CalAmp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CalAmp Bundle

CalAmp operates within a dynamic market shaped by intense rivalry, the bargaining power of its customers, and the constant threat of new entrants. Understanding these forces is crucial for navigating its competitive landscape. The full Porter's Five Forces analysis provides a deep dive into these pressures, revealing CalAmp's strategic positioning and potential vulnerabilities. Ready to gain a comprehensive view of CalAmp's competitive environment and unlock actionable insights for strategic planning?

Suppliers Bargaining Power

CalAmp's reliance on specialized hardware, such as IoT modules and semiconductor chips, places significant bargaining power in the hands of its suppliers. These components are fundamental to CalAmp's telematics and location-based services. For instance, the persistent global semiconductor shortages experienced through 2023 and into 2024 have demonstrated how limited availability can empower chip manufacturers to dictate terms and pricing.

The market for specialized telematics hardware and IoT modules often features a concentrated supplier base. This means companies like CalAmp may face limited options for sourcing critical, high-performance components, as players such as Teltonika, Xirgo Technologies, Jimi IoT, and Queclink dominate significant portions of the aftermarket segment. This concentration grants these specialized suppliers considerable leverage.

The intricate process of developing and integrating telematics hardware into complex systems, particularly for Original Equipment Manufacturer (OEM) applications, necessitates strict adherence to rigorous quality standards and demands deep technical collaboration. This inherent complexity can significantly elevate switching costs for CalAmp if they were to consider changing core suppliers, as any new integration would require substantial investments in time and resources to ensure compatibility and performance.

Proprietary Technology and Patents

Suppliers possessing proprietary technology or robust patent protection in critical components, such as specialized communication modules or advanced tracking hardware, can exert significant bargaining power. This allows them to influence pricing and supply conditions, as alternatives may be scarce or non-existent. CalAmp's reliance on such specialized inputs means that suppliers with unique technological advantages can command premium pricing.

For instance, a supplier holding patents for a novel low-power wide-area network (LPWAN) chip crucial for IoT applications would have considerable leverage. This situation is mirrored by CalAmp's own strategic use of intellectual property, as evidenced by its active patent filings in areas like device management and data analytics.

- Proprietary Technology: Suppliers with unique, patented technologies in areas like advanced GPS receivers or secure communication chips gain pricing power.

- Patent Portfolios: An extensive patent portfolio for a supplier in a niche component can limit CalAmp's sourcing options, increasing supplier leverage.

- Limited Alternatives: If few other suppliers offer comparable technology, the bargaining power of those with proprietary solutions increases significantly.

- CalAmp's IP Strategy: CalAmp's own investment in patents highlights the industry's recognition of intellectual property as a competitive advantage, a factor that also empowers its upstream suppliers.

Supplier's Financial Health and Reliability

The financial health of CalAmp's suppliers is a critical factor in its operational stability. For instance, a disruption in the supply chain for essential components used in their Edge Devices or Connected Car Solutions could lead to significant production delays. In 2023, CalAmp reported that its cost of goods sold was approximately $245 million, highlighting the substantial volume of materials and components it procures.

Any financial distress experienced by a key supplier could directly impact CalAmp's ability to meet market demand. This is particularly relevant given the company's reliance on specialized electronic components and manufacturing services. For example, a sudden bankruptcy or production halt by a primary semiconductor provider could halt the assembly of critical hardware.

- Supplier Financial Stability: CalAmp's revenue in fiscal year 2024 was $310.7 million, underscoring the need for a robust and financially sound supplier base to support this revenue generation.

- Reliability Concerns: A single supplier experiencing financial difficulties could jeopardize the consistent availability of components for CalAmp's diverse product portfolio.

- Operational Impact: Production stoppages or significant lead time increases from unreliable suppliers can directly affect CalAmp's capacity to fulfill customer orders, impacting its market position.

CalAmp's suppliers hold considerable sway due to the specialized nature of components like IoT modules and semiconductor chips, which are vital for its telematics offerings. The persistent global semiconductor shortages through 2023 and into 2024 highlighted how limited supply empowers chip manufacturers to dictate terms and pricing, directly impacting companies like CalAmp.

