Canara Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Navigate the dynamic landscape affecting Canara Bank with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a competitive advantage by leveraging these actionable insights for your own strategic planning. Download the full PESTLE analysis now to unlock critical market intelligence.

Political factors

As a significant public sector bank, Canara Bank's strategic direction and operational framework are heavily shaped by the Indian government's policies and mandates. The government's decisions on recapitalization, potential mergers, and divestment strategies for public sector banks (PSBs) directly influence Canara Bank's long-term planning and overall financial stability.

Recent government initiatives, such as the EASE (Enhanced Access and Service Excellence) reforms, are geared towards bolstering governance standards and facilitating PSBs' access to capital markets. These reforms are crucial for Canara Bank to enhance its competitive edge and financial resilience in the evolving banking landscape.

The Indian government's push for financial inclusion, notably through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), significantly influences Canara Bank's strategic direction. This program aims to provide access to banking, insurance, and pension services to all citizens, directly impacting the bank's customer acquisition and service delivery models. As of March 31, 2024, PMJDY had facilitated over 51 crore bank accounts, highlighting the massive scale of government efforts Canara Bank participates in.

Canara Bank actively supports these national objectives by expanding its presence in underserved rural and semi-urban regions. The bank often receives government-mandated targets for opening new accounts and distributing financial products under various inclusion schemes, ensuring its growth is aligned with broader socio-economic development goals. This strategic alignment allows Canara Bank to tap into a vast, previously unbanked population, fostering both social impact and business expansion.

The Reserve Bank of India (RBI) and the Ministry of Finance are continuously shaping the banking landscape through regulatory reforms. For instance, the upcoming Banking Laws (Amendment) Act, 2025, is expected to introduce stricter guidelines on corporate governance and audit quality, impacting how banks like Canara Bank operate. These evolving norms are designed to bolster financial stability and safeguard depositor interests.

Privatization Agenda

The Indian government has signaled its intent to amend existing legislation to enable the privatization of public sector banks, although Canara Bank is not slated for immediate divestment. This evolving policy landscape creates a degree of uncertainty around future ownership and operational independence, impacting Canara Bank's long-term strategic planning and how the market perceives its trajectory.

This potential policy shift could significantly alter the competitive dynamics within the Indian banking sector. For instance, the government has progressively reduced its stake in some public sector undertakings, a trend that might extend to banking. In fiscal year 2023-24, the government's focus remained on consolidation and strengthening public sector banks, with no major privatization announcements for large entities like Canara Bank. However, the underlying legislative intent remains a key political factor to monitor.

- Legislative Amendments: The government's stated intention to amend banking laws is a crucial political factor.

- Future Ownership Uncertainty: Potential privatization introduces ambiguity regarding Canara Bank's future ownership structure.

- Operational Autonomy: Changes in ownership could affect the bank's operational freedom and decision-making processes.

- Market Perception: The privatization agenda influences investor sentiment and the bank's valuation.

Geopolitical Stability and Trade Policies

India's overall geopolitical stability is a crucial backdrop for its banking sector. A stable environment encourages foreign investment and fosters confidence, which directly benefits banks like Canara. For instance, as of early 2024, India's strong diplomatic ties and its position as a growing global economic player contribute to a generally favorable investment climate.

Trade policies enacted by the Indian government significantly influence economic activity, which in turn impacts banking. While the Reserve Bank of India (RBI) has indicated that direct impacts from global trade tensions on the banking system are currently limited, indirect effects are always a consideration. Shifts in export-import volumes, driven by these policies, can alter credit demand and supply for businesses dealing in international trade.

- Foreign Direct Investment (FDI) Inflows: India's FDI inflows have shown resilience, with sectors like services and computer software and hardware attracting significant investment, indirectly supporting banking sector growth through increased economic activity.

- Trade Balance: India's trade deficit, while a persistent challenge, is closely monitored by policymakers. Changes in this balance can signal shifts in economic health that affect lending and deposit growth for banks.

- Geopolitical Alliances: India's active participation in forums like the Quad and its strengthening relationships with key trading partners aim to create a more predictable international economic environment, benefiting businesses and the financial sector.

Government policies directly impact Canara Bank's operations, from regulatory frameworks set by the RBI and Ministry of Finance to initiatives like financial inclusion. The ongoing EASE reforms aim to improve PSB governance and capital access, with Canara Bank expected to benefit from enhanced operational efficiency and market competitiveness.

The government's commitment to financial inclusion, exemplified by the Pradhan Mantri Jan Dhan Yojana (PMJDY), drives Canara Bank's expansion into underserved areas. As of March 31, 2024, PMJDY had facilitated over 51 crore accounts, underscoring the scale of this national effort and its influence on the bank's customer outreach strategies.

