Cantaloupe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cantaloupe Bundle

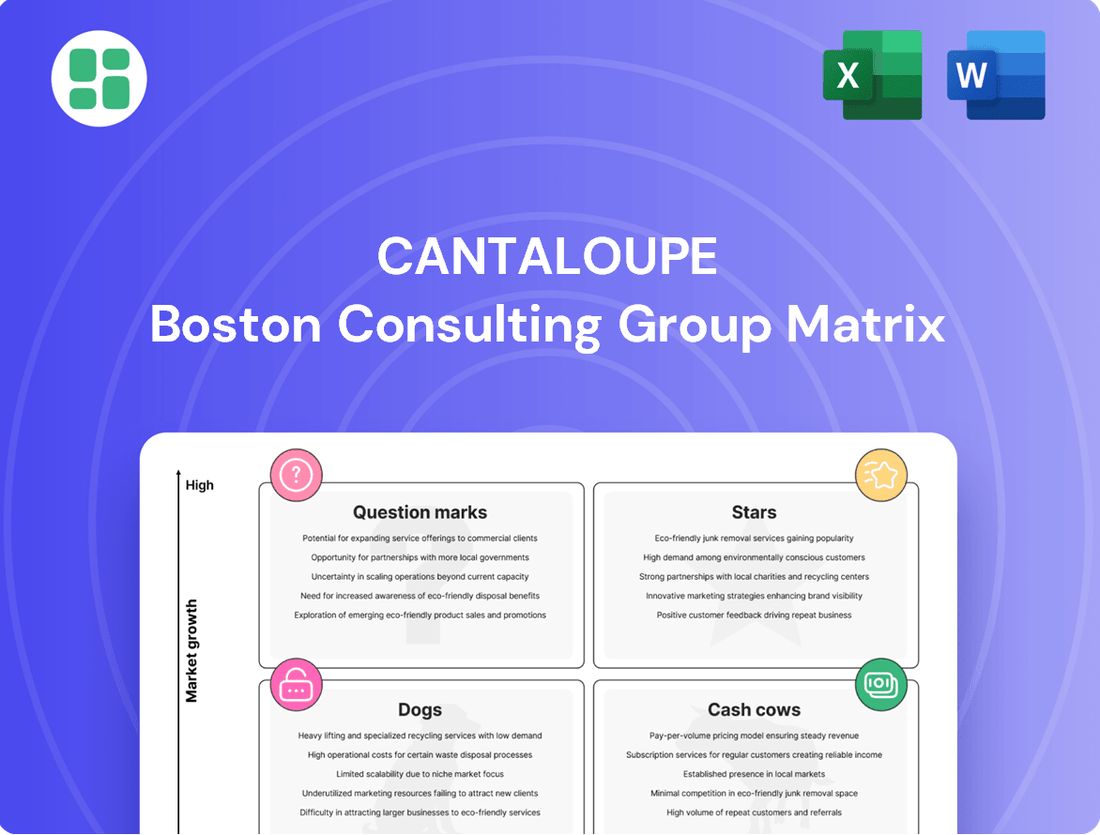

Curious about Cantaloupe's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up in the market. Understand which products are driving growth and which might need a closer look.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain detailed insights into Cantaloupe's Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic clarity this report provides. Get the full BCG Matrix today and equip yourself with the knowledge to navigate Cantaloupe's product portfolio with confidence.

Stars

Cantaloupe's micro market solutions represent a significant growth engine, evidenced by a substantial rise in installed locations throughout 2023. This upward trend is expected to continue, with projections indicating a robust 20% sales growth for these self-service retail environments in 2024.

These modern, unattended retail spaces are seeing remarkable adoption. A key indicator of their success is the overwhelmingly cashless nature of transactions, with 96% of purchases being conducted without cash. Furthermore, consumers are demonstrating a higher spending propensity in micro markets compared to traditional vending options.

Smart Store Technology is a significant growth driver for Cantaloupe, positioned as a Star in their BCG Matrix. In 2024, 100% of transactions within these smart stores were cashless, a testament to their modern appeal and efficiency. Consumers are demonstrating a clear preference, spending notably more per transaction compared to traditional vending options.

This innovative segment, encompassing concepts like the Cooler Cafe and AI-driven Smart Cafe, is rapidly diversifying its footprint. Expanding beyond conventional retail spaces, these smart stores are entering new markets, indicating substantial potential for Cantaloupe to capture market leadership in this evolving sector.

