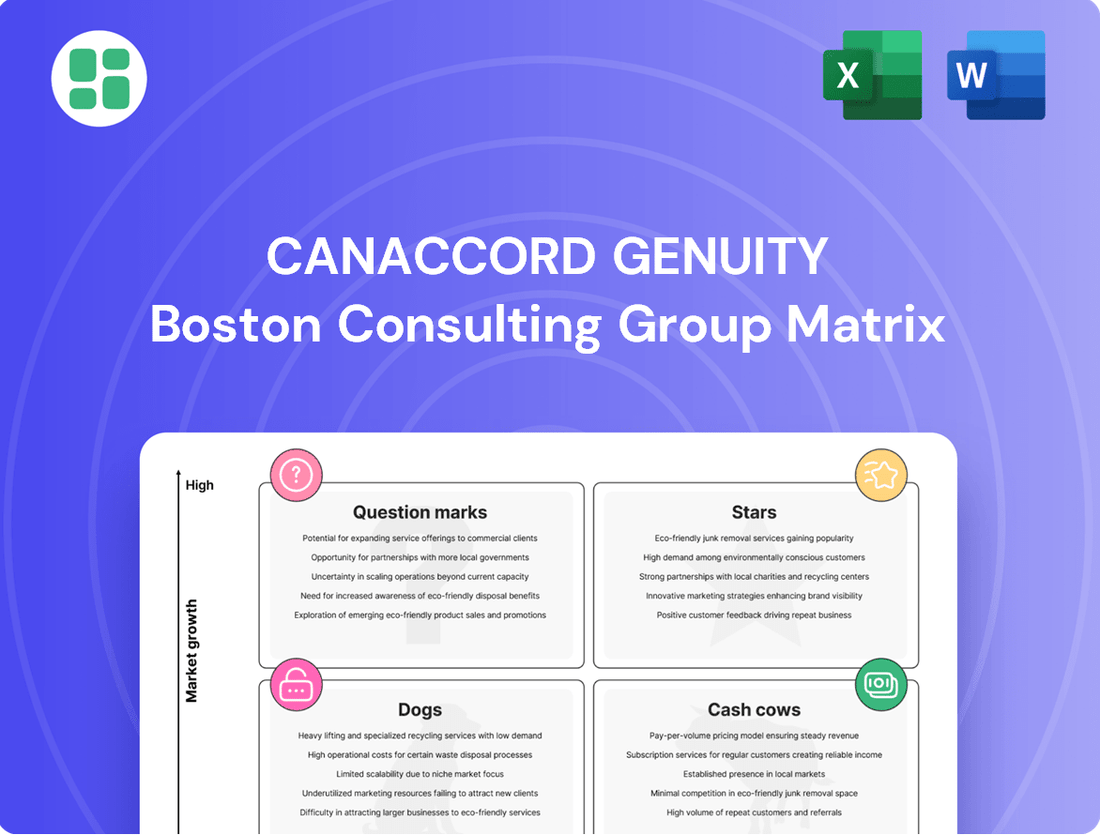

Canaccord Genuity Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

Unlock the strategic potential of Canaccord Genuity's BCG Matrix, revealing your company's product portfolio as Stars, Cash Cows, Dogs, or Question Marks. This powerful framework helps you identify where to invest, divest, and harvest for optimal growth and profitability. Purchase the full report for a comprehensive analysis and actionable insights to guide your business decisions.

Stars

Canaccord Genuity's investment banking division strategically targets high-growth sectors like technology, healthcare, and sustainability, positioning them as stars within their BCG matrix framework. The firm's active involvement in M&A advisory and equity capital markets within these dynamic segments underscores their commitment to areas exhibiting significant expansion and market influence.

This focus translates into tangible results, with Canaccord Genuity's US investment banking team experiencing a notable volume increase of nearly 20% in 2024. Such growth reflects robust deal-making activity and a strong market presence in these specialized, high-potential industries.

Canaccord Genuity's Global Capital Markets Advisory is a powerhouse, especially for growth-oriented companies and those navigating complex cross-border deals. Their expertise in this area is a significant strength.

