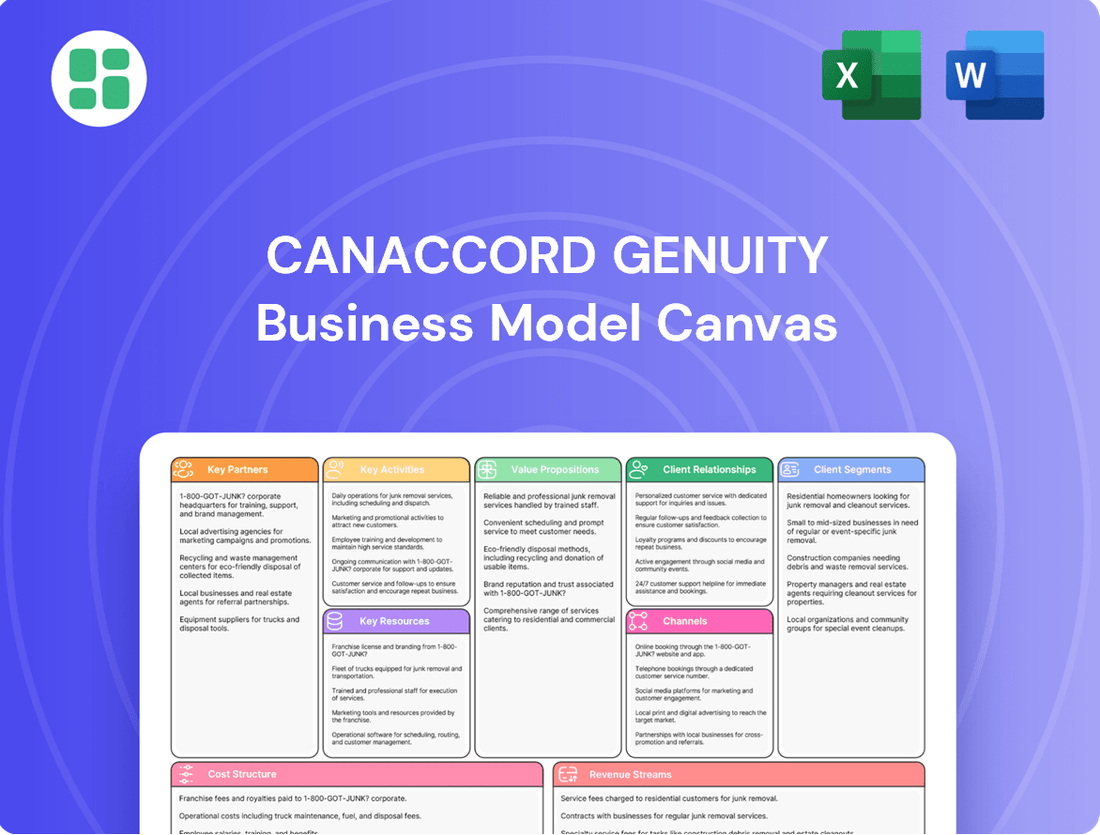

Canaccord Genuity Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

Discover the strategic architecture of Canaccord Genuity's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their client relationships, revenue streams, and competitive advantages, offering invaluable insights for strategic planning. Unlock the full blueprint to understand how they navigate the financial services landscape and drive growth.

Partnerships

Canaccord Genuity actively builds strategic alliances with niche firms to bolster its advisory services, especially in dynamic, high-growth industries. These collaborations are crucial for accessing specialized knowledge and expanding service offerings.

A prime example is the business collaboration agreement inked in November 2024 with Carbon Reduction Capital LLC (CRC-IB). This partnership specifically targets the burgeoning energy transition sector, aiming to synergistically enhance M&A, project finance, and capital raising capabilities for both entities.

Through this alliance, Canaccord Genuity seeks to significantly broaden its mid-market advisory footprint and deepen its expertise in critical areas such as wind power, solar energy, energy storage solutions, and carbon capture technologies, reflecting a strategic move to capture emerging market opportunities.

Canaccord Genuity strategically targets acquisitions to broaden its global wealth management reach and grow client assets. These partnerships are crucial for enhancing investment management and financial planning services.

Notable recent acquisitions include Brooks Macdonald Asset Management International Ltd. in early 2025 and Cantab Asset Management Ltd. in the UK during October 2024. These moves significantly boosted client assets and overall wealth management capabilities.

Canaccord Genuity's correspondent brokerage services, a key component of its Corporate and Other administrative segment, involve providing essential infrastructure and support to other financial institutions. This strategic offering allows Canaccord Genuity to leverage its global reach and operational capabilities to serve a broader market. In 2024, this segment played a crucial role in the firm's overall revenue generation.

Technology and Platform Providers

Canaccord Genuity's strategic alliances with technology and platform providers are fundamental to elevating client satisfaction and streamlining internal operations. These collaborations are vital for delivering sophisticated, integrated financial solutions.

Significant investments in platforms like Envestnet and Avaloq underscore this commitment. These platforms enable Canaccord Genuity to offer seamless experiences for both investment advisors and their clients, fostering a robust and adaptable infrastructure for sustained expansion within its wealth management sector.

These partnerships are not merely about adopting new tools; they are about building an ecosystem that supports growth and innovation.

- Envestnet: A leading provider of wealth management technology and services, offering a comprehensive suite of solutions that Canaccord Genuity leverages to enhance advisor productivity and client engagement.

- Avaloq: A global leader in integrated banking software and wealth management solutions, providing a platform that supports complex financial operations and regulatory compliance.

