Calibre Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

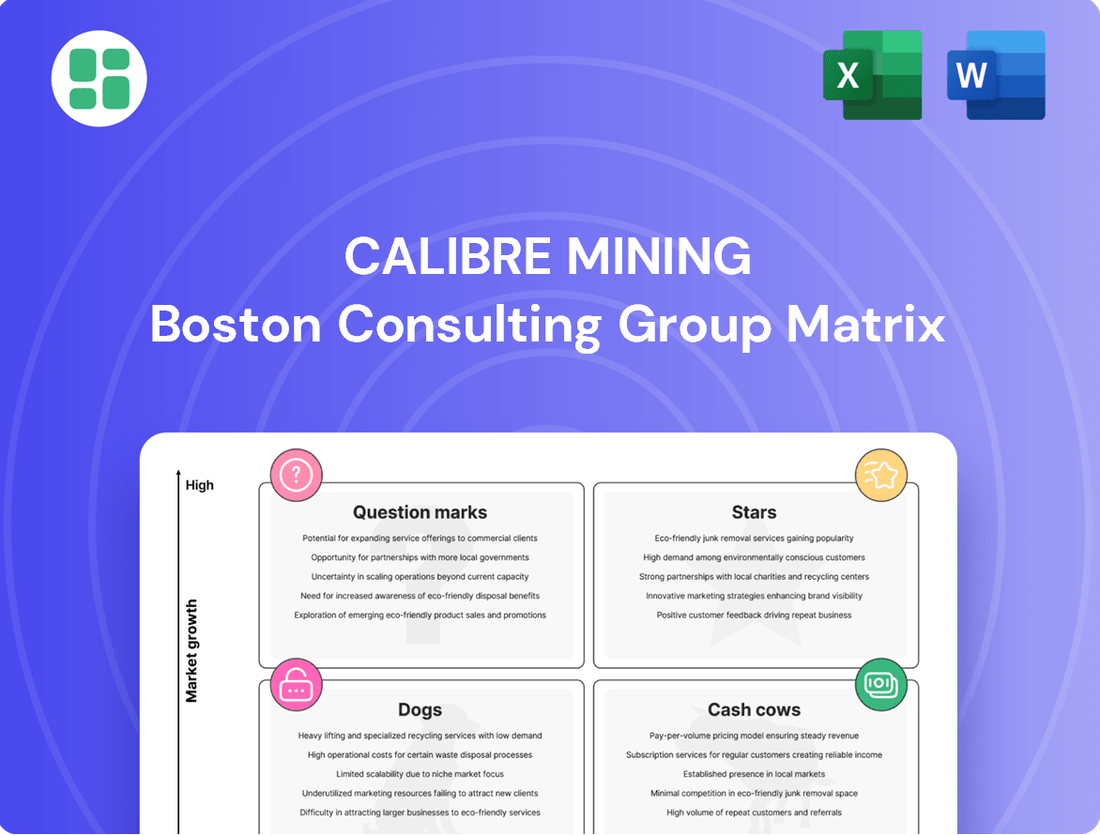

Curious about Calibre Mining's strategic positioning? Our preview highlights key areas, but the full BCG Matrix unlocks the complete picture of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report for a deep dive into their product portfolio and actionable insights to inform your investment decisions.

Stars

The Valentine Gold Mine, located in Newfoundland & Labrador, Canada, stands as Calibre Mining's premier development asset, with initial gold output projected for the second quarter of 2025.

This significant multi-million-ounce project is poised to elevate Calibre into a diversified, mid-tier gold producer, forecasting an average annual production of roughly 195,000 ounces over its operational life.

With construction advancements reaching over 77% by July 2024 and climbing to 81% by September 2024, Valentine is a critical factor in Calibre's anticipated surge in production and market presence within a burgeoning gold district.

Recent exploration at Calibre Mining's Valentine Gold Mine has uncovered significant high-grade gold discoveries, extending beyond current resource estimates. For instance, the Frank Zone has shown drill results over 40% higher than initial Mineral Reserve grades, pointing to substantial potential for resource growth.

This aggressive exploration, with the largest program at Valentine planned for 2025, strongly supports a high-growth outlook for this key asset.

