Capgemini Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capgemini Bundle

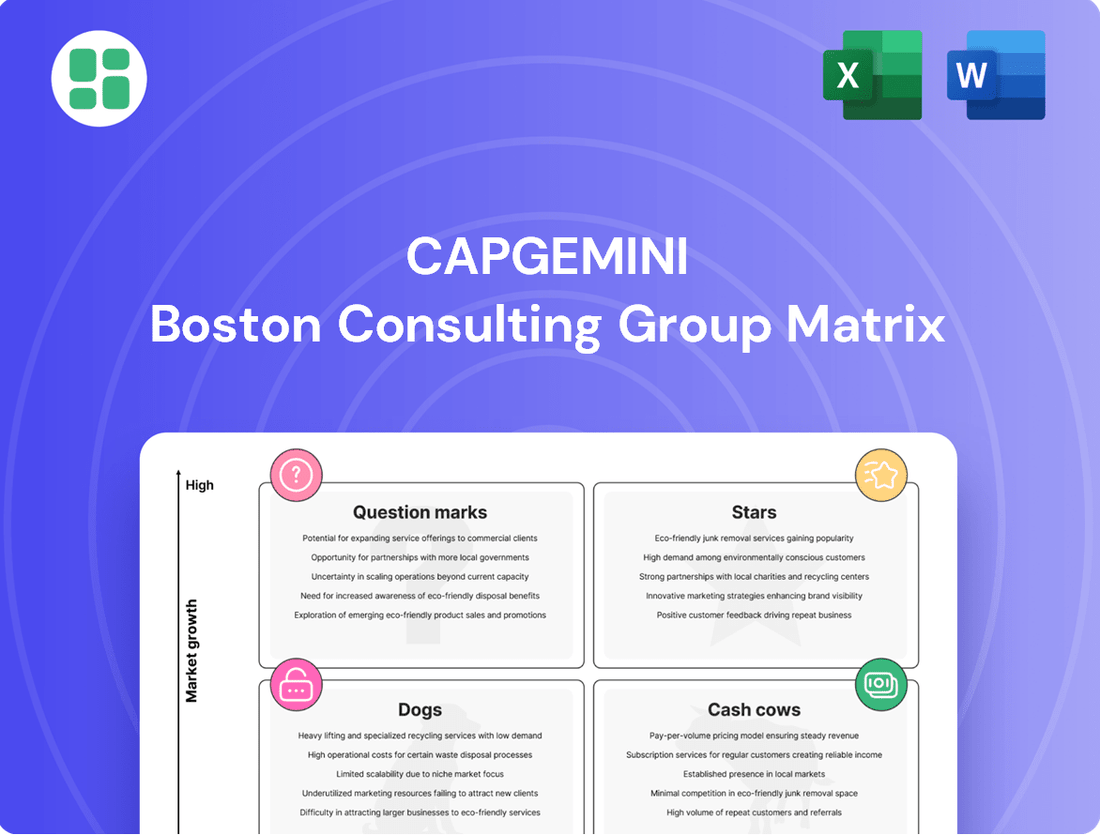

Uncover the strategic positioning of Capgemini's portfolio by understanding its BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear roadmap for resource allocation and future investments. Don't miss out on the actionable insights that can drive your business forward.

Ready to transform your strategic planning? Purchase the full Capgemini BCG Matrix report to gain a comprehensive understanding of each quadrant, detailed data-backed recommendations, and a clear path to optimizing your product portfolio for maximum growth and profitability.

Stars

Capgemini is strategically investing in AI and Generative AI (GenAI), with GenAI representing a substantial 5% of bookings in Q4 2024 and growing to over 6% in Q1 2025. This demonstrates a clear and increasing demand from clients for these advanced solutions.

To meet this demand, Capgemini is building an AI-ready workforce, planning to hire up to 45,000 professionals in India in 2025, with a strong emphasis on AI expertise. They are also launching client platforms for experimenting with industry-specific GenAI applications.

This aggressive push into AI and GenAI positions Capgemini as a frontrunner in a rapidly expanding market. The company is leveraging these technologies to drive significant transformation and enhance operational efficiencies for its clients.

Capgemini stands out as a leader in the global cloud professional services market, a sector experiencing consistent expansion. Their services, which now incorporate Generative AI, are designed to accelerate cloud migrations and deliver innovative cloud solutions, boosting client efficiency.

