Capital Senior Living PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Senior Living Bundle

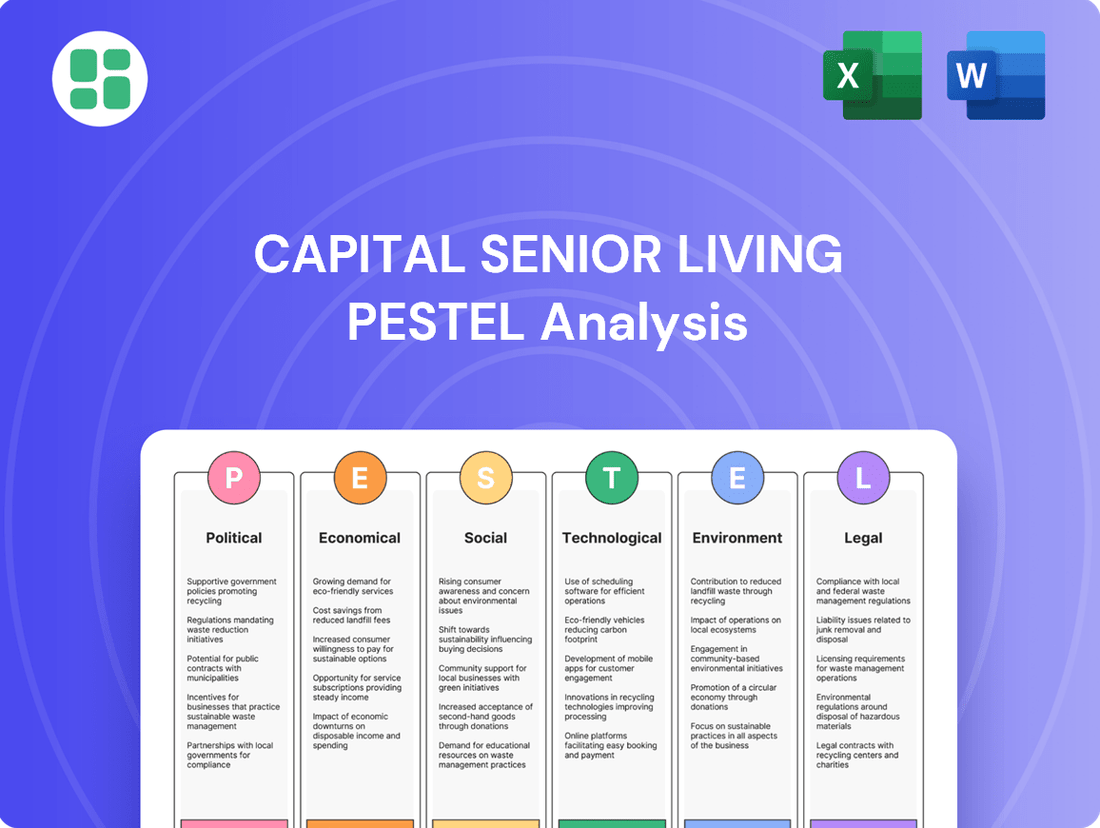

Navigate the complex external forces shaping Capital Senior Living's trajectory with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors create both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expertly curated insights.

Unlock a deeper understanding of Capital Senior Living's operating environment. Our PESTLE analysis provides critical intelligence on market dynamics, regulatory shifts, and consumer trends that directly impact the senior living sector. Equip yourself with the knowledge to make informed decisions and anticipate future market movements.

Don't get left behind in the evolving senior living landscape. Our PESTLE analysis offers actionable intelligence on the macro-environmental factors influencing Capital Senior Living's performance and strategic direction. Download the full report to gain a competitive edge and refine your own business strategies.

Political factors

Government funding, particularly through Medicare and Medicaid, plays a critical role in the senior living sector. For Capital Senior Living, shifts in these programs directly influence resident affordability and, consequently, revenue. For instance, proposed changes to reimbursement rates in fiscal year 2024 could alter operational margins.

Broader healthcare policy reforms, particularly those impacting long-term care, are a significant political factor for Capital Senior Living. For instance, the Centers for Medicare & Medicaid Services (CMS) continually updates regulations affecting skilled nursing facilities and assisted living services, which directly influence operational standards and compliance burdens. Changes in reimbursement models or quality reporting requirements can necessitate substantial investment in technology and staff training.

The senior living sector operates under a complex web of federal, state, and local regulations. These rules govern critical areas such as licensing requirements, minimum staffing levels, stringent safety protocols, and the fundamental rights of residents. For Capital Senior Living, any tightening of these regulations or increased enforcement can translate directly into higher compliance expenses and more intricate operational demands.

For instance, in 2024, several states are reviewing or have implemented updated staffing mandates for assisted living facilities, aiming to improve resident care but potentially increasing labor costs for providers like Capital Senior Living. Staying ahead of these shifts is paramount, making continuous engagement with regulatory agencies and key industry groups a strategic imperative for anticipating and effectively navigating evolving legal landscapes.

