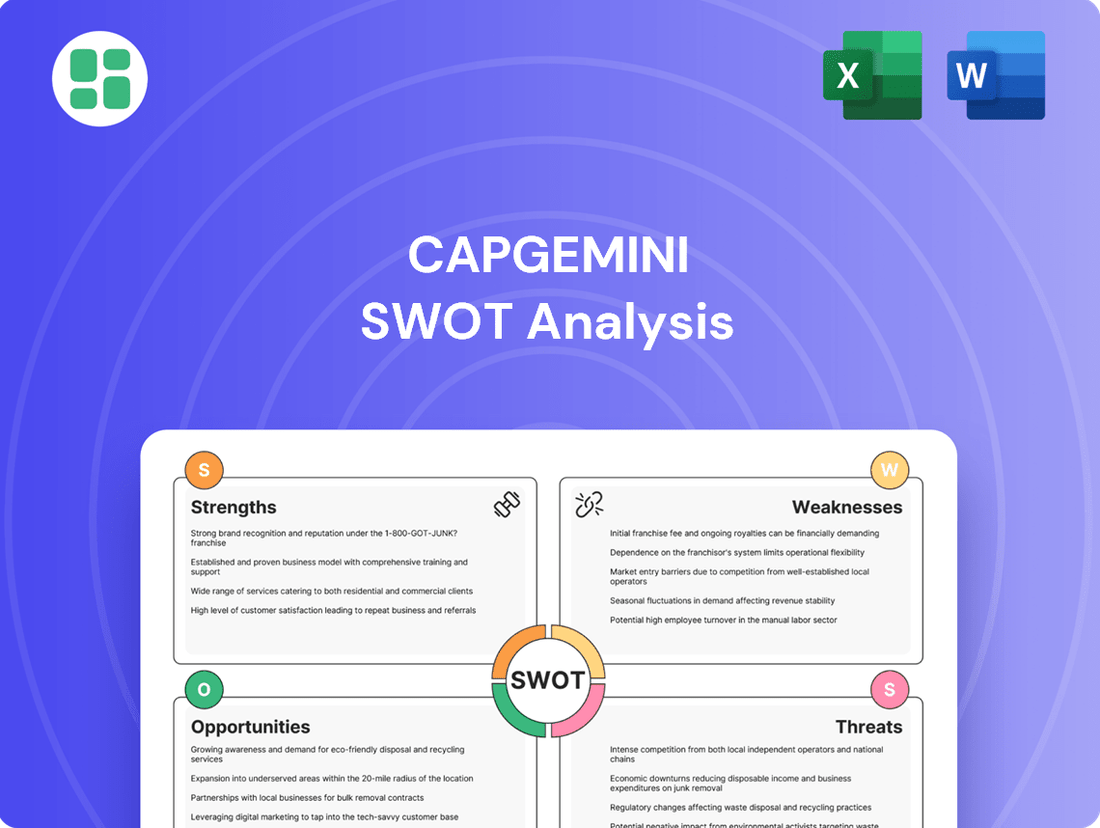

Capgemini SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capgemini Bundle

Capgemini's strategic position is shaped by its robust technological capabilities and global reach, but also faces intense competition and evolving market demands. Understanding these dynamics is crucial for any stakeholder looking to navigate the IT services landscape.

Want the full story behind Capgemini's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capgemini stands as a prominent global leader in IT consulting, professional services, and outsourcing. Its expansive service portfolio covers the entire spectrum, from initial strategy development to ongoing operations, making it a one-stop shop for many clients.

This broad range of services, encompassing consulting, technology implementation, and outsourcing solutions, allows Capgemini to cater to a wide array of client requirements across numerous industries. For instance, in 2023, the company reported €23.2 billion in revenue, showcasing its significant market reach and client engagement.

The company's strength lies in its ability to deliver integrated solutions. By blending cutting-edge technologies with profound sector-specific knowledge, Capgemini solidifies its robust market position. This approach enables them to achieve tangible outcomes for clients focused on technological advancement.

Capgemini is strategically investing in high-growth sectors like Cloud, Data, and Artificial Intelligence, including Generative AI and Agentic AI. This focus is a key strength, driving significant bookings and demonstrating client demand for AI-powered business transformations.

The company's commitment to these advanced technologies places it as a leader in digital innovation. For instance, in the first quarter of 2024, Capgemini reported a 7% like-for-like revenue increase, with strong performance in its Intelligent Industry segment, which heavily leverages these emerging tech areas.

