Capital Senior Living Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Senior Living Bundle

Capital Senior Living faces moderate buyer power as residents have some choice in providers, but switching costs can be a deterrent. The threat of new entrants is a significant concern, as the growing demand for senior living can attract new operators. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Capital Senior Living’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The senior living sector, including companies like Capital Senior Living, experiences considerable bargaining power from its labor force, especially caregivers and nurses. These direct care staff are crucial, and ongoing workforce challenges and shortages, with skilled nursing staffing declining since early 2020, grant them significant leverage.

This leverage is clearly reflected in wage trends. Between 2019 and 2024, wages for senior living employees saw a substantial increase of 33%. This upward pressure on compensation directly impacts operational expenses for Capital Senior Living and similar organizations.

Suppliers of critical goods and services, like food, medical supplies, and utilities, are gaining leverage as inflation continues to climb, driving up overall operational expenses for Capital Senior Living. This economic reality directly impacts the company's profit margins, making diligent cost control absolutely essential.

For instance, the Consumer Price Index (CPI) for food away from home saw a significant increase in 2024, impacting dining costs for senior living facilities. Similarly, energy prices, a major utility expense, experienced volatility throughout the year.

To counteract these rising costs and maintain financial health, Capital Senior Living, like many in the industry, relies more heavily on group purchasing organizations (GPOs). These organizations are vital for negotiating better pricing on supplies, thereby helping communities manage their budgets more effectively and ensuring a degree of financial stability amidst inflationary pressures.

As senior living facilities like Capital Senior Living increasingly adopt technology for everything from managing operations to enhancing resident care and marketing, the companies providing specialized software, smart home solutions, and data analytics are becoming more influential. Capital Senior Living's need for these advanced tools to boost efficiency and improve the resident experience means these technology suppliers hold significant bargaining power.

Real Estate and Construction Services

For Capital Senior Living, suppliers in the real estate and construction services sector can exert significant bargaining power. This is particularly true for services related to property maintenance, renovations, and new community development. The impact of these suppliers is amplified by current market conditions.

Several factors contribute to this elevated supplier power in 2024. High material costs, driven by ongoing supply chain disruptions and increased demand, directly translate to higher project expenses for Capital Senior Living. Furthermore, persistent labor shortages within the construction trades mean that skilled labor commands higher wages and can be more selective about projects, increasing the cost and lead times for essential services.

- Rising Material Costs: Lumber prices, for instance, have seen considerable volatility. While not at their absolute peaks of early 2022, they remain elevated compared to pre-pandemic levels, impacting renovation and construction budgets.

- Construction Labor Shortages: The U.S. Bureau of Labor Statistics projected a need for over 400,000 additional residential construction workers in 2023 alone, highlighting the ongoing scarcity of skilled tradespeople.

- Financing Hurdles: Increased interest rates in 2023 and continuing into 2024 make financing for new construction or major renovations more expensive, potentially limiting the number of available contractors and increasing the leverage of those who can secure financing.

Specialized Medical and Care Equipment Suppliers

Suppliers of specialized medical and care equipment, particularly those catering to memory care and residents with higher acuity needs, wield considerable bargaining power. This is because the critical nature of their products often translates to fewer readily available alternatives for senior living operators.

While basic supplies might have a broad supplier base, making it easier for Capital Senior Living to negotiate, unique or technologically advanced equipment can significantly limit purchasing flexibility. For instance, in 2024, the demand for advanced fall detection systems and specialized mobility aids saw a notable increase, potentially strengthening the hand of suppliers offering these innovations.

- Criticality of Offerings: Specialized equipment for memory care and higher acuity residents is essential, giving suppliers leverage.

- Limited Alternatives: Unique or advanced medical equipment often means fewer supplier choices for senior living facilities.

- Market Trends: Increased demand for advanced care technologies in 2024 likely boosted supplier bargaining power in these segments.

The bargaining power of suppliers for Capital Senior Living is significant, particularly for specialized labor and critical goods. Wage increases for caregivers and nurses, up 33% between 2019 and 2024, directly reflect their leverage. Suppliers of food and utilities also gain power due to inflation, with food-away-from-home costs rising in 2024.

Technology providers for operational efficiency and resident care are also influential. Furthermore, real estate and construction suppliers benefit from high material costs and labor shortages, with lumber prices remaining elevated and the construction sector facing a projected need for over 400,000 additional workers in 2023.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Capital Senior Living |

|---|---|---|

| Skilled Labor (Caregivers, Nurses) | Workforce shortages, critical role in care delivery | Increased wage pressure, higher operating costs |

| Food & Utilities | Inflationary pressures, volatility in commodity and energy prices | Elevated supply costs, impact on profit margins |

| Technology Providers | Need for efficiency and enhanced resident experience, specialized solutions | Increased reliance on key tech vendors, potential for higher pricing |

| Construction & Renovation Services | High material costs, labor shortages, financing hurdles | Increased project expenses, longer lead times for development/maintenance |

| Specialized Medical Equipment | Criticality of products, limited alternative suppliers | Reduced purchasing flexibility, potential for higher equipment costs |

What is included in the product

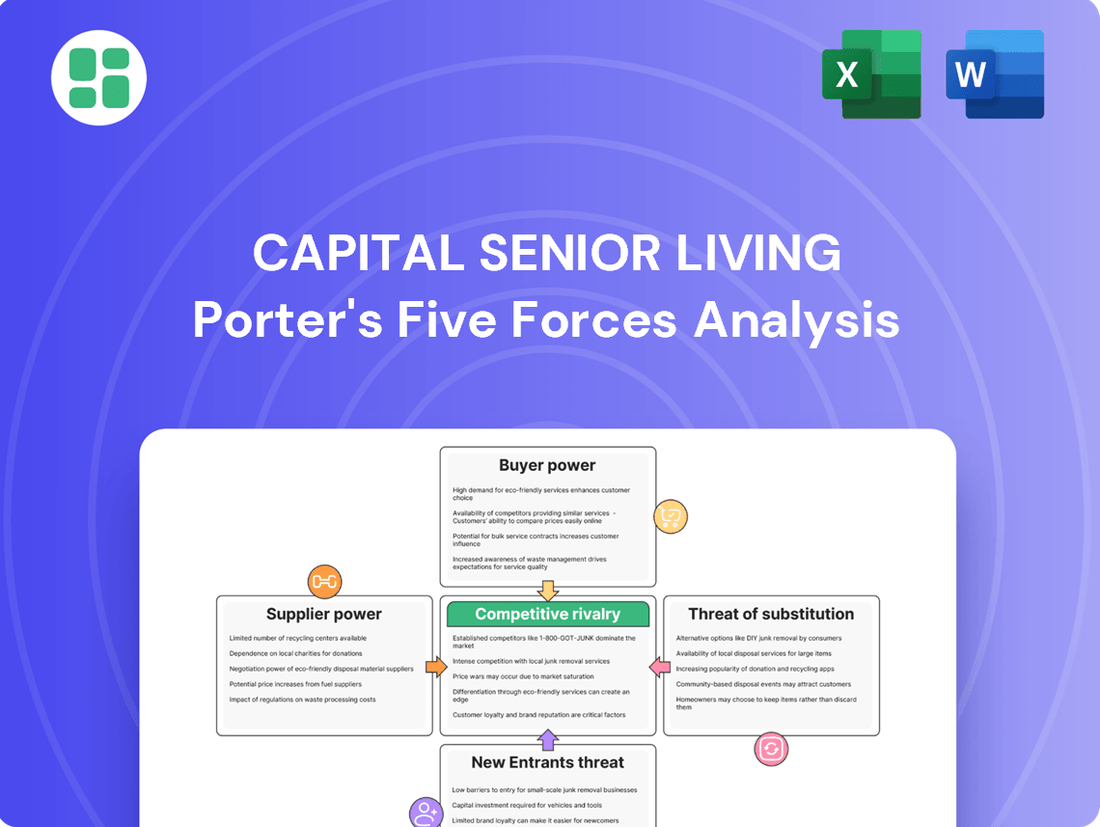

This analysis of Capital Senior Living's competitive environment examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments for Capital Senior Living.

