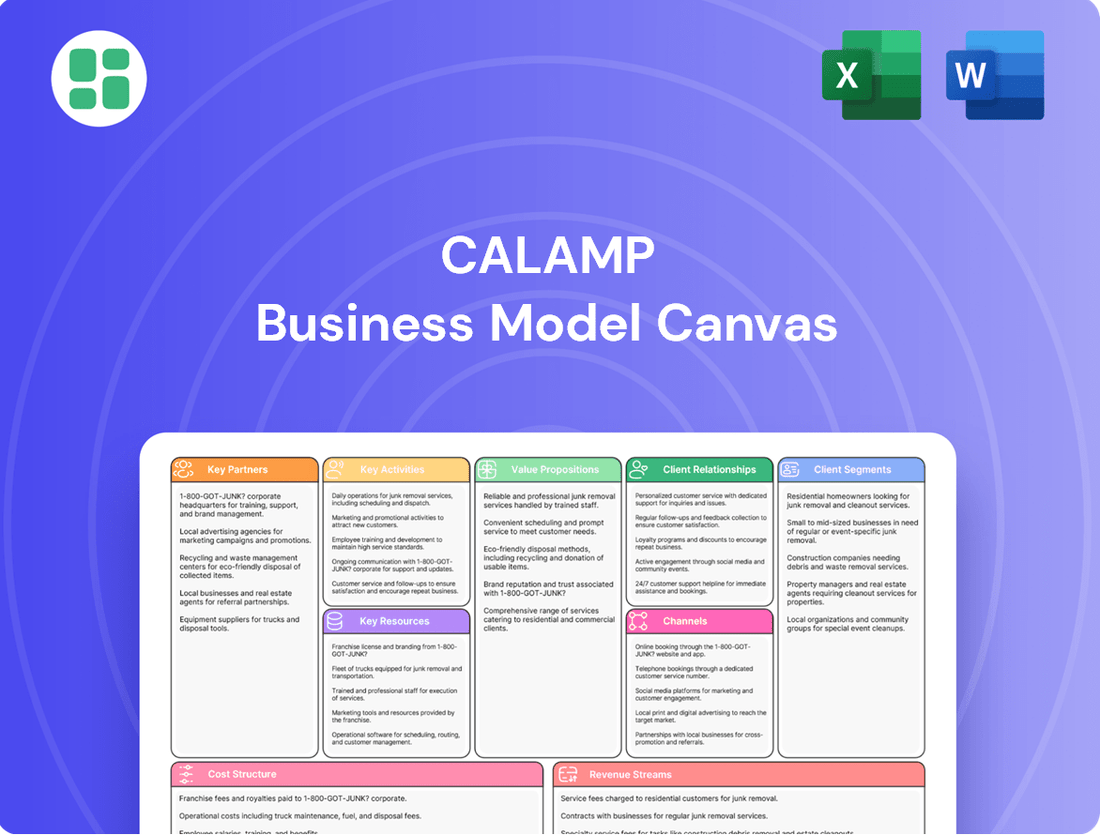

CalAmp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CalAmp Bundle

Unlock the strategic core of CalAmp's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how CalAmp leverages its technology and services to create value for its customers and maintain a competitive edge in the IoT market. Discover their key partnerships, revenue streams, and cost structures.

Partnerships

CalAmp's operations are deeply intertwined with technology and network providers, forming a critical backbone for its telematics services. These partnerships are essential for guaranteeing the consistent flow of data from their connected devices to their customers.

Key collaborators include major cellular network operators, ensuring widespread and reliable connectivity for CalAmp's edge devices, which is vital for real-time asset tracking and management. For instance, in 2024, the global IoT connections market continued its robust expansion, with cellular IoT alone projected to exceed 3.5 billion connections by year-end, highlighting the indispensable nature of these network relationships.

Furthermore, CalAmp leverages partnerships with cloud infrastructure providers. This allows for the scalable processing and storage of the vast amounts of data generated by its telematics solutions, enabling advanced analytics and insights for clients across diverse industries.

CalAmp relies on a network of hardware component suppliers for essential electronic parts and manufacturing services to build its telematics devices and sensors.

These partnerships are crucial for a stable supply chain, ensuring the quality of their products, and driving innovation in advanced hardware development.

Effective management of these supplier relationships directly impacts CalAmp's cost control and the consistent availability of its products in the market.

CalAmp's key partnerships with automotive OEMs and rental companies, especially in Europe, are crucial for its connected car strategy. These collaborations allow for the direct integration of CalAmp's technology into new vehicles, streamlining deployment and expanding market penetration.

These partnerships are vital for providing enhanced services such as vehicle tracking and stolen vehicle recovery directly to consumers and fleet managers. For example, in 2024, CalAmp continued to deepen its ties with major European automakers, aiming to embed its telematics solutions from the factory floor, thereby capturing a larger share of the connected vehicle market.

Channel Partners & Resellers

CalAmp's strategic reliance on channel partners and resellers, many associated with the established LoJack brand, is a cornerstone of its market reach. This network acts as an extension of CalAmp's direct sales force, facilitating the distribution of its telematics products and software solutions across a broad geographic and customer base.

These partnerships are crucial for expanding market penetration efficiently. By collaborating with existing distribution networks, CalAmp can access diverse regions and customer segments without the substantial investment required to build out its own direct sales infrastructure in every market. This model allows for agility and faster market entry.

For instance, in fiscal year 2024, CalAmp reported that a significant portion of its revenue was generated through its indirect sales channels, underscoring the vital role these partners play. This approach enables CalAmp to offer its specialized telematics and asset tracking solutions to a wider array of businesses, from small enterprises to large fleets, leveraging the local market expertise and established customer relationships of its partners.

- Global Reach: CalAmp utilizes a worldwide network of channel partners and resellers, including those linked to the LoJack brand, to distribute its telematics products and software.

- Market Penetration: These partnerships allow CalAmp to expand its market presence into various regions and customer segments without needing extensive direct sales infrastructure everywhere.

