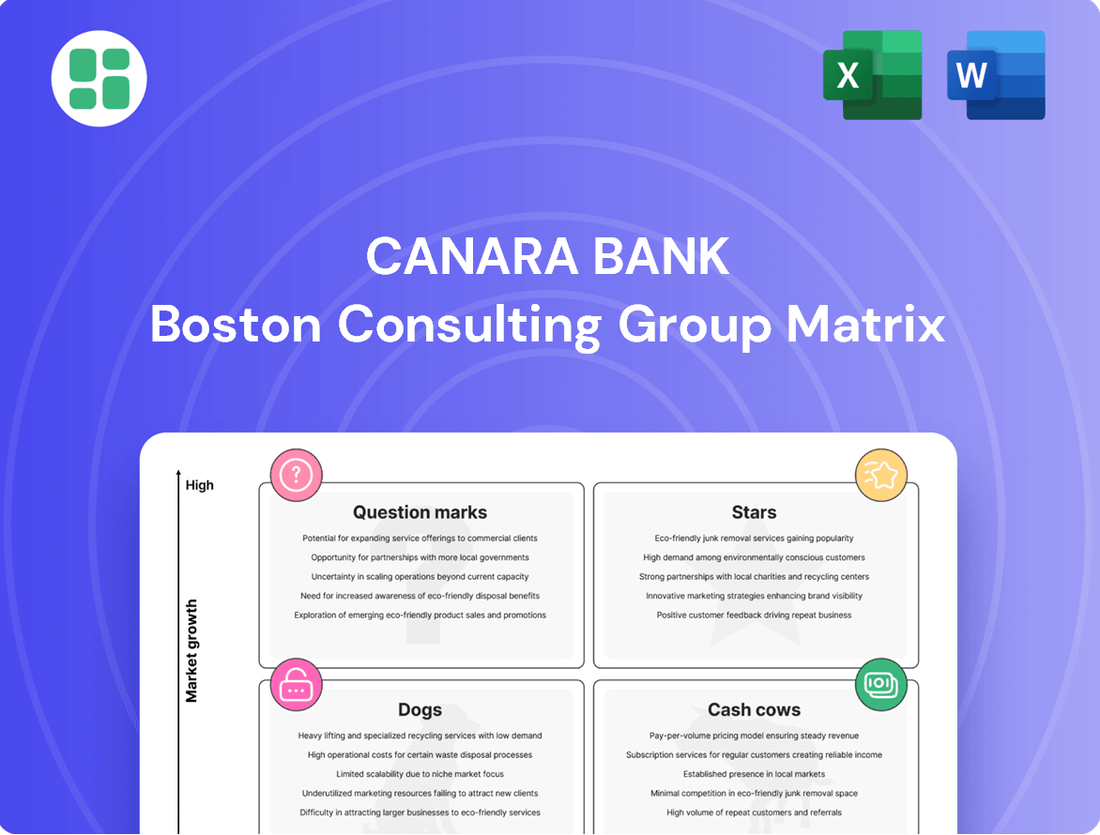

Canara Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Curious about Canara Bank's strategic product portfolio? This glimpse into their BCG Matrix reveals where their offerings might be positioned as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture!

Unlock the complete Canara Bank BCG Matrix to gain a comprehensive understanding of their market share and growth potential for each product. This detailed analysis provides the actionable insights you need to make informed strategic decisions and capitalize on opportunities.

Purchase the full report today and equip yourself with a powerful tool for evaluating Canara Bank's product performance and planning future investments. It's your shortcut to competitive clarity in the dynamic banking sector.

Stars

Digital Lending Platforms represent a Star in Canara Bank's BCG Matrix, driven by the bank's substantial Rs 1,500 crore investment in digital transformation. This focus is clearly aimed at capturing the high-growth potential within retail digital lending, encompassing personal and small business loans.

The bank's robust 33.92% growth in retail advances during Q1 FY26 underscores the increasing customer adoption of these digital channels. Canara Bank is strategically leveraging data mining to further propel growth in key areas like housing and vehicle loans, while also aiming to significantly boost its CASA accounts from 8-12% to a target of 20%, reinforcing the Star status of its digital lending initiatives.

Canara Bank is strategically focusing on MSME digital lending, identifying it as a key growth driver with promising returns. The bank plans to roll out a comprehensive digital platform for its 20 million MSME clients, aiming to expedite loan approvals up to Rs 2 crore by simplifying verification and underwriting.