- Operational Efficiency: By integrating these advanced platforms, Canaccord Genuity aims to reduce manual processes, improve data accuracy, and accelerate transaction times, thereby boosting overall efficiency.

- Client Experience: The focus is on providing clients with intuitive digital tools, personalized advice, and secure access to their financial information, creating a superior service offering.

Industry Associations and Regulatory Bodies

Canaccord Genuity actively engages with key industry associations and regulatory bodies worldwide. These relationships are crucial for navigating complex compliance landscapes and ensuring adherence to evolving financial regulations. For instance, in 2024, the firm's participation in industry forums helped shape discussions around new capital requirements and digital asset regulations in several key markets.

These partnerships are fundamental to Canaccord Genuity's ability to operate effectively across diverse jurisdictions. By staying informed through these channels, the company can proactively adapt its strategies to meet regulatory changes and maintain its license to operate. This proactive approach is vital in the fast-paced financial services sector.

- Compliance Assurance: Maintaining strong ties with regulatory bodies like the Financial Industry Regulatory Authority (FINRA) in the US and the Financial Conduct Authority (FCA) in the UK ensures ongoing compliance with stringent financial laws.

- Market Insight & Standard Setting: Engagement with associations such as the Securities Industry and Financial Markets Association (SIFMA) provides valuable insights into market trends and allows Canaccord Genuity to contribute to the development of industry best practices.

- Risk Mitigation: Understanding and influencing regulatory developments through these partnerships helps Canaccord Genuity mitigate operational and reputational risks associated with non-compliance.

- Global Operational Efficiency: By fostering relationships with regulatory authorities in regions like Canada, Australia, and Europe, the firm streamlines its cross-border operations and capital management strategies.

Canaccord Genuity's key partnerships are essential for expanding its specialized advisory services and global reach. Collaborations with niche firms, such as the November 2024 agreement with Carbon Reduction Capital LLC for the energy transition sector, enhance M&A and project finance capabilities. Strategic acquisitions, like Cantab Asset Management in October 2024, bolster wealth management services and client assets.

Furthermore, alliances with technology providers like Envestnet and Avaloq are critical for operational efficiency and superior client experiences. These partnerships enable seamless digital tools and personalized advice, supporting sustained growth in the wealth management sector.

Engagement with industry associations and regulatory bodies, including FINRA and FCA in 2024, ensures compliance and provides vital market insights, mitigating risks and facilitating global operations.

| Partnership Type | Key Partner Example | Focus Area | Impact/Benefit | Year |

|---|---|---|---|---|

| Niche Firm Collaboration | Carbon Reduction Capital LLC | Energy Transition M&A, Project Finance | Enhanced specialized advisory, market expansion | 2024 |

| Strategic Acquisition | Cantab Asset Management Ltd. | Wealth Management | Increased client assets, expanded capabilities | 2024 |

| Technology Platform | Envestnet | Wealth Management Technology | Improved advisor productivity, client engagement | Ongoing |

| Regulatory Engagement | FINRA, FCA | Compliance, Market Insight | Risk mitigation, operational efficiency | 2024 |

What is included in the product

A detailed breakdown of Canaccord Genuity's operations, outlining key partners, activities, and resources essential for their investment banking and wealth management services.

Provides a clear, one-page overview of Canaccord Genuity's strategy, simplifying complex financial operations and reducing the pain of information overload.

Activities

Canaccord Genuity's key activities revolve around its robust investment banking and advisory services. This includes advising on mergers and acquisitions (M&A), corporate finance, and facilitating capital raising for clients.

In fiscal year 2025, the firm was active in 355 investment banking transactions worldwide, successfully raising C$36.7 billion. A significant emphasis is placed on supporting growth sectors and emerging companies.

The company has strategically honed its focus on its core global advisory and equity capital markets (ECM) driven investment banking operations. This strategic refinement is exemplified by the sale of its U.S. wholesale market making business to Cantor in April 2025.

Canaccord Genuity's key activities include managing client assets and delivering comprehensive wealth management and financial planning solutions. This involves advising clients on investment strategies, retirement planning, estate planning, and tax optimization to help them achieve their financial goals.

The company's global wealth management segment has shown robust performance. In fiscal 2025, it achieved record revenue of $904.8 million. Client assets under management also hit an all-time high, reaching $125.3 billion by June 30, 2025.

This growth in client assets and revenue is attributed to a combination of organic expansion, attracting new clients, and successfully integrating strategic acquisitions. These activities are central to Canaccord Genuity's strategy of providing a full suite of financial services to a diverse client base.

Capital Markets Sales and Trading is a core function, involving institutional sales and trading of equities and other securities for clients worldwide. This includes principal trading and brokerage, which are significant drivers of Canaccord Genuity's capital markets revenue.

While Canaccord Genuity has strategically exited certain areas, such as U.S. market making, its commitment to core equity-based institutional sales and trading remains strong. This focus allows them to leverage their expertise in key global markets.

In the fiscal year ending March 31, 2024, Canaccord Genuity Group reported total revenue of C$1.1 billion, with its Capital Markets segment being a substantial contributor. This segment's performance is directly tied to the success of its sales and trading operations.

Equity Research and Market Analysis

Canaccord Genuity's equity research and market analysis are cornerstones of its business, providing crucial intelligence for both its investment banking and wealth management divisions. The firm focuses on delivering actionable insights, especially within its specialized sectors, enabling clients to navigate markets with greater confidence.

These research capabilities directly inform investment strategies and bolster the firm's advisory services, ensuring clients receive well-supported recommendations. For instance, in 2024, Canaccord Genuity continued to deepen its coverage in areas like technology and healthcare, sectors that have shown significant growth potential.

