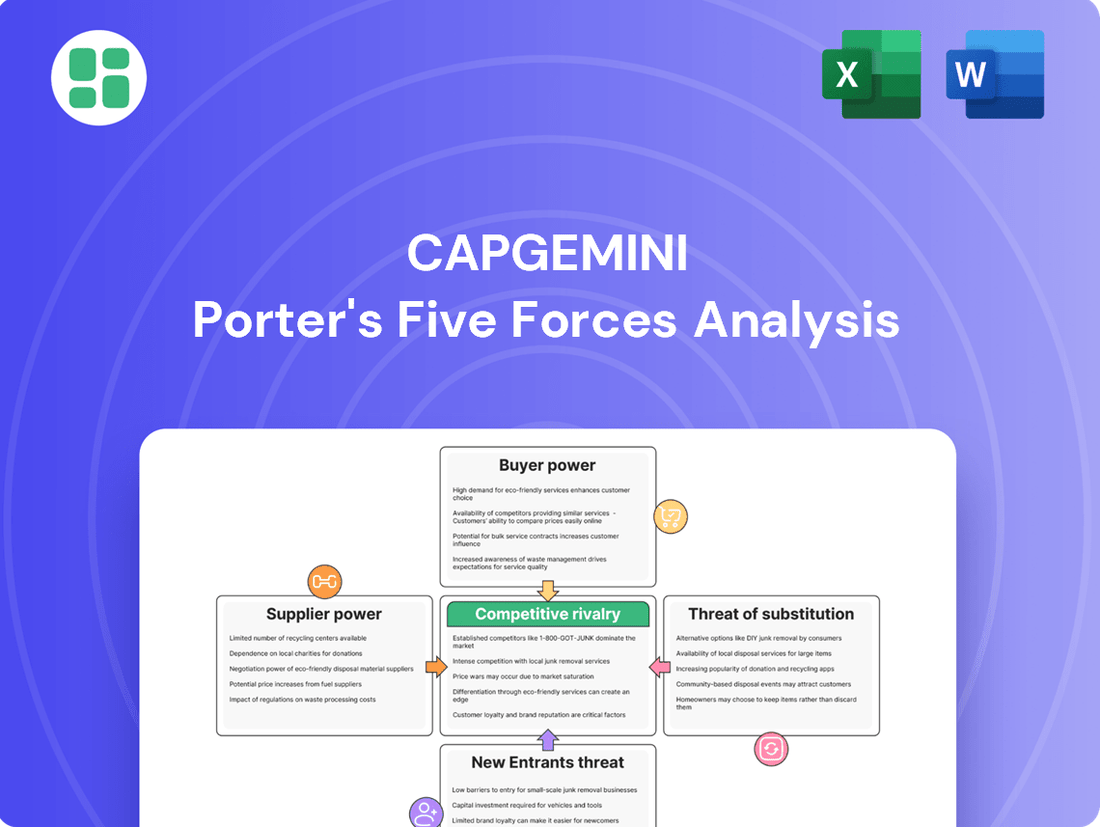

Capgemini Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capgemini Bundle

Capgemini operates in a dynamic consulting landscape, where the threat of new entrants is moderate, and the bargaining power of buyers can be significant due to the availability of alternative solutions. Understanding these pressures is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Capgemini’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Capgemini's reliance on a vast, globally distributed workforce of over 340,000 employees in more than 50 countries underscores the critical role of talent. The intense demand for specialized expertise, particularly in rapidly evolving fields such as artificial intelligence, generative AI, and cloud computing, grants highly skilled individuals and concentrated talent pools a notable degree of bargaining power.

The company's ambitious hiring objectives, including a significant focus on recruiting AI-ready professionals in key regions like India, directly reflect the strategic imperative to secure and retain a highly skilled workforce amidst fierce competition for talent.

