Capita PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capita Bundle

Navigate the dynamic landscape affecting Capita with our comprehensive PESTLE analysis. Uncover how political shifts, economic fluctuations, and technological advancements are shaping its strategic direction. Equip yourself with critical insights to anticipate challenges and seize opportunities. Download the full analysis now for an actionable roadmap.

Political factors

Government spending policies directly shape Capita's revenue streams, particularly within its public sector segment. For instance, the UK government's commitment to digital transformation in public services, as highlighted in the 2024 Spring Budget with increased funding for technology upgrades, creates opportunities for Capita's IT and digital solutions.

Conversely, periods of fiscal consolidation, such as the projected tightening of public sector budgets in certain European economies for 2025, could pressure Capita's existing contracts and slow the acquisition of new ones. This austerity can lead to reduced demand for outsourced services, impacting contract renewals and overall revenue growth.

However, strategic investments in areas like healthcare IT or citizen services, as seen with the NHS digital transformation plans for 2024-2025, can offer significant growth potential for Capita. These initiatives often require specialized expertise in areas where Capita operates, creating new business avenues.

The UK government's approach to outsourcing public services significantly impacts Capita's primary market. A move towards bringing services back in-house or imposing stricter regulations on private providers can present challenges for Capita. Conversely, continued government reliance on external specialists for efficiency gains and modernization efforts bolsters Capita's revenue streams. For instance, in 2023, government departments spent an estimated £290 billion on procurement, with a notable portion allocated to outsourced services, highlighting the scale of this market.

Capita navigates a complex regulatory landscape, especially within its public sector contracts. For instance, the UK government's Procurement Act 2023, which came into effect in October 2024, introduced significant changes to how public services are procured, requiring enhanced transparency and supplier due diligence. This means Capita must continually adapt its processes to align with these evolving procurement rules to maintain its eligibility for new and existing contracts.

Data protection regulations, such as the UK GDPR and the Data Protection Act 2018, are critical for Capita, given its handling of sensitive citizen and employee data. A breach or non-compliance could result in substantial fines; for example, the Information Commissioner's Office (ICO) can levy penalties of up to £17.5 million or 4% of global annual turnover. Staying compliant is paramount to avoid financial penalties and safeguard its reputation.

Political Stability and Government Changes

Political stability is a cornerstone for predictable economic policy, and shifts in government can significantly alter the landscape for public sector reforms and spending. For example, the 2024 UK general election, anticipated in the latter half of the year, could introduce policy adjustments impacting infrastructure investment and public service funding, potentially affecting companies with substantial government contracts.

A stable political environment fosters greater confidence for long-term investments and strategic planning. Conversely, major political events, such as unexpected election outcomes or significant policy reversals, can create volatility. For instance, the ongoing political realignments in the European Union in 2024 might influence regulatory frameworks affecting various industries, demanding adaptive strategies from businesses operating within the bloc.

- Government stability directly correlates with predictable policy environments, crucial for long-term business planning.

- Public sector spending priorities can shift dramatically with changes in government, impacting sectors reliant on state funding.

- Investor confidence is highly sensitive to political certainty; instability can lead to capital flight or delayed investment decisions.

- Regulatory changes stemming from political shifts can create both opportunities and challenges for businesses, requiring agile responses.

Brexit and Trade Relationships

Brexit's ongoing impact continues to shape the UK's economic landscape and government policies, influencing critical areas like talent mobility, supply chain resilience, and regulatory alignment. For a company like Capita, this translates into potential challenges in attracting and retaining skilled professionals from the European Union, alongside broader economic conditions that can affect client spending and strategic investments.

The UK's trade relationships post-Brexit present a complex environment for businesses. For Capita, navigating these evolving trade dynamics can affect operational costs and market access. For instance, the UK's trade deficit with the EU widened in early 2024, highlighting ongoing adjustments in bilateral trade flows.

- Talent Mobility: Post-Brexit visa requirements can affect Capita's ability to recruit EU talent, potentially impacting service delivery and innovation.

- Supply Chain Costs: New customs procedures and tariffs can increase the cost of imported goods and services, affecting Capita's operational expenses.

- Regulatory Divergence: Differences in regulations between the UK and the EU may create compliance burdens and affect the seamless operation of Capita's services across different markets.

- Economic Uncertainty: The lingering economic uncertainty associated with Brexit can lead to cautious client spending, impacting Capita's revenue streams.

Government spending policies significantly influence Capita's revenue, particularly in the public sector. For example, the UK's 2024 Spring Budget indicated increased funding for technology upgrades, benefiting Capita's digital solutions. Conversely, fiscal tightening in some European economies in 2025 could pressure existing contracts and slow new business acquisition.