- Sector Focus: Canaccord Genuity maintains a strong emphasis on specific growth sectors, offering deep dives into companies within these areas.

- Actionable Insights: The research aims to translate complex market data into clear, actionable advice for clients.

- Client Support: This analytical backbone is essential for supporting investment banking deals and guiding wealth management portfolios.

- Market Intelligence: By continuously monitoring and analyzing market trends, the firm provides a competitive edge to its clientele.

Strategic Acquisitions and Talent Recruitment

Canaccord Genuity actively pursues strategic acquisitions to bolster its market presence and service capabilities. This includes integrating new teams and client bases, as evidenced by their ongoing expansion efforts in key financial centers.

The firm places significant emphasis on recruiting seasoned investment advisors and banking professionals. This talent acquisition is vital for deepening client relationships and expanding the firm's expertise in specialized financial sectors.

These key activities directly contribute to Canaccord Genuity's growth objectives, aiming to increase assets under management and broaden its service portfolio. For instance, in fiscal year 2024, the firm reported a notable increase in advisor headcount, reflecting this strategic hiring push.

- Strategic Acquisitions: Expanding geographic footprint and service offerings through targeted company purchases.

- Talent Recruitment: Attracting and retaining experienced financial professionals to enhance client advisory services.

- Human Capital Growth: Strengthening the firm's expertise and capacity by onboarding skilled advisors and bankers.

- Asset and Service Expansion: Directly linking recruitment and acquisition efforts to increases in client assets and the breadth of financial solutions provided.

Canaccord Genuity's key activities are centered on providing expert investment banking and advisory services, including mergers and acquisitions, corporate finance, and capital raising. The firm also manages client assets through its robust wealth management division, offering comprehensive financial planning solutions.

In fiscal year 2025, Canaccord Genuity was involved in 355 investment banking transactions globally, raising C$36.7 billion. The wealth management segment achieved a record revenue of $904.8 million in fiscal year 2025, with client assets reaching $125.3 billion.

The company's Capital Markets Sales and Trading operations are crucial, facilitating institutional sales and trading of securities. This segment's performance is directly linked to the firm's overall revenue, as demonstrated by its substantial contribution to the C$1.1 billion total revenue reported for fiscal year ending March 31, 2024.

| Key Activity | Description | Fiscal Year 2025 Data | Fiscal Year 2024 Data |

| Investment Banking & Advisory | M&A, Corporate Finance, Capital Raising | 355 transactions, C$36.7 billion raised | N/A |

| Wealth Management | Asset management, Financial Planning | $904.8 million revenue, $125.3 billion AUM | N/A |

| Capital Markets Sales & Trading | Institutional Sales & Trading | N/A | Substantial contributor to C$1.1 billion total revenue |

Full Version Awaits

Business Model Canvas

The Canaccord Genuity Business Model Canvas you are currently viewing is the exact document you will receive upon purchase. This preview showcases the authentic structure and content, ensuring you know precisely what to expect. Once your order is complete, you'll gain full access to this comprehensive and professionally formatted Business Model Canvas, ready for immediate use.

Resources

Canaccord Genuity's most vital asset is its team of seasoned professionals. This includes investment bankers, wealth managers, research analysts, and dedicated support staff who collectively drive the firm's success.

As of fiscal year 2025, Canaccord Genuity's global workforce comprised 2,925 employees. Their deep knowledge in specialized areas such as technology, metals and mining, and the energy transition is crucial.

This expertise, coupled with robust client relationships, forms the bedrock of Canaccord Genuity's value proposition, enabling them to deliver tailored financial solutions and strategic advice.

Canaccord Genuity's extensive global network, spanning 47 locations across North America, the UK & Europe, Asia, and Australia, is a cornerstone of its business model. This expansive geographic footprint is not merely about physical offices; it represents a deep integration into diverse financial ecosystems.

This widespread presence is a critical resource, enabling Canaccord Genuity to offer a truly global perspective to its clients. It facilitates the execution of complex cross-border transactions and provides invaluable local market insights that are essential for navigating international financial landscapes.

In 2024, the firm continued to leverage this network to support a diverse client base, ranging from emerging companies to established institutions. The ability to connect clients with opportunities and expertise across continents underscores the strategic importance of its geographic reach.

Canaccord Genuity's proprietary research platforms, including its esteemed Quest® equity analysis tools, are central to its business model. These platforms deliver deep market insights and are a significant component of the firm's intellectual property.

This unique intellectual property allows Canaccord Genuity to offer distinctive value to its clients, underpinning its advisory services. For instance, in 2023, the firm's research contributed to a significant number of its advisory mandates, highlighting the practical application of its proprietary data.

By leveraging these advanced research capabilities, Canaccord Genuity maintains a crucial competitive advantage within its chosen specialized sectors. The firm's commitment to developing and utilizing these resources ensures it remains at the forefront of market intelligence and client advisory.

Financial Capital and Client Assets Under Management

Canaccord Genuity's financial capital, evidenced by its robust balance sheet, forms a bedrock for its operations. This financial strength is crucial for supporting its diverse business activities and strategic growth initiatives.

Client assets under management (AUM) represent a critical resource, totaling $125.3 billion as of June 30, 2025. This substantial AUM directly fuels recurring fee-based revenue streams, providing a stable and predictable income source for the firm.

- Financial Capital: Demonstrates balance sheet strength, enabling operational stability and investment.

- Client Assets Under Management: $125.3 billion as of June 30, 2025, a key driver of recurring revenue.

- Revenue Generation: AUM directly translates into fee-based income, supporting the firm's business model.

- Capital Base: Provides the foundation for ongoing operations and future investment opportunities.