- Efficiency: Leveraging existing partner networks provides a cost-effective method for reaching new markets and customer bases.

- Revenue Contribution: In fiscal year 2024, indirect sales channels were a significant contributor to CalAmp's overall revenue, highlighting the importance of these key partnerships.

System Integrators & Software Developers

CalAmp partners with system integrators and software developers to ensure its telematics data and solutions integrate smoothly with customer ERP and fleet management systems. This collaboration allows for the creation of comprehensive, customized solutions that address intricate operational needs, thereby boosting the overall value delivered to clients.

These partnerships are crucial for extending CalAmp's reach and capabilities. For instance, by integrating with platforms like SAP or Oracle, CalAmp's telematics data can provide real-time insights directly within a customer's core business processes. This seamless flow of information empowers better decision-making and operational efficiency.

- Integration Expertise: System integrators bring specialized knowledge to embed CalAmp's telematics into diverse enterprise software.

- Enhanced Functionality: Software developers create add-on applications that leverage CalAmp's data for specific industry needs.

- Market Reach: Partnerships expand access to new customer segments and vertical markets.

- Scalability: Collaborative development ensures solutions can scale with customer growth and evolving technological landscapes.

CalAmp's ecosystem thrives on strategic alliances with technology providers, network operators, and hardware suppliers. These partnerships are fundamental for delivering reliable telematics services, ensuring data flow from devices to clients.

Key collaborators include cellular network operators, critical for consistent connectivity, and cloud infrastructure providers for scalable data processing. In 2024, the IoT connections market showed strong growth, with cellular IoT alone projected to surpass 3.5 billion connections, underscoring the importance of these network relationships.

| Partner Type | Role | Example/Impact |

|---|---|---|

| Network Operators | Connectivity | Ensure reliable data transmission for telematics devices. |

| Cloud Providers | Data Processing & Storage | Enable scalable analytics and insights from vast data volumes. |

| Hardware Suppliers | Component Sourcing | Provide essential parts for device manufacturing, impacting quality and cost. |

What is included in the product

CalAmp's Business Model Canvas focuses on providing device, software, and analytics solutions for the transportation and logistics industry, leveraging a recurring revenue model through its SaaS platform.

This model details CalAmp's approach to customer relationships, key resources, and cost structure, emphasizing its role as a connected intelligence provider.

CalAmp's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their entire business, enabling quick identification of core components and strategic alignment.

This structured approach simplifies complex strategies, making it ideal for brainstorming and team collaboration to adapt and refine their value proposition.

Activities

CalAmp's commitment to Research & Development is central to its strategy, with significant investment poured into advancing its telematics hardware, cloud platform, and software applications. This focus ensures the creation of cutting-edge solutions for its diverse customer base.

Key R&D efforts in 2024 are concentrated on developing next-generation edge devices, which are crucial for processing data closer to the source, thereby improving efficiency and reducing latency. The company is also enhancing its AI-driven analytics capabilities, exemplified by advancements in its CrashBoxx AI technology, to provide deeper insights and predictive functionalities.

Furthermore, CalAmp prioritizes improving the overall user experience across its product suite. This continuous innovation is vital for maintaining a competitive advantage in the rapidly evolving telematics market and effectively addressing the dynamic needs of its clients, including those in the fleet management and asset tracking sectors.

CalAmp's key activities center on continuously developing, maintaining, and improving its cloud-based software platform and diverse applications. This ongoing effort ensures customers receive user-friendly dashboards, real-time data visualization, and sophisticated analytical tools crucial for efficient fleet and asset management.

The company's commitment lies in building robust, secure, and scalable software solutions. For instance, in fiscal year 2024, CalAmp reported a focus on enhancing its SaaS recurring revenue streams, directly linked to the ongoing development and support of its platform capabilities, aiming to provide customers with reliable and advanced fleet management technology.

CalAmp's core operations revolve around the meticulous design, strategic sourcing, and efficient manufacturing of telematics devices and sensors. These hardware components are the bedrock upon which their asset tracking and data capture solutions are built. This involves a deep understanding of technological requirements and the ability to translate them into reliable, functional products.

Managing a sophisticated global supply chain is paramount to ensuring the consistent availability of high-quality hardware. CalAmp navigates this complexity to source components and assemble devices that reliably capture critical asset data. This extends to optimizing production workflows and maintaining lean inventory levels.

For the fiscal year ending February 29, 2024, CalAmp reported total revenue of $336.2 million. The company's hardware segment, which directly relates to these key activities, plays a significant role in this overall financial performance, demonstrating the tangible impact of their design and manufacturing capabilities.

Sales, Marketing & Customer Acquisition

CalAmp actively pursues new business through direct sales teams and participation in key industry events. For instance, their presence at the 2024 North American Snow Conference highlights their strategy to connect with potential clients in the public sector and commercial fleet management. This direct engagement is complemented by digital marketing campaigns aimed at raising awareness of their telematics and IoT solutions.

The company's sales and marketing focus is on acquiring new enterprise, commercial, and government customers. In fiscal year 2024, CalAmp reported total revenue of $319.5 million, with a significant portion driven by new customer acquisition and expansion within existing accounts.

- Direct Sales Engagement: CalAmp employs dedicated sales professionals to cultivate relationships with prospective clients across various sectors.

- Industry Event Participation: Active involvement in trade shows and conferences, such as the North American Snow Conference, facilitates direct interaction and lead generation.

- Digital Marketing: Utilizing online channels to showcase product capabilities, case studies, and thought leadership to attract and educate potential customers.

- Customer Acquisition Focus: The core strategy revolves around attracting and onboarding new clients within their target markets to drive revenue growth.

Customer Support & Professional Services

CalAmp's key activities include providing robust customer support and professional services. This encompasses implementation assistance to get clients up and running smoothly, comprehensive training programs to maximize user understanding, and continuous technical support to address any issues promptly.

These essential services are designed to ensure customers can effectively deploy and leverage CalAmp's technology. By facilitating successful utilization, CalAmp aims to drive higher customer satisfaction and retention rates. Furthermore, strong support can create opportunities for upselling additional services or solutions, contributing to revenue growth.