Regulatory changes are critical for Capita, given its public sector contracts. The UK's Procurement Act 2023, effective October 2024, mandates greater transparency, requiring Capita to adapt its processes. Data protection regulations, like UK GDPR, impose strict compliance requirements, with potential fines up to £17.5 million or 4% of global annual turnover for breaches.

Political stability directly impacts policy predictability and investor confidence. The anticipated 2024 UK general election could lead to policy shifts affecting public service funding and infrastructure investment. Political realignments within the EU in 2024 might also influence regulatory frameworks, necessitating adaptive strategies.

Brexit's ongoing impact affects talent mobility and supply chain resilience. Post-Brexit visa rules can impact Capita's ability to recruit EU talent, while new customs procedures may increase operational costs. Regulatory divergence between the UK and EU can create compliance challenges and affect service operations across markets.

| Political Factor | Impact on Capita | Supporting Data/Example |

| Government Spending | Directly affects revenue, especially in public sector contracts. | UK Spring Budget 2024: Increased funding for technology upgrades. |

| Regulatory Environment | Requires continuous adaptation of processes and compliance. | UK GDPR: Fines up to £17.5M or 4% of global turnover for non-compliance. |

| Political Stability | Influences policy predictability and investment decisions. | Anticipated 2024 UK General Election: Potential policy shifts impacting public service funding. |

| Brexit | Impacts talent mobility, supply chains, and regulatory alignment. | Widened UK trade deficit with EU in early 2024, indicating ongoing adjustments. |

What is included in the product

The Capita PESTLE Analysis dissects the external macro-environmental factors impacting the organization across political, economic, social, technological, environmental, and legal dimensions.

This comprehensive evaluation provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

Provides a clear, actionable framework that helps businesses proactively identify and mitigate external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

High inflation rates present a significant challenge for Capita, potentially increasing operational costs for wages, technology, and suppliers. For instance, the UK's Consumer Price Index (CPI) remained elevated at 2.3% in April 2024, down from 3.2% in March, but still above the Bank of England's 2% target, indicating persistent cost pressures.

The ongoing cost of living crisis, driven by these inflationary pressures, could dampen demand for Capita's services. Consumers and public sector bodies facing tighter budgets may reduce discretionary spending or seek more cost-effective solutions, impacting revenue streams for the company.

Effectively managing cost inflation is crucial for Capita to maintain profitability. The ability to pass on increased expenses to clients without significantly impacting service demand will be a key determinant of financial performance in the current economic climate.

Fluctuations in interest rates directly influence Capita's cost of capital, impacting its ability to fund crucial investments in technology upgrades, potential acquisitions, or necessary restructuring. For instance, if the Bank of England base rate, which influences many commercial lending rates, were to rise significantly in 2024 or 2025, Capita's borrowing costs for new projects would increase, potentially making them less attractive and slowing down strategic expansion.

Higher interest rates generally translate to more expensive capital, which can act as a brake on Capita's strategic initiatives. This increased cost of borrowing might force the company to re-evaluate the scale or timing of its planned investments, prioritizing those with the most immediate and certain returns to offset the higher financing expenses.

The broader economic environment, heavily shaped by prevailing interest rates, also has a knock-on effect on Capita's clients. When borrowing becomes more costly for businesses, their own financial health can be strained, leading to a reduced willingness to commit capital to large-scale transformation projects that Capita typically facilitates.

The UK economy is projected to grow by 0.5% in 2024 and 1.1% in 2025 according to the Office for Budget Responsibility (OBR), while global growth is expected to moderate. This subdued growth environment can impact client spending on consulting and digital services, potentially leading to project deferrals for companies like Capita.

However, even in a slower growth scenario, the ongoing need for digital transformation and efficiency improvements remains a key driver for consulting demand. Capita's focus on public sector contracts, which are often less cyclical than private sector spending, could provide a degree of resilience.

Client Budget Constraints

Capita's diverse client base, encompassing both public sector bodies and private enterprises, frequently operates under significant budget constraints. This financial pressure directly influences their purchasing decisions, creating a strong demand for cost-effective service delivery and value-driven solutions.

The ongoing need for efficiency means clients may actively seek out lower-cost alternatives or push for renegotiation of existing contracts. For Capita, this translates into a direct impact on revenue streams and profit margins, necessitating a sharp focus on demonstrating tangible return on investment for their services.

- Public Sector Austerity: Many government departments and local authorities in the UK, a key market for Capita, continue to face tight fiscal policies. For instance, the UK government's commitment to fiscal responsibility, as outlined in recent spending reviews, means public sector clients are highly sensitive to cost increases.

- Private Sector Margin Pressure: In the private sector, companies are also experiencing margin pressures due to inflation and economic uncertainty. A 2024 survey indicated that over 60% of businesses were reviewing supplier contracts to identify cost savings.