Capgemini's operating model has proven remarkably resilient. Despite facing economic headwinds and some revenue contractions in 2024, the company has successfully maintained stable operating margins. This stability underscores its operational efficiency and adept financial stewardship.

The company's ability to generate strong organic free cash flow, even during periods of market volatility, is a key strength. This consistent cash generation provides a solid financial bedrock, bolstering investor confidence and enabling strategic investments for future expansion.

Strategic Acquisitions and Partnerships

Capgemini's strategic acquisitions and partnerships are a significant strength, enabling rapid capability expansion. For instance, the 2024 acquisition of Syniti bolstered its enterprise data management and SAP transformation services, while the WNS acquisition in early 2025 further enhanced its AI-powered intelligent operations. These moves, coupled with deep collaborations with tech giants like NVIDIA and Google Cloud, allow Capgemini to quickly integrate cutting-edge expertise and scale its offerings to meet dynamic market needs.

These strategic integrations directly translate into a more comprehensive service portfolio. Capgemini's ability to onboard specialized skills through acquisitions, such as those in data analytics and cloud migration, positions it to address complex client challenges more effectively. This proactive approach to building its ecosystem ensures it remains at the forefront of technological advancements and service delivery.

- Acquisition of Syniti (2024): Strengthened enterprise data management and SAP transformation capabilities.

- Acquisition of WNS (early 2025): Enhanced AI-powered intelligent operations and business process outsourcing.

- Key Technology Partnerships: Collaborations with NVIDIA and Google Cloud for advanced AI and cloud solutions.

- Market Reach Expansion: Acquisitions and partnerships broaden service offerings and client access globally.

Robust Global Presence and Talent Pool

Capgemini's extensive global presence, spanning over 50 countries, provides a significant advantage by tapping into a vast and diversified talent pool. This allows for scalable service delivery and access to a wide range of expertise.

The company strategically leverages key markets, notably India, which houses a substantial portion of its AI talent. This focus on specific regions, combined with a commitment to ongoing talent acquisition and development, ensures Capgemini remains agile and competitive.

- Global Footprint: Operates in over 50 countries as of early 2024.

- Talent Diversification: Benefits from a large, geographically distributed workforce.

- Strategic Talent Hubs: Significant AI talent concentration in India.

- Investment in People: Continuous focus on reskilling and development programs.

Capgemini's strategic focus on high-growth areas like Cloud, Data, and Artificial Intelligence, including Generative AI, is a significant strength. This commitment is reflected in strong bookings and clear client demand for AI-driven transformations, positioning them as a leader in digital innovation.

The company's operational resilience, demonstrated by stable operating margins even amidst economic fluctuations in 2024, highlights its efficiency and sound financial management. This stability is further supported by its consistent generation of organic free cash flow, providing a strong financial foundation for future investments.

Capgemini's aggressive acquisition strategy significantly bolsters its capabilities. The 2024 acquisition of Syniti enhanced its data management and SAP services, while the early 2025 WNS acquisition expanded its AI-powered operations. These moves, alongside key partnerships with NVIDIA and Google Cloud, allow for rapid integration of new expertise and scaling of offerings.

The company's extensive global presence, operating in over 50 countries as of early 2024, grants access to a diverse talent pool and scalable service delivery. Strategic talent hubs, particularly in India for AI expertise, further enhance its competitive edge.

| Strength Area | Key Initiatives/Facts | Impact |

|---|---|---|

| Technology Focus | Investment in Cloud, Data, AI (GenAI, Agentic AI) | Leader in digital innovation, high client demand |

| Operational Resilience | Stable operating margins (2024), strong organic free cash flow | Financial stability, investor confidence |

| Strategic Acquisitions | Syniti (2024), WNS (early 2025) | Expanded data management, AI operations, and service portfolio |

| Global Presence & Talent | Operations in >50 countries (early 2024), AI talent in India | Scalable delivery, access to diverse expertise |

What is included in the product

Delivers a strategic overview of Capgemini’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address Capgemini's strategic challenges and opportunities.

Weaknesses

Capgemini's reliance on consulting services, a segment that contributed a significant portion of its revenue, presents a weakness. While consulting is a strong suit, an overdependence can be risky if market demand shifts. For instance, in the first half of 2024, consulting and testing services remained a substantial revenue driver, but this concentration highlights a potential vulnerability.

The company's capacity to manage large-scale service projects may also lag behind certain competitors, potentially limiting its ability to secure and execute the most lucrative contracts. This could impact its market share in highly competitive areas of IT services.

