CalAmp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CalAmp Bundle

Uncover CalAmp's strategic product positioning with our insightful BCG Matrix preview. See where their innovations fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for their market share and growth potential.

Ready to transform this understanding into actionable strategy? Purchase the full CalAmp BCG Matrix report for a comprehensive breakdown, including data-driven recommendations and a clear roadmap for optimizing your investments and product portfolio.

Stars

CalAmp's Connected Car Solutions, spearheaded by its LoJack International segment, are firmly positioned as a Star in the BCG matrix. This is underscored by the recent opening of a new LoJack France office in 2025, signaling aggressive expansion.

The broader connected car market is booming, with projections indicating a compound annual growth rate exceeding 19% between 2025 and 2030. This robust market trajectory, coupled with CalAmp's strategic focus and investment, solidifies the Connected Car Solutions unit as a high-growth, high-market-share contender.

CalAmp's advanced AI video safety solutions, including their Vision 2.0/2.1 dash cams, are a significant growth driver, boosting Average Revenue Per User (ARPU) and attracting new bookings. These innovations are directly addressing the market's increasing need for AI-enhanced telematics to improve driver behavior and reduce operational expenses.

The incorporation of artificial intelligence into commercial telematics systems is a pivotal trend, and CalAmp is capitalizing on this by offering solutions that enhance safety and operational efficiency. This focus on AI is crucial for staying competitive in the evolving telematics landscape.

CalAmp's next-generation fleet management platform, with features like predictive maintenance and advanced route optimization, is a strong contender. These innovations are designed to cut costs and boost safety, appealing to businesses focused on efficiency. In 2024, the fleet management market saw continued growth, with companies like CalAmp investing heavily in R&D to stay ahead.

Integrated IoT and Edge Computing Solutions

CalAmp's integrated IoT and Edge Computing Solutions are positioned as a strong contender, particularly with recent advancements. The launch of new edge-enabled gateways, such as the LMU-4350LB in July 2025, highlights this. These devices offer expanded edge programmability and global LTE Cat 1 connectivity, directly addressing the burgeoning demand in the IoT and edge computing sectors.

These innovative gateways empower customers by allowing them to deploy custom applications directly on the device. This capability is crucial for implementing sophisticated strategies focused on enhancing safety and operational efficiency across various industries. This strategic move by CalAmp is designed to secure a larger share of the rapidly expanding intelligent edge market.

- Market Growth: The global edge computing market is projected to reach $80.6 billion by 2028, growing at a CAGR of 23.0% from 2021, according to MarketsandMarkets.

- Product Innovation: The LMU-4350LB's enhanced edge programmability and global LTE Cat 1 support are key differentiators.

- Customer Benefits: Enabling on-device application execution drives significant improvements in real-time data processing and decision-making for safety and efficiency.

- Strategic Positioning: CalAmp's focus on intelligent edge solutions aligns with industry trends and positions the company for substantial market capture.

Solutions for Supply Chain Visibility and Logistics Optimization

Businesses are increasingly pushing for real-time insights into their supply chains, and CalAmp's integrated IoT sensor and telematics solutions for cargo and cold chain monitoring are well-positioned for significant expansion. The market is shifting, recognizing that simple visibility isn't enough; companies providing dynamic, adaptive supply chain management will gain a competitive edge. CalAmp's solutions aim to reduce risk and boost profitability by offering this enhanced responsiveness.

The global supply chain management market was valued at approximately $25.5 billion in 2023 and is projected to reach $48.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.6%. This growth is driven by the demand for efficiency and transparency. CalAmp's focus on real-time tracking and condition monitoring directly addresses these market needs.

- IoT Integration: CalAmp leverages IoT devices for continuous data collection on asset location, temperature, humidity, and other critical parameters.

- Telematics for Logistics: Their telematics solutions provide real-time tracking and performance data for fleets, enabling better route optimization and fuel efficiency.

- Cold Chain Management: Specific offerings ensure the integrity of temperature-sensitive goods, a crucial aspect for pharmaceuticals and perishables.

- Risk Mitigation and Profitability: By offering enhanced visibility and control, CalAmp's solutions help prevent spoilage, theft, and delays, directly impacting a company's bottom line.

CalAmp's Connected Car Solutions, particularly its LoJack International segment, are positioned as Stars due to their high market share in a rapidly expanding sector. The company's aggressive expansion, evidenced by new office openings in 2025, and significant investment in AI-driven telematics for driver behavior and operational cost reduction, reinforces this status.

The broader connected car market is experiencing significant growth, projected to expand at a CAGR exceeding 19% from 2025 to 2030. CalAmp's focus on AI-powered solutions like Vision 2.0/2.1 dash cams directly addresses the market's demand for enhanced safety and efficiency, further solidifying its Star position.

CalAmp's next-generation fleet management platform, featuring predictive maintenance and advanced route optimization, is another key Star. The fleet management market continued its upward trend in 2024, with companies like CalAmp investing heavily in R&D to maintain a competitive edge.