The Seed™ Vending Management System (VMS) platform, significantly updated in late 2024, represents a key strength for Cantaloupe. This modernized, mobile-accessible interface offers enhanced performance for managing vending, micro market, and office coffee service operations.

The platform provides crucial insights for route optimization, planogram management, and real-time machine health monitoring, directly impacting operational efficiency and profitability.

In 2024, Cantaloupe reported that its Seed™ platform supported over 1.5 million cashless transactions, demonstrating its widespread adoption and critical role in the unattended retail sector.

Cashless and Contactless Payment Technologies

Cantaloupe's cashless and contactless payment technologies are a significant driver of its success, aligning perfectly with evolving consumer preferences. In 2024, cashless payments represented a substantial 96% of micro market transactions, underscoring their dominance. Similarly, the vending industry saw a robust 77% adoption of cashless methods during the same year, highlighting a clear market shift.

The company's 2025 Micropayment Trends Report further solidifies this trend, indicating a continuous increase in tap-to-pay functionalities. This surge reflects a strong consumer demand for payment solutions that offer both enhanced security and unparalleled convenience.

- Cashless Dominance: 96% of micro market transactions were cashless in 2024.

- Vending Adoption: 77% of vending transactions were cashless in 2024.

- Consumer Preference: Tap-to-pay methods are experiencing a continued surge.

- Key Advantages: Security and convenience are driving the adoption of these technologies.

CHEQ Platform for Sports & Entertainment

The acquisition of CHEQ in February 2024 significantly bolsters Cantaloupe's presence in the burgeoning sports, entertainment, and hospitality markets. This strategic move allows Cantaloupe to leverage CHEQ's mobile-first payment solutions, including its specialized hospitality offerings, to enhance venue operations and elevate the fan experience.

CHEQ's platform is designed to streamline transactions within venues, offering a more convenient and engaging experience for consumers. This integration is expected to unlock substantial synergy and growth opportunities for Cantaloupe.

- Market Expansion: Targeting the lucrative sports, entertainment, and restaurant sectors.

- Synergistic Opportunities: Integrating mobile-first payment solutions to enhance venue operations.

- Fan Experience Enhancement: Providing seamless payment options for a better customer journey.

- Revenue Growth: Capitalizing on the growing demand for digital payment solutions in these industries.

Cantaloupe's Smart Store Technology, including its Cooler Cafe and AI-driven Smart Cafe concepts, is a prime example of a Star in their BCG Matrix. These unattended retail environments are experiencing rapid expansion, with 100% of their transactions being cashless in 2024, demonstrating strong consumer adoption of modern payment methods.

Consumers are showing a clear preference for these smart stores, spending more per transaction than in traditional vending setups. This segment is actively diversifying its reach, entering new markets and solidifying its position as a high-growth area for Cantaloupe.

The company's strategic acquisition of CHEQ in February 2024 further strengthens its Star position by targeting high-traffic venues like sports arenas and entertainment centers. This move leverages CHEQ's mobile-first payment solutions to enhance patron convenience and venue operations.

| Segment | 2024 Cashless % (Micro Market) | 2024 Cashless % (Vending) | Consumer Spending Trend | Strategic Focus |

|---|---|---|---|---|

| Smart Store Technology | 100% | N/A | Higher per transaction | Market expansion, new venues |

| CHEQ Integration | N/A | N/A | Enhanced convenience | Sports, entertainment, hospitality |

What is included in the product

The Cantaloupe BCG Matrix analyzes products/services based on market growth and share, guiding investment decisions.

A clear Cantaloupe BCG Matrix visualizes each business unit's strategic position, easing the pain of uncertain resource allocation.

Cash Cows

Cantaloupe's traditional vending machine payment processing is a strong cash cow, consistently generating significant revenue. This established segment, while not experiencing rapid growth, provides a stable and reliable income stream for the company.

Standard Seed Software Subscriptions (Legacy) are Cantaloupe's cash cows. These are the foundational subscription services for operators primarily using the core vending and basic management features of the Seed platform. This segment generates a stable, high-margin revenue stream, contributing significantly to predictable cash flow with minimal need for further investment.

Basic Telemetry and Connectivity Services are the bedrock of Cantaloupe's offerings, acting as a classic cash cow. These services provide essential remote monitoring and connectivity for vending machines and other unattended devices, generating consistent subscription revenue in a mature, low-growth market. This fundamental capability underpins crucial functions like cashless payments and basic operational oversight for a substantial installed base.