The demand for Capgemini's cloud expertise remains robust, driven by businesses prioritizing digital transformation initiatives. This strong client interest underscores the critical role cloud adoption plays in modern business strategy.

Capgemini's commitment to data and analytics transformation remains a cornerstone of its client offerings, directly supporting digital transformation initiatives. The company observes robust demand for its data and AI services, underscoring their critical role in modern business strategies.

A significant development in December 2024 was Capgemini's acquisition of Syniti, a prominent player in enterprise data management. This strategic move bolsters Capgemini's capacity to deliver data-driven digital core business transformations, particularly for clients undertaking extensive SAP S/4HANA migrations.

This acquisition is poised to significantly enhance Capgemini's capabilities within the high-growth data management sector. By integrating Syniti's expertise, Capgemini aims to empower clients to unlock greater value and insights from their enterprise data assets.

Cybersecurity Services

Cybersecurity Services represent a Stars segment for Capgemini, fueled by escalating cyber threats and stringent regulations. The global cost of cybercrime is anticipated to hit $10.5 trillion annually by 2025, underscoring the immense market demand.

Capgemini is actively addressing these challenges by embedding AI and machine learning into its security solutions. They are also highlighting quantum security as a critical future requirement, demonstrating a forward-thinking approach.

- High Growth Potential: Driven by increasing cybercrime costs and regulatory mandates.

- Technological Advancement: Integration of AI, machine learning, and focus on quantum security.

- Strategic Positioning: Proactive and adaptive strategies like zero trust architecture.

- Market Relevance: Addressing critical and evolving security needs for businesses worldwide.

Digital Transformation Consulting

Capgemini's strategy and transformation consulting services are showing robust growth, especially evident in 2024 and into Q1 2025. This upward trend highlights their established role as a key advisor for businesses navigating digital and sustainable change.

The demand for these services is being driven by client focus on transformation initiatives designed to boost agility, reduce costs, and enhance overall efficiency. This strategic imperative directly fuels the need for Capgemini's specialized, high-value consulting solutions.

Within the BCG matrix framework, Capgemini's Digital Transformation Consulting stands out as a Star.

- High Market Share: Capgemini commands a significant portion of the digital transformation consulting market.

- Growing Market: The overall market for digital and sustainable transformation services is expanding rapidly as businesses globally seek technological leverage.

- Client-Driven Demand: Businesses are actively investing in transformation to improve agility, cost-effectiveness, and efficiency.

- Strategic Importance: Capgemini's consulting services are critical for clients undertaking complex digital and sustainability journeys.

Capgemini's Digital Transformation Consulting is a Star, characterized by its substantial market share and the rapid expansion of the digital and sustainable transformation services sector. This segment benefits from strong client demand driven by the need for enhanced agility, cost reduction, and improved efficiency.

The company's strategic focus on these areas positions it for continued leadership. Capgemini's consulting services are vital for clients navigating complex digital and sustainability initiatives, making this a high-growth, high-share area.

This segment's performance is a key indicator of Capgemini's ability to capitalize on major market trends. The ongoing investment in digital transformation by businesses globally directly fuels the success of this Star.

The cybersecurity services offered by Capgemini also fall into the Star category. With cybercrime projected to cost $10.5 trillion annually by 2025, the market demand is immense. Capgemini is integrating AI and machine learning into its security solutions and looking ahead to quantum security.

| Business Unit | BCG Category | Key Drivers | Market Data/Projections |

|---|---|---|---|

| Digital Transformation Consulting | Star | Client focus on agility, cost reduction, efficiency; rapid market growth. | Digital transformation market expected to grow significantly through 2025. |

| Cybersecurity Services | Star | Escalating cyber threats, stringent regulations, AI integration. | Global cybercrime costs projected at $10.5 trillion annually by 2025. |

What is included in the product

The Capgemini BCG Matrix offers strategic guidance by categorizing business units or products into Stars, Cash Cows, Question Marks, and Dogs to inform investment decisions.

Capgemini BCG Matrix offers a clear, actionable view of your portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Capgemini's Traditional IT Outsourcing & Managed Services, representing 29% of their 2024 Group revenues, are firmly positioned as Cash Cows. These mature offerings, encompassing long-term IT infrastructure and application management contracts, deliver consistent and predictable revenue, despite a slight dip in Q1 2025 for Operations & Engineering.