Customers Bargaining Power

The decision to move into a senior living community represents a major financial undertaking for both seniors and their families. Given that assisted living facilities, for instance, had an average monthly cost of $5,511 in 2024, and in-home care also carries significant expenses, customers are naturally very attuned to pricing and meticulously compare available choices.

This considerable financial outlay inherently equips potential residents and their families with substantial bargaining power. They are motivated to scrutinize every aspect of the cost versus value proposition, driving providers to offer competitive pricing and comprehensive service packages.

Prospective residents and their families can easily access a wealth of information online, including detailed reviews, pricing structures, and service offerings for various senior living communities. This accessibility allows for straightforward comparison shopping, directly impacting a provider's ability to command premium pricing without justification.

In 2024, the digital landscape continues to empower consumers. For instance, platforms aggregating senior living facility data, such as Caring.com or A Place to Grow, provide users with extensive comparison tools. This transparency means that providers like Capital Senior Living must offer competitive pricing and superior service to attract and retain residents, as customers can readily identify and switch to more appealing options.

The bargaining power of customers in the senior living sector, particularly for Capital Senior Living, is significantly influenced by the growing demand for personalized and holistic care. Seniors and their families are no longer satisfied with one-size-fits-all solutions; they seek tailored care plans that address specific health needs and preferences, alongside a rich array of lifestyle amenities and a focus on overall well-being.

This shift empowers consumers, as communities that excel at customization and fostering engaging environments gain a competitive edge. For instance, a recent survey indicated that over 70% of prospective senior living residents prioritize personalized care plans when making their selection. This means providers must be adaptable and responsive to individual requirements, giving customers more leverage to choose those who best meet their evolving expectations.

Evolving Preferences and Expectations

The bargaining power of customers is significantly influenced by evolving preferences and expectations, particularly from the incoming generations of seniors like Baby Boomers and early Gen X. These groups often arrive with higher demands for amenities, seamless technology integration, and robust community engagement programs. For instance, a 2024 AARP survey indicated that 77% of adults aged 50 and older want to age in place, suggesting a strong preference for environments that support active and independent living, which translates to greater customer leverage.

This heightened desire for active, purposeful lifestyles, coupled with a growing interest in sustainable and eco-friendly practices, compels senior living providers such as Capital Senior Living to continually adapt their offerings. Failure to meet these evolving needs can lead to customer churn. In 2023, the senior living industry saw occupancy rates fluctuate, with providers needing to innovate to attract and retain residents, underscoring the direct impact of customer expectations on provider strategies and, consequently, their bargaining power.

- Higher Expectations: Incoming senior generations demand better amenities, technology, and community activities.

- Active Lifestyles: Seniors seek opportunities for engagement and purposeful living, influencing service design.

- Sustainability Focus: Growing preference for eco-friendly practices adds another layer to customer influence.

- Market Responsiveness: Providers must adapt to these demands to maintain occupancy and competitive standing.

High Switching Costs (Post-Move-In)

While seniors and their families hold significant sway during the initial search for a senior living community, the landscape shifts dramatically once a resident is settled. The physical and emotional toll of relocating an elderly individual, coupled with the establishment of routines and social connections within a new environment, creates substantial switching costs. This effectively diminishes their bargaining power once they've moved in, as the prospect of another disruptive move becomes a deterrent.

For Capital Senior Living, this dynamic means the initial customer acquisition phase is intensely competitive, with providers vying for residents through pricing and amenities. However, once a resident is established, the retention of that resident becomes more assured due to these high post-move-in switching costs. This is a critical factor in managing revenue stability and operational efficiency within the industry.

- High Switching Costs: Physical and emotional effort of moving seniors, plus establishing new routines.

- Reduced Bargaining Power Post-Move-In: Residents are less likely to switch due to the disruption involved.

- Initial Competition: Providers face strong customer power during the selection process.

- Industry Insight: In 2024, the senior living sector continued to emphasize community integration and resident comfort to leverage these post-move-in stickiness factors.

Customers in the senior living market, including those considering Capital Senior Living, wield considerable bargaining power due to the significant financial commitment involved. The average monthly cost for assisted living in 2024 was $5,511, making price a primary driver in decision-making. This financial weight incentivizes families to meticulously compare options and seek the best value.

The ease of access to information online further amplifies customer power. Platforms like Caring.com allow for direct comparisons of pricing and services, forcing providers to remain competitive. In 2024, transparency in pricing and service offerings became paramount, as customers could readily identify and switch to more appealing alternatives.

Furthermore, evolving customer expectations, particularly from Baby Boomers, contribute to this leverage. A 2024 AARP survey revealed that 77% of adults aged 50 and older prefer to age in place, highlighting a demand for communities that support active, independent living. This necessitates providers to offer robust amenities and engaging programs to attract and retain residents.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Cost of Services | High (Significant financial outlay) | Avg. Assisted Living Cost: $5,511/month |

| Information Accessibility | High (Online comparison tools) | Platforms like Caring.com |

| Customer Expectations | Increasing (Personalized care, amenities) | 77% of 50+ prefer aging in place (AARP) |

| Switching Costs (Post-Move-In) | Lowers power once resident is settled | Focus on community integration for retention |

Preview Before You Purchase

Capital Senior Living Porter's Five Forces Analysis

This preview showcases the comprehensive Capital Senior Living Porter's Five Forces Analysis, detailing the competitive landscape within the senior living industry. You are viewing the exact document you will receive immediately after purchase, offering a complete and professionally formatted analysis ready for your strategic planning. This includes an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, providing actionable insights.

Rivalry Among Competitors

The senior living sector is indeed a crowded space, with Capital Senior Living navigating a landscape dotted with a multitude of local, regional, and national players. This fragmentation means the company constantly contends with a diverse array of competitors, ranging from other publicly traded giants to smaller, privately held operators, all vying for the same resident base. For instance, in 2024, the senior living industry continued to see new entrants alongside established providers, intensifying localized competition where occupancy rates are a key battleground.

The senior housing market is experiencing a significant imbalance between strong demand and limited new supply. Demographic trends, with the large Baby Boomer generation entering their senior years, are fueling a historic surge in demand for senior living options. This robust demand is a key driver for the industry.

However, new construction starts for senior housing have plummeted to record lows, a trend that has been particularly pronounced in 2023 and is expected to continue into 2024. This constrained supply, coupled with the escalating demand, creates a highly competitive environment for operators. The scarcity of new units means existing communities with desirable locations and services are in high demand, intensifying the rivalry among providers to attract and retain residents.

Competitors in the senior living sector actively seek to attract residents by offering distinct services and appealing amenities. This differentiation often includes specialized care programs, such as memory care, alongside lifestyle enhancements like robust wellness initiatives, varied dining experiences, and the incorporation of modern technology.

Capital Senior Living faces intense rivalry where success hinges on its ability to consistently invest in and prominently showcase its unique value propositions. For instance, in 2024, the senior living industry saw continued emphasis on personalized care plans and community engagement, with operators investing in staff training and technology to improve resident experiences.

Pricing Strategies and Affordability Concerns

Competitive rivalry in the senior living sector, including for Capital Senior Living, is significantly influenced by pricing strategies and the inherent affordability concerns of its target demographic. Operators must navigate a complex landscape where pricing models vary considerably across independent living, assisted living, and memory care services. This necessitates a delicate balance between achieving sustainable rent growth and ensuring services remain accessible to a broad range of seniors, particularly as economic headwinds can impact consumer spending power.

The pressure to remain competitive on price is substantial. For instance, a 2024 report indicated that the average monthly cost for assisted living in the U.S. can range from $4,000 to $6,000, with memory care often commanding higher rates. This creates a challenging environment where providers like Capital Senior Living must differentiate on value and service quality rather than solely on price, while still acknowledging the financial realities faced by many families.

- Pricing Models: Differentiated pricing across independent, assisted, and memory care segments.

- Affordability: Balancing rent increases with consumer economic pressures.

- Transparency: Emerging state requirements for pricing disclosure influencing competitive tactics.