The market for these specialized telematics components is often dominated by a few key players, limiting CalAmp's sourcing options and increasing supplier leverage. This concentration, coupled with the high costs associated with integrating new suppliers due to technical complexities and proprietary technology, further strengthens the bargaining power of these upstream providers.

Supplier financial stability is also a crucial factor, as disruptions can impact CalAmp's production. With CalAmp's cost of goods sold around $245 million in 2023 and revenue at $310.7 million in fiscal year 2024, ensuring the reliability of its supplier base is paramount to maintaining operational continuity and meeting market demand.

| Factor | Impact on CalAmp | Supporting Data/Example |

| Supplier Concentration | Limited choice, increased leverage for suppliers | Domination of aftermarket telematics hardware by players like Teltonika, Xirgo Technologies |

| Switching Costs | High integration costs, dependency on existing suppliers | Complex development and integration for OEM applications |

| Proprietary Technology | Pricing power for suppliers, limited alternatives | Patents on critical components like LPWAN chips |

| Supplier Financial Health | Risk of production disruption | CalAmp's 2023 Cost of Goods Sold: ~$245 million; FY2024 Revenue: $310.7 million |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CalAmp's position in the connected device and IoT solutions market.

Instantly identify and address competitive threats with a dynamic, interactive model of CalAmp's Porter's Five Forces.

Customers Bargaining Power

CalAmp's customer base is quite varied, spanning sectors like transportation, logistics, government, and education. This means they offer solutions for fleet management, tracking assets, and even student safety, as seen with their Here Comes the Bus application. This broad reach is a key factor when considering how much sway customers have.

While major clients, particularly in large enterprise or government sectors, can exert significant influence due to the sheer volume of their business and the strategic necessity of telematics solutions, the wide array of industries CalAmp serves helps to spread out this power. For instance, in 2023, CalAmp reported revenue from its various segments, with a notable portion coming from its recurring software and services, indicating a mix of large and smaller customer engagements.

Customers are increasingly looking for telematics solutions that do more than just track assets. They want integrated platforms that seamlessly combine hardware, software, and advanced analytics, including AI-powered insights and cloud services. This shift towards comprehensive, end-to-end offerings means customers are less likely to switch providers if their current partner can deliver this sophisticated ecosystem.

CalAmp observes varying price sensitivities among its customer base. While some enterprise clients focus on sophisticated features and unwavering reliability, others, especially those in intensely competitive or budget-conscious industries, exhibit greater price sensitivity. This dynamic can exert downward pressure on CalAmp's pricing strategies, particularly for its more standardized telematics offerings or in markets where substitute solutions are abundant.

Availability of Competitors and Alternatives

The telematics market, where CalAmp operates, is highly competitive, featuring a significant number of players. Companies such as Samsara, Verizon Connect, Motive, and Geotab offer a wide range of solutions, providing customers with ample choices.

This abundance of alternatives directly translates into increased bargaining power for customers. They can readily compare features, pricing structures, and the quality of service offered by various providers, enabling them to negotiate more favorable terms.

- Competitive Landscape: The telematics sector is crowded, with established players and emerging innovators constantly vying for market share.

- Customer Choice: A broad spectrum of providers means customers are not dependent on a single supplier, enhancing their leverage.

- Information Availability: Easy access to comparative data on features and pricing empowers customers to make informed decisions and demand better value.

Importance of Customer Service and Customization

CalAmp's emphasis on a customer-first approach and superior service highlights how crucial customer retention is in their industry. This focus directly addresses the bargaining power of customers, as satisfied clients are less likely to seek alternatives.

Customers in this sector often demand customized solutions, smooth integration with their current infrastructure, and reliable technical assistance. These requirements mean that providers who can deliver on these fronts effectively mitigate the customer's ability to switch, even when faced with competitive pricing or features from other vendors.

- Customer Retention Focus: CalAmp's commitment to exceptional customer service directly combats customer churn.

- Tailored Solutions: Meeting specific customer needs reduces the incentive to switch providers.

- Integration and Support: Seamless system integration and responsive technical support are key differentiators that strengthen customer loyalty.

- Reduced Switching Propensity: By offering high-value, customized services, CalAmp can lessen the impact of customer bargaining power.