The inherent stability of these services, bolstered by Capgemini's vast global delivery network and deep client relationships, ensures a reliable source of cash flow. This segment continues to be a bedrock for the company's financial performance, generating substantial and dependable earnings.

Capgemini's large-scale ERP implementation and support services, particularly for systems like SAP, represent a significant Cash Cow. Their acquisition of Syniti, a company focused on SAP S/4HANA transformations, further solidifies this position. This area benefits from a stable, recurring demand from large enterprises, ensuring consistent revenue streams.

While the ERP market itself might not be experiencing explosive growth, the ongoing need for upgrades, maintenance, and support for these complex systems provides a reliable revenue base for Capgemini. The company's established expertise and extensive client relationships allow for high-profit margins in this mature segment.

In 2024, the demand for digital transformation, including ERP modernization, remains strong. Capgemini's deep bench of SAP consultants and their proven track record in managing complex, multi-year implementations contribute to the profitability and stability of this service line, making it a core Cash Cow for the organization.

Application Maintenance and Support (AMS) represents a significant Cash Cow for Capgemini, anchoring its Applications & Technology services segment. This area contributed a substantial 62% to the group's overall revenues in 2024, underscoring its importance.

The consistent demand for keeping existing enterprise applications running smoothly fuels stable, high-margin revenue streams. Clients depend on these essential services for their day-to-day operations, creating a reliable income base for Capgemini.

Capgemini's established and efficient delivery models for AMS further enhance its profitability. These mature processes allow for cost-effective service provision, maximizing the margins on this critical business function.

Infrastructure Services

Capgemini's Infrastructure Services, encompassing datacenter and network management, function as Cash Cows within the BCG matrix. These services, though in a mature market, generate a substantial and reliable income for the company. Capgemini benefits from significant long-term agreements, utilizing its extensive global presence and operational prowess to secure a strong market position and predictable cash flow, even as the industry evolves towards cloud technologies.

These established services contribute significantly to Capgemini's financial stability. For instance, in 2023, Capgemini reported strong performance in its Application Services segment, which often includes aspects of infrastructure management, demonstrating the continued revenue generation from these mature offerings. The company's ability to manage large-scale, complex infrastructure for a diverse client base underpins this consistent cash generation.

- Stable Revenue Streams: Datacenter and network management provide a consistent and predictable income.

- Long-Term Contracts: Capgemini secures substantial, multi-year agreements in these service areas.

- Global Scale and Efficiency: Leveraging its worldwide operations to maintain market share and profitability.

- Resilience Amidst Cloud Shift: Continued cash flow generation despite the industry's move towards cloud-native solutions.

Business Process Outsourcing (BPO)

Capgemini's acquisition of WNS for $3.3 billion in July 2025 positions its Business Process Outsourcing (BPO) segment as a strong Cash Cow. This move consolidates a mature market, ensuring stable revenue streams for Capgemini.

The strategy involves transforming traditional BPO into an 'Agentic AI-powered Intelligent Operations powerhouse.' This evolution aims to maintain robust revenue and potentially boost margins through automation and the introduction of advanced, AI-driven services.

- Market Maturity: BPO is a well-established sector, providing predictable and consistent revenue.

- Strategic Acquisition: The $3.3 billion purchase of WNS in July 2025 signals Capgemini's commitment to strengthening its position.

- AI Integration: The shift towards 'Agentic AI-powered Intelligent Operations' promises enhanced efficiency and higher value services.

- Revenue Stability: This segment is expected to generate substantial and reliable income, supporting overall business growth.

Capgemini's Application Maintenance and Support (AMS) is a prime example of a Cash Cow, contributing a significant 62% to the group's 2024 revenues. This segment thrives on the consistent, high-margin income generated from keeping existing enterprise applications operational, a necessity for client day-to-day business. Capgemini's efficient delivery models further optimize profitability in this crucial area.

Traditional IT Outsourcing & Managed Services, representing 29% of Capgemini's 2024 revenue, are also solid Cash Cows. These long-term contracts for IT infrastructure and application management provide stable, predictable cash flow, underpinned by Capgemini's extensive global network and strong client relationships. Despite a minor Q1 2025 dip in Operations & Engineering, this segment remains a financial bedrock.