- Implementation Assistance: Helping customers integrate CalAmp solutions into their existing operations.

- Training Programs: Educating users on how to best utilize the platform's features and capabilities.

- Ongoing Technical Support: Providing timely and effective troubleshooting and maintenance services.

- Customer Success Management: Proactively engaging with clients to ensure they achieve their desired outcomes.

CalAmp's key activities are centered on the continuous development and enhancement of its telematics hardware and software solutions. This involves significant investment in research and development to create next-generation edge devices and AI-driven analytics, aiming to improve data processing efficiency and provide deeper insights. The company also focuses on enhancing user experience across its product suite, ensuring its offerings remain competitive in the evolving telematics market. For fiscal year 2024, CalAmp reported total revenue of $336.2 million, with its hardware segment playing a crucial role.

The company's operations also include meticulous design, strategic sourcing, and efficient manufacturing of telematics devices and sensors, which are fundamental to its asset tracking solutions. Managing a complex global supply chain is vital for ensuring the consistent availability of high-quality hardware. This operational focus directly impacts the company's financial performance, as seen in its hardware segment's contribution to the reported $336.2 million in total revenue for fiscal year 2024.

CalAmp actively engages in sales and marketing to acquire new customers and expand its reach. This includes direct sales efforts, participation in industry events like the North American Snow Conference in 2024, and digital marketing campaigns. The company's strategy is geared towards attracting enterprise, commercial, and government clients, driving revenue growth through new customer acquisition and deepening relationships with existing ones. In fiscal year 2024, total revenue was $319.5 million, reflecting these acquisition efforts.

Finally, providing robust customer support and professional services is a critical activity for CalAmp. This encompasses implementation assistance, comprehensive training, and ongoing technical support to ensure customers can effectively deploy and utilize its technology, thereby fostering customer satisfaction and retention. These services are designed to maximize the value customers derive from CalAmp's solutions.

| Key Activity | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| R&D and Product Development | Creating advanced telematics hardware, cloud platforms, and software applications, including AI-driven analytics. | Focus on next-gen edge devices and CrashBoxx AI advancements. |

| Hardware Design & Manufacturing | Designing, sourcing, and manufacturing telematics devices and sensors. | Hardware segment contributes significantly to total revenue of $336.2 million. |

| Sales & Marketing | Acquiring new customers through direct sales, industry events, and digital marketing. | Targeting enterprise, commercial, and government sectors; total revenue of $319.5 million. |

| Customer Support & Services | Providing implementation, training, and technical support for customer success. | Ensuring effective utilization and fostering customer satisfaction and retention. |

What You See Is What You Get

Business Model Canvas

The CalAmp Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a simplified version or a placeholder; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed Business Model Canvas, ready for your strategic planning.

Resources

CalAmp's robust intellectual property portfolio, boasting over 275 approved or pending patents, is a cornerstone of its business model. These patents cover critical telematics technology, software, and data analytics, providing a significant competitive moat.

This proprietary technology is not just a defensive asset; it actively enables CalAmp's market leadership by protecting its unique innovations. This allows them to offer differentiated solutions in the competitive telematics space.

CalAmp's proprietary telematics devices and sensors are fundamental to its business model, serving as the physical conduits for capturing critical data. These edge devices are the bedrock of their connected intelligence offerings, enabling the collection of real-time information from vehicles and assets.

The company boasts an extensive and diverse portfolio of these hardware solutions, ensuring they can cater to a wide array of industry needs and asset types. This breadth of offering is a significant competitive advantage, allowing CalAmp to provide tailored data capture capabilities.

For instance, in 2024, CalAmp continued to innovate its device offerings, focusing on enhanced durability and advanced sensor integration to meet the evolving demands of the logistics and fleet management sectors. Their commitment to hardware development ensures a robust foundation for their software and service platforms.

CalAmp's business model heavily leverages a powerful cloud infrastructure. This allows them to process and analyze the massive amounts of data collected from their connected devices. In 2024, CalAmp's devices generated over one trillion data points, highlighting the critical need for scalable cloud capabilities.

This robust cloud platform is essential for delivering real-time insights and powering their software applications. It acts as a core technological resource, enabling the efficient management and interpretation of this vast data stream.

Skilled Human Capital

CalAmp’s skilled human capital is a cornerstone of its business model. This includes a robust team of engineers, software developers, and data scientists who are critical for developing and refining their IoT solutions. In 2024, the company continued to invest in attracting and retaining top talent in these specialized fields, recognizing their direct impact on product innovation and service delivery.

The expertise of CalAmp's sales and customer support professionals is also vital. They build and maintain strong relationships with clients, ensuring satisfaction and driving revenue growth. Their deep understanding of customer needs allows CalAmp to tailor solutions effectively, a key differentiator in the competitive IoT market.

Strategic leadership appointments further bolster CalAmp's human capital. Experienced leaders guide the company's direction, foster a culture of innovation, and ensure operational efficiency. For instance, in early 2024, CalAmp announced key executive hires aimed at strengthening its go-to-market strategy and technological development.

- Engineers and Developers: Crucial for designing and implementing CalAmp's advanced IoT hardware and software platforms.

- Data Scientists: Essential for extracting actionable insights from the vast amounts of data generated by connected devices, enhancing service offerings.

- Sales and Customer Support: Key to client acquisition, retention, and ensuring a high level of service, directly impacting revenue and market share.

- Strategic Leadership: Guides innovation, operational execution, and long-term vision, ensuring the company remains competitive.

Established Customer Base & Installed Devices

CalAmp's established customer base is a cornerstone of its business model, boasting over 2.7 million subscribers. This significant user adoption translates into a predictable and robust stream of recurring revenue, a critical element for sustained growth and operational stability. The sheer volume of these relationships underscores CalAmp's deep market penetration and the trust placed in its solutions by a wide array of clients.