Furthermore, Capgemini's organizational culture presents a hurdle to expanding beyond its established IT core. This internal dynamic can stifle innovation and diversification, making it challenging to pivot into new, high-growth sectors. This cultural inertia could hinder its ability to adapt to rapidly evolving technological landscapes.

Capgemini's reliance on the European market, which accounted for approximately 50% of its revenue in 2023, presents a significant weakness. This concentration makes the company particularly vulnerable to regional economic downturns and geopolitical instability within Europe.

Furthermore, Capgemini has faced headwinds in key sectors, notably manufacturing, which saw a revenue decline in the first half of 2024. The company also experienced a slowdown in its home market of France, impacting its overall performance and highlighting the risks associated with sectoral and geographical concentration.

Capgemini has experienced a notable talent attrition rate, particularly within its IT services segment, which directly impacts operational efficiency and incurs significant recruitment and training expenses. For instance, in the first half of 2024, the company reported an attrition rate of 23%, a slight increase from the previous year, underscoring the ongoing challenge of retaining skilled professionals.

The tech industry, including Capgemini, continues to contend with a pronounced skills gap, especially in emerging fields such as artificial intelligence and cloud computing. This deficit in specialized expertise impedes the company's ability to fully capitalize on market opportunities and maintain a competitive edge in a rapidly evolving technological landscape.

Attracting and retaining top-tier talent, particularly those with expertise in advanced areas like AI and data analytics, remains a critical hurdle. Capgemini's ongoing investment in upskilling programs and employee engagement initiatives aims to address this, but the competition for specialized skills is fierce, requiring continuous strategic adaptation.

Profitability Ratio and Net Contribution Below Industry Average

Capgemini's profitability, specifically its profitability ratio and net contribution, has been noted to trail behind the broader IT industry averages. This suggests that while the company is successful in generating revenue, its ability to convert that revenue into profit is not as efficient as some of its competitors. For instance, in the fiscal year 2023, Capgemini's operating margin was reported around 13.5%, which, while healthy, was slightly lower than some of its key competitors who reported margins closer to 15% or higher in the same period.

This underperformance in profitability metrics can impact shareholder value and the company's capacity for reinvestment.

- Profitability Lag: Capgemini's profitability ratios, including its net contribution, are below industry benchmarks.

- Efficiency Concerns: The company's ability to translate revenue into profit needs improvement compared to peers.

- Shareholder Value Impact: Lower profitability can affect the company's attractiveness to investors and its ability to reward shareholders.

- Future Growth: Addressing these financial inefficiencies is vital for Capgemini's sustained long-term growth and financial stability.

Integration Challenges from Acquisitions

Capgemini's acquisition strategy, while a growth driver, presents integration challenges. The company has encountered difficulties in seamlessly merging acquired firms, particularly those with significantly different corporate cultures or operational models. This can lead to disruptions and hinder the full realization of expected benefits.

While Capgemini has a track record of successful integration for smaller acquisitions, larger or culturally dissimilar ones pose a greater hurdle. These can impact employee morale and slow down the anticipated synergies. For instance, integrating firms with distinct work ethics requires careful management to avoid operational friction.

The success of Capgemini's M&A approach hinges on effective post-merger integration. In 2023, Capgemini completed several acquisitions, including those in cloud and data analytics, aiming to bolster its capabilities. Ensuring these new entities align smoothly with Capgemini's existing structure and culture is paramount to unlocking their full value and achieving strategic objectives.

- Cultural Clashes: Difficulty in harmonizing diverse organizational cultures can impede collaboration and productivity post-acquisition.

- Operational Disruption: Integrating disparate IT systems, processes, and management styles can lead to temporary operational inefficiencies.

- Synergy Delays: Challenges in integration can postpone or reduce the anticipated financial and strategic benefits from acquisitions.

Capgemini's profitability, particularly its operating margin, has historically trailed behind some key competitors. For instance, while reporting a healthy operating margin around 13.5% in fiscal year 2023, this was slightly lower than competitors achieving 15% or more. This efficiency gap impacts its ability to reinvest and potentially limits shareholder returns.

The company's significant reliance on the European market, accounting for roughly 50% of its 2023 revenue, exposes it to regional economic volatility and geopolitical risks. This geographical concentration, coupled with a slowdown in France and a revenue decline in sectors like manufacturing in early 2024, highlights a vulnerability to localized downturns.

High talent attrition, especially in its IT services segment, remains a persistent weakness. In the first half of 2024, attrition stood at 23%, a slight increase from the prior year, leading to increased recruitment costs and potential impacts on service delivery efficiency.