- Demand for Value: Clients are increasingly scrutinizing contracts not just on price, but on the demonstrable value and efficiency gains delivered. Capita's ability to prove a clear ROI, such as through improved operational efficiency or cost reduction for clients, becomes a critical differentiator.

Labor Market Dynamics and Wage Inflation

The availability of skilled talent, especially in digital and technology sectors, remains a critical economic factor for Capita. Prevailing wage rates directly impact operating costs. For instance, in the UK, average weekly earnings saw a notable increase, growing by 5.9% in the year to April 2024, indicating ongoing wage pressures across the economy.

A persistently tight labor market, as seen in many developed economies, can exacerbate recruitment challenges and drive up compensation expectations. This environment necessitates proactive investment in employee training and development programs, alongside the implementation of competitive remuneration packages to attract and retain essential personnel. The UK unemployment rate stood at 4.4% in the three months to April 2024, showing a slight increase but still reflecting a relatively engaged workforce.

- Talent Availability: High demand for digital and tech skills impacts recruitment for Capita.

- Wage Inflation: Rising average earnings, like the 5.9% UK increase to April 2024, directly affect operating expenses.

- Labor Market Tightness: A low unemployment rate (4.4% in the UK to April 2024) can lead to increased competition for staff.

- Strategic Response: Investment in training and competitive compensation is crucial for talent retention.

The economic landscape, marked by persistent inflation and a cost-of-living crisis, directly impacts Capita's operational costs and client spending. With UK CPI at 2.3% in April 2024, the company faces increased expenses for wages and suppliers, while clients may scale back on services due to budget constraints.

Interest rate fluctuations, such as the Bank of England's base rate, influence Capita's cost of capital and the financial health of its clients. Higher borrowing costs can deter investment in large projects, potentially slowing Capita's growth initiatives.

Projected subdued economic growth for the UK (0.5% in 2024, 1.1% in 2025 per OBR) suggests clients might defer projects, though Capita's public sector focus offers some resilience against economic downturns.

The tight labor market and rising wages, with UK average earnings up 5.9% year-on-year to April 2024, increase Capita's operating expenses and necessitate strategic investment in talent retention.

| Economic Factor | Impact on Capita | Supporting Data (2024/2025) |

|---|---|---|

| Inflation | Increased operational costs, potential reduction in client spending | UK CPI: 2.3% (April 2024) |

| Interest Rates | Higher cost of capital, reduced client investment capacity | Bank of England Base Rate influences borrowing costs |

| Economic Growth | Potential project deferrals, but public sector resilience | UK GDP growth forecast: 0.5% (2024), 1.1% (2025) (OBR) |

| Labor Market | Wage inflation, talent acquisition challenges | UK Average Weekly Earnings growth: 5.9% (to April 2024) |

