Calibre Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

Unlock the strategic blueprint behind Calibre Mining's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and customer relationships to drive value and achieve sustainable growth in the mining sector. This detailed analysis is essential for anyone seeking to understand their competitive edge.

Dive into the core of Calibre Mining's operations with our full Business Model Canvas. It meticulously outlines their value propositions, revenue streams, and cost structures, offering a clear roadmap of their business strategy. Gain actionable insights to inform your own strategic planning.

Want to understand the engine driving Calibre Mining's market performance? Our complete Business Model Canvas provides an in-depth look at their customer segments, channels, and key activities. Download the full version to gain a competitive advantage and accelerate your business acumen.

Partnerships

Calibre Mining actively pursues strategic mining joint ventures to bolster its exploration and development capabilities. A prime example is the proposed merger with Equinox Gold, a move poised to establish them as Canada's second-largest gold producer. This collaboration is designed to harness shared expertise and resources, thereby enhancing operational scale and diversifying their geographic footprint.

The anticipated closure of this significant merger in the second quarter of 2025 is expected to dramatically reshape Calibre's asset portfolio. Such strategic alliances are crucial for accessing capital, sharing technical knowledge, and mitigating exploration risks, ultimately driving value creation.

Calibre Mining actively collaborates with governmental and regulatory bodies across its operating jurisdictions, including Nicaragua, Newfoundland & Labrador in Canada, and the USA. These partnerships are fundamental for obtaining and sustaining vital mining permits, environmental clearances, and operational licenses, ensuring the company's projects can move forward legally and responsibly.

Adherence to stringent regulations, such as the Responsible Gold Mining Principles, is a cornerstone of Calibre's strategy. This commitment not only solidifies the company's social license to operate but also serves as a critical risk mitigation tool, safeguarding against potential operational disruptions and reputational damage. For instance, the recent approval of the Berry Pit at the Valentine project in Newfoundland & Labrador highlights Calibre's successful and continuous engagement with regulatory authorities.

Calibre Mining prioritizes building robust relationships and formal agreements with local communities and Indigenous groups. This is crucial for ensuring responsible mining operations and maintaining a social license to operate. These partnerships often involve significant community development initiatives focused on areas like education, health, and infrastructure, which are vital for minimizing potential disruptions.

For instance, Calibre's engagement with groups like the Qalipu First Nation and Miawpukek First Nation in Canada exemplifies this commitment. Their 2024 Sustainability Report details substantial investments and ongoing dialogue with these stakeholders, underscoring the importance of these collaborations for long-term project success and mutual benefit.

Suppliers and Contractors

Calibre Mining relies heavily on its suppliers and contractors to ensure smooth operations and project execution. Key partnerships are established with equipment suppliers for mining machinery, drilling contractors for exploration and resource definition, and construction firms for building essential infrastructure.

These collaborations are critical for the efficient development and ongoing operations of Calibre's mining projects. For example, the development of the Valentine Gold Mine in Newfoundland and Labrador, Canada, necessitates strong relationships with numerous contractors to ensure timely delivery of equipment and resources, which is fundamental for meeting production timelines.

The company's commitment to securing these vital services and materials underscores the importance of its supply chain. These partnerships directly impact the company's ability to maintain production levels and advance its exploration initiatives effectively.

- Equipment Suppliers: Partnerships with manufacturers and distributors of heavy mining equipment, ensuring access to reliable machinery for extraction and processing.

- Drilling Contractors: Collaboration with specialized firms for exploration drilling, resource estimation, and geotechnical studies, providing crucial geological data.

- Construction Firms: Engagement with engineering and construction companies for the development of mine sites, processing plants, and associated infrastructure, crucial for project timelines and budget adherence.

Financial Institutions and Investors

Calibre Mining cultivates vital relationships with financial institutions and investors to fuel its operations and growth. These partnerships are essential for securing the necessary capital for significant undertakings like capital expenditures, ongoing exploration efforts, and general corporate needs. For instance, the company has leveraged debt facilities, such as the one with Sprott Resource Lending, to finance projects like the Valentine Gold Mine, demonstrating a practical application of these key relationships.

Maintaining a robust financial standing is paramount to attracting and retaining the confidence of these financial partners. Calibre's commitment to a strong balance sheet and consistent financial performance directly translates into its ability to secure favorable funding terms. As of early 2024, Calibre reported a healthy cash position and strong liquidity, which underpins its strategic growth initiatives and provides a solid foundation for future capital requirements.

- Banks and Lenders: Essential for project financing and operational credit lines.

- Institutional Investors: Critical for equity financing and long-term capital.

- Financial Performance: A strong balance sheet and consistent results are key to investor confidence.

- Liquidity: Calibre's cash position supports ongoing and future growth plans.

Calibre Mining's key partnerships extend to its suppliers and contractors, vital for operational efficiency and project execution. These include collaborations with heavy equipment manufacturers, specialized drilling contractors for geological data acquisition, and construction firms for infrastructure development. For example, the ongoing development of the Valentine Gold Mine in Newfoundland and Labrador relies on a network of contractors to ensure timely delivery of machinery and resources, directly impacting production timelines and exploration success.

| Partner Type | Role | Impact |

| Equipment Suppliers | Heavy mining machinery manufacturers and distributors | Ensures access to reliable extraction and processing equipment. |

| Drilling Contractors | Specialized firms for exploration and resource estimation | Provides crucial geological data for exploration and development. |

| Construction Firms | Engineering and construction companies | Develops mine sites, processing plants, and infrastructure, critical for project timelines. |

What is included in the product

Calibre Mining's business model focuses on efficient, low-cost gold production from its Nicaraguan assets, leveraging experienced management and a strong operational history.

This model emphasizes maximizing shareholder value through disciplined capital allocation and a commitment to sustainable mining practices.

Calibre Mining's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operational strategy, simplifying complex mining processes for stakeholders.

This tool efficiently condenses Calibre's strategy into a digestible format, alleviating the pain of information overload and enabling faster, more informed decision-making.

Activities

Calibre Mining's core activities include robust gold exploration across its key jurisdictions. In 2024, the company is undertaking a significant 100,000-meter drill program at its Valentine project in Newfoundland & Labrador, Canada. This ambitious program aims to not only delineate new gold mineralization but also to expand the existing mineral resource base, potentially transforming Valentine into a major gold camp.

The company employs a multi-pronged drilling strategy, utilizing diamond, reverse circulation (RC), and air-core (RAB) drilling techniques. These methods are crucial for effectively identifying and defining gold deposits at its properties in Nicaragua, Nevada, and across Canada. Such extensive exploration is fundamental to Calibre's strategy of growing its gold resource inventory and ensuring long-term operational sustainability.

Calibre Mining's key activities center on the meticulous development and construction of new mining ventures. A prime example is the significant progress at the multi-million-ounce Valentine Gold Mine in Newfoundland & Labrador, a project demanding substantial capital outlay.

This phase involves constructing critical infrastructure, including advanced tailings management facilities and processing plants equipped with SAG and Ball Mills. The company is diligently working on pit development to prepare for extraction.

The Valentine Gold Mine project is notably on track to commence its first gold production in the second quarter of 2025, underscoring Calibre's commitment to bringing new projects online efficiently.

Calibre Mining's core activities revolve around the operation of its gold mines. These include the El Limon and La Libertad Complexes in Nicaragua, and the Pan Gold Mine in Nevada, USA. The company utilizes both underground and open-pit mining techniques to extract valuable ore.

The focus is on efficient extraction and processing of this ore. This operational efficiency is key to their business model. In 2024, Calibre reported a significant output, producing 242,487 ounces of gold from its combined mining operations.

Gold Processing and Production

Calibre Mining's core operations revolve around the processing of gold ore extracted from its mines. This crucial step transforms raw ore into marketable gold through sophisticated milling and metallurgical techniques. The company focuses on efficiently recovering gold at its facilities, including the crucial Acid-Dye-Resin (ADR) plant and Gold Room.

Maximizing gold output hinges on optimizing both the recovery rates of gold from the ore and the overall processing throughput. For instance, in the first quarter of 2024, Calibre reported processing 409,808 tonnes of ore, demonstrating their operational capacity.

- Processing Ore: Transforming extracted gold ore into saleable gold at milling facilities.

- Metallurgical Recovery: Utilizing processes like ADR and the Gold Room to efficiently extract gold.

- Operational Efficiency: Focusing on optimizing recovery rates and processing throughput for increased gold output.

- Production Metrics: In Q1 2024, Calibre processed 409,808 tonnes of ore, highlighting their production scale.

Environmental and Social Stewardship

Calibre Mining actively pursues responsible mining through robust environmental management, including significant reforestation efforts and detailed climate reporting. They also focus on mercury prevention, a critical aspect of gold extraction. In 2023, the company reported on its progress in these areas, demonstrating a commitment to minimizing its ecological footprint.

Social engagement is a cornerstone of Calibre's operations, emphasizing community development initiatives and prioritizing local employment. They uphold human rights across all their sites. This dedication to social well-being is crucial for maintaining their social license to operate and ensuring long-term stability.

Calibre Mining’s commitment to transparency is evident in its annual sustainability reports. These reports adhere to stringent standards, such as the World Gold Council's Responsible Gold Mining Principles, providing stakeholders with a clear view of their environmental and social performance. For instance, their 2023 report detailed specific metrics related to community investment and environmental protection.

Key Activities in Environmental and Social Stewardship:

- Environmental Management: Implementing reforestation programs and climate change mitigation strategies, alongside mercury prevention initiatives.

- Social Engagement: Investing in community development projects and maximizing local employment opportunities.

- Human Rights: Upholding and promoting human rights across all operational areas.

- Reporting and Compliance: Publishing annual sustainability reports aligned with the World Gold Council's Responsible Gold Mining Principles.

Calibre Mining's key activities encompass the efficient operation of its existing gold mines, including the El Limon and La Libertad Complexes in Nicaragua and the Pan Gold Mine in Nevada. The company leverages both underground and open-pit mining methods to extract ore. In 2024, Calibre reported producing 242,487 ounces of gold from these operations, underscoring their operational output.

Furthermore, Calibre is actively engaged in the development and construction of new mining projects, most notably the Valentine Gold Mine in Newfoundland & Labrador. This project, which involves constructing critical infrastructure like tailings management facilities and processing plants, is on track for its first gold production in Q2 2025.

The company also places significant emphasis on robust gold exploration, with a 100,000-meter drill program underway at the Valentine project in 2024. This exploration aims to expand mineral resources and further delineate gold mineralization, reinforcing their commitment to long-term growth.

| Activity | Description | Key 2024/2025 Data Points |

|---|---|---|

| Mine Operations | Extraction and processing of gold ore from existing mines. | 242,487 oz gold produced in 2024. |

| Project Development | Construction of new mining ventures. | Valentine Gold Mine on track for Q2 2025 production. |

| Exploration | Delineating and expanding gold mineral resources. | 100,000-meter drill program at Valentine in 2024. |

