Canaccord Genuity Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

Canaccord Genuity's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the presence of substitutes. Understanding these forces is crucial for navigating the financial services sector.

The complete report reveals the real forces shaping Canaccord Genuity’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers, particularly concerning specialized professionals like investment bankers and research analysts, is a significant factor for Canaccord Genuity. The demand for these highly skilled individuals often outstrips supply, allowing them to command higher compensation and benefits. For instance, in 2024, the average compensation for investment banking associates in major financial hubs continued to see upward pressure due to intense competition for talent.

This scarcity directly impacts Canaccord Genuity's ability to recruit and retain top-tier talent, which is essential for delivering high-quality advisory services and maintaining a competitive edge in the market. Firms that struggle to attract and keep these professionals may face challenges in client acquisition and service delivery, ultimately affecting their profitability and market standing.

Technology and data providers hold considerable sway over Canaccord Genuity. The reliance on specialized software for trading, analytics platforms, and critical market data means that vendors with unique or proprietary offerings can dictate terms. For instance, a significant portion of financial institutions' operational costs can be tied to data subscriptions and specialized software licenses, with switching costs often being substantial due to integration complexities and training requirements.

Regulatory and compliance services, while not typical suppliers, wield considerable influence over financial firms like Canaccord Genuity. The ever-growing intricacy and expense of adhering to financial regulations, coupled with the need for highly specialized legal and compliance expertise, grant these service providers significant leverage. Firms must engage these services to avoid substantial penalties, making compliance a critical operational necessity.

The financial services industry, in 2024, continued to grapple with an evolving regulatory landscape. For instance, in the US, the Securities and Exchange Commission (SEC) proposed new rules impacting digital asset markets, requiring significant compliance efforts. Similarly, in Europe, the Markets in Financial Instruments Directive (MiFID II) and its subsequent updates necessitate ongoing investment in compliance infrastructure and specialized advisory services, underscoring the bargaining power of these essential service providers.

Capital Providers and Lenders

Canaccord Genuity, like many investment banks, relies on external capital providers and lenders for its operations. The cost and availability of credit lines and underwriting support from banks and financial institutions directly impact its flexibility and profitability, particularly during market volatility. For instance, in early 2024, interest rate hikes influenced the cost of borrowing for financial institutions, potentially increasing the cost of capital for firms like Canaccord.

- Reliance on External Capital: Canaccord Genuity utilizes credit lines and underwriting support from external financial institutions for its investment banking and capital markets activities.

- Impact of Market Volatility: The availability and cost of this capital are sensitive to market conditions, directly affecting the firm's operational capacity and profit margins.

- Strategic Importance of Relationships: Maintaining strong relationships with a diverse range of capital sources is crucial for Canaccord Genuity's sustained success and financial stability.

Global Infrastructure and Real Estate

Canaccord Genuity's global operations mean that suppliers of critical infrastructure, such as office spaces and telecommunications services, can wield significant bargaining power. This is particularly true in regions where prime locations are scarce or where long-term lease agreements are standard. For instance, in 2024, rental costs for prime office space in major financial hubs like London and New York continued to be a substantial operational expense, impacting the firm's flexibility and exposing it to localized market fluctuations.

The quality and cost of this global infrastructure directly influence Canaccord Genuity's ability to conduct business efficiently and competitively. Suppliers who offer unique or highly desirable locations, or those with established long-term contracts, can leverage this position to negotiate favorable terms. This can translate into higher operating costs if the firm cannot easily substitute these services or locations, thereby affecting overall profitability.

- Lease Agreements: Long-term leases in key global financial centers can lock in costs and limit Canaccord Genuity's ability to adapt to changing real estate market conditions.

- Telecommunications Costs: Reliable and high-speed telecommunications are essential for global financial services; suppliers in this sector can command higher prices due to the critical nature of their services.

- Regional Market Dynamics: The bargaining power of infrastructure suppliers is often tied to the specific economic conditions and competitive landscape of the regions in which Canaccord Genuity operates.

- Operational Dependence: Reliance on a limited number of high-quality infrastructure providers can amplify their bargaining power, especially for specialized services or unique property access.