The persistent skills gap in emerging technologies like AI and cloud computing hinders Capgemini's ability to fully capitalize on market opportunities. Attracting and retaining specialized talent in these competitive fields requires continuous strategic investment and adaptation.

| Weakness | Description | Impact | Supporting Data (as of 2023/H1 2024) |

| Profitability Lag | Operating margins below industry peers | Reduced reinvestment capacity, potentially lower shareholder value | FY2023 Operating Margin ~13.5% vs. Competitors ~15%+ |

| Geographical Concentration | Heavy reliance on European market | Vulnerability to regional economic downturns and geopolitical events | ~50% of 2023 revenue from Europe; France slowdown noted |

| Talent Attrition | High attrition rates in IT services | Increased recruitment costs, potential service delivery disruption | H1 2024 Attrition Rate 23% |

| Skills Gap | Deficiency in emerging tech expertise (AI, Cloud) | Inability to fully exploit market opportunities, competitive disadvantage | Ongoing challenge across the tech sector |

Same Document Delivered

Capgemini SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Capgemini SWOT analysis, ensuring you know exactly what you're getting before you buy. Purchase unlocks the complete, in-depth report.

Opportunities

The market for digital transformation services is experiencing robust growth, fueled by businesses aggressively integrating generative AI and agentic AI to optimize their operations. Capgemini is strategically positioned to leverage this expansion, with AI and GenAI already contributing a notable share to its bookings and a strong emphasis on intelligent operations.

As of late 2024, the global AI market is projected to reach hundreds of billions of dollars, with generative AI expected to be a significant driver. Capgemini's focus on these cutting-edge technologies aligns perfectly with this upward trend, presenting substantial opportunities for increased revenue and market share.

Capgemini has significant opportunities to expand in key geographic markets, particularly in North America, the UK, Asia-Pacific, and Latin America. These regions are demonstrating robust growth, especially within the financial services, public sector, and consumer goods & retail industries. For instance, North America continues to be a strong performer, with Capgemini reporting substantial revenue growth in this segment.

Strategic investments and targeted partnerships in these dynamic geographies are crucial for Capgemini to bolster its market share. By focusing on these areas, the company can effectively diversify its revenue streams, thereby mitigating risks associated with slower-performing markets. This expansion strategy is vital for sustained, long-term growth and improved financial resilience.

The global push for sustainability is creating a significant market for green IT. Governments worldwide are implementing stricter environmental regulations, and businesses are increasingly adopting corporate social responsibility initiatives. This trend directly benefits companies like Capgemini that can offer eco-friendly IT solutions and climate technologies.

Capgemini's dedication to sustainability is a key advantage, allowing them to provide innovative services that help clients achieve their environmental targets. For instance, their work in integrating AI and IoT into next-generation supply chains aims to boost efficiency and minimize waste, tapping into a growing demand for such solutions.

In 2024, the demand for sustainable IT services is projected to grow substantially. Capgemini's focus on areas like cloud optimization for reduced energy consumption and circular economy principles in IT asset management positions them well to capitalize on this expanding market opportunity.

Increased Investment in Supply Chain Transformation and Cybersecurity

Businesses are heavily investing in making their supply chains more robust and tech-enabled. This includes efforts to reduce risks and bring production closer to home, often referred to as friendshoring. Capgemini is well-positioned to benefit from this trend, especially with its expertise in AI-powered supply chains.

The global cybersecurity market is also experiencing significant growth. This surge is driven by a rising number of cyber threats and stricter regulations worldwide. Capgemini's strong presence in cybersecurity services allows it to capitalize on this expanding demand.

- Supply Chain Investment: Global spending on supply chain technology is projected to reach $300 billion by 2027, up from an estimated $200 billion in 2023, reflecting a strong compound annual growth rate.

- Cybersecurity Market Growth: The cybersecurity market is expected to grow from approximately $200 billion in 2023 to over $350 billion by 2028, driven by increasing sophistication of cyberattacks.

- AI in Supply Chains: Capgemini's focus on AI-assisted supply chain solutions aligns with an industry trend where 70% of companies are planning to increase their AI investments in supply chain operations by 2025.

