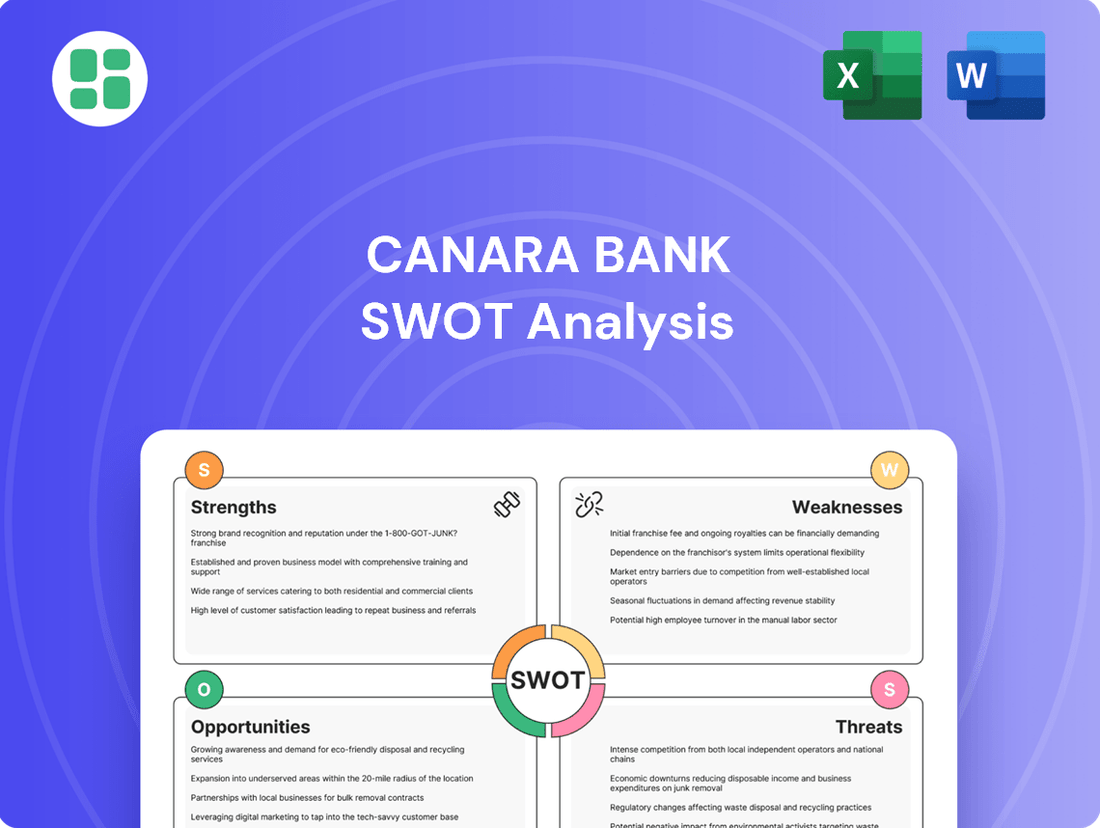

Canara Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Canara Bank boasts strong brand recognition and a robust digital presence, key strengths in today's competitive banking landscape. However, potential challenges like increasing competition and evolving regulatory frameworks necessitate a deeper understanding of its strategic positioning.

Want the full story behind Canara Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Canara Bank commands an impressive physical footprint with over 9,500 branches and more than 13,400 ATMs strategically located throughout India as of 2023. This extensive network ensures remarkable accessibility for customers, spanning urban centers, semi-urban towns, and crucial rural areas. Such a widespread presence is a significant advantage in serving a broad demographic and promoting financial inclusion.

Canara Bank, as a significant public sector undertaking, benefits immensely from its majority ownership by the Government of India. This backing instills a high degree of stability and credibility, fostering greater confidence among depositors and investors alike. For instance, as of March 31, 2024, the Government of India held a 62.93% stake in Canara Bank, underscoring this strong governmental linkage.