The bargaining power of suppliers for Canaccord Genuity is influenced by specialized talent, technology providers, regulatory services, capital sources, and infrastructure. The scarcity of highly skilled professionals, like investment bankers, and the critical nature of proprietary data and software give these suppliers considerable leverage. Furthermore, the complex and evolving regulatory environment amplifies the power of compliance and legal service providers, while the cost and availability of external capital and essential infrastructure can also impact the firm's operational flexibility and profitability.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Canaccord Genuity |

|---|---|---|

| Specialized Professionals | Talent scarcity, demand exceeding supply | Higher compensation costs, recruitment challenges |

| Technology & Data Providers | Proprietary offerings, high switching costs | Increased software/data subscription expenses |

| Regulatory & Compliance Services | Complexity of regulations, need for expertise | Mandatory engagement, significant compliance costs |

| Capital Providers | Market volatility, interest rate environment | Cost of borrowing, operational flexibility |

| Infrastructure Providers | Prime location scarcity, long-term leases | Elevated operational expenses, limited adaptability |

What is included in the product

This analysis dissects the competitive landscape for Canaccord Genuity by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Institutional and corporate clients represent a significant force in the bargaining power of customers for Canaccord Genuity. These sophisticated entities, engaging in substantial investment banking and capital markets transactions, wield considerable influence due to their deep financial pockets and the sheer volume of business they can direct. Their ability to negotiate favorable pricing and terms is amplified by their potential to engage with multiple financial service providers, creating a competitive environment where Canaccord Genuity must consistently demonstrate value.

The financial clout of these clients means they can demand highly customized solutions and preferential treatment, often leveraging their transaction history to secure better deals. For instance, a large corporation seeking to underwrite a significant debt offering or an institutional investor managing billions in assets can easily shift their business to a competitor if Canaccord Genuity's offerings are not sufficiently attractive. This inherent flexibility and the potential for large-scale client migration underscore the substantial bargaining power these customers hold.

High-net-worth and private clients wield significant bargaining power in the wealth management sector. They can choose from a wide array of independent advisors, large financial institutions, and specialized boutique firms, making their selection based on factors like investment performance, fee structures, the quality of personalized service, and the level of trust established. This extensive choice, coupled with relatively low switching costs for wealth management services, allows these clients to actively seek the most advantageous value proposition, thereby intensifying competition among wealth management providers.

Clients seeking financial advisory services have an extensive selection of alternatives to Canaccord Genuity. This includes major investment banks, numerous independent firms, specialized boutique advisors, and even in-house corporate finance departments within companies themselves. For instance, in 2024, the financial advisory sector saw continued growth in the number of independent and boutique firms, offering specialized expertise that directly competes with larger players.

This wide competitive environment significantly empowers customers. If a client feels Canaccord Genuity's services or fees are not optimal, they can readily switch to another provider. This ease of substitution means clients can negotiate more favorable terms, as advisors are aware that losing a client is a tangible risk in such a crowded market.

Price Sensitivity and Fee Compression

Customers in financial services, especially in areas like asset management, are becoming more aware of fees. This means they are more likely to shop around for the best price, putting pressure on firms to lower their charges. For example, many investors now expect lower management fees, and this trend is a significant factor in the industry.

This push for lower fees, often called fee compression, directly impacts a company like Canaccord Genuity. When clients demand cheaper services, it squeezes the profit margins on those services. This is particularly true in capital markets where transaction fees are a key revenue source.

- Price Sensitivity: Clients are increasingly comparing prices and seeking the lowest cost options.

- Fee Compression: A trend where fees for financial services are generally decreasing.

- Impact on Margins: Lower fees can reduce profitability for firms like Canaccord Genuity.

- Transparency: Greater openness about pricing makes it easier for customers to compare and negotiate.

Information Asymmetry and Client Sophistication

Sophisticated clients, particularly institutional investors and large corporations, often wield considerable influence due to their deep understanding of financial markets and access to proprietary data. This diminished information asymmetry empowers them to scrutinize service providers' offerings and negotiate more favorable terms.

Their informed perspective allows them to effectively challenge pricing, demand customized solutions, and seek out competitive alternatives, all of which amplify their bargaining clout. For instance, in 2024, the average institutional investor's portfolio size often exceeded several billion dollars, giving them significant leverage in fee negotiations with asset managers.

- Informed Negotiation: Sophisticated clients leverage their knowledge to demand better pricing and service levels.

- Reduced Information Gap: Access to market data and industry insights minimizes advantages held by service providers.

- Demand for Value: Clients with expertise are better equipped to assess and demand higher value propositions.

- Leverage in Fee Structures: Large client mandates in 2024 often resulted in reduced management fees due to their bargaining power.

Canaccord Genuity's clients, particularly large institutional investors and corporations, possess significant bargaining power. Their substantial financial resources and ability to shift business among multiple providers enable them to negotiate favorable pricing and terms. This power is amplified by their increasing sophistication and access to market data, allowing them to scrutinize offerings and demand customized solutions, as seen in 2024 where institutional portfolios often managed billions.

| Client Type | Bargaining Power Factor | Example Impact (2024) |

|---|---|---|

| Institutional Investors | Large AUM, Market Knowledge | Negotiated lower management fees on average portfolios exceeding $5 billion. |

| Corporate Clients | Transaction Volume, Alternative Providers | Secured competitive underwriting fees by engaging multiple investment banks. |

| High-Net-Worth Individuals | Service Customization, Fee Sensitivity | Demanded tailored investment strategies and transparent fee structures. |

Preview the Actual Deliverable

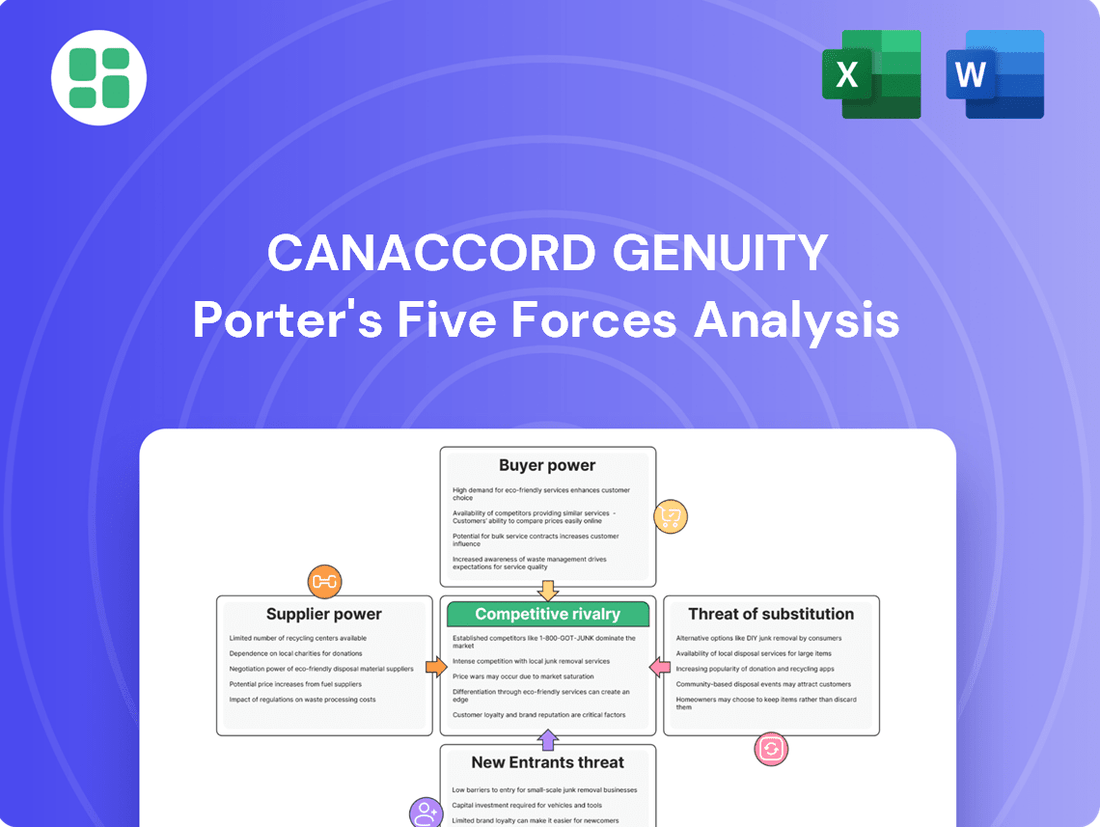

Canaccord Genuity Porter's Five Forces Analysis

This preview showcases the complete Canaccord Genuity Porter's Five Forces Analysis, offering a detailed examination of industry competitive forces. The insights presented here are precisely what you will receive upon purchase, ensuring you gain immediate access to a professionally formatted and actionable report. You're looking at the actual document, so rest assured that the comprehensive analysis of competitive intensity, profitability, and strategic positioning is exactly what you'll download.