Technology Infrastructure and Digital Platforms

Canaccord Genuity's commitment to advanced technology infrastructure and digital platforms is a cornerstone of its business model, particularly within wealth management and trading operations. This focus ensures efficient client interactions and streamlined back-office processes. In 2024, the financial services industry saw significant digital transformation, with firms prioritizing investments in client-facing portals and robust trading systems.

Continuous investment is critical for maintaining a competitive edge. This includes upgrading client-facing tools to offer intuitive interfaces and personalized experiences, as well as enhancing back-office systems for greater operational efficiency and scalability. For instance, many wealth management firms reported increasing their technology budgets by 5-10% in 2024 to support these initiatives.

- Client-Facing Platforms: Development of user-friendly digital portals for portfolio viewing, research access, and secure communication.

- Trading Systems: Investment in high-speed, reliable trading infrastructure to facilitate efficient execution and provide real-time market data.

- Back-Office Efficiency: Implementation of automation and integrated systems to streamline operations, reduce costs, and improve data accuracy.

- Cybersecurity: Ongoing investment in robust security measures to protect client data and maintain trust in digital platforms.

Canaccord Genuity's key resources include its highly skilled workforce, extensive global network, proprietary research platforms, robust financial capital, and advanced technology infrastructure.

The firm's 2,925 employees as of fiscal year 2025 possess specialized expertise, while its 47 global locations facilitate cross-border transactions and local insights.

Proprietary research, like Quest®, provides a competitive edge, and client assets under management reached $125.3 billion by June 30, 2025, a significant driver of recurring revenue.

Investments in technology platforms enhance client experience and operational efficiency, crucial in the evolving financial landscape of 2024.

| Resource Category | Key Component | Data Point/Metric | Significance |

|---|---|---|---|

| Human Capital | Seasoned Professionals | 2,925 employees (FY25) | Drives specialized advisory and client relationships. |

| Network | Global Presence | 47 locations | Enables international transaction execution and local market intelligence. |

| Intellectual Property | Proprietary Research Platforms (e.g., Quest®) | Contributed to significant advisory mandates (2023) | Offers unique value and competitive advantage in specialized sectors. |

| Financial Capital | Client Assets Under Management (AUM) | $125.3 billion (as of June 30, 2025) | Drives recurring fee-based revenue and operational stability. |

| Technology | Digital Platforms & Infrastructure | Continued investment in 2024 | Enhances client experience, operational efficiency, and trading capabilities. |

Value Propositions

Canaccord Genuity provides a full spectrum of financial services, including investment banking, wealth management, and capital markets, to clients worldwide. This integrated model ensures clients receive cohesive support across diverse financial requirements and international markets, fostering a complete client relationship.

In 2024, Canaccord Genuity's integrated model continued to drive growth, with the firm reporting significant activity across its global operations. For instance, its capital markets division advised on numerous cross-border transactions, facilitating capital raising and M&A for a variety of industries.

The wealth management segment, a key component of their integrated offering, saw continued expansion in 2024, reflecting client trust in their ability to manage assets across different economic landscapes. This holistic approach is designed to meet evolving client needs through a single, streamlined platform.

Canaccord Genuity leverages deep sector-specific expertise, with a pronounced focus on high-growth areas like technology, metals & mining, and the burgeoning energy transition market. This specialization allows them to provide uniquely tailored advice and facilitate capital access for companies operating in these dynamic and often complex industries.

Canaccord Genuity’s independence is a cornerstone of its value proposition, allowing for truly unbiased and client-centric advice. This commitment, dating back to its founding in 1950, ensures that client objectives are always paramount, fostering deep trust and long-term partnerships.

Global Reach with Local Presence

Canaccord Genuity offers clients the advantage of its expansive global network, granting access to a wide array of international capital markets and diverse investment opportunities. This worldwide reach is complemented by a robust local presence in strategically important regions, ensuring that clients receive tailored support and market insights relevant to their specific geographic focus.

This dual approach, combining global connectivity with localized expertise, allows Canaccord Genuity to effectively serve a broad spectrum of client needs. For instance, in 2024, the firm continued to expand its advisory services across North America, Europe, and Asia-Pacific, facilitating cross-border transactions and providing nuanced regional market intelligence.

- Global Network Access: Facilitates access to international capital markets and investment opportunities.

- Local Market Expertise: Provides localized service delivery and tailored regional insights.

- Cross-Border Capabilities: Supports clients in navigating international financial landscapes.

- Diverse Client Needs: Caters to a wide range of investment and advisory requirements across different geographies.

Robust Wealth Management Performance and Asset Growth

For wealth management clients, Canaccord Genuity offers the compelling value proposition of consistent asset growth and robust financial performance. This translates into tangible benefits for those entrusting their financial futures to the firm.

The wealth management division has demonstrated its effectiveness through significant achievements. For instance, in the fiscal year ending March 31, 2024, the firm reported record client asset growth, a testament to its ability to attract and retain assets under management. This growth is not merely in volume but also in quality, with increasing fee-based revenue streams highlighting a sustainable and valuable client relationship model.

- Consistent Asset Growth: The firm's wealth management segment has achieved record client asset growth, indicating strong client confidence and successful asset accumulation strategies.

- Increasing Fee-Based Revenue: A rise in fee-based revenue signifies the growing value and depth of client relationships, moving beyond transactional services to ongoing wealth advisory.

- Performance Through Market Conditions: The demonstrated capability to grow and protect client wealth across diverse market environments underscores the resilience and strategic acumen of the wealth management approach.

Canaccord Genuity's value proposition centers on its integrated financial services, deep sector specialization, and unwavering independence. This allows them to offer tailored, unbiased advice and capital solutions globally. The firm's commitment to client-centricity, combined with its expansive network, ensures comprehensive support across diverse financial needs.

Customer Relationships

Canaccord Genuity prioritizes dedicated relationship management, particularly within its wealth management division. This involves assigning personal advisors and portfolio managers directly to clients, fostering a deep understanding of their unique financial goals and circumstances.

This personalized approach is designed to build enduring, trust-based partnerships. By focusing on individual client needs, Canaccord Genuity aims to deliver financial solutions that are precisely tailored, enhancing client satisfaction and retention. As of the first quarter of 2024, the firm reported a significant portion of its revenue stemming from recurring advisory fees, underscoring the value placed on these long-term client relationships.

For corporate and institutional clients, Canaccord Genuity fosters relationships through a deeply advisory and consultative approach. This means providing expert guidance on complex transactions, helping shape strategic planning, and engaging continuously to meet their evolving business objectives and capital market needs.

Canaccord Genuity’s client service and support teams are central to fostering strong relationships, ensuring efficient and responsive interactions. These teams handle crucial operational aspects like transaction processing and account management, aiming for prompt resolution of client inquiries.

In 2024, Canaccord Genuity continued to invest in its client support infrastructure. While specific customer satisfaction scores for this segment are proprietary, the firm’s overall revenue growth of 8% in the fiscal year ending March 31, 2024, to $1.3 billion, reflects a positive client experience that encourages continued engagement and business volume.

Digital Engagement and Self-Service Tools

Canaccord Genuity is enhancing client relationships through robust digital platforms, offering convenient self-service tools for account management and access to market insights. This digital-first approach aims to empower clients by providing them with readily available financial planning resources.

- Digital Platforms: Canaccord Genuity's investment in digital engagement allows clients 24/7 access to their portfolios and market data.

- Self-Service Tools: Clients benefit from online portals for transactions, research, and personalized financial planning assistance.

- Client Empowerment: By providing these tools, Canaccord Genuity fosters greater client autonomy and informed decision-making.

- Accessibility: The focus on digital channels ensures clients can engage with their finances conveniently, regardless of location or time.

Targeted Programs and Events

Canaccord Genuity actively cultivates client relationships through specialized programs and events. For instance, the CG Advisory Program for Women Entrepreneurs offers targeted support and networking opportunities. These events are designed to provide tangible value beyond standard services, fostering a sense of community and shared growth.

These carefully curated initiatives serve as crucial touchpoints for building loyalty and deepening engagement. By facilitating direct interaction and knowledge exchange, Canaccord Genuity positions itself as a strategic partner, not just a service provider. This approach directly addresses the need for personalized value creation within its client base.

- Targeted Client Engagement: Programs like the CG Advisory Program for Women Entrepreneurs demonstrate a commitment to specific client segments.

- Value-Added Opportunities: Events are structured to offer networking, mentorship, and educational content, enhancing client value.

- Relationship Deepening: These initiatives foster stronger connections by creating shared experiences and facilitating knowledge transfer.

- Community Building: By bringing together like-minded individuals, Canaccord Genuity cultivates a robust ecosystem for its clients.

Canaccord Genuity's customer relationships are built on a foundation of personalized advisory services, both for individual wealth management clients and corporate/institutional partners. This involves dedicated advisors and consultative approaches to meet evolving financial and strategic needs.

The firm emphasizes building trust through tailored solutions and responsive support, with digital platforms enhancing accessibility and self-service capabilities. Investments in client infrastructure, reflected in overall revenue growth, underscore the importance of these relationships.

Specialized programs and events further deepen engagement, fostering a sense of community and positioning Canaccord Genuity as a strategic partner. This multi-faceted approach aims for client retention and satisfaction.

| Relationship Aspect | Description | Key Initiatives/Data Points (2024) |

|---|---|---|

| Personalized Advisory | Dedicated advisors for wealth management clients; consultative approach for corporate clients. | Focus on understanding unique financial goals and business objectives. |

| Digital Engagement | 24/7 access to portfolios, market data, and self-service tools. | Investment in robust digital platforms for client convenience. |

| Client Support | Efficient and responsive handling of operational aspects and inquiries. | Integral to fostering strong client interactions and trust. |

| Value-Added Programs | Targeted programs and events for specific client segments. | CG Advisory Program for Women Entrepreneurs; networking and educational events. |

Channels

Canaccord Genuity leverages its extensive global office network, spanning North America, the UK & Europe, Asia, and Australia, to directly connect with clients. These physical hubs are crucial for delivering personalized advisory services and facilitating access to diverse local markets.

In 2024, Canaccord Genuity maintained a significant presence with offices in key financial centers worldwide, underscoring its commitment to client accessibility. This network is instrumental in fostering direct relationships and providing tailored financial solutions.

Canaccord Genuity's dedicated investment advisors and investment bankers form a core channel, directly connecting with a broad client base. These professionals offer tailored guidance and execute transactions, fostering enduring client partnerships.

Canaccord Genuity leverages sophisticated online platforms and digital client portals to offer wealth management clients seamless access to their account details, proprietary research, and a suite of self-service tools. This digital infrastructure is crucial for delivering convenience and elevating the client experience, reflecting the evolving expectations in financial services.

These digital channels are designed to empower clients, allowing them to manage investments, view performance reports, and access market insights at their convenience. For instance, in 2024, the firm continued to invest in enhancing its digital capabilities, with a reported increase in client engagement through these portals, indicating a growing reliance on digital touchpoints for financial management.

Proprietary Research and Publications

Canaccord Genuity leverages its proprietary research and publications as a key channel to disseminate valuable market insights and in-depth analysis. These reports are crucial for informing their existing client base and actively attracting new business by highlighting the firm's sophisticated analytical prowess and deep industry knowledge.

These publications serve a dual purpose: educating clients on market trends and demonstrating Canaccord Genuity's thought leadership. For instance, in 2024, the firm continued to produce a steady stream of sector-specific reports and macroeconomic analyses, which are often cited by financial media, underscoring their influence and reach.

- Dissemination of Expertise: Proprietary research acts as a direct conduit for sharing the firm's analytical capabilities and market outlook.

- Client Engagement: These publications foster deeper relationships with existing clients by providing them with actionable intelligence.

- Business Development: Showcasing unique research attracts prospective clients and talent, reinforcing Canaccord Genuity's brand as a knowledge leader.

- Market Influence: Widely cited reports enhance the firm's reputation and visibility within the financial industry.

Industry Conferences and Events

Industry conferences and events serve as crucial channels for Canaccord Genuity to connect with potential and existing clients, fostering both acquisition and relationship deepening. These gatherings offer invaluable opportunities for face-to-face interaction, allowing the firm to showcase its expertise and build trust.

In 2024, Canaccord Genuity actively participated in and hosted numerous events, underscoring their commitment to market engagement. For instance, their presence at major financial summits like the BMO Capital Markets Global Metals & Mining Conference provided direct access to a concentrated audience of industry leaders and investors.

These events are not just about networking; they are platforms for thought leadership. By presenting insights on market trends and investment strategies, Canaccord Genuity reinforces its position as a knowledgeable advisor. This strategic engagement can directly translate into new business opportunities and strengthened client loyalty.

- Client Acquisition: Events attract a high volume of potential clients, increasing the pipeline for new business.

- Relationship Building: Direct interaction at conferences strengthens existing client relationships and fosters new ones.

- Thought Leadership: Presenting at events showcases expertise and builds credibility within the industry.

- Market Intelligence: Conferences offer insights into competitor activities and emerging market trends.

Canaccord Genuity's channels are a blend of direct personal interaction, digital accessibility, and expert content dissemination. This multi-faceted approach ensures broad reach and deep engagement with a diverse client base.

The firm's global office network and dedicated investment advisors form the bedrock of its direct client relationships, facilitating personalized service. Complementing this, sophisticated online platforms provide wealth management clients with convenient, self-service access to accounts and research, a feature further enhanced by ongoing digital investment in 2024.

Proprietary research and industry conferences serve as vital channels for thought leadership and business development. In 2024, Canaccord Genuity's active participation in key financial events, such as the BMO Capital Markets Global Metals & Mining Conference, highlighted their commitment to market engagement and showcasing expertise.

| Channel Type | Description | Key Activities (2024 Focus) | Client Benefit |

|---|---|---|---|

| Direct Advisory | Personalized guidance from investment advisors and bankers. | Client meetings, transaction execution, relationship management. | Tailored solutions, trusted advice. |

| Digital Platforms | Online portals for account access, research, and self-service tools. | Platform enhancements, increased client engagement via digital touchpoints. | Convenience, real-time information access. |

| Proprietary Research | Dissemination of market insights and in-depth analysis through reports. | Publication of sector-specific reports, macroeconomic analyses, media citations. | Informed decision-making, demonstration of expertise. |

| Industry Events | Participation in and hosting of conferences and events. | Active presence at financial summits, networking, thought leadership presentations. | Face-to-face interaction, market intelligence, brand building. |

Customer Segments

Canaccord Genuity caters to high-net-worth individuals and private clients, offering bespoke wealth management, financial planning, and investment solutions. This segment prioritizes personalized guidance and sophisticated strategies designed to grow and preserve their substantial assets, aiming to meet intricate financial objectives.

These clients, often with complex portfolios and significant financial aspirations, seek a trusted partner for comprehensive financial stewardship. For instance, in 2024, the global wealth management market continued to see strong demand from this demographic, with assets under management for high-net-worth individuals reaching trillions of dollars, underscoring the importance of tailored advisory services.

Canaccord Genuity serves a wide array of institutional investors, including pension funds, endowments, mutual funds, and hedge funds, offering them tailored capital markets solutions. These sophisticated clients demand in-depth equity research, efficient sales and trading execution, and privileged access to distinctive investment opportunities. For instance, in the fiscal year ending March 31, 2024, Canaccord Genuity's capital markets segment reported significant revenue contributions, reflecting the substantial engagement from these institutional client bases.

Canaccord Genuity's core customer base includes growth-oriented corporations and emerging companies, with a strategic emphasis on sectors like technology, healthcare, metals & mining, and energy transition. These businesses are actively pursuing expansion and require sophisticated investment banking services.

These clients typically engage Canaccord Genuity for critical corporate finance activities, including mergers and acquisitions (M&A) advisory and various capital raising initiatives. For instance, in 2023, the technology sector alone saw global M&A volume reach $575 billion, highlighting the significant demand for such services among growth-focused firms.

Emerging companies, in particular, rely on Canaccord Genuity to navigate complex capital markets and secure the funding necessary for research and development, market penetration, and scaling operations. The firm's expertise in these niche and high-growth areas allows it to effectively support companies aiming for significant market share gains.

Publicly Traded Companies

Canaccord Genuity offers crucial capital markets and advisory services to publicly traded companies. They facilitate equity and debt offerings, provide corporate broking, and manage investor relations, helping these companies thrive in public markets.

This segment is vital for companies seeking to raise capital or enhance their visibility among investors. Canaccord's deep understanding of public market dynamics and investor sentiment is a key asset.

- Capital Raising: Assisting companies with initial public offerings (IPOs) and secondary offerings. For instance, in 2023, IPOs globally raised over $200 billion, a significant market for Canaccord's services.

- Corporate Broking: Acting as a liaison between companies and the investment community, ensuring effective communication and market perception.

- Investor Relations: Helping companies build and maintain strong relationships with shareholders and potential investors.

- Advisory Services: Providing strategic advice on mergers, acquisitions, and other corporate finance activities.

Charities and Not-for-Profit Organizations

Canaccord Genuity offers specialized wealth management services tailored for charities and not-for-profit organizations. These services are designed to help these entities effectively manage their endowments and investment portfolios, ensuring they can meet and exceed their philanthropic goals.

This segment highlights Canaccord Genuity's dedication to serving a wide array of clients, extending its expertise beyond traditional for-profit businesses to support organizations with vital social missions. For instance, in 2024, the not-for-profit sector continued to seek robust investment strategies to ensure long-term sustainability and impact.

- Endowment Management: Providing strategies to grow and preserve capital for long-term organizational needs.

- Investment Advisory: Offering guidance on asset allocation and investment selection aligned with mission objectives and risk tolerance.

- Philanthropic Support: Assisting in structuring investments to maximize the impact of charitable giving and operational funding.

- Compliance and Reporting: Ensuring adherence to regulatory requirements and providing transparent financial reporting.

Canaccord Genuity serves a diverse client base, including high-net-worth individuals and private clients seeking personalized wealth management and sophisticated investment strategies. They also cater to institutional investors like pension funds and endowments, providing tailored capital markets solutions and in-depth research.

Growth-oriented corporations and emerging companies are key segments, relying on Canaccord for investment banking services such as M&A and capital raising, particularly in technology, healthcare, and energy transition sectors. Publicly traded companies also utilize their expertise for equity and debt offerings and investor relations.

Furthermore, charities and not-for-profit organizations benefit from specialized wealth management to grow and preserve their endowments, ensuring they meet philanthropic goals. This broad reach underscores Canaccord's commitment to supporting various financial needs across different client types.

Cost Structure

Compensation and benefits represent a substantial cost for Canaccord Genuity, reflecting the people-intensive nature of financial services. This category encompasses salaries, performance-based bonuses, and commissions paid to advisors, investment bankers, and essential support personnel.

For a firm like Canaccord Genuity, which relies heavily on the expertise and client relationships of its workforce, employee costs are a primary driver of its cost structure. This investment in human capital is crucial for generating revenue through advisory, underwriting, and trading activities.

Canaccord Genuity's commitment to a robust technological backbone involves significant ongoing investments. In 2024, the firm continued to allocate substantial resources towards upgrading its digital platforms and core infrastructure, recognizing their critical role in client service and operational efficiency.

These technology and infrastructure expenditures are not merely operational necessities but strategic investments. They are essential for maintaining a competitive edge, facilitating seamless trading, providing advanced analytical tools to clients, and ensuring the security of sensitive financial data against ever-evolving cyber threats.

For instance, the financial services industry as a whole saw cybersecurity spending increase by an estimated 10-15% in 2024, reflecting the heightened risk landscape. Canaccord Genuity's own outlays in this area are a direct response to this trend, underpinning their ability to operate reliably and compliantly in a digital-first environment.

Canaccord Genuity, like many financial institutions, faces substantial regulatory and compliance expenses. Operating across numerous global markets means adhering to a complex web of financial regulations, which translates into significant costs for licensing, legal services, and ongoing audits. For instance, in 2024, the financial services industry globally continued to see increased spending on compliance, with many firms allocating upwards of 10-15% of their operating budget to meet these requirements.

These costs are not static; they evolve with new legislation and stricter enforcement. This necessitates continuous investment in robust internal controls, risk management systems, and specialized personnel to ensure adherence to standards like those set by the SEC, FCA, and other international regulatory bodies. The commitment to compliance is crucial for maintaining operational integrity and market access.

Office and Operational Expenses

Canaccord Genuity's office and operational expenses are significant, reflecting its global presence. These costs encompass rent, utilities, and general administrative overheads across its international network of offices. For instance, in fiscal year 2024, the firm reported substantial expenses related to its physical infrastructure, supporting its operations in key financial hubs.

Strategic investments in enhancing its workspace infrastructure also contribute to these costs. The firm has been actively upgrading and expanding its flagship offices, such as those in Vancouver and New York, to accommodate growth and improve employee productivity. These capital expenditures are crucial for maintaining a competitive edge and fostering a conducive work environment.

- Global Office Network: Costs for rent, utilities, and administrative support across all international locations.

- Workspace Investments: Capital expenditures on new and upgraded office spaces, particularly in major centers like Vancouver and New York.

- Operational Overheads: Day-to-day expenses required to keep the business functioning smoothly.

Acquisition and Integration Costs

Canaccord Genuity's pursuit of inorganic growth significantly impacts its cost structure, particularly through acquisition and integration expenses. These costs encompass thorough due diligence, legal and advisory fees, and the complex process of merging newly acquired entities and their client portfolios into the firm's established infrastructure. For instance, during periods of aggressive expansion, these upfront costs can represent a substantial portion of the firm's operational expenditures.

The financial commitment involved in acquiring and integrating businesses is substantial and directly influences profitability, especially when the firm is actively pursuing strategic expansion. These are not minor expenses; they are critical investments made to scale the business and broaden its market reach.

- Due Diligence: Costs associated with investigating the financial health and operational viability of potential acquisition targets.

- Legal and Advisory Fees: Expenses incurred for legal counsel, investment bankers, and other advisors throughout the M&A process.

- Integration Expenses: Costs related to merging IT systems, operational processes, and human resources of acquired firms.

- Client Asset Transition: Expenditures involved in smoothly transferring and onboarding client relationships and assets from acquired businesses.

Canaccord Genuity's cost structure is significantly shaped by its global operations and the need for robust technology. Employee compensation, including salaries and bonuses, forms a major expense due to the firm's reliance on skilled professionals. Investments in upgrading digital platforms and cybersecurity are also substantial, reflecting the industry's increasing digital demands and threat landscape; for example, cybersecurity spending in financial services saw an estimated 10-15% increase in 2024.

Regulatory compliance represents another significant cost, with firms dedicating a considerable portion of their budget, often 10-15% in 2024, to meet diverse global regulations. Operational expenses, including rent and utilities for its international offices, are also considerable, with notable capital expenditures on enhancing workspaces in key locations like Vancouver and New York. Furthermore, the firm incurs substantial costs for acquisitions and integrations, covering due diligence, legal fees, and the complex process of merging new entities.

| Cost Category | Description | 2024 Relevance/Data |

|---|---|---|

| Compensation & Benefits | Salaries, bonuses, commissions for employees. | Primary driver due to people-intensive nature of services. |

| Technology & Infrastructure | Digital platform upgrades, core infrastructure, cybersecurity. | Critical for client service, efficiency, and security; industry cybersecurity spending up 10-15% in 2024. |

| Regulatory & Compliance | Licensing, legal services, audits for global operations. | Significant ongoing investment; industry compliance spending often 10-15% of operating budget in 2024. |

| Office & Operational Expenses | Rent, utilities, administrative overheads across global offices. | Reflects global presence; capital expenditures on key offices like Vancouver and New York. |

| Acquisition & Integration Costs | Due diligence, legal fees, merging acquired entities. | Substantial upfront costs during periods of aggressive expansion. |

Revenue Streams

Commissions and fees from wealth management represent a significant revenue driver for Canaccord Genuity. This includes advisory fees, asset management charges, and transaction commissions.

The shift towards a fee-based model enhances revenue stability. For example, in the first quarter of fiscal year 2026, wealth management generated C$242.9 million, marking a 12.5% increase compared to the previous year.

Canaccord Genuity generates significant revenue through its investment banking division. This includes fees earned from advising on mergers and acquisitions (M&A), assisting companies with corporate financing, and underwriting services for capital raising activities.

For the fiscal year 2025, the company reported advisory revenue of $305.0 million. Investment banking activities, encompassing a range of capital markets services, contributed $215.3 million to revenue during the same period.

Canaccord Genuity generates income through principal trading, where it buys and sells securities using its own capital. This activity is a key component of its capital markets revenue, though the firm has focused on optimizing these operations, such as its U.S. wholesale market making business.

Interest Income

Canaccord Genuity generates interest income primarily from the cash balances held by its clients, as well as from its lending activities and investments in various financial instruments. This income is a significant component of their overall revenue, though it is sensitive to changes in market interest rates.

For instance, in the fiscal year ending March 31, 2024, Canaccord Genuity reported substantial interest income. The firm's ability to leverage client assets and deploy capital effectively directly impacts this revenue stream.

- Client Cash Balances: Interest earned on uninvested client funds held in various accounts.

- Lending Activities: Income generated from providing loans and credit facilities to clients and counterparties.

- Financial Instruments: Returns from investments in fixed-income securities and other interest-bearing assets.

- Interest Rate Sensitivity: Revenue can increase when interest rates rise and decrease when rates fall, impacting profitability.

Other Services and Miscellaneous Income

Canaccord Genuity captures additional revenue through a variety of other services and miscellaneous income. This segment is crucial for diversifying its earnings beyond core investment banking and wealth management activities.

A significant portion of this miscellaneous income originates from activities like warrant and fee share inventory positions, particularly in markets like Australia and Canada, which are often bundled within broader investment banking revenue. These positions allow the firm to participate in the upside of capital-raising activities.

Other miscellaneous financial services contribute to this revenue stream, encompassing a range of specialized offerings tailored to client needs. For instance, in 2024, Canaccord Genuity reported substantial income from these ancillary services, demonstrating their ongoing importance to the firm's overall financial performance.

- Warrant and Fee Share Inventory: Generates income from equity positions taken in client companies during capital raises.

- Miscellaneous Financial Services: Includes fees from specialized advisory, consulting, and other financial product offerings.

- Geographic Focus: Key contributions often come from inventory positions in Australia and Canada, integrated into investment banking.

- Revenue Diversification: These streams provide a buffer and supplement core business segment performance.

Canaccord Genuity's revenue streams are diverse, encompassing wealth management, investment banking, and other financial services. The company leverages its expertise in these areas to generate income through commissions, fees, and principal trading activities.

For the fiscal year ended March 31, 2024, Canaccord Genuity reported total revenue of C$1.15 billion. Wealth management revenue was C$716.7 million, while investment banking and capital markets revenue stood at C$345.9 million.

| Revenue Stream | Fiscal Year 2024 (C$ millions) | Year-over-Year Change |

|---|---|---|

| Wealth Management | 716.7 | +10.5% |

| Investment Banking & Capital Markets | 345.9 | -15.2% |

| Total Revenue | 1150.4 | -4.1% |

Business Model Canvas Data Sources

The Canaccord Genuity Business Model Canvas is constructed using a blend of proprietary financial models, extensive market research, and deep industry expertise. This multi-faceted approach ensures a comprehensive and accurate representation of our strategic framework.