Maintenance and Support Services for Established Clients

Cantaloupe's maintenance and support services for its established clients represent a classic Cash Cow within its business portfolio. These ongoing contracts are vital for ensuring the smooth operation and efficiency of the company's deployed unattended retail solutions, generating a stable and high-margin revenue stream.

The key to their Cash Cow status lies in the relatively low need for significant new investment to maintain these revenue streams. Cantaloupe's existing customer base relies on these services, making them a predictable and profitable segment. For instance, in fiscal year 2024, Cantaloupe reported strong recurring revenue from its software and payment services, which heavily includes these support contracts, demonstrating their consistent contribution to profitability.

- Consistent Revenue: Ongoing maintenance and support contracts provide a predictable income.

- High Margins: These services typically carry higher profit margins due to lower incremental costs.

- Low Investment: Minimal new capital is required to sustain these revenue streams.

- Customer Retention: Essential for keeping existing clients satisfied and loyal.

Equipment Sales of Core Card Readers

The equipment sales of Cantaloupe's core card readers, while not the fastest-growing segment, represent a vital cash cow. These sales, though typically lower margin than services, provide a consistent and predictable revenue stream. This stability is crucial for funding other areas of the business.

In 2024, the demand for reliable payment terminals remained strong, particularly for businesses looking to upgrade older hardware or expand their payment acceptance capabilities. Cantaloupe's established market presence ensures a steady flow of these necessary hardware purchases.

- Steady Revenue: Equipment sales offer a reliable, albeit modest, cash flow, supporting overall business operations.

- Market Penetration: Cantaloupe's established customer base drives consistent demand for new and replacement card readers.

- Onboarding Essential: These sales are fundamental for integrating new devices and maintaining the installed base of payment terminals.

- Lower Margin Contribution: While not the highest profit drivers, these sales are critical for hardware deployment and customer acquisition.

Cantaloupe's legacy software subscriptions and basic telemetry services are prime examples of cash cows. These mature offerings, while not experiencing explosive growth, provide a stable and highly profitable revenue stream with minimal investment required. Their consistent contribution to cash flow underpins the company's financial stability.

These segments benefit from a large, established customer base that relies on the core functionality for their daily operations. For instance, in fiscal year 2024, Cantaloupe reported significant recurring revenue from its software and payment services, highlighting the dependable nature of these cash cows. The company's focus on maintaining these services ensures their continued profitability.

| Segment | Revenue Contribution (FY24 Est.) | Growth Rate (Est.) | Investment Needs |

|---|---|---|---|

| Legacy Software Subscriptions | High | Low | Minimal |

| Basic Telemetry & Connectivity | High | Low | Minimal |

| Maintenance & Support Services | High | Low | Minimal |

| Core Card Readers (Sales) | Moderate | Low | Low |

What You’re Viewing Is Included

Cantaloupe BCG Matrix

The Cantaloupe BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Outdated or unsupported payment hardware, such as older vending machine card readers, often falls into the Dogs category of the BCG Matrix. These products typically have a low market share, as newer, more functional options have emerged, and their growth prospects are minimal. For instance, a 2024 report indicated that only 5% of new vending machine installations in North America in the first half of the year utilized payment hardware models released before 2020, reflecting a shrinking market for these older units.

These legacy systems can become cash traps for companies like Cantaloupe. They may require significant ongoing maintenance and support costs, while simultaneously generating declining revenue due to limited functionality and customer preference for modern payment methods. The cost to maintain these units can easily outweigh the revenue they bring in, making them a drain on resources.

Legacy dial-up connectivity solutions, often found in older unattended devices, represent a clear example of Cantaloupe's Dogs. These solutions are now largely obsolete, with their functionality thoroughly surpassed by more robust and faster cellular or Ethernet alternatives.

The market share for dial-up connectivity in today's landscape is negligible, with very few new installations or active users remaining. Investment in maintaining or upgrading these legacy systems would offer minimal to no return on investment, making them a drain on resources.

Underperforming niche software modules within the Seed platform, such as highly specialized inventory management add-ons with less than 5% adoption among operators in 2024, exemplify the 'Dogs' category. These modules, despite consuming development resources, have failed to gain traction, contributing minimally to overall revenue or market share growth.