What You See Is What You Get

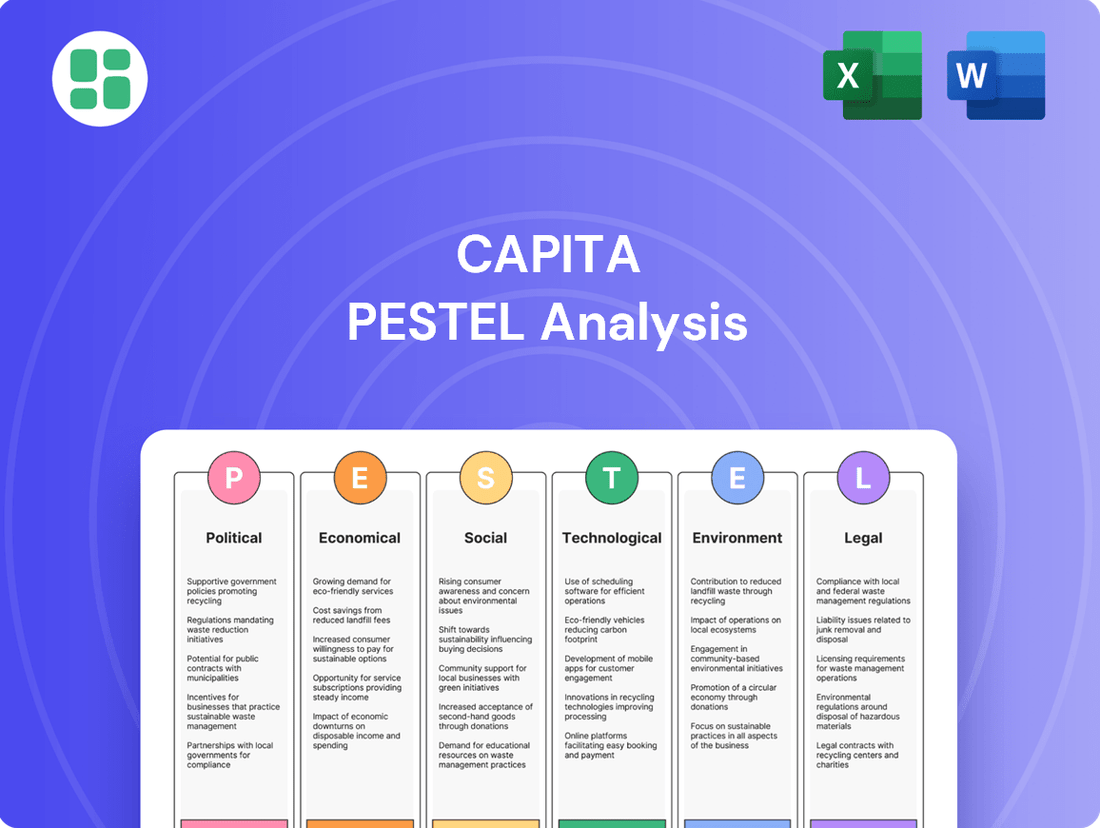

Capita PESTLE Analysis

The preview shown here is the exact Capita PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Capita.

The content and structure shown in the preview is the same Capita PESTLE Analysis document you’ll download after payment, offering valuable insights for strategic planning.

Sociological factors

The workforce is aging, with the average age of employees in many developed nations rising. For instance, in the UK, the proportion of the workforce aged 50 and over has been steadily increasing, reaching over 25% in recent years. This demographic shift necessitates new approaches to talent management, including phased retirement options and knowledge transfer programs to retain experienced staff.

Younger generations, particularly Gen Z, entering the workforce often have different expectations regarding work-life balance, company culture, and career progression. Capita needs to adapt its recruitment and retention strategies to appeal to these groups, focusing on flexible working arrangements and opportunities for continuous learning.

The persistent digital skills gap remains a significant challenge. Reports from 2024 indicate that a substantial percentage of businesses struggle to find candidates with the necessary IT and data analytics skills. Capita must therefore prioritize ongoing investment in upskilling its current employees and developing robust training programs to ensure it can meet the evolving technological demands of its clients.

Public and media sentiment towards outsourcing, particularly for essential public services, directly influences Capita's brand image and future contract prospects. Negative coverage, often stemming from service disruptions or public dissatisfaction, can create significant political headwinds, pressuring government bodies to limit private sector involvement. For instance, in the UK, a 2024 YouGov poll indicated that 58% of adults believe private companies should not be involved in delivering public services, a figure that rose to 65% for healthcare.

Societal expectations are increasingly emphasizing digital fluency and advanced tech expertise. This surge in demand for skills in areas like artificial intelligence, cloud infrastructure, and cybersecurity directly impacts companies like Capita.

Capita's ability to secure and keep skilled professionals in these critical fields is paramount to its operational effectiveness and future growth. For instance, the global demand for cybersecurity professionals is projected to reach 3.5 million unfilled positions by the end of 2025, highlighting the intense competition for talent.

To thrive in this environment, Capita must cultivate an attractive proposition for its workforce. This includes offering clear avenues for professional development and fostering a supportive workplace culture, as companies that prioritize employee well-being and career progression often see higher retention rates, with some studies showing that companies with strong cultures experience 3x higher revenue growth.

Hybrid Work Models

The shift towards hybrid work models, accelerated by events in 2020, continues to redefine workplace norms. By late 2024, studies indicate that a significant majority of companies are offering some form of hybrid arrangement, impacting everything from employee expectations to operational logistics. This trend necessitates that Capita not only optimizes its internal structure to accommodate flexible working but also develops robust solutions to aid clients in their own workforce transitions, influencing demand for office space and IT infrastructure upgrades.

Capita's ability to leverage and support these evolving work structures is crucial. For instance, the demand for digital collaboration tools and cybersecurity solutions designed for distributed teams has surged. By 2025, it's projected that IT spending on remote work enablement will remain a key growth area, presenting opportunities for Capita to offer specialized services that enhance productivity and security in these new environments.

- Employee Expectations: Surveys in early 2024 showed over 70% of employees prefer a hybrid work model, prioritizing flexibility.

- IT Infrastructure: Companies are investing heavily in cloud-based solutions and enhanced network security to support remote and hybrid teams.

- Service Delivery: Capita can capitalize by offering digital transformation services focused on enabling seamless hybrid operations for its clients.

- Real Estate Impact: The sustained adoption of hybrid work is leading to a reassessment of traditional office space needs, with companies downsizing or reconfiguring physical footprints.

Focus on Diversity, Equity, and Inclusion (DEI)

Societal expectations around Diversity, Equity, and Inclusion (DEI) are increasingly shaping corporate behavior. Capita's proactive approach to DEI can significantly bolster its brand image and attract top talent, as a growing number of professionals prioritize working for organizations that align with their values. This focus also influences client relationships, with many businesses now vetting suppliers based on their DEI commitments.