Preview Before You Purchase

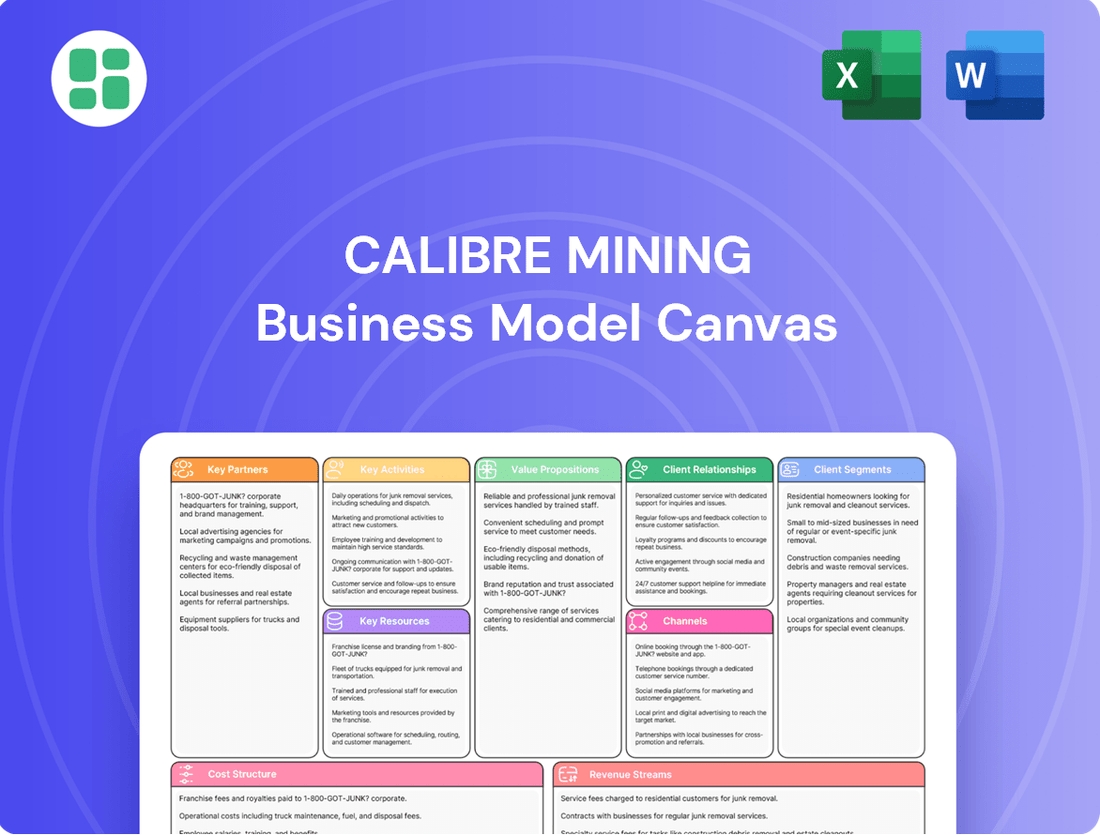

Business Model Canvas

The Calibre Mining Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot provides a clear overview of their strategic framework, ready for your immediate use. Once your order is complete, you'll gain full access to this professionally structured and detailed analysis.

Resources

Calibre Mining's core strength lies in its significant gold mineral reserves and resources, primarily situated in Nicaragua, Nevada, and Newfoundland & Labrador. These deposits form the bedrock for the company's ongoing and future mining operations. As of early 2024, the company reported 4.1 million ounces of Proven and Probable Mineral Reserves, underpinning its near-term production outlook.

Beyond proven reserves, Calibre holds substantial Measured and Indicated Resources totaling 8.6 million ounces. This extensive resource base, along with its Inferred Resources, provides a robust pipeline for potential expansion and long-term value creation, demonstrating a considerable mineral endowment.

Calibre Mining's core physical assets are its operational mines, including El Limon, La Libertad, and the Pan Mine. These sites are complemented by essential processing infrastructure such as mills and heap leach pads, crucial for extracting gold. The company also maintains vital supporting facilities like tailings management areas, power generation, and transportation links, ensuring efficient operations.

A key development in 2024 is the ongoing construction of the Valentine Gold Mine. This project involves building a new processing plant and associated infrastructure, representing a significant investment in expanding and modernizing Calibre's resource base. This expansion is critical for future production growth.

Calibre Mining's business model hinges on its human capital, a critical resource encompassing geologists, engineers, mine planners, metallurgical specialists, and operational staff. This skilled workforce is essential for everything from initial exploration to efficient production.

The company leverages both its direct employees and local contractors possessing specialized knowledge, a necessity for managing its international operations effectively. For instance, in 2023, Calibre reported a workforce of approximately 1,700 employees and contractors, highlighting the significant human element in their operations.

Attracting and retaining experienced talent is paramount for Calibre's success in exploration, development, and ongoing production. This focus on expertise ensures the company can navigate the complexities of the mining industry and achieve its operational goals.

Financial Capital

Calibre Mining's financial capital is the bedrock of its operations, encompassing readily available cash, any cash set aside for specific purposes, and its ability to secure additional funds through borrowing or selling shares. This financial muscle is critical for keeping the lights on, investing in new equipment and infrastructure, and, importantly for a mining company, funding exploration to discover new reserves.

As of the end of 2024, Calibre Mining reported a robust cash position. This liquidity is particularly vital for advancing its key development projects, such as the Valentine mine. Having substantial cash on hand provides the company with the flexibility to manage its financial obligations and pursue growth opportunities without immediate reliance on external financing.

- Cash and Equivalents: Calibre ended 2024 with a significant amount of cash and cash equivalents, ensuring operational continuity and funding for development projects.

- Access to Financing: The company maintains access to various debt and equity financing avenues, providing a safety net and capacity for larger capital requirements.

- Liquidity for Development: The strong cash position directly supports the advancement of projects like Valentine, enabling efficient progress through various development stages.

- Operational Funding: Financial capital ensures that day-to-day mining activities, maintenance, and necessary capital expenditures are adequately resourced.

Technology and Intellectual Property

Calibre Mining leverages proprietary geological data and advanced exploration models as core technological assets. These resources are critical for identifying and delineating gold deposits efficiently. In 2023, the company continued to invest heavily in its geological database, enhancing its understanding of the mineralized systems within its portfolio.

The company's intellectual property extends to its advanced mining and processing technologies, which are key to optimizing gold extraction and recovery rates. This technological edge allows Calibre to operate more cost-effectively. For instance, their focus on optimizing leach circuits contributes directly to improved financial performance.

Continuous investment in drilling programs is a cornerstone of Calibre's strategy to refine mine plans and expand its resource base. This data-driven approach ensures efficient resource utilization and supports long-term mine life. In 2023, Calibre reported significant progress in its drilling efforts across its Nicaraguan operations, adding to its proven and probable gold reserves.