Capgemini's strategic reliance on technology partners, particularly hyperscalers like Microsoft, AWS, and Google, grants these entities significant bargaining power. These partners provide the foundational platforms and cutting-edge tools essential for Capgemini's service delivery and innovation. For instance, in 2024, cloud infrastructure spending by enterprises continued its upward trajectory, with hyperscalers capturing a substantial share, underscoring their critical role.

While Capgemini actively engages in co-creation with these giants, mitigating some of their influence, the dependence on access to advanced technologies remains a key factor. The ability to integrate new AI capabilities or specialized cloud services often hinges on the terms dictated by these powerful technology providers. This dynamic highlights the delicate balance Capgemini must maintain to leverage these partnerships effectively without being overly constrained by supplier power.

Capgemini relies on a diverse array of independent software vendors (ISVs) and specialized platform providers to craft robust client solutions. As the market increasingly favors integrated and AI-powered offerings, the distinctiveness and necessity of specific software or platforms can amplify these vendors' bargaining leverage. This dynamic is evident as Capgemini acquired WNS's vertical platforms, highlighting the strategic imperative of securing control over these critical technological building blocks.

Infrastructure and Connectivity Providers

Capgemini's reliance on infrastructure and connectivity providers for its global operations and cloud services means these suppliers can exert significant bargaining power. The sheer scale of Capgemini's needs, particularly with its increasing adoption of hybrid cloud orchestration, can lead to concentrated demand, giving larger providers leverage. For instance, major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) often dictate terms due to their market dominance and the significant switching costs involved for a company of Capgemini's size.

The bargaining power of these infrastructure and connectivity providers is amplified by several factors:

- High Switching Costs: Migrating extensive IT operations and data across different cloud providers or infrastructure vendors involves substantial time, cost, and potential disruption, making Capgemini less agile in changing suppliers.

- Provider Concentration: The market for hyperscale cloud infrastructure is relatively concentrated, with a few dominant players holding a significant share, increasing their ability to set terms. In 2024, the top three public cloud providers (AWS, Azure, GCP) continued to command over 60% of the global cloud infrastructure market.

- Criticality of Service: The seamless functioning of Capgemini's services is directly dependent on the reliability and performance of these infrastructure providers, giving them considerable influence over contract negotiations.

Proprietary Tools and Methodologies

Capgemini's reliance on specialized proprietary tools and methodologies, whether internally developed or licensed, can influence supplier bargaining power. For instance, if a particular AI integration platform, crucial for delivering advanced client solutions, is controlled by a limited number of providers, those suppliers gain leverage. In 2024, the demand for cutting-edge AI and data analytics tools, a core area for Capgemini, saw significant growth, potentially increasing the bargaining power of suppliers offering unique technological advantages.

Suppliers of highly specialized consulting frameworks or unique technology solutions that are integral to Capgemini's service delivery can command greater influence. This is particularly true when these tools are not easily replicable or substitutable. The integration of advanced AI capabilities, a strategic focus for Capgemini, often necessitates partnerships with firms possessing distinct intellectual property in areas like machine learning algorithms or specialized data processing software.

- Proprietary Tool Dependence: Capgemini's ability to deliver certain high-value services may hinge on specific proprietary software or methodologies.

- Supplier Concentration: If only a few firms offer critical, specialized tools or frameworks, their bargaining power increases.

- AI Integration Needs: The push for advanced AI solutions means Capgemini might depend on external suppliers for unique AI platforms or algorithms, enhancing supplier leverage.

- Industry Standard Adoption: The adoption of certain industry-standard proprietary tools can also empower their suppliers if they become essential for competitive service delivery.

Capgemini's reliance on specialized software vendors and proprietary platforms, especially those offering advanced AI capabilities, grants these suppliers significant bargaining power. When these tools are critical for delivering unique client solutions and are not easily substitutable, their influence grows. For instance, the increasing demand for cutting-edge AI and data analytics tools in 2024 amplifies the leverage of suppliers providing distinct technological advantages.

The concentration of providers in niche technology areas, coupled with high switching costs for Capgemini, further strengthens supplier leverage. This is particularly evident in the cloud infrastructure market, where a few dominant hyperscalers like AWS, Microsoft Azure, and Google Cloud Platform (GCP) command over 60% of the global market share as of 2024, dictating terms due to their market dominance and the substantial costs associated with migration.

Capgemini's strategic acquisitions, such as WNS's vertical platforms, highlight the imperative to control critical technological building blocks and mitigate supplier power. However, the ongoing need for integration with advanced AI capabilities often necessitates partnerships with firms possessing unique intellectual property, thereby maintaining supplier leverage in specific areas.

| Factor | Impact on Capgemini | Supporting Data (2024) |

| Supplier Concentration (Cloud) | High Bargaining Power | Top 3 hyperscalers hold >60% global cloud market share. |

| Proprietary AI Tools | Increased Supplier Leverage | High demand for unique AI/data analytics tools. |

| Switching Costs | Reduced Agility, Increased Supplier Power | Significant cost and disruption for IT operations migration. |

| Criticality of Service | Supplier Influence in Negotiations | Service delivery directly depends on infrastructure provider reliability. |

What is included in the product

Capgemini's Porter's Five Forces analysis dissects the competitive intensity within the IT services industry, examining supplier power, buyer bargaining, threat of new entrants, substitute services, and rivalry among existing players.

Quickly identify and mitigate competitive threats with a dynamic visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Capgemini's bargaining power of customers is significantly influenced by its large and sophisticated client base. These clients are typically major enterprises in sectors like financial services, manufacturing, and the public sector, often representing substantial portions of Capgemini's revenue from individual contracts.

These sophisticated clients, often possessing dedicated procurement teams and deep market knowledge, have considerable leverage. For instance, in 2024, large enterprise IT services contracts frequently involved competitive bidding processes where pricing and service level agreements were heavily scrutinized, giving clients the upper hand in negotiations.

The sheer size of the projects undertaken by these clients further amplifies their bargaining power. They can demand customized solutions, specific delivery timelines, and favorable payment terms, knowing that Capgemini, like other major IT service providers, relies on these high-value engagements for growth.

Clients are laser-focused on cutting costs and boosting efficiency, making them a powerful force. This means Capgemini must prove its value and offer competitive pricing to meet demands for tangible returns on technology and consulting. For instance, in 2024, many companies are scrutinizing every expenditure, seeking solutions that directly contribute to bottom-line savings.

The IT consulting and services sector is a crowded space, brimming with both global giants and specialized firms offering comparable solutions. This sheer volume of choice directly empowers customers.

Clients can readily compare offerings and pricing from major players such as Accenture, IBM, Deloitte, and Infosys, making provider switching a low-friction activity if dissatisfaction arises or superior deals appear. For instance, in 2024, the IT services market was valued at over $1.3 trillion, with a significant portion of that revenue driven by client retention and the ability to negotiate favorable terms due to the competitive landscape.

This fierce competition among IT service providers naturally amplifies the bargaining power of customers. They can leverage the availability of alternatives to demand better pricing, service levels, and customized solutions, knowing that if one vendor doesn't meet their needs, many others will.

Shifting Demand for High-Value Services

Customers are increasingly prioritizing digital transformation, but their focus has shifted. They now demand high-value, outcome-based services in areas like cloud, data analytics, and artificial intelligence, moving away from traditional IT outsourcing.

This evolution empowers clients, as they can now select partners who offer specialized expertise and demonstrate a clear ability to drive innovation and deliver tangible business results. For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, with a significant portion driven by advanced services.

- Shift to Outcome-Based Services: Clients are seeking demonstrable business improvements, not just IT support.

- Demand for Specialized Expertise: Cloud, AI, and data analytics skills are highly valued, giving customers leverage.

- Strategic Partnership Expectations: Businesses want providers who can co-innovate and deliver measurable ROI.

- Market Data: The global AI market alone was estimated to grow substantially in 2024, indicating strong demand for these high-value services.

