Cantaloupe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

Cantaloupe, a sweet and refreshing fruit, enjoys strong consumer demand due to its health benefits and versatility. However, it faces challenges from seasonal availability and potential competition from other fruits. Understanding these dynamics is crucial for anyone involved in the fruit industry.

Want the full story behind cantaloupe's market position, including its key strengths, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research in the produce sector.

Strengths

Cantaloupe provides a complete set of technology solutions for unattended retail. This includes everything from cashless payment systems to tools for monitoring inventory remotely and managing self-service kiosks. This end-to-end approach means clients can rely on one provider for essential business operations, streamlining processes and improving the customer experience.

The company's broad range of products, such as micro-payment processing, self-checkout stations, mobile ordering apps, connected point-of-sale systems, and cloud-based enterprise software, caters to diverse needs. These solutions are valuable across various industries, including food and beverage, hospitality, and entertainment sectors.

Cantaloupe solidified its standing as a global leader in self-service commerce, evidenced by its expansive customer base and a significant number of active devices. This leadership is further underscored by the company's robust revenue expansion, particularly in fiscal year 2025, where subscription and transaction fees saw notable increases. This upward trajectory is fueled by a clear shift in consumer behavior towards self-service and cashless payment options, a trend that is actively reshaping the convenience commerce sector.

Cantaloupe's commitment to innovation is a significant strength, evident in their continuous development of cutting-edge products. Recent launches like Smart Store technology, Go Micro kiosks, and the Smart Aisle are designed to tackle critical industry issues such as labor scarcity and pilferage by integrating AI and sophisticated technology.

Strategic acquisitions bolster Cantaloupe's market position and product breadth. The recent integration of CHEQ, a leader in sports and entertainment payment solutions, and SB Software, a UK-based entity, significantly broadens their geographical footprint and service capabilities, reinforcing their competitive edge.

Robust Financial Performance and Outlook

Cantaloupe demonstrated robust financial performance in fiscal year 2025, with revenue climbing to $269.1 million, a significant 23% year-over-year increase. The company also saw its adjusted gross profit margin improve to 44.5%. This strong showing was further bolstered by a substantial 48% rise in adjusted EBITDA, reaching $66.1 million, and a 29% increase in operating cash flow to $57.8 million, underscoring operational efficiency and strong cash generation capabilities.

The outlook for fiscal year 2025 remains exceptionally positive, with Cantaloupe projecting continued growth. Management anticipates revenue to be between $290 million and $300 million, representing a 7.7% to 11.5% increase from FY2025. Furthermore, adjusted EBITDA is expected to grow to between $70 million and $75 million, signaling sustained profitability and confidence in the company's strategic direction and market position.

- Revenue Growth: Fiscal year 2025 revenue reached $269.1 million, up 23% year-over-year.

- Profitability Improvement: Adjusted EBITDA grew 48% to $66.1 million in FY2025.

- Positive Outlook: FY2026 revenue projected between $290 million and $300 million.

- Cash Flow Strength: Operating cash flow increased by 29% to $57.8 million in FY2025.

Extensive Customer and Device Network

Cantaloupe's extensive customer and device network is a significant strength, processing over a billion transactions annually. This vast network spans more than a million active locations, demonstrating deep market penetration. The company's technology is widely adopted across key markets including the U.S., U.K., EU countries, Australia, and Mexico, ensuring a robust and consistent revenue stream from recurring subscription and transaction fees.

Cantaloupe's extensive customer and device network is a significant strength, processing over a billion transactions annually across more than a million active locations. This deep market penetration ensures a robust revenue stream from recurring subscription and transaction fees. The company's technology adoption spans key markets like the U.S., U.K., EU, Australia, and Mexico, highlighting its global reach and stability.

The company's commitment to innovation is evident in its continuous development of cutting-edge products like Smart Store technology and Go Micro kiosks, designed to address industry challenges such as labor shortages. Strategic acquisitions, including CHEQ and SB Software, have further expanded their product offerings and geographical presence, solidifying their competitive edge in the unattended retail market.

| Metric | FY2025 Value | FY2025 vs. FY2024 Growth | FY2026 Projection |

|---|---|---|---|

| Revenue | $269.1 million | 23% | $290 - $300 million |

| Adjusted EBITDA | $66.1 million | 48% | $70 - $75 million |

| Operating Cash Flow | $57.8 million | 29% | N/A |

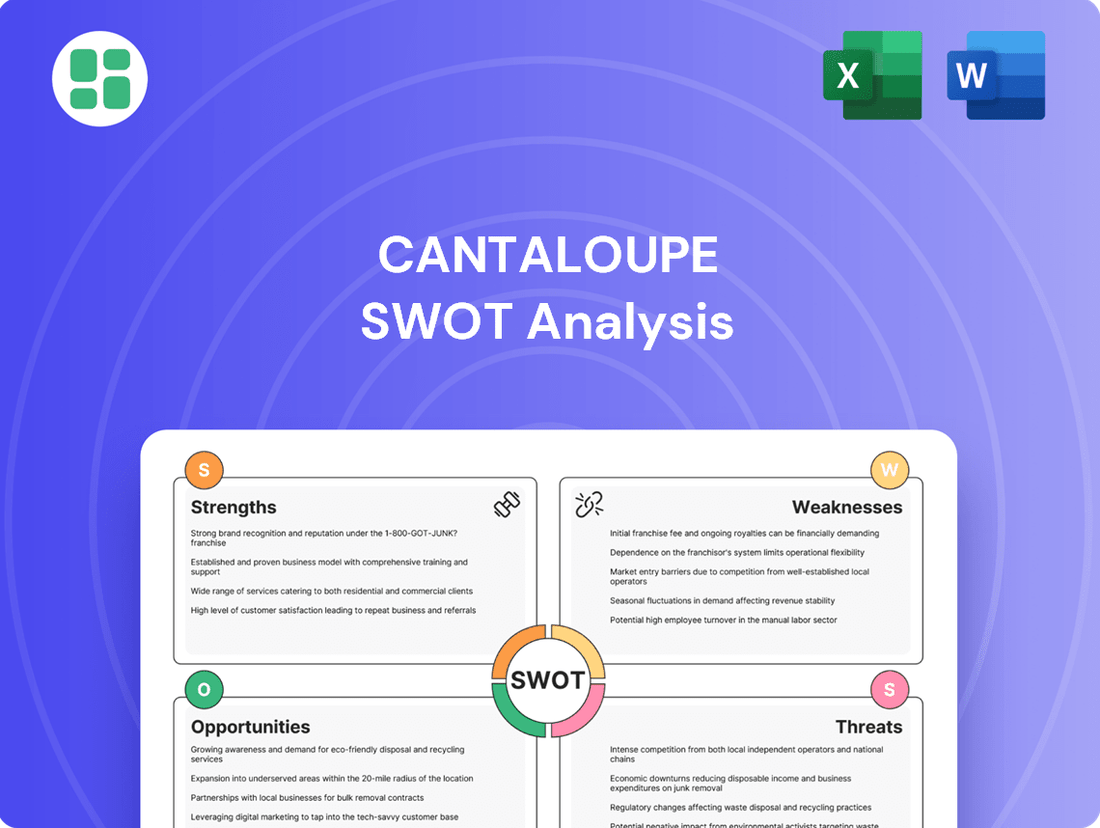

What is included in the product

Analyzes Cantaloupe’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address cantaloupe market challenges and capitalize on opportunities.

Weaknesses

Cantaloupe's business model shows a significant reliance on equipment sales, a trend that has seen a notable decrease in recent fiscal quarters. For instance, in the first quarter of fiscal year 2024, the company reported a decline in revenue from its unattended retail hardware segment.

This dependence on hardware means Cantaloupe is vulnerable to supply chain issues and shifts in demand for new equipment installations. If these factors negatively impact hardware sales, it could directly hinder overall revenue expansion, even with growth in subscription and transaction-based services.

Cantaloupe faces significant headwinds from intense competition within the fintech and unattended retail sectors. Numerous companies, from broad financial technology providers to niche unattended retail solution specialists, vie for market share. This crowded field can exert downward pressure on pricing, necessitate constant investment in new features, and make it challenging to retain existing customers.

Cantaloupe's business is heavily reliant on the unattended retail market, meaning its success is closely tied to how well this sector performs overall. Any slowdown in the growth of self-checkout or vending machines, or a shift in consumer preference away from these options, could directly hurt Cantaloupe's earnings. For instance, while the unattended retail market saw significant growth, reaching an estimated $12.5 billion globally in 2023, a projected growth rate deceleration to 7% in the coming years presents a potential headwind.

Potential Cybersecurity and Data Privacy Risks

Cantaloupe, as a digital payments and software provider, manages sensitive customer and transaction data, making it a target for cyber threats. This exposes the company to significant cybersecurity risks and data privacy concerns, including navigating complex compliance regulations. A data breach could lead to substantial financial penalties and a severe blow to its reputation, impacting customer trust and future business.

- Cybersecurity Breaches: The company's reliance on digital infrastructure presents inherent vulnerabilities to hacking and data theft.

- Data Privacy Regulations: Compliance with evolving data privacy laws, such as GDPR and CCPA, requires continuous investment and vigilance.

- Reputational Damage: A single security incident can erode customer confidence, leading to lost business and long-term brand damage.

- Financial Penalties: Non-compliance with data protection regulations can result in significant fines, as seen with other fintech companies facing millions in penalties.

Integration Challenges with Acquisitions

Cantaloupe's growth strategy has involved acquiring other companies to broaden its reach and services. However, integrating these acquisitions, such as SB Software and CHEQ, often brings significant hurdles. These can range from aligning different IT systems and operational processes to merging diverse company cultures.

These integration challenges can manifest in various ways, potentially leading to operational disruptions and increased expenses. For instance, if the technology stacks of acquired companies are not seamlessly merged, it could hinder efficiency and slow down the realization of expected benefits. In 2023, many companies across various sectors reported higher-than-anticipated integration costs post-acquisition, with some estimates suggesting integration expenses can add 10-20% to the deal value.

A key risk is the potential failure to achieve the projected synergies from these deals. If the integration is not managed effectively, the combined entity might not operate as efficiently as planned, impacting profitability and shareholder value. This could mean that the anticipated cost savings or revenue enhancements from the acquisition simply don't materialize, leaving the company with a less advantageous financial position than initially forecast.

Specific integration challenges can include:

- Technological Compatibility: Merging disparate software systems and data infrastructure can be complex and costly.

- Cultural Differences: Reconciling different organizational cultures and employee expectations requires careful management to avoid internal friction.

- Operational Synergies: Achieving expected efficiencies in supply chains, sales processes, or administrative functions can be delayed or unrealized if integration is poor.

- Customer Transition: Ensuring a smooth transition for customers of acquired businesses is crucial to retain market share and avoid reputational damage.

Cantaloupe's reliance on equipment sales makes it susceptible to market downturns and supply chain disruptions, as seen in its Q1 FY2024 revenue dip in hardware. This dependence limits its ability to mitigate risks even when subscription services grow. The company also faces intense competition in the fintech and unattended retail sectors, which can pressure pricing and necessitate continuous innovation, impacting profitability.

Full Version Awaits

Cantaloupe SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cantaloupe SWOT analysis, offering a clear snapshot of its market position. Purchase unlocks the complete, in-depth report for your strategic planning.

Opportunities

Cantaloupe can significantly broaden its reach by applying its self-service commerce technology to sectors beyond traditional vending, like hospitality, entertainment venues, and even automotive dealerships and large residential complexes. This diversification taps into new revenue streams and customer bases.

The acquisition of CHEQ in late 2023, valued at approximately $10 million, directly positions Cantaloupe to penetrate the high-growth sports and entertainment markets, offering tailored payment and engagement solutions for these venues.

Further international expansion presents a substantial opportunity, building upon Cantaloupe's existing footprint in key markets including the U.S., U.K., various EU countries, Australia, and Mexico, potentially doubling its addressable market.

The growing consumer desire for effortless shopping experiences is a prime chance for Cantaloupe to bolster its AI and tech integration. By expanding on solutions like its Smart Aisle, which leverages AI and 3D cameras, Cantaloupe can offer operators significant operational efficiencies, potentially cutting labor costs by up to 20% in pilot programs, and boosting customer interaction.

The global move towards cashless and contactless payments is a major opportunity. Consumers increasingly prefer the ease and safety of these methods, a trend that has only intensified. In 2024, the global digital payments market was valued at over $10 trillion and is projected to grow significantly, with contactless payments forming a substantial part of this expansion.

Cantaloupe, with its expertise in micro-payment processing and cashless systems, is perfectly positioned to benefit from this shift. By continuing to enhance its payment solutions and promoting their use in vending machines, laundromats, and other unattended retail settings, Cantaloupe can capture a larger share of this growing market.

Strategic Partnerships and Collaborations

Cantaloupe is well-positioned to leverage strategic partnerships, a key opportunity for growth. For instance, their collaboration with Fundbox to introduce Cantaloupe Capital for small business financing in 2023 highlights their ability to create new revenue streams. This type of alliance not only expands their market reach but also strengthens their ecosystem by offering more complete solutions.

Further integrations with other hardware providers present another avenue for expansion. By partnering with complementary technology companies, Cantaloupe can enhance its existing offerings and attract a wider array of customers seeking integrated payment and management solutions.

- Expanding Services: Partnerships can lead to the development of new financial products, like the Cantaloupe Capital initiative, broadening their service portfolio.

- Market Penetration: Collaborations with hardware providers can open doors to new customer segments and geographic markets.

- Ecosystem Enhancement: Integrating with other players strengthens Cantaloupe's value proposition by offering a more comprehensive and seamless user experience.

Modernization of Traditional Retail through Self-Service

The retail sector is actively embracing modernization, with a strong push towards self-service technologies to streamline operations and improve customer satisfaction. This trend is driven by a need to manage rising labor costs and evolving consumer preferences for convenience. Cantaloupe, with its established presence in unattended retail, is well-positioned to capitalize on this shift, offering its expertise to traditional retailers looking to integrate grab-and-go concepts or self-checkout systems.

This expansion into traditional retail presents a significant growth avenue. For instance, the U.S. convenience store market, a key segment for self-service, is projected to reach over $800 billion by 2027, indicating substantial demand for innovative solutions. Cantaloupe's technology can facilitate this by enabling:

- Seamless integration of self-checkout kiosks.

- Development of unattended grab-and-go retail spaces within larger stores.

- Enhanced inventory management for these new retail formats.

Cantaloupe has a prime opportunity to expand its self-service commerce technology beyond vending into sectors like hospitality and entertainment, as demonstrated by its acquisition of CHEQ for approximately $10 million in late 2023, targeting the high-growth sports and entertainment markets.

Further international expansion is a significant growth avenue, as Cantaloupe already operates in key markets including the U.S., U.K., EU countries, Australia, and Mexico, potentially doubling its addressable market.

The increasing consumer preference for cashless and contactless payments, a market valued at over $10 trillion in 2024, presents a major opportunity for Cantaloupe to leverage its micro-payment processing expertise.

Strategic partnerships, such as the 2023 Cantaloupe Capital initiative with Fundbox, offer new revenue streams and market reach, while integrations with other hardware providers can enhance offerings and attract new customers.

The retail sector's modernization, including the adoption of self-service and grab-and-go concepts, provides a substantial growth opportunity, especially considering the U.S. convenience store market is projected to exceed $800 billion by 2027.

| Opportunity Area | Key Driver | Cantaloupe's Position | Example/Data Point |

|---|---|---|---|

| Sector Diversification | Demand for self-service solutions | Leveraging existing tech in new markets | Targeting hospitality, entertainment, automotive |

| International Expansion | Globalization of retail | Established presence in multiple regions | Potential to double addressable market |

| Cashless Payments | Consumer preference for convenience and safety | Expertise in micro-payments and cashless systems | Global digital payments market > $10 trillion (2024) |

| Strategic Partnerships | Ecosystem building and new service offerings | Proven success with financing and tech integrations | Cantaloupe Capital with Fundbox (2023) |

| Retail Modernization | Labor cost management and evolving consumer habits | Positioned for self-checkout and grab-and-go integration | U.S. convenience store market > $800 billion by 2027 |

Threats

The unattended retail and digital payments sectors are drawing significant attention from major tech players and agile startups. These new entrants often possess substantial financial backing and advanced technological expertise, posing a direct challenge to Cantaloupe's market position. For example, while Amazon Go has seen adjustments, its underlying concept highlights the potential for technologically superior solutions to disrupt the industry.

Economic uncertainties, including inflation and potential recessions, pose a significant threat by dampening consumer spending. This directly impacts impulse purchases, a key driver for vending machines and micro markets, which are central to Cantaloupe's business model.

During economic downturns, operators may delay or cancel investments in new equipment and technology. This could slow down Cantaloupe's equipment sales and hinder the acquisition of new customers, affecting revenue streams.

The relentless pace of technological change, particularly in areas like contactless payments, artificial intelligence for customer service, and advanced retail automation, presents a significant threat to Cantaloupe. Staying ahead requires constant investment in research and development to ensure their vending and unattended retail solutions remain cutting-edge.

If Cantaloupe fails to adapt swiftly to new payment technologies or evolving consumer demands for seamless self-service options, their offerings risk becoming outdated. For instance, a rapid shift towards biometric payment systems or highly personalized AI-driven retail experiences could marginalize current technology if not proactively integrated.

Regulatory Changes and Data Security Compliance

Evolving regulations concerning digital payments and data privacy, such as GDPR and CCPA, present a significant threat. These changes can lead to substantial compliance costs and operational hurdles for Cantaloupe. For instance, in 2024, the global cost of data privacy compliance was estimated to be in the billions, a figure expected to rise.

Failure to keep pace with these evolving legal landscapes could result in severe penalties. Cantaloupe's handling of sensitive transaction data makes it particularly vulnerable to hefty fines and legal disputes. A data breach or non-compliance incident could also severely damage its hard-earned reputation among consumers and business partners.

- Increased Compliance Costs: Adapting to new data privacy and payment regulations can require significant investment in technology and personnel.

- Operational Complexity: Implementing and maintaining compliance across various jurisdictions adds layers of operational difficulty.

- Reputational Risk: Non-compliance or data security breaches can lead to a loss of customer trust and damage brand image.

- Financial Penalties: Fines for regulatory violations, especially concerning data privacy, can be substantial, impacting profitability.

Integration Risks from Acquisition by 365 Retail Markets

Cantaloupe's acquisition by 365 Retail Markets, announced in late 2023, presents integration risks. While the deal offers shareholders a premium, the shift to private ownership and merging two substantial businesses introduces potential hurdles. These include aligning corporate cultures, retaining critical talent, and minimizing operational disruptions during the transition.

Successfully integrating Cantaloupe into 365 Retail Markets is crucial for realizing projected synergies. Failure to manage these integration challenges effectively could impede future growth initiatives and stifle innovation within the combined entity. For instance, if key engineers or sales leaders depart, it could directly impact product development timelines and market penetration strategies.

- Cultural Clashes: Merging distinct company cultures can lead to employee dissatisfaction and reduced productivity.

- Loss of Key Personnel: Critical employees might leave during the acquisition, impacting operational continuity and institutional knowledge.

- Operational Disruption: The process of integrating systems and workflows can temporarily disrupt day-to-day business, affecting service delivery and revenue.

- Synergy Realization: Achieving the anticipated cost savings and revenue enhancements from the merger is not guaranteed and depends heavily on effective integration execution.

Intense competition from tech giants and nimble startups entering the unattended retail space poses a significant threat, as these players often bring substantial financial resources and advanced technological capabilities. Furthermore, economic volatility, including inflation and recessionary fears, directly impacts consumer discretionary spending, a key revenue driver for Cantaloupe's vending and micro-market solutions. The rapid evolution of payment technologies and consumer preferences for seamless self-service options also necessitates continuous R&D investment to prevent Cantaloupe's offerings from becoming obsolete.

| Threat Category | Specific Threat | Impact on Cantaloupe | Data/Example (2024/2025) |

|---|---|---|---|

| Competition | New Entrants (Tech Giants & Startups) | Market share erosion, pricing pressure | Amazon Go's disruptive potential highlights the threat of technologically superior solutions. |

| Economic Factors | Inflation & Recessionary Fears | Reduced consumer spending on impulse purchases | Consumer confidence indices in key markets may show declines impacting vending machine usage. |

| Technological Advancements | Rapid Payment/Retail Tech Evolution | Risk of outdated offerings, need for constant R&D investment | The global market for AI in retail is projected to grow significantly, demanding integration of advanced features. |

| Regulatory Environment | Data Privacy & Payment Regulations | Increased compliance costs, potential penalties, reputational damage | Global data privacy compliance costs estimated in billions in 2024, with ongoing increases. |

| Integration Risks | Acquisition by 365 Retail Markets | Cultural clashes, loss of key personnel, operational disruption | Successful integration is critical to realizing projected synergies from the late 2023 acquisition. |

SWOT Analysis Data Sources

This Cantaloupe SWOT analysis is built upon a foundation of robust data, including recent sales figures, consumer preference surveys, and agricultural yield reports. These sources provide a comprehensive view of the market and operational landscape.