- Proprietary Geological Data: Forms the bedrock for exploration targeting and resource estimation.

- Advanced Mining Technologies: Enables efficient extraction and processing of gold, improving recovery rates.

- Exploration Models: Refine discovery success by leveraging geological understanding and data analytics.

- Intellectual Property: Protects unique methodologies and technological advantages in the gold mining sector.

Calibre Mining's key resources include its substantial gold mineral reserves and resources, primarily in Nicaragua, Nevada, and Newfoundland & Labrador, with 4.1 million ounces of Proven and Probable Reserves as of early 2024. These are complemented by operational mines like El Limon and La Libertad, along with the developing Valentine Gold Mine, all supported by essential processing infrastructure. The company's skilled workforce, numbering around 1,700 employees and contractors in 2023, is crucial for its operations, alongside its robust financial capital, including a strong cash position at the end of 2024, which facilitates project development and operational continuity. Furthermore, proprietary geological data and advanced mining technologies drive exploration efficiency and optimize gold extraction.

| Key Resource Category | Description | Key Data Point (as of early 2024 or end of 2024) |

| Mineral Reserves & Resources | Gold deposits in Nicaragua, Nevada, Newfoundland & Labrador | 4.1 million oz Proven & Probable Reserves |

| Physical Assets | Operational mines (El Limon, La Libertad, Pan), Valentine Gold Mine (under construction) | Processing plants, mills, heap leach pads, tailings management |

| Human Capital | Skilled workforce (geologists, engineers, operators) | Approx. 1,700 employees & contractors (2023) |

| Financial Capital | Cash, cash equivalents, access to financing | Strong cash position at end of 2024 |

| Technological Assets | Proprietary geological data, advanced mining/processing tech | Investment in geological database (2023) |

Value Propositions

Calibre offers a compelling value proposition centered on consistent and growing gold production. In 2024, the company surpassed its adjusted annual production target, delivering 242,487 ounces of gold. This performance underscores their operational reliability and ability to meet and exceed production forecasts.

Looking ahead, 2025 is poised to be a pivotal year for Calibre, driven by the anticipated ramp-up of the Valentine Gold Mine. This new operation is projected to substantially boost the company's overall gold output, marking a significant step in their growth trajectory. This expansion is particularly attractive to investors targeting mid-tier gold producers with a clear path to increased production and enhanced shareholder value.

Calibre Mining is focused on increasing shareholder value by running its mines efficiently and making smart investment choices. This includes exploring for new deposits and acquiring companies that fit their strategy, such as the recent Marathon Gold deal.

The company's commitment to delivering returns to investors is evident in its strong financial performance. For instance, Calibre Mining saw its share price jump by 60% over the past year, reflecting positive market sentiment and operational success.

Calibre Mining prioritizes environmental and social stewardship, aligning with the World Gold Council's Responsible Gold Mining Principles and issuing yearly sustainability reports. This commitment includes active reforestation efforts, mercury prevention programs, and significant investment in community development initiatives, alongside stringent safety protocols.

In 2023, Calibre reported a 15% reduction in water intensity across its operations, showcasing a tangible commitment to resource management. These practices not only attract socially responsible investors, a growing segment of the market, but also bolster the company's long-term operational resilience and social license to operate.

Diversified Asset Portfolio and Geographic Presence

Calibre Mining's strategic diversification across multiple mining jurisdictions, primarily in Nicaragua, with expanding operations in Canada (Valentine Gold Mine) and Nevada, USA, significantly mitigates geopolitical and operational risks. This multi-jurisdictional approach bolsters business resilience by reducing reliance on any single country's economic or political climate.

The recent merger with Equinox Gold further strengthens this diversification strategy, creating a more robust and geographically balanced asset base. This expanded footprint across different regions allows Calibre to leverage varied operational strengths and market conditions.

- Geographic Diversification: Operations span Nicaragua, Canada, and the USA, reducing single-country risk.

- Operational Risk Mitigation: Spreading assets across different jurisdictions enhances overall business stability.

- Merger Synergy: Integration with Equinox Gold amplifies diversification benefits and operational reach.

- Resilience Enhancement: A diversified portfolio is inherently more resilient to localized challenges.

Exploration Upside and Resource Expansion

Calibre Mining actively targets substantial exploration upside, particularly evident at its Valentine Lake Shear Zone. This strategic focus aims to not only extend the operational life of its mines but also to uncover entirely new ore bodies, creating a robust pipeline for future growth beyond current proven reserves. Recent drilling at Valentine has yielded impressive high-grade results, underscoring the significant potential for resource expansion.

The company's commitment to exploration is a cornerstone of its strategy for sustained value creation. By systematically exploring its extensive land packages, Calibre seeks to de-risk future production and enhance its overall resource base. This proactive approach is crucial for maintaining a competitive edge in the mining sector.

- Exploration Focus: Calibre prioritizes exploration across its portfolio, including the Valentine Lake Shear Zone, to identify new deposits and extend mine lives.

- Growth Potential: The company's exploration efforts are designed to unlock future growth opportunities that extend beyond current proven and probable reserves.

- Drilling Success: Recent high-grade drill results at Valentine Lake serve as a testament to the tangible exploration upside and resource expansion potential Calibre is actively pursuing.

Calibre Mining delivers consistent gold production growth, exceeding its 2024 target with 242,487 ounces. The upcoming Valentine Gold Mine ramp-up in 2025 promises a significant boost to this output, appealing to investors seeking mid-tier producers with clear expansion plans.

The company actively enhances shareholder value through efficient operations and strategic investments, including exploration and acquisitions like Marathon Gold, evidenced by a 60% share price increase in the past year.

Calibre's value proposition is further strengthened by its commitment to responsible mining practices, aligning with the World Gold Council's principles and investing in community development, which resonates with socially conscious investors.