The bargaining power of CalAmp's customers is significant due to the highly competitive telematics market, offering customers numerous alternatives like Samsara, Verizon Connect, and Geotab. This competitive landscape allows customers to easily compare offerings and negotiate for better terms, especially for standardized solutions. CalAmp's focus on customized, integrated solutions and strong customer support helps to mitigate this power by increasing switching costs and customer loyalty.

| Factor | Impact on CalAmp | Mitigation Strategies |

|---|---|---|

| Market Competition | High bargaining power for customers due to many providers | Differentiate through specialized solutions and superior service |

| Customer Needs | Demand for integrated, AI-powered solutions | Invest in R&D for advanced features and cloud services |

| Price Sensitivity | Varies by customer segment, with some prioritizing cost | Offer tiered pricing and demonstrate value beyond price |

| Switching Costs | Can be high for customers with integrated systems | Ensure seamless integration and provide robust ongoing support |

Preview Before You Purchase

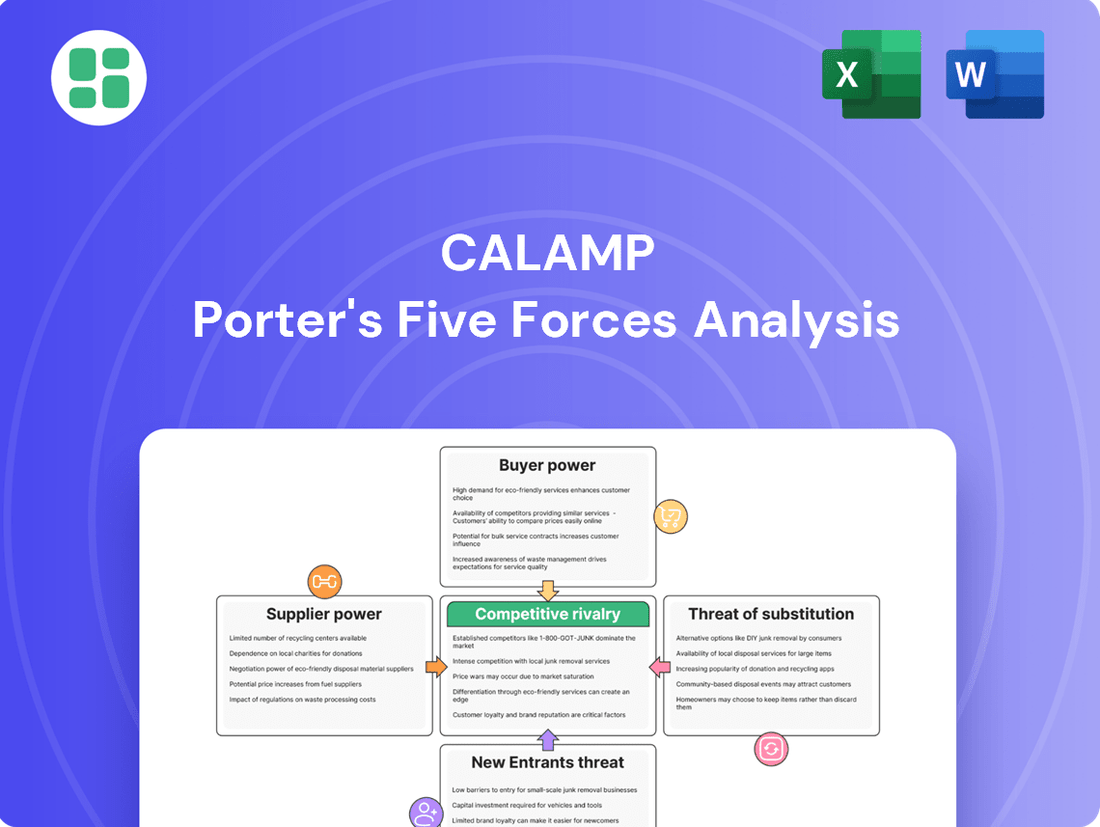

CalAmp Porter's Five Forces Analysis

This preview showcases the comprehensive CalAmp Porter's Five Forces Analysis, detailing the competitive landscape of the telematics and IoT solutions market. The document you see here is precisely the same professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. You can trust that the analysis presented is the complete, ready-to-use document, providing a thorough understanding of CalAmp's strategic positioning.

