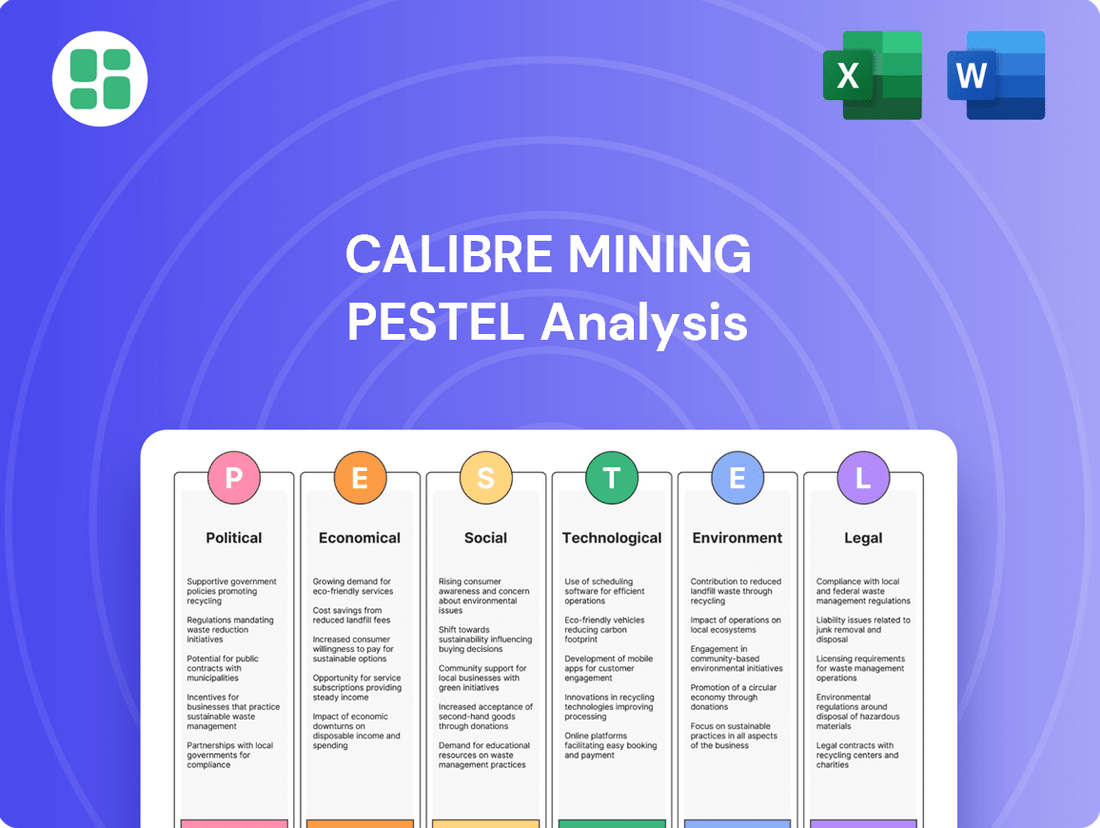

Calibre Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

Unlock the full picture of Calibre Mining's operating environment with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its trajectory and discover how to leverage these insights for your own strategic advantage. Download the complete analysis now for actionable intelligence.

Political factors

Calibre Mining's operations are heavily concentrated in Nicaragua, a nation experiencing persistent political instability and a concerning disregard for the rule of law. This volatile environment directly impacts the predictability of the investment climate for companies like Calibre.

The current Ortega-Murillo administration has solidified its grip on power, raising significant concerns among foreign investors. There are worries about the potential for arbitrary regulatory changes and the risk of property expropriation, which could directly affect Calibre's assets and future development plans.

Consequently, this political landscape presents considerable reputational risks and operational uncertainties for Calibre Mining. For instance, in 2023, Nicaragua was ranked 153 out of 180 countries in Reporters Without Borders' World Press Freedom Index, highlighting the broader governance challenges that can spill over into economic and business environments.

The Nicaraguan government's proactive stance on expanding mining concessions, with granted land more than doubling from 2021 to 2023, presents a significant opportunity for Calibre Mining. This expansion signals a clear governmental focus on bolstering the mining industry.

However, this rapid growth in concessions also introduces potential challenges regarding the efficiency of approval processes and the rigorous enforcement of environmental and public health standards. Calibre Mining must actively manage these regulatory complexities to leverage the expanded concessions effectively.