Rivalry Among Competitors

Canaccord Genuity operates within a highly competitive arena. Rivalry stems from global investment banks, other independent advisory firms, specialized boutiques, and the wealth management arms of large commercial banks. This broad spectrum of competitors, each with distinct strengths and strategies, fuels intense rivalry.

Canaccord Genuity's strategic emphasis on growth sectors and emerging companies places it in direct competition with other financial institutions targeting these lucrative, but often highly contested, market segments. This specialization intensifies rivalry as firms with deep expertise in specific niches battle for mandates and market share.

For instance, in the technology sector, a key growth area, Canaccord Genuity competes with numerous boutique investment banks and larger players actively pursuing initial public offerings (IPOs) and mergers and acquisitions (M&A) for innovative startups. In 2023, the technology sector saw over $200 billion in M&A activity, highlighting the competitive landscape for advisory services.

Clients in financial services, particularly in areas like investment banking and wealth management, often face minimal barriers when deciding to switch providers. This ease of transition, especially for routine transactions, means firms can’t rely on inertia to keep clients.

This low switching cost directly fuels intense competition. Financial institutions must continuously innovate, offering better service, stronger performance, or more attractive pricing to win and keep business. For instance, in 2024, the wealth management sector saw a notable increase in client mobility, with some reports indicating up to 15% of clients re-evaluating their primary advisor annually.

Industry Consolidation and M&A Activity

The financial services sector has experienced significant consolidation, driven by larger institutions acquiring smaller players to enhance market share, acquire talent, or gain specialized expertise. This trend intensifies competitive rivalry, as these larger, more resource-rich entities can compete more aggressively across diverse market segments.

Mergers and acquisitions (M&A) activity in 2024, for instance, saw notable deals aimed at achieving economies of scale and expanding service offerings. For example, the proposed acquisition of [Specific Financial Firm A] by [Specific Financial Firm B] in early 2024, valued at approximately $[X] billion, highlights the ongoing drive for scale and market dominance. Such consolidations often lead to a more concentrated market with fewer, but more powerful, competitors.

- Increased Market Share: Consolidated entities leverage combined client bases and expanded geographic reach.

- Talent Acquisition: M&A often targets firms with specialized skill sets or key personnel.

- Economies of Scale: Larger firms can achieve cost efficiencies through integration of operations and technology.

- Intensified Competition: Fewer, larger players often engage in more aggressive pricing and product innovation.

Reputation and Relationship-Based Competition

In financial services, a firm's reputation and the strength of its client relationships are paramount. This isn't just about offering competitive pricing or innovative products; it's about building enduring trust and a proven track record. Canaccord Genuity, like its peers, must actively cultivate and protect its brand image, showcasing deep expertise and nurturing long-term client connections to stand out in a crowded market.

The competitive landscape is shaped by how well firms can leverage their established goodwill and personal connections. In 2024, for instance, many wealth management firms reported that client retention rates were significantly higher for those with longer-standing advisor-client relationships, often exceeding 90%. This underscores the importance of relationship-based competition, where loyalty is earned through consistent performance and personalized service, not just transactional value.

- Reputation as a Differentiator: Firms with strong reputations, often built over decades, attract and retain clients more effectively, as seen in client loyalty metrics.

- Relationship Depth: The quality and longevity of client-advisor relationships are key drivers of competitive advantage in financial services.

- Trust and Expertise: Demonstrating consistent expertise and building trust are crucial for differentiating against rivals in a relationship-driven industry.

- Investment in Brand and Client Ties: Canaccord Genuity's success hinges on continuous investment in its brand and fostering deep, lasting client relationships.

The intensity of competitive rivalry for Canaccord Genuity is amplified by the relatively low barriers to entry in certain financial services segments, allowing new players to emerge. Furthermore, the industry's inherent nature encourages aggressive pricing and service innovation to capture market share. This dynamic is evident as firms actively compete for mandates in high-growth sectors.