Potential legislative amendments regarding the privatization of public sector banks introduce a layer of uncertainty for Canara Bank's future ownership and operational autonomy, even if immediate divestment is not planned.

What is included in the product

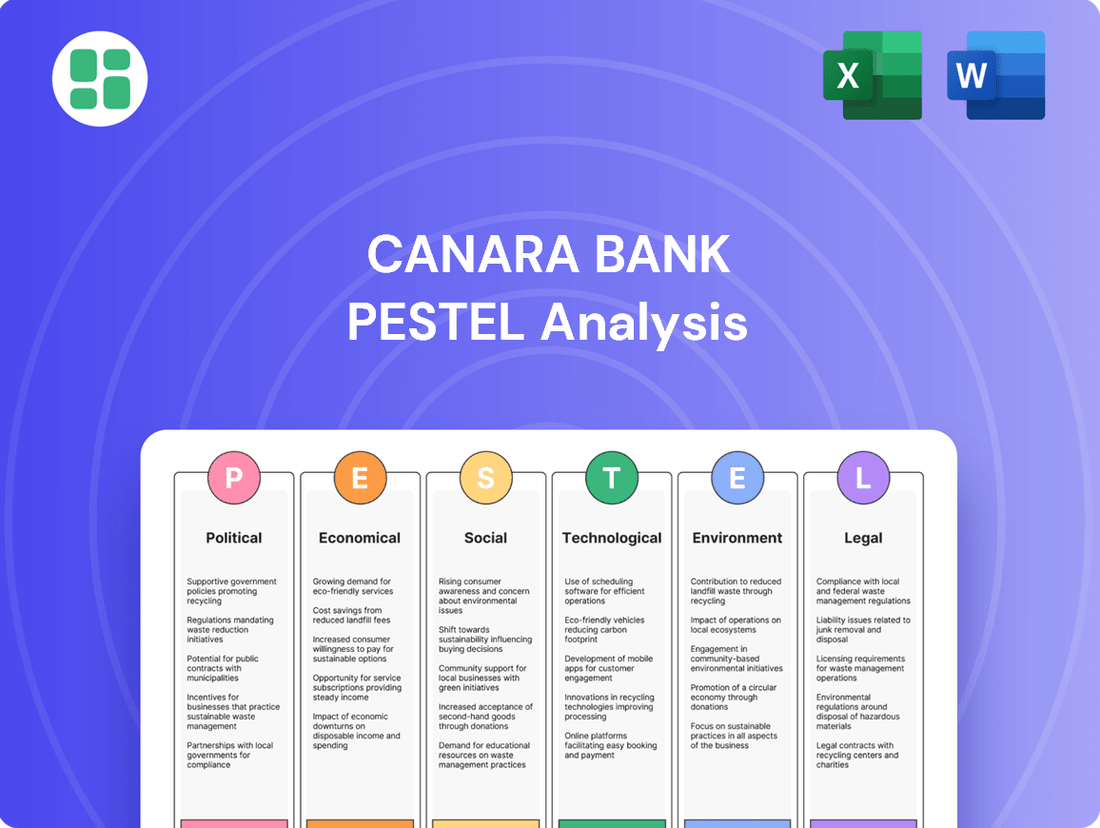

This PESTLE analysis examines the external macro-environmental forces impacting Canara Bank, covering Political stability, Economic growth, Social trends, Technological advancements, Environmental concerns, and Legal regulations.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats arising from these dynamic factors.

A concise PESTLE analysis for Canara Bank, presented in a digestible format, alleviates the pain of sifting through lengthy reports by offering clear insights into external factors impacting the bank's strategy.

This PESTLE analysis for Canara Bank serves as a pain point reliever by providing a structured overview of political, economic, social, technological, environmental, and legal influences, enabling faster and more informed strategic decision-making.

Economic factors

India's robust economic expansion, with real GDP growth anticipated to surpass 6.5% in fiscal year 2026, creates a favorable landscape for financial institutions like Canara Bank.

This sustained growth directly stimulates credit demand across various segments, including retail consumers, businesses, and the agricultural sector, thereby bolstering Canara Bank's potential for loan portfolio growth and increased revenue streams.

The Reserve Bank of India's (RBI) monetary policy, particularly repo rate adjustments, significantly shapes the interest rate landscape for banks like Canara Bank. A reduction in the repo rate, for instance, aims to stimulate economic activity by making borrowing cheaper.

However, this lower interest rate environment can compress Net Interest Margins (NIMs). For Canara Bank, this was evident with a reported NIM of approximately 2.95% in the first quarter of FY25, a slight decrease from the previous year, highlighting the challenge of balancing asset yields with funding costs.