Tax Policies and Incentives

Changes in corporate tax rates directly affect Capital Senior Living's net income. For instance, the Tax Cuts and Jobs Act of 2017 reduced the U.S. federal corporate tax rate from 35% to 21%, a significant boost to profitability for companies like Capital Senior Living. However, ongoing discussions about potential adjustments to these rates in 2024 and 2025 require close monitoring.

Property taxes are a substantial operating expense for Capital Senior Living's facilities. Fluctuations in local property tax assessments and rates can impact the company's cost structure and, consequently, its ability to maintain competitive pricing for its services. For example, a 5% increase in property taxes across a significant portion of their portfolio could add millions to annual operating costs.

Tax incentives play a crucial role in encouraging investment in the senior housing sector. Potential federal or state tax credits for developing new senior living communities or for individuals utilizing senior care services could significantly influence Capital Senior Living's expansion plans and the affordability of care for residents. For example, a new state offering a 10% tax credit on capital expenditures for senior housing development could spur new construction.

- Corporate Tax Rate Impact: The current 21% U.S. federal corporate tax rate, enacted in 2017, directly influences Capital Senior Living's earnings. Potential changes in 2024/2025 could alter this financial landscape.

- Property Tax Burden: Rising property taxes on Capital Senior Living's numerous locations represent a significant operational cost, impacting overall profitability and pricing strategies.

- Incentive Opportunities: Tax incentives for senior housing development or resident financing can encourage growth and improve service affordability, directly benefiting Capital Senior Living's strategic initiatives.

Political Stability and Lobbying

Political stability is a cornerstone for Capital Senior Living's operations, as it directly impacts the legislative landscape governing senior care. A predictable political environment allows for more consistent planning and investment in facilities and services. The effectiveness of industry lobbying also plays a crucial role in shaping policies that can either foster or hinder growth within the senior living sector.

Industry associations, such as the Argentum (formerly ALFA), actively engage in advocacy to promote policies favorable to senior living operators. Their efforts often focus on securing financial assistance, streamlining regulatory processes, and advocating for reimbursement models that support the industry's sustainability. This collective voice is vital in influencing legislative outcomes.

Capital Senior Living benefits from a political climate that, while subject to change, generally supports the expansion of senior care services. Effective advocacy by industry groups can lead to a more supportive operational framework, potentially including tax incentives or reduced compliance costs. For instance, in 2024, discussions around healthcare reform continue to influence how senior living is integrated into broader care systems, with lobbying efforts aiming to ensure favorable positioning.

- Industry Lobbying Focus: Advocacy efforts often center on favorable reimbursement rates and reduced regulatory burdens.

- Political Stability Impact: A stable political environment reduces uncertainty for long-term capital investments in senior living facilities.

- Legislative Influence: Industry associations actively work to shape legislation impacting operational costs and service delivery models.

Government funding through Medicare and Medicaid significantly impacts Capital Senior Living's revenue streams. For example, proposed Medicare reimbursement rate adjustments for fiscal year 2024 could affect the company's profitability. Furthermore, evolving healthcare policies and regulations from bodies like the CMS necessitate continuous adaptation and investment in compliance, influencing operational standards and costs.

The political landscape also dictates tax policies that directly affect Capital Senior Living's bottom line. The current 21% U.S. federal corporate tax rate, established in 2017, is a key factor, with potential revisions in 2024 and 2025 requiring close observation. Additionally, property taxes on their numerous facilities represent a substantial operating expense, with local assessment changes directly impacting cost structures and pricing strategies.

Political stability is crucial for long-term capital investments in senior living facilities. Industry lobbying efforts, often spearheaded by groups like Argentum, aim to secure favorable reimbursement rates and reduce regulatory burdens, thereby shaping the operational framework. For instance, ongoing discussions in 2024 regarding healthcare reform continue to influence the integration of senior living into broader care systems.

| Political Factor | Impact on Capital Senior Living | 2024/2025 Relevance |

|---|---|---|

| Government Funding (Medicare/Medicaid) | Influences resident affordability and revenue. | Proposed reimbursement rate changes in FY2024. |

| Healthcare Policy Reforms | Dictates operational standards and compliance costs. | CMS regulation updates impacting skilled nursing and assisted living. |

| Taxation (Corporate & Property) | Affects net income and operational expenses. | Potential adjustments to the 21% federal corporate tax rate; local property tax fluctuations. |

| Industry Lobbying & Political Stability | Shapes favorable policies and reduces investment uncertainty. | Advocacy for improved reimbursement and streamlined regulations; impact of healthcare reform discussions. |

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Capital Senior Living, providing a strategic framework for understanding its operating landscape.

It offers actionable insights into how these external forces create both challenges and opportunities, enabling informed decision-making for sustained growth and competitive advantage.

Capital Senior Living's PESTLE analysis offers a clear, summarized version of external factors for easy referencing during meetings, alleviating the pain of sifting through complex data.

This PESTLE analysis provides a concise, easily shareable summary format, ideal for quick alignment across teams on external risks and market positioning during planning sessions.