Internal Capabilities and Insourcing Potential

Large clients, particularly those with significant IT needs, consistently hold the leverage to bring services in-house. This insourcing potential is amplified when technologies become more accessible or when off-the-shelf software solutions can effectively manage critical business functions. For instance, the growing maturity of cloud-based platforms and automation tools in 2024 means that a company might find it more cost-effective to manage certain IT operations internally rather than outsourcing them.

This capability directly impacts Capgemini's pricing power. When clients perceive that they can replicate services internally, perhaps through a combination of existing staff and readily available technology, they are less likely to accept premium pricing for outsourced solutions. This threat encourages Capgemini to remain competitive and continuously demonstrate value to retain business, as clients can indeed shift functions back to internal teams if the cost-benefit analysis favors it.

Consider the trend in 2024 where many enterprises are investing in upskilling their internal IT departments. A survey by Gartner in late 2023 indicated that over 60% of large organizations planned to increase their internal digital talent acquisition or training budgets for 2024, specifically targeting areas like data analytics and cloud management, which were previously heavily reliant on external providers.

- Insourcing Threat: Clients can bring IT functions in-house, particularly for strategic or critical processes.

- Technology Accessibility: Easier adoption of technologies and availability of off-the-shelf software empower clients.

- Pricing Power Impact: This capability limits Capgemini's ability to command higher prices.

- Client Leverage: Clients can credibly threaten to insource, forcing Capgemini to be competitive.

Capgemini's customers possess significant bargaining power due to their large size, sophisticated procurement processes, and the highly competitive nature of the IT services market. Clients can readily compare offerings and negotiate favorable terms, especially as they increasingly demand outcome-based, specialized services in areas like cloud and AI. For instance, in 2024, the IT services market exceeded $1.3 trillion, highlighting the intense competition and client leverage.

The ability for clients to insource IT functions, particularly with the increasing accessibility of mature cloud platforms and automation tools, further limits Capgemini's pricing power. Many large organizations in 2024 were investing in upskilling their internal IT teams, with over 60% planning increased digital talent budgets according to Gartner, reinforcing this client leverage.

| Factor | Impact on Capgemini | 2024 Context |

|---|---|---|

| Client Size & Sophistication | High leverage in negotiations | Large enterprises scrutinize pricing and SLAs |

| Competitive Landscape | Amplifies customer power | IT services market > $1.3 trillion |

| Shift to Outcome-Based Services | Requires demonstrable value | Demand for AI, cloud, data analytics |

| Insourcing Potential | Limits pricing power | Increased internal IT investment by clients |

Full Version Awaits

Capgemini Porter's Five Forces Analysis

This preview showcases the complete Capgemini Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the IT services sector. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, providing actionable insights without any placeholders or surprises. You can confidently expect to download this comprehensive report, ready for immediate use in your strategic planning and decision-making processes.

Rivalry Among Competitors

The IT consulting, technology, and outsourcing sector is incredibly crowded, with a multitude of global companies all vying for business. This means Capgemini faces stiff competition from major players like Accenture, IBM, Deloitte, TCS, Infosys, and Cognizant, who offer very similar services.

In 2024, the IT services market is projected to reach over $1.5 trillion globally, highlighting the sheer scale of competition. Capgemini's success hinges on its ability to constantly innovate and set itself apart from these numerous formidable rivals in this dynamic industry.

The race to lead in digital transformation and artificial intelligence is intensifying, making it a critical factor in the IT services industry. Companies like Capgemini are pouring resources into AI and generative AI capabilities, recognizing them as key differentiators. This focus creates a highly competitive environment for securing client projects and attracting top AI talent.

Capgemini's strategic investments, including its partnership with NVIDIA for AI supercomputing centers, underscore the high stakes involved. In 2023, Capgemini reported its AI revenue growing significantly, reflecting the market demand and its commitment to staying at the forefront of this technological shift. This intense rivalry means providers must constantly innovate to maintain their competitive edge.