Effectively managing the cost of deposits and the rates offered on loans is paramount for banks to sustain profitability amidst fluctuating interest rates. This requires strategic pricing of both liabilities and assets to maintain a healthy spread.

Canara Bank has seen a significant improvement in its asset quality. For instance, by the end of the third quarter of fiscal year 2024 (Q3 FY24), the bank's Gross Non-Performing Assets (GNPAs) ratio stood at a healthy 4.76%, a notable decrease from previous periods. This trend reflects a stronger financial foundation.

The reduction in NPAs, with Net NPAs also declining to 1.31% in Q3 FY24, means Canara Bank needs to set aside less money for potential loan losses. This directly boosts the bank's profitability and frees up capital, enabling more robust lending activities and strategic investments.

Inflationary Pressures and Deposit Growth

Inflationary pressures in India have remained a significant concern, impacting the cost of funds for banks like Canara Bank. For instance, India's retail inflation hovered around 5.1% in early 2024, a figure that influences the interest rates banks must offer to attract and retain deposits. This environment makes mobilizing low-cost deposits increasingly challenging as competition for customer funds intensifies, with other banks and financial instruments offering more attractive yields.

The dynamic between robust credit growth and slower deposit expansion presents a key strategic hurdle. While Canara Bank has likely seen healthy demand for loans, the ability to fund this growth through deposits is critical. Elevated loan-to-deposit ratios, a common metric reflecting a bank's reliance on deposits for lending, can signal increased funding costs and potential liquidity risks. As of early 2024, the overall banking sector's loan-to-deposit ratio was approaching 80%, underscoring the need for proactive deposit mobilization strategies.

- Inflationary Environment: India's Consumer Price Index (CPI) inflation averaged approximately 5.1% in the first quarter of 2024, necessitating higher deposit rates to remain competitive.

- Deposit Growth Lag: While credit growth in the Indian banking system was robust, estimated at over 15% year-on-year in early 2024, deposit growth lagged, creating funding pressure.

- Loan-to-Deposit Ratio: The banking sector's average loan-to-deposit ratio neared 80% by Q1 2024, highlighting the importance of managing funding costs and increasing deposit market share.

- Funding Cost Management: Banks are compelled to offer competitive deposit rates, directly impacting their Net Interest Margins (NIMs) and overall profitability.

Retail Credit Growth and Consumer Spending

Canara Bank is strategically expanding its retail credit offerings, witnessing robust growth in this segment. This expansion is fueled by a healthy consumer spending environment, which is a direct result of supportive government policies and overall economic buoyancy. The demand for various retail loan products, from mortgages to auto loans and credit cards, is on the rise, directly benefiting the bank's loan book and generating valuable fee income.

Consumer spending in India has been a key driver of economic activity. For instance, retail credit growth in India saw a notable increase, with bank credit to the retail sector growing by approximately 15-20% year-on-year through much of 2023 and into early 2024, reflecting strong consumer demand. This trend is expected to continue as disposable incomes rise and consumer confidence remains high.

- Retail loan disbursements for housing and vehicles have seen double-digit percentage growth in the fiscal year ending March 2024.

- Credit card outstanding balances have also shown a consistent upward trajectory, indicating increased consumer credit utilization.

- Government initiatives such as tax rebates and infrastructure spending have indirectly boosted consumer confidence and spending power.

- Canara Bank's retail advances as a percentage of total advances have steadily increased, highlighting their focus on this profitable segment.

India's economic momentum is a significant tailwind for Canara Bank. With real GDP growth projected to exceed 6.5% in FY26, the demand for credit across retail, corporate, and agricultural sectors is robust, directly benefiting the bank's loan portfolio expansion and revenue generation.

However, managing funding costs amid inflationary pressures is crucial. India's retail inflation, around 5.1% in early 2024, forces banks to offer higher deposit rates, impacting Net Interest Margins (NIMs), which stood at approximately 2.95% for Canara Bank in Q1 FY25.

Canara Bank's improved asset quality, with Gross NPAs at 4.76% and Net NPAs at 1.31% by Q3 FY24, strengthens its financial foundation, reducing provisioning needs and enhancing profitability for further lending and investment.