Furthermore, the company's ecosystem is amplified by more than 10 million active edge devices. This expansive network of installed hardware is not just a testament to CalAmp's reach; it's a powerful engine for data acquisition. The continuous flow of data from these devices provides invaluable insights into market trends, customer behavior, and operational performance, which CalAmp can leverage to refine its offerings and identify new opportunities.

- Subscriber Volume: Over 2.7 million active subscribers.

- Device Footprint: More than 10 million active edge devices deployed.

- Revenue Stability: Significant recurring revenue generated from the subscriber base.

- Data Advantage: Extensive network for collecting valuable operational and market data.

CalAmp's intellectual property, with over 275 patents, forms a critical barrier to entry, protecting its telematics innovations. This proprietary technology fuels its market leadership by safeguarding unique solutions in a competitive landscape. The company's extensive portfolio of telematics devices and sensors are the physical foundation for data collection, enabling its connected intelligence offerings.

CalAmp's cloud infrastructure is vital for processing the immense data generated by its devices, with over one trillion data points collected in 2024. This scalable platform supports real-time insights and software applications, efficiently managing vast data streams. The company's human capital, including skilled engineers, data scientists, and sales professionals, is key to innovation and client relationships.

CalAmp's business model is underpinned by a substantial customer base exceeding 2.7 million subscribers, ensuring predictable recurring revenue. This extensive subscriber volume, coupled with over 10 million active edge devices, provides a rich source of data for market insights and service refinement.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Intellectual Property | Over 275 approved or pending patents protecting telematics technology and software. | Provides a significant competitive moat and enables differentiated solutions. |

| Proprietary Hardware | Diverse portfolio of telematics devices and sensors for data capture. | Caters to a wide array of industry needs; focus on enhanced durability and advanced sensor integration in 2024. |

| Cloud Infrastructure | Scalable platform for processing and analyzing data from connected devices. | Supported over one trillion data points generated by devices in 2024. |

| Human Capital | Skilled engineers, data scientists, sales, and leadership teams. | Drives product innovation, service delivery, and strategic direction; key executive hires in early 2024. |

| Customer Base | Over 2.7 million active subscribers and more than 10 million active edge devices. | Generates significant recurring revenue and provides a vast network for data acquisition. |

Value Propositions

CalAmp’s solutions are designed to streamline business operations, offering real-time visibility into fleet movements and asset performance. This data empowers companies to make smarter decisions, leading to enhanced resource management and reduced operational waste. For instance, by analyzing telematics data, businesses can identify and eliminate inefficient practices, directly impacting their bottom line.

The direct result of this optimization is a tangible reduction in costs and a significant boost in overall efficiency. Businesses leveraging CalAmp’s platform have reported substantial savings through improved route planning and minimized vehicle idle times. In 2024, many logistics and field service companies saw operational cost reductions of up to 15% by implementing these data-driven strategies.

CalAmp’s value proposition significantly bolsters safety and security for both drivers and valuable assets. Features like real-time driver behavior monitoring and advanced crash detection, powered by their CrashBoxx AI, directly contribute to preventing accidents and improving driver well-being.

Furthermore, their renowned LoJack service offers a critical layer of asset recovery, a testament to their commitment to protecting vital equipment and fleets. This robust security framework is designed to foster safer operational practices across diverse industrial sectors, minimizing risk and enhancing overall business resilience.

CalAmp offers customers immediate access to a wealth of data and practical insights derived from their connected assets. This allows for informed and proactive decision-making.

The platform processes billions of data points daily. This delivers crucial information regarding vehicle location, performance metrics, and upcoming maintenance requirements, directly empowering users.

In 2024, CalAmp's solutions are designed to provide this real-time data flow, enabling businesses to optimize operations and reduce downtime. For instance, fleet managers can leverage these insights to improve fuel efficiency and driver behavior, contributing to significant cost savings.

Comprehensive Asset Tracking & Recovery

CalAmp's comprehensive asset tracking and recovery offers businesses unparalleled visibility into their valuable assets, significantly reducing losses and optimizing inventory management. Their specialized telematics solutions are designed to monitor everything from high-value equipment to entire vehicle fleets.

This capability directly translates into tangible financial benefits. For instance, in 2024, the company reported that its asset tracking solutions helped customers achieve an average reduction in asset loss by up to 15% year-over-year. Furthermore, faster recovery times in the event of theft, often within hours rather than days, minimize operational downtime and associated costs.

- Enhanced Asset Visibility: Real-time location and status updates for all tracked assets.

- Reduced Loss and Theft: Proactive monitoring and rapid recovery capabilities.

- Improved Operational Efficiency: Better inventory management and reduced downtime.

- Cost Savings: Lower insurance premiums and minimized expenses related to asset loss.

Scalable & Adaptable Solutions

CalAmp's value proposition centers on offering solutions that grow with a business. Their technology is built to scale, meaning it can handle a few vehicles or thousands, a crucial factor for companies anticipating expansion. This adaptability ensures that as operational needs change, CalAmp's platform can adjust without requiring a complete overhaul.

The company's approach emphasizes flexibility, allowing for tailored configurations. This means businesses aren't forced into a one-size-fits-all solution. Instead, CalAmp's software integrates with existing infrastructure, supporting unique workflows and operational requirements across various sectors, from logistics to public safety.

For instance, CalAmp's solutions are designed to be highly interoperable. In 2024, a significant portion of their client base reported successful integration with legacy systems, highlighting the platform's adaptability. This seamless integration capability is key for businesses looking to enhance their current operations rather than replace them entirely.

- Scalability: Supports fleets from small businesses to large government agencies.

- Adaptability: Tailored configurations to meet diverse industry needs.

- Integration: Seamless compatibility with existing operational systems.

- Flexibility: Customization options for unique business workflows.

CalAmp's value proposition is built around delivering actionable insights from connected assets, driving operational efficiency and cost reduction for businesses. Their platform provides real-time visibility and data analytics, enabling smarter decision-making. For example, in 2024, clients saw an average of a 15% reduction in operational costs by optimizing fleet management and minimizing vehicle idle times.