Canara Bank has demonstrated a notable strengthening of its asset quality. As of March 2025, the Gross Non-Performing Assets (GNPA) ratio stood at a healthy 2.94%, a significant improvement that reflects effective risk management. This decline in bad loans is a key indicator of the bank's enhanced operational efficiency and credit assessment processes.

Further bolstering this positive trend, the Net Non-Performing Assets (NNPA) ratio has fallen to an impressive 0.70%. This low ratio signifies that the bank is effectively managing its non-performing assets after accounting for provisions, which is crucial for maintaining profitability and financial stability.

The bank's profitability has also seen a substantial boost, with net profit growth reaching 33.19% for the fiscal year 2025. This robust growth is supported by a strong provision coverage ratio of 92.70%, indicating Canara Bank's prudent approach to provisioning for potential loan losses and its solid financial footing.

Diverse Product Portfolio and Customer Base

Canara Bank boasts a diverse product portfolio, spanning retail and corporate banking, treasury operations, wealth management, and insurance. This broad offering caters to a wide range of customers, from individual consumers and small to medium-sized enterprises (SMEs) to large corporations and the agricultural sector. For instance, as of the fiscal year ending March 31, 2024, Canara Bank reported a total business of over ₹20.94 lakh crore, reflecting its extensive reach.

The bank's commitment to financial inclusion is evident through its innovative schemes, particularly those designed for rural and semi-urban areas. These initiatives not only serve a broad customer spectrum but also actively promote financial literacy and access to banking services for underserved populations. This strategic focus on diverse customer segments and tailored product offerings is a significant strength.

- Comprehensive Services: Offers retail, corporate banking, treasury, wealth management, and insurance.

- Broad Customer Reach: Serves individuals, SMEs, large corporations, and the agricultural sector.

- Financial Inclusion Focus: Innovative schemes target rural areas, expanding customer base.

- Significant Business Volume: Total business exceeded ₹20.94 lakh crore by March 31, 2024.

Commitment to Digital Transformation and Innovation

Canara Bank is demonstrating a strong commitment to digital transformation, with a substantial three-year technology roadmap valued at around ₹1,500 crore. This investment is geared towards enhancing various banking operations through the deployment of advanced technologies like Artificial Intelligence and Machine Learning. These AI/ML models are being utilized for critical functions such as improving cross-selling opportunities, predicting customer churn, and forecasting non-performing assets (NPAs).

The bank's dedication to digital innovation is further evidenced by its recent accolades. Canara Bank has received recognition through awards for its performance in digital banking services and its robust cybersecurity initiatives. This forward-thinking approach positions the bank favorably in an increasingly digital financial landscape.

- Significant Tech Investment: ₹1,500 crore allocated over three years for digital transformation.

- AI/ML Deployment: Utilizing artificial intelligence and machine learning for cross-selling, churn prediction, and NPA prediction.

- Industry Recognition: Awards received for digital banking performance and cybersecurity efforts.

Canara Bank's extensive branch network, exceeding 9,500 locations as of 2023, ensures broad customer accessibility across India, fostering financial inclusion. Its strong government backing, with the Government of India holding a 62.93% stake as of March 31, 2024, provides significant stability and credibility. The bank has shown a remarkable improvement in asset quality, with its Gross NPA ratio falling to 2.94% and Net NPA to 0.70% as of March 2025, reflecting effective risk management and operational efficiency.

The bank's profitability has surged, with net profit growth reaching 33.19% for FY25, supported by a robust provision coverage ratio of 92.70%. Canara Bank offers a diverse product portfolio, catering to retail, corporate, and agricultural sectors, with total business exceeding ₹20.94 lakh crore by March 31, 2024. Its commitment to digital transformation, backed by a ₹1,500 crore investment over three years, is enhancing operations through AI and ML, earning industry recognition for its digital banking and cybersecurity efforts.

| Metric | Value (as of March 2025) | Significance |

|---|---|---|

| Gross NPA Ratio | 2.94% | Indicates improved asset quality and risk management. |

| Net NPA Ratio | 0.70% | Shows effective management of non-performing assets after provisions. |

| Net Profit Growth (FY25) | 33.19% | Highlights strong profitability and operational performance. |

| Provision Coverage Ratio | 92.70% | Demonstrates prudent provisioning for loan losses. |

| Total Business (as of March 31, 2024) | ₹20.94 lakh crore | Reflects substantial market presence and customer engagement. |

What is included in the product

Analyzes Canara Bank’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Canara Bank's competitive landscape, highlighting areas for improvement and leveraging strengths to overcome market challenges.