Capita's own DEI initiatives demonstrate a commitment to fostering an inclusive workplace culture. For instance, in 2023, Capita reported that 37% of its senior leadership positions were held by women, and it continues to set targets for increasing representation from ethnic minority groups. These efforts are not just about social responsibility; they directly translate into a more innovative workforce and better understanding of diverse customer needs.

- Enhanced Employer Brand: Capita's strong DEI performance, such as its ongoing efforts to improve gender and ethnic diversity in leadership roles, makes it a more attractive employer in a competitive talent market.

- Improved Client Relations: By embedding DEI into its service delivery, Capita can better meet the evolving expectations of its clients, many of whom are prioritizing ethical and inclusive supply chains.

- Innovation and Performance: Diverse teams are often linked to increased innovation and better problem-solving, which can translate into improved business outcomes for Capita and its clients.

- Societal Alignment: Capita's commitment to DEI reflects and reinforces broader societal trends, enhancing its reputation as a responsible corporate citizen.

Societal attitudes towards the role of technology in daily life and business operations continue to evolve rapidly. Capita must align its service offerings with public demand for digital solutions and efficient technological integration. For example, by early 2025, consumer expectations for seamless online customer service are at an all-time high, with over 80% of customers expecting immediate responses.

The increasing emphasis on sustainability and ethical business practices also influences consumer and client choices. Capita's commitment to environmental, social, and governance (ESG) principles is becoming a critical factor in securing new contracts and maintaining existing ones. A 2024 study by Deloitte found that 65% of consumers consider a company's sustainability efforts when making purchasing decisions.

Public perception of data privacy and security is a paramount sociological factor. As data breaches become more common, public trust in organizations handling sensitive information is eroding. Capita's robust data protection measures and transparent communication are essential to maintaining client confidence and public approval. In 2024, data privacy concerns were cited as a top reason for customer churn by 45% of businesses.

Technological factors

The rapid evolution of AI and automation offers Capita significant opportunities to streamline operations and develop innovative client solutions. For instance, AI-powered analytics can improve decision-making in areas like customer service and data processing, potentially boosting efficiency by up to 30% in certain functions, as observed in industry benchmarks for 2024.

However, these advancements necessitate substantial investment in research and development, alongside a commitment to upskilling Capita's workforce to manage and leverage these new technologies effectively. The need for continuous adaptation is critical, as failure to integrate these tools could lead to a competitive disadvantage in the evolving service landscape.

Furthermore, the disruptive potential of AI and automation on traditional service delivery models is a key strategic consideration for Capita. Companies that fail to adapt risk being outpaced by more agile competitors, highlighting the imperative for proactive integration and strategic foresight in the face of technological change.

Capita's business is significantly boosted by the widespread adoption of cloud computing and digital transformation across various industries. As businesses increasingly prioritize modernizing their IT systems and workflows, Capita's skills in cloud migration, integrating different platforms, and developing digital strategies are in high demand. This trend necessitates ongoing technological advancement within Capita to meet evolving client needs.

The increasing complexity of cyber threats presents a substantial risk to Capita, especially considering the sensitive client data and critical infrastructure they handle. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial implications of inadequate security.

Maintaining client trust and avoiding expensive security incidents necessitates strong cybersecurity protocols and adherence to data protection laws like GDPR. Capita's commitment to robust security measures is crucial for its reputation and operational continuity.

Continuous investment in advanced security technologies and specialized personnel is vital for Capita to stay ahead of evolving cyber risks. This proactive approach ensures the safeguarding of both Capita's and its clients' digital assets.

Emergence of New Digital Service Offerings

The technological landscape is constantly shifting, paving the way for novel digital services like advanced analytics and intelligent automation. Capita needs to stay ahead of the curve by innovating and creating new offerings to satisfy changing client demands. This necessitates swift product development and a keen awareness of market trends.

For instance, the global market for AI-powered business process automation is projected to reach $36.5 billion by 2025, a significant increase from previous years. Companies like Capita are investing heavily in these areas.

- AI and Machine Learning: Development of predictive analytics and personalized customer experiences.

- Cloud Computing: Expansion of scalable and flexible digital service delivery models.

- Cybersecurity: Enhanced offerings to protect sensitive client data in an increasingly digital world.

- Data Analytics Platforms: Tools for deeper insights and informed decision-making for clients.

Data Analytics and Insights for Decision-Making

The sheer volume and intricacy of data available today demand sophisticated data analytics. Capita's strength lies in its capacity to transform this raw information into clear, actionable insights for its clients. This is crucial for businesses aiming to navigate complex markets and make strategic choices.