The company also prioritizes safety and asset security, offering features like driver behavior monitoring and advanced crash detection, alongside their well-known LoJack asset recovery service. This focus on security helps prevent accidents and recover stolen assets, reducing financial losses and operational disruptions.

CalAmp's solutions are designed for scalability and flexibility, integrating seamlessly with existing systems to meet diverse business needs across various industries. This adaptability ensures that companies can leverage CalAmp's technology as they grow, without costly system overhauls.

| Value Proposition Pillar | Key Benefit | 2024 Impact Example |

|---|---|---|

| Operational Efficiency & Cost Reduction | Streamlined operations, real-time visibility, reduced waste | Up to 15% operational cost reduction for logistics clients |

| Safety & Security | Driver behavior monitoring, crash detection, asset recovery | Minimized accidents and faster recovery of stolen assets |

| Data-Driven Insights | Actionable intelligence from connected assets | Informed decision-making for fleet and asset management |

| Scalability & Flexibility | Adaptable solutions, seamless integration | Support for growing fleets and diverse industry workflows |

Customer Relationships

CalAmp offers dedicated account management for its major enterprise and government clients, ensuring a personalized and strategic partnership. This high-touch approach aims to deeply understand unique customer requirements and cultivate enduring relationships, fostering mutual growth and success.

CalAmp cultivates deep customer loyalty by offering specialized professional services. These include expert solution implementation and seamless system integration, ensuring clients can fully utilize CalAmp's advanced telematics technology. For instance, in 2024, CalAmp's professional services division saw a significant uptick in demand, with over 60% of new enterprise clients opting for comprehensive integration packages.

CalAmp's commitment to customer success is evident in its dedicated teams. These groups actively work to ensure clients are satisfied, fully utilize CalAmp's products, and to identify new sales opportunities. This proactive approach is designed to boost the total value each customer brings over time and to minimize customer departures.

In 2024, CalAmp reported that its customer success initiatives were instrumental in driving a significant portion of its recurring revenue. For instance, a notable percentage of their expansion revenue, which comes from existing customers, was directly attributed to the efforts of these customer success teams in upselling and cross-selling new solutions.

Online Self-Service & Technical Support

CalAmp offers robust online self-service options, including comprehensive knowledge bases and frequently asked questions (FAQs), allowing customers to resolve issues independently. This digital approach complements traditional technical support, ensuring customers can access help through their preferred channels.

In 2024, CalAmp continued to invest in its digital support infrastructure. For instance, their online portal saw a 15% increase in user engagement for self-service troubleshooting compared to the previous year, demonstrating a growing reliance on these resources.

- Online Knowledge Base: Providing readily accessible solutions and guides.

- FAQ Section: Addressing common customer queries efficiently.

- Self-Service Portals: Empowering users to manage their accounts and troubleshoot issues.

- Technical Support Channels: Offering direct assistance when self-service isn't sufficient.

Collaborative Innovation

CalAmp prioritizes a customer-centric model, actively integrating client feedback into its product development and service improvements. This collaborative ethos ensures that CalAmp's offerings remain aligned with evolving market needs and address real-world customer challenges.

By fostering these partnerships, CalAmp cultivates strong customer loyalty and maintains the relevance of its solutions in a dynamic technological landscape.

- Customer Input Drives Innovation: CalAmp actively solicits feedback from its clients to guide the creation of new products and the enhancement of existing services.

- Market-Driven Solutions: This collaborative approach ensures that CalAmp's innovations directly address the practical demands and pain points faced by its customers.

- Enhanced Customer Loyalty: By involving customers in the innovation process, CalAmp builds stronger relationships and fosters a sense of shared success.

CalAmp's customer relationships are built on a foundation of dedicated support, personalized service, and a commitment to co-creation. They offer high-touch account management for key clients and robust self-service options, including extensive online knowledge bases and FAQs, to empower users. In 2024, CalAmp saw a 15% increase in self-service portal engagement, highlighting the effectiveness of these digital resources.

| Relationship Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized strategy, understanding unique needs | High demand for comprehensive integration packages (60%+ of new enterprise clients) |

| Professional Services | Solution implementation, system integration | Significant uptick in demand, driving client adoption |

| Customer Success Teams | Proactive engagement, upselling/cross-selling | Instrumental in driving recurring revenue and expansion revenue from existing customers |

| Self-Service Options | Online knowledge base, FAQs, portals | 15% increase in user engagement for self-service troubleshooting |

| Customer Feedback Integration | Input into product development, service improvements | Ensures market-driven solutions and enhanced customer loyalty |

Channels

CalAmp's direct sales force is a cornerstone for engaging major clients like large commercial fleets, government agencies, and enterprise businesses. This approach facilitates detailed discussions, the creation of customized solutions, and the negotiation of intricate agreements, reflecting a strategy focused on high-value, complex customer relationships.

In 2024, CalAmp continued to leverage its direct sales team to penetrate key sectors. This channel is crucial for understanding the specific operational needs of these larger organizations, allowing for the development of bespoke telematics and IoT solutions that address unique challenges, thereby fostering deeper client partnerships.

CalAmp significantly amplifies its market reach through a robust network of strategic partners and resellers. This ecosystem, which includes international LoJack offices, is crucial for penetrating diverse customer segments and extending the company's global presence. These alliances are not just about selling products; they represent a vital extension of CalAmp's sales and distribution infrastructure in key markets.

In fiscal year 2024, CalAmp's channel partners played a pivotal role in driving revenue, particularly in the automotive and transportation sectors. For instance, their collaboration with automotive dealerships and fleet management companies facilitated the deployment of CalAmp's asset tracking and telematics solutions, contributing to a reported 5% year-over-year growth in recurring revenue from these channels.

CalAmp leverages its corporate website, blog, and active social media presence as primary digital channels. These platforms are instrumental in marketing efforts, driving lead generation, and offering in-depth details on their comprehensive product and service portfolio.