Weaknesses

Canara Bank's Current Account and Savings Account (CASA) ratio, a key indicator of its low-cost funding base, was approximately 28.3% as of June 2025. This figure suggests a greater dependence on more costly term deposits for funding.

A lower CASA ratio can put pressure on the bank's net interest margins (NIMs). Compared to competitors with stronger CASA profiles, Canara Bank might face a higher overall cost of funds, impacting its profitability and competitive pricing strategies.

Despite ongoing efforts, Canara Bank has encountered persistent challenges in consistently delivering top-tier customer service, with a notable gap identified in its marketing effectiveness. While its operational approach is generally perceived as superior to many other public sector banks, instances of customer dissatisfaction regarding query resolution and the functionality of online platforms have been reported.

This customer experience gap, particularly concerning efficient query handling and user-friendly digital interfaces, could impede the bank's ability to attract and retain valuable customer segments, especially those with higher income levels who often prioritize seamless digital interactions and responsive support.

Canara Bank faces intense competition from nimble private sector banks such as HDFC Bank, ICICI Bank, and Axis Bank. These competitors often outpace public sector banks in adopting new technologies and offering customer-focused services.

The agility of private banks allows them to quickly introduce innovative products and digital solutions, which can attract and retain customers. This poses a direct challenge to Canara Bank's efforts to expand its market share and maintain profitability in a rapidly evolving financial landscape.

Operational Efficiency Challenges

Canara Bank, while actively pursuing digital transformation, may still face some operational inefficiencies rooted in its traditional public sector bank characteristics. These can manifest when compared to the agility of more technologically advanced private sector banks.

Despite ongoing initiatives to curb operational expenses, the sheer scale of the bank and its reliance on legacy systems can create significant hurdles in achieving peak efficiency. For instance, while many private banks have streamlined processes through cloud-native architectures, Canara Bank's integration of newer technologies with existing infrastructure requires careful management.

- Legacy Systems: Continued reliance on older IT infrastructure can slow down transaction processing and hinder the seamless integration of new digital services.

- Scale of Operations: Managing a vast network of branches and a large customer base, inherent to a public sector bank, can inherently lead to higher operational overheads compared to smaller, more focused private entities.

- Digital Adoption Pace: While digital offerings are expanding, ensuring uniform adoption and proficiency across all customer segments and employee levels remains a continuous challenge.

Potential for Margin Pressures

Canara Bank faces potential margin pressures, evidenced by a decline in its Net Interest Margin (NIM). The NIM moderated to 2.55% in the first quarter of fiscal year 2026, a decrease from 2.90% recorded in the same quarter of the previous year.

This compression is largely attributed to increasing deposit costs and a highly competitive pricing environment within the banking sector. These factors collectively put a strain on the bank's ability to maintain its net interest income, even as other income sources show growth.

- NIM Decline: Canara Bank's Net Interest Margin (NIM) fell to 2.55% in Q1FY26 from 2.90% in Q1FY25.

- Rising Deposit Costs: An increase in the cost of deposits is a primary driver of margin pressure.

- Competitive Environment: The intense competition in pricing among banks also squeezes NIMs.

Canara Bank's Net Interest Margin (NIM) experienced a dip, falling to 2.55% in the first quarter of fiscal year 2026 from 2.90% in the same period of fiscal year 2025. This compression is primarily driven by escalating deposit costs and a fiercely competitive pricing landscape within the banking sector.

The bank's Current Account and Savings Account (CASA) ratio stood at approximately 28.3% as of June 2025, indicating a greater reliance on more expensive term deposits for its funding needs. This lower CASA ratio can negatively impact the bank's net interest margins and overall cost of funds when compared to peers with stronger CASA profiles.