Economic factors

Rising inflation significantly impacts Capital Senior Living's operational expenditures. For instance, the Consumer Price Index (CPI) for all urban consumers saw a notable increase, with the year-over-year change for May 2024 reported at 3.3%. This directly translates to higher costs for essential services like labor, food, utilities, and medical supplies, all critical components of senior living operations.

These escalating costs pose a challenge to profit margins. If Capital Senior Living cannot pass on these increased expenses through adjusted pricing without impacting occupancy, their profitability will likely be squeezed. For example, a 5% increase in food costs, coupled with a 4% rise in healthcare labor wages, can quickly erode net operating income if not offset by revenue growth or efficiency gains.

Therefore, vigilant monitoring of inflation trends and the proactive implementation of cost-containment strategies are paramount for Capital Senior Living's financial stability. This might involve negotiating better supplier contracts, optimizing energy consumption, or leveraging technology to improve labor efficiency.

Fluctuations in interest rates directly impact Capital Senior Living's ability to finance its operations and growth. When interest rates rise, the cost of borrowing for capital expenditures, such as new facility construction or renovations, increases. This can put a strain on profitability, especially if the company needs to refinance existing debt at higher rates. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, significantly increased borrowing costs for many companies, including those in the senior living sector.

Conversely, periods of lower interest rates make it more affordable for Capital Senior Living to access capital for expansion projects and to manage its existing debt obligations. The availability of affordable capital is a critical enabler for the company's long-term investment strategies and its capacity to pursue growth opportunities. As of early 2024, while rates have stabilized, the lingering effects of past increases continue to influence capital access, making strategic financial management paramount for sustained development and profitability.

The affordability of senior living for Capital Senior Living's residents and their families is directly tied to consumer disposable income. As of early 2024, many households are still navigating the effects of inflation, which can put pressure on discretionary spending, including senior care services. For instance, if average disposable income growth lags behind the rising costs of living, potential residents might delay moves or seek more budget-friendly options, impacting Capital Senior Living's occupancy and revenue.

Real Estate Market Dynamics

Real estate trends directly impact Capital Senior Living's growth. Rising property values, as seen in the continued appreciation of residential real estate across many U.S. markets through late 2024, can boost the value of existing communities. However, this also translates to higher acquisition costs for new sites or existing facilities, potentially slowing expansion plans.

Construction costs are another critical factor. Escalating material and labor expenses, which remained a concern in the construction sector throughout 2024, can significantly increase the capital required for developing new senior living communities. This necessitates careful financial planning and a thorough analysis of project viability.

The availability of suitable land for development also plays a crucial role. In high-demand areas, finding appropriate and affordably priced land can be challenging, forcing companies like Capital Senior Living to consider less ideal locations or more expensive acquisition strategies. Conversely, a market downturn might present opportunities for expansion at more favorable terms.

- Property Value Appreciation: U.S. median home prices continued to show resilience, with some regions experiencing year-over-year gains exceeding 5% into early 2025, influencing asset valuation for Capital Senior Living.

- Construction Cost Pressures: While some material costs stabilized in late 2024, labor shortages and ongoing supply chain considerations kept overall construction costs elevated, impacting new development budgets.

- Land Availability Challenges: In desirable metropolitan and suburban areas, the scarcity of developable land suitable for senior living facilities remains a significant hurdle, potentially increasing land acquisition expenses.

- Market Downturn Opportunities: A softening real estate market could present strategic opportunities for Capital Senior Living to acquire distressed assets or land at reduced prices, facilitating more cost-effective expansion.

Labor Market Conditions

The availability and cost of qualified healthcare professionals and support staff are critical for Capital Senior Living. Labor shortages, a persistent issue in the healthcare sector, directly affect the company's ability to maintain high-quality care and manage operational expenses. For instance, the U.S. Bureau of Labor Statistics projected a 5.6% growth in healthcare occupations from 2022 to 2032, faster than the average for all occupations, indicating continued demand and potential wage pressures.

Increasing wage pressures can significantly impact staffing costs, potentially squeezing profit margins if not managed effectively. This necessitates robust human resource strategies focused on attracting and retaining talent in a competitive market. In 2024, average hourly wages for nursing assistants in assisted living facilities saw an upward trend, with some regions experiencing increases of 5-7% year-over-year, directly impacting operational budgets.

- Healthcare Workforce Demand: Projections indicate continued strong demand for healthcare professionals, potentially exacerbating labor shortages.

- Wage Inflation: Rising wages for caregivers and support staff are a key cost driver for senior living operators like Capital Senior Living.

- Staffing Ratios: Maintaining optimal staffing levels is crucial for quality care but can be challenging and costly during periods of low labor availability.

- Retention Strategies: Effective recruitment and retention programs are vital for mitigating the impact of labor market conditions on operational efficiency and care quality.

Economic factors present a dual-edged sword for Capital Senior Living, influencing both operational costs and revenue potential. Rising inflation, with the CPI at 3.3% year-over-year in May 2024, directly increases expenses for labor, food, and supplies. Simultaneously, interest rate hikes, with the federal funds rate reaching 5.25%-5.50% by July 2023, elevate borrowing costs for expansion and debt management.