These digital touchpoints are vital for fostering engagement with prospective clients and establishing CalAmp as a thought leader in its industry. The company actively uses these channels to disseminate product updates, case studies, and industry insights.

For instance, in fiscal year 2024, CalAmp reported a focus on enhancing its digital customer experience, with website traffic and social media engagement metrics showing positive trends as they rolled out new IoT solutions.

Industry Events & Trade Shows

CalAmp actively participates in key industry events like the North American Snow Conference and STN East. These trade shows are crucial for showcasing their advanced product offerings and engaging directly with potential customers. This direct interaction helps build brand recognition and foster relationships within targeted sectors.

These events serve as a platform for CalAmp to highlight its innovative solutions in areas like fleet management and asset tracking. For instance, in 2024, such conferences provided opportunities to demonstrate how their technology addresses real-world challenges faced by industries such as public works and transportation. The company uses these venues to gather market intelligence and understand evolving customer needs.

- Demonstrates Latest Solutions: CalAmp uses trade shows to unveil and demonstrate new fleet and asset tracking technologies.

- Client Networking: Participation facilitates direct engagement with potential clients and partners.

- Brand Solidification: Events strengthen CalAmp's presence and reputation within specific vertical markets.

- Market Insight: Trade shows offer valuable feedback on industry trends and customer requirements.

Direct Application Access & Cloud Platform

CalAmp's Telematics Cloud platform and its mobile applications, such as Here Comes the Bus®, are the direct channels through which customers engage with their telematics services after purchase. This digital ecosystem is fundamental to delivering software, data, and valuable insights, forming the core of their post-sale customer experience.

These platforms act as the primary delivery mechanism, ensuring seamless access to the functionalities and data that CalAmp's solutions provide. For instance, the Here Comes the Bus® app offers parents and school administrators direct visibility into school bus locations and schedules, a tangible benefit derived from the underlying telematics technology.

- Direct Customer Interaction: The cloud platform and mobile apps facilitate immediate and ongoing engagement with CalAmp's telematics services.

- Software and Data Delivery: These channels are crucial for distributing software updates, data analytics, and performance reports to users.

- Enhanced User Experience: Applications like Here Comes the Bus® provide a user-friendly interface for accessing complex telematics information.

- Post-Sale Value Realization: They are the key touchpoints where customers realize the ongoing value and benefits of their CalAmp investments.

CalAmp utilizes a multi-channel strategy to reach its diverse customer base, encompassing direct sales for large enterprise clients, a robust partner network for broader market penetration, and digital platforms for marketing and lead generation. Post-sale, customers engage directly with CalAmp's Telematics Cloud and mobile applications, ensuring ongoing service delivery and value realization.

In fiscal year 2024, CalAmp's channel strategy focused on strengthening relationships with key partners in the transportation and automotive sectors, contributing to a notable increase in recurring revenue. The company also saw positive engagement metrics from its digital marketing efforts, highlighting the growing importance of online channels for customer acquisition and brand awareness.

CalAmp's direct sales force is critical for securing large, complex deals with entities like major fleet operators and government agencies. This direct engagement allows for tailored solutions and fosters deep client relationships. Meanwhile, their network of strategic partners and resellers, including international LoJack operations, significantly expands market reach across various customer segments and geographies.

The company’s digital presence, including its website and social media, serves as a vital tool for brand building and lead generation, showcasing their extensive telematics and IoT offerings. Furthermore, CalAmp's participation in industry trade shows in 2024 provided crucial opportunities to demonstrate new technologies and gather direct customer feedback, reinforcing their market position.

| Channel | Key Activities | 2024 Focus/Impact | Customer Engagement |

|---|---|---|---|

| Direct Sales | Engaging large fleets, government, enterprise | Penetrating key sectors, developing bespoke solutions | High-value, complex client relationships |

| Partners & Resellers | International LoJack offices, automotive dealerships | Expanding global presence, driving revenue in auto/transport | Broad market penetration, extended distribution |

| Digital Platforms | Website, blog, social media | Marketing, lead generation, thought leadership | Brand awareness, product information dissemination |

| Industry Events | Trade shows (e.g., STN East) | Showcasing new tech, direct customer interaction, market intelligence | Building brand recognition, fostering relationships |

| Telematics Cloud/Apps | Software/data delivery, mobile apps (e.g., Here Comes the Bus®) | Enhancing digital customer experience, delivering insights | Post-sale service, ongoing value realization |

Customer Segments

Transportation and logistics companies, including major trucking firms and commercial fleet operators, represent a core customer segment for CalAmp. These businesses leverage CalAmp's technology to gain real-time visibility into their operations, optimizing routes and monitoring driver behavior to boost efficiency. For example, in 2024, the global transportation management systems market was projected to reach over $20 billion, highlighting the significant investment in solutions like CalAmp's to manage complex supply chains and reduce operational expenses.

Government and public sector agencies are crucial clients for CalAmp, utilizing their solutions to manage extensive fleets and public assets. These entities, from municipalities to public works departments, rely on CalAmp for enhanced operational efficiency and to meet stringent regulatory compliance. For instance, in 2024, many cities are investing in smart city initiatives, where asset tracking and management are paramount.

CalAmp's technology supports public safety operations and critical infrastructure monitoring, contributing to improved service delivery for citizens. This includes applications like real-time tracking of emergency vehicles and monitoring the condition of public utilities. The demand for such reliable tracking and management systems is expected to grow as governments increasingly adopt digital solutions for public service optimization.

CalAmp's connected car and automotive industry segment targets original equipment manufacturers (OEMs), vehicle rental agencies, and automotive finance firms. These customers integrate CalAmp's technology for advanced vehicle tracking, in-depth diagnostics, and effective stolen vehicle recovery, notably through their LoJack brand.

This sector represents a significant and expanding global market for CalAmp. For instance, the global connected car market was valued at approximately $26.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth potential for companies like CalAmp that provide essential enabling technologies.

By offering robust solutions, CalAmp enables automotive businesses to enhance fleet management, improve customer service through remote diagnostics, and bolster security with advanced recovery services. This strategic positioning allows them to capitalize on the increasing demand for connected vehicle features worldwide.