Capgemini is sharpening its competitive edge by focusing on specialized industry expertise and fostering strong alliances. This strategy aims to deliver unique value, moving beyond simple price competition.

The company highlights its deep understanding of sectors like financial services and manufacturing, coupled with collaborations with tech giants such as Google Cloud, Microsoft, and AWS. These partnerships are crucial for co-developing innovative solutions, as seen in Capgemini's reported revenue growth of 5.4% in 2023, reaching €23.2 billion, partly driven by its cloud and digital transformation services.

Industry Growth and Market Consolidation

The global IT services market is a vast and expanding arena, projected to reach approximately $1.5 trillion by 2024, according to various industry reports. This robust growth presents opportunities for numerous companies, but it also fuels intense competition.

The sector is witnessing significant consolidation, with mergers and acquisitions becoming a key strategy for gaining market share and enhancing capabilities. For instance, Capgemini's acquisition of WNS's digital engineering business in early 2024 highlights this trend, demonstrating a clear pursuit of scale and specialized expertise.

This M&A activity is driven by several factors:

- Market Expansion: Companies seek to broaden their geographic reach and client base through acquisitions.

- Capability Enhancement: Acquiring firms gain access to new technologies, specialized skills, and innovative solutions.

- Competitive Positioning: Consolidation allows larger players to strengthen their competitive advantage and fend off smaller, agile rivals.

- Revenue Diversification: M&A can open up new revenue streams and reduce reliance on existing service offerings.

Pressure on Pricing and Margins

Competitive rivalry in the IT services sector, including Capgemini, intensifies pricing pressure as clients increasingly prioritize cost reduction. This dynamic forces providers to balance competitive bids with the need to sustain healthy operating margins. Firms must therefore focus on enhancing operational efficiencies and delivering higher-value, differentiated services to safeguard profitability.

Capgemini's financial performance demonstrates this ongoing challenge. For instance, in the first quarter of 2024, the company reported revenue growth of 2.4% year-on-year, reaching €5.52 billion. While this indicates continued demand, the need to manage costs and maintain margins remains a critical strategic imperative in a market where price is a significant factor for many clients.

- Intense Competition: The IT services market is crowded, leading to aggressive pricing strategies among players like Capgemini.

- Client Cost Focus: Many clients are actively seeking to optimize their IT spending, directly impacting service provider margins.

- Margin Management: Capgemini, like its peers, must innovate and improve efficiency to protect its operating profit margins.

- Value-Added Services: Shifting towards higher-margin, specialized services is a key strategy to counter pricing pressures.

The IT consulting landscape is intensely competitive, with numerous global firms offering similar services, forcing companies like Capgemini to differentiate through specialization and innovation. This fierce rivalry, evident in the projected $1.5 trillion global IT services market in 2024, drives a constant need for technological advancement, particularly in AI and digital transformation, to secure clients and talent.

Capgemini's strategy involves leveraging deep industry expertise and strategic alliances with tech leaders to offer unique value, moving beyond mere price competition. This approach is supported by acquisitions, such as the early 2024 purchase of WNS's digital engineering business, aiming to expand capabilities and market share in a consolidating industry.

The intense competition also translates to pricing pressure, compelling Capgemini and its rivals to balance competitive bids with margin protection through operational efficiencies and higher-value services. For instance, Capgemini's Q1 2024 revenue growth of 2.4% to €5.52 billion highlights sustained demand but underscores the ongoing challenge of cost management and margin maintenance.

| Competitor | 2023 Revenue (approx. USD billions) | Key Service Areas |

|---|---|---|

| Accenture | $64.9 | Strategy, Consulting, Technology, Operations |

| IBM | $61.9 | Hybrid Cloud, AI, Consulting, Software |

| Deloitte | $64.9 (Global) | Consulting, Audit, Tax, Advisory |

| TCS | $28.0 | IT Services, Consulting, Digital Transformation |

| Infosys | $16.7 | Digital, Cloud, Engineering Services |

| Cognizant | $19.4 | Digital, Technology, Operations |

SSubstitutes Threaten

Many large enterprises are increasingly building robust in-house IT and digital transformation teams. For instance, in 2024, a significant percentage of Fortune 500 companies reported expanding their internal digital capabilities to manage core operations and strategic projects. This trend directly substitutes for external consulting services.

Clients opting to develop or enhance their internal expertise, especially for routine maintenance or specific, less complex digital initiatives, can bypass the need for external providers like Capgemini. This insourcing strategy allows for greater control and potentially lower costs for certain tasks, posing a direct threat.

The growing maturity of cloud platforms and readily available low-code/no-code solutions further empowers organizations to handle more digital tasks internally. This accessibility reduces the perceived necessity of external partners for a wider range of services, impacting Capgemini's market share.

The rise of sophisticated, user-friendly off-the-shelf software and SaaS solutions presents a significant threat to companies offering custom development or consulting. These readily available options, often cloud-based, provide faster deployment and lower initial costs, making them an attractive alternative for businesses needing specific functionalities without a full project. For instance, the global SaaS market was projected to reach over $300 billion in 2024, highlighting the widespread adoption of these alternatives.

The increasing sophistication of automation and AI-driven platforms poses a substantial threat of substitution for Capgemini. These technologies, including advanced AI agents, can now perform tasks previously requiring human expertise, directly impacting service lines like business process outsourcing and routine IT support.

For instance, the ability of AI to handle complex queries and automate workflows means clients might opt for these internal or third-party AI solutions instead of engaging Capgemini for certain managed services. This shift could reduce the need for traditional IT operations and business process outsourcing engagements.

Capgemini's own significant investments in agentic AI underscore the disruptive potential of these technologies. As of early 2024, the market for AI in business process automation is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars globally in the coming years, directly competing with Capgemini's service offerings.

Niche Consulting Firms and Expert Networks

The increasing prevalence of niche consulting firms and expert networks presents a significant threat of substitutes for larger players like Capgemini. These specialized entities can offer highly targeted expertise, effectively addressing specific client needs that might otherwise be handled by a broader consulting engagement. For instance, a boutique firm focusing solely on AI implementation within the financial sector could provide a more agile and cost-effective solution than a large, diversified consultancy for a particular project.

These specialized firms often leverage deep industry knowledge and access to specific talent pools, allowing them to deliver tailored advice and solutions. This trend is particularly evident as businesses seek highly specialized skills for discrete projects, rather than comprehensive, long-term engagements. The consulting market saw continued growth in specialized services in 2024, with many boutique firms carving out profitable niches.

- Niche firms offer specialized expertise, directly competing for project-based work.

- Agility and cost-effectiveness are key advantages for these specialized substitutes.

- The trend towards niche solutions is a growing concern for larger, diversified consultancies.

- Clients may opt for specialized firms when their needs are highly focused and do not require a full-service provider.

Open-Source Technologies and Community Support

The rise of robust open-source technologies and their vibrant community support presents a significant threat of substitutes for traditional IT service providers like Capgemini. These alternatives empower clients to develop and maintain solutions internally, often at a lower cost and with greater flexibility.

While complex, large-scale digital transformations still necessitate expert guidance, many technology implementations and problem-solving scenarios can now be addressed effectively using open-source tools. This can directly reduce the demand for external IT services, impacting the revenue streams of companies like Capgemini.

- Open-Source Adoption Growth: The global open-source market was valued at approximately $22.2 billion in 2023 and is projected to grow significantly, indicating increasing client comfort and capability with these technologies.

- Community-Driven Innovation: Active communities around projects like Linux, Kubernetes, and various AI frameworks provide extensive documentation, support, and continuous development, often rivaling proprietary solutions.

- Cost Reduction for Clients: Companies can significantly cut down on software licensing fees and often reduce reliance on expensive external consultants for implementation and maintenance, making open-source a compelling substitute.

- Talent Pool Availability: The increasing availability of skilled professionals proficient in open-source technologies further lowers the barrier to entry for in-house development and support.

