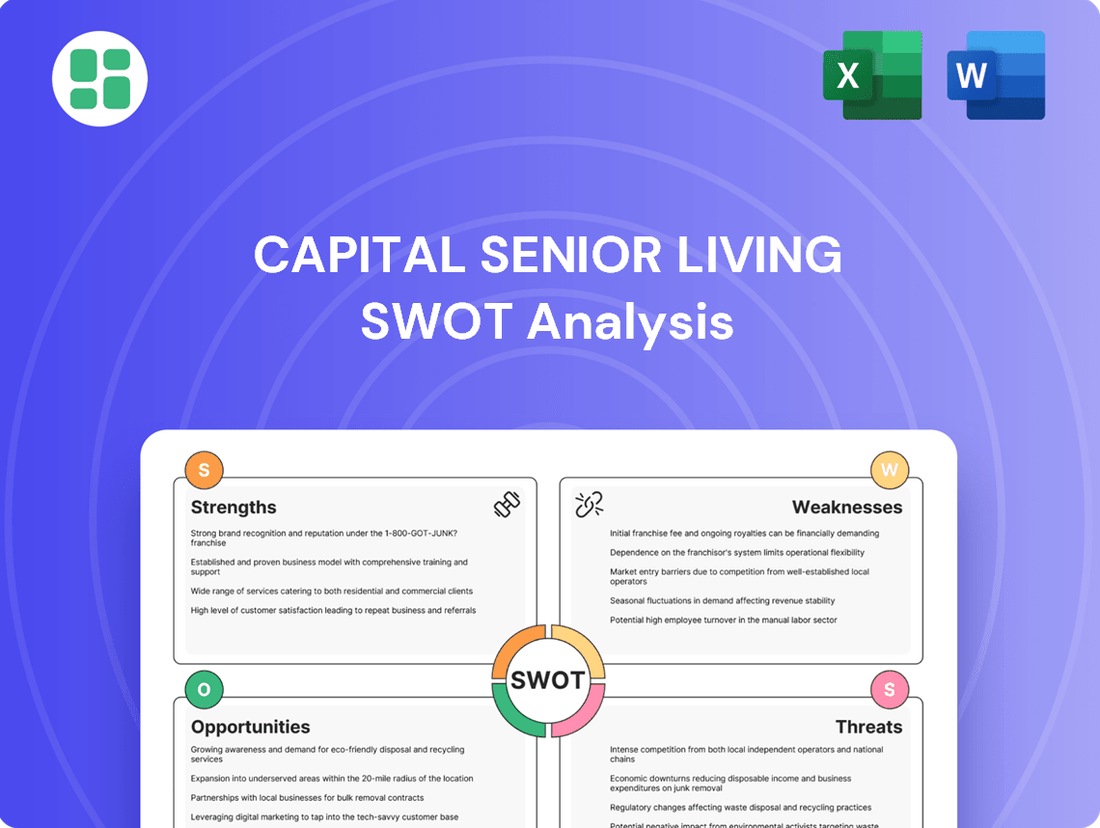

Capital Senior Living SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Capital Senior Living SWOT analysis, giving you a clear understanding of what to expect. Once purchased, you'll gain access to the complete, in-depth report for your strategic planning needs.

Opportunities

The demographic wave of Baby Boomers, born between 1946 and 1964, is undeniably a massive tailwind. In 2024, this cohort ranges from 60 to 78 years old, meaning a significant portion is entering the age bracket where senior living services become increasingly relevant. This sustained demand growth is a prime opportunity for Capital Senior Living.

To capitalize, Capital Senior Living can strategically expand its footprint in areas experiencing high concentrations of this aging demographic, offering a diverse range of services from independent living to memory care. The sheer volume of need is substantial; industry projections indicate a significant shortfall in available senior living units, with estimates suggesting millions of new units will be required over the next decade to accommodate this demographic shift.

Capital Senior Living can harness technology to boost its operations and resident satisfaction. Integrating AI for predictive maintenance and VR for immersive community tours can streamline processes and attract new residents. For instance, data analytics can personalize care plans, improving resident well-being and reducing staff workload, a critical factor given the projected shortage of healthcare workers.

The senior living sector is seeing some smaller, less resilient operators potentially exit the market. This creates a prime opportunity for established companies like Capital Senior Living to acquire high-quality assets. An improving lending environment for strong players further supports this strategy, allowing for swift portfolio expansion and increased market share.

Focus on Wellness and Personalized Care Models

Consumer preferences are shifting towards holistic wellness and highly personalized care, a trend that Capital Senior Living can leverage. By expanding its wellness programs to include mental, social, and physical well-being initiatives, the company can better meet the evolving needs of seniors. This aligns with the growing demand for tailored lifestyle options that cater to individual preferences and health requirements.

Capital Senior Living has an opportunity to significantly enhance its value proposition by focusing on these personalized care models. This could involve developing more sophisticated assessment tools to create truly individualized care plans, rather than one-size-fits-all approaches. Offering flexible service packages, allowing residents to choose specific amenities or care levels, will also be key to attracting a broader demographic, particularly the discerning Baby Boomer generation who often seek greater autonomy and choice.

The market is increasingly rewarding providers who demonstrate a commitment to these personalized wellness approaches. For instance, a 2024 AARP survey indicated that 77% of adults aged 50 and older prefer to age in place, with access to in-home care and wellness services being crucial factors. Capital Senior Living can capitalize on this by:

- Expanding telehealth and remote monitoring services to support personalized health management.

- Developing specialized programs for cognitive health, fitness, and nutrition based on individual resident profiles.

- Offering tiered service options that allow residents to customize their care and lifestyle packages.

- Partnering with local wellness providers to bring diverse health and fitness activities directly to communities.