The bank's strategic focus on retail credit, supported by strong consumer spending and government policies, is yielding positive results. Retail credit growth in India averaged 15-20% year-on-year through early 2024, a trend Canara Bank is well-positioned to capitalize on.

| Economic Factor | Canara Bank Relevance | Data Point (Q1 2024 or FY24) |

|---|---|---|

| GDP Growth Projection | Favorable lending environment | > 6.5% (FY26) |

| Inflation Rate (CPI) | Impacts funding costs & NIMs | ~ 5.1% (Q1 2024) |

| Canara Bank NIM | Profitability indicator | ~ 2.95% (Q1 FY25) |

| Canara Bank GNPA Ratio | Asset quality | 4.76% (Q3 FY24) |

| Canara Bank NNPA Ratio | Asset quality | 1.31% (Q3 FY24) |

| Retail Credit Growth (Industry) | Growth driver for retail segment | 15-20% YoY (Early 2024) |

Preview the Actual Deliverable

Canara Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canara Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Canara Bank's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a robust framework for understanding Canara Bank's business environment.

Sociological factors

Financial literacy remains a significant factor influencing digital banking adoption in India. While urban centers show higher engagement, rural and semi-urban areas often lag due to lower financial awareness. This disparity means Canara Bank must prioritize customer education to ensure all segments can effectively utilize its digital offerings and understand its financial products, thereby maximizing reach and service impact.

India's demographic landscape is a significant factor for Canara Bank. With a substantial young population, estimated to be over 50% below the age of 25 in 2024, there's a massive opportunity for growth in services catering to this segment, like digital banking and investment products. This youthful demographic is also driving rapid urbanization, with a notable increase in the proportion of Indians living in cities, which will require banks to adapt their offerings.

The increasing urbanization means a growing concentration of customers in urban and semi-urban areas. Canara Bank needs to ensure its digital platforms are robust and user-friendly to attract and retain this tech-savvy urban population. Simultaneously, the bank must continue to serve its established rural customer base, potentially by leveraging technology to bridge geographical divides and offer specialized agricultural finance products.

Consumers increasingly favor digital banking, with mobile-first experiences becoming the norm. Canara Bank needs to keep improving its mobile app and online services to meet these shifting demands and stay ahead.

A significant portion of banking transactions are now conducted digitally. For instance, in Q3 2024, Canara Bank reported a substantial increase in digital transactions, highlighting the critical need for robust digital offerings.

Social Responsibility and Community Engagement

Canara Bank, as a public sector undertaking, actively pursues social responsibility and community engagement, aligning with national development goals. Its commitment to financial inclusion is evident through its participation in government-led initiatives, aiming to bring unbanked populations into the formal financial system. For instance, in FY23, Canara Bank reported a significant increase in its Jan Dhan accounts, demonstrating its reach.

The bank's support extends to crucial sectors like MSMEs and agriculture, providing tailored financial products and services that foster growth and stability. This focus not only strengthens its public image but also directly contributes to economic upliftment. In the fiscal year ending March 2024, Canara Bank saw a substantial rise in its MSME loan portfolio, reflecting its dedication to this vital segment.

- Financial Inclusion: Canara Bank's active participation in government schemes like Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to expand banking access.

- MSME Support: The bank offers specialized credit schemes and advisory services to Micro, Small, and Medium Enterprises, crucial for economic growth.

- Agricultural Financing: Canara Bank provides agricultural loans and financial literacy programs to farmers, supporting the agrarian economy.

- Community Development: Initiatives like financial literacy camps and support for rural infrastructure projects showcase its commitment to broader societal well-being.

Employment Trends and Skill Development

Canara Bank's workforce is undergoing a significant transformation, emphasizing the critical need for enhanced digital literacy and customer-centric methodologies to drive its modernization agenda. This focus is crucial for adapting to evolving banking landscapes and meeting customer expectations in an increasingly digital world.

The bank's strategic decision to assign financial inclusion targets to its apprentices underscores a commitment to practical skill development. This initiative not only aims to broaden the bank's outreach but also to improve operational efficiency by leveraging its human capital more effectively. For instance, as of March 2024, Canara Bank has been actively engaging in financial inclusion drives, aiming to onboard a substantial number of new customers into formal banking channels, with apprentices playing a key role in these efforts.

- Digital Skill Enhancement: Training programs are being implemented to equip employees with advanced digital banking skills, including data analytics and cybersecurity awareness.

- Customer-Centricity Training: A renewed emphasis is placed on customer service training to foster personalized banking experiences and build stronger customer relationships.

- Apprentice Role in Financial Inclusion: Apprentices are being tasked with specific financial inclusion goals, such as educating rural populations on banking products and services, contributing to Canara Bank's social responsibility mandate.

- Upskilling for Future Banking: The bank is investing in continuous learning initiatives to ensure its workforce remains adept at navigating the future of financial services, including the integration of AI and machine learning.

Societal attitudes towards digital banking are rapidly evolving, with a growing preference for convenience and accessibility. Canara Bank's push for digital transformation aligns with this trend, but it must also address varying levels of digital literacy across different demographics to ensure broad adoption. The bank's commitment to financial inclusion, as seen in its increased Jan Dhan accounts in FY23, reflects a societal imperative to bring more people into the formal financial system.