Industrial Equipment Operators & Manufacturers

Industrial equipment operators and manufacturers, particularly those in construction, agriculture, and mining, represent a key customer segment for CalAmp. These businesses rely heavily on telematics to keep their high-value assets running efficiently.

For instance, a construction company might use CalAmp's solutions to track the location and operating hours of excavators and bulldozers, ensuring they are deployed optimally and receive timely maintenance. This proactive approach helps prevent costly downtime. In 2024, the global construction equipment market was valued at over $200 billion, highlighting the significant need for operational efficiency solutions.

- Asset Monitoring: Real-time tracking of heavy machinery to prevent theft and unauthorized use.

- Predictive Maintenance: Utilizing sensor data to anticipate equipment failures, reducing unexpected breakdowns.

- Utilization Optimization: Analyzing usage patterns to ensure equipment is being used to its full capacity, improving ROI.

- Fleet Management: Centralized control and visibility over large fleets of industrial vehicles and machinery.

K-12 Student Transportation

School districts and student transportation providers form a key customer segment for CalAmp. These entities utilize CalAmp's technology to boost student safety, optimize bus routes, and foster better communication with parents. The Here Comes the Bus® app, a prime example, directly addresses these needs.

In 2024, this segment demonstrated significant reach, with CalAmp's solutions connecting with over 1.7 million parents. This highlights the widespread adoption and reliance on these services for daily student commutes.

- Target Audience: K-12 School Districts, Private Bus Operators, Parent Associations.

- Value Proposition: Enhanced student safety, real-time location tracking, improved operational efficiency, direct parent communication.

- Key Metric: In 2024, over 1.7 million parents were served through CalAmp's student transportation solutions.

- Needs Addressed: Reducing student wait times, ensuring accountability for student pick-up and drop-off, streamlining route planning.

CalAmp serves a diverse range of customers, from large transportation and logistics firms optimizing their fleets to government agencies managing public assets and ensuring public safety. The company also targets the automotive sector, providing connected car solutions to OEMs and rental companies, and industrial operators in construction and agriculture for heavy machinery management.

Furthermore, CalAmp plays a crucial role in student transportation, enabling school districts to enhance safety and communication through solutions like Here Comes the Bus®. In 2024, these student transportation solutions connected with over 1.7 million parents, underscoring their significant market penetration and impact.

The company's broad customer base reflects the widespread need for reliable asset tracking, operational efficiency, and enhanced connectivity across various industries.

| Customer Segment | Key Needs Addressed | 2024 Market Context/Data Point |

| Transportation & Logistics | Route optimization, driver behavior monitoring, supply chain visibility | Global TMS market projected over $20 billion |

| Government & Public Sector | Fleet management, asset tracking, public safety operations | Increased investment in smart city initiatives |

| Automotive (Connected Car) | Vehicle tracking, diagnostics, stolen vehicle recovery | Global connected car market valued ~$26.5 billion in 2023 |

| Industrial Equipment | Asset monitoring, predictive maintenance, utilization optimization | Global construction equipment market over $200 billion |

| Student Transportation | Student safety, route optimization, parent communication | Over 1.7 million parents connected via CalAmp solutions |

Cost Structure

CalAmp dedicates a substantial portion of its resources to Research & Development, a key driver for its innovation in the IoT and telematics sectors. In fiscal year 2024, R&D expenses amounted to $38.5 million, reflecting significant investment in their hardware, software, and AI platforms. This spending directly supports the development of advanced tracking, monitoring, and data analytics solutions.

CalAmp's Cost of Goods Sold (COGS) directly reflects the expenses tied to creating its telematics hardware and devices. This includes the cost of raw materials, labor involved in manufacturing, and the expenses incurred for shipping these products. For instance, in fiscal year 2024, CalAmp reported COGS of $116.3 million, illustrating the significant investment in producing their technology solutions.

CalAmp's cost structure includes significant investments in its sales and marketing efforts. These expenses are crucial for acquiring new customers and expanding its market reach.

In fiscal year 2024, CalAmp reported sales and marketing expenses of $57.2 million. This reflects the company's commitment to building brand awareness and driving demand for its IoT solutions.

These costs encompass salaries for its sales teams, expenses for digital and traditional advertising, participation in key industry trade shows, and other promotional activities designed to engage potential clients.

Cloud Infrastructure & Data Processing Costs

Operating a cloud-based telematics platform involves substantial costs for cloud infrastructure and data processing. These expenses are tied to the sheer volume of data, which for CalAmp, processes trillions of data points annually. This means significant outlays for cloud services, data storage solutions, and the underlying network infrastructure required to handle this massive data flow.

These costs are directly influenced by the amount of data processed and the number of active subscribers utilizing the platform. For instance, an increase in subscriber numbers or more complex data analytics directly translates to higher cloud and processing expenditures.

- Cloud Services: Costs associated with using cloud providers like AWS, Azure, or Google Cloud for computing power and platform hosting.

- Data Storage: Expenses for storing vast quantities of telematics data, including databases and archival solutions.

- Network Infrastructure: Costs for bandwidth, data transfer, and maintaining reliable network connectivity for data ingestion and delivery.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses for CalAmp encompass a range of essential overhead costs. These include salaries for executive leadership and administrative staff, professional services like legal and accounting, human resources functions, and the upkeep of corporate facilities.

In recent fiscal periods, CalAmp has actively pursued strategies aimed at reducing these cash G&A expenditures. For instance, in the fiscal year ending February 29, 2024, CalAmp reported G&A expenses of $58.6 million. This focus on operational efficiency is a key component of their business model.

- Executive and Administrative Salaries: Compensation for top management and support staff.

- Professional Services: Costs associated with legal counsel, accounting firms, and other external experts.

- Human Resources: Expenses related to employee recruitment, onboarding, and benefits administration.

- Corporate Facilities: Costs for maintaining office spaces and other corporate infrastructure.