Large-scale ERP implementation and support, particularly for SAP, along with Infrastructure Services like datacenter and network management, also function as Cash Cows. The acquisition of Syniti and WNS (for $3.3 billion in July 2025) further solidifies these mature markets, ensuring stable revenue streams and reinforcing Capgemini's financial resilience.

| Service Area | BCG Category | 2024 Revenue Contribution | Key Characteristics |

|---|---|---|---|

| Application Maintenance & Support (AMS) | Cash Cow | 62% | Stable, high-margin revenue from ongoing application support; efficient delivery models. |

| Traditional IT Outsourcing & Managed Services | Cash Cow | 29% | Predictable cash flow from long-term contracts; strong global delivery and client relationships. |

| ERP Implementation & Support (e.g., SAP) | Cash Cow | Significant | Mature market with consistent demand for upgrades and maintenance; strong expertise. |

| Infrastructure Services (Datacenter, Network) | Cash Cow | Significant | Reliable income from long-term agreements; leverages global scale and operational efficiency. |

| Business Process Outsourcing (BPO) | Cash Cow (post-WNS acquisition) | Growing | Mature market consolidation; transitioning to 'Agentic AI-powered Intelligent Operations' for enhanced efficiency. |

Full Transparency, Always

Capgemini BCG Matrix

The Capgemini BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no altered content, and no hidden surprises – just the complete, analysis-ready strategic tool. You can confidently assess its value, knowing the final version is precisely what you see here, ready for immediate integration into your business planning and decision-making processes.

Dogs

Capgemini may possess proprietary software solutions that are becoming outdated. These legacy products often struggle to compete with newer cloud-native or open-source technologies, resulting in a diminished market share and limited growth potential. For instance, while specific figures for Capgemini's legacy software aren't publicly detailed, the broader IT services market in 2024 shows a strong shift towards cloud adoption, with Gartner projecting worldwide end-user spending on public cloud services to reach $679 billion in 2024, up from $632 billion in 2023.

These older offerings typically require ongoing maintenance without generating significant new revenue streams. They might persist due to existing client contracts, but their ability to attract new business or substantial investment is highly questionable. Such products represent a drain on resources, offering minimal returns and making them prime candidates for strategic divestment or a carefully managed phase-out.

Highly niche, non-scalable localized IT support services represent a challenging segment for Capgemini within the BCG matrix. These engagements, often characterized by small, geographically constrained contracts, struggle to align with Capgemini's core strategy of global digital transformation and high-value offerings. Their limited market share and difficulty in scaling mean they are unlikely to contribute significantly to revenue growth or bolster strategic market positioning.

These localized IT support services typically operate in low-growth segments, facing stiff local competition or catering to extremely specific, limited client needs. Consequently, they consume valuable Capgemini resources without yielding substantial returns. For instance, while Capgemini's overall revenue reached €23.2 billion in 2023, these niche services likely represent a minuscule fraction, failing to drive the kind of expansion seen in their cloud or data analytics offerings.

Capgemini's legacy hardware-specific consulting and maintenance services are positioned in a declining market due to the widespread shift towards cloud adoption and modernized solutions. These offerings cater to aging hardware components and highly customized on-premise systems with diminishing demand.

In 2024, the global IT services market continues its strong pivot towards cloud, with Gartner projecting worldwide IT spending to reach $5.1 trillion in 2024, an increase of 6.8% from 2023, with cloud services being a significant driver. This trend directly impacts the demand for legacy hardware support, suggesting a shrinking addressable market for Capgemini's specialized services in this niche.

These specialized services are likely to represent cash traps for Capgemini, as they require dedicated expertise and resources within a market segment that offers little to no future growth potential. The company's market share in these increasingly obsolete areas is expected to be low, making it difficult to generate substantial returns or achieve significant scale.

Commoditized Basic IT Helpdesk Services (Non-Strategic)

Commoditized basic IT helpdesk services, lacking advanced automation or specialized skills, often exist in intensely competitive, low-margin markets. If Capgemini holds a minimal differentiated market share in these particular offerings, they would be classified as Dogs within the BCG matrix.

These services typically generate low returns and contribute minimally to Capgemini's strategic growth objectives, which are more focused on higher-value areas such as artificial intelligence and cloud computing. For instance, the global IT helpdesk market, while substantial, sees significant price pressure in its basic service segments, impacting profitability for providers without unique value propositions.

- Low Market Share: Capgemini's share in basic, non-strategic IT helpdesk is minimal.