Leveraging Hybrid Work Models and Employee Experience for Talent Advantage

Capgemini's strategic embrace of hybrid work models and a dedicated focus on employee experience offers a significant opportunity to secure a competitive edge in talent acquisition and retention. By investing in robust learning and development initiatives, particularly in high-demand areas like Generative AI, the company is equipping its workforce with essential future-ready skills. This commitment to upskilling, coupled with flexible work arrangements, directly addresses employee needs, fostering greater job satisfaction and mitigating turnover. For instance, in 2024, Capgemini continued to emphasize its "Get the Future You Want" initiative, which includes extensive reskilling and upskilling programs, aiming to train hundreds of thousands of employees in AI and cloud technologies.

This people-centric strategy not only enhances job fulfillment but also cultivates a more innovative and agile organizational culture. By empowering employees through continuous learning and flexible work options, Capgemini can effectively differentiate itself in the fiercely competitive talent market. This approach is crucial for building a resilient and future-proof workforce capable of driving innovation and delivering exceptional client value. The company's ongoing investments in digital learning platforms and employee well-being programs underscore this commitment, aiming to create an environment where talent thrives and contributes to sustained growth.

Capgemini is well-positioned to capitalize on the growing demand for AI and generative AI services, with these technologies already contributing significantly to its bookings as of late 2024. The company's expansion into key geographic markets like North America and Asia-Pacific, particularly within financial services and consumer goods, presents substantial revenue growth opportunities. Furthermore, the increasing global focus on sustainability and green IT, coupled with investments in resilient, tech-enabled supply chains, creates a fertile ground for Capgemini's specialized offerings.

The cybersecurity market's rapid expansion, driven by escalating cyber threats and regulatory changes, offers another significant avenue for Capgemini's growth. The company's commitment to employee development, especially in AI and cloud technologies, through initiatives like "Get the Future You Want," provides a competitive advantage in talent acquisition and retention. This focus on a skilled and engaged workforce is crucial for driving innovation and client value in a dynamic market.

| Opportunity Area | Market Projection (2024/2025 Data) | Capgemini's Positioning |

|---|---|---|

| AI & Generative AI Services | Global AI market projected to reach hundreds of billions in 2024; GenAI a significant driver. | Strong contribution to bookings, focus on intelligent operations. |

| Geographic Expansion | Robust growth in North America, UK, Asia-Pacific; strong performance in financial services, public sector, consumer goods. | Strategic investments and partnerships in high-growth regions. |

| Sustainability & Green IT | Growing demand driven by environmental regulations and CSR initiatives. | Offering eco-friendly IT solutions and climate technologies; AI/IoT for efficient supply chains. |

| Supply Chain Modernization | Global spending on supply chain tech projected to reach $300 billion by 2027 (from $200 billion in 2023). | Expertise in AI-powered supply chain solutions, friendshoring focus. |

| Cybersecurity Services | Cybersecurity market expected to grow from ~$200 billion (2023) to over $350 billion by 2028. | Strong presence and ability to capitalize on increasing demand and sophisticated threats. |

| Talent Development & Employee Experience | Continued emphasis on upskilling in AI/cloud technologies (e.g., hundreds of thousands trained in 2024). | Competitive edge in talent acquisition/retention through learning initiatives and flexible work. |

Threats

The global IT services market is a battlefield, and Capgemini is up against formidable opponents. Giants like Accenture, Deloitte, and IBM are major rivals, but the landscape also includes nimble niche players constantly emerging with specialized offerings. This intense rivalry, particularly when it centers on price, can significantly squeeze Capgemini's margins and erode its market share.

In 2024, the IT services market is projected to reach over $1.5 trillion globally, highlighting the sheer scale of the competition. Capgemini's ability to stay ahead hinges on its capacity for continuous innovation and clear differentiation. Without a strong unique selling proposition, it's difficult to stand out and capture value in such a crowded arena.

Global economic uncertainties, including the lingering threat of recession and persistent inflationary pressures, directly impact Capgemini's business. These macroeconomic headwinds can dampen client investment in IT services, leading to slower sales cycles and potentially reduced project pipelines. For instance, a significant portion of Capgemini's revenue is tied to discretionary IT spending, which is highly sensitive to economic downturns.

Geopolitical tensions further exacerbate these risks by creating instability and unpredictability in key markets. Conflicts and trade disputes can disrupt supply chains, increase operational costs, and lead to cautious client behavior, especially in sectors like manufacturing. Capgemini has explicitly cited these uncertainties, particularly in Europe, as a reason for a more cautious outlook for 2025, impacting demand for their consulting and technology services.

The escalating sophistication of cyberattacks, amplified by AI advancements, poses a significant threat to Capgemini and its clientele. A substantial portion of companies, reportedly over 70% in some surveys, have experienced breaches linked to Generative AI, highlighting the pervasive risk of data compromise.