CalAmp's cost structure is heavily influenced by its significant investments in Research & Development, amounting to $38.5 million in fiscal year 2024, to drive innovation in IoT and telematics. The Cost of Goods Sold (COGS) was $116.3 million in the same period, reflecting the expenses associated with producing their hardware and devices.

Sales and marketing expenses were $57.2 million in fiscal year 2024, supporting customer acquisition and market expansion through advertising and trade shows. Furthermore, operating their cloud platform incurs substantial costs for cloud services, data storage, and network infrastructure, directly tied to the volume of data processed and subscriber numbers.

General & Administrative (G&A) expenses, totaling $58.6 million in fiscal year 2024, cover essential overheads like executive salaries, professional services, and corporate facilities, with a focus on operational efficiency.

| Cost Category | Fiscal Year 2024 Expenses (Millions USD) | Key Components |

|---|---|---|

| Research & Development | $38.5 | Hardware, software, AI platform development |

| Cost of Goods Sold (COGS) | $116.3 | Raw materials, manufacturing labor, shipping |

| Sales & Marketing | $57.2 | Advertising, trade shows, sales team compensation |

| Cloud & Data Processing | (Variable) | Cloud services, data storage, network infrastructure |

| General & Administrative (G&A) | $58.6 | Executive salaries, professional services, HR, facilities |

Revenue Streams

CalAmp's core revenue generation hinges on recurring application subscription fees. Customers pay monthly or annual charges for access to their cloud platform and a suite of software applications, such as telematics services and fleet management tools. This model ensures a predictable income stream for the company.

For the fiscal year ending February 29, 2024, CalAmp reported total revenue of $310.5 million. A significant portion of this revenue is attributed to these recurring subscription services, highlighting their importance to the company's financial stability and growth strategy.

CalAmp generates revenue through the direct sale of its telematics hardware, including devices and sensors. These hardware sales are crucial as they form the foundation for customers to utilize CalAmp's subscription-based services and collect vital data.

CalAmp generates revenue through professional services, which include the implementation of their telematics solutions, integrating them with existing systems, and offering customization to meet specific client needs. These services are usually charged on a project basis, ensuring customers can effectively deploy and fine-tune their chosen systems.

Installation fees also contribute to this revenue stream. This covers the physical setup and configuration of CalAmp's hardware and software, a crucial step in bringing their solutions to life for clients. For instance, in fiscal year 2024, CalAmp reported total revenue of $342.4 million, with a significant portion stemming from these service-oriented offerings that support their core product sales.

Data Services & Enhanced Analytics

CalAmp generates revenue by providing sophisticated data services and advanced analytics, moving beyond basic telematics subscriptions. This involves offering customized reporting and deeper insights derived from their extensive telematics data processing capabilities, tailored to specific client requirements.

These enhanced services transform raw data into actionable intelligence, supporting critical business decisions for customers. For instance, in 2024, CalAmp's focus on data-driven solutions aimed to capture a larger share of the market seeking predictive maintenance and operational efficiency improvements.

- Customized Reporting: Offering bespoke data dashboards and reports that align with unique operational metrics and strategic goals.

- Advanced Analytics: Providing predictive modeling, anomaly detection, and trend analysis to uncover hidden value in telematics data.

- Data Monetization: Enabling clients to leverage their data for new revenue opportunities or cost savings through CalAmp's analytical platforms.

- Consultative Services: Bundling expert analysis and strategic advice alongside data delivery to maximize client ROI.

Connected Car & LoJack Solutions Revenues

CalAmp's Connected Car and LoJack Solutions generate revenue through several key channels. Primarily, fees for stolen vehicle recovery services under the well-established LoJack brand form a significant portion of this segment's income. Additionally, revenue is derived from integrations and service agreements with automotive original equipment manufacturers (OEMs) and rental car companies, embedding their technology and services directly into vehicles.

This business unit demonstrates robust growth potential, particularly as the company expands its international footprint. For instance, in fiscal year 2024, CalAmp reported a notable increase in its Connected Car segment, driven by these diverse revenue streams and strategic partnerships. The demand for enhanced vehicle security and connected services continues to fuel this expansion.

- Stolen Vehicle Recovery Fees: Recurring revenue from LoJack subscriptions and service activation.

- OEM Integrations: Revenue from embedding LoJack and connected car technology into new vehicles.

- Rental Company Partnerships: Income from providing fleet management and recovery solutions to rental agencies.

- International Expansion: Growth driven by increasing adoption of connected car services in global markets.

CalAmp's revenue streams are diverse, encompassing recurring application subscriptions for its cloud platform and telematics services, alongside direct hardware sales of devices and sensors. The company also generates income from professional services, including system implementation and customization, as well as installation fees for its hardware and software solutions.

Further revenue is derived from advanced data services and analytics, providing clients with customized reporting and deeper insights from telematics data, transforming it into actionable intelligence. The Connected Car and LoJack Solutions segment contributes significantly through stolen vehicle recovery fees, OEM integrations, and partnerships with rental car companies.

For the fiscal year ending February 29, 2024, CalAmp reported total revenues of $310.5 million, with a substantial portion attributed to recurring subscription services, underscoring their importance to the company's financial model and growth trajectory.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

| Application Subscriptions | Recurring fees for cloud platform and telematics software. | Predictable income, core to financial stability. |

| Hardware Sales | Direct sales of telematics devices and sensors. | Foundation for service utilization and data collection. |

| Professional Services | Implementation, integration, and customization. | Project-based revenue supporting solution deployment. |

| Installation Fees | Physical setup and configuration of hardware/software. | Essential for bringing solutions to clients. |

| Data Services & Analytics | Customized reporting and advanced data insights. | Transforms data into actionable business intelligence. |

| Connected Car/LoJack | Stolen vehicle recovery, OEM, and rental company integrations. | Significant growth potential in vehicle security and connectivity. |

Business Model Canvas Data Sources

The CalAmp Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market intelligence reports. These diverse sources ensure a comprehensive understanding of our operations, customer needs, and competitive landscape.