Rivalry Among Competitors

The telematics and connected intelligence sector is a bustling arena, filled with a diverse array of companies, from seasoned industry leaders to agile newcomers. This fragmentation fuels a highly competitive environment where staying ahead requires constant innovation and unique product development.

CalAmp operates within this dynamic landscape, facing pressure from numerous competitors vying for market share. For instance, in 2024, the global telematics market was valued at an estimated $30.5 billion, with projections indicating significant growth, underscoring the intense competition and the need for strategic differentiation.

CalAmp operates in a highly competitive landscape, facing intense rivalry from numerous well-established players. Companies like Samsara, Verizon Connect, Motive, Geotab, Trimble MAPS, Fleet Complete, and Lytx offer robust fleet management and telematics solutions, often boasting strong brand loyalty and significant market penetration.

Competitive rivalry in the telematics and IoT solutions sector, where CalAmp operates, is intense and largely driven by rapid technological advancements. The landscape is constantly evolving with new developments in artificial intelligence, the seamless integration of the Internet of Things (IoT), and the widespread adoption of cloud-based services. This means companies are in a perpetual race to innovate and offer cutting-edge features.

Companies are actively launching new functionalities designed to enhance efficiency and provide deeper insights. Examples include predictive maintenance capabilities, sophisticated driver behavior analysis tools, and advanced data analytics platforms. These innovations are not just incremental upgrades; they represent significant leaps forward, forcing all players, including CalAmp, to commit substantial resources to research and development to maintain their competitive edge and market relevance.

For instance, the global IoT market size was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, highlighting the demand for such integrated solutions. Companies investing heavily in R&D for AI-powered analytics in 2024 are positioning themselves to capture a larger share of this expanding market, putting pressure on established players like CalAmp to keep pace with these technological shifts.

Pricing Pressure and Feature Parity

As telematics solutions mature, certain core functionalities are becoming increasingly standardized, which naturally leads to heightened pricing pressure. Competitors often find themselves offering very similar basic features, forcing a greater emphasis on competitive pricing strategies and the development of unique value-added services or bundled offerings to differentiate themselves in the market.

CalAmp's strategy to combat this pressure hinges on its capacity to deliver comprehensive, integrated solutions encompassing hardware, software, and advanced analytics. This integrated approach is crucial for standing out in a crowded marketplace where feature parity is common.

- Intensifying Price Competition: The telematics industry, particularly in segments like fleet management, experiences significant pricing pressure as core features become commoditized. For instance, basic GPS tracking and geofencing capabilities are now widely available across many providers.

- Focus on Value-Added Services: To counter price wars, companies like CalAmp increasingly focus on differentiating through services such as advanced driver behavior monitoring, predictive maintenance analytics, and enhanced reporting capabilities, which command higher margins.

- Bundled Solutions as a Differentiator: Offering integrated hardware, software, and data analytics packages can create a more compelling value proposition than standalone hardware or software. This approach aims to lock in customers and provide a stickier, more comprehensive solution.

- CalAmp's Strategic Positioning: CalAmp's ability to provide end-to-end solutions, from the device to the cloud platform and data insights, is a key element in its strategy to maintain competitive advantage and mitigate the impact of pricing pressure from competitors offering more fragmented solutions.

Strategic Partnerships and M&A Activity

Strategic partnerships and mergers and acquisitions are crucial in shaping the competitive arena. Companies actively pursue these avenues to broaden their expertise, extend their market presence, and enhance their technological capabilities. For instance, CalAmp's transition to a private entity in 2023, a move aimed at deleveraging and fostering innovation, underscores the strategic importance of such actions in bolstering a company's competitive standing.

This consolidation trend is evident across the IoT sector, where CalAmp operates. In 2024, the industry continued to see significant M&A activity as larger players acquired smaller, innovative firms to gain access to new technologies and customer bases. This dynamic intensifies rivalry by creating more formidable competitors and potentially altering market share distribution.