Occupancy Rate Recovery and Market Positioning

The senior living sector has witnessed a robust rebound in occupancy, with rates approaching pre-pandemic levels by the first quarter of 2024. This upward trend is expected to persist, intensifying competition as providers vie to fill their available units and maximize revenue streams.

This recovery fuels aggressive sales and marketing campaigns among competitors, creating a highly competitive environment. Companies are investing heavily in outreach and promotional activities to capture market share.

- Occupancy Rate Rebound: By Q1 2024, senior living occupancy rates neared pre-pandemic figures, signaling a strong industry recovery.

- Aggressive Competition: The positive occupancy momentum drives competitors to intensify sales and marketing efforts to fill units.

- Revenue Optimization: Companies are focused on optimizing revenue through strategic pricing and occupancy management.

- Market Share Focus: Intense rivalry means a significant emphasis on capturing and retaining market share in a recovering landscape.

The competitive rivalry within the senior living sector is fierce, driven by a fragmented market and a surge in demand against constrained supply. Companies like Capital Senior Living must differentiate through services, amenities, and pricing to attract residents. For instance, in 2024, the industry saw continued investment in personalized care and technology to enhance resident experiences, while balancing affordability concerns with rising operational costs.

| Competitor Type | Key Differentiators | 2024 Focus Areas |

|---|---|---|

| National Chains | Brand recognition, economies of scale, diverse service offerings | Technology integration, specialized care programs (e.g., memory care) |

| Regional Operators | Strong local presence, community ties, tailored services | Staff training, resident engagement activities, localized marketing |

| Independent/Boutique Providers | Unique lifestyle, high-touch service, niche markets | Personalized resident experiences, flexible care plans, upscale amenities |

SSubstitutes Threaten

In-home care services represent a significant substitute threat to Capital Senior Living. These services allow seniors to age in place, receiving assistance with daily living activities directly in their own residences. This offers a strong sense of familiarity and comfort, often appealing to seniors and their families.

While the cost of full-time in-home care can sometimes exceed that of assisted living facilities, the perceived benefits of staying in a familiar environment can make it a preferred choice. This is especially true for individuals who require only a moderate level of support, making the substitute particularly potent.

The in-home care market has seen substantial growth. For instance, the U.S. in-home care market was valued at approximately $150 billion in 2023 and is projected to grow, indicating a strong and expanding substitute option for traditional senior living communities.

Many seniors prefer to age in place, supported by family, which acts as a significant substitute for formal senior living. This informal care can fulfill the need for assistance and companionship, lessening the demand for communities like those offered by Capital Senior Living. For instance, in 2024, an estimated 2.5 million Americans aged 65 and older lived with family members, highlighting the prevalence of this substitute care model.

The rise of technology-enabled independent living presents a significant threat to senior living providers like Capital Senior Living. Advancements in smart home devices, wearable health monitors, and sophisticated remote monitoring systems allow seniors to age in place more safely and comfortably. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to grow substantially, offering seniors enhanced safety features and connectivity.

Telehealth services further bolster this trend, enabling seniors to consult with healthcare professionals from their homes, reducing the perceived need for on-site medical support often found in senior living communities. This technological accessibility can delay or even eliminate the necessity for a move, directly impacting the demand for traditional senior living solutions. By 2025, it's estimated that over 30% of healthcare interactions could occur remotely, underscoring the growing viability of home-based care.

Adult Day Programs and Community Centers

For seniors who want social interaction and supervised activities but do not require full-time residential care, adult day programs and community centers act as viable substitutes. These alternatives offer respite for family caregivers and fulfill social needs, potentially delaying or preventing a transition to a senior living community.

These substitute services can be significantly more affordable than full-time senior living. For instance, the average cost of adult day care in the US can range from $70 to $150 per day, which is considerably less than the monthly fees for assisted living. This cost differential makes them an attractive option for many families.

- Cost Savings: Adult day programs are generally less expensive than full-time senior living, offering a more budget-friendly alternative for social engagement and care.

- Caregiver Respite: These programs provide crucial breaks for family caregivers, allowing them to manage their own lives while ensuring their loved ones receive social and supervised attention.