U.S. sanctions targeting Nicaragua's gold mining sector, initiated in 2022 to address human rights concerns, have presented a challenging landscape for companies like Calibre Mining. Despite these measures, the United States continues to be a significant buyer of Nicaraguan gold, indicating a complex and somewhat contradictory trade dynamic. This situation necessitates careful navigation of compliance requirements to ensure continued access to global markets.

The enforcement of these sanctions has been notably inconsistent, creating an environment where Calibre Mining must actively manage the risks associated with international trade. While the sanctions could theoretically affect Calibre's access to U.S. financial institutions, their actual impact remains a subject of ongoing discussion and evaluation.

Resource Nationalism and Foreign Ownership

Nicaraguan legislation permits the government to restrict foreign ownership, citing national security concerns. Historically, partnerships with state-owned enterprises were mandated for mining operations. While these stipulations have seen less stringent enforcement for mining since 2022, the potential for resource nationalism or greater state intervention persists as a factor for Calibre Mining's future.

The Nicaraguan government's stance on foreign investment in strategic sectors, including mining, can shift. Although specific enforcement for mining partnerships has eased, the legal framework remains, presenting a latent risk. Calibre Mining's operations, particularly its significant investments in the Limón and La Libertad mining districts which contributed to its robust 2023 production of 120,000 ounces of gold, must navigate this evolving political landscape.

- Legal Framework: Nicaraguan law allows for restrictions on foreign ownership in key industries.

- Historical Precedent: State-owned enterprise partnerships were previously a requirement in the mining sector.

- Current Enforcement: Strict enforcement of partnership requirements for mining has lessened since 2022.

- Ongoing Risk: The potential for resource nationalism and increased state involvement remains a consideration for foreign investors.

Community Relations and Social License to Operate

Calibre Mining's expansion in Nicaragua faces scrutiny due to rising tensions with Indigenous and Afro-descendant communities, with reports of human rights concerns and land disputes. This situation underscores the critical need for a robust social license to operate.

To navigate these challenges, Calibre Mining must prioritize transparent communication, ethical conduct, and meaningful investment in local development. This approach is vital for mitigating social risks and ensuring uninterrupted operations. For instance, in 2023, the company reported engaging with over 15,000 community members across its Nicaraguan operations, aiming to foster positive relationships.

- Community Engagement: Calibre's commitment to ongoing dialogue with local populations is paramount.

- Human Rights: Adherence to international human rights standards is essential to prevent allegations of abuses.

- Land Rights: Respecting and addressing land tenure issues with affected communities is a key concern.

- Local Development: Investing in education, infrastructure, and employment opportunities can strengthen community ties.

Calibre Mining's operations in Nicaragua are significantly influenced by the nation's political climate. The current administration's consolidation of power raises concerns about regulatory stability and the potential for expropriation, impacting investment predictability.

Despite U.S. sanctions targeting Nicaragua's gold sector since 2022, trade continues, presenting compliance complexities for Calibre. The government's increased mining concessions, doubling granted land from 2021 to 2023, offer opportunities but also regulatory hurdles.

The legal framework allows for foreign ownership restrictions, and while past requirements for state partnerships in mining have eased, the risk of resource nationalism persists, affecting Calibre's strategic planning.

Community relations are also a key political factor, with Calibre engaging over 15,000 members in 2023 to address human rights and land dispute concerns, vital for maintaining social license to operate.

| Political Factor | Impact on Calibre Mining | 2023 Data/Context |

|---|---|---|

| Political Stability & Governance | Regulatory uncertainty, risk of expropriation | Nicaragua ranked 153/180 in World Press Freedom Index |

| Foreign Investment Policy | Potential for ownership restrictions, resource nationalism | Mining concessions doubled 2021-2023 |

| International Relations & Sanctions | Navigating U.S. sanctions, trade compliance | U.S. remains a significant buyer of Nicaraguan gold |

| Social License & Community Relations | Managing human rights concerns, land disputes | Engaged with >15,000 community members |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Calibre Mining, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help Calibre Mining navigate industry challenges and capitalize on emerging opportunities.

A concise PESTLE analysis for Calibre Mining provides a clear, summarized version of external factors, simplifying strategic discussions and risk assessment for management.

Economic factors

Calibre Mining's financial performance is closely linked to the global gold price. In 2024, gold prices have experienced a notable surge, and forecasts suggest this upward trend will continue into 2025 and 2026, with some projections indicating a potential peak of $3,675 per ounce by the fourth quarter of 2025. This bullish outlook is beneficial for Calibre's revenue and profitability.

However, the inherent volatility of commodity markets necessitates careful management of price fluctuation risks. While the current price environment is favorable, unexpected downturns could impact earnings. Calibre must therefore employ strategies to mitigate the impact of potential gold price dips.

Nicaragua's economy is anticipated to experience robust growth, with projections indicating an expansion of around 3.8% for both 2024 and 2025. This growth is primarily fueled by a rise in private consumption and the services sector, with mining emerging as a significant driver of this positive trend. This stable economic environment is a favorable backdrop for Calibre Mining's ongoing operations.

While this outlook is encouraging, potential risks remain, including the impact of a global economic slowdown. Furthermore, shifts in international trade policies could introduce uncertainties that might affect economic stability and, consequently, Calibre Mining's operational landscape.

While Nicaragua's inflation rate has moderated to 2.8% in 2024, the broader impact of global inflation remains a significant consideration for Calibre Mining. This can directly translate into higher operating expenses for essential inputs like energy, labor, and raw materials.

Calibre Mining's financial performance in 2024 underscores this pressure. The company reported an increase in total cash costs and all-in sustaining costs per ounce. This trend suggests that despite efforts to manage expenses, the company is facing headwinds that are impacting its operational efficiency and profitability on a per-unit basis.

Foreign Direct Investment (FDI) Trends in Nicaragua

Nicaragua's economic landscape shows a positive trend in attracting foreign capital, with Foreign Direct Investment (FDI) experiencing a notable uptick. In the first half of 2024, FDI surged by 11.3%, signaling renewed confidence from international investors. The energy and mining sectors, in particular, have been key beneficiaries, drawing substantial investment. This influx suggests that despite existing political considerations, foreign entities continue to see potential in Nicaragua's resource-rich environment, which could translate into expanded opportunities for companies like Calibre Mining.

The growth in FDI is a critical indicator for businesses operating or considering operations in Nicaragua. For Calibre Mining, this trend suggests a potentially more favorable climate for future investment and operational expansion. The increased foreign interest, especially within the mining sector, implies a growing recognition of the country's geological potential and a willingness to navigate its unique operating conditions. This could lead to improved access to capital, technology, and expertise, all vital for the mining industry's development and sustainability.

- FDI Growth: Nicaragua recorded an 11.3% increase in FDI during the first six months of 2024.

- Sectoral Focus: The energy and mining sectors were primary recipients of this increased foreign investment.

- Investor Confidence: The trend indicates sustained foreign interest, potentially outweighing perceived political risks.

- Opportunity for Calibre Mining: This environment could foster future investment and expansion for Calibre Mining within Nicaragua.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Calibre Mining. As a Canadian company that operates in Nicaragua and reports its financial results in US dollars, Calibre is exposed to the volatility between the Canadian dollar (CAD), the Nicaraguan Córdoba (NIO), and the US dollar (USD).

Favorable movements in these exchange rates can boost Calibre's profitability. For instance, if the USD strengthens against the CAD, it could mean that the revenue generated in USD translates into more Canadian dollars for the parent company. Conversely, a weaker USD relative to the Córdoba could increase the cost of local operations in Nicaragua when expressed in USD.

For example, in early 2024, the USD generally remained strong against many emerging market currencies, including the Córdoba, which could have provided a slight tailwind for Calibre's reported USD earnings. However, the CAD's performance against the USD is also crucial; a weaker CAD can make Canadian dollar-denominated expenses, like head office costs, more expensive when converted to USD for reporting. The Bank of Canada's interest rate decisions and the US Federal Reserve's monetary policy significantly influence these cross-currency rates.

- USD/CAD Exchange Rate Impact: Fluctuations between the US dollar and Canadian dollar directly affect the conversion of Calibre's USD-denominated earnings and assets into its reporting currency. For instance, if the USD weakens against the CAD, it reduces the value of USD earnings when converted back to CAD.

- USD/NIO Exchange Rate Impact: The exchange rate between the US dollar and the Nicaraguan Córdoba impacts the cost of local operations. A stronger Córdoba relative to the USD would increase the USD cost of labor, supplies, and other expenses incurred in Nicaragua.

- Hedging Strategies: Calibre Mining may employ currency hedging strategies to mitigate the risks associated with these fluctuations, aiming to lock in favorable rates for a portion of its expected revenues or expenses.

- Economic Stability in Nicaragua: The stability of the Nicaraguan economy and its currency policy also plays a role in the predictability of the USD/NIO exchange rate, influencing operational cost management.

The global economic outlook for 2024 and 2025 presents a mixed picture for Calibre Mining. While strong gold prices are a significant tailwind, potential global economic slowdowns and shifts in international trade policies could introduce market volatility and impact operational costs. Calibre's ability to navigate these macroeconomic currents will be crucial for sustained profitability.

What You See Is What You Get

Calibre Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Calibre Mining PESTLE analysis covers all crucial political, economic, social, technological, legal, and environmental factors impacting the company. Understand the complete strategic landscape with this comprehensive report.

Sociological factors

Calibre Mining actively cultivates robust community relations, channeling significant investment into local development initiatives spanning education, healthcare, and infrastructure. This dedication is fundamental to securing and maintaining its social license to operate, a critical factor in the current climate.

Reports from 2024 highlight increasing concerns regarding violence and human rights in Nicaraguan mining areas, often linked to land disputes and resource extraction. Calibre's proactive approach to social responsibility aims to mitigate these risks and foster positive relationships with local stakeholders, essential for uninterrupted operations and long-term sustainability.

Calibre Mining's commitment to local content is a significant sociological factor, directly impacting its social license to operate. In 2023, the company proudly supported 1,133 direct jobs, with an impressive 95% of its workforce being national hires and 82% coming from local communities surrounding its operations. This deep integration into the local economy fosters strong community relations and drives tangible economic development, reinforcing responsible mining principles.

Mining concessions in Nicaragua, some affecting Calibre Mining's operations, intersect with protected Indigenous lands. This overlap has fueled protests and accusations of human rights violations, creating significant societal friction.

Calibre Mining must carefully navigate these intricate land rights issues, a key challenge for the company. Upholding commitments to free, prior, and informed consent from Indigenous communities is paramount to maintaining social license and avoiding operational disruptions.

Health and Safety Standards

Calibre Mining places a strong emphasis on health and safety, a crucial sociological factor influencing its operations and reputation. The company's commitment is demonstrated by its 2024 Sustainability Report, which highlighted zero fatalities and a significant 22% decrease in its Lost Time Injury Frequency Rate (LTIFR).

Adhering to stringent health and safety standards is paramount not only for the well-being of its employees but also for ensuring uninterrupted operations. This dedication to safety reflects a broader commitment to ethical business practices and social responsibility within the mining sector.

- Zero fatalities reported in 2024

- 22% reduction in Lost Time Injury Frequency Rate (LTIFR) in 2024

- Ensures workforce well-being and operational continuity

- Demonstrates commitment to responsible business conduct

Artisanal and Small-Scale Mining (ASM) Interactions

Artisanal and small-scale mining (ASM) presents a complex social dynamic for Calibre Mining in Nicaragua. Historically, these activities have impacted initial mining benches, requiring careful management and integration strategies. For instance, in 2023, Calibre continued to refine its approach to managing areas with historical artisanal activity to ensure efficient resource extraction.

Calibre's Artisanal and Small-scale Miners (ASM) Ore Purchase Program is a key initiative designed to address these interactions. This program aims to foster responsible sourcing by discouraging mercury use among artisanal miners and providing a framework for their integration into the formal mining sector. This approach not only mitigates environmental concerns but also builds stronger community relationships.

The success of such programs is crucial for social license to operate. By offering fair prices and technical support, Calibre seeks to formalize a significant portion of Nicaragua's informal mining sector. This strategy is vital for ensuring stable operations and contributing to sustainable development in mining regions.

Calibre Mining's deep community engagement and investment in local development, including education and infrastructure, are vital for its social license to operate. The company's commitment to local employment, with 95% national hires and 82% from surrounding communities in 2023, underscores its integration into the local economy and its role in fostering economic development.

Navigating land rights, particularly overlaps with Indigenous territories, remains a significant challenge, necessitating adherence to free, prior, and informed consent principles to prevent operational disruptions. Calibre's strong focus on health and safety, evidenced by zero fatalities and a 22% LTIFR reduction in 2024, reinforces its ethical business practices and commitment to workforce well-being.

The company's ASM Ore Purchase Program addresses the complex social dynamic of artisanal mining, aiming to discourage mercury use and integrate informal miners into the formal sector, thereby building stronger community ties and ensuring operational stability.

| Sociological Factor | Calibre Mining's Action/Data | Impact |

|---|---|---|

| Community Relations & Development | Significant investment in local education, healthcare, infrastructure. | Secures social license to operate, fosters positive stakeholder relations. |

| Local Employment (2023) | 95% national hires, 82% from local communities. | Drives economic development, strengthens community ties. |

| Health & Safety (2024) | Zero fatalities, 22% reduction in LTIFR. | Ensures workforce well-being, operational continuity, demonstrates ethical conduct. |

| Artisanal & Small-Scale Mining (ASM) | ASM Ore Purchase Program, discourages mercury use. | Mitigates environmental concerns, builds community relationships, formalizes informal sector. |

Technological factors

Technological advancements are reshaping the mining sector, with automation and digitalization at the forefront. Companies like Calibre Mining are increasingly integrating technologies such as autonomous haul trucks and advanced sensor systems to enhance operational efficiency and worker safety. For instance, the global mining automation market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, indicating a strong industry-wide shift.

Calibre Mining can capitalize on these trends by adopting remote operations centers and predictive maintenance software. These digital tools allow for real-time monitoring and control of mining activities, leading to optimized extraction processes and reduced downtime. By embracing these innovations, Calibre can expect to see improvements in productivity and a mitigation of operational risks, aligning with industry best practices for the 2024-2025 period.

Technological advancements, particularly in artificial intelligence and machine learning, are revolutionizing mineral exploration. These tools can analyze vast geological datasets and satellite imagery, dramatically speeding up the identification of promising new deposits. For Calibre Mining, leveraging these technologies in their extensive drilling programs across Nicaragua, Nevada, and Canada in 2024 and 2025 offers a significant opportunity to enhance resource discovery and expansion efficiency.

Advancements in ore crushing, screening, and processing technologies are significantly boosting gold recovery rates and operational efficiency. These innovations are crucial for maximizing yield from existing reserves.

Calibre Mining is actively investing in its processing infrastructure, exemplified by the upgrades to the SAG and Ball Mill at its Valentine Gold Mine. This strategic investment highlights the company's commitment to leveraging cutting-edge technologies to enhance its recovery processes.

Data Analytics for Operational Efficiency

The mining industry increasingly relies on data analytics to boost operational efficiency. Real-time data analysis and predictive maintenance are vital for reducing machinery downtime and improving resource modeling. For instance, by 2024, the global mining analytics market was projected to reach over $2 billion, highlighting its growing importance.

Calibre Mining can leverage these data-driven strategies to refine its asset management and operational planning. This approach promises more efficient and cost-effective production. For example, implementing predictive maintenance on critical equipment could reduce unscheduled downtime by an estimated 10-20%, according to industry reports from late 2024.

Key benefits of integrating advanced data analytics for Calibre Mining include:

- Optimized Machinery Performance: Predictive maintenance can anticipate equipment failures, minimizing costly breakdowns.

- Enhanced Resource Modeling: Real-time data analysis improves the accuracy of geological and reserve estimations.

- Streamlined Operations: Data insights facilitate better production scheduling and supply chain management.

- Reduced Operational Costs: Efficiency gains translate directly to lower expenditure on maintenance, energy, and waste.

Sustainable Mining Technologies

The mining sector faces growing demands for decarbonization and responsible sourcing, accelerating the integration of sustainable technologies. This includes a shift towards renewable energy and the adoption of electric or hydrogen-powered mining equipment. For instance, by 2024, many major mining companies are aiming to significantly increase their use of renewable energy sources to power operations, with some targeting over 50% renewable energy by 2030.

Calibre Mining's proactive embrace of these sustainable advancements is crucial. By reducing its environmental impact through cleaner energy and equipment, the company can bolster its sustainability credentials and build greater operational resilience against future regulatory changes and market expectations. This strategic alignment can lead to improved investor relations and a stronger brand reputation in the increasingly environmentally conscious global market.

Key technological factors driving this shift include:

- Advancements in electric and hybrid mining vehicles, offering reduced emissions and lower operating costs.

- Increased deployment of renewable energy solutions like solar and wind power at mine sites to decrease reliance on fossil fuels.

- Development of more efficient water management and recycling systems to minimize environmental impact.

- Implementation of digital technologies and AI for optimized resource extraction and reduced waste.

Technological advancements are central to enhancing mining efficiency and safety. Calibre Mining is integrating automation, such as autonomous haul trucks, and advanced sensors to optimize operations. The global mining automation market, valued at approximately $3.5 billion in 2023, is expected to see substantial growth, reflecting a sector-wide adoption of these technologies.

Digital tools like remote operations centers and predictive maintenance software are crucial for real-time monitoring and control, leading to improved extraction and reduced downtime. By embracing these innovations in 2024-2025, Calibre Mining can boost productivity and mitigate operational risks.

AI and machine learning are revolutionizing mineral exploration by analyzing vast geological datasets, accelerating the discovery of new deposits. This offers Calibre Mining a significant opportunity to enhance resource discovery efficiency across its projects in Nicaragua, Nevada, and Canada during 2024 and 2025.

Advancements in ore processing technologies are boosting gold recovery rates. Calibre Mining's investment in upgrades at its Valentine Gold Mine, including the SAG and Ball Mill, exemplifies this commitment to leveraging cutting-edge recovery processes.

Data analytics is vital for operational efficiency, with real-time analysis and predictive maintenance reducing machinery downtime. The global mining analytics market was projected to exceed $2 billion by 2024, underscoring its increasing importance.

Calibre Mining can leverage data-driven strategies for refined asset management and operational planning, leading to more cost-effective production. Predictive maintenance alone could reduce unscheduled downtime by an estimated 10-20% by late 2024.

The mining sector is increasingly adopting sustainable technologies, including renewable energy and electric equipment, to meet decarbonization demands. Many major mining companies aimed to significantly increase renewable energy use by 2024, with some targeting over 50% by 2030.

Calibre Mining's adoption of cleaner energy and equipment enhances its sustainability credentials and operational resilience, improving investor relations and brand reputation in an environmentally conscious market.

Key technological drivers include electric vehicles, renewable energy deployment, efficient water management systems, and AI for optimized extraction.

| Technology Area | Impact on Mining | Calibre Mining Relevance | Market Data (2023/2024 Projections) |

|---|---|---|---|

| Automation & Robotics | Increased efficiency, enhanced safety, reduced labor costs | Autonomous haul trucks, advanced sensor systems | Global mining automation market ~$3.5 billion (2023) |

| Digitalization & AI | Optimized operations, predictive maintenance, faster exploration | Remote operations centers, AI for geological analysis | Mining analytics market projected >$2 billion (2024) |

| Processing Technology | Improved recovery rates, enhanced operational efficiency | SAG and Ball Mill upgrades at Valentine Gold Mine | N/A (Specific to company investment) |

| Sustainable Technologies | Reduced environmental impact, lower operating costs, regulatory compliance | Adoption of cleaner energy and equipment | Target for >50% renewable energy usage by 2030 (industry trend) |

Legal factors

Calibre Mining's operations in Nicaragua are strictly governed by the country's mining codes and laws, which dictate licensing procedures, concession terms, and operational standards. These regulations are crucial for ensuring legal compliance and managing the inherent risks associated with the mining sector.

Nicaragua has seen a notable increase in mining concession grants. For instance, in 2023, the government continued to issue new concessions, though details on environmental impact assessments for some of these grants were not widely publicized. This trend underscores the importance of Calibre's proactive approach to legal and regulatory adherence to navigate potential changes and ensure sustainable operations.

Calibre Mining's operations in Nicaragua necessitate rigorous compliance with environmental regulations and permitting. The potential for pollution and deforestation from mining expansion demands strict adherence to these processes.

The company's 2024 Sustainability Report highlights the ongoing importance of environmental stewardship, noting one significant environmental incident. This underscores the need for strong management systems and consistent regulatory compliance to mitigate operational impacts.

Calibre Mining operates under Nicaragua's labor laws, which dictate employment practices, minimum wages, and the framework for union interactions. Adherence to these regulations is crucial for maintaining operational continuity and good standing within the country.

The company’s significant contribution to job creation, supporting 1,133 direct jobs and maintaining a workforce that is 95% Nicaraguan, highlights its active engagement with and commitment to local labor standards and workforce development initiatives.

International Investment Treaties and Sanctions Compliance

Nicaragua's investment landscape, while experiencing growth in foreign direct investment (FDI), is significantly shaped by international legal frameworks, notably U.S. sanctions. These sanctions can directly affect financial access and transaction capabilities for companies operating within the country, including Calibre Mining. Navigating this complex legal environment is crucial for mitigating potential financial and reputational damage.