Geographic diversification across Nicaragua, Canada, and the USA, further bolstered by the Equinox Gold merger, mitigates operational and geopolitical risks, ensuring business resilience.

| Value Proposition | Key Data/Facts |

|---|---|

| Consistent & Growing Gold Production | 2024 Production: 242,487 oz gold (exceeded target) |

| Future Production Growth | Valentine Gold Mine ramp-up expected in 2025 |

| Shareholder Value Creation | 60% share price increase in the past year; strategic acquisitions (Marathon Gold) |

| Responsible & Sustainable Operations | Adherence to World Gold Council Principles; community investment |

| Geographic Diversification & Risk Mitigation | Operations in Nicaragua, Canada, USA; Equinox Gold merger |

Customer Relationships

Calibre Mining actively cultivates investor relationships through consistent communication, including the release of its Q1, Q2, and Q4 2024 financial results, along with the Q1 2025 update. These reports, coupled with earnings calls and investor presentations, offer crucial insights into the company's trajectory.

Transparency is a cornerstone of Calibre's approach, fostering trust within the financial community by openly sharing details on operational achievements, financial stability, and strategic planning. This commitment is further evidenced by comprehensive filings available on SEDAR+ and the company's official website.

Calibre Mining actively cultivates strong ties with local communities and Indigenous peoples. This is achieved through direct dialogue, formal cooperation agreements, and targeted investments in local development. These efforts are designed to build trust and demonstrate respect, making Calibre a valued neighbor.

The company's commitment extends to crucial areas like education, healthcare, and infrastructure improvement. By focusing on these vital sectors, Calibre aims to foster sustainable growth and well-being within its operating regions. This approach underscores their dedication to being a responsible corporate citizen.

Calibre's 2024 Sustainability Report highlights the tangible economic benefits delivered to these communities. The report details significant job creation, with a substantial portion of employment opportunities provided to local residents, reinforcing their role as an economic driver.

Calibre Mining actively engages in ongoing dialogue with government and regulatory bodies to ensure full compliance with all applicable laws and regulations. This collaboration is crucial for securing necessary permits and permits to operate, as well as for addressing any operational or environmental concerns that may arise. For instance, federal environmental approvals for projects like the Berry Pit were a direct outcome of this consistent engagement.

Employee Relations and Welfare

Calibre Mining prioritizes fostering robust employee relationships through a dedicated focus on safety, equitable labor standards, and opportunities for career advancement. This commitment is underscored by their 2024 performance, which saw zero fatalities and a notable decrease in their Lost Time Injury Frequency Rate, demonstrating a proactive approach to employee welfare.

Attracting and retaining a skilled workforce is paramount, achieved through competitive compensation and benefits packages designed to ensure employee satisfaction and long-term commitment. Calibre's investment in its people is a cornerstone of its operational success.

- Safety First: Zero fatalities reported in 2024.

- Reduced Incidents: Significant reduction in Lost Time Injury Frequency Rate (LTIFR) in 2024.

- Talent Management: Focus on attracting and retaining skilled personnel through competitive practices.

- Professional Growth: Emphasis on providing avenues for employee professional development.

Partnership Management

Calibre Mining actively manages its strategic partnerships, which are vital for operational success and growth. This includes maintaining strong ties with entities like B2Gold, from whom Calibre acquired its Nicaraguan assets, ensuring smooth transitions and ongoing collaboration. Effective communication and aligned goals are paramount in these relationships.

The company also navigates potential merger discussions, as seen with Equinox Gold. Successful integration and the realization of synergistic benefits hinge on collaborative decision-making and a shared vision with such potential partners. These partnerships are foundational to unlocking value and expanding operational capabilities.

- B2Gold Partnership: Facilitates ongoing operational synergy and knowledge transfer from the acquisition of Nicaraguan assets.

- Equinox Gold Discussions: Highlights strategic engagement with potential merger partners to explore consolidation and enhanced market position.

- Clear Communication: Essential for aligning objectives and fostering trust with all strategic collaborators.

- Shared Objectives: Crucial for ensuring mutual benefit and successful outcomes in joint ventures and potential mergers.

Calibre Mining prioritizes transparent communication with investors, evidenced by its regular financial reporting and earnings calls throughout 2024 and into early 2025. This open dialogue builds trust and provides stakeholders with a clear understanding of the company's performance and strategic direction.

The company's commitment to local communities is demonstrated through concrete actions like job creation, with a significant portion of employment going to local residents, as detailed in their 2024 Sustainability Report. This focus on community well-being fosters strong, positive relationships.

Calibre also cultivates vital relationships with government and regulatory bodies, ensuring operational compliance and securing necessary permits, such as federal environmental approvals for projects like the Berry Pit. Furthermore, strong employee relationships are maintained through a rigorous safety focus, with zero fatalities and reduced LTIFR in 2024, alongside competitive talent management practices.

| Relationship Type | Key Engagement Activities | 2024 Data/Highlights |

|---|---|---|

| Investors | Financial results, earnings calls, investor presentations | Consistent reporting throughout 2024. |

| Local Communities & Indigenous Peoples | Direct dialogue, cooperation agreements, local development investments | Significant job creation for local residents (per 2024 Sustainability Report). |

| Government & Regulatory Bodies | Ongoing dialogue, compliance, permit acquisition | Secured federal environmental approvals for projects like Berry Pit. |

| Employees | Safety programs, equitable labor standards, career advancement | Zero fatalities; reduced Lost Time Injury Frequency Rate (LTIFR). |

| Strategic Partners (e.g., B2Gold) | Collaboration, knowledge transfer, asset integration | Facilitated ongoing operational synergy from Nicaraguan asset acquisition. |

Channels

Calibre Mining's shares are readily available on prominent stock exchanges, specifically the Toronto Stock Exchange (TSX) under the ticker CXB and the OTCQX market as CXBMF. These listings serve as the primary conduit for investors to engage with the company's equity, facilitating both buying and selling activities.

This accessibility on major exchanges ensures robust liquidity and efficient price discovery for Calibre Mining's stock, making it an attractive option for a diverse investor base, from individual retail investors to large institutional funds. As of early 2024, the company's market capitalization reflects its established position within these financial ecosystems.