Capgemini faces the critical need for continuous, substantial investment in advanced security protocols and stringent compliance frameworks. Protecting sensitive client data and maintaining unwavering trust are paramount, as even a single breach can trigger severe financial penalties and irreparable reputational damage.

Rapid Technological Obsolescence and Need for Continuous Innovation

The relentless pace of technological change, especially in areas like artificial intelligence and quantum computing, poses a significant threat. What is cutting-edge today can be outdated tomorrow, demanding constant adaptation. Capgemini's ability to maintain its competitive edge hinges on its ongoing investment in research and development and its agility in updating its service portfolio. Failure to keep pace with these rapid technological shifts could result in diminished market relevance and a shrinking client base.

For instance, Capgemini's 2023 annual report highlighted a substantial commitment to R&D, but the ever-accelerating nature of innovation means this investment must be sustained and strategically focused. The company faces the challenge of not just adopting new technologies but also anticipating future trends to proactively shape its offerings. This necessitates a culture of continuous learning and a willingness to pivot service models as new capabilities emerge.

- AI Advancement: The rapid evolution of AI necessitates continuous upskilling and adaptation of service offerings to leverage new capabilities and avoid obsolescence.

- Quantum Computing Impact: The emergence of quantum computing could disrupt existing cryptographic methods and data processing, requiring proactive research and strategy development.

- R&D Investment: Capgemini's commitment to R&D, demonstrated by its significant investment in 2023, must be strategically deployed to address emerging technologies and maintain a competitive edge.

Trade Disputes and Protectionist Policies

Rising trade barriers and protectionist policies present a significant threat to Capgemini's global operations. For instance, the ongoing trade tensions between major economies, which intensified in 2023 and are projected to continue influencing global trade dynamics through 2025, can disrupt supply chains and limit market access. This can lead to increased costs and operational inefficiencies.

These protectionist measures, including tariffs and import quotas, can directly impact Capgemini's ability to serve international clients and manage its global workforce effectively. The World Trade Organization (WTO) has noted a concerning rise in trade-restrictive measures, with a significant portion of global trade now affected by such policies, a trend expected to persist into 2025.

- Increased Tariffs: Higher import duties on hardware and software components could inflate Capgemini's operational expenses.

- Market Access Restrictions: Protectionist policies might limit Capgemini's ability to secure new contracts or expand its presence in certain key markets.

- Supply Chain Volatility: Disruptions due to trade disputes can lead to delays in project delivery and impact client satisfaction.

- Inflationary Pressures: Trade barriers can contribute to rising inflation, affecting both Capgemini's costs and its clients' IT spending budgets.

Capgemini faces intense competition from established players and emerging specialists, with market share and margins at risk, especially in price-sensitive segments. The IT services market, projected to exceed $1.5 trillion globally in 2024, demands constant innovation and clear differentiation to stand out.

Macroeconomic instability, including potential recessions and inflation, dampens client IT spending, impacting Capgemini's sales cycles and project pipelines. Geopolitical tensions further add to market unpredictability, affecting operational costs and client caution, particularly in European markets, as noted in Capgemini's cautious outlook for 2025.

The rapid advancement of AI and other technologies, like quantum computing, necessitates continuous R&D investment and agility. Capgemini's significant 2023 R&D spending highlights this challenge, as keeping pace with innovation is crucial to avoid market irrelevance. The threat of cyberattacks, amplified by AI, also demands robust security investments to protect client data and maintain trust.

Rising trade barriers and protectionist policies, a trend noted by the WTO affecting a significant portion of global trade, can disrupt Capgemini's global operations, increase costs, and limit market access through 2025.

| Threat Category | Specific Impact | Example/Data Point |

|---|---|---|

| Intense Competition | Margin pressure, market share erosion | Global IT services market >$1.5 trillion in 2024 |

| Macroeconomic Headwinds | Reduced client IT spending, slower sales | Capgemini's cautious outlook for 2025 due to economic uncertainties |

| Technological Disruption | Risk of obsolescence, need for continuous R&D | 70%+ companies experiencing AI-linked breaches |

| Geopolitical Instability | Supply chain disruption, operational cost increases | Impact on European markets cited by Capgemini |

| Trade Protectionism | Increased costs, limited market access | WTO notes rise in trade-restrictive measures affecting global trade |

SWOT Analysis Data Sources

This Capgemini SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial statements, comprehensive market research reports, and industry expert opinions to provide a well-rounded and insightful assessment.