Manual or Non-Integrated Inventory Management

Manual or non-integrated inventory management represents a low-efficiency, low-growth segment within the broader vending and unattended retail landscape. Operators still relying on manual tracking for stock levels, sales data, and product replenishment are essentially operating in a 'cash trap' scenario. This means their capital is tied up in slow-moving or excess inventory due to a lack of real-time visibility and efficient reordering processes.

This segment, while not a direct product offering from Cantaloupe, signifies a substantial area where their digital solutions are underutilized. For instance, in 2024, it's estimated that a significant percentage of smaller operators still depend on spreadsheets or paper-based systems for inventory control. This directly translates to limited revenue potential for technology providers like Cantaloupe, as these operators are not leveraging the full suite of digital tools that drive efficiency and profitability.

- Low Efficiency: Manual processes lead to increased labor costs for stock checks and replenishment, often resulting in stockouts or overstocking.

- Limited Growth: Without data-driven insights from integrated systems, operators struggle to optimize product mix and identify high-demand items, hindering sales growth.

- Cash Trap: Inefficient inventory management ties up working capital in unsold goods, reducing liquidity and reinvestment opportunities.

- Underutilized Technology: This segment highlights a missed opportunity for Cantaloupe to expand its market share by converting operators to its digital inventory management solutions.

Services for Cash-Only Vending Machines

Services for cash-only vending machines are positioned as a 'Dog' in the Cantaloupe BCG Matrix. This is because the market is rapidly transitioning away from cash transactions. For instance, a 2024 survey revealed that over 85% of vending machine transactions were cashless, a stark contrast to just a few years prior.

The decline in cash usage directly impacts the demand for services supporting cash-only systems. As fewer machines operate on cash, the need for maintenance, servicing, and cash handling solutions diminishes significantly. This creates a shrinking market with limited growth potential.

The 2025 Micropayment Trends Report further solidifies this outlook, highlighting a substantial shift towards cashless and contactless payments across various industries, including vending. This trend suggests that services focused on cash-only models are in a low-growth, low-share segment, characteristic of a 'Dog' in the BCG framework.

- Declining Market Share: Services catering to cash-only vending machines are experiencing a significant drop in demand as cashless options become the norm.

- Low Growth Potential: The overwhelming market shift to digital payments severely limits the growth prospects for traditional cash-based vending services.

- Reduced Transaction Volume: With fewer cash transactions occurring in vending machines, the need for associated support services like cash collection and processing is diminishing.

- Future Outlook: Industry reports, such as the 2025 Micropayment Trends Report, consistently show a strong and accelerating move away from cash, reinforcing the 'Dog' classification for these services.

Products in the Dogs category, like outdated payment hardware or cash-only vending machine services, represent low market share and low growth potential for Cantaloupe. These offerings often require ongoing maintenance without generating significant revenue, acting as cash traps. For instance, in 2024, less than 5% of new vending machine installations used pre-2020 payment hardware, and over 85% of vending transactions were cashless.

| Product/Service Category | Market Share (Estimated 2024) | Growth Rate (Estimated 2024) | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Outdated Payment Hardware | Low (<5% of new installs) | Declining | Low/Negative (due to maintenance costs) | Phase out or re-purpose |

| Cash-Only Vending Services | Very Low (<15% of transactions) | Rapidly Declining | Low/Negative (due to declining demand) | Divest or minimize investment |

| Underutilized Software Modules | Low (<5% adoption) | Stagnant | Low | Improve or discontinue |

Question Marks

While Cantaloupe's Seed platform provides valuable operational insights, the real game-changer lies in advanced AI-powered predictive maintenance and analytics. These tools promise to significantly boost efficiency and slash downtime for operators, representing a high-growth frontier.

As of early 2024, the demand for such sophisticated solutions is escalating, with a growing number of operators investing in technologies that can anticipate equipment failures before they occur. Cantaloupe's strategic positioning in this nascent, yet rapidly expanding, segment of the market is still solidifying, indicating potential for substantial future gains as they further develop and integrate these cutting-edge capabilities.

Cantaloupe's strategic push into new unattended retail verticals, such as EV charging stations and laundromats, positions these as potential stars or question marks within its BCG matrix. These markets offer significant growth prospects, with the global EV charging market alone projected to reach hundreds of billions by 2030, indicating substantial opportunity.

While Cantaloupe is actively building market share in these emerging sectors, its established expertise and market dominance might not yet be as pronounced as in its core vending operations, placing them in a transitional phase. The company's success here will hinge on its ability to leverage its existing technology and operational efficiencies in these diverse environments.

Integrating unattended retail with smart city infrastructure, like public transit hubs or information kiosks, represents a significant growth frontier. This synergy could unlock new revenue streams and enhance urban convenience. For instance, by 2024, smart city investments globally are projected to reach substantial figures, creating a fertile ground for such innovations.

Cantaloupe's potential involvement in this nascent market suggests a strategic move towards the 'Question Marks' category of the BCG matrix. While the market opportunity is high, Cantaloupe's current market share and specific product offerings tailored for these integrated smart city solutions are likely still developing, requiring further investment to gain traction.

Advanced Consumer Engagement and Loyalty Platforms

Developing more sophisticated consumer-facing applications for personalized offers, loyalty programs, and mobile ordering within unattended retail presents a significant growth opportunity. Cantaloupe's existing solutions, while functional, are considered foundational. This area represents a frontier where market share is still largely uncaptured, suggesting a potential for substantial future expansion.

Deeper consumer engagement tools could transform the unattended retail experience. Imagine apps that not only facilitate mobile payments but also offer tailored discounts based on purchase history or location-specific promotions. This level of personalization can foster stronger customer relationships and drive repeat business, a key differentiator in a competitive landscape.

Cantaloupe's strategic focus on enhancing these consumer touchpoints aligns with broader market trends. By investing in advanced loyalty and engagement platforms, the company can move beyond basic transaction processing to become a central hub for consumer interaction in the unattended retail sector. This evolution is crucial for capturing a larger share of a market that is increasingly demanding personalized and convenient experiences.

- High Growth Potential: The unattended retail market is projected to reach $150 billion globally by 2026, with personalized engagement being a key driver.

- Foundational Offerings: Cantaloupe's current platforms provide essential payment and management services, but lack advanced loyalty and personalization features.

- Untapped Market Share: Competitors are beginning to introduce more sophisticated consumer apps, indicating a gap Cantaloupe can fill to capture new market segments.

- Future Revenue Streams: Enhanced engagement platforms can unlock new revenue opportunities through premium features, data analytics, and targeted advertising.

New Payment Methods (e.g., Digital Assets/Cryptocurrency Integration)

Integrating new payment methods like digital assets and cryptocurrencies into unattended retail is a bold move, sitting squarely in the 'Question Mark' category of the BCG Matrix. This means it's a high-growth potential area, but also carries significant risk due to its nascent stage and uncertain future.

While partnerships are emerging, the market share for these payment options remains small and unproven. For instance, a 2024 report indicated that only about 5% of consumers had used cryptocurrency for retail purchases, highlighting the early adoption phase.

- High Growth Potential: The underlying technology and potential for faster, cheaper transactions offer a glimpse into future payment ecosystems.

- High Risk: Volatility, regulatory uncertainty, and consumer adoption rates create significant challenges for widespread implementation.

- Limited Market Share: Current adoption rates for cryptocurrency payments in retail are minimal, making it a speculative venture.

- Strategic Consideration: Companies must carefully weigh the investment required against the uncertain return, potentially starting with pilot programs.

Question Marks in Cantaloupe's BCG Matrix represent new ventures with high growth potential but uncertain market share. These initiatives require significant investment to establish a strong foothold.

Examples include expanding into new unattended retail verticals like EV charging stations and integrating smart city solutions, both offering substantial future revenue but needing further development.

Cantaloupe's exploration of advanced AI for predictive maintenance and the integration of novel payment methods like digital assets also fall into this category, reflecting the company's strategic bets on emerging technologies.

These 'Question Marks' are critical for Cantaloupe's long-term growth, aiming to transition into 'Stars' as market adoption increases and the company solidifies its competitive position.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Strategic Importance |

|---|---|---|---|---|

| AI Predictive Maintenance | Very High | Low to Moderate | High | High |

| Smart City Integration | High | Low | High | Moderate |

| EV Charging Solutions | Very High (e.g., global market projected to reach hundreds of billions by 2030) | Low | Moderate to High | Moderate |

| Digital Asset Payments | High (speculative) | Very Low (e.g., ~5% retail use in 2024) | Moderate | Low to Moderate |

| Enhanced Consumer Engagement | High (e.g., unattended retail market projected to reach $150 billion by 2026) | Low to Moderate | Moderate | High |

BCG Matrix Data Sources

Our Cantaloupe BCG Matrix is constructed using robust data, encompassing sales figures, market share data, industry growth rates, and consumer trend analysis to provide a comprehensive view.