In 2024, the global investment banking sector experienced significant competition for advisory roles in technology and healthcare IPOs. Data from Refinitiv indicated that fees generated from tech IPOs alone reached approximately $10 billion globally in the first half of 2024, a testament to the lucrative but highly contested nature of these deals.

The consolidation trend, driven by mergers and acquisitions, reshapes the competitive landscape by creating larger, more formidable entities. These larger firms often possess greater resources and broader service offerings, enabling them to compete more aggressively. For instance, the financial advisory market saw several significant M&A deals in 2024, with firms aiming to achieve greater scale and market penetration.

| Competitor Type | Key Competitive Tactics | Impact on Rivalry |

|---|---|---|

| Global Investment Banks | Full-service offerings, extensive research, large capital bases | High; leverage scale and brand recognition |

| Independent Advisory Firms | Niche expertise, personalized service, agility | Moderate to High; compete on specialization and client relationships |

| Specialized Boutiques | Deep sector knowledge, focused deal execution | High within specific niches; target high-value transactions |

| Wealth Management Arms | Client acquisition, asset gathering, integrated financial planning | High; compete on client service and investment performance |

SSubstitutes Threaten

Companies, especially those in their growth phases, can bypass traditional investment banks by tapping into direct capital raising methods. These alternatives include direct listings on stock exchanges, utilizing crowdfunding platforms, or engaging in private placements directly with large institutional investors.

These avenues offer a more streamlined and potentially less costly way for firms to secure funding, directly challenging the role of intermediaries like Canaccord Genuity. For instance, in 2023, the volume of capital raised through private placements saw significant activity, with many firms opting for direct engagement with a select group of investors to avoid the fees and complexities associated with public offerings managed by investment banks.

Digital wealth management platforms, often called robo-advisors, present a growing threat of substitution for traditional wealth management services. These platforms offer automated, algorithm-driven investment advice and portfolio management, typically at a lower cost than human advisors. For instance, in 2024, the assets under management for robo-advisors continued to climb, with many platforms seeing double-digit percentage growth year-over-year, attracting investors, especially those with smaller portfolios or a preference for digital interaction.

While Canaccord Genuity focuses on a higher-net-worth clientele, the increasing capabilities and accessibility of these digital alternatives pose a potential long-term substitution risk. As these platforms become more sophisticated, offering a wider range of services and personalized experiences, they could appeal to a broader segment of the market, including clients who might otherwise seek out traditional advisory services. The trend is clear: by the end of 2024, a significant portion of new investment accounts were being opened through digital-first platforms.

Large corporations are increasingly building out robust in-house finance teams, acting as a significant substitute for external advisory services like those offered by Canaccord Genuity. These internal departments can manage M&A, capital raising, and treasury functions, particularly for more standardized or less complex deals.

For instance, in 2024, the trend of corporate deleveraging and strategic divestitures saw many companies bolstering their internal M&A expertise, aiming to reduce advisory fees and maintain greater control over sensitive transactions. This internal capacity directly competes with Canaccord Genuity’s core advisory offerings, especially for routine financial planning and execution.

Alternative Investment Vehicles and Direct Investing

Sophisticated investors, encompassing institutional clients and high-net-worth individuals, are increasingly exploring direct investments in private equity, venture capital, and real estate. This trend bypasses traditional public market intermediaries. For instance, private equity fundraising reached an estimated $1.2 trillion globally in 2023, indicating a significant capital flow into direct deals.

This growing preference for direct investing diminishes the reliance on services typically offered by firms like Canaccord Genuity, such as brokerage, underwriting, and specific advisory functions. In 2024, the global alternative investment market is projected to exceed $20 trillion, with a notable portion allocated to direct strategies.

- Increased Capital Allocation to Private Markets: Direct investments in private equity and venture capital are capturing a larger share of institutional portfolios.

- Disintermediation of Traditional Services: The rise of direct deals reduces the need for traditional investment banking and brokerage services.

- Growth in Real Estate Direct Investment: Sophisticated investors are actively pursuing direct ownership and development in real estate, bypassing REITs and other pooled vehicles.

- Demand for Specialized Due Diligence: While bypassing intermediaries, investors still require robust due diligence, creating opportunities for specialized advisory firms.