Despite advancements, Canara Bank faces challenges in consistently providing premium customer service, particularly in marketing effectiveness. Reported instances of customer dissatisfaction regarding query resolution and digital platform usability persist, potentially hindering its ability to attract and retain high-value customer segments.

| Weakness | Description | Impact | Relevant Data |

|---|---|---|---|

| NIM Compression | Deterioration in Net Interest Margin due to rising deposit costs and competitive pricing. | Reduced profitability and potential pricing disadvantages. | NIM declined to 2.55% in Q1FY26 from 2.90% in Q1FY25. |

| Lower CASA Ratio | Higher dependence on costly term deposits for funding. | Increased cost of funds, potentially affecting net interest margins. | CASA ratio at 28.3% as of June 2025. |

| Customer Service Gaps | Inconsistent customer service, especially in query resolution and digital platform user experience. | Risk of losing customers, particularly high-income segments prioritizing seamless digital interactions. | Customer dissatisfaction reported regarding query handling and online platforms. |

| Competition from Private Banks | Private sector banks are quicker in adopting new technologies and offering customer-centric services. | Challenges in market share expansion and maintaining profitability. | Agile competitors like HDFC Bank, ICICI Bank, and Axis Bank. |

What You See Is What You Get

Canara Bank SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll find a comprehensive breakdown of Canara Bank's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning. The full, detailed analysis is unlocked upon purchase.

Opportunities

Canara Bank has a substantial opportunity to grow by expanding its reach into India's rural and semi-urban markets, where a significant portion of the population still requires accessible banking services. Leveraging its existing branch network, which stood at over 9,500 branches as of March 31, 2024, the bank can tailor financial products and digital solutions to meet the specific needs of these demographics, fostering financial inclusion and unlocking new revenue streams.

Canara Bank’s significant ₹1,500 crore investment in its technology roadmap, which includes advanced AI/ML models and a new Data and Analytics Centre, positions it to capitalize on the growing digital banking landscape. This investment is a direct opportunity to create more personalized customer experiences and streamline operations, meeting evolving customer expectations for seamless digital interactions.

Further strategic collaborations with fintech firms offer a pathway to accelerate innovation and broaden the bank's service portfolio. By partnering with agile fintech players, Canara Bank can quickly integrate new technologies, expand its reach into underserved segments, and enhance overall operational efficiency, thereby strengthening its competitive edge in the digital financial services sector.

Canara Bank is strategically utilizing its vast customer data to identify avenues for cross-selling and upselling financial products. This includes promoting offerings like housing and vehicle loans, as well as encouraging the acquisition of CASA accounts, thereby deepening customer relationships and expanding product penetration.

By employing advanced data analytics, the bank aims to pinpoint specific customer needs and preferences. This data-driven approach is crucial for driving incremental growth and enhancing fee-based income through the delivery of tailored financial solutions to its existing client base.

In the fiscal year 2023-24, Canara Bank reported a significant increase in its retail loan portfolio, with housing and vehicle loans forming a substantial part of this growth, indicating the success of their cross-selling initiatives. The bank's focus on CASA accounts also contributed to a healthy deposit base, supporting its lending activities.

Government Initiatives and Financial Inclusion Programs

Canara Bank, as a public sector undertaking, is strategically positioned to leverage government initiatives aimed at financial inclusion. Programs like the Pradhan Mantri SVANidhi scheme, which supports street vendors, directly align with the bank's mandate and offer avenues for growth. By actively participating, Canara Bank not only meets social objectives but also broadens its customer base and strengthens its priority sector lending portfolio.

The bank's involvement in these government schemes translates into tangible benefits. For instance, as of March 2024, Canara Bank has disbursed over ₹5,000 crore under various government-backed schemes, significantly contributing to financial inclusion targets. This active participation helps in expanding the bank's footprint in underserved areas and attracting new customer segments.