The company's integrated IoT and Edge Computing Solutions, highlighted by the July 2025 launch of edge-enabled gateways like the LMU-4350LB, are also Stars. These devices offer enhanced programmability and global LTE Cat 1 connectivity, tapping into the burgeoning demand for intelligent edge capabilities.

CalAmp's IoT sensor and telematics solutions for cargo and cold chain monitoring are poised for substantial growth, addressing the increasing need for real-time supply chain insights. The global supply chain management market, valued at approximately $25.5 billion in 2023, is projected to reach $48.1 billion by 2030, growing at a CAGR of 9.6%.

| CalAmp Business Unit | BCG Matrix Position | Key Growth Drivers | Market Trend Alignment |

|---|---|---|---|

| Connected Car Solutions (LoJack) | Star | Market expansion, AI integration for safety, increased ARPU | Booming connected car market (CAGR >19% 2025-2030) |

| Fleet Management Solutions | Star | Predictive maintenance, route optimization, cost reduction | Continued fleet management market growth (2024) |

| IoT & Edge Computing Solutions | Star | Edge programmability, global LTE Cat 1, on-device applications | Rapid growth in edge computing market (CAGR 23.0% 2021-2028) |

| Supply Chain & Cargo Monitoring | Star | Real-time tracking, cold chain integrity, risk mitigation | Growing supply chain management market (CAGR 9.6% 2023-2030) |

What is included in the product

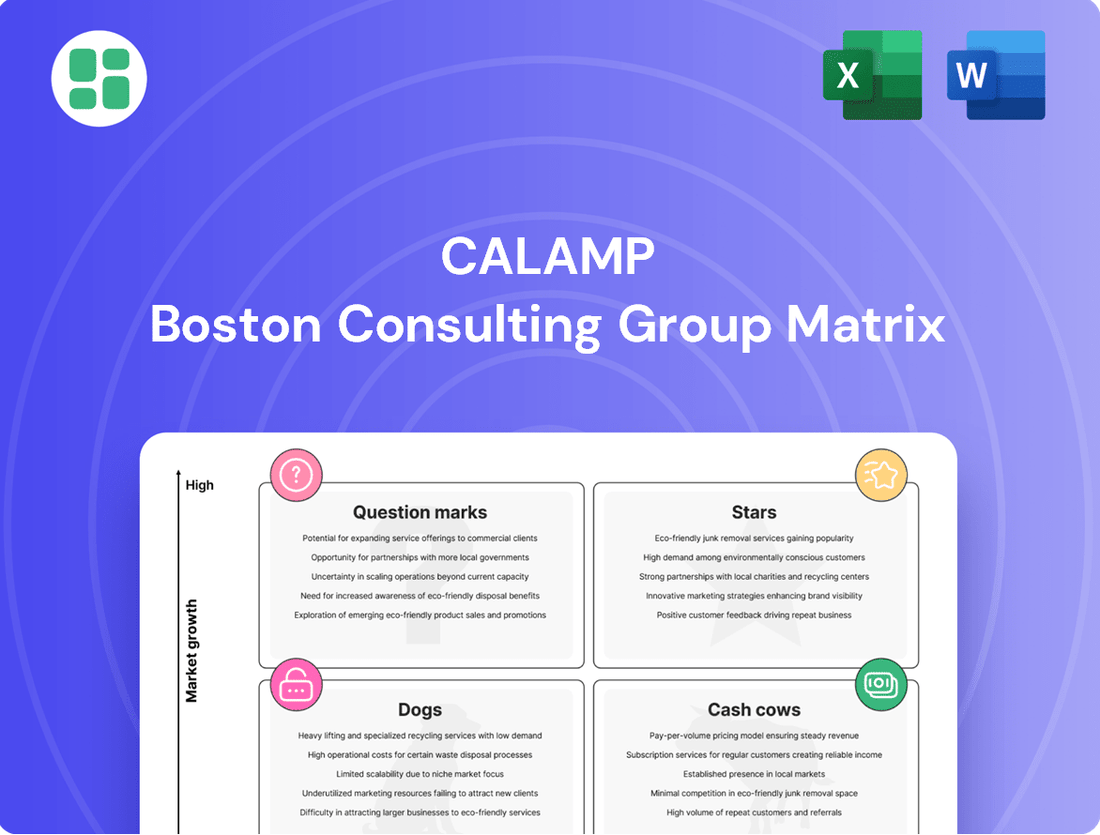

The CalAmp BCG Matrix categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment and resource allocation.

Clear visualization of CalAmp's portfolio, simplifying strategic resource allocation.

Cash Cows

The Here Comes the Bus® app stands as CalAmp's prime Cash Cow. In 2024, it served over 1.7 million parents, highlighting its dominant market share and leadership in student safety and family engagement.

This established application consistently generates recurring revenue, requiring minