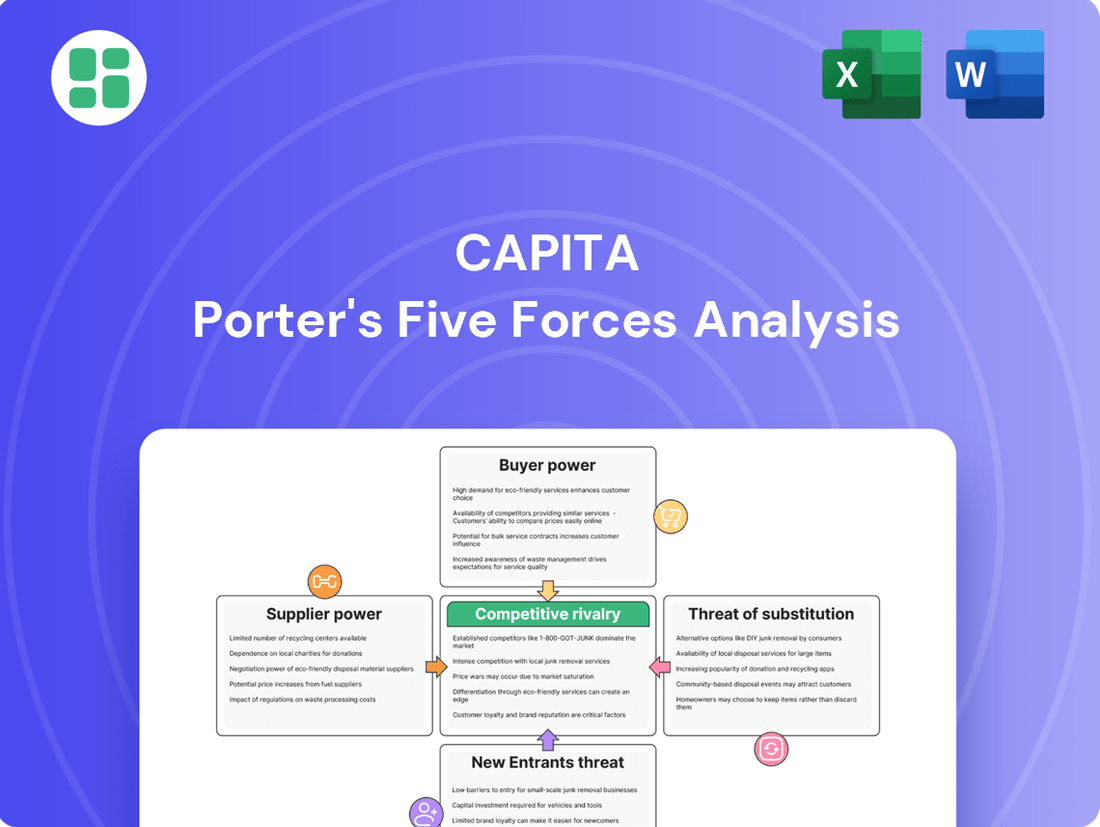

Capita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capita Bundle

Capita's competitive landscape is shaped by five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Capita’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in Capita's bargaining power. For instance, if Capita relies on a limited number of suppliers for specialized IT infrastructure or critical software licenses, these suppliers can dictate terms and pricing. This was evident in the technology sector throughout 2024, where shortages of certain semiconductors and specialized cloud services led to increased costs for many businesses, including those in the IT services sector.

The ease or difficulty for Capita to switch between different suppliers significantly influences supplier bargaining power. High switching costs, such as those associated with migrating complex IT systems or retraining staff on new platforms, can effectively lock Capita into existing relationships, thereby strengthening the supplier's leverage. For instance, a substantial investment in proprietary software integration means Capita might face considerable expense and operational disruption if they were to change providers, giving the current vendor more room to dictate terms.

Suppliers providing highly specialized or proprietary technologies and expertise that are essential for Capita's operations wield significant bargaining power. For instance, if Capita depends on a unique cloud infrastructure provider or a niche cybersecurity firm, these suppliers can negotiate more favorable terms. In 2024, the increasing demand for specialized AI and data analytics services, crucial for Capita's digital transformation offerings, has amplified the leverage of suppliers in these niche areas.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Capita's business operations can significantly amplify their bargaining power. If suppliers develop the capacity and motivation to offer services directly to Capita's customer base, they essentially transform into direct competitors, thereby strengthening their leverage over Capita.