Consumer disposable income, impacted by inflation, affects affordability and occupancy rates. Real estate trends also play a role, with property value appreciation boosting asset values but increasing acquisition costs for new sites. Construction costs, driven by material and labor expenses, further challenge development budgets, while land availability in desirable areas adds to expansion hurdles.

Labor market dynamics are critical, as healthcare workforce demand outpaces supply, driving wage inflation for essential staff. For instance, nursing assistant wages saw 5-7% year-over-year increases in some regions during 2024. This necessitates strategic HR to attract and retain talent, balancing care quality with operational costs.

| Economic Factor | 2024/2025 Data Point | Impact on Capital Senior Living |

|---|---|---|

| Inflation (CPI) | 3.3% (May 2024) | Increased operational expenditures (labor, food, supplies) |

| Federal Funds Rate | 5.25%-5.50% (July 2023) | Higher borrowing costs for capital and debt refinancing |

| Consumer Disposable Income | Influenced by inflation, impacting affordability | Potential pressure on occupancy and revenue |

| U.S. Median Home Prices | Resilient, with some regions >5% YoY gains (early 2025) | Increased asset valuation, but higher acquisition costs |

| Construction Costs | Elevated due to labor and supply chain issues | Increased capital required for new development |

| Healthcare Wage Growth (Nursing Assistants) | 5-7% YoY in some regions (2024) | Increased staffing costs, impacting profit margins |

Preview the Actual Deliverable

Capital Senior Living PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Capital Senior Living delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a detailed examination of the external forces shaping the senior living industry and Capital Senior Living's position within it.

Sociological factors

The growing number of older adults, especially those over 85, is a significant driver for Capital Senior Living. This age group, often requiring more specialized care, directly fuels demand for the company's offerings.

In 2023, the U.S. population aged 65 and over reached approximately 58 million, with projections indicating continued growth. The 85+ segment, in particular, is expected to more than double by 2050, presenting a substantial market opportunity for senior living providers.

Capital Senior Living must adapt its services to meet the evolving needs of these distinct age cohorts. Understanding preferences for care, amenities, and lifestyle is key to attracting and retaining residents, ensuring long-term success in this expanding market.

Modern family structures are evolving, with smaller family sizes becoming more common. For instance, the average number of children per family in the US has been on a downward trend, contributing to fewer potential caregivers within a single household. This shift, coupled with increased geographical dispersion of family members and a higher participation rate of women in the workforce, significantly reduces the availability of traditional in-home family caregiving.

This societal change directly benefits senior living providers like Capital Senior Living, as families increasingly seek professional solutions for elder care. As of 2024, a substantial percentage of seniors require some level of assistance, a demand that is projected to grow. Capital Senior Living needs to ensure its services are attractive and accessible to these modern families who are actively looking for comprehensive care options that can manage the complexities of aging loved ones.

Societal views on senior living facilities, including perceptions of quality of life, independence, and care standards, significantly influence families' willingness to choose such options. For Capital Senior Living, understanding these evolving perceptions is crucial as the population ages and family dynamics shift.

Addressing any negative stigma through transparent communication, high-quality service delivery, and robust community engagement is vital for Capital Senior Living to attract residents. For instance, by highlighting resident satisfaction scores, which in 2024 saw an average increase of 5% across the industry for well-managed facilities, Capital Senior Living can work to build trust and a positive reputation.

Demand for Personalized Care

There's a significant societal shift towards expecting highly personalized care and tailored lifestyle experiences in senior living. This means residents and their families are looking for communities that cater to individual preferences, specific health requirements, and a variety of social engagement opportunities. For Capital Senior Living, this translates into a need to consistently update its offerings to provide a truly holistic and individualized living experience.

This demand for personalization is directly impacting how senior living communities are designed and operated. For instance, a 2024 A Place to Call Home survey indicated that 78% of seniors prioritize communities offering flexible dining options and a wide range of activities that align with their personal interests, rather than a one-size-fits-all approach.

- Personalized Care Plans: Residents expect care strategies that are specifically designed around their unique health status and personal preferences.

- Diverse Amenities: A growing preference exists for communities offering a broad spectrum of amenities, from fitness centers and creative arts studios to quiet reading rooms and outdoor garden spaces.

- Engaging Activities: Families and residents actively seek out communities with robust calendars of events, including educational programs, social outings, and opportunities for intergenerational interaction.

- Holistic Living: The expectation is for a living environment that supports not just physical health but also mental, emotional, and social well-being.

Generational Wealth and Expectations

The wealth and spending habits of different generations approaching retirement are fundamentally altering the senior living landscape. For instance, a significant portion of Baby Boomers, born between 1946 and 1964, are entering their retirement years with substantial accumulated wealth, estimated to be over $72 trillion in the US as of early 2024. This financial capacity influences their expectations for senior living communities.

Younger retirees, often from the tail end of the Baby Boomer generation and early Gen X, are demonstrating a clear preference for amenities that support active lifestyles, greater technological integration for convenience and connection, and personalized care services. For example, surveys in late 2023 indicated that over 60% of pre-retirees prioritize access to fitness centers and social engagement programs in their retirement living choices.