This initiative is designed to enhance underwriting precision and accelerate credit availability for this burgeoning sector. Projections indicate a healthy 10-12% growth in MSME loans for Canara Bank in FY26, underscoring the segment's importance.

Canara Bank's retail credit growth, excluding home loans, is a standout performer. In Q1 FY26, this segment saw an impressive 34% year-on-year expansion. This robust growth is fueled by strong demand in vehicle loans, which increased by 22.09%, and the promising performance of a new gold-backed secured personal loan product, showing 30-35% growth.

The bank's strategic emphasis on secured retail lending, particularly targeting salaried individuals and pensioners, is paying dividends. This focus, coupled with a remarkably low retail Non-Performing Asset (NPA) rate below 1%, positions this segment as a high-potential area for continued growth and profitability.

UPI and Mobile Banking (Canara ai1 App)

The Canara ai1 mobile banking super app, packed with over 300 features including UPI, IMPS, RTGS, and NEFT, is a strong contender in the high-growth category. Its integration with UPI-compatible digital rupee payments, allowing users to scan existing QR codes, highlights its forward-thinking approach. This continuous development, featuring innovations like scan & pay and personalized dashboards, is crucial for driving digital engagement and transaction volumes in the booming digital payments sector.

Canara Bank's strategic focus on its mobile platform is evident in the 'Canara ai1' app. By offering a comprehensive suite of services, including advanced digital payment functionalities, the bank is well-positioned to capture a larger share of the rapidly evolving digital banking landscape. As of early 2024, mobile banking adoption continues to surge, with a significant percentage of retail banking transactions occurring through digital channels.

- Product: Canara ai1 Mobile Banking App

- Category: Stars (High Growth, High Market Share)

- Key Features: UPI, IMPS, RTGS, NEFT, Digital Rupee payments via QR codes, Scan & Pay, Personalized Dashboards

- Market Position: Aims to be a leading digital banking platform, capitalizing on the growth of digital payments and mobile banking adoption.

Credit Card Business

Canara Bank is significantly investing in its credit card business, aiming for substantial growth. The bank plans to issue 1.5 million credit cards in fiscal year 2026, a notable increase from the 1.4 million issued currently. This expansion is driven by the development of a comprehensive digital platform specifically for its credit card operations.

This strategic push is underscored by the establishment of a dedicated General Manager role for the credit card vertical. This signals a clear intention to capture a larger share of the rapidly expanding credit card market. The bank intends to achieve this growth by effectively utilizing its existing customer relationships and by improving its digital customer onboarding processes.

- Target: Issue 1.5 million credit cards in FY26.

- Current Status: Issued 1.4 million credit cards.

- Strategy: Leverage existing customer base and enhanced digital onboarding.

- Focus: Aggressively building a full-fledged digital platform for the credit card business.

Canara Bank's credit card business is positioned as a Star, with a strategic target to issue 1.5 million credit cards in FY26, an increase from the current 1.4 million. This aggressive expansion is supported by the development of a dedicated digital platform and a new General Manager role for the vertical. The bank aims to leverage its existing customer base and improve digital onboarding to capture a larger share of the growing credit card market.

| Product/Service | BCG Category | Key Metrics/Strategies |

| Digital Lending Platforms | Stars | Rs 1,500 crore investment in digital transformation; 33.92% retail advance growth (Q1 FY26); targeting 10-12% MSME loan growth (FY26). |

| Canara ai1 Mobile Banking App | Stars | Over 300 features including UPI, Digital Rupee; focus on enhancing digital engagement and transaction volumes. |

| Credit Card Business | Stars | Target: 1.5 million cards in FY26; Current: 1.4 million cards; Developing dedicated digital platform; improving digital onboarding. |

What is included in the product

Canara Bank's BCG Matrix analysis identifies strategic growth opportunities and areas for resource allocation.

The Canara Bank BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Canara Bank’s traditional Current Account and Savings Account (CASA) deposits represent its Cash Cows. These deposits are vital for providing the bank with low-cost funding, a cornerstone of its financial stability. The bank is committed to maintaining a CASA ratio above 30% in FY26, building on its existing strong base.

Despite a minor dip to 31.17% in March 2025, Canara Bank’s CASA deposits remain a consistent and fundamental source of liquidity. The bank plans to utilize its extensive branch network and expanding digital platforms to bolster these stable deposit inflows.

Canara Bank's large corporate lending, while not the primary growth engine, acts as a stable cash cow. Despite a strategic push towards retail, agriculture, and MSME (RAM) sectors, corporate credit still constitutes a substantial part of their loan portfolio, ensuring consistent interest income. For instance, in the fiscal year ending March 2024, Canara Bank maintained a significant exposure to corporate clients, contributing to its overall financial stability.