Leveraging advanced tools like machine learning and business intelligence is becoming a significant competitive advantage. Capita’s proficiency in these areas directly fuels demand for its data-centric transformation services, as organizations increasingly rely on data to guide their operations and growth strategies.

For instance, in 2024, the global big data analytics market was projected to reach over $300 billion, highlighting the immense value placed on data-driven decision-making. Capita's ability to tap into this trend positions it well.

- Increased Demand for Data-Driven Strategies: Businesses are actively seeking partners who can help them extract value from their data.

- Capita's Analytics Capabilities: The company's investment in machine learning and AI tools is a key differentiator.

- Client Benefits: Enhanced decision-making, improved operational efficiency, and better customer understanding are direct outcomes for clients.

- Market Growth: The expanding analytics market presents significant opportunities for Capita's service offerings.

Capita is leveraging advancements in AI and automation to enhance its service delivery and develop innovative client solutions, with AI-powered analytics showing potential efficiency gains of up to 30% in certain functions as of 2024 benchmarks.

The company's growth is further propelled by the widespread adoption of cloud computing and digital transformation, leading to increased demand for Capita's expertise in cloud migration and digital strategy development.

However, Capita faces significant risks from evolving cyber threats, underscored by the 2024 global average data breach cost of $4.45 million, necessitating robust cybersecurity investments and adherence to data protection regulations.

The company is actively investing in areas like AI and advanced data analytics, recognizing the global market for AI-powered business process automation is projected to reach $36.5 billion by 2025, and the big data analytics market exceeded $300 billion in 2024.

| Technological Factor | Impact on Capita | Opportunity/Risk | 2024/2025 Data Point |

|---|---|---|---|

| AI & Automation | Streamlining operations, new client solutions | Opportunity for efficiency gains | Potential 30% efficiency boost in specific functions |

| Cloud Computing & Digital Transformation | Increased demand for IT modernization services | Opportunity for service expansion | High demand for cloud migration and digital strategy |

| Cybersecurity Threats | Risk to sensitive client data and infrastructure | Risk of financial loss and reputational damage | Global average data breach cost: $4.45 million (2024) |

| Data Analytics & Machine Learning | Transforming data into actionable insights | Competitive advantage in data-driven services | AI in automation market: $36.5 billion by 2025; Big Data Analytics market: >$300 billion (2024) |

Legal factors

Capita, like all businesses handling personal data, faces stringent data protection laws such as GDPR and UK GDPR. These regulations dictate how Capita must collect, process, store, and secure customer and employee information, impacting everything from marketing to HR practices.

Failure to comply can lead to severe penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. For Capita, this means investing heavily in data governance, privacy by design, and ongoing staff training to avoid significant financial and reputational damage.

Capita's operations are heavily influenced by its contractual obligations and Service Level Agreements (SLAs), particularly with government bodies. For instance, in 2023, Capita faced scrutiny over its handling of the UK's TV licensing contract, highlighting the critical nature of meeting SLA targets. Failure to adhere to these terms can result in significant financial penalties, potentially impacting revenue streams and profitability, as seen in past performance issues that led to contract renegotiations.

The company must maintain rigorous contract management and performance monitoring systems to ensure compliance and mitigate risks associated with SLA breaches. These legal frameworks dictate service delivery standards and client expectations, making adherence paramount to maintaining client relationships and avoiding costly disputes. Capita's financial reports often detail provisions for potential penalties, underscoring the financial implications of these legal commitments.

Capita's significant market share in areas like government outsourcing and IT services means its operations and potential acquisitions are closely watched under competition law. Regulatory bodies such as the UK's Competition and Markets Authority (CMA) are tasked with ensuring fair competition and preventing monopolies. For instance, in 2023, the CMA continued its scrutiny of various sectors, and any large-scale acquisitions by Capita would likely undergo rigorous review to assess their impact on market competition.

The potential for regulatory intervention could influence Capita's strategic growth, particularly if it seeks to expand through mergers or acquisitions that might lead to a dominant market position. Such scrutiny aims to safeguard consumer interests and maintain a level playing field for smaller competitors. Capita must navigate these legal frameworks to ensure its business development aligns with antitrust regulations, potentially impacting its ability to consolidate market power.

Employment Law and Workforce Rights

Capita, as a significant employer, navigates a complex landscape of employment laws. These regulations dictate fair wages, safe working conditions, and prohibit discrimination, impacting everything from recruitment to termination. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over in April 2024, a key factor in managing payroll costs.

Shifts in labor legislation or increased union activity can directly affect Capita's operational agility and expenses. Proactive human resource strategies and rigorous legal adherence are crucial to mitigate these risks. In 2023, the UK government consulted on proposals to strengthen worker rights, potentially leading to changes in areas like flexible working requests and redundancy protections.

- Minimum Wage Compliance: Adhering to the National Living Wage and National Minimum Wage rates is a constant requirement, with annual adjustments impacting payroll budgets.