The increasing urbanization in India, with a significant portion of the population under 25 in 2024, presents both opportunities and challenges. Canara Bank must cater to the tech-savvy urban youth while continuing to serve its rural base, potentially through enhanced digital platforms and tailored products like agricultural finance, which saw a substantial rise in its MSME loan portfolio by March 2024.

Canara Bank's role as a public sector undertaking involves a strong focus on social responsibility, including supporting MSMEs and agriculture. By providing specialized financial products and engaging in community development initiatives, the bank contributes to economic upliftment and strengthens its public image, aligning with national development goals.

Technological factors

Canara Bank is heavily investing in its digital transformation, with a significant focus on modernizing its IT infrastructure. This strategic move aims to bolster customer service and improve operational efficiency across the board.

The bank is optimizing its end-to-end IT operations, a crucial step for streamlining service delivery in today's competitive banking landscape. This modernization effort is designed to create a more agile and responsive banking experience for its customers.

To achieve this, Canara Bank is implementing advanced tools for preventive and predictive intelligence. For instance, in the fiscal year 2023-24, the bank reported a substantial increase in its digital transaction volume, highlighting the success of these modernization efforts in driving adoption and usage of its digital platforms.

Canara Bank, like all entities in India's financial landscape, is navigating an escalating wave of sophisticated cyber threats. These range from traditional phishing and ransomware attacks to increasingly complex AI-driven assaults designed to breach defenses and compromise systems. The Reserve Bank of India (RBI) has consistently highlighted the growing cyber risks, with reports indicating a substantial rise in cyber incidents targeting Indian banks, necessitating constant vigilance and adaptation.

To counter these persistent dangers, Canara Bank must maintain significant and ongoing investments in its cybersecurity infrastructure. This includes implementing advanced threat detection systems, robust data encryption protocols, and regular security audits. The protection of sensitive customer financial data and the overall stability of the bank's operations are paramount, requiring a proactive and adaptive approach to cybersecurity in the face of evolving threat landscapes.

Canara Bank is actively integrating Artificial Intelligence (AI) and Machine Learning (ML) across its operations. These technologies are being deployed to enhance customer engagement through sophisticated upselling and cross-selling strategies, aiming to boost revenue by an estimated 5-10% in targeted segments by the end of 2025.

Furthermore, AI/ML models are crucial for predicting customer churn, allowing the bank to proactively retain valuable clients, and for forecasting Non-Performing Assets (NPA), thereby improving risk management and financial stability. This strategic adoption is projected to reduce operational costs by up to 15% by 2024 through increased automation and better resource allocation.

Mobile Banking and Digital Payments

The surge in mobile banking and digital payment systems, particularly India's Unified Payments Interface (UPI), is fundamentally reshaping the banking landscape. By the end of 2023, UPI transactions had surpassed 117 billion, a testament to its pervasive adoption and convenience. Canara Bank is actively participating in this digital transformation, having launched its own digital rupee application and continuously refining its mobile banking offerings to ensure customers can conduct transactions smoothly and efficiently.

Canara Bank's commitment to digital innovation is evident in its strategic focus on enhancing user experience through its mobile platform. This includes the integration of advanced features and a user-friendly interface, catering to the growing demand for instant and accessible banking services. As of early 2024, the bank reported a significant increase in its digital transaction volumes, reflecting customer trust and the effectiveness of its digital initiatives.

- UPI Transaction Growth: India's UPI processed over 117 billion transactions in 2023, highlighting the rapid shift towards digital payments.

- Digital Rupee Adoption: Canara Bank's introduction of a digital rupee app signifies its proactive engagement with central bank digital currency (CBDC) initiatives.

- Mobile Banking Enhancements: Continuous upgrades to Canara Bank's mobile banking services aim to provide seamless and secure transaction experiences for its customer base.

- Increased Digital Volumes: Early 2024 data indicates a substantial rise in digital transaction volumes for Canara Bank, underscoring the success of its digital strategy.

FinTech Partnerships and Innovation

The burgeoning FinTech sector offers Canara Bank significant avenues for growth and efficiency improvements, though it also introduces competitive pressures. By forging strategic alliances, such as its collaboration with Kyndryl, Canara Bank is actively upgrading its digital infrastructure. This partnership aims to bolster service uptime and leverage advanced data analytics for better decision-making, crucial for navigating the dynamic financial technology landscape.

Canara Bank's commitment to digital transformation is evident in its proactive approach to integrating new technologies. For instance, the bank has been investing in cloud migration and cybersecurity enhancements to ensure robust and secure digital services. This focus on technological advancement is vital for meeting evolving customer expectations and maintaining a competitive edge against agile FinTech disruptors.

- Digital Service Expansion: Canara Bank aims to expand its digital service offerings, including enhanced mobile banking features and online account management, to cater to a growing digitally-savvy customer base.

- FinTech Integration: The bank is exploring opportunities to integrate FinTech solutions for areas like payments, lending, and wealth management to streamline operations and offer innovative products.

- Data Analytics Investment: Significant investment is being directed towards data analytics capabilities to derive actionable insights from customer data, thereby improving personalized service delivery and risk management.

- Cybersecurity Fortification: Strengthening cybersecurity measures remains a top priority to protect customer data and maintain trust in the bank's digital platforms amidst increasing cyber threats.

Canara Bank is heavily investing in its digital transformation, with a significant focus on modernizing its IT infrastructure to bolster customer service and improve operational efficiency. The bank is optimizing its end-to-end IT operations, implementing advanced tools for preventive and predictive intelligence, and reported a substantial increase in digital transaction volume in fiscal year 2023-24.

The bank is actively integrating AI and ML to enhance customer engagement and predict customer churn, aiming to boost revenue and reduce operational costs. Furthermore, Canara Bank is participating in the digital currency initiatives by launching its digital rupee application and continuously refining its mobile banking offerings to ensure seamless transactions.

Canara Bank's commitment to digital innovation is evident in its focus on enhancing user experience through its mobile platform, with early 2024 data showing a significant increase in digital transaction volumes. The burgeoning FinTech sector presents opportunities, and the bank is forging strategic alliances, such as with Kyndryl, to upgrade its digital infrastructure and leverage data analytics.

The bank is investing in cloud migration and cybersecurity enhancements to ensure robust and secure digital services, vital for meeting customer expectations and competing with FinTech disruptors. Canara Bank aims to expand its digital service offerings, explore FinTech integrations, and fortify cybersecurity measures to protect customer data and maintain trust.

| Technology Focus | Key Initiatives | Impact/Data (FY 2023-24/Early 2024) |

|---|---|---|

| Digital Transformation | IT Infrastructure Modernization | Substantial increase in digital transaction volume |

| AI/ML Integration | Customer engagement, churn prediction, NPA forecasting | Projected 5-10% revenue boost in targeted segments by end of 2025; projected 15% operational cost reduction by 2024 |

| Digital Payments & CBDC | Mobile banking enhancements, Digital Rupee app | UPI transactions surpassed 117 billion in 2023 |

| Cybersecurity | Advanced threat detection, encryption, audits | Ongoing investment to counter escalating cyber threats |

Legal factors

Recent amendments to the Banking Regulation Act, effective from 2025, are ushering in substantial reforms impacting bank governance, audit standards, and depositor safeguards. These changes are designed to bolster the stability and integrity of the banking sector.

Canara Bank, as a prominent public sector bank, faces the imperative of rigorous adherence to these revised legal stipulations. This includes adapting to new definitions of 'substantial interest' and updated guidelines on director tenures, ensuring all operational aspects align with the updated regulatory landscape.

The Reserve Bank of India (RBI) sets stringent prudential norms that significantly shape Canara Bank's operations. These include guidelines on income recognition, asset classification, provisioning, and risk weights, which are crucial for maintaining financial stability. For instance, the RBI's recent directives on project finance, effective from 2024, mandate higher provisioning coverage for certain exposures, directly impacting Canara Bank's profitability and capital adequacy ratios.

Adherence to these evolving RBI guidelines directly influences Canara Bank's financial reporting accuracy and its ability to meet capital requirements. In the fiscal year 2023-24, banks like Canara were closely monitoring the impact of these norms on their balance sheets, particularly concerning their lending practices and overall risk management framework.

With the surge in digital banking, Canara Bank faces heightened scrutiny under data privacy and consumer protection laws. Regulations like the Digital Personal Data Protection Act, 2023, mandate stringent handling of customer information, requiring robust cybersecurity measures and transparent data usage policies. Failure to comply can lead to significant penalties, impacting customer trust and operational continuity.

Anti-Money Laundering (AML) and KYC Regulations

Canara Bank operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations mandated by the Reserve Bank of India (RBI). These rules are fundamental in the fight against financial crime. In 2023, the Financial Intelligence Unit-India (FIU-IND) reported over 1.3 million suspicious transaction reports (STRs), highlighting the ongoing need for robust compliance. The bank must maintain rigorous procedures to identify and prevent illicit financial activities.