- Low Growth: The market for undifferentiated helpdesk services exhibits slow growth.

- Low Profitability: These services operate on thin margins due to intense competition.

- Non-Strategic Focus: They do not align with Capgemini's push into advanced digital services.

Very Specific Legacy Mainframe Application Modernization (Declining Niche)

Very Specific Legacy Mainframe Application Modernization falls into the Dogs category of the Capgemini BCG Matrix. This niche involves supporting highly specialized, bespoke legacy mainframe applications for a shrinking client base. The market segment itself is experiencing negative growth, and Capgemini's involvement might be limited to a few long-standing clients.

These modernization projects demand deep, specialized, and costly expertise. The declining market segment means that while the revenue might exist, the overall growth potential is minimal, and the return on investment can be questionable. In 2024, the demand for such highly specific mainframe skills continues to contract, with many organizations actively seeking to move away from these older systems.

- Declining Market: The overall demand for very specific legacy mainframe modernization is shrinking, with an estimated negative growth rate in this particular niche.

- High Expertise Cost: Specialized skills required for these bespoke applications are expensive and difficult to find, increasing project costs.

- Limited Growth Potential: The focus is on maintaining existing systems for a small, dwindling client base, offering little opportunity for expansion or new client acquisition.

- Potential Cash Trap: Resources invested in these services may not yield significant strategic value or future growth, potentially becoming a drain on Capgemini's resources.

Capgemini's "Dogs" represent offerings with low market share in low-growth markets, often requiring significant resource investment without commensurate returns. These can include highly commoditized services or niche legacy solutions that are becoming obsolete. For example, basic, undifferentiated IT helpdesk services, if not automated or specialized, would likely fall into this category due to intense competition and low margins.

These segments are characterized by their inability to scale or generate substantial new revenue. They may persist due to existing client relationships but do not contribute to Capgemini's strategic growth objectives, which are increasingly focused on areas like AI and cloud. The IT services market in 2024 continues to emphasize digital transformation, making legacy offerings less attractive.

Capgemini's legacy hardware-specific consulting and maintenance services are a prime example of a Dog. The market's strong pivot towards cloud adoption, with global IT spending projected to reach $5.1 trillion in 2024, directly diminishes the demand for supporting aging on-premise systems. These services represent a cash trap with minimal future growth potential.

Very specific legacy mainframe application modernization also fits the Dog profile. Despite the need for costly, specialized expertise, this niche is experiencing negative growth. Organizations are actively moving away from older systems, limiting Capgemini's ability to acquire new clients or expand its market share in this area.

| Service Area | BCG Category | Market Characteristics | Capgemini's Position | Financial Implication |

|---|---|---|---|---|

| Basic IT Helpdesk | Dog | Low growth, high competition, low margins | Low market share, undifferentiated | Low profitability, resource drain |

| Legacy Hardware Support | Dog | Declining market due to cloud shift | Niche, diminishing demand | Cash trap, minimal ROI |

| Specific Legacy Mainframe Modernization | Dog | Negative growth, shrinking client base | Limited scalability, high expertise cost | Questionable ROI, potential resource drain |

Question Marks

Capgemini is actively exploring quantum computing, viewing it as both a significant cybersecurity risk and a future transformative technology. This positions quantum computing consulting as a potential future Star within their service offerings, though it currently has a minimal market share.

While the quantum computing market is still developing, Capgemini's early investments and research signify a strategic move towards capturing future high-growth opportunities. Their success in translating these early efforts into market leadership and substantial revenue will determine if this segment evolves into a true Star.

Capgemini is actively investigating the Metaverse and Web3, recognizing their potential for innovative digital experiences. These nascent markets, while offering substantial growth prospects, currently exhibit limited widespread adoption, meaning Capgemini's market share is likely nascent.

Significant investment is essential for developing robust solutions and establishing a foothold in these emerging domains. This positions Metaverse and Web3 initiatives as high-risk, high-reward ventures, akin to question marks in a BCG matrix, with the potential to ascend to star status should mainstream adoption materialize.

Capgemini is heavily investing in sustainable technology consulting and Green IT, recognizing the surge in client demand for climate action solutions. Their recent reports indicate a significant uptick in client spending on sustainability initiatives, underscoring technology's crucial role in achieving environmental goals.