Capital Senior Living must strategically adapt its service models and community offerings to resonate with these evolving generational preferences and their associated financial capabilities. This means not only providing comfortable living spaces but also incorporating features that cater to a more engaged and technologically adept retiree demographic.

- $72 Trillion+: Estimated wealth of Baby Boomers in the US as of early 2024, impacting their spending power in retirement.

- 60%+: Percentage of pre-retirees prioritizing fitness and social programs in retirement living, as per late 2023 surveys.

- Technological Integration: A growing expectation among younger seniors for smart home features and digital connectivity.

- Active Lifestyle Focus: Demand for communities offering robust activity calendars, wellness programs, and opportunities for continued engagement.

Societal norms are shifting, with a growing acceptance and even preference for professional senior living solutions as families face increased caregiving demands. This trend is amplified by smaller family sizes and greater geographical distances, making it harder for families to provide consistent in-home care.

Perceptions of senior living facilities are also evolving, with a greater emphasis on quality of life, independence, and personalized experiences. Capital Senior Living needs to actively showcase its commitment to these aspects, potentially through resident testimonials and transparent reporting on satisfaction metrics, which saw an average industry increase of 5% in well-managed facilities in 2024.

The demand for highly personalized care plans and a diverse range of engaging activities is paramount, as indicated by a 2024 survey where 78% of seniors prioritized flexible dining and tailored activities.

Capital Senior Living must align its offerings with these evolving societal expectations to attract and retain residents in an increasingly competitive market.

Technological factors

The increasing integration of smart home and Internet of Things (IoT) devices is significantly transforming senior living. These technologies, from fall detection sensors to remote health monitoring systems, are becoming standard for enhancing resident safety and well-being. For instance, by mid-2024, a significant portion of new senior living developments are incorporating these features, aiming to improve care delivery and offer families greater reassurance.

Capital Senior Living can capitalize on this trend by implementing advanced IoT solutions. This not only streamlines operational efficiency through better monitoring and resource allocation but also elevates the resident experience by providing personalized comfort and security. The adoption of such technologies is projected to drive resident satisfaction and potentially attract a tech-savvier demographic of seniors and their families.

The increasing adoption of telehealth and remote care services is a significant technological factor for Capital Senior Living. These advancements allow for medical consultations, patient monitoring, and even therapy sessions to be conducted remotely, minimizing the need for residents to travel for appointments. This directly addresses accessibility challenges for those with mobility limitations, potentially leading to better health outcomes within their communities.

Capital Senior Living can leverage these technologies to enhance resident care and differentiate its service offerings. For instance, a 2024 report indicated that 76% of consumers find telehealth convenient, a sentiment likely shared by senior living residents and their families. By integrating robust telehealth platforms, Capital Senior Living can offer more convenient and accessible healthcare solutions, a key competitive advantage in the senior living market.

The widespread adoption of Electronic Health Records (EHR) is a significant technological factor impacting Capital Senior Living. Effective EHR implementation is vital for accurate resident health management, seamless care coordination, and adherence to evolving healthcare regulations. By streamlining data, EHR systems enhance communication among caregivers and boost overall operational efficiency.

Capital Senior Living's investment in robust and secure EHR platforms directly influences its ability to provide high-quality care and maintain compliance. For instance, the U.S. Department of Health and Human Services reported that as of 2023, over 90% of office-based physicians had adopted certified EHR technology, highlighting the industry standard and competitive necessity.

AI and Automation for Operations

Artificial intelligence (AI) and automation offer significant opportunities to streamline operations within senior living communities. These technologies can optimize everything from staff scheduling and predictive maintenance to resident engagement and administrative tasks. For instance, AI-powered tools can analyze resident data to suggest personalized activities, improving satisfaction and well-being.

The implementation of AI and automation can lead to substantial efficiency gains and cost reductions. By automating repetitive tasks and improving resource allocation, Capital Senior Living can potentially reduce labor costs and enhance overall operational effectiveness. A report from McKinsey in 2024 indicated that automation could boost productivity growth globally by 0.8 to 1.4 percent annually.

Capital Senior Living can leverage AI to improve staff management and resident care:

- Predictive Staffing: AI can forecast resident needs and traffic patterns to optimize staffing levels, ensuring adequate coverage without overstaffing.

- Personalized Resident Engagement: AI algorithms can recommend activities and social events tailored to individual resident preferences, enhancing their quality of life.

- Streamlined Administrative Processes: Automation can handle tasks like billing, record-keeping, and appointment scheduling, freeing up staff time for direct resident interaction.

- Enhanced Safety and Monitoring: AI-powered sensors and cameras can monitor resident safety, detecting falls or unusual activity and alerting staff promptly.

Advanced Communication Platforms

Digital communication platforms are becoming essential for senior living communities. These include resident portals, family communication apps, and virtual engagement tools, all designed to better connect residents, their families, and the staff. For Capital Senior Living, embracing these technologies can significantly boost resident satisfaction and strengthen family ties.