A significant challenge emerging in 2024 is the rise of deepfake technology, which poses a threat to the integrity of video KYC processes. Canara Bank needs to adapt its systems to detect and mitigate sophisticated identity fraud attempts facilitated by these advanced technologies. Failure to do so could lead to regulatory penalties and reputational damage.

- RBI Mandates: Strict adherence to RBI's AML and KYC guidelines is non-negotiable for Canara Bank.

- Financial Crime Prevention: Robust compliance frameworks are essential to detect and prevent money laundering and other illicit financial activities.

- Deepfake Threat: The increasing sophistication of deepfakes presents a new challenge for verifying customer identities during video KYC.

- Compliance Costs: Implementing and maintaining advanced detection systems for identity fraud can incur significant operational costs.

Corporate Governance Standards

Canara Bank, as a public sector undertaking, operates under a stringent legal framework governing corporate governance. Recent directives from the Reserve Bank of India (RBI) and the Ministry of Finance in 2024 have further emphasized enhanced transparency and accountability measures. These regulations aim to align public sector banks with global best practices in board oversight and management efficiency, ensuring robust corporate oversight.

The evolving legal landscape mandates stricter adherence to disclosure norms and risk management protocols. For instance, the Banking Regulation Act, 1949, and subsequent amendments continually shape the operational and governance standards. Canara Bank's commitment to these evolving standards is crucial for maintaining stakeholder confidence and regulatory compliance.

- Enhanced Board Independence: New guidelines in 2024 focus on increasing the proportion of independent directors on bank boards to ensure objective decision-making.

- Stricter Disclosure Requirements: Regulations now demand more granular and timely disclosures on financial performance, risk exposures, and related party transactions.

- Robust Risk Management Frameworks: Legal mandates require banks to implement and continuously update comprehensive risk management policies, including credit, market, and operational risks.

- Cybersecurity Governance: With increasing digital operations, recent legal pronouncements emphasize strong governance around cybersecurity and data protection.

Canara Bank must navigate a complex web of legal and regulatory requirements, including updated Banking Regulation Act provisions effective 2025 concerning governance and depositor safeguards. The Reserve Bank of India's (RBI) prudential norms, such as those for project finance from 2024, directly impact capital adequacy and profitability. Furthermore, data privacy laws like the Digital Personal Data Protection Act, 2023, necessitate robust cybersecurity and transparent data handling, while stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations demand vigilance against financial crime, a challenge amplified by emerging threats like deepfakes in identity verification.

| Regulatory Area | Key Legislation/Directive | Impact on Canara Bank | Relevant Year(s) |

|---|---|---|---|

| Banking Governance | Banking Regulation Act Amendments | Enhanced transparency, accountability, director tenures | 2025 |

| Prudential Norms | RBI Directives on Project Finance | Higher provisioning, impact on capital adequacy | 2024 |

| Data Privacy | Digital Personal Data Protection Act | Strict customer data handling, cybersecurity mandates | 2023 |

| Financial Crime Prevention | RBI AML/KYC Guidelines | Robust compliance, detection of illicit activities | Ongoing (FIU-IND reported 1.3M+ STRs in 2023) |

| Identity Verification | Emerging Threat of Deepfakes | Need for advanced fraud detection in video KYC | 2024 onwards |

Environmental factors

The global and national focus on Environmental, Social, and Governance (ESG) factors is significantly influencing financial decision-making. This trend is compelling institutions like Canara Bank to embed ESG principles into their core strategies.

Canara Bank is actively integrating ESG into its operations, evident in its development of comprehensive ESG policies and the promotion of sustainable business practices. This proactive approach is driven by rising stakeholder expectations and increasing regulatory mandates within India's banking sector.

In 2023, Canara Bank reported a significant increase in its green financing initiatives, disbursing over ₹5,000 crore towards renewable energy projects, underscoring its commitment to environmental sustainability.

The Reserve Bank of India (RBI) has issued draft guidelines emphasizing the need for regulated entities, including banks like Canara Bank, to enhance their resilience against climate change impacts. This proactive stance underscores the growing recognition of climate-related financial risks.

Canara Bank must now actively assess and manage both physical risks, such as damage from extreme weather events impacting collateral, and transition risks, which arise from shifts to a low-carbon economy affecting borrowers' business models. For instance, a significant portion of the bank's loan book might be exposed to sectors vulnerable to climate policy changes or technological disruptions.

In 2023, the Indian banking sector, as a whole, saw a notable increase in lending to renewable energy projects, indicating a broader trend towards green financing. Canara Bank's strategic response to these RBI guidelines will be crucial in navigating these evolving environmental factors and ensuring the long-term sustainability of its financial operations.