Calibre Mining's commitment to resource expansion in Nicaragua is a key driver of its growth, particularly evident in its continued exploration efforts. The company has been actively investing in its Limon Mine Complex and the Eastern Borosi project, uncovering significant high-grade gold mineralization and making new discoveries. This strategic focus is designed to extend the operational life of its mines and bolster resource confidence, effectively solidifying its market position in these core areas.

Volcan Open Pit Mine

The Volcan open pit mine is poised to become a significant contributor to Calibre Mining's production profile. Commercial production is anticipated in Q3 2024, with a substantial impact expected in the latter half of the year, especially in the fourth quarter.

Following initial hurdles, the ore quality at Volcan is now meeting expectations, positioning it as a crucial new source of high-grade material for the Libertad mill. This development is key to Calibre's growth strategy.

- Volcan's expected commercial production start: Q3 2024

- Significant production contribution anticipated in H2 2024, particularly Q4

- Ore quality now aligning with projections after early challenges

- Volcan serves as a new, high-growth production source for the Libertad mill

Strategic Acquisition and Diversification

Calibre Mining's strategic acquisition of Marathon Gold in early 2024 marked a significant turning point, integrating the Valentine Gold Mine into its operational portfolio. This move diversifies Calibre's asset base, notably expanding its presence into Canada, a stable and well-regarded mining jurisdiction.

The addition of the Valentine Gold Mine is projected to enhance Calibre's production profile and reduce its geographical concentration, thereby mitigating risks associated with single-region reliance. This diversification is a key component of Calibre's strategy to solidify its position as a prominent mid-tier gold producer.

- Acquisition of Valentine Gold Mine: Completed in early 2024, this acquisition diversifies Calibre's asset base into Canada.

- Reduced Geographic Concentration: The move lessens reliance on existing operations, enhancing risk management.

- Market Share Growth: Entry into a stable Canadian jurisdiction opens new avenues for expansion and increased market presence.

- Mid-Tier Producer Transformation: The acquisition positions Calibre as a more significant player in the global gold mining landscape.

The Valentine Gold Mine, acquired in early 2024, is Calibre Mining's flagship development project, targeted for initial gold production in Q2 2025. This Canadian asset is projected to average approximately 195,000 ounces of gold annually over its life, significantly boosting Calibre's profile. With construction over 81% complete by September 2024 and ongoing high-grade exploration, Valentine represents a high-growth star in Calibre's portfolio, poised to transform the company into a diversified mid-tier producer.

| Asset | Status | Projected Production (Annual Avg.) | Key Development Metric | BCG Category |

|---|---|---|---|---|

| Valentine Gold Mine | Development | ~195,000 oz | Construction >81% complete (Sep 2024) | Star |

| Volcan Mine | Operating | Significant contributor (H2 2024) | Commercial Production: Q3 2024 | Cash Cow (emerging) |

| Limon Mine Complex | Operating | Established production | Ongoing exploration for resource growth | Cash Cow |

| Eastern Borosi Project | Exploration/Development | Potential future contributor | Active high-grade exploration | Question Mark |

What is included in the product

Calibre Mining's BCG Matrix offers a tailored analysis of its mining assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides strategic insights into which mining units to invest in, hold, or divest based on their market share and growth potential.

A clear BCG matrix visualizes Calibre Mining's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

The La Libertad Complex in Nicaragua, a key asset for Calibre Mining, functions as a robust cash cow within its BCG matrix. This established operation, which includes a central milling facility, efficiently processes ore from several surrounding satellite mines. This hub-and-spoke model is crucial for maintaining consistent production and generating steady cash flow for the company.

As of the first quarter of 2024, Calibre Mining reported that the La Libertad Complex produced 22,759 ounces of gold. This mature operation's reliable output underpins Calibre's financial stability, providing a predictable revenue stream that supports exploration and development at other company assets.

The El Limon Complex in Nicaragua is a cornerstone of Calibre Mining's operations, featuring both underground and open-pit mines alongside a milling facility. This established gold producer has historically been a significant contributor to the company's output and cash flow.

While geotechnical challenges impacted operations in Q2 2024, the complex is projected to recover with ore tonnes expected to be mined in the latter half of the year. This resilience underscores El Limon's role as a foundational asset for Calibre, ensuring continued gold production.

The Pavon Gold Mine is a significant Cash Cow for Calibre Mining, consistently contributing to production growth. In 2023, Pavon, along with the Limon mine, produced 100,986 ounces of gold, with Pavon being a key component of this output.

As a satellite deposit supplying the Libertad mill, Pavon perfectly illustrates Calibre's successful hub-and-spoke model, optimizing resource utilization and driving efficiency. This strategic integration ensures a steady and reliable stream of cash flow for the company.

Pan Mine (Nevada, USA)

Calibre Mining's Pan Mine, acquired in 2022, is a key producing heap leach gold operation in Nevada, USA. This asset plays a role in diversifying Calibre's overall gold production and cash flow generation. While specific quarterly output can fluctuate, the mine generally contributes to the company's sales, especially from its Nevada-based operations.

The Pan Mine offers valuable geographical diversification for Calibre Mining, complementing its larger operations in Nicaragua. Although its production scale is smaller than the Nicaraguan hubs, it provides a stable, consistent source of gold. This diversification is important for managing operational risks and broadening the company's revenue streams.

- Pan Mine Acquisition: Acquired by Calibre Mining in 2022.

- Operation Type: Producing heap leach gold operation.

- Contribution: Adds to diversified production and cash flow, particularly from Nevada assets.

- Strategic Value: Provides geographical diversification and consistent production.

Consistent Operating Cash Flow

Calibre Mining's existing mines are reliable sources of operating cash flow. This consistent generation of cash is vital for keeping operations running smoothly and for pursuing new growth opportunities.

The company's strong cash generation means it can fund its own exploration and development projects. This self-funding capability also helps Calibre Mining maintain a healthy financial position.

- Consistent Operating Cash Flow: Calibre Mining's established mines are key contributors to its financial strength.

- Financial Stability: Robust cash flow allows for reinvestment in exploration and development.

- Self-Funding Growth: The company's ability to fund its own expansion demonstrates the value of its current assets.

Calibre Mining's established operations, particularly the La Libertad and El Limon complexes in Nicaragua, along with the Pavon Gold Mine, function as its primary cash cows. These assets consistently generate substantial operating cash flow, providing the financial backbone for the company's activities. The Pan Mine in Nevada also contributes to this steady revenue stream, offering geographical diversification.

| Asset | Production (Q1 2024) | Contribution to Cash Flow |

| La Libertad Complex | 22,759 oz gold | Primary contributor, stable revenue |

| El Limon Complex | Projected recovery in H2 2024 | Foundational asset, ongoing production |

| Pavon Gold Mine | Key component of 2023 output (100,986 oz with Limon) | Optimized resource utilization, reliable cash |

| Pan Mine | Diversified production | Geographical diversification, consistent source |

Preview = Final Product

Calibre Mining BCG Matrix

The Calibre Mining BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic analysis of Calibre Mining's business units.

Dogs

Smaller, high-cost satellite deposits within Calibre Mining's portfolio, while not always explicitly labeled as 'dogs,' can be considered in this category. These operations often demand substantial capital for modest returns, consuming resources disproportionately to their output or future prospects. For instance, if a satellite mine in 2024 had a cash cost of $1,800 per ounce, significantly above the company's average of $1,250 per ounce, and contributed less than 5% to total production, it would likely be a candidate for divestment or reduced investment to streamline the overall asset base.

Calibre Mining manages a broad exploration portfolio, and some early-stage ventures, like those in its Nicaragua concessions, might not pan out economically despite initial capital allocation. These projects, having absorbed exploration funds without showing substantial resource expansion or future production viability, fit the 'dog' category in the BCG matrix.

For instance, if a project in the Eastern Cordillera region of Colombia, which received $2 million in exploration spending in 2023, fails to delineate a commercially viable resource by mid-2024, it would be reclassified. Continued funding without clear positive indicators for such projects can indeed become a significant cash drain, impacting overall financial performance.

The Volcan open pit faced production headwinds in 2024, with ore deliveries falling short of budget due to increased historical artisanal mining. This activity directly impacted the site's full-year output, highlighting a significant operational challenge.

While improvements are anticipated at Volcan, persistent historical artisanal mining in certain areas poses ongoing complexities for efficient and safe extraction. These challenging zones, where the difficulties of extraction might outweigh the potential economic returns, could be categorized as 'dogs' within a strategic assessment.

Divested or Depleted Assets

Divested or depleted assets for Calibre Mining would fall into the Dogs category of the BCG Matrix. These are past investments or properties that have either been sold off or have concluded their economically viable production phase. They no longer contribute to the company's current revenue streams or cash flow generation.

These assets represent investments that have reached their natural conclusion and are no longer active contributors to Calibre's operational portfolio. Their inclusion in the Dogs quadrant signifies a lack of growth potential and minimal contribution to the company's overall market share or profitability.

- Divested Properties: Assets previously owned by Calibre that have been sold to other entities.

- Depleted Mines: Operations that have reached the end of their economic mine life and are no longer producing.

- Non-Contributing Assets: Any former operational sites or resource holdings that are not currently generating revenue or cash.

- Historical Investments: Past expenditures on properties that have yielded their value and are now inactive.

Inefficient Infrastructure or Obsolete Equipment

Inefficient infrastructure or obsolete equipment at Calibre Mining's operations would likely be categorized as a 'dog' in the BCG matrix. This signifies assets that have low market share and low growth potential, often due to their inherent limitations.

For instance, older processing plants requiring significant capital for essential repairs without a clear return on investment, or equipment that consistently underperforms, leading to higher per-unit production costs, fit this description. In 2024, Calibre Mining reported ongoing efforts to optimize its operational efficiency. However, specific details on which assets might be considered 'dogs' due to obsolescence are not publicly disclosed, but the principle remains that such assets drain resources.

These 'dog' assets can manifest in several ways:

- High Maintenance Costs: Equipment that frequently breaks down, necessitating costly repairs and unplanned downtime, directly impacting operational budgets. For example, if a particular mill requires over 20% of its operational budget in repairs annually, it could be a candidate for being a 'dog'.

- Low Throughput or Recovery Rates: Obsolete technology may limit the volume of material processed or result in lower precious metal recovery, making these units less competitive compared to modern facilities.

- Increased Operating Expenses: Older machinery often consumes more energy and requires more consumables, leading to higher operating expenses per ounce of gold produced.

Calibre Mining's 'dogs' are typically divested or depleted assets, meaning mines that have finished their economically viable production or properties that have been sold. These are historical investments that no longer contribute to current revenue or cash flow, representing a lack of growth potential and minimal impact on the company's market share or profitability.

Inefficient infrastructure or obsolete equipment also falls into this category. Such assets, characterized by low market share and low growth, often incur high maintenance costs, possess low throughput or recovery rates, and contribute to increased operating expenses per ounce, as seen with older processing plants or consistently underperforming machinery.

For instance, a satellite deposit with a 2024 cash cost of $1,800 per ounce, significantly above the company's average of $1,250, and contributing less than 5% to production, would be a prime candidate for divestment. Similarly, exploration projects absorbing funds without viable resource delineation, like a Colombian venture receiving $2 million in 2023 but failing to show positive indicators by mid-2024, also fit the 'dog' profile.

| Asset Type | BCG Category | Rationale | Example Metric (2024) |

|---|---|---|---|

| Divested Properties | Dog | No longer owned, no contribution to revenue. | N/A (Sold) |

| Depleted Mines | Dog | End of economic mine life, no current production. | N/A (Production ceased) |

| High-Cost Satellite Deposit | Dog | High cash costs, low production contribution. | Cash Cost: $1,800/oz vs. Avg: $1,250/oz |

| Unsuccessful Exploration Project | Dog | Capital spent without viable resource delineation. | Exploration Spend: $2M (2023), No commercial resource by mid-2024 |

| Obsolete Processing Plant | Dog | High maintenance, low efficiency, poor ROI. | Annual Repair Budget > 20% of operational budget |

Question Marks

Calibre Mining's Valentine Gold Project boasts significant early-stage exploration targets beyond its current defined reserves. The Valentine Lake Shear Zone and the Parallel Northwest Contact, spanning tens of kilometers, remain largely untested, presenting a substantial opportunity for future resource discovery.

These promising zones require considerable drilling and investment to delineate new resources and ultimately convert them into mineable reserves. The potential upside is the establishment of a new major gold camp, significantly expanding Calibre's asset base.

Calibre Mining is actively investing in the exploration and development of new satellite deposits in Nicaragua and Nevada. These projects, such as the Limon Norte expansion and the Eastern Borosi projects in Nicaragua, represent potential growth drivers but are currently classified as question marks in the BCG matrix. As of early 2024, significant capital is being allocated to de-risk these assets and define their economic feasibility.