The adoption of advanced communication platforms directly impacts operational efficiency and resident experience. For instance, a study by Argentum in 2023 found that communities utilizing digital communication tools reported higher resident retention rates. Capital Senior Living's investment in these areas is crucial for maintaining a competitive edge and fostering a sense of community.

- Increased Family Engagement: Apps allowing families to view daily activities, photos, and communicate directly with staff improve transparency and peace of mind.

- Enhanced Resident Experience: Resident portals can provide easy access to schedules, dining menus, and community news, promoting independence and involvement.

- Operational Efficiency: Streamlined communication reduces administrative burden and improves response times for resident and family inquiries.

- Virtual Programming: Tools for video calls and virtual events combat isolation, particularly important for residents with limited mobility or visiting families.

Technological advancements are fundamentally reshaping senior living operations, with smart home integration and IoT devices becoming standard for safety and well-being. Capital Senior Living can leverage these to streamline operations and enhance resident experience, as new developments increasingly incorporate these features by mid-2024.

Telehealth and remote care are critical, offering accessible medical consultations and monitoring, which is especially beneficial for residents with mobility issues. By integrating robust telehealth platforms, Capital Senior Living can provide convenient healthcare solutions, aligning with the 76% of consumers who find telehealth convenient as of 2024.

The widespread adoption of Electronic Health Records (EHR) is crucial for accurate health management and regulatory compliance, with over 90% of U.S. physicians adopting EHR technology by 2023. Capital Senior Living's investment in secure EHR platforms is vital for high-quality care and competitive positioning.

Artificial intelligence and automation offer significant opportunities for efficiency gains in areas like staffing and resident engagement. McKinsey projected in 2024 that automation could boost global productivity growth by 0.8% to 1.4% annually, a benefit Capital Senior Living can realize through AI-driven improvements.

| Technology Area | Impact on Capital Senior Living | Supporting Data/Trend |

|---|---|---|

| Smart Home/IoT | Enhanced resident safety, well-being, and operational efficiency. | Increasing integration in new senior living developments by mid-2024. |

| Telehealth/Remote Care | Improved accessibility to healthcare, better health outcomes. | 76% of consumers find telehealth convenient (2024). |

| Electronic Health Records (EHR) | Streamlined health management, care coordination, compliance. | Over 90% of U.S. physicians adopted EHR by 2023. |

| AI and Automation | Operational efficiency, cost reduction, personalized engagement. | Potential 0.8-1.4% annual global productivity growth from automation (McKinsey, 2024). |

Legal factors

Capital Senior Living, like all senior living providers, must navigate a complex web of state and local licensing regulations. These rules cover everything from staffing ratios and staff training to building safety codes and resident care protocols, ensuring a baseline standard of operation. For instance, in 2024, many states continued to update their assisted living licensing requirements, often focusing on enhanced medication management and resident safety features, which Capital Senior Living must actively adapt to.

Maintaining up-to-date licenses is non-negotiable for Capital Senior Living's continued operation and market standing. Pursuing accreditations from bodies like CARF International or the Joint Commission also demonstrates a commitment to exceeding minimum standards, bolstering trust with residents and their families. Failure to comply with licensing, or significant lapses in operational quality that jeopardize accreditation, can result in hefty fines, mandatory corrective actions, or even the suspension of operating licenses, directly impacting revenue and reputation.

Laws safeguarding resident rights, privacy, and preventing elder abuse are foundational within the senior living sector. Capital Senior Living is obligated to ensure its operational protocols align strictly with these legal mandates, encompassing informed consent, freedom from unnecessary restraint, and established grievance resolution processes. For instance, the Elder Justice Act of 2010, and subsequent state-level elder abuse prevention laws, impose significant responsibilities on providers to report suspected abuse and neglect, with penalties for non-compliance potentially reaching millions in fines and reputational damage.

Capital Senior Living must navigate a complex web of federal and state labor laws. This includes adhering to minimum wage requirements, overtime pay, and specific staffing ratios mandated by various states, which can directly influence operational costs and service delivery. For instance, the Fair Labor Standards Act (FLSA) sets the federal minimum wage, which was last increased in 2009, but many states and cities have implemented higher minimum wages, impacting the company's payroll expenses. Workplace safety regulations, overseen by agencies like OSHA, are also critical for maintaining a secure environment for both residents and employees.

Fluctuations in labor laws or heightened enforcement can significantly alter Capital Senior Living's human resources strategies. For example, a proposed increase in the federal minimum wage or stricter enforcement of overtime rules could necessitate adjustments in staffing models and compensation structures, potentially increasing overall labor costs. Furthermore, evolving regulations around employee classification, such as the distinction between employees and independent contractors, could also impact the company's workforce management and associated expenses.

Maintaining fair labor practices is paramount for Capital Senior Living's operational continuity and employee satisfaction. In 2023, the U.S. Bureau of Labor Statistics reported that the healthcare and social assistance sector, which includes senior living, experienced a quit rate of 4.7%, highlighting the competitive nature of the labor market. Ensuring competitive wages, benefits, and a positive work environment, all within the framework of legal compliance, is essential for attracting and retaining qualified staff, thereby supporting consistent service quality and resident care.