The global drive towards a greener economy is significantly boosting opportunities in green financing, with a notable rise in green loans and bonds. Canara Bank can capitalize on this trend by offering specialized sustainable financial products designed to fund environmentally conscious projects. For instance, financing renewable energy installations or advanced waste management systems aligns perfectly with India's ambitious sustainability targets, such as the National Green Hydrogen Mission aiming for 5 million metric tons of green hydrogen production by 2030.

Regulatory Push for Sustainable Banking

The Reserve Bank of India (RBI) is increasingly emphasizing sustainable banking, introducing frameworks for green deposits and guidelines for climate risk disclosures. This regulatory push directly impacts Canara Bank, requiring adaptation to new standards. For instance, the RBI’s September 2023 discussion paper on climate risk outlined potential supervisory expectations for banks, signaling a move towards more stringent environmental, social, and governance (ESG) reporting.

Canara Bank, like its peers, needs to align its operations with these evolving regulations. This includes developing strategies to encourage funding for environmentally sustainable projects and strengthening its internal risk management frameworks to account for climate-related financial risks. The bank's ability to navigate these regulatory changes will be crucial for its long-term sustainability and competitive positioning in the Indian banking sector.

Key aspects of this regulatory environment include:

- Green Finance Initiatives: The RBI's focus on green deposits encourages banks to mobilize funds specifically for environmentally friendly projects, potentially opening new avenues for Canara Bank's lending portfolio.

- Climate Risk Disclosure: Mandates for disclosing climate-related financial risks, as seen in global trends and anticipated by the RBI, will require robust data collection and reporting capabilities.

- Sustainable Lending Practices: Regulations are steering banks towards prioritizing lending to sectors and projects that contribute to environmental sustainability, influencing credit assessment and portfolio management.

- ESG Integration: The broader regulatory trend supports the integration of ESG factors into core banking operations, from governance structures to product development.

Operational Carbon Footprint Reduction

Canara Bank, like many financial institutions, is prioritizing the reduction of its operational carbon footprint. This focus aligns with the broader banking industry's commitment to sustainability. While specific 2024 or 2025 targets for Canara Bank's direct operational emissions reduction weren't readily available, the sector is actively pursuing initiatives to minimize environmental impact.

Key strategies being adopted across the banking sector include:

- Investing in sustainable energy sources for bank branches and data centers.

- Implementing energy-efficient technologies and practices within office spaces.

- Promoting reduced paper usage and digital transformation to lower resource consumption.

- Exploring green building certifications for new and existing infrastructure.

These efforts reflect a growing awareness of the environmental responsibilities of financial corporations and their role in contributing to a low-carbon economy. The push for operational efficiency also often leads to cost savings, creating a dual benefit for the bank.

The increasing global and national emphasis on Environmental, Social, and Governance (ESG) factors is reshaping financial decision-making, pushing institutions like Canara Bank to embed sustainability into their core strategies. This is driven by growing stakeholder expectations and evolving regulatory landscapes, particularly in India.

Canara Bank is actively responding to these environmental shifts, evident in its increased green financing. In 2023, the bank disbursed over ₹5,000 crore towards renewable energy projects, demonstrating a commitment to environmental stewardship and aligning with India's sustainability goals, such as the National Green Hydrogen Mission targeting 5 million metric tons of production by 2030.

The Reserve Bank of India (RBI) is also playing a crucial role, issuing guidelines that require banks to enhance resilience against climate change impacts and promoting frameworks for green deposits and climate risk disclosures. This regulatory push, exemplified by the September 2023 discussion paper on climate risk, signals a move towards more stringent ESG reporting and sustainable lending practices.

Canara Bank's strategic alignment with these environmental factors includes managing both physical and transition risks, such as potential impacts on borrowers from climate policy changes. The bank is also focusing on reducing its operational carbon footprint through initiatives like investing in sustainable energy for its infrastructure and promoting digital transformation.

| Metric | 2023 Data/Target | Significance for Canara Bank |

|---|---|---|

| Green Financing Disbursed | ₹5,000 crore+ | Demonstrates commitment to renewable energy and sustainable projects. |

| National Green Hydrogen Mission Target | 5 million metric tons by 2030 | Opportunity for Canara Bank to finance significant green projects. |

| RBI Climate Risk Disclosure Expectations | Outlined in Sept 2023 discussion paper | Requires enhanced data collection and reporting for climate-related financial risks. |

PESTLE Analysis Data Sources

Our Canara Bank PESTLE Analysis is built upon a robust foundation of data sourced from official Reserve Bank of India (RBI) publications, economic survey reports, and reputable financial news outlets. We meticulously integrate insights from government policy documents, industry-specific research, and international financial institutions to ensure comprehensive coverage.