Calibre Mining's acquisition of projects like Gold Rock in Nevada, through the Fiore Gold transaction, places them in the question mark category of the BCG matrix. These are advanced exploration-stage assets with considerable growth prospects, but they are not yet producing. For instance, as of late 2023, Gold Rock was undergoing ongoing exploration and resource definition, indicating its pre-production status.

The question mark designation stems from the significant capital investment and de-risking efforts required before these projects can transition to production. This typically involves comprehensive feasibility studies, securing necessary permits, and further exploration to confirm economic viability. Calibre's strategy involves advancing these assets, aiming to convert their potential into operational mines, a process that demands careful financial planning and execution.

Projects with Geotechnical or Permitting Challenges

Projects facing unexpected geotechnical issues or complex permitting processes, much like the initial hurdles encountered at Calibre Mining's Volcan operation, would fall into the question mark category of the BCG matrix. These situations present high potential rewards but are characterized by significant uncertainty, requiring substantial investment of both capital and time to overcome. Consequently, their immediate impact on market share and profitability is often constrained.

For instance, if a project requires extensive and costly ground stabilization due to unforeseen geological conditions, or if permitting timelines extend significantly beyond initial projections due to regulatory complexities, these factors directly translate into increased project costs and delayed revenue generation. This uncertainty places them in a precarious position within the BCG matrix, demanding careful management and strategic decision-making.

- Geotechnical Uncertainty: Unexpected ground conditions can necessitate costly redesigns and extended construction periods, diverting resources from other growth areas.

- Permitting Delays: Lengthy and unpredictable permitting processes can significantly impact project timelines and the ability to capture market opportunities swiftly.

- Capital Intensity: Addressing these challenges often requires substantial, unplanned capital injections, potentially straining financial resources and impacting overall company valuation.

- Market Share Impact: Delays and cost overruns can allow competitors to gain a foothold or increase their market share while the question mark project is under development.

Strategic Acquisitions Post-Equinox Gold Merger

Following the significant merger with Equinox Gold, announced in early 2024, Calibre Mining is poised to enter a new phase of strategic acquisitions. This union, creating Canada's second-largest gold producer, opens doors for high-growth potential projects that demand substantial capital investment and careful integration. These would be Calibre's "Question Marks" in a BCG matrix context.

Calibre's strategic acquisitions post-merger would likely target exploration or development projects exhibiting strong growth prospects but also carrying higher risk and requiring significant capital. For instance, acquiring a promising early-stage exploration property in a proven gold district, or a development-stage asset with a substantial, yet unproven, resource estimate, would fit this category. These ventures require meticulous due diligence and strategic planning to unlock their full value.

- New Exploration Projects: Acquiring licenses in underexplored regions with geological potential for significant gold discoveries.

- Development Stage Assets: Targeting mines in the feasibility or early construction phases that require capital infusion to reach production.

- Synergistic Acquisitions: Purchasing projects that complement existing operations, offering economies of scale or access to new geological trends.

- Geographic Diversification: Expanding into new mining jurisdictions to mitigate country-specific risks and tap into diverse resource bases.

Calibre Mining's exploration projects in Nicaragua and Nevada, such as Limon Norte and Eastern Borosi, are classified as question marks in the BCG matrix. These projects represent significant growth potential but require substantial capital investment and de-risking efforts to confirm economic viability. As of early 2024, Calibre is actively allocating resources to advance these assets, aiming to convert their potential into producing mines.

| Project Area | BCG Category | Key Characteristics | Investment Focus (as of early 2024) |

|---|---|---|---|

| Valentine Gold Project (Exploration Targets) | Question Mark | Significant early-stage exploration targets beyond current reserves; large, largely untested zones. | Continued drilling and investment to delineate new resources. |

| Nicaragua (Limon Norte Expansion, Eastern Borosi) | Question Mark | Potential growth drivers but require de-risking and definition of economic feasibility. | Significant capital allocation for exploration and development. |

| Nevada (Gold Rock) | Question Mark | Advanced exploration-stage asset with growth prospects, not yet producing. | Ongoing exploration and resource definition. |

BCG Matrix Data Sources

Our Calibre Mining BCG Matrix is built on a foundation of robust financial disclosures, detailed operational reports, and comprehensive market research. This blend of internal and external data ensures an accurate representation of each business unit's performance and market standing.