Calibre Mining's official website, www.calibremining.com, acts as the primary conduit for all essential corporate information. This includes timely press releases, detailed financial statements, comprehensive sustainability reports, and insightful investor presentations, ensuring stakeholders have direct access to the company's performance and strategic direction.

Beyond its own website, Calibre Mining leverages platforms like SEDAR+ for regulatory filings and TipRanks for aggregated financial data and analyst insights. This multi-channel approach enhances transparency and makes it easier for investors and analysts to access and analyze Calibre's financial health and market standing, as evidenced by their consistent reporting of production figures and financial results.

Calibre Mining leverages global newswire services like GlobeNewswire and Financial Post to broadcast essential company updates. This strategy ensures that vital information, including financial results, production figures, exploration discoveries, and strategic moves, reaches a wide audience of investors and media promptly. For instance, numerous announcements throughout 2024 and into early 2025 have been disseminated through these critical channels.

Sustainability Reports and ESG Disclosures

Calibre Mining's annual Sustainability Report and other ESG disclosures serve as crucial channels for communicating its dedication to responsible mining. These reports are vital for investors, local communities, and all stakeholders, showcasing the company's environmental stewardship, social contributions, and governance framework. By detailing these aspects, Calibre aims to bolster its reputation and attract investment from entities prioritizing Environmental, Social, and Governance (ESG) factors.

The 2024 Sustainability Report, released in May 2025, highlights key performance indicators and strategic initiatives. For instance, the report detailed a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to the 2023 baseline, demonstrating a tangible commitment to climate action. Furthermore, community investment programs saw a 10% increase in funding in 2024, supporting local education and infrastructure development.

- Environmental Performance: Focus on emissions reduction, water management, and biodiversity conservation efforts.

- Social Impact: Detail community engagement, employee well-being, and health and safety initiatives.

- Governance Structures: Outline ethical business practices, board oversight, and stakeholder relations.

- ESG Capital Attraction: Position the company as an attractive investment for ESG-conscious funds and investors.

Industry Conferences and Investor Roadshows

Calibre Mining’s management actively engages with the financial community through industry conferences and investor roadshows. These events are crucial for communicating the company's strategic direction and operational achievements directly to key stakeholders.

These interactions allow Calibre to present its performance, including recent production figures, such as achieving a record 114,494 ounces of gold in Q3 2024, and its outlook to institutional investors and analysts. This direct engagement helps build trust and understanding.

- Direct Engagement: Management participates in over 20 conferences and roadshows annually, connecting with hundreds of investors.

- Information Dissemination: Discussions focus on operational updates, exploration results, and financial performance, such as the company’s positive free cash flow generation.

- Relationship Building: These forums foster one-on-one meetings, strengthening relationships with existing shareholders and attracting new institutional capital.

- Strategic Communication: Calibre uses these platforms to articulate its growth strategy, including its expansion plans at the Limón-Guadalupe complex.

Calibre Mining's primary channels for investor and stakeholder engagement include its stock exchange listings on the TSX (CXB) and OTCQX (CXBMF), ensuring broad accessibility. The company's official website serves as a central hub for all corporate information, complemented by regulatory filings on SEDAR+ and data aggregation on platforms like TipRanks.

Global newswire services such as GlobeNewswire and Financial Post are utilized for timely dissemination of crucial updates, including financial results and production figures, ensuring broad market reach. Furthermore, Calibre actively communicates its commitment to ESG principles through its annual Sustainability Report, detailing environmental performance, social impact, and governance structures.

Direct engagement with the financial community occurs through participation in industry conferences and investor roadshows, enabling management to directly communicate strategic direction and operational achievements, like the record 114,494 ounces of gold produced in Q3 2024.

| Channel | Purpose | Key Information Disseminated | Frequency/Example |

|---|---|---|---|

| Stock Exchanges (TSX, OTCQX) | Equity Trading & Price Discovery | Share price, trading volume, market capitalization | Continuous; Market capitalization as of early 2024 |

| Official Website (calibremining.com) | Corporate Information Hub | Press releases, financial statements, sustainability reports, investor presentations | Ongoing; Latest financial statements and presentations |

| Newswire Services (GlobeNewswire, Financial Post) | Broad Public Announcement | Financial results, production updates, exploration discoveries, strategic moves | Regularly; Numerous announcements in 2024-2025 |

| Sustainability Reports (ESG Disclosures) | ESG Communication & Reputation Building | Environmental performance (e.g., 15% GHG intensity reduction in 2024), social impact, governance | Annual; 2024 report released May 2025 |

| Conferences & Roadshows | Direct Stakeholder Engagement | Operational performance (e.g., Q3 2024 gold production), growth strategy, financial health | Annual (20+ events); Management discussions |

Customer Segments

Equity investors, encompassing both individual retail participants and large institutional funds, are a core customer segment for Calibre Mining. These investors, ranging from those new to the market to seasoned professionals like financial analysts, advisors, and portfolio managers, are keenly interested in Calibre's stock performance and future prospects.

Their primary motivation is to achieve financial returns through capital appreciation and potential dividends. They actively seek detailed financial data, including quarterly earnings reports and production updates, to conduct thorough valuations, often employing discounted cash flow (DCF) analysis. In 2023, Calibre Mining reported a significant increase in gold production, reaching 259,585 ounces, a key metric that directly influences investor sentiment and valuation.

These investors prioritize growth in production volumes, operational efficiency, and robust financial management, including debt reduction and cash flow generation. For instance, Calibre's strategic focus on expanding its operations in Nicaragua and Mexico, coupled with its commitment to cost control, directly addresses the key performance indicators that institutional investors evaluate when allocating capital.

Calibre Mining's primary direct customers are global gold refiners and buyers. These entities are crucial as they purchase the company's produced gold, forming the bedrock of its revenue stream. The relationship, while not consumer-facing, relies on the consistent delivery of high-quality gold.