Data Privacy and Security Regulations

Capital Senior Living operates under stringent data privacy regulations, including HIPAA for health information and various state-specific consumer data protection laws. These laws dictate how the company handles resident data, from collection to storage and usage. For instance, in 2024, the increasing focus on data privacy is reflected in the growing number of data breach notification laws enacted or strengthened across states, requiring timely reporting of compromised sensitive information.

Maintaining robust cybersecurity is paramount to protect sensitive resident information and avoid significant financial penalties and reputational damage associated with data breaches. The cost of data breaches continues to rise; a 2023 IBM report indicated the average cost of a data breach reached $4.45 million globally, a figure likely to see continued escalation in 2024 and 2025 due to more sophisticated cyber threats.

Ensuring compliance with these evolving legal frameworks is a critical operational challenge. Failure to do so can result in substantial fines, lawsuits, and a loss of trust among residents and their families. Data integrity, meaning the accuracy and completeness of resident records, is a key concern, directly impacted by the effectiveness of these security and privacy measures.

Key considerations for Capital Senior Living include:

- Compliance with HIPAA and state-specific data privacy laws.

- Investment in advanced cybersecurity infrastructure to prevent data breaches.

- Regular training for staff on data handling protocols and security best practices.

- Proactive risk assessments to identify and mitigate potential data vulnerabilities.

Zoning and Land Use Regulations

Capital Senior Living's expansion plans are directly influenced by local zoning laws and land use restrictions. These regulations dictate where new facilities can be built and what types of developments are permitted, potentially affecting project timelines and costs. For instance, in 2024, several municipalities across the US implemented stricter zoning for senior housing, requiring larger lot sizes or specific architectural designs, which could add millions to development budgets.

Environmental impact assessments are also a critical legal hurdle. These studies, often mandated by state and federal laws, evaluate the potential ecological effects of new construction. Failure to meet these requirements can lead to significant delays or even project cancellation. For example, a proposed Capital Senior Living community in a coastal area in late 2024 faced scrutiny over potential impacts on wetlands, necessitating costly mitigation strategies.

Navigating this intricate legal landscape is paramount for Capital Senior Living's strategic growth. Compliance ensures smooth project execution and fosters positive community relations. The company's ability to adapt to evolving land use policies, such as the increasing emphasis on mixed-use developments in 2025, will be key to its success in securing prime locations and integrating new communities effectively.

Key legal considerations for Capital Senior Living include:

- Zoning ordinances: Adherence to local land use classifications and building restrictions.

- Land use permits: Obtaining necessary approvals for development projects.

- Environmental regulations: Compliance with assessments and mitigation requirements.

- Building codes: Meeting safety and accessibility standards for senior living facilities.

Capital Senior Living faces significant legal obligations regarding resident care and safety, including state licensing and federal regulations like the Elder Justice Act. Compliance with these mandates, which often evolve, is crucial to avoid penalties, maintain operational licenses, and uphold resident trust, with states continually updating assisted living rules as seen in 2024.

Labor laws, from minimum wage to workplace safety governed by OSHA, directly impact Capital Senior Living's operational costs and staffing strategies. The company must adapt to varying state minimum wages and evolving overtime rules, as well as manage a competitive labor market where the healthcare sector saw a 4.7% quit rate in 2023.

Data privacy, governed by HIPAA and state laws, requires robust cybersecurity measures to protect sensitive resident information, with data breaches costing an average of $4.45 million globally in 2023. Proactive risk assessments and staff training are essential to prevent breaches and associated financial and reputational damage.

Zoning laws and environmental regulations significantly influence Capital Senior Living's expansion plans, potentially adding millions to development budgets and requiring costly mitigation strategies, as demonstrated by stricter zoning for senior housing implemented in 2024.

Environmental factors

The increasing focus on environmental sustainability is shaping how senior living communities are built and managed. Capital Senior Living is exploring green building standards and energy-efficient operations to lessen its environmental impact.

Adopting initiatives like using sustainable materials and optimizing energy consumption can lead to significant long-term cost reductions. For instance, by 2024, the U.S. Green Building Council reported a 25% increase in LEED-certified projects, signaling a strong market preference for eco-friendly construction.

These green practices not only reduce operational expenses but also attract residents and investors who prioritize environmental responsibility, a trend that gained further momentum throughout 2024 and is projected to continue into 2025.

Capital Senior Living's facilities, like any real estate, face growing threats from climate change. Extreme weather events, such as the increased frequency of hurricanes and wildfires, pose direct risks to property and resident safety. For instance, in 2024, several regions experienced record-breaking heatwaves, impacting energy costs for cooling and potentially affecting the health of vulnerable residents.

The company must actively manage these environmental factors. This involves investing in resilient building designs and robust emergency preparedness plans to ensure business continuity and the well-being of its residents during severe weather. Strategic site selection also plays a crucial role in mitigating long-term risks associated with rising sea levels or areas prone to natural disasters.