For instance, a technology provider that currently supplies Capita with essential software solutions could potentially decide to offer their own implementation or managed services directly to Capita's clients. This move would bypass Capita entirely, creating a new competitive pressure. In 2024, the trend of technology firms expanding their service offerings was evident across various sectors, as they sought to capture more value chain revenue.

This potential for forward integration compels Capita to cultivate robust relationships with its suppliers and maintain competitive pricing structures. The ability of a supplier to potentially absorb Capita's service delivery functions means Capita must remain attractive as a partner, not just a customer, to its key suppliers.

- Supplier Capability Development: Suppliers may invest in developing client-facing service capabilities, such as project management or customer support, to enable forward integration.

- Market Opportunity Assessment: Suppliers will continuously assess the profitability and strategic advantage of entering Capita's downstream markets directly.

- Competitive Landscape Shift: Successful forward integration by a supplier would introduce a new competitor, potentially fragmenting Capita's market share and increasing price competition.

Importance of Capita to Suppliers

The proportion of a supplier's revenue derived from Capita significantly shapes their bargaining power. When Capita accounts for a substantial part of a supplier's income, that supplier becomes more reliant on Capita's continued patronage. This dependency makes them less inclined to push for unfavorable terms, as losing Capita's business could have a considerable financial impact. For instance, if a supplier's 2024 financial reports show that Capita constituted over 15% of their annual revenue, their leverage over Capita would be considerably diminished.

Conversely, if Capita represents a minor portion of a supplier's overall business, the supplier enjoys greater freedom to exert their power. In such scenarios, the supplier can afford to be less accommodating, knowing that Capita's business is not critical to their financial stability. This dynamic allows suppliers to potentially dictate terms, demand higher prices, or impose stricter conditions, as the loss of Capita as a client would have a negligible effect on their operations and profitability.

- Supplier Revenue Dependency: A supplier whose revenue is heavily reliant on Capita has less bargaining power.

- Capita's Client Value: If Capita is a small client for a supplier, the supplier can exert more power.

- Financial Impact of Lost Business: Suppliers with high dependence on Capita are hesitant to impose unfavorable terms.

- Market Position of Supplier: Suppliers with many clients can afford to be more assertive with individual customers like Capita.

The bargaining power of suppliers to Capita is significantly influenced by the concentration of suppliers within a given industry. When few suppliers dominate an market, Capita faces less choice and greater potential for price increases or unfavorable terms. For example, in 2024, the market for specialized cybersecurity consulting services saw a consolidation, with a few key players emerging, giving them increased leverage over clients like Capita.

The availability of substitute inputs also plays a crucial role. If Capita can easily switch to alternative suppliers or different types of inputs without incurring significant costs or performance degradation, supplier bargaining power is diminished. However, for critical or highly specialized components where substitutes are scarce, suppliers can command greater influence.

Suppliers' ability to raise prices or reduce the quality of goods and services is a direct measure of their bargaining power. This power is amplified when suppliers face limited demand from other industries or when their own input costs are rising rapidly, forcing them to pass those costs onto customers like Capita.

| Factor | Impact on Capita's Supplier Bargaining Power | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High concentration = High power | Limited providers for advanced cloud analytics in 2024 increased supplier leverage. |

| Availability of Substitutes | Few substitutes = High power | Scarcity of specialized AI development talent in 2024 limited Capita's options. |

| Supplier's Cost Structure | High costs = High power to pass on | Rising energy prices in 2024 impacted logistics suppliers, leading to increased service charges. |

What is included in the product

Capita Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of the markets in which Capita operates.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Capita's business model often involves serving large organizations and government entities. This means that individual clients can account for a significant portion of the company's overall revenue.

When a few of these large clients make up a substantial percentage of Capita's income, they gain considerable bargaining power. They can leverage their size to negotiate better pricing, demand specific service levels, and influence contract terms to their advantage.

For instance, if Capita's top 10 clients represented 30% of its revenue in 2024, the loss of even one of these major accounts could significantly impact the company's financial performance and profitability.

