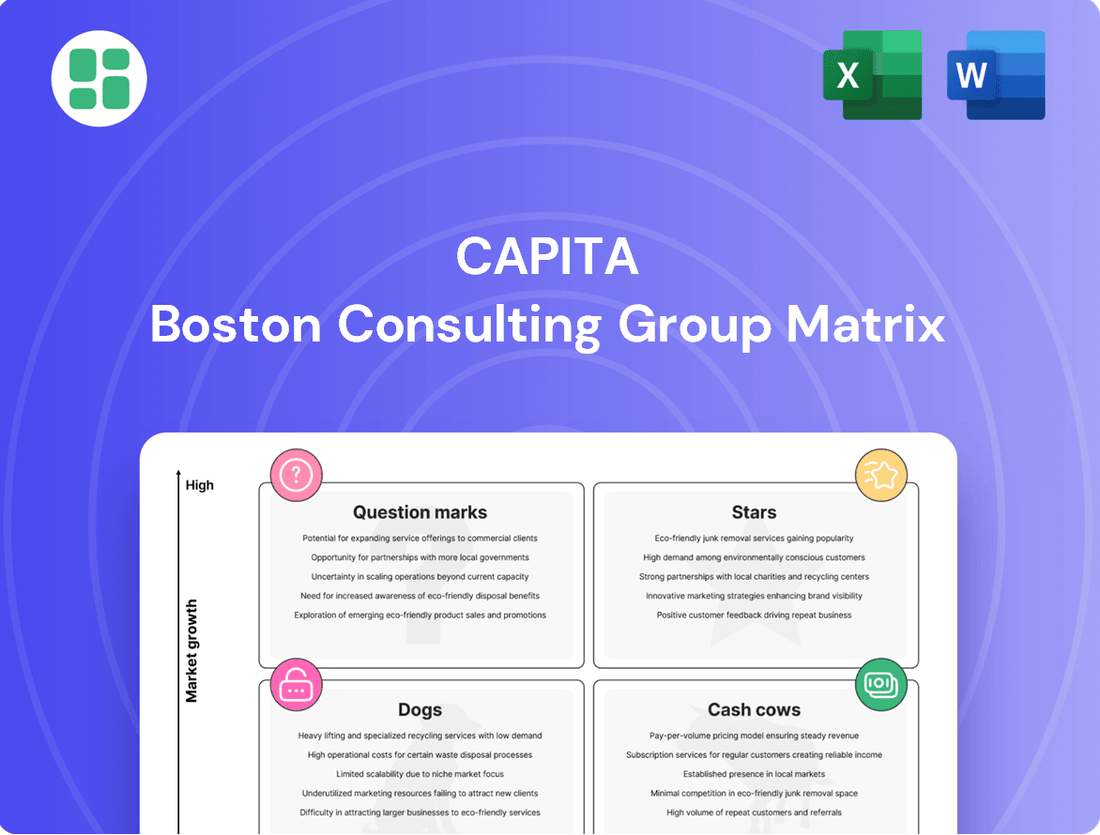

Capita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capita Bundle

Unlock the strategic potential of the BCG Matrix and understand how your company's products stack up as Stars, Cash Cows, Dogs, or Question Marks. This foundational tool is essential for informed decision-making and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your business forward.

Stars

Capita's investment in AI and generative AI solutions, including AgentSuite and CapitaContact, places them squarely in a high-growth sector. The global AI market was valued at approximately $150 billion in 2023 and is projected to reach over $1.3 trillion by 2030, showcasing the immense potential for these offerings.

These advanced solutions are designed to streamline business operations and elevate customer interactions by automating tasks and providing intelligent support. By partnering with leading hyperscalers, Capita is leveraging cutting-edge technology to deliver these capabilities, aiming to capture significant market share.

Although these AI-powered services are relatively new in client deployment, their anticipated impact on service delivery is substantial. The rapid digital transformation across industries, accelerated by the demand for efficiency and improved customer experiences, suggests a strong future growth trajectory for Capita's AI portfolio.