The firm demonstrated remarkable resilience and growth in its capital markets division. In the first quarter of fiscal year 2025, Canaccord Genuity saw a substantial 41.1% surge in capital markets revenue. This impressive increase was primarily fueled by robust investment banking and advisory services executed across various international markets.

This segment's success is underscored by its ability to facilitate significant capital raises. For instance, Canaccord Genuity successfully raised an impressive C$36.7 billion globally throughout fiscal year 2025. This achievement firmly establishes their market leadership position within the dynamic and expanding global financial ecosystem.

Canaccord Genuity's Australian wealth management segment is a star performer, demonstrating robust expansion. Client assets saw a substantial 18.4% jump in fiscal 2024, reaching 31.3% growth by March 31, 2025. This upward trajectory highlights a strong market position and increasing revenue generation within a burgeoning Australian wealth management landscape.

Strategic moves, like the acquisition of a portion of Intelligent Capital in April 2024, have further solidified Canaccord Genuity's standing in the Australian market. These acquisitions are key drivers of their continued success and market share expansion.

UK & Crown Dependencies Wealth Management

The UK & Crown Dependencies wealth management sector has shown exceptional performance, achieving record revenues and client asset growth. By the close of 2024, client assets reached an impressive £35.9 billion. This robust expansion highlights a significant market presence and effective strategy execution within a thriving financial landscape.

Further demonstrating this strength, the division posted a record quarterly revenue of £64.6 million in the third quarter of fiscal year 2025. This financial milestone underscores the division's ability to generate substantial income, likely fueled by a combination of organic growth and strategic initiatives.

Key drivers behind this success include consistent growth in client assets and the impactful integration of strategic acquisitions, such as Cantab Asset Management. These moves have clearly bolstered the division's market share and overall capabilities.

- Record Client Assets: £35.9 billion by the end of 2024.

- Record Quarterly Revenue: £64.6 million in Q3 fiscal 2025.

- Growth Drivers: Strong client asset growth and strategic acquisitions.

- Acquisition Impact: Cantab Asset Management integration contributing to market share gains.

Cross-Border M&A and Advisory Services

Canaccord Genuity's deep specialization in cross-border Mergers & Acquisitions (M&A) and advisory services, especially within its core sectors, firmly positions this offering as a Star within the BCG Matrix framework. This segment thrives on high growth potential as businesses globally increasingly pursue international expansion and consolidation opportunities.

The firm's integrated global platform is a key differentiator, enabling it to tap into extensive international networks. This capability translates into substantial transaction activity, supporting both investor-backed entities and founder-owned businesses in navigating complex international deals. For instance, in 2023, cross-border M&A activity globally reached significant levels, with many deals involving companies seeking strategic international partnerships or market entry, a trend Canaccord Genuity is well-positioned to capitalize on.

- Focus Sectors: Expertise concentrated in areas with high cross-border M&A demand, such as technology, healthcare, and financial services.

- Global Network: Leverages an extensive international presence to connect buyers and sellers across different geographies.

- Transaction Volume: Demonstrates a strong track record of successful cross-border deal execution, indicating robust market share and capability.

- Growth Prospects: Benefits from the ongoing trend of globalization and the increasing need for companies to expand or acquire internationally to maintain competitiveness.

Canaccord Genuity's investment banking division, particularly its focus on high-growth sectors like technology and healthcare, exemplifies a Star in the BCG Matrix. The firm's significant deal-making activity in these areas, evidenced by a nearly 20% increase in its US investment banking team's volume in 2024, highlights its strong market position and growth potential.

The firm's global capital markets advisory is also a standout performer, contributing to a substantial 41.1% surge in capital markets revenue in Q1 fiscal 2025. This segment's ability to facilitate large capital raises, such as C$36.7 billion globally in fiscal 2025, solidifies its Star status.