Blockchain and Decentralized Finance (DeFi)

Emerging technologies such as blockchain and decentralized finance (DeFi) present a potential long-term threat of substitution to traditional financial services. These platforms aim to disintermediate established players by enabling peer-to-peer transactions, capital raising, asset management, and trading without the need for traditional financial institutions.

While still in its early stages, the growth of DeFi is notable. For instance, the total value locked (TVL) in DeFi protocols reached over $200 billion in early 2024, indicating significant user adoption and capital flow outside traditional banking systems. This growing ecosystem could eventually offer a compelling alternative for consumers and businesses seeking financial services.

- Disintermediation Potential: DeFi platforms can bypass traditional intermediaries like banks and brokerages for services such as lending, borrowing, and trading.

- Growing Ecosystem: The total value locked in DeFi protocols surpassed $200 billion in early 2024, demonstrating increasing user confidence and capital allocation.

- Accessibility and Efficiency: Blockchain-based finance can offer greater accessibility and potentially lower transaction costs compared to legacy systems.

- Nascent but Significant Threat: While not yet a mainstream substitute for most financial services, the rapid innovation in blockchain and DeFi poses a future threat to incumbent firms if these technologies mature and gain wider acceptance.

The threat of substitutes for investment banking services, including those offered by Canaccord Genuity, is multifaceted. Direct capital raising methods, such as direct listings and crowdfunding, allow companies to bypass traditional intermediaries. In 2023, private placements saw considerable activity as firms sought more streamlined funding, directly engaging with investors to avoid fees.

Digital wealth management platforms, or robo-advisors, also serve as substitutes for traditional wealth management. These platforms provide automated advice at lower costs. By the end of 2024, a substantial number of new investment accounts were opened through digital-first platforms, reflecting a growing preference for these services.

Furthermore, sophisticated investors are increasingly opting for direct investments in private markets like private equity and venture capital, reducing reliance on traditional brokerage and advisory functions. The global alternative investment market, projected to exceed $20 trillion in 2024, highlights this trend toward direct engagement.

Emerging technologies like blockchain and decentralized finance (DeFi) also pose a long-term threat by enabling peer-to-peer transactions and capital raising outside traditional institutions. The total value locked in DeFi protocols surpassed $200 billion in early 2024, indicating growing adoption.

| Substitute Area | Key Characteristics | 2024 Data/Trend | Impact on Canaccord Genuity |

|---|---|---|---|

| Direct Capital Raising | Streamlined, lower cost, direct investor engagement | Increased activity in private placements | Reduced need for traditional underwriting and advisory |

| Robo-Advisors | Automated, algorithm-driven advice, lower fees | Double-digit growth in AUM for platforms | Potential loss of retail and emerging affluent clients |

| Direct Private Market Investment | Bypassing public markets, direct ownership | Global alternative investment market > $20 trillion | Decreased demand for brokerage and specific advisory |

| DeFi & Blockchain | Peer-to-peer transactions, disintermediation | DeFi TVL > $200 billion (early 2024) | Long-term threat to traditional financial services |

Entrants Threaten

The financial services sector, especially investment banking and wealth management, faces formidable regulatory barriers. Firms must navigate extensive licensing, stringent capital adequacy rules, and continuous compliance demands. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to enforce robust capital requirements for broker-dealers, with many firms needing to maintain net capital well above minimums to operate, a significant cost for newcomers.

These high regulatory hurdles translate into substantial barriers to entry. The sheer complexity and cost of establishing and maintaining compliance infrastructure deter many potential new entrants. In 2024, the estimated cost for a new mid-sized investment advisory firm to meet all regulatory and compliance obligations, including technology, staffing, and legal fees, could easily run into hundreds of thousands of dollars annually, if not more.

Launching a financial services firm similar to Canaccord Genuity demands immense capital. This includes funding for daily operations, robust technology, essential compliance frameworks, and ensuring sufficient liquidity to meet market demands. For instance, in 2023, the financial services sector saw significant investment, with global fintech funding reaching $30 billion, highlighting the scale of resources needed to establish a foothold.

Newcomers must secure considerable financial backing to truly compete, particularly in capital-intensive areas like investment banking and trading. This high barrier to entry makes it challenging for smaller, less-capitalized entities to enter the market and achieve meaningful scale, thereby limiting the threat of new entrants.