- Discrimination Laws: Ensuring equal opportunities and preventing discrimination based on protected characteristics remains a cornerstone of employment law, requiring robust internal policies and training.

- Redundancy Procedures: Strict legal processes must be followed during redundancies, including consultation periods and fair selection criteria, to avoid costly legal challenges.

- Worker Rights: Evolving legislation around worker rights, such as the right to request flexible working or protections against unfair dismissal, necessitates ongoing review of HR practices.

Public Procurement Regulations

Capita's deep engagement with public sector contracts necessitates rigorous compliance with intricate public procurement regulations. These regulations are designed to ensure that government contracts are awarded through a fair, transparent process that maximizes value for taxpayer money. For instance, in the UK, the Public Contracts Regulations 2015 (as amended) set out detailed procedures for procurements above certain financial thresholds, impacting how Capita bids for and secures government work.

Failure to navigate these rules effectively can have severe repercussions. Capita could face disqualification from bidding processes, leading to significant revenue loss. Moreover, legal challenges from competitors or regulatory bodies can disrupt operations and incur substantial costs. Reputational damage stemming from procurement breaches can also erode trust with government clients and the public.

- Regulatory Scrutiny: Capita must continuously monitor and adapt to evolving procurement laws and guidelines, such as changes to the UK's Procurement Act 2023, which aims to simplify and modernize public procurement.

- Compliance Costs: Adhering to these regulations involves significant investment in legal expertise, robust bidding processes, and internal compliance frameworks.

- Bid Rigor: The detailed documentation and adherence to strict timelines required for public bids represent a substantial operational undertaking for Capita.

- Contractual Safeguards: Public sector contracts often include stringent clauses related to performance, data security, and ethical conduct, which Capita must meticulously uphold.

Capita's operations are subject to a complex web of legal and regulatory frameworks that shape its business practices and risk exposure. These include data protection laws like GDPR, which impose strict rules on handling personal information, carrying penalties of up to 4% of global annual turnover for non-compliance. The company's significant reliance on government contracts means it must adhere to public procurement regulations and stringent Service Level Agreements (SLAs), with breaches potentially leading to financial penalties, as seen in past performance issues affecting revenue.

Furthermore, Capita's market position necessitates compliance with competition laws to prevent monopolistic practices, with potential acquisitions subject to thorough review by authorities like the UK's Competition and Markets Authority. As a major employer, the company must also navigate evolving employment legislation, including minimum wage laws, with the UK's National Living Wage increasing to £11.44 per hour for those aged 21+ from April 2024, directly impacting payroll costs.

| Legal Area | Key Regulations/Considerations | Impact on Capita | Example Data/Trend (2023-2025) |

|---|---|---|---|

| Data Protection | GDPR, UK GDPR | Strict data handling, storage, security; fines up to 4% global turnover or €20 million | Ongoing investment in data governance and privacy training. |

| Contractual Compliance | Service Level Agreements (SLAs), Government Contracts | Penalties for non-performance, revenue impact | Scrutiny over TV licensing contract (2023) highlighted SLA adherence criticality. |

| Competition Law | Antitrust regulations, CMA oversight | Review of mergers/acquisitions, market dominance assessment | Acquisitions would face rigorous market competition impact review. |

| Employment Law | Minimum Wage, Worker Rights, Discrimination | Payroll costs, HR practices, potential for legal challenges | UK National Living Wage £11.44/hr (April 2024) impacts payroll; ongoing consultation on worker rights. |

| Public Procurement | Public Contracts Regulations 2015 (as amended), Procurement Act 2023 | Fair bidding processes, compliance costs, disqualification risk | Adaptation to simplified procurement processes; bid rigor requires significant operational investment. |

Environmental factors

Capita faces growing demands for detailed ESG reporting, driven by regulators and stakeholders alike. For instance, in 2024, the UK's Financial Conduct Authority (FCA) introduced new sustainability disclosure rules for listed companies, requiring more transparency around climate-related financial risks.

Meeting these ESG standards is crucial for Capita's reputation and its ability to attract investment, clients, and skilled employees. Companies demonstrating strong ESG performance, such as reporting a reduction in their carbon footprint, are increasingly favored by investors; a 2024 report by Morningstar indicated that ESG-focused funds saw significant inflows, outpacing traditional funds.

This includes specific disclosures on environmental impact, like Capita's efforts to reduce its operational carbon emissions, which are becoming a key metric for evaluating corporate responsibility. By providing clear data on sustainability initiatives, Capita can enhance its competitive edge in a market where environmental stewardship is paramount.

Societal and governmental pressure is mounting for businesses to achieve carbon neutrality, directly impacting Capita's operational strategies. This means Capita must meticulously assess its own carbon footprint and actively implement energy-efficient practices, potentially including a shift towards renewable energy sources. By 2024, for instance, the UK government has set a legally binding target to reduce emissions by at least 68% compared to 1990 levels, a benchmark that influences all sectors.