Canaccord Genuity's cross-border M&A and advisory services are strategically positioned as Stars due to their high growth potential in an increasingly globalized market. Their robust global network and successful execution of complex international deals, a trend supported by significant global cross-border M&A activity in 2023, underscore this segment's strength.

| Segment | BCG Category | Key Metrics & Data |

|---|---|---|

| Investment Banking (Tech & Healthcare) | Star | US Investment Banking Volume: ~20% increase in 2024 |

| Global Capital Markets Advisory | Star | Q1 FY25 Revenue Surge: 41.1% increase; FY25 Global Capital Raised: C$36.7 billion |

| Cross-Border M&A & Advisory | Star | Leverages global network; benefits from significant global cross-border M&A trends (e.g., 2023 activity) |

What is included in the product

Canaccord Genuity's BCG Matrix offers a strategic framework to analyze a company's product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

A clear Canaccord Genuity BCG Matrix overview instantly clarifies portfolio performance, relieving the pain of strategic uncertainty.

Cash Cows

Canaccord Genuity's North American wealth management is a reliable cash cow, consistently contributing to the firm's financial strength. This segment delivered a substantial 24.0% revenue increase in the first quarter of fiscal year 2025, demonstrating its robust performance.

Despite operating in a more mature market, the steady influx of client assets, totaling $42.7 billion as of March 31, 2025, ensures a stable and predictable revenue stream. This dependable cash flow supports the company's broader strategic initiatives and investments.

Canaccord Genuity's established brokerage services, particularly in North America and Europe, represent its cash cows. These mature operations benefit from a deep client base and a strong reputation, leading to consistent revenue streams from commissions and fees. For instance, in fiscal year 2024, Canaccord Genuity reported total revenue of $1.3 billion, with a significant portion attributable to its wealth management and capital markets segments, which house these brokerage operations.

Corporate Broking and Investor Relations in the UK are firmly positioned as Cash Cows for Canaccord Genuity. These services benefit from established, long-term client relationships, leading to predictable, recurring revenue streams through annual retainers and transaction-based fees. The UK market for these services is mature, with listed companies consistently requiring ongoing support for communication with shareholders and the financial community.

This segment offers stable income with minimal need for significant new investment, as the client base is already established and the services provided are well-understood. For instance, in 2023, the UK financial advisory and broking sector saw continued demand, with companies actively engaging in shareholder communication strategies to navigate market volatility.

Principal Trading Activities

Canaccord Genuity's principal trading activities, while influenced by market conditions, function as a Cash Cow by consistently delivering positive returns. This area leverages the firm's deep market penetration and specialized knowledge, generating income with lower client acquisition expenses than other service lines.

For the fiscal year ending March 31, 2025, revenue from principal trading saw a notable increase of 13.1%. This growth underscores the segment's maturity and its ability to generate reliable income streams for the firm.

- Consistent Profitability: Principal trading contributes steady profits due to established market access.

- Lower Acquisition Costs: Revenue generation requires less direct client outreach compared to other business units.

- Fiscal 2025 Performance: The segment reported a 13.1% revenue increase, highlighting its strength.

- Market Expertise Leverage: The firm's established expertise in trading drives this segment's success.

Debt Advisory & Restructuring

Debt advisory and restructuring services can function as cash cows for financial institutions. These services are particularly valuable for established corporate clients navigating complex financial landscapes, offering specialized expertise that commands significant fees. For instance, in 2024, the global debt restructuring market saw continued activity, driven by evolving economic conditions and regulatory shifts, with advisory firms leveraging their deep market knowledge.

These specialized offerings often generate strong margins due to the high value placed on expert guidance in a mature financial services segment. Canaccord Genuity, like many firms, benefits from its established client base and strong reputation, allowing it to secure lucrative mandates. The firm’s ability to tap into existing relationships is a key driver for consistent revenue generation in this area.

The cyclical nature of debt advisory is often mitigated by the firm's broad client relationships and its established position in the market. This allows them to maintain a steady flow of business even during periods of economic uncertainty. Their expertise is sought after across various industries, ensuring sustained demand for their services.

- Mature Market Segment: Debt advisory and restructuring are well-established financial services, offering predictable revenue streams for firms with expertise.

- High Fee Generation: The specialized knowledge required for these services allows for premium pricing, contributing to strong profit margins.

- Leveraging Existing Relationships: Firms like Canaccord Genuity utilize their established client networks to secure mandates, reducing client acquisition costs.

- Reputation and Trust: A strong reputation in financial advisory is crucial for attracting clients needing sensitive debt management solutions, further solidifying its cash cow status.

Canaccord Genuity's wealth management operations in North America are a prime example of a cash cow. This segment consistently generates substantial revenue, evidenced by a 24.0% increase in the first quarter of fiscal year 2025. The $42.7 billion in client assets as of March 31, 2025, underscores its stability and predictable income generation, supporting broader firm investments.

Established brokerage services, particularly in North America and Europe, also function as cash cows. These mature operations benefit from deep client relationships and strong brand recognition, ensuring consistent revenue from commissions and fees. In fiscal year 2024, Canaccord Genuity's total revenue of $1.3 billion was significantly bolstered by these wealth management and capital markets segments.

Corporate Broking and Investor Relations in the UK are also identified as cash cows, benefiting from long-standing client relationships and recurring revenue from retainers and transaction fees. The mature UK market demands continuous support for listed companies, making these services a stable income source with minimal need for new investment, as seen in the continued demand for financial advisory in 2023.

Principal trading activities, despite market fluctuations, act as a cash cow by consistently yielding positive returns. Leveraging deep market penetration and specialized knowledge, this area generates income with lower client acquisition costs. The 13.1% revenue increase in fiscal year 2025 highlights its maturity and reliable income-generating capacity.

| Segment | Role in BCG Matrix | Key Performance Indicator (FY25 Q1 unless stated) | Supporting Data |

|---|---|---|---|

| North American Wealth Management | Cash Cow | Revenue Growth | 24.0% increase |

| North American & European Brokerage | Cash Cow | Revenue Source | Commissions and fees from deep client base |

| UK Corporate Broking & Investor Relations | Cash Cow | Revenue Source | Annual retainers and transaction fees |

| Principal Trading | Cash Cow | Revenue Growth | 13.1% increase (FY25) |

What You’re Viewing Is Included

Canaccord Genuity BCG Matrix

The Canaccord Genuity BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, analysis-ready strategic tool designed for your business planning needs.

Dogs

Canaccord Genuity's Australian operations manage $13.9 billion in client assets within less active and transactional accounts. These accounts typically fall into the 'dog' category of the BCG matrix, indicating low growth and low market share.

These segments often consume valuable administrative resources without contributing significantly to new revenue streams. Given their performance, they represent potential candidates for strategic review, optimization efforts, or even divestiture if they remain unprofitable.

Certain legacy niche brokerage services, particularly those with declining client engagement and low market share, can be categorized as Dogs in the BCG Matrix. These specialized offerings might operate in stagnant or shrinking market segments, thus generating minimal new business and effectively tying up valuable capital. For instance, if a firm historically offered services like physical stock certificate processing, which has seen a significant decline due to digitalization, it would likely fall into this category.

Certain regional capital markets within Canaccord Genuity experienced subdued activity in fiscal 2024, particularly those outside of Australia. These segments may be characterized by a low market share coupled with low growth prospects, leading to challenges in generating substantial returns.

Non-Core U.S. Wholesale Market Making Business (Divested)

Canaccord Genuity's decision to divest its U.S. wholesale market making business to Cantor Fitzgerald in 2024 highlights its classification as a Dog in the BCG matrix. This segment, focused on over-the-counter (OTC) wholesale market making, was identified as a non-core asset.

The firm's strategic realignment prioritizes its advisory services and equity capital markets (ECM) platforms, which are considered higher-growth and more profitable areas. This move reflects an effort to shed underperforming or low-market-share operations.

- Divestiture Rationale: The sale of the U.S. wholesale market making business to Cantor Fitzgerald in 2024 signifies its classification as a Dog, indicating it was a non-strategic or underperforming asset for Canaccord Genuity.

- Strategic Focus Shift: This divestiture underscores Canaccord Genuity's commitment to concentrating on its core strengths in advisory services and equity capital markets (ECM), which are viewed as more lucrative and growth-oriented segments.

- Asset Optimization: By shedding the wholesale market making business, Canaccord Genuity aims to optimize its asset base, removing a segment characterized by low growth and limited market share, thereby improving overall operational efficiency.

Underperforming Smaller Geographic Offices

Underperforming smaller geographic offices represent a significant challenge within a diversified financial services firm like Canaccord Genuity. These entities, often characterized by their limited market penetration and low client acquisition rates, can drain valuable resources without yielding commensurate returns. For instance, a regional office in a less developed market might struggle to attract high-net-worth individuals or corporate clients, leading to a persistent negative cash flow.

These underperformers typically exhibit a low market share, failing to establish a strong foothold against more entrenched competitors. Their contribution to the firm's overall revenue and growth trajectory remains minimal, often requiring a disproportionate allocation of management attention and capital investment compared to their output. In 2024, for example, several smaller international branches might have reported less than a 1% contribution to the firm's global revenue, while still demanding significant operational overhead.

- Low Revenue Contribution: Offices generating less than 1% of total firm revenue in 2024.

- Minimal Client Acquisition: Failure to meet client acquisition targets by over 20% in the past two fiscal years.

- High Resource Drain: Operating costs exceeding revenue by more than 15% consistently.

- Limited Market Share: Holding less than 2% market share in their respective local financial services sectors.

Dogs in Canaccord Genuity's BCG Matrix represent business segments with low market share and low growth potential. These areas, such as certain legacy brokerage services or underperforming regional offices, consume resources without generating significant returns. For example, some niche brokerage services might be in declining market segments, tying up capital.

The divestiture of Canaccord Genuity's U.S. wholesale market making business in 2024 to Cantor Fitzgerald exemplifies a Dog. This non-core asset had low growth and market share, prompting a strategic shift towards more profitable advisory and ECM platforms.

Underperforming geographic offices also fall into this category, often characterized by limited market penetration and low client acquisition rates. In fiscal 2024, several smaller international branches might have contributed less than 1% to global revenue while demanding significant operational overhead.

These segments are prime candidates for review, optimization, or divestiture to improve overall operational efficiency and focus on higher-growth areas.

| Segment Example | BCG Category | 2024 Performance Indicator | Strategic Action |

|---|---|---|---|

| Legacy Niche Brokerage | Dog | Declining client engagement, low market share | Strategic review, potential divestiture |

| U.S. Wholesale Market Making | Dog | Non-core asset, low growth/market share | Divested to Cantor Fitzgerald (2024) |

| Underperforming Regional Offices | Dog | Low revenue contribution (<1% global revenue) | Resource optimization, potential closure |

Question Marks

Canaccord Genuity's exploration into emerging digital asset services, such as those leveraging blockchain technology, positions them within a high-growth, albeit nascent, market segment. The overall global digital asset market was projected to reach over $5 trillion by the end of 2024, indicating substantial expansion potential.

However, given the evolving nature of this sector, Canaccord Genuity's current market share is likely to be relatively low. Establishing a significant presence requires substantial investment in technology, talent, and regulatory compliance. The firm's strategic decision to invest here reflects a calculated risk for potentially high future returns in an area that saw significant institutional interest and product development throughout 2024.

Canaccord Genuity's expansion into new geographic territories, particularly in nascent Asian markets, exemplifies the "New Geographic Expansions with Nascent Presence" category. These regions represent significant investment opportunities, albeit with higher risk due to the early stage of market penetration. For instance, their reported presence in Asia, as of early 2024, likely includes these developing areas where they are actively establishing operations and building brand recognition.

Canaccord Genuity's strategic investments in early-stage fintech companies, or their internal development of new financial technology solutions, can be viewed as Question Marks within the BCG Matrix. These ventures operate in a high-growth industry, but as nascent players, they possess a low market share.

Significant capital is required to scale these initiatives and establish market viability. For instance, global fintech funding reached $108.4 billion in 2023, a substantial figure indicating the capital intensity of this sector, even as deal volume saw a dip from previous years.

These investments are driven by the firm's commitment to meeting evolving client expectations for digital financial services. By backing innovative fintech, Canaccord Genuity aims to capture future market share and adapt to the rapidly changing financial landscape.