- Government Schemes: Canara Bank actively participates in programs like PM SVANidhi, encouraging small business growth and financial inclusion.

- Customer Base Expansion: These initiatives allow the bank to reach new demographics and increase its overall customer numbers.

- Priority Sector Lending: Participation directly supports the bank's compliance with priority sector lending mandates, crucial for regulatory standing.

- Social Impact: By supporting financial inclusion, Canara Bank enhances its corporate social responsibility profile and community engagement.

Growth in Retail and RAM Credit Segments

Canara Bank is capitalizing on robust growth within its retail and RAM (Retail, Agriculture, MSME) credit segments. As of March 2025, the bank reported an impressive 42.80% surge in its retail credit portfolio, alongside a solid 13.23% expansion in RAM credit. This dual-pronged approach positions Canara Bank for substantial business growth and enhanced profitability.

The bank's strategic emphasis on these key areas, coupled with initiatives like developing a comprehensive credit card platform, is a significant opportunity. This focus is expected to unlock further avenues for expansion and revenue generation, leveraging the increasing demand for retail and MSME financing.

Key growth drivers include:

- Accelerated Retail Credit Expansion: A 42.80% growth in retail credit by March 2025 demonstrates strong market penetration and customer uptake.

- RAM Segment Strength: The 13.23% growth in Retail, Agriculture, and MSME credit highlights the bank's commitment to supporting diverse economic sectors.

- Strategic Platform Development: The ongoing development of a full-fledged credit card platform is poised to capture a larger share of the retail spending market.

- Profitability Enhancement: Continued success in these segments directly translates to improved net interest margins and overall financial performance.

Canara Bank has a significant opportunity to expand its digital offerings and enhance customer experience through its ₹1,500 crore technology investment. This includes leveraging advanced AI/ML models and a new Data and Analytics Centre to drive personalized services and operational efficiency.

Strategic collaborations with fintech companies present a chance to accelerate innovation, broaden its service portfolio, and reach new customer segments. This approach allows Canara Bank to quickly integrate cutting-edge technologies and improve its competitive standing in the digital banking space.

The bank is well-positioned to capitalize on the growing retail and MSME credit segments, as evidenced by its 42.80% surge in retail credit and 13.23% expansion in RAM credit by March 2025. Developing a comprehensive credit card platform further strengthens its ability to capture a larger market share.

| Opportunity Area | Key Initiatives | Data Point (as of March 2025) |

|---|---|---|

| Digital Transformation | AI/ML, Data Analytics Centre | ₹1,500 crore investment in technology |

| Fintech Partnerships | Accelerated innovation, expanded services | N/A (ongoing strategy) |

| Retail & MSME Growth | Credit card platform development | 42.80% Retail Credit Growth, 13.23% RAM Credit Growth |

Threats

Canara Bank faces stiff competition from a crowded Indian banking landscape, including aggressive private sector players and nimble fintech startups. This rivalry puts pressure on deposit growth and customer retention, particularly as competitors often boast superior digital offerings. For instance, by the end of FY24, the Indian banking sector saw a significant surge in digital transactions, with UPI alone processing over 120 billion transactions, highlighting the growing importance of digital capabilities.

Canara Bank, like all financial institutions, faces significant threats from evolving regulatory landscapes. The Reserve Bank of India (RBI) frequently updates its policies, impacting everything from capital adequacy ratios to asset classification norms. For instance, the RBI's pronouncements on provisioning coverage ratios or new liquidity coverage ratios can necessitate substantial capital adjustments and operational overhauls.

Adapting to these regulatory shifts presents a continuous challenge, demanding ongoing investment in compliance infrastructure and skilled personnel. Failure to comply can lead to penalties and reputational damage. In 2024, the banking sector is still navigating the implications of Basel III finalization, which mandates higher capital buffers, directly affecting profitability and lending capacity.

An economic slowdown presents a significant threat, potentially increasing Canara Bank's non-performing assets (NPAs) and credit costs. While the bank has demonstrated progress in asset quality, the recent rapid growth in its loan book means that the impact of any macroeconomic downturn on loan performance needs careful monitoring.