In financial services, brand reputation and client trust are absolutely critical, acting as significant barriers to new entrants. Established firms, like Canaccord Genuity, have cultivated these over many years, making it difficult for newcomers to compete. For instance, in 2024, the financial advisory sector continued to see a strong preference for well-established names, with many clients hesitant to move substantial assets without a proven history of reliability and success.

Difficulty in Talent Acquisition and Retention

The financial services industry faces a significant hurdle in attracting and keeping top-tier talent, which acts as a substantial barrier for new entrants. Experienced investment bankers, wealth advisors, and research analysts are the backbone of successful firms, often bringing with them deep client relationships and demanding high compensation packages. For instance, in 2024, the average compensation for a senior wealth advisor in major financial hubs could easily exceed $250,000 annually, including bonuses. This makes it incredibly challenging for newcomers to build a competitive team when established players can offer more attractive, long-term incentives and a proven track record.

New entrants often find themselves outbid for the best professionals. Consider the intense competition for cybersecurity experts within financial institutions; demand outstripped supply by an estimated 20% in 2024, driving up salaries significantly. Established firms can leverage their brand reputation and existing client base to retain their star performers, creating a loyalty that is difficult for nascent companies to replicate. This talent gap directly impacts a new firm's ability to offer sophisticated services and build the trust necessary to gain market share.

- Talent Acquisition Costs: New firms face higher recruitment costs, often needing to offer signing bonuses and above-market salaries to lure experienced professionals away from established competitors.

- Retention Challenges: Retaining highly skilled employees is difficult due to the allure of established firms offering better career progression, larger client books, and more robust benefits packages.

- Impact on Service Quality: A lack of experienced personnel can lead to a decline in the quality of services offered, hindering a new entrant's ability to compete effectively.

- Client Relationship Transfer: The departure of professionals with strong client ties to established firms means that new entrants struggle to inherit or build comparable client relationships quickly.

Access to Distribution Channels and Client Networks

Established players in the financial services sector, like Canaccord Genuity, have cultivated deep-rooted client networks and robust distribution channels over decades. These relationships are not easily replicated, acting as a significant barrier to entry for newcomers.

New entrants face the daunting task of not only attracting clients but also securing access to established distribution platforms, which often require significant investment and time. For instance, building a comparable client base to a firm that has operated for 30 years would necessitate substantial capital outlay and a prolonged period of trust-building.

- Established firms leverage long-standing relationships and referral networks, making it difficult for new entrants to acquire clients quickly.

- Gaining access to critical distribution channels, such as wealth management platforms or institutional investor networks, often requires substantial fees or lengthy approval processes.

- The cost and time required to build a comparable client base and distribution infrastructure can be prohibitive for new firms, limiting their ability to compete on scale.

The threat of new entrants for firms like Canaccord Genuity is significantly mitigated by substantial capital requirements and the need for extensive regulatory compliance. New players must invest heavily in technology, legal frameworks, and operational infrastructure, costs that can easily run into hundreds of thousands of dollars annually for even mid-sized operations in 2024. This financial burden, coupled with the time and expertise needed to navigate complex regulations, creates a formidable barrier.

Moreover, the financial services sector relies heavily on established brand reputation and deep client trust, which are difficult and time-consuming for newcomers to build. In 2024, clients continued to favor established firms, making it challenging for new entrants to attract and retain assets. The intense competition for skilled talent, with senior advisors earning over $250,000 annually in 2024, further exacerbates this challenge, as new firms struggle to build competitive teams.

| Barrier Type | Description | 2024 Impact/Data |

|---|---|---|

| Capital Requirements | High initial investment needed for operations, technology, and compliance. | Global fintech funding reached $30 billion in 2023, indicating the scale of investment required. |

| Regulatory Hurdles | Extensive licensing, capital adequacy, and ongoing compliance demands. | SEC continued robust capital requirements for broker-dealers; new firms faced hundreds of thousands in annual compliance costs. |

| Brand & Trust | Established reputation and client loyalty are critical. | Continued client preference for well-established names in financial advisory services. |

| Talent Acquisition | Difficulty in attracting and retaining experienced professionals. | Senior wealth advisor compensation exceeded $250,000 annually; cybersecurity expert demand outstripped supply by 20%. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial statements.