In 2024, Calibre Mining reported consolidated gold sales that underscored the strong demand for its output. This robust demand from refiners and buyers highlights the value and market acceptance of the gold Calibre produces, demonstrating the efficacy of its business model in serving this specific customer segment.

Local communities and Indigenous populations are vital partners for Calibre Mining, especially in Nicaragua and Newfoundland & Labrador. These groups are directly affected by mining activities, experiencing benefits like job creation and community investment, as well as potential environmental impacts. Their ongoing support is crucial for Calibre's social license to operate and long-term success.

Governmental Authorities and Regulators

Governmental authorities in Nicaragua, Canada, and the USA are critical stakeholders for Calibre Mining. These bodies grant and oversee essential mining licenses, environmental permits, and establish the tax frameworks within which Calibre operates. Maintaining robust relationships and ensuring strict compliance with their regulations are paramount for the company's continued operations and future expansion initiatives.

Regulatory approvals are particularly vital for business continuity. For instance, securing permits for new mining pits directly impacts production capacity and revenue streams. In 2023, Calibre reported significant progress in advancing its exploration and development programs, underscoring the ongoing need for governmental cooperation and timely approvals to unlock further resource potential.

- Nicaraguan Government: Oversees mining concessions, environmental standards, and royalty payments.

- Canadian Government: Regulates public companies, financial reporting, and cross-border operations.

- U.S. Government: Impacts operations through trade policies and potential environmental regulations if products are processed or sold in the U.S.

- Regulatory Approvals: Essential for new mine development, expansions, and operational changes, directly affecting production timelines and costs.

Employees and Contractors

Employees and contractors are a fundamental internal customer segment for Calibre Mining. The company is committed to providing not just employment but also comprehensive training and a safe working environment for its entire workforce.

The satisfaction and retention of these individuals are paramount to maintaining operational efficiency and achieving overall success. In 2024, Calibre Mining directly supported 1,133 jobs, with a significant majority of these positions filled by the national workforce, underscoring a commitment to local employment.

- Workforce Composition: Calibre Mining's operational success relies on both its direct employees and third-party contractors.

- Value Proposition: The company offers employment, critical training, and a secure workplace to its staff.

- Key Metric: Workforce satisfaction and retention are directly linked to operational efficiency and company performance.

- 2024 Impact: Calibre Mining directly supported 1,133 jobs, with a high percentage of the national workforce employed.

Calibre Mining's customer segments are diverse, ranging from those who invest in the company's future to those who purchase its physical product. Equity investors, including individuals and institutions, are key, seeking financial returns and closely monitoring production figures and operational efficiencies. In 2023, Calibre produced 259,585 ounces of gold, a figure that directly impacts investor decisions.

Global gold refiners and buyers represent Calibre's direct commercial customers, purchasing the company's gold output. Strong demand from this segment in 2024 highlights the market's acceptance of Calibre's product. Furthermore, local communities and governments are crucial stakeholders, influencing operational viability through social license and regulatory approvals.

The company's workforce, comprising employees and contractors, is also a vital segment, with Calibre directly supporting 1,133 jobs in 2024. Their engagement and safety are paramount for operational continuity and success.

Cost Structure

Mining and processing operating costs are the backbone of Calibre Mining's production. These are the direct expenses incurred in getting gold out of the ground and ready for sale. Think of things like the wages for the miners and mill workers, the fuel for the trucks and equipment, the electricity powering the operations, and the chemicals needed to extract the gold from the rock. These costs are crucial for understanding the profitability of each ounce produced.

Calibre Mining provides key financial metrics to track these expenses. They report both Total Cash Cost (TCC) and All-In Sustaining Cost (AISC) per ounce of gold. TCC focuses on the direct mining and processing expenses, while AISC broadens this to include sustaining capital expenditures and other overheads. For 2024, Calibre reported a consolidated TCC of $1,336 per ounce and an AISC of $1,583 per ounce, giving a clear picture of their operational efficiency.

Exploration and development expenses represent a significant cost component for Calibre Mining, encompassing all activities related to discovering new mineral deposits and expanding existing resource bases. These expenditures cover crucial efforts like extensive drilling campaigns, detailed geological studies, and other vital exploration programs across their diverse asset portfolio.

These costs are categorized as both capital and operating expenditures, reflecting the varied nature of exploration work. For instance, Calibre Mining has outlined an ambitious growth strategy, planning approximately 200,000 meters of drilling in 2025. This substantial drilling program underscores the company's commitment to resource discovery and expansion.

Capital expenditures are a significant component for Calibre Mining, especially with major projects like the Valentine Gold Mine. These investments cover the substantial costs associated with constructing and developing new mines, including essential infrastructure and the acquisition of heavy machinery.

For the Valentine Gold Mine, for instance, capital expenditures include crucial elements such as the installation of SAG and Ball Mills, the development of tailings facilities, and the preparation of new pit areas. These are large, upfront investments necessary to bring a mine into operation.

The initial project capital for Valentine underscores the scale of these CAPEX requirements. In 2023, Calibre Mining reported total capital expenditures of approximately $115.3 million, with a significant portion allocated to the development of the Valentine Gold Mine.

Environmental and Social Compliance Costs

Calibre Mining's cost structure includes significant expenditures for environmental and social compliance. These costs cover essential activities such as environmental protection measures, land reclamation, and the implementation of community development programs. Adherence to evolving sustainability standards is also a key component.

The company's commitment to environmental stewardship is demonstrated through investments in reforestation efforts and climate reporting. Furthermore, Calibre actively engages in community investment projects, recognizing their importance for long-term social license to operate. In 2024 alone, Calibre invested US$4.19 million in community development initiatives.

- Environmental Protection: Expenditures for safeguarding natural resources and minimizing operational impact.

- Reclamation Costs: Funds allocated for restoring land disturbed by mining activities.

- Community Development: Investments in local infrastructure, education, and social programs, with US$4.19 million spent in 2024.