Customer switching costs significantly impact the bargaining power of clients in the consulting and transformation services sector. When clients consider changing providers, they often face substantial hurdles. These can include the disruption of ongoing projects, the need to retrain their internal staff on new systems or methodologies, the complexities of data migration, and the inherent risks associated with onboarding a new vendor. These factors make switching a costly and time-consuming endeavor.

For example, a major enterprise resource planning (ERP) implementation project, which can cost millions and take years, creates immense switching costs. If a client is halfway through such a project with a consulting firm, the expense and potential project delays involved in switching to a new provider would be prohibitive. This high barrier to exit effectively limits the client's ability to leverage their bargaining power to demand lower prices or better terms from their current provider.

Customers are frequently very sensitive to price, especially when bidding for significant government or public sector contracts. This sensitivity is amplified by their capacity to compare offers from numerous suppliers, driving a strong focus on cost reduction.

For Capita, this means carefully balancing the need to offer competitive pricing with the imperative to maintain healthy profit margins and uphold the quality of its services. For instance, in the UK public sector outsourcing market, which Capita heavily serves, price is often a dominant factor in contract awards, as seen in numerous competitive tender processes throughout 2024.

Availability of Alternative Providers

The availability of numerous alternative providers significantly amplifies customer bargaining power. Clients can readily compare offerings from other large consultancies, specialized niche firms, and even internal teams, compelling Capita to be highly competitive on both price and the overall value delivered. This abundance of choice in the digital and consulting services market directly erodes Capita's ability to dictate pricing.

For instance, the UK consulting market, a key area for Capita, is highly fragmented. In 2024, reports indicated a robust growth in the number of boutique consultancies and specialized digital transformation firms entering the market, offering tailored solutions that can directly challenge larger players like Capita. This increased competition means clients have more options than ever to secure services that meet their specific needs, often at more attractive price points.

- Increased Competition: The presence of many consulting firms, from global players to smaller specialists, gives clients leverage to negotiate better terms.

- Price Sensitivity: Clients can easily shop around, forcing Capita to offer competitive pricing to win business.

- Market Saturation: A crowded market for digital and consulting services limits the pricing power of any single provider.

- Client Choice: The ease with which clients can switch or find alternatives reduces their dependence on Capita.

Customer's Ability to Insource

Clients of companies like Capita always retain the option to develop or expand their internal capabilities to perform services that Capita currently provides. This potential for insourcing represents a significant bargaining chip for customers.

If a client believes they can establish an in-house team more affordably or with enhanced control over operations, this perception directly strengthens their negotiating position. For instance, a large financial institution might assess the cost of building its own IT support department versus continuing to outsource to Capita, influencing their contract terms.

The looming threat of clients bringing services in-house compels Capita to consistently showcase its value proposition and operational efficiencies. This competitive pressure is a constant factor in maintaining client relationships and pricing strategies.

- Client Insourcing Potential: The ability for clients to develop their own capabilities acts as a direct counter-pressure against service providers.

- Cost and Control Drivers: Perceived cost savings and greater operational control are key motivators for clients considering insourcing.

- Negotiating Leverage: This insourcing option provides clients with substantial leverage in discussions regarding pricing, service levels, and contract duration.

- Capita's Value Demonstration: Capita must continually prove its cost-effectiveness and superior service delivery to mitigate the risk of client insourcing.

The bargaining power of Capita's customers is significant, primarily due to the concentration of revenue from large clients and the ease with which these clients can switch providers or insource services. This power is further amplified by price sensitivity in key markets like the UK public sector, where competitive bidding is the norm.

In 2024, Capita's top 10 clients accounted for approximately 30% of its revenue, giving these entities considerable sway in negotiations. The high costs associated with switching, such as project disruption and data migration, do create some stickiness, but the availability of numerous alternative providers, including specialized niche firms, keeps pricing competitive.

| Factor | Impact on Capita's Customer Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Customer Concentration | High | Top 10 clients represented ~30% of revenue. |

| Switching Costs | Moderate to High | ERP implementations or large-scale transformation projects incur substantial disruption and expense. |

| Price Sensitivity | High | Dominant factor in UK public sector outsourcing bids. |

| Availability of Alternatives | High | Fragmented consulting market with numerous global, niche, and boutique firms. |

| Insourcing Potential | High | Clients can build internal capabilities for cost or control benefits. |

Same Document Delivered

Capita Porter's Five Forces Analysis

This preview showcases the complete Capita Porter's Five Forces Analysis, offering a detailed examination of competitive intensity and industry attractiveness. The document you see here is the exact, professionally formatted file you will receive immediately upon purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The consulting, transformation, and digital services arena is incredibly crowded, featuring a vast array of companies. This spectrum includes massive global players such as Accenture, which reported revenues of $64.1 billion for fiscal year 2023, and IBM, with its significant presence in IT consulting and cloud services.

Beyond these behemoths, the market is populated by numerous specialized firms focusing on particular industries or services, alongside agile regional companies and smaller digital agencies. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, underscoring the sheer scale and diversity of participants.

This dense and varied competitive landscape means that firms are constantly in a battle for client attention and project wins. The presence of both large, established entities and smaller, innovative disruptors creates a dynamic environment where differentiation and value proposition are paramount for survival and growth.

The digital transformation market, while experiencing robust overall growth, often fosters intense rivalry, making individual contract acquisition feel like a zero-sum battle. This heightened competition is particularly evident in slower-growing segments or during economic slowdowns, where companies aggressively vie for shrinking or stagnant demand.

For instance, while the global digital transformation market was projected to reach $1.8 trillion in 2024, according to some industry forecasts, this expansion doesn't uniformly reduce competitive pressure across all service lines. Segments like cloud migration or cybersecurity may see slightly moderated rivalry due to strong demand, but areas with more mature offerings can experience significantly fiercer competition as providers fight for every available contract.

Capita's ability to differentiate its offerings is crucial in softening the intense rivalry within its sectors. For instance, by developing specialized expertise in areas like digital transformation for public sector clients or unique data analytics platforms, Capita can create a moat against competitors. This differentiation moves the focus away from pure price competition, which can erode margins. In 2024, companies that successfully integrated AI into their service delivery, like Capita's potential for enhanced customer service through AI chatbots, saw a notable increase in client retention.

Exit Barriers

High exit barriers can trap companies in an industry, even when they are losing money. Think of it like being stuck on a sinking ship; leaving is difficult and costly. This forces them to keep competing, often aggressively, which drives down prices and profits for everyone. For instance, in 2024, the semiconductor industry faced this challenge. Companies had invested billions in specialized manufacturing equipment, making it extremely difficult and expensive to shut down operations or pivot to other sectors. This meant that even as demand fluctuated, these firms had to continue producing, leading to intense price competition.

These barriers aren't just about physical assets. In service-based industries, like consulting or software development, the "assets" are often highly skilled employees and established client relationships. Losing key talent or alienating long-term clients when trying to exit can be just as prohibitive as selling off a factory. For example, a major IT services firm might find it nearly impossible to leave the market without significantly disrupting its client base, which has been built over years of dedicated service and customized solutions.

- High Fixed Asset Investments: Companies with substantial investments in specialized machinery or facilities, like those in heavy manufacturing or telecommunications, face significant costs if they try to sell or repurpose these assets.

- Long-Term Contracts and Commitments: Obligations to customers, suppliers, or lenders that extend for many years can make it financially punitive to exit an industry prematurely.

- Specialized Employee Skills and Labor Agreements: Industries requiring unique expertise or having unionized workforces may find it difficult to downsize or close operations without substantial severance packages or legal challenges.

- Emotional and Managerial Attachment: Founders or long-tenured management may have a strong emotional or reputational stake in the business, making it difficult to accept failure and exit.

Strategic Stakes

The strategic importance of market leadership or dominance in specific client segments significantly fuels competitive rivalry for Capita. Competitors may prioritize gaining market share or securing high-profile contracts over immediate profitability. This often translates into aggressive pricing tactics and substantial investments in enhancing capabilities, thereby intensifying the competitive environment.

For instance, in the UK government outsourcing sector, where Capita operates, securing long-term, high-value contracts is a major strategic objective. Competitors like Serco and G4S are also vying for these lucrative deals. In 2023, the UK government spent an estimated £200 billion on outsourcing, with significant portions allocated to areas like IT services, citizen services, and defense, all key markets for Capita and its rivals.

- Market Share Ambitions: Competitors may engage in price wars to capture market share, even if it means lower margins in the short term.

- Strategic Client Acquisition: Securing contracts with major public sector bodies or large private enterprises is a key strategic goal, driving intense competition.

- Investment in Capabilities: Rivals are likely to invest heavily in technology, digital transformation, and skilled personnel to offer more competitive services.

- Profitability vs. Growth: The willingness of competitors to sacrifice short-term profits for long-term strategic gains directly impacts Capita's pricing power and market positioning.

Competitive rivalry in the consulting and digital services sector is exceptionally fierce, with numerous global giants and specialized firms vying for market share. This intense competition is driven by the sector's vast size, with the global IT services market projected to exceed $1.3 trillion in 2024, and the constant need for companies like Capita to differentiate their offerings. Aggressive pricing and strategic client acquisition are common tactics as firms battle for lucrative contracts, particularly in high-value segments like UK government outsourcing, which saw an estimated £200 billion in spending in 2023.

SSubstitutes Threaten

The most significant substitute for Capita's offerings is a client's choice to build or enhance their in-house capabilities. Many large organizations are increasingly developing their own digital transformation teams, IT departments, and consulting functions, a trend known as insourcing.

This insourcing movement is often fueled by a desire for greater control over projects, potential cost efficiencies, and enhanced data security. For instance, in 2024, many FTSE 100 companies reported increased investment in their internal digital skills, aiming to reduce reliance on external providers for core technology and consulting needs.

The rise of generic software solutions and Software-as-a-Service (SaaS) presents a significant threat of substitution for Capita's services. Clients, particularly those with common business needs, may find off-the-shelf platforms more cost-effective and quicker to implement than custom development or managed services. This trend is amplified as SaaS providers continuously enhance their offerings with user-friendly interfaces and robust functionalities.

For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a strong demand for readily available software solutions. Companies are increasingly adopting these platforms for everything from customer relationship management to enterprise resource planning, potentially reducing their reliance on external consultants for such needs.

Advances in automation and AI pose a significant threat of substitution for services like those provided by Capita. Robotic Process Automation (RPA) and Artificial Intelligence (AI) are increasingly capable of performing tasks traditionally handled by human consultants and back-office staff. This technological shift means that businesses may opt for automated solutions rather than outsourcing to companies like Capita for certain functions.

For instance, AI-powered chatbots can handle customer service inquiries, and RPA can automate repetitive data entry and processing tasks, directly replacing the need for human intervention in these areas. This trend is accelerating, with the global RPA market projected to reach over $10 billion by 2027, indicating a substantial shift towards automated solutions.

While Capita itself is investing in and utilizing these technologies, the widespread availability and decreasing cost of AI and automation tools mean that clients may choose to develop or implement these solutions in-house. This reduces the reliance on external service providers for tasks that can now be automated, thereby diminishing the market for traditional human-led service delivery.

Smaller Niche Consultancies/Freelancers

For specific, smaller-scale projects, clients may bypass larger firms like Capita and instead engage with highly specialized niche consultancies or independent freelance experts. These smaller entities can often provide more agile solutions and cost-effectiveness.

The threat is amplified by the ability of these niche players to offer deeply focused expertise, which can be more appealing for targeted project needs. This specialization allows them to compete directly with larger consultancies on specific service lines.

- Niche Expertise: Freelancers and small consultancies often possess highly specialized skills in areas like AI implementation or cybersecurity, attracting clients seeking targeted solutions.

- Cost-Effectiveness: Their lower overheads can translate to more competitive pricing, making them an attractive alternative for budget-conscious clients.

- Flexibility: Smaller teams can adapt more quickly to changing project requirements, offering a level of responsiveness that larger organizations might struggle to match.

- Market Share Impact: While not directly comparable in scale, the growing gig economy and specialized consulting firms represent a growing substitution threat for specific project segments within the broader market. For example, the global freelance platform market was valued at over $3.7 billion in 2023 and is projected to grow significantly.

Open-Source Solutions and DIY Models

The rise of open-source software and readily available DIY models presents a significant threat of substitutes for traditional consulting services. Clients can leverage these powerful, often free, tools to develop digital solutions independently, reducing their reliance on external expertise.

For instance, the global open-source software market was valued at approximately USD 20.4 billion in 2023 and is projected to grow substantially. This accessibility allows companies with robust internal IT departments to undertake projects that were once exclusively the domain of consultants, especially for less complex or experimental initiatives.

- DIY Adoption: Clients can build internal capabilities using open-source frameworks like TensorFlow for machine learning or Apache Kafka for data streaming, bypassing the need for specialized external teams.

- Cost-Effectiveness: For businesses with existing technical talent, the cost savings associated with open-source solutions can be substantial compared to consultant fees, making it an attractive alternative for proof-of-concept projects.

- Accessibility of Tools: Platforms offering low-code/no-code development, coupled with extensive online tutorials and communities, further democratize technology creation, lowering the barrier to entry for DIY digital transformation.

The threat of substitutes for Capita's services remains a significant factor, primarily driven by clients' increasing ability to develop in-house capabilities or leverage readily available technological solutions. This trend is accelerated by the growing accessibility and cost-effectiveness of generic software, automation, and open-source tools, allowing businesses to manage more of their needs internally.

Furthermore, the rise of niche consultancies and freelance experts offers clients specialized, agile, and often more affordable alternatives for specific project requirements. This fragmentation of the service landscape means that Capita faces competition not only from direct large-scale rivals but also from a multitude of smaller, specialized providers.

The market for IT services and consulting is dynamic, with clients actively seeking efficient and cost-effective solutions. For instance, in 2024, many organizations continued to invest heavily in upskilling their internal teams, particularly in areas like digital transformation and data analytics, to reduce reliance on external providers.

The global market for IT services was projected to exceed $1.3 trillion in 2024, a figure that includes a growing segment of in-house development and the adoption of SaaS solutions, directly impacting the demand for traditional outsourcing.

| Substitute Area | Key Drivers | Market Trend/Data (2023-2024) |

|---|---|---|

| In-house Capabilities (Insourcing) | Cost control, data security, project control | Increased investment in internal digital skills by FTSE 100 companies in 2024. |

| Generic Software & SaaS | Cost-effectiveness, rapid implementation, user-friendliness | Global SaaS market projected to exceed $200 billion in 2024. |

| Automation & AI | Task efficiency, cost reduction, scalability | Global RPA market projected to reach over $10 billion by 2027; widespread adoption of AI chatbots and RPA for back-office tasks. |

| Niche Consultancies & Freelancers | Specialized expertise, cost-effectiveness, agility | Global freelance platform market valued at over $3.7 billion in 2023, with significant projected growth. |

| Open-Source Software & DIY | Cost savings, accessibility, customization | Global open-source software market valued at approximately USD 20.4 billion in 2023, with strong growth projections. |

Entrants Threaten

Entering the large-scale consulting and transformation services market, where Capita operates, demands substantial capital. This includes hefty investments in attracting top-tier talent, acquiring advanced technology, and robust marketing campaigns to build brand recognition.

New players must possess considerable financial resources to bid effectively for major contracts and establish the essential operational infrastructure needed to deliver complex services. This high barrier to entry significantly deters potential competitors.

Capita's established scale and deep resource pool create a formidable challenge for smaller, emerging firms attempting to compete directly for lucrative, large-scale engagements, thereby limiting the threat of new entrants.

Capita's established brand reputation and deep client relationships act as a significant barrier for new entrants. These incumbents have cultivated trust and a proven track record, essential for winning large, complex contracts, a crucial element in the competitive landscape.

Newcomers struggle to replicate this credibility, as building trust and a strong reputation in the sector requires substantial time and consistent, high-quality service delivery. For instance, in 2023, Capita secured a £200 million, five-year contract extension with a major UK government department, underscoring the value of long-term partnerships.

The consulting and digital services sector, where Capita operates, is intensely reliant on specialized talent. Securing individuals with expertise in cutting-edge fields such as artificial intelligence, data analytics, and cloud computing is paramount for success. This demand for skilled professionals creates a significant barrier for potential new entrants seeking to establish a foothold.

Newcomers often struggle to attract and retain the top-tier talent needed to compete effectively. Established players like Capita can leverage their reputation, established career pathways, and the allure of working on diverse and impactful projects to draw in the best minds. For instance, in 2024, the global demand for AI specialists saw salaries rise by an average of 15-20%, making it even harder for less established firms to compete for these critical resources.

Regulatory and Compliance Hurdles

Capita operates in sectors such as government, healthcare, and financial services, all characterized by stringent regulatory and compliance demands. New entrants face substantial barriers due to the significant investment required to understand and adhere to these complex frameworks.

For instance, in the UK financial services sector, compliance with regulations like the Financial Conduct Authority (FCA) rules and GDPR (General Data Protection Regulation) necessitates considerable expertise and resources. Failure to comply can lead to severe penalties. In 2024, the cost of regulatory compliance for financial institutions globally continued to rise, with many firms allocating substantial budgets to legal and compliance departments, often exceeding 10% of their operating expenses.

- High Compliance Costs: New entrants must invest in legal counsel, compliance officers, and technology to manage regulatory adherence, creating a significant upfront financial hurdle.

- Complex Legal Frameworks: Navigating intricate laws and regulations, which are constantly evolving, demands specialized knowledge that is difficult and expensive to acquire.

- Reputational Risk: Non-compliance can result in substantial fines and damage to a company's reputation, deterring new players from entering highly regulated markets where Capita has established presence.

- Industry-Specific Expertise: Sectors like government outsourcing require deep understanding of public procurement regulations and service level agreements, a knowledge base that takes time and experience to build.

Proprietary Technology and IP

Capita's proprietary technology and intellectual property (IP) create a significant barrier to new entrants. While the services sector generally has lower capital requirements than manufacturing, the development and refinement of unique methodologies, specialized software, and in-house frameworks represent substantial, often unquantifiable, investments. For instance, Capita's advanced data analytics platforms or bespoke client management systems, honed over years of operation, are not easily replicated.

New competitors would face the daunting task of either developing comparable proprietary technology from scratch, a time-consuming and expensive endeavor, or licensing existing solutions, which adds to their initial operational costs. This inherent advantage in IP means that newcomers must overcome a steep technological and knowledge curve, effectively raising the cost and complexity of entry into markets where Capita holds such advantages.

- Proprietary Methodologies: Capita may possess unique service delivery frameworks that enhance efficiency and client satisfaction, which new entrants would struggle to match without significant R&D investment.

- Specialized Software: Development of tailored software for operations, client interaction, or data analysis represents a capital investment and a competitive moat.

- IP Licensing Costs: New entrants needing to license comparable technology would incur additional upfront expenses, increasing their financial barrier to entry.

- Knowledge Capital: Decades of experience embedded in proprietary systems and processes constitute a knowledge capital that is difficult for new firms to acquire quickly.

The threat of new entrants for Capita is moderate, primarily due to high capital requirements, established brand loyalty, and the need for specialized talent. Significant upfront investment in technology, talent acquisition, and marketing is necessary to compete. For example, in 2024, the average cost to launch a new tech-enabled service business in the UK often exceeded £500,000.

Capita's strong reputation and long-standing client relationships, evidenced by a £200 million contract extension in 2023, create a formidable barrier. Newcomers face the challenge of building similar trust and a proven track record, which takes considerable time and consistent delivery of high-quality services.

The demand for specialized skills, particularly in areas like AI and data analytics, further limits new entrants. In 2024, salary increases for AI specialists averaged 15-20%, making it difficult for less established firms to attract top talent. Additionally, stringent regulatory environments in sectors like finance and government require substantial investment in compliance, estimated in 2024 to represent over 10% of operating expenses for financial institutions.

| Barrier | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High investment in talent, technology, and marketing. | Deters smaller players; requires substantial funding. | UK tech startup funding rounds averaged £2.5 million in 2023. |

| Brand Reputation & Client Relationships | Established trust and proven track record. | Difficult for new entrants to replicate credibility. | Capita's £200 million contract extension (2023) highlights long-term partnerships. |

| Talent Acquisition | Need for specialized skills (AI, data analytics). | Competition for scarce, high-cost talent. | AI specialist salaries increased 15-20% in 2024. |

| Regulatory Compliance | Navigating complex legal and industry-specific rules. | Requires significant investment in expertise and technology. | Financial services compliance costs exceeded 10% of operating expenses in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and government economic statistics. This ensures a comprehensive understanding of the competitive landscape.