While the overall sustainability market is expanding rapidly, Capgemini's precise market share within specialized segments like Green IT is still solidifying. This area presents substantial growth opportunities fueled by evolving regulations and corporate Environmental, Social, and Governance (ESG) commitments, demanding ongoing investment for market leadership.

Hyper-Personalized Customer Experience (CX) AI Solutions

Hyper-personalized customer experience (CX) AI solutions leverage advanced artificial intelligence to craft ultra-tailored interactions, meeting a growing business demand for enhanced customer engagement. This segment shows significant growth potential as companies increasingly focus on creating unique customer journeys.

Capgemini is actively investing in digital and intelligent transformation, including customer experience, to build capabilities in this high-demand area. However, achieving dominant market share in AI-driven personalized CX requires substantial upfront investment in research and development, specialized talent, and ongoing market education. While Capgemini is building its presence, its leadership in this specific niche is still developing.

- Market Growth: The global AI in CX market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5.5 billion by 2028, indicating a strong compound annual growth rate.

- Investment Needs: Developing sophisticated AI for hyper-personalization requires significant R&D expenditure, estimated to be 15-20% of revenue for leading firms in this space.

- Talent Gap: A shortage of AI and CX specialists means companies like Capgemini need to invest heavily in recruitment and training, with demand for these roles increasing by over 30% year-over-year.

- Competitive Landscape: While Capgemini is expanding, established players with deep AI expertise and existing CX platforms are currently leading in market share for highly personalized solutions.

Niche Blockchain-as-a-Service Implementations

Niche Blockchain-as-a-Service (BaaS) implementations, while holding significant disruptive potential, are currently navigating an evolving enterprise adoption landscape, especially for industry-specific applications. Capgemini is likely focusing its investments on developing specialized BaaS offerings tailored to distinct use cases such as enhanced supply chain traceability and robust digital identity management.

These niche BaaS solutions operate within a high-growth market segment. However, their current market share might be relatively low, a common scenario for technologies in their nascent stages. This is compounded by the ongoing need for substantial client education and the continuous development of scalable, client-ready platforms.

- Market Growth: The global BaaS market was projected to reach $25.5 billion by 2024, indicating substantial growth potential for specialized offerings.

- Adoption Challenges: Enterprise adoption of blockchain for niche use cases faces hurdles like integration complexity and the need for regulatory clarity, impacting early market share.

- Capgemini's Strategy: Capgemini's focus on niche BaaS aligns with market trends, aiming to capture value by addressing specific industry pain points with tailored blockchain solutions.

- Success Factors: Future success for these niche BaaS implementations will be critically dependent on achieving wider market adoption and demonstrating the scalability and tangible benefits of their solutions.

Niche Blockchain-as-a-Service (BaaS) implementations, while holding significant disruptive potential, are currently navigating an evolving enterprise adoption landscape, especially for industry-specific applications. Capgemini is likely focusing its investments on developing specialized BaaS offerings tailored to distinct use cases such as enhanced supply chain traceability and robust digital identity management.

These niche BaaS solutions operate within a high-growth market segment. However, their current market share might be relatively low, a common scenario for technologies in their nascent stages. This is compounded by the ongoing need for substantial client education and the continuous development of scalable, client-ready platforms.

The global BaaS market was projected to reach $25.5 billion by 2024, indicating substantial growth potential for specialized offerings. Enterprise adoption of blockchain for niche use cases faces hurdles like integration complexity and the need for regulatory clarity, impacting early market share. Capgemini's focus on niche BaaS aligns with market trends, aiming to capture value by addressing specific industry pain points with tailored blockchain solutions.

| Area of Focus | Market Growth Potential | Current Market Share | Investment Strategy | BCG Classification |

|---|---|---|---|---|

| Quantum Computing Consulting | High (Emerging) | Low (Nascent) | Exploratory Investment | Question Mark |

| Metaverse & Web3 Services | Very High (Emerging) | Low (Nascent) | Significant Investment | Question Mark |

| Sustainable Technology & Green IT | High (Rapidly Expanding) | Solidifying (Growing) | Strategic Investment | Potential Star/Cash Cow |

| AI in Hyper-Personalized CX | High (Strong Growth) | Developing (Expanding) | Substantial Investment | Question Mark |

| Niche Blockchain-as-a-Service (BaaS) | High (Niche Growth) | Low (Nascent/Evolving) | Targeted Investment | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, including sales figures, customer feedback, and competitive intelligence, to provide actionable strategic recommendations.