Clients are increasingly prioritizing partners who demonstrate a strong commitment to sustainability, demanding eco-conscious solutions. This trend is evident in the growing market for green finance and sustainable procurement policies adopted by major corporations. For example, a significant portion of FTSE 100 companies are now reporting on their Scope 1 and Scope 2 emissions, signaling a clear market demand for verifiable environmental performance.

Capita's extensive supply chain is increasingly scrutinized for its environmental footprint. The company is focused on evaluating the environmental practices of its suppliers and actively promoting sustainable sourcing initiatives to reduce its overall impact.

Managing and mitigating environmental risks within the supply chain is a critical component of Capita's responsible business strategy. This involves ensuring that suppliers adhere to environmental standards and that materials are sourced in an eco-friendly manner, aligning with growing stakeholder expectations for corporate environmental stewardship.

Client Demand for Sustainable Solutions

Client demand for sustainable solutions is a significant environmental factor influencing businesses like Capita. Many clients, especially within the public sector and those in eco-conscious industries, are increasingly looking for partners who can showcase robust environmental performance and provide sustainable service offerings. Capita's capacity to embed environmental considerations directly into how it designs and delivers its services presents a clear competitive edge in this evolving market.

This trend is backed by growing market data. For instance, a 2024 report indicated that over 60% of major corporations now have formal sustainability targets integrated into their procurement processes. Furthermore, the sustainable investment market, which often aligns with client preferences, saw continued growth through 2024, with assets under management reaching new highs, reflecting a broader shift in financial priorities towards environmental, social, and governance (ESG) factors.

This client-driven demand translates into tangible opportunities and challenges:

- Increased demand for green procurement: Clients are actively seeking suppliers with demonstrable environmental certifications and practices, impacting tender evaluations.

- Competitive advantage through sustainability: Companies like Capita that proactively integrate sustainability into their core offerings can differentiate themselves and attract environmentally motivated clients.

- Reputational risk for inaction: Failing to meet evolving client expectations regarding sustainability can lead to reputational damage and loss of business.

- Innovation in service delivery: The pressure to offer sustainable solutions encourages innovation in service design, operational efficiency, and resource management.

Climate Change Adaptation and Resilience

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, pose significant risks to Capita's operational continuity and supply chain stability. For instance, the UK experienced its hottest year on record in 2022, with temperatures reaching 40.3°C, leading to disruptions in transportation and infrastructure.

Capita must proactively integrate climate change adaptation strategies and build resilience across its physical infrastructure and service delivery frameworks. This focus on preparedness is becoming a critical factor for business continuity, asset protection, and maintaining service levels amidst a changing climate.

The company's strategic planning needs to account for potential impacts such as:

- Increased operational costs due to climate-related disruptions.

- Supply chain vulnerabilities exposed by extreme weather events.

- Reputational damage if services are significantly impacted by climate events.

- Opportunities in developing climate-resilient solutions for clients.

Environmental factors are increasingly shaping Capita's operational landscape and strategic decisions. Heightened regulatory scrutiny, exemplified by the FCA's 2024 sustainability disclosure rules, mandates greater transparency on climate-related risks. This push for environmental accountability is directly influencing how Capita manages its carbon footprint, with a focus on energy efficiency and potentially renewable energy adoption to meet government targets, such as the UK's 2024 goal of at least 68% emissions reduction.

Client demand for sustainable solutions is a significant driver, with over 60% of major corporations now integrating sustainability into their procurement processes as of 2024. This trend benefits companies like Capita that can offer eco-conscious services, providing a competitive edge. Conversely, failure to adapt to these environmental expectations poses reputational risks and can lead to loss of business.

Climate change itself presents tangible risks, including operational disruptions from extreme weather events, as evidenced by the UK's record-breaking heat in 2022. Capita must therefore build resilience into its infrastructure and service delivery to mitigate increased operational costs and supply chain vulnerabilities.

| Environmental Factor | Impact on Capita | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Regulatory Pressure (ESG Reporting) | Increased compliance costs, need for enhanced transparency | FCA's 2024 sustainability disclosure rules |

| Client Demand for Sustainability | Competitive advantage, new business opportunities | >60% of major corporations integrate sustainability into procurement (2024) |

| Climate Change Risks | Operational disruption, supply chain vulnerability | UK's 2022 record temperatures impacting infrastructure |

| Carbon Neutrality Goals | Operational strategy shifts, investment in efficiency | UK government's 2024 emissions reduction target (68% vs 1990) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of publicly available data, including government publications, economic indicators from international organizations, and reputable industry research. We ensure each factor is supported by timely and credible information.