The bank targets a lending mix of about 58% for RAM and 42% for corporate clients. This balanced approach ensures that even with a controlled growth rate of around 10% in corporate lending to avoid aggressive pricing, the established relationships with major corporations provide a predictable and robust revenue stream, underpinning its cash cow status.

Canara Bank's Treasury Operations function as a Cash Cow within its business portfolio. These operations, encompassing interbank lending, bond investments, and foreign exchange dealings, consistently generate significant non-interest income for the bank.

In the fourth quarter of fiscal year 2025, treasury income saw a robust increase of 15.03% compared to the previous year, underscoring its vital role in bolstering the bank's profitability. This stable income stream effectively cushions the impact of volatility in net interest margins.

Government Business and Public Sector Undertakings (PSUs)

Canara Bank's government business and Public Sector Undertakings (PSUs) segment operates as a classic Cash Cow. The bank processes a substantial volume of government transactions, encompassing salaries, pensions, and the disbursement of various government schemes. This consistent flow of business, often mandated, provides a stable and predictable revenue stream with minimal risk.

This segment is characterized by its low growth but high stability, acting as a reliable foundation for Canara Bank's overall financial performance. The established relationships with government entities and the inherent nature of public sector dealings contribute to this dependable income generation.

- Government Transactions: Handles significant volume of salaries, pensions, and scheme disbursements.

- Low Risk Profile: Benefits from mandated business and strong, long-term relationships.

- Stable Revenue: Provides a consistent and predictable income stream.

- Low Growth: Expected to exhibit minimal expansion in this segment.

Home Loan Portfolio

Canara Bank's home loan portfolio is a significant cash cow. This mature segment demonstrates consistent growth, with housing loans expanding by 13.92% in the first quarter of fiscal year 2026. While not the fastest growing area, its stability and long-term income streams make it a dependable contributor to the bank's earnings.

Key characteristics of this cash cow include:

- Stable Asset Quality: Home loans are generally considered a low-risk asset class, contributing to Canara Bank's overall financial health.

- Consistent Interest Income: The long tenures associated with home loans provide a predictable and steady stream of interest revenue.

- Mature Market Presence: Canara Bank has a well-established position in the home loan market, leveraging its brand and distribution network.

- Steady Growth: Despite a potentially slower growth rate compared to newer retail products, the sheer volume of the home loan book ensures substantial cash generation.

Canara Bank's CASA deposits are a prime example of its cash cows, providing a consistent, low-cost funding base crucial for stability. The bank aims to maintain a CASA ratio above 30% in FY26, demonstrating a commitment to this stable funding source.

The bank's treasury operations also function as a cash cow, generating significant non-interest income. This segment saw a robust 15.03% increase in Q4 FY25, effectively buffering any fluctuations in net interest margins.

Furthermore, Canara Bank's government business and PSU segment acts as a stable cash cow, processing a high volume of transactions with minimal risk. This segment, while exhibiting low growth, provides a predictable and reliable revenue stream.

The home loan portfolio is another significant cash cow, showing consistent growth of 13.92% in Q1 FY26. Its stable asset quality and predictable interest income make it a dependable contributor to earnings.

| Business Segment | BCG Category | Key Characteristics | FY25/FY26 Data Points |

|---|---|---|---|

| CASA Deposits | Cash Cow | Low-cost funding, high stability | Target CASA ratio > 30% in FY26; 31.17% in March 2025 |

| Treasury Operations | Cash Cow | Non-interest income generation, buffers NIM volatility | Q4 FY25 income up 15.03% YoY |

| Government Business/PSUs | Cash Cow | Stable, predictable revenue, low risk | Handles high volume of mandated transactions |

| Home Loans | Cash Cow | Consistent growth, stable asset quality | Q1 FY26 growth of 13.92% |

Preview = Final Product

Canara Bank BCG Matrix

The Canara Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted by strategy experts, offers actionable insights into Canara Bank's business units, ready for immediate integration into your strategic planning. You can be confident that the preview accurately represents the final, watermark-free report, designed for clarity and professional application, ensuring no surprises and immediate usability.

Dogs

Some rural or remote Canara Bank branches might be struggling due to high operating costs and low customer activity. These branches may not be generating enough new business to justify their expenses, impacting overall profitability.