The threat of substitutes for Capgemini is multifaceted, stemming from clients building in-house capabilities, the rise of specialized niche firms, and the increasing adoption of open-source technologies. These alternatives offer greater control, cost savings, and tailored solutions, directly challenging traditional IT and consulting services.

For instance, many enterprises are expanding their internal digital teams, a trend that directly substitutes for external consulting. Furthermore, the global SaaS market's projected growth to over $300 billion in 2024 highlights the widespread adoption of readily available software solutions that can replace custom development needs.

The increasing sophistication of AI and automation also presents a significant substitution threat. AI agents can now perform tasks previously handled by human experts, impacting service lines like business process outsourcing. The market for AI in business process automation is expected to reach hundreds of billions of dollars globally in the coming years, directly competing with Capgemini's offerings.

Finally, the growing prevalence of niche consulting firms and expert networks offers highly specialized expertise, often at a more competitive price point. These specialized entities directly compete for project-based work where clients seek targeted solutions rather than broad engagements.

Entrants Threaten

Entering the global IT consulting and services arena, much like Capgemini operates, demands immense capital. We're talking about significant investments in state-of-the-art infrastructure, cutting-edge technology, and building a widespread global delivery network. For instance, in 2024, major IT service providers continued to invest billions in cloud infrastructure and AI development to maintain their competitive edge.

Newcomers must overcome substantial financial obstacles to even begin building the essential operational capabilities, acquire advanced technological assets, and establish a footprint across diverse geographical regions. This creates a formidable barrier, effectively shielding established companies like Capgemini from the immediate threat of new, smaller competitors entering at a comparable scale.

Capgemini's robust brand reputation, cultivated over 55 years, along with deep-seated client trust among large enterprises, presents a significant hurdle for new competitors. These established relationships are crucial as clients undertaking complex transformation projects demand proven reliability and security, elements that new entrants struggle to quickly demonstrate.

Building this level of trust and proving consistent performance is a lengthy, resource-intensive process, making it difficult for newcomers to displace incumbents like Capgemini. In the high-stakes world of enterprise IT services, trust is not just a reputational asset; it's a fundamental requirement for securing and retaining lucrative, long-term contracts.

The IT services sector demands a vast and diverse pool of highly skilled professionals. New companies entering this market would face significant hurdles in recruiting and retaining the necessary talent, especially in rapidly evolving areas such as artificial intelligence, cloud computing, and cybersecurity. For instance, as of early 2024, the global demand for cybersecurity professionals alone was projected to outstrip supply by over 3 million individuals.

Deep Industry Expertise and Client Relationships

Capgemini's deep industry expertise, honed over decades, acts as a significant barrier to new entrants. This specialized knowledge allows them to craft highly tailored solutions for clients across diverse sectors, a feat difficult for newcomers to replicate quickly. For instance, in 2023, Capgemini reported significant growth in its consulting services, a testament to its ability to win complex, sector-specific projects where deep understanding is paramount.

New entrants often struggle to establish the kind of entrenched client relationships that Capgemini enjoys. These relationships are built on trust, a proven track record, and a deep understanding of client needs, all cultivated over years of successful engagement. Without this established trust, competing for lucrative, long-term transformation projects becomes a considerable challenge.

The accumulated industry knowledge is not easily acquired. It takes years of dedicated effort, investment in talent, and practical experience to build the kind of expertise that allows firms like Capgemini to anticipate market shifts and deliver innovative solutions. This learning curve presents a substantial hurdle for any potential competitor seeking to enter the market and compete effectively.

Key factors contributing to the threat of new entrants:

- Established Client Networks: Capgemini's long-standing relationships provide a stable revenue base and preferential access to new business opportunities.

- Specialized Knowledge Base: Years of experience in sectors like financial services and manufacturing allow for highly targeted and effective service delivery.

- High Switching Costs for Clients: Clients often face significant costs and risks when switching to a new service provider, especially for critical IT and business transformation projects.