Invest in Renovation and Repositioning of Existing Assets

Given the increasing costs and complexities of new construction, Capital Senior Living can pursue a growth strategy by focusing on renovating and repositioning its existing communities. This approach offers a more capital-efficient path to enhancing its portfolio.

Investing in capital expenditures for upgrades can significantly improve the resident experience and operational efficiency. By modernizing facilities, adding contemporary amenities, and updating interior designs, the company can attract a broader resident base and justify premium pricing.

For instance, a well-executed renovation can lead to tangible improvements in occupancy rates and average daily rates (ADRs). In 2024, the senior living sector has seen a trend where updated properties command higher rents; some reports indicate that renovated communities can see a 5-10% increase in ADRs compared to unrenovated counterparts.

- Renovation Strategy: Focus on updating outdated facilities to meet current resident expectations.

- Amenity Enhancement: Introduce modern amenities like updated dining spaces, fitness centers, and technology integration.

- Competitive Advantage: Position existing communities to compete more effectively with newer developments.

- Financial Impact: Aim for improved occupancy and higher average daily rates post-renovation.

The significant demographic shift, with millions of Baby Boomers entering their senior years, presents a substantial and sustained demand for senior living services. Capital Senior Living is well-positioned to capture this growing market by expanding its service offerings and geographic reach to align with where this demographic is concentrated.

Threats

The persistent labor shortage, especially for essential roles like care aides and nursing assistants, is a major concern for Capital Senior Living. Projections indicate this issue will likely continue for the foreseeable future, directly impacting the company's ability to maintain adequate staffing levels.

Rising wages driven by this scarcity, alongside potential new federal staffing requirements, present a significant financial challenge. These factors could substantially increase operational expenses, potentially forcing compromises on staffing ratios, which in turn could negatively affect the quality of care provided to residents. This decline in care quality could then lead to lower resident satisfaction and ultimately harm the company's financial performance.

The senior living sector, including Capital Senior Living, faces a growing threat from increasing regulatory burdens. State and potential federal oversight, particularly around resident safety, medication protocols, and staffing levels, is intensifying. For instance, in 2024, many states continued to review and update their licensing requirements for assisted living facilities, often with a focus on enhanced staff training and resident dependency assessments.

Non-compliance with these evolving rules carries significant financial and reputational risks. Fines for violations can be substantial, and legal liabilities can arise from inadequate adherence to safety and care standards. A 2024 report from a leading healthcare compliance firm indicated that the average cost of regulatory fines for non-compliant senior care facilities had increased by 15% compared to the previous year.

Adapting to and maintaining compliance with these dynamic regulations demands considerable investment in resources, technology, and ongoing staff education. Capital Senior Living must allocate significant capital and operational focus to ensure it meets the ever-changing requirements, a challenge that could impact profitability and operational flexibility.

Persistent inflation continues to squeeze operational costs for Capital Senior Living, impacting everything from staffing to supplies. This, coupled with the potential for elevated interest rates throughout 2024 and into 2025, creates a challenging environment for maintaining profitability.

Higher borrowing costs directly threaten the company's ability to finance new development projects or refinance existing debt. This increased cost of capital can significantly curb expansion initiatives and delay crucial property upgrades, limiting future growth potential.

Intense Market Competition and Pricing Pressures

Capital Senior Living faces significant threats from intense market competition and resulting pricing pressures. While the demand for senior living services remains robust, specific geographic areas can become saturated with operators, both established and new. This heightened competition often forces providers to lower prices or offer concessions to attract and retain residents, impacting revenue and profitability. For instance, in markets with a high concentration of communities, average monthly rents for assisted living can see slower growth or even declines due to this competitive dynamic.

The need to differentiate and maintain high occupancy rates becomes paramount. Communities that fail to invest in property upgrades, enhanced amenities, or specialized care programs are particularly vulnerable. This can lead to challenges in maintaining strong occupancy levels, as consumers have more choices and are often swayed by price or perceived value. Reports from mid-2024 indicated that occupancy rates in some competitive senior housing markets struggled to surpass 85%, a key benchmark for profitability.

- Increased competition from new developments and existing operators in key markets.

- Downward pressure on pricing and potential for discounting to maintain occupancy.

- Challenges in retaining residents and attracting new ones without significant investment in community upgrades and services.

- Risk of lower average daily rates and reduced revenue per occupied room due to competitive pressures.

Shifting Preferences Towards Home and Community-Based Care

A significant threat to Capital Senior Living stems from the growing preference and increased funding for home and community-based care services (HCBS). This trend could siphon potential residents away from traditional senior living facilities.

If the cost of facility-based care continues to outpace in-home support options, more seniors may choose to age in place. This shift could directly impact occupancy rates for Capital Senior Living communities.

- Growing HCBS Market: The U.S. HCBS market is projected to reach $200 billion by 2027, indicating a strong consumer and governmental push towards non-facility-based care.

- Cost Sensitivity: For instance, in 2024, the average monthly cost for assisted living in the U.S. was around $5,000, while in-home care services, though variable, can often present a more budget-friendly alternative for certain needs.

- Occupancy Impact: A decline in occupancy rates, even by a few percentage points, can significantly affect revenue and profitability for senior living operators like Capital Senior Living.

Intensifying competition, particularly in saturated markets, poses a significant threat to Capital Senior Living. This can lead to downward pricing pressure and a need for increased investment in amenities and services to attract and retain residents, potentially impacting revenue per occupied room. For example, reports from mid-2024 indicated that occupancy rates in some competitive senior housing markets struggled to surpass 85%, a key benchmark for profitability.

SWOT Analysis Data Sources

This Capital Senior Living SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a robust and reliable basis for evaluating the company's strategic position.