- Social and Activity Engagement: They offer seniors opportunities for socialization, therapeutic activities, and meals, addressing the need for community and stimulation without a residential commitment.

- Market Penetration: The number of adult day centers in the US has been steadily growing, indicating increasing demand and a competitive threat to traditional senior living models.

Continuing Care Retirement Communities (CCRCs) or Nursing Homes

While Continuing Care Retirement Communities (CCRCs) and traditional nursing homes offer distinct levels of service, they can function as substitutes for Capital Senior Living's offerings, particularly for residents requiring more intensive medical care. For individuals with significant health needs, nursing homes present a direct alternative to assisted living or memory care services. These facilities are generally more expensive due to the higher level of medical support provided.

The demand for skilled nursing care, a core offering in nursing homes, remained robust. In 2024, the U.S. nursing home market was valued at approximately $175 billion, indicating a substantial segment of seniors seeking this type of care. This market size underscores the competitive pressure from nursing homes for residents who may otherwise consider Capital Senior Living's higher-acuity services.

- Higher Medical Needs: Nursing homes provide a higher degree of medical supervision and intervention, making them a substitute for residents with complex health conditions.

- Cost Differential: While generally more expensive, the comprehensive medical services offered by nursing homes can justify the cost for specific patient populations.

- Market Size: The significant valuation of the U.S. nursing home market in 2024 highlights the availability and demand for these alternative senior care models.

In-home care services and family support represent significant substitutes for Capital Senior Living, offering seniors the comfort of familiar surroundings and personalized assistance. The U.S. in-home care market, valued at approximately $150 billion in 2023, demonstrates the growing preference for aging in place. Furthermore, in 2024, an estimated 2.5 million Americans aged 65 and older lived with family, highlighting the prevalence of informal care networks that reduce demand for senior living communities.

Technology-enabled independent living, including smart home devices and telehealth, provides another potent substitute. The global smart home market reached about $100 billion in 2023, offering enhanced safety and connectivity for seniors at home. Telehealth is also expanding, with projections suggesting over 30% of healthcare interactions could be remote by 2025, diminishing the perceived need for on-site medical support in senior living facilities.

Affordable alternatives like adult day programs and community centers also act as substitutes, providing social engagement and respite for caregivers. The average daily cost for adult day care, ranging from $70 to $150, is considerably less than full-time senior living. The increasing number of adult day centers reflects a growing demand for these more accessible options.

Nursing homes, while offering higher medical acuity, can also serve as substitutes for Capital Senior Living's more intensive care services. The U.S. nursing home market was valued at roughly $175 billion in 2024, indicating a substantial segment of seniors requiring comprehensive medical support that these facilities provide.

Entrants Threaten

Entering the senior living sector, like that of Capital Senior Living, requires a significant financial commitment. New players must be prepared to invest heavily in acquiring suitable land, constructing state-of-the-art facilities, and outfitting them with necessary amenities and equipment. For instance, the average cost to build a new senior living facility can range from $20 million to $50 million or more, depending on size and location, creating a substantial hurdle.

This considerable upfront capital outlay, coupled with lengthy development and regulatory approval processes, acts as a formidable barrier. It effectively deters many potential new entrants who may lack the necessary financial resources or the patience for the extended return on investment timeline typical in this industry.

The senior living sector is heavily regulated, with state and federal laws dictating everything from licensing and staffing levels to the quality of care provided. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize stringent quality reporting for skilled nursing facilities, a segment often intertwined with senior living operations. This intricate web of compliance, including specific building codes and operational protocols, acts as a formidable barrier for any new company attempting to enter the market.

The threat of new entrants into the senior living sector, specifically for companies like Capital Senior Living, is significantly influenced by the immense challenge of establishing brand reputation and trust. Building a credible name and a strong sense of reliability requires years of dedicated effort, consistently delivering high-quality care and fostering positive resident experiences.

New players must overcome the hurdle of gaining the confidence of potential residents and their families, who frequently base their decisions on established reputations and personal recommendations. For instance, in 2024, studies indicated that over 70% of individuals seeking senior living options prioritize community reputation and resident testimonials when making their final choice, highlighting the significant barrier to entry that brand equity presents.