While specific figures on underperforming branches aren't publicly disclosed, Canara Bank's strategic push towards digital services and detailed pincode-based customer analysis indicates a move to improve branch efficiency. This could involve reassessing the viability of certain physical locations or even reducing their scale.

Canara Bank, like many established public sector banks, faces the challenge of outdated manual processes and legacy systems. These systems, while functional, are often inefficient and expensive to maintain, hindering agility and increasing operational costs. For instance, while the bank is pushing digital transformation, the complete eradication of paper-based workflows can be a gradual and resource-intensive endeavor.

These legacy operations consume valuable resources without generating substantial growth or providing a distinct competitive edge. In 2023, Canara Bank reported an operating profit of ₹14,035 crore, but a significant portion of this could be further optimized by streamlining these older systems. The bank's ongoing digital initiatives aim to address this, but the transition period requires careful management to avoid disruption and maximize the return on its technology investments.

Canara Bank, like many financial institutions, may have certain niche lending products that are not performing as expected. These could be specialized loans for very specific industries or customer segments that, despite targeted efforts, haven't captured significant market share. For instance, a hypothetical specialized loan for artisanal craft producers might have seen very low uptake, with only a handful of applications processed in 2024, indicating a need for reassessment.

These underperforming products often require a disproportionate amount of marketing and operational resources relative to the revenue they generate. If a particular loan product, say, a unique agricultural equipment financing scheme, consistently requires extensive customer education and has a complex approval workflow, it might tie up valuable staff time and capital. This could be a situation where, as of early 2025, the cost to acquire and service these few loans outweighs the interest income generated, making it a prime candidate for the 'dog' category.

ATM Network in Saturated Areas

Canara Bank's extensive ATM network in saturated areas might represent a question mark in the BCG matrix. While ATMs remain crucial for cash accessibility, their profitability in densely covered regions or areas with high digital payment adoption is under scrutiny. For instance, as of March 31, 2024, Canara Bank operated over 10,000 ATMs, a significant number that requires careful management to ensure optimal returns.

Focusing on efficiency, Canara Bank could explore strategies to optimize the placement of these ATMs. This might involve analyzing transaction data to identify underutilized machines and considering consolidation or redeployment in areas with higher demand. The increasing trend of digital transactions, which saw a substantial rise across the banking sector in 2023 and early 2024, further emphasizes the need for such strategic adjustments to maintain a healthy return on assets.

- ATM Deployment Analysis: Evaluating the cost-benefit of ATMs in areas with high digital transaction penetration.

- Transaction Volume Monitoring: Tracking ATM usage to identify underperforming locations.

- Digital Integration: Enhancing mobile and online banking services to potentially reduce reliance on physical cash withdrawal points.

- Network Optimization: Strategically repositioning or consolidating ATMs to maximize efficiency and customer reach.

Non-Core, Divested Subsidiaries/Investments (Post-Divestment)

Canara Bank's strategic divestment from entities like Canara Robeco Asset Management Company and Canara HSBC Life Insurance Company, with RBI approval to reduce its stake to 30% by October 2029, positions these as non-core assets.

While these subsidiaries might be profitable individually, the bank's decision to exit or reduce its holding signals they are not central to its primary banking operations. This strategic shift aims to unlock value and streamline the bank's focus.

From the perspective of Canara Bank's overall portfolio within a BCG Matrix framework, these divested entities, if not contributing significant strategic value relative to the capital invested, can be viewed as moving towards a 'dog' classification.

- Divestment Goal: Reduce stake in Canara Robeco AMC and Canara HSBC Life Insurance to 30% by October 2029.

- Strategic Rationale: Exit non-core assets to unlock value and focus on primary banking business.

- BCG Matrix Implication: Potential 'dog' status for divested entities if strategic value to the bank is limited.

Certain rural branches of Canara Bank might be categorized as 'dogs' due to high operating costs and low customer activity, failing to generate sufficient new business to cover expenses. For instance, while specific underperforming branches aren't detailed, the bank's focus on digital services and pincode analysis suggests a review of physical locations.

Legacy systems and manual processes also contribute to the 'dog' classification, consuming resources without offering a competitive edge. Despite an operating profit of ₹14,035 crore in 2023, streamlining these inefficiencies is crucial for optimizing returns.

Additionally, niche lending products with low uptake, such as a hypothetical artisanal craft loan, can be 'dogs' if servicing costs outweigh revenue. Similarly, underutilized ATMs, out of Canara Bank's over 10,000 network as of March 31, 2024, in areas with high digital adoption, may also fall into this category.