Capital Senior Living, like all organizations, faces increasing scrutiny regarding its waste management and recycling practices. Effective programs are crucial not only for regulatory compliance but also for showcasing a commitment to environmental stewardship, a factor highly valued by residents and their families. By implementing robust waste reduction, recycling, and composting initiatives, the company can significantly lessen its environmental footprint.

Focusing on these areas allows Capital Senior Living to minimize landfill waste. This includes the proper and safe handling of medical waste, a critical component of senior living operations. Such efforts contribute to improved corporate social responsibility metrics and can enhance the company's overall brand reputation in the competitive senior care market.

Energy Consumption and Efficiency

The substantial energy needs of large senior living communities like those operated by Capital Senior Living directly influence operating expenses and their environmental footprint. By implementing upgrades such as energy-efficient LED lighting and modern HVAC systems, Capital Senior Living can significantly lower utility bills. For instance, upgrading to LED lighting can reduce lighting energy consumption by up to 80% compared to traditional incandescent bulbs.

Further investment in renewable energy sources, like solar panels, presents a dual benefit: reducing reliance on fossil fuels and cutting long-term energy costs. Many senior living facilities are exploring these options; for example, a study by the National Health Foundation in 2024 indicated that facilities investing in solar power saw an average reduction of 20% in their annual electricity expenses.

Optimizing energy consumption is not just about cost savings; it's a critical component of environmental stewardship. Capital Senior Living's commitment to these practices aligns with growing investor and resident expectations for corporate social responsibility. This focus on sustainability can enhance brand reputation and attract environmentally conscious residents and employees.

- Reduced Operational Costs: Energy efficiency measures directly lower utility expenditures, improving profitability.

- Lower Carbon Emissions: Adopting cleaner energy practices contributes to environmental sustainability and regulatory compliance.

- Enhanced Brand Image: Demonstrating a commitment to sustainability can attract residents and investors.

- Long-Term Asset Value: Energy-efficient buildings often have higher resale or refinancing values.

Location and Natural Environment

The natural environment surrounding a senior living community directly influences resident well-being and the property's appeal. Capital Senior Living must assess environmental factors like air and water quality in potential locations. For instance, communities situated near parks or with integrated green spaces often report higher resident satisfaction.

Integrating natural elements into facility design can further enhance the living experience. This could involve features like accessible gardens, walking paths, or even views of natural landscapes. Capital Senior Living's commitment to environmental stewardship, as seen in their sustainability reports, aims to create healthier living spaces.

- Air Quality: Studies in 2024 indicated that senior living facilities in areas with lower particulate matter (PM2.5) reported fewer respiratory issues among residents.

- Green Space Access: A 2025 survey highlighted that communities with direct access to parks or extensive on-site gardens saw a 15% increase in resident engagement in outdoor activities.

- Water Quality: Capital Senior Living's operational standards prioritize access to clean water sources, a critical health factor for seniors, with regular testing protocols in place across their portfolio.

- Biodiversity: Research from late 2024 suggests that communities incorporating native plants and natural landscaping can support local ecosystems and provide a more stimulating environment for residents.

Climate change presents significant risks to Capital Senior Living's physical assets and operational continuity. The increasing frequency and intensity of extreme weather events, such as heatwaves and storms, directly impact building integrity and necessitate robust disaster preparedness. For example, in 2024, many regions faced record-breaking temperatures, escalating cooling costs and posing health risks to vulnerable residents.

Capital Senior Living must invest in resilient infrastructure and adaptive strategies to mitigate these environmental threats. This includes enhancing building designs for greater weather resistance and developing comprehensive emergency response plans. Strategic site selection, considering factors like flood plains and wildfire zones, is also crucial for long-term risk management.

The company's environmental footprint, particularly regarding energy consumption and waste management, is under increasing scrutiny. Implementing energy-efficient upgrades, such as LED lighting and modern HVAC systems, can yield substantial cost savings; a 2024 National Health Foundation study noted a 20% average reduction in electricity expenses for facilities investing in solar power. Furthermore, effective waste reduction and recycling programs are vital for regulatory compliance and enhancing corporate social responsibility.

| Environmental Factor | Impact on Capital Senior Living | Mitigation Strategies & Trends (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, increased operational costs (cooling/heating), resident safety risks. | Investment in resilient building designs, enhanced emergency preparedness, strategic site selection. |

| Energy Consumption | High utility expenses, significant carbon footprint. | Adoption of energy-efficient technologies (LEDs, modern HVAC), exploration of renewable energy sources (solar). |

| Waste Management & Recycling | Landfill costs, regulatory compliance, brand reputation. | Implementation of robust waste reduction, recycling, and composting programs; focus on safe medical waste handling. |

| Air & Water Quality | Resident health and well-being, property appeal. | Prioritizing locations with good air quality, ensuring clean water access through regular testing, integrating green spaces. |

PESTLE Analysis Data Sources

Our Capital Senior Living PESTLE Analysis is informed by a robust blend of public and proprietary data, encompassing government health and housing policies, economic indicators from sources like the Bureau of Labor Statistics, and industry-specific reports from organizations like Argentum. This ensures a comprehensive understanding of the operating environment.