For instance, if GDP growth falters significantly in 2024-2025, the risk of loan defaults could rise. Canara Bank's net NPA ratio stood at 1.65% as of March 31, 2024, a positive trend, but a prolonged economic downturn could reverse this improvement, impacting profitability.

Cybersecurity and Data Privacy Risks

As digital banking becomes more prevalent, Canara Bank faces substantial cybersecurity and data privacy risks. A breach could result in significant financial losses and severely damage its reputation, impacting customer trust. For instance, the Reserve Bank of India reported a 50% increase in cyber incidents in the Indian banking sector in 2023 compared to the previous year, highlighting the growing threat landscape.

These threats manifest in various forms:

- Phishing and Social Engineering Attacks: Malicious actors attempt to trick customers into revealing sensitive information.

- Ransomware and Malware: Sophisticated software can disrupt operations and hold data hostage.

- Data Breaches: Unauthorized access to customer databases can lead to identity theft and financial fraud.

- Insider Threats: Accidental or intentional misuse of access by employees poses a risk.

Interest Rate Volatility and Liquidity Challenges

Interest rate volatility poses a significant threat to Canara Bank. Fluctuations can squeeze its Net Interest Margin (NIM), especially if the cost of attracting deposits outpaces the returns from loans. For instance, a rapid increase in deposit rates in late 2023 and early 2024, driven by monetary policy tightening, put pressure on bank margins across the sector.

Ongoing market liquidity challenges also present a hurdle. These difficulties can complicate Canara Bank's ability to secure stable funding at competitive rates, potentially hindering its capacity to support loan growth and meet its credit expansion objectives. The Reserve Bank of India's liquidity management operations, which have seen periods of tightening, directly influence the cost and availability of funds for banks.

- Impact on NIM: Rising deposit costs can erode the difference between interest earned on loans and interest paid on deposits.

- Funding Costs: Market liquidity issues can drive up the cost of borrowing for the bank.

- Credit Growth Constraints: Difficulty in maintaining optimal funding structures may limit the bank's ability to disburse new loans.

- Regulatory Environment: Changes in monetary policy and liquidity management by the central bank directly affect these challenges.

Intensifying competition from private banks and fintech firms, coupled with evolving regulatory frameworks, presents a significant challenge for Canara Bank. Economic downturns could also lead to an increase in non-performing assets, impacting profitability.

Cybersecurity risks are a growing concern, with a notable rise in incidents reported across the banking sector, necessitating robust defenses against data breaches and fraud.

Interest rate volatility and market liquidity challenges can affect the bank's net interest margins and its ability to secure stable funding for loan growth.

| Threat Category | Description | Impact on Canara Bank | Relevant Data/Trend |

|---|---|---|---|

| Competition | Aggressive private banks and fintechs | Pressure on deposits, customer retention, digital offerings | UPI transactions exceeded 120 billion in FY24 |

| Regulatory Changes | RBI policy updates (e.g., Basel III finalization) | Capital adequacy, operational adjustments, compliance costs | Basel III finalization mandates higher capital buffers |

| Economic Slowdown | Potential rise in NPAs, increased credit costs | Impact on asset quality and profitability | Net NPA ratio was 1.65% as of March 31, 2024 |

| Cybersecurity Risks | Data breaches, ransomware, phishing | Financial losses, reputational damage, loss of customer trust | Cyber incidents in Indian banking sector up 50% in 2023 |

| Interest Rate Volatility | Squeezed Net Interest Margin (NIM) | Erosion of profitability if deposit costs rise faster than loan yields | Deposit rates saw increases in late 2023/early 2024 |

| Market Liquidity | Difficulty in securing stable funding | Higher funding costs, potential constraints on credit growth | RBI liquidity management operations influence fund availability |

SWOT Analysis Data Sources

This Canara Bank SWOT analysis is built upon a foundation of credible data, including the bank's official financial statements, comprehensive market research reports, and expert opinions from financial analysts. These sources provide a robust understanding of the bank's performance, competitive landscape, and future outlook.