CalAmp's strategic decision to go private was partly driven by the need to address its debt load, which stood at approximately $135 million as of early 2024, and to allocate capital more effectively towards research and development. This allows for greater flexibility in pursuing strategic partnerships or acquisitions without the immediate scrutiny of public markets.

- CalAmp's debt reduction and focus on innovation are key strategic drivers.

- M&A activity in the IoT sector is a significant trend in 2024, intensifying competition.

- Private ownership offers CalAmp enhanced strategic flexibility.

The competitive rivalry within the telematics and connected intelligence sector is fierce, driven by a crowded market and rapid technological advancements.

Companies like Samsara, Verizon Connect, and Geotab are major players, offering sophisticated solutions that challenge CalAmp. The global telematics market's estimated $30.5 billion valuation in 2024 highlights the significant competition for market share.

This intense rivalry forces companies to differentiate through value-added services and integrated offerings, as basic functionalities become commoditized, leading to price pressures.

CalAmp's strategy to navigate this involves focusing on its end-to-end solutions and leveraging its private status, achieved in 2023, for greater R&D and strategic flexibility.

| Competitor | Key Offerings | Market Position Indication (2024) |

| Samsara | Integrated fleet management, asset tracking, safety | Strong growth, significant market penetration |

| Verizon Connect | Fleet telematics, driver behavior, compliance | Established player with broad service portfolio |

| Geotab | Fleet management software, telematics devices | Large global install base, data analytics focus |

| Trimble MAPS | Route optimization, logistics solutions | Specialized in transportation and logistics |

SSubstitutes Threaten

For basic asset or vehicle tracking, simpler, more cost-effective alternatives exist. SIM card-based tracking using a driver's mobile phone can substitute for dedicated telematics hardware. While these solutions may lack advanced features, they appeal to businesses with tighter budgets or less intricate tracking needs.

Large enterprises with substantial IT budgets and specialized needs may choose to develop proprietary in-house fleet management and asset tracking systems. This approach allows for deep customization and integration with existing enterprise resource planning (ERP) or supply chain management (SCM) software. For instance, a major logistics company might invest millions in developing a bespoke solution to precisely match its complex operational workflows, bypassing off-the-shelf telematics providers.

The increasing integration of telematics systems directly into new vehicles by original equipment manufacturers (OEMs) presents a substantial long-term substitute threat to aftermarket telematics providers. As embedded solutions become standard, the demand for aftermarket devices for new vehicles is likely to decline, impacting companies like CalAmp.

By 2024, many major automotive manufacturers have announced or are actively rolling out advanced telematics capabilities as standard features in their new models, ranging from enhanced safety and diagnostics to infotainment and remote vehicle management.

Generic IoT Platforms and Manual Processes

Generic IoT platforms offer a lower-cost alternative for data collection from sensors, potentially bypassing specialized telematics solutions. For instance, businesses might opt for readily available cloud-based IoT services instead of CalAmp's integrated offerings for less complex monitoring needs.

Manual processes for fleet management and asset monitoring also serve as substitutes, especially for smaller operations or non-critical assets. These methods, while less efficient, represent a significant cost-saving substitute. In 2024, the global market for fleet management software was estimated to be around $30 billion, with a portion of this representing manual or less sophisticated solutions.

- Generic IoT Platforms: Offer broad data collection capabilities, often at a lower price point than specialized telematics.

- Manual Processes: Traditional methods of tracking and monitoring assets, particularly viable for smaller fleets or less complex operations.

- Cost-Effectiveness: These substitutes are attractive due to their lower upfront and ongoing costs compared to integrated telematics solutions.

- Market Adoption: While less feature-rich, the accessibility and affordability of generic platforms and manual methods can appeal to a segment of the market, especially small to medium-sized businesses.

Alternative Data Collection Methods

While CalAmp's telematics solutions offer advanced GPS tracking and data, substitutes exist for specific functions. Technologies like Radio-Frequency Identification (RFID) or Bluetooth tags can track assets or inventory, though they typically provide less granular, real-time location data compared to GPS. For instance, in warehouse management, RFID might suffice for item identification and movement within a defined area, a task where full GPS might be overkill.

Manual methods also present a threat. Traditional logbooks or simple manual reporting systems can substitute for telematics in scenarios where detailed, immediate data isn't critical. For example, a small business might use manual driver logs for compliance, which is a less sophisticated but still functional alternative to an automated telematics system for that specific need. In 2024, the adoption of simpler tracking methods for non-critical asset management remained a viable alternative for cost-sensitive businesses.

These substitutes, while often less sophisticated, can be adequate for less demanding applications, potentially limiting the market share for comprehensive telematics providers like CalAmp in certain segments. For example, a company needing only basic proof of delivery might find a mobile app with manual check-ins a sufficient substitute for a full-fledged telematics platform.

- RFID and Bluetooth tags: Offer asset tracking but typically lack real-time, granular location data.

- Manual reporting and logbooks: Serve as simpler alternatives for less data-intensive needs.

- Cost-effectiveness: These substitutes can be more budget-friendly for specific, limited applications.

- Adequacy for specific tasks: For basic functions like proof of delivery, simpler methods may be sufficient.

The threat of substitutes is significant for CalAmp, as simpler, lower-cost alternatives exist for many telematics functions. For basic asset tracking, mobile phone-based solutions or even manual processes can suffice for businesses with limited budgets or less complex needs. Furthermore, the increasing integration of telematics by vehicle manufacturers themselves presents a direct substitute for aftermarket solutions, potentially diminishing the market for companies like CalAmp.

By 2024, the global fleet management software market, valued at approximately $30 billion, includes a segment that relies on these less sophisticated or manual alternatives. Generic IoT platforms also offer a more generalized, often cheaper, approach to data collection, bypassing specialized telematics providers for less demanding applications. While these substitutes may lack the advanced features of integrated telematics, their cost-effectiveness and accessibility make them a viable option for a portion of the market.

| Substitute Type | Description | Key Advantage | Example Use Case |

|---|---|---|---|

| Mobile Phone Tracking | Utilizing driver's smartphones with SIM cards for location data. | Low cost, leverages existing hardware. | Small businesses needing basic driver location for deliveries. |

| Manual Processes | Logbooks, manual check-ins, or paper-based reporting. | Minimal to no technology cost, simple to implement. | Very small fleets or tracking non-critical assets where real-time data isn't essential. |

| OEM Embedded Telematics | Telematics systems built directly into new vehicles by manufacturers. | Seamless integration, often standard feature. | New vehicle buyers opting for manufacturer-provided fleet management or safety features. |

| Generic IoT Platforms | Cloud-based services for broad sensor data collection. | Flexibility, potentially lower cost for basic data aggregation. | Companies monitoring environmental sensors or simple asset status without complex analytics. |

Entrants Threaten

The telematics industry, particularly for companies like CalAmp that provide both hardware and software, demands considerable upfront investment. This includes significant spending on research and development for advanced Edge Devices and sophisticated software platforms, as well as the costs associated with setting up robust manufacturing capabilities and essential technology infrastructure.

These substantial capital requirements serve as a formidable barrier to entry for new players. For instance, developing and launching a new telematics device can easily cost millions of dollars in R&D and tooling alone. In 2024, the average cost for a company to bring a new connected hardware product to market, including certifications and initial production runs, can range from $5 million to $15 million.

The telematics industry demands sophisticated expertise in hardware development, cloud-based software platforms, and intricate system integration. New players must surmount substantial technological barriers and assemble highly specialized engineering talent to establish a competitive foothold. For instance, developing a reliable telematics device requires deep knowledge of embedded systems, wireless communication protocols, and data security, areas where established firms like CalAmp have cultivated decades of experience.

The telematics sector faces significant hurdles due to stringent regulatory and compliance demands. For instance, mandates like the Electronic Logging Device (ELD) rule in the US, requiring commercial vehicles to log hours of service electronically, necessitate substantial investment and technical know-how for new entrants to navigate. Similarly, evolving data privacy laws across different regions add layers of complexity and cost, making it challenging for smaller, less-resourced companies to enter the market and comply effectively.

Need for Established Distribution Channels and Customer Relationships

New entrants face a significant hurdle in establishing the necessary distribution channels and cultivating deep customer relationships, especially when targeting major commercial fleets, government agencies, and automotive original equipment manufacturers (OEMs). These established players often have long-standing contracts and loyalty programs that are difficult for newcomers to penetrate.

CalAmp's existing subscriber base, which numbered over 1 million active subscribers as of the first quarter of fiscal year 2025, provides a substantial competitive moat. This existing network and the company's strategic partnerships offer a considerable advantage over new market entrants attempting to build their own infrastructure and client trust from scratch.

- Established Distribution: CalAmp leverages existing relationships with telematics service providers and system integrators, reducing the cost and time for new market entrants to build similar networks.

- Customer Loyalty: Large commercial fleets and government entities often prioritize reliability and proven track records, making it challenging for new entrants to displace incumbent solutions.

- OEM Integration: Securing integration with automotive OEMs requires significant time, investment, and proven performance, a barrier that CalAmp has already overcome.

- Brand Recognition: Years of operation have allowed CalAmp to build brand recognition and trust within its target markets, a factor that new entrants must spend considerable resources to replicate.

Brand Recognition and Trust

In the asset tracking and safety sector, brand recognition and trust are incredibly important. Established companies like CalAmp, which owns well-known brands such as LoJack and Here Comes the Bus, have built this trust over many years. This long market presence means they have a proven track record of reliability, which makes it tough for new companies to quickly earn the same level of credibility and customer confidence.

For instance, LoJack, a brand under CalAmp, has been a household name in vehicle recovery for decades. This deep-rooted recognition means that consumers often turn to familiar brands when seeking safety and tracking solutions. New entrants face the significant hurdle of not only developing comparable technology but also overcoming the established brand loyalty and perceived dependability of incumbents.

CalAmp's strong brand equity is a significant barrier. In 2023, LoJack reported a substantial number of vehicle recoveries, underscoring its continued effectiveness and customer reliance. This consistent performance reinforces the trust consumers place in the brand, making it difficult for newcomers to compete on reputation alone.

- Brand Loyalty: Decades of service have fostered deep customer loyalty for brands like LoJack, making it hard for new entrants to gain market share.

- Proven Reliability: CalAmp's brands have a history of successful performance in critical safety and tracking applications.

- Customer Confidence: Established brands benefit from a higher baseline of trust, which new entrants must work hard to build.

- Market Inertia: Customers often stick with familiar and trusted solutions, creating inertia that new competitors must actively overcome.

The threat of new entrants in the telematics sector, where CalAmp operates, is generally considered moderate. Significant capital investment is required for R&D, manufacturing, and infrastructure, with new hardware product launches costing upwards of $5 million to $15 million in 2024. Furthermore, deep technical expertise in embedded systems, wireless communication, and data security is essential, presenting a steep learning curve for newcomers.

Regulatory compliance, such as the ELD mandate in the US, adds another layer of complexity and cost. Established distribution channels, strong customer relationships with large fleets and OEMs, and brand recognition, exemplified by CalAmp's LoJack brand, create substantial barriers. CalAmp's over 1 million active subscribers as of Q1 FY25 also contribute to customer loyalty and market inertia, making it challenging for new players to gain traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, manufacturing, and infrastructure costs. | Significant financial hurdle; new hardware can cost $5M-$15M to launch in 2024. |

| Technical Expertise | Need for specialized knowledge in hardware, software, and integration. | Requires highly skilled engineering talent, difficult to acquire quickly. |

| Regulatory Compliance | Navigating complex regulations like ELD rules and data privacy laws. | Adds cost and complexity, demanding significant legal and technical resources. |

| Distribution & Relationships | Accessing established channels and building trust with large clients. | Long-standing contracts and loyalty make penetration difficult. |

| Brand Recognition & Loyalty | Overcoming established brand trust and customer inertia. | New entrants must invest heavily in marketing to build credibility. |

Porter's Five Forces Analysis Data Sources

Our CalAmp Porter's Five Forces analysis is built upon a foundation of robust data, including CalAmp's SEC filings, investor presentations, and industry-specific market research reports from firms like Gartner and IDC. We also incorporate data from financial news outlets and competitive intelligence platforms to provide a comprehensive view of the industry landscape.