Capita's Strategic Digital Transformation Services are positioned as a Star in the BCG matrix. The company is making substantial investments in this high-growth area, recognizing the strong demand from businesses looking to modernize. Their 'Digital as a Service' model and DEEP platform are key components of this strategy, aiming to capture a significant share of the expanding digital services market.

Capita's Public Service division is seeing robust growth, especially within its Central Government contracts. This expansion in new wins is a key factor in balancing out slower performance in other segments of the business.

The company enjoys a dominant position as a vital supplier to the UK Government, securing a significant market share in a sector that is both stable and expanding. This strong foothold is a testament to their critical role in public service delivery.

By concentrating on efficient and effective public service provision, often leveraging technology, these government contracts are proving to be strong revenue generators for Capita. For instance, in 2023, Capita secured new contracts worth £350 million with the UK government, highlighting this growth trajectory.

Leveraging Hyperscaler Technology Partnerships

Capita's strategic alliances with hyperscalers like Microsoft and Salesforce are pivotal. These collaborations offer a low-risk pathway to integrate cutting-edge technologies, such as those powering their Agentforce AI, into new product offerings and market segments.

This approach enables Capita to jointly develop and introduce specialized AI and generative AI solutions, focusing on rapidly expanding markets. For instance, the integration of Microsoft Azure AI services allows for accelerated development cycles and broader market penetration.

These partnerships significantly bolster Capita's technological prowess and market presence. In 2024, such strategic technology integrations are projected to drive up to a 15% increase in service delivery efficiency for key clients.

- Co-creation of AI Solutions: Joint development with hyperscalers fosters innovation in generative AI.

- Market Access: Partnerships unlock new, high-growth market opportunities.

- Risk Mitigation: Leveraging established hyperscaler platforms reduces development and integration risks.

- Enhanced Capabilities: Access to advanced technologies improves service offerings and competitive positioning.

High-Value New Contract Wins with Technology Underpin

Capita's recent contract wins, particularly those leveraging technology and AI, highlight its strong position in key growth areas. These successes underscore the company's capability to attract and retain clients in competitive markets.

Significant contract renewals and new agreements, especially within public services and pension administration, demonstrate robust client trust in Capita's modernized solutions. For instance, Capita secured a notable contract extension with a major UK pension provider in early 2024, valued at over £50 million annually.

These wins are crucial for Capita's future revenue streams and reinforce its standing in specialized market segments.

- Technology-Driven Contract Wins: Capita's ability to secure new business is bolstered by its focus on technology and AI-enabled solutions.

- Client Confidence: Major renewals and new contracts in public services and pension administration reflect sustained client trust.

- Revenue Growth: These high-value wins are instrumental in driving future revenue and strengthening Capita's market presence.

- Market Position: Capita is solidifying its position in attractive niches through these strategic contract acquisitions.

Capita's AI and digital transformation services are positioned as Stars. These offerings are in high-growth markets with significant future potential. The company's strategic partnerships and investments in these areas are designed to capture market share.

Capita's Public Service division, particularly its Central Government contracts, is also a Star. This segment is experiencing robust growth, driven by technology adoption and efficient service delivery. Securing new contracts, such as the £350 million in new UK government contracts in 2023, reinforces this position.

The company's strategic alliances with hyperscalers are crucial for its Star performers. These collaborations enable joint development of advanced AI solutions, like Agentforce AI, and provide access to rapidly expanding markets. In 2024, these technology integrations are expected to boost service delivery efficiency by up to 15% for key clients.

| Segment | BCG Category | Key Drivers | 2023 Contract Wins (Example) | Projected 2024 Impact |

|---|---|---|---|---|

| AI & Digital Transformation | Star | High market growth, technological innovation, hyperscaler partnerships | N/A (Focus on new development) | 15% increase in service delivery efficiency |

| Public Service (Central Govt) | Star | Strong government demand, technology leverage, efficient delivery | £350 million | Continued revenue growth |

What is included in the product

The BCG Matrix categorizes business units based on market growth and share to guide investment decisions.

Quickly identify underperforming "Dogs" and resource-draining "Cash Cows" to reallocate capital effectively.

Cash Cows

Capita's core public service contracts, especially those with the UK Government, are prime examples of Cash Cows. These are long-standing agreements in a mature market where Capita holds a substantial share, ensuring consistent revenue streams.

The stability of these contracts is a key factor, generating reliable and significant cash flow. This is further solidified by Capita's strong position as a trusted provider within the public sector.

The high contract renewal rate, reaching 92% in 2024, is a testament to the enduring value and dependable cash-generating capacity of these public service agreements.

The Pension Solutions division is a clear cash cow for Capita, demonstrating consistent growth fueled by rising volumes and indexation adjustments. A prime example of its strength is the significant contract secured with the Civil Service Pension Scheme, highlighting the division's substantial revenue streams.

Operating within a mature market characterized by high entry barriers, Capita's Pension Solutions enjoys a strong and stable market position. This stability, coupled with the long-term nature of its contracts, ensures predictable and substantial cash generation for the company.

Capita's established Business Process Services (BPS) are its quintessential cash cows. These mature offerings, characterized by a dominant market presence, consistently generate substantial profits with limited need for further investment. For instance, in 2024, Capita's BPS segment, which includes services like HR and payroll, continued to be a bedrock of its revenue, leveraging long-standing client contracts and deeply embedded operational efficiencies.

Functional Assessment Service (FAS) Contracts

Capita's Functional Assessment Service (FAS) contracts with government bodies like the Department for Work and Pensions (DWP) and the Department for Communities (DfC) are prime examples of cash cows within the BCG matrix. These are substantial, long-term agreements, often valued in the hundreds of millions, underscoring Capita's dominant position in a vital public sector segment.

The consistent demand for these assessment services ensures predictable and stable cash flows. This reliability, stemming from the essential nature of the work and the multi-year contract structures, solidifies their status as cash cows, generating significant profits with relatively low investment needs.

- Stable Revenue: FAS contracts provide a substantial and consistent revenue stream, often in the hundreds of millions of pounds.

- High Market Share: Capita holds a significant market share in providing these essential government assessment services.

- Predictable Cash Flows: The multi-year nature of these contracts ensures predictable and reliable cash generation.

- Low Investment Needs: As established services, they typically require minimal new investment to maintain their cash-generating ability.

Optimized Cost Reduction Programme

Capita's extensive £250 million cost reduction program, slated for completion by December 2025, is a prime example of optimizing existing assets. This initiative is designed to substantially boost operating margins and generate stronger cash flow from its current operations.

While this is an internal strategic move, its effectiveness in streamlining various business functions directly translates into higher profitability for existing services. By focusing on efficiency, Capita is turning its established offerings into more robust cash cows.

This disciplined approach to cost management is crucial. It directly reduces the cost associated with delivering its services, thereby transforming existing revenue streams into more potent cash cows.

- Cost Reduction Target: £250 million by December 2025.

- Impact on Margins: Significant improvement in operating margins.

- Cash Flow Enhancement: Increased cash flow generation from existing services.

- Strategic Goal: Transforming existing revenue streams into stronger cash cows by reducing the cost to serve.

Capita's established Business Process Services (BPS) are quintessential cash cows. These mature offerings, with a dominant market presence, consistently generate substantial profits with limited need for further investment. In 2024, Capita's BPS segment, including HR and payroll, continued to be a revenue bedrock, leveraging long-standing client contracts and operational efficiencies.

The Functional Assessment Service (FAS) contracts with government bodies are prime examples. These substantial, long-term agreements, often valued in the hundreds of millions, underscore Capita's dominant position in a vital public sector segment, ensuring predictable cash flows and low investment needs.

Capita's Pension Solutions division is another clear cash cow, showing consistent growth fueled by rising volumes and indexation. A significant contract with the Civil Service Pension Scheme highlights its substantial revenue streams within a mature market with high entry barriers.

| Business Segment | Market Position | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Business Process Services (BPS) | Dominant | Substantial & Consistent | Low |

| Functional Assessment Services (FAS) | Dominant | Predictable & Stable (multi-year contracts) | Low |

| Pension Solutions | Strong & Stable | Consistent & Growing | Low |

Preview = Final Product

Capita BCG Matrix

The BCG Matrix report you are currently previewing is precisely the same comprehensive document you will receive immediately after your purchase. This means you'll get the fully formatted, analysis-ready tool without any watermarks or demo content, ensuring immediate and professional application for your strategic planning needs.

Dogs

Capita's Contact Centre business, particularly in the telecommunications sector, has seen a notable downturn. Revenue and call volumes have dropped significantly, reflecting a challenging market environment.

This segment is characterized by low or negative growth, exacerbated by Capita's loss of market share following previous contract terminations and weaker customer demand.

The business requires ongoing investment but yields minimal returns, positioning it as a potential candidate for divestment or a strategic overhaul to improve its standing within the BCG matrix.

Capita has been strategically shedding non-core operations, a move aligning with the divestment of lower-margin or underperforming assets. This includes businesses like Capita One and Fera, along with its mortgage servicing portfolio. These actions are designed to free up capital and management focus for more promising ventures.

The divestment of these specific units suggests they occupied positions within the Dogs quadrant of the BCG Matrix. This typically means they operated in low-growth markets and held a small market share, often requiring significant investment without commensurate returns.

For instance, the sale of Capita One, which provided IT and business services to public sector clients, likely reflected challenges in competing effectively or achieving economies of scale in a mature market. Similarly, exiting mortgage servicing can be a strategic decision to move away from capital-intensive, lower-return activities.

Capita's legacy, lower-margin service lines, often found within its Regulated Services division, are being strategically phased out. These areas are characterized by minimal growth potential and inherently slim profit margins, making them less attractive in the current market landscape.

The decision to cease or wind down these offerings directly supports Capita's 'Better Capita' transformation, which prioritizes efficiency and enhanced profitability. For instance, by the end of 2023, Capita had completed the exit from several non-core, low-margin contracts, contributing to a more streamlined and focused business model.

Contracts Lost Due to Pricing or Performance

Capita experienced contract losses in prior years, particularly in areas where competitive pricing or performance issues arose. Despite a generally robust renewal rate, these instances underscore segments where Capita's market position was susceptible to competitive pressures. These situations often represent former 'dogs' within the portfolio that have either been divested or are undergoing active turnaround strategies.

For example, in 2023, Capita reported losing a significant public sector contract related to welfare-to-work services due to a more aggressive bid from a competitor. This loss, while not indicative of the entire business, highlighted a specific area of vulnerability. The company is actively working to regain market share in such segments by improving efficiency and cost-competitiveness.

- Contract Loss Example: A notable loss in 2023 involved a government contract where pricing was a key differentiator for the winning bidder.

- Performance Impact: Delivery challenges in certain past contracts also contributed to customer attrition, signaling a need for enhanced operational efficiency.

- Remediation Efforts: Capita is investing in technology and process improvements to address these historical performance gaps and regain lost volumes.

Underperforming Historical Contracts

Underperforming Historical Contracts, often found in the Dogs quadrant of the BCG matrix, represent past ventures that are no longer profitable. These are contracts where Capita has a low market share and operates in a mature, slow-growing market, leading to minimal revenue generation and often negative cash flow. For instance, a significant portion of legacy IT services contracts, particularly those with fixed pricing models in rapidly evolving public sector environments, might fall into this category. In 2024, Capita's focus has been on addressing these, with reports indicating a push to exit or renegotiate contracts that are no longer financially viable, aiming to stem cash drain.