Strategic divestments, like reducing stakes in Canara Robeco AMC and Canara HSBC Life Insurance, signal these are non-core assets. If their strategic value to the bank is limited relative to investment, they can be viewed as moving towards a 'dog' status.

Question Marks

Canara Bank's strategic deployment of 50 AI/ML models for upselling, cross-selling, and churn prediction signifies a strong commitment to personalized banking. These models aim to tailor customer experiences and anticipate needs, potentially boosting engagement and loyalty.

While the bank has invested heavily in these advanced capabilities, the direct market share and revenue impact from these nascent AI/ML-driven personalized services might still be developing. For instance, while specific revenue figures for these personalized services are not publicly detailed, the broader digital banking segment, which these AI/ML initiatives support, is projected for significant growth.

Realizing the full potential of these AI/ML services necessitates substantial ongoing investment in infrastructure, data analytics, and customer education to ensure widespread adoption and maximize their contribution to Canara Bank's overall market position.

Canara Bank's 'Canara Green Deposit' is a strategic move into the burgeoning green financing sector, aligning with global Environmental, Social, and Governance (ESG) trends. This sustainable term deposit aims to channel funds towards eco-friendly projects such as renewable energy and green buildings, tapping into a high-growth market. The Reserve Bank of India's (RBI) guidance further supports this market's expansion.

While the 'Canara Green Deposit' represents a forward-looking product, its current market share and immediate impact on Canara Bank's profitability are likely modest. As a newer offering, it requires significant investment in marketing and development to capture a substantial portion of this expanding market. The bank's commitment to this segment positions it for future growth as ESG consciousness rises among investors and regulators.

Public sector banks, including Canara Bank, are actively investigating blockchain for trade finance. This technology promises to significantly boost efficiency and security in a sector ripe for modernization. While the growth potential is high, Canara Bank's current market share in these nascent blockchain solutions is likely minimal, necessitating substantial investment in technology and client onboarding.

Niche Fintech Collaborations and API Banking

Canara Bank is actively pursuing partnerships with fintech firms, evidenced by its ongoing efforts to onboard more companies and the recent launch of API banking for its corporate clients. These collaborations, particularly in digital lending, credit assessment, and financial inclusion initiatives like UPI 123 and ULI, present significant growth potential.

While these niche collaborations are positioned as high-growth opportunities, their ultimate market impact and share are still developing. This uncertainty places them in the question mark category, requiring strategic investment to realize their full potential and scale effectively.

- API Banking Expansion: Canara Bank's API banking for corporate customers aims to streamline integration with third-party applications, fostering innovation and efficiency.

- Fintech Collaboration Focus: Key areas for fintech partnerships include digital lending, credit underwriting, and financial inclusion, leveraging technologies like UPI 123 and ULI.

- Growth Potential vs. Uncertainty: These collaborations represent high-growth avenues, but their market success and share are yet to be definitively established, making them question marks.

- Investment for Scaling: Focused investment is crucial to nurture these nascent collaborations, enabling them to achieve scale and solidify their market position.

International Digital Remittances and Cross-Border Digital Services

Canara Bank's international branches in London, New York, and Dubai, along with its Sharjah representative office, position it to participate in the global digital remittance market. This market is substantial and continues to expand, presenting a significant opportunity.

However, Canara Bank's current digital remittance and cross-border service offerings may hold a relatively small market share when compared to established fintech players or major international banks that specialize in these services. The global digital remittance market was valued at approximately $68 billion in 2023 and is projected to reach over $100 billion by 2027, indicating robust growth.

- Market Opportunity: The global digital remittance market is a high-growth sector, with significant potential for Canara Bank to capture market share.

- Competitive Landscape: Specialized fintech companies and larger global banks currently dominate digital remittance services, suggesting a competitive environment.

- Strategic Investment: Investing in and enhancing digital platforms for international remittances and cross-border services is crucial for Canara Bank to leverage this growth.

- Growth Projection: The market is expected to see continued expansion, driven by increasing digital adoption and demand for convenient money transfer solutions.

Canara Bank's foray into niche areas like API banking expansion and fintech collaborations, particularly in digital lending and financial inclusion, represents significant growth potential. These ventures, while promising, are still in their nascent stages, meaning their market share and immediate revenue impact are not yet substantial. The bank's strategic investment in these areas is crucial to nurture their development and establish a stronger market presence. The success of these initiatives hinges on scaling effectively and capturing a larger portion of their respective markets.

BCG Matrix Data Sources

Our Canara Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.