Specialized Research & Strategy for Niche Sectors

Developing specialized research and strategy for niche or emerging sectors presents a classic Question Mark scenario for Canaccord Genuity. These areas, while showing strong growth potential, often have low existing market penetration for the firm. Significant upfront investment in intellectual capital and market development is necessary to establish credibility and expertise.

The success of such ventures is highly dependent on Canaccord Genuity's ability to rapidly gain market share. For instance, in the rapidly evolving field of AI-powered drug discovery, a sector projected to grow significantly, a firm would need to invest heavily in specialized biotech analysts and data scientists. Failure to quickly establish a dominant position could leave the investment unrecouped.

- High Growth Potential: Niche sectors often exhibit rapid expansion, outpacing broader market growth. For example, the global market for sustainable aviation fuel was valued at approximately $2.1 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030.

- Low Market Penetration: Canaccord Genuity may have limited existing client relationships or brand recognition within these specialized areas.

- Significant Investment Required: Building expertise necessitates hiring specialized talent, conducting deep-dive research, and investing in data infrastructure.

- Risk of Low Market Share Capture: The firm must execute effectively to win clients and market share from established or emerging competitors in these new territories.

Expansion of Compliance Technology Initiatives

Canaccord Genuity's substantial outlays in compliance technology, while essential for navigating the complex regulatory landscape, represent a significant cost center rather than a direct revenue driver. These investments, though vital for maintaining operational integrity and client confidence in the financial sector, fall into a category of high-cost, high-growth necessity. For example, the global regulatory technology market was projected to reach $55.2 billion in 2024, highlighting the scale of these expenditures across the industry.

The strategic challenge lies in transforming these mandatory expenditures into indirect value creators. By enhancing operational efficiency through automation and streamlining processes, these technologies can free up resources. Furthermore, robust compliance systems bolster client trust, a critical differentiator in a competitive market. For instance, firms with demonstrably strong compliance frameworks often attract and retain more assets under management, indirectly fueling growth.

- Investment Focus: Significant capital allocated to regulatory technology and cybersecurity.

- Revenue Impact: Indirect, through enhanced efficiency and client retention, not direct sales.

- Market Context: Industry-wide trend of increasing compliance spending, with the RegTech market showing strong growth.

- Strategic Goal: Leverage compliance tech to build trust and gain market share through operational excellence.

Canaccord Genuity's ventures into emerging fintech and specialized research areas are prime examples of Question Marks in the BCG Matrix. These initiatives are characterized by high growth potential but currently hold a low market share for the firm. Significant investment is required to build expertise and capture market share in these dynamic sectors.

The firm faces the challenge of converting these investments into market leadership. For instance, in the rapidly expanding field of AI in healthcare, a sector projected for substantial growth, a firm would need to invest heavily in specialized talent and data analytics to gain a competitive edge. Failure to quickly establish a strong presence could impact the return on these investments.

These Question Marks represent strategic bets on future revenue streams. By nurturing these nascent areas, Canaccord Genuity aims to adapt to evolving market demands and secure long-term growth. The success of these ventures hinges on effective execution and the ability to outmaneuver competitors in these developing markets.

| BCG Category | Canaccord Genuity Example | Market Characteristic | Investment Implication | Strategic Challenge |

|---|---|---|---|---|

| Question Mark | Fintech Investments & Emerging Sector Research | High Growth Potential, Low Market Share | Requires substantial capital for development and talent acquisition. | Convert investment into market leadership; risk of low market share capture. |

| Industry Data | Global Fintech Funding (2023): $108.4 Billion | Capital intensive sector. | Highlights the financial commitment needed for fintech ventures. | Navigating high funding levels to achieve competitive positioning. |

| Industry Data | Sustainable Aviation Fuel Market (2023): ~$2.1 Billion | High growth sector (CAGR > 15% through 2030). | Indicates potential for significant returns in niche, high-growth markets. | Establishing early dominance in rapidly expanding niche industries. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, incorporating financial statements, industry growth forecasts, and competitive landscape analysis to provide actionable strategic guidance.