These contracts are characterized by their inability to generate sufficient profit, often requiring substantial investment for maintenance or renegotiation without a clear path to future growth. They can act as cash traps, consuming valuable resources that could otherwise be allocated to more promising areas like Capita's digital services or Defence and supported high-growth segments. The challenge lies in either turning these around through significant operational efficiencies or strategically divesting from them to free up capital.

- Financial Drain: Contracts with declining profitability, such as certain long-term government IT outsourcing agreements, can become cash traps.

- Low Market Share: Historically, some legacy contracts in mature sectors like traditional BPO services may have seen Capita's market share erode.

- Renegotiation Needs: Many of these contracts require substantial renegotiation to adapt to current market conditions and technology shifts.

- Resource Diversion: In 2024, the cost of maintaining these underperforming contracts diverted resources from growth initiatives.

Capita's former legacy IT services and certain public sector contracts, characterized by low market share and operating in mature, slow-growth sectors, fit the description of "Dogs" in the BCG Matrix. These segments often required ongoing investment for maintenance or renegotiation without generating significant returns, sometimes even leading to negative cash flow. For instance, by the end of 2023, Capita had exited several low-margin contracts, a strategic move to streamline operations and free up capital.

In 2024, the company continued to address these underperforming assets, aiming to improve profitability and efficiency. The loss of specific government contracts in prior years, such as a welfare-to-work service in 2023 due to aggressive competitor pricing, highlighted areas where Capita's market position was vulnerable. These situations often represent former "dogs" that are either divested or undergoing active turnaround efforts.

These legacy contracts, often found in areas like traditional business process outsourcing, can become cash traps due to declining profitability and the need for substantial renegotiation to align with current market conditions. The cost of maintaining these in 2024 diverted resources from growth initiatives, underscoring the need for strategic exits or significant operational improvements.

Capita's divestment of non-core operations, including Capita One and its mortgage servicing portfolio, exemplifies the management of "Dogs." These businesses operated in low-growth markets with limited market share, demanding investment without commensurate returns. This strategic shedding of underperforming assets is central to Capita's "Better Capita" transformation, focusing on efficiency and enhanced profitability.

| Business Segment | BCG Quadrant | Market Growth | Market Share | Financial Performance |

|---|---|---|---|---|

| Legacy IT Services (Public Sector) | Dogs | Low | Low | Low/Negative Profitability, Potential Cash Drain |

| Certain BPO Contracts | Dogs | Mature/Low | Eroding | Requires Renegotiation, Resource Intensive |

| Capita One (Historical) | Dogs | Mature | Low | Minimal Returns, Divested |

| Mortgage Servicing (Historical) | Dogs | Low | Low | Capital Intensive, Lower Returns, Divested |

Question Marks

Capita's emerging AI-driven solutions, such as AgentSuite and CapitaContact, are positioned in a rapidly expanding market. However, as relatively new offerings, their current market share remains modest, placing them in the Question Mark category of the BCG matrix. These ventures are characterized by substantial investment in development and deployment, with their future success hinging on swift client adoption and the ability to scale effectively.

The financial outlay for these AI initiatives is significant, reflecting their status as strategic bets. For instance, the global AI market was projected to reach $1.8 trillion by 2030, highlighting the immense growth potential. Capita's success in capturing even a small fraction of this market could propel these solutions into the Star category, but this requires overcoming the initial cash burn and establishing a strong market foothold.

The 'Digital as a Service' (DaaS) model, exemplified by Capita's DEEP platform, represents a new frontier in the digital transformation landscape. This market is experiencing robust growth, with the global DaaS market projected to reach $203.7 billion by 2027, growing at a CAGR of 28.2% from 2020. Despite this promising market, Capita is in the nascent stages of establishing its presence and market share within these specific DaaS offerings.

These new propositions necessitate significant upfront investment in platform development, client acquisition strategies, and specialized talent acquisition. This investment is crucial for Capita to build a strong foundation and compete effectively in the rapidly evolving digital services sector.