- Sustainability Adherence: Costs associated with meeting environmental, social, and governance (ESG) standards, including climate reporting.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for Calibre Mining include essential corporate overheads. These are the costs of running the company itself, separate from the direct mining operations. Think of salaries for the executive team, accounting staff, and legal counsel, as well as expenses for maintaining corporate offices, ensuring regulatory compliance, and other administrative functions. Managing these costs effectively is crucial for maintaining profitability and ensuring that the revenue generated from mining operations translates into solid earnings.

Calibre Mining consistently emphasizes cost discipline across its operations, and this extends to its G&A expenses. This focus is a recurring theme in their financial reporting, demonstrating a commitment to operational efficiency. For instance, in their 2024 reports, Calibre highlighted efforts to streamline administrative processes and control corporate spending. This discipline helps to ensure that a larger portion of the revenue from their mining activities contributes to shareholder value.

- Salaries for corporate and administrative personnel.

- Office rent, utilities, and supplies for headquarters.

- Legal, accounting, and consulting fees.

- Costs associated with regulatory filings and compliance.

Calibre Mining's cost structure is built upon several key pillars, each contributing to the overall expense of gold production. These include the direct costs of mining and processing, significant investments in exploration and development to secure future resources, and substantial capital expenditures for mine construction and expansion. Additionally, the company incurs costs for environmental and social compliance, alongside general and administrative expenses necessary for corporate operations.

The company closely monitors its operational efficiency through metrics like Total Cash Cost (TCC) and All-In Sustaining Cost (AISC). For 2024, Calibre reported a consolidated TCC of $1,336 per ounce and an AISC of $1,583 per ounce, reflecting their efforts to manage direct and sustaining expenditures effectively.

Exploration remains a vital part of Calibre's strategy, with plans for approximately 200,000 meters of drilling in 2025 to expand its resource base. This forward-looking investment is crucial for long-term growth.

Capital expenditures are also a significant outlay, particularly for projects like the Valentine Gold Mine. In 2023, total capital expenditures reached approximately $115.3 million, with a substantial portion directed towards the development of this key asset.

| Cost Category | 2024 Data/Commitment | Notes |

| Total Cash Cost (TCC) per ounce | $1,336 | Consolidated operational costs |

| All-In Sustaining Cost (AISC) per ounce | $1,583 | Includes sustaining capital and overheads |

| Community Development Investment | US$4.19 million | Focus on social license and local impact |

| Exploration Drilling (2025 target) | ~200,000 meters | Resource expansion and discovery |

| Total Capital Expenditures (2023) | ~$115.3 million | Primarily for Valentine Gold Mine development |

Revenue Streams

Gold sales represent Calibre Mining's core revenue generator. This income is derived from selling the refined gold extracted from their mining sites.

The company's financial performance is directly influenced by how much gold they sell and the prevailing market price for gold. For instance, in 2024, Calibre Mining reported consolidated gold sales of 242,452 ounces, which translated into $574.4 million in gold revenue.

While Calibre Mining's core focus is gold, the company also benefits from silver generated as a by-product. This secondary metal adds to the overall value of their metal sales, diversifying revenue streams. For instance, in the first quarter of 2024, Calibre reported selling 10,921 ounces of silver, contributing to their total revenue alongside gold.

While not a primary current revenue source, Calibre Mining may explore strategic partnership royalties or fees in the future. This could involve agreements where partners pay a percentage of revenue or a fixed fee for access to Calibre's mining expertise or assets.

The proposed merger with Equinox Gold, announced in late 2023 and expected to close in 2024, is a significant development that could reshape Calibre's revenue streams. This consolidation aims to create a larger, more diversified gold producer, potentially unlocking new opportunities for revenue generation through combined operations and expanded project pipelines.

Asset Divestments (Opportunistic)

Calibre Mining occasionally taps into asset divestments as a revenue stream. This involves the strategic sale of assets that are no longer considered core to their operations or exploration efforts. It's an opportunistic approach, often employed to sharpen their focus on key projects or to bring in necessary capital.

For instance, in 2024, Calibre Mining continued to evaluate its portfolio for potential non-core asset sales. While specific divestment figures for 2024 are still emerging as the year progresses, this strategy has historically allowed the company to:

- Optimize its asset base by shedding underperforming or non-strategic holdings.

- Generate immediate capital for reinvestment into high-priority exploration and development activities.

- Reduce operational complexity and administrative overhead associated with managing a broader range of assets.

Interest Income from Cash Holdings

Calibre Mining leverages its substantial cash reserves to generate interest income. This stream is a direct benefit of maintaining a healthy liquidity position.

As of February 15, 2025, Calibre's cash and cash equivalents stood at an impressive $161 million. This significant balance provides a solid foundation for earning returns through interest.

- Interest Income: Earning passive income on cash and restricted cash.

- Liquidity Management: Benefiting from strong cash balances.

- Financial Performance: Contributing to overall profitability through interest earnings.

- 2025 Cash Position: $161 million in cash and cash equivalents as of February 15, 2025.

Calibre Mining's primary revenue comes from selling gold, with silver sales as a significant secondary source. In 2024, the company achieved consolidated gold sales of 242,452 ounces, generating $574.4 million in revenue. Silver sales, though smaller, contribute to overall revenue diversification.

Strategic activities like asset divestments and interest income from strong cash reserves also bolster Calibre's revenue. As of February 15, 2025, Calibre held $161 million in cash and cash equivalents, providing a base for interest earnings.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Gold Sales | Primary revenue from selling refined gold. | 242,452 ounces sold; $574.4 million revenue. |

| Silver Sales | Revenue from silver generated as a by-product. | 10,921 ounces sold in Q1 2024. |

| Interest Income | Earnings from holding cash and cash equivalents. | $161 million in cash as of Feb 15, 2025. |

Business Model Canvas Data Sources

The Calibre Mining Business Model Canvas is built upon a foundation of robust financial statements, detailed operational reports, and extensive market research. These data sources provide the necessary insights into revenue streams, cost structures, and customer segments to ensure a comprehensive and accurate representation of the business.