Complex Ecosystem of Partnerships and Alliances

The intricate web of established partnerships presents a significant barrier to new entrants. Companies like Capgemini have spent years building deep relationships with key technology providers, cloud giants such as Microsoft Azure and Amazon Web Services, and specialized software firms. These collaborations are not merely transactional; they involve co-development and integrated service offerings that are difficult for newcomers to replicate. For instance, in 2023, Capgemini announced an expanded collaboration with Google Cloud to accelerate digital transformation for enterprises, highlighting the strategic importance of such alliances.

Replicating this extensive network of co-creative alliances requires substantial time, investment, and demonstrated credibility. New entrants would struggle to gain access to the same level of technical integration and joint go-to-market strategies that incumbents leverage. This complex ecosystem effectively locks in existing customers and makes it challenging for new players to offer comparable end-to-end solutions.

Consider these points regarding the threat of new entrants due to the complex ecosystem:

- Established Partnerships: Incumbents possess deep-rooted alliances with major technology vendors and hyperscalers, critical for delivering comprehensive solutions.

- Co-creation and Integration: These partnerships often involve joint product development and deeply integrated service offerings, which are difficult for new firms to establish quickly.

- Time and Investment Barrier: Building a comparable partner network requires significant time, capital, and a proven track record, posing a substantial hurdle for new market entrants.

The IT services industry, where Capgemini operates, presents significant barriers to new entrants, primarily due to the immense capital required for infrastructure, technology, and global reach. For example, leading IT firms continued substantial investments in cloud and AI development throughout 2024, underscoring the high entry costs. These financial demands make it challenging for smaller players to compete at scale, effectively protecting established firms.

Furthermore, building the necessary brand reputation and client trust takes considerable time and consistent performance, which new entrants struggle to achieve quickly. Clients undertaking complex projects prioritize proven reliability, making it difficult for newcomers to gain traction against incumbents with established relationships. This trust factor is a critical, albeit intangible, barrier.

The need for highly skilled talent, particularly in emerging fields like AI and cybersecurity, also poses a significant challenge. As of early 2024, the global demand for cybersecurity professionals was projected to exceed supply by over 3 million, highlighting the intense competition for talent that new entrants must navigate.

Capgemini's deep industry expertise and established client networks further solidify its position. These long-standing relationships, built on trust and a proven track record, provide a stable revenue base and preferential access to new opportunities, making it difficult for new firms to displace them.

| Barrier Type | Description | Impact on New Entrants | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Capital Requirements | High investment in infrastructure, technology, and global operations. | Significant financial hurdle, limiting entry to well-funded organizations. | Continued multi-billion dollar investments by major IT service providers in cloud and AI infrastructure. |

| Brand Reputation & Client Trust | Cultivating trust and a proven track record takes years. | New entrants struggle to win complex, long-term projects requiring high reliability. | Client preference for established providers in critical IT transformation projects. |

| Talent Acquisition & Retention | Need for specialized, in-demand skills (e.g., AI, cybersecurity). | Intense competition for talent makes it difficult for new firms to build capable teams. | Global cybersecurity talent shortage projected to exceed 3 million professionals in early 2024. |

| Industry Expertise | Deep, sector-specific knowledge and understanding of client needs. | Newcomers find it hard to replicate tailored solutions and anticipate market shifts. | Capgemini's reported significant growth in consulting services in 2023, driven by complex, sector-specific projects. |

| Established Partnerships | Deep alliances with technology vendors and hyperscalers. | Difficult for new entrants to match integrated service offerings and co-development opportunities. | Expanded collaborations, like Capgemini's with Google Cloud in 2023, to accelerate enterprise digital transformation. |

Porter's Five Forces Analysis Data Sources

Our Capgemini Porter's Five Forces analysis is built upon a robust foundation of data, leveraging insights from Capgemini's own internal market intelligence, client engagements, and extensive industry research databases. This blend ensures a comprehensive understanding of competitive dynamics.