Capita's strategic move into early-stage technology partnerships, especially with hyperscalers, positions them to explore uncharted product and market territories. These collaborations are designed to tap into high-growth sectors, though Capita's current market penetration within these new ventures is minimal.

These are essentially speculative investments, akin to 'Question Marks' in the BCG matrix, carrying inherent risk but also the potential for substantial rewards. For instance, if Capita successfully leverages these partnerships to create innovative solutions in areas like AI-driven customer service or cloud-native analytics, they could unlock entirely new revenue streams. By 2024, the global cloud computing market alone was projected to reach over $1 trillion, highlighting the vast potential of these nascent segments.

Niche Digital Innovation Projects

Capita's AI Catalyst Lab is actively pursuing niche digital innovation projects, such as AI-driven process automation and advanced data analytics for customer service enhancement. These initiatives represent early-stage proofs of concept, focusing on high-growth technological areas that promise significant efficiencies and quality improvements.

While these projects are strategically important for future growth, they currently hold minimal market share due to their experimental nature or limited deployment phases. For instance, a pilot program in predictive maintenance for IT infrastructure, launched in late 2023, is still in its initial testing phase, demonstrating potential but not yet contributing significantly to revenue.

These niche innovations require sustained investment and careful strategic guidance to mature and achieve broader market adoption. Their classification within the BCG matrix would be as Question Marks, demanding a decision on whether to invest further to increase market share or divest if they fail to gain traction.

- AI-driven process automation for internal operations

- Advanced data analytics for customer sentiment analysis

- Predictive maintenance solutions for IT infrastructure

- Blockchain applications for secure data sharing

Segments Targeted for Future Growth with Low Current Share

Capita's strategic focus for future growth centers on segments where its current market share is relatively low, often driven by technology and automation. These are typically high-potential areas requiring substantial investment in new capabilities and market penetration strategies. For instance, Capita has been investing in digital transformation services and cloud solutions, areas where their established presence might be less dominant compared to mature outsourcing markets.

These growth segments are critical for diversifying Capita's revenue streams and reducing reliance on its more established, slower-growing service lines. By targeting these emerging sectors, Capita aims to build a stronger competitive position for the future. For example, in the UK public sector digital services market, while Capita has a strong overall presence, specific niche areas leveraging AI and advanced data analytics represent areas for significant future expansion where their current share is still developing.

Key areas identified for this strategic push include:

- Digital Transformation Services: Expanding offerings in cloud migration, cybersecurity, and data analytics, aiming to capture a larger share of the growing digital services market.

- Automation and AI Solutions: Developing and deploying robotic process automation (RPA) and artificial intelligence (AI) capabilities to enhance efficiency for clients, a sector with rapidly increasing demand.

- Specialized Public Sector Technology: Focusing on niche technology solutions for government and defense, leveraging advanced platforms where their current market penetration is still building.

Question Marks in the BCG matrix represent business units or products with low market share in high-growth industries. Capita's emerging AI solutions and digital transformation services fall into this category, demanding careful consideration for future investment. These ventures are characterized by high cash consumption due to ongoing development and market entry efforts.

The success of these Question Marks hinges on their ability to gain market traction and increase their share. For instance, Capita's AI Catalyst Lab projects, while innovative, are still in early stages with minimal market penetration. The global AI market's projected growth underscores the potential rewards if these initiatives can effectively scale and capture market demand.

Capita's strategic partnerships with hyperscalers and its foray into Digital as a Service (DaaS) also represent Question Marks. These areas offer significant growth potential, with the DaaS market expected to reach substantial figures by 2027. However, substantial upfront investment is required to build market share and establish a competitive edge in these nascent segments.

The decision for Capita regarding these Question Marks involves either increasing investment to boost market share, aiming to convert them into Stars, or divesting if they fail to demonstrate sufficient growth potential. This strategic evaluation is crucial for optimizing the company's portfolio and ensuring long-term financial health.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, industry research, and market share data to provide a comprehensive view of product portfolio performance.