Labor Market Challenges

New entrants in the senior living sector face a significant hurdle with existing labor market challenges, particularly the shortage of qualified caregivers and healthcare professionals. This makes it exceptionally difficult to staff new facilities to the required standards. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 19% growth for home health and personal care aides, a rate much faster than the average for all occupations, highlighting the intense competition for this vital workforce.

The fierce competition for talent directly translates into rising wages, presenting a substantial operational cost and a barrier to entry for new companies. This wage inflation, driven by demand and scarcity, can erode profit margins from the outset. The need to offer competitive compensation packages to attract and retain staff means new entrants must have robust financial backing to absorb these increased labor costs.

- Caregiver Shortage: Many regions experience critical shortages of trained and experienced caregivers, a fundamental requirement for senior living operations.

- Rising Wages: To attract scarce talent, new operators must contend with escalating wage demands, impacting initial operating expenses.

- Retention Difficulty: High turnover rates in the caregiving sector further compound the challenge, requiring continuous recruitment efforts and investment.

Access to Financing and Market Knowledge

Securing adequate financing for new senior living projects presents a significant hurdle for potential entrants, particularly given the economic uncertainties observed in 2024. High interest rates and tighter lending standards can make it difficult to raise the substantial capital required for development and operations.

Furthermore, new players often struggle with a deficit in crucial local market knowledge. Understanding specific demographic needs, zoning regulations, and competitive landscapes is vital. For instance, a new entrant might overlook the nuanced preferences of a particular senior demographic in a specific geographic area, a detail an established operator like Capital Senior Living would already leverage.

- Financing Challenges: Rising construction costs and interest rates in 2024 increased the capital required for new senior living facilities, potentially limiting the number of well-funded entrants.

- Market Knowledge Gap: Incumbents benefit from established relationships with local healthcare providers, referral sources, and a deep understanding of resident preferences, which new entrants need considerable time and resources to replicate.

- Operational Expertise: Navigating complex healthcare regulations, staffing challenges, and resident care standards requires specialized knowledge that is difficult for new entrants to acquire quickly.

The threat of new entrants into the senior living market, impacting companies like Capital Senior Living, is considerably low due to substantial capital requirements. Building a new facility can cost upwards of $20 million to $50 million, a significant barrier for many. This high upfront investment, coupled with lengthy development timelines, deters potential competitors who may not have access to such extensive funding or a long-term investment horizon.

Regulatory hurdles also play a crucial role in limiting new entrants. The sector is subject to stringent state and federal laws, covering everything from licensing and staffing to care quality. For example, in 2024, continued emphasis on quality reporting by agencies like CMS means new players must navigate a complex compliance landscape before even opening their doors.

Brand reputation and trust are paramount in senior living, presenting another significant barrier. Building a reputable name takes years of consistent, high-quality care and positive resident experiences. By 2024, market research indicated that over 70% of individuals seeking senior living options rely heavily on community reputation and testimonials, making it difficult for new entrants to gain traction against established providers.

The labor market, particularly the shortage of qualified caregivers, poses a substantial challenge. In 2024, the U.S. Bureau of Labor Statistics projected a 19% growth for home health and personal care aides, signaling intense competition for this essential workforce. This scarcity drives up wages, increasing operational costs for new entrants and making it difficult to staff facilities adequately.

| Barrier | Description | 2024 Relevance |

| Capital Investment | High costs for land acquisition, construction, and outfitting facilities. | Estimated $20M-$50M+ per facility. |

| Regulatory Compliance | Navigating complex licensing, staffing, and care quality standards. | Continued stringent quality reporting requirements from CMS. |

| Brand Reputation & Trust | Building credibility through years of quality service and positive resident experiences. | Over 70% of consumers prioritize reputation and testimonials. |

| Labor Shortage | Difficulty in attracting and retaining qualified caregivers and healthcare professionals. | Projected 19% growth for care aides, increasing wage competition. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Capital Senior Living leverages data from company 10-K filings, industry association reports, and market research databases like IBISWorld to assess competitive intensity and industry structure.