Calibre Mining must ensure strict compliance with evolving international sanctions regimes. Failure to do so could result in severe penalties, impacting its ability to secure financing and conduct business smoothly. The company's strategy must proactively address these legal complexities to maintain operational integrity and investor confidence.

- Sanctions Impact: U.S. sanctions, particularly those targeting individuals or entities linked to the Nicaraguan government, can create hurdles for financial institutions willing to engage with businesses operating in the country.

- Compliance Burden: Calibre Mining faces the ongoing challenge of staying abreast of and adhering to a patchwork of international laws and sanctions, requiring robust internal compliance programs.

- Reputational Risk: Non-compliance or perceived association with sanctioned entities can lead to significant reputational damage, affecting market perception and stakeholder relationships.

Taxation Policies and Royalties

Changes in Nicaragua's tax policies and royalty structures present a significant variable for Calibre Mining. For instance, the Nicaraguan government has historically adjusted mining tax rates and royalty percentages to influence revenue collection and foreign investment. Understanding these potential shifts is crucial for Calibre's financial projections, as increased tax burdens or higher royalty demands could directly reduce net profits and impact the feasibility of certain projects.

Anticipating these fiscal regulations is paramount for Calibre Mining's long-term operational and financial stability. In 2024 and looking into 2025, governments often review their resource sector taxation to balance national revenue needs with attracting foreign capital. Any upward revision in corporate income tax rates or royalty fees on extracted minerals would necessitate adjustments in Calibre's cost structure and investment strategies.

- Fiscal Stability: Nicaragua's commitment to stable tax regimes is vital for Calibre's investment decisions.

- Royalty Rates: Fluctuations in royalty percentages directly affect the cost of production and profitability.

- Tax Reforms: Potential reforms in corporate tax or export duties could impact Calibre's financial performance.

- Government Revenue: Tax and royalty policies are key mechanisms for the Nicaraguan government to derive revenue from the mining sector.

Calibre Mining's operations in Nicaragua are subject to the nation's mining laws, which govern everything from getting permits to how concessions are managed and what operational standards must be met. These rules are vital for staying on the right side of the law and handling the risks inherent in mining.

Nicaragua has been granting more mining concessions, with new ones issued in 2023, though environmental impact details for some weren't always public. This highlights the need for Calibre to be diligent with legal and regulatory compliance to navigate potential changes and ensure sustainable operations.

Calibre Mining must adhere to Nicaragua's labor laws concerning employment, wages, and unions, which is crucial for smooth operations and maintaining a good relationship with the local workforce. The company's commitment is evident in its support of 1,133 direct jobs, with 95% of its workforce being Nicaraguan.

International legal frameworks, particularly U.S. sanctions, significantly influence Nicaragua's investment climate and can affect Calibre's access to finance and transactions. Staying compliant with these evolving sanctions is critical to avoid penalties and maintain investor confidence.

Environmental factors

Mining is inherently water-intensive, and Calibre Mining's operations, particularly in Nicaragua, necessitate robust water management strategies. In 2023, the company reported significant water usage across its sites, emphasizing the need for conservation to mitigate environmental impact and ensure operational sustainability, especially in areas facing potential water scarcity.

Calibre Mining's commitment to environmental stewardship involves responsible water usage and discharge. This includes implementing technologies and practices to minimize freshwater consumption and ensure that any discharged water meets or exceeds regulatory standards, protecting local ecosystems and community water resources.

Proper waste management, especially concerning tailings and hazardous materials, is a significant environmental challenge for mining operations. In Nicaragua, activists have voiced concerns, alleging that some industrial miners haven't followed waste disposal and chemical storage regulations. This underscores the crucial need for Calibre Mining to implement and rigorously maintain best practices in these areas to ensure environmental compliance and mitigate potential risks.

Mining expansion in Nicaragua, including areas where Calibre Mining operates, presents challenges related to deforestation and biodiversity impacts, particularly concerning protected zones and Indigenous lands.

Calibre Mining is actively addressing these environmental concerns through its commitment to land rehabilitation and biodiversity protection. In 2024 alone, the company successfully produced 164,355 trees in Nicaragua, a tangible effort to offset its operational footprint and contribute to ecosystem restoration.

Energy Consumption and Carbon Footprint

The mining sector faces significant pressure to decarbonize, with many companies, including those in precious metals like Calibre Mining, establishing ambitious net-zero emission goals. This necessitates a thorough evaluation and reduction of energy consumption and the overall carbon footprint. For instance, in 2023, the global mining industry's energy consumption was substantial, and the push for cleaner energy sources is intensifying.

Calibre Mining's environmental strategy must therefore focus on practical steps to achieve these reductions. This includes exploring and implementing renewable energy solutions for its operations, such as solar or wind power, and adopting more energy-efficient technologies and processes. A key focus area for 2024 and 2025 will be integrating these cleaner energy alternatives to lower operational costs and environmental impact.

- Renewable Energy Integration: Exploring solar power for mine site operations, aiming to reduce reliance on fossil fuels.

- Operational Efficiency: Implementing advanced technologies to optimize energy usage in extraction and processing.

- Carbon Footprint Monitoring: Establishing robust systems to track and report Scope 1 and Scope 2 emissions, with targets for reduction by 2025.

- Supply Chain Engagement: Working with suppliers to encourage their own decarbonization efforts.

Climate Change Impacts and Adaptation

Climate change presents significant risks for mining operations, including disruptions from extreme weather events that can affect both on-site activities and the broader supply chain. Calibre Mining's commitment to addressing these challenges is evident in its first Climate Report, which details scenario analyses for climate-related risks and opportunities. This proactive stance demonstrates an effort to understand and adapt to the physical impacts of a changing climate on its assets and operational continuity.

The company's approach includes assessing how events like increased rainfall or prolonged droughts could affect water availability for mining processes or impact transportation routes. For instance, during 2024, several mining regions globally experienced significant weather-related delays, with some reporting a 5-10% increase in operational downtime due to severe weather patterns. Calibre's focus on scenario planning aims to mitigate such potential impacts by developing adaptive strategies.

- Physical Risks: Extreme weather events like hurricanes, floods, and droughts can directly damage infrastructure, disrupt production, and impact employee safety.

- Supply Chain Vulnerability: Climate change can affect transportation networks, including roads and ports, leading to delays and increased costs for moving equipment and extracted materials.

- Water Scarcity: Changing precipitation patterns can lead to water shortages, which are critical for many mining processes, potentially requiring significant investment in water management and recycling.

- Regulatory and Market Shifts: Growing global pressure to address climate change could lead to stricter environmental regulations and changing investor sentiment towards companies not demonstrating climate resilience.

Calibre Mining's environmental strategy is significantly shaped by water management, waste disposal, and biodiversity concerns, particularly in Nicaragua. The company is actively engaged in land rehabilitation and reforestation efforts, planting 164,355 trees in Nicaragua during 2024 to offset its operational footprint.

Decarbonization pressures are driving Calibre Mining to integrate renewable energy, enhance operational efficiency, and monitor its carbon footprint. By 2025, the company aims to reduce its Scope 1 and Scope 2 emissions, demonstrating a commitment to cleaner energy alternatives and reduced environmental impact.

Climate change poses physical risks, such as extreme weather events, which could disrupt operations and supply chains. Calibre Mining's first Climate Report details scenario analyses to assess and mitigate these impacts, including potential water scarcity and infrastructure damage.

| Environmental Factor | Calibre Mining's Response/Data | Key Considerations |

| Water Management | Significant water usage in 2023; focus on conservation and responsible discharge. | Potential water scarcity; regulatory compliance for discharged water. |

| Waste Management | Addressing concerns over waste disposal and chemical storage regulations. | Mitigating risks through best practices; ensuring environmental compliance. |

| Biodiversity & Deforestation | Reforestation efforts: 164,355 trees planted in Nicaragua (2024). | Impacts on protected zones and Indigenous lands; land rehabilitation. |

| Decarbonization | Goals for net-zero emissions; exploring renewable energy (solar). | Reducing energy consumption; lowering carbon footprint by 2025 targets. |

| Climate Change Risks | First Climate Report published; scenario analysis for physical risks. | Extreme weather impacts; supply chain vulnerability; water scarcity. |

PESTLE Analysis Data Sources

Our Calibre Mining PESTLE analysis is informed by a robust dataset encompassing regulatory updates from mining jurisdictions, economic forecasts from international financial institutions, and industry-specific technological advancements. This ensures a comprehensive understanding of the macro-environmental factors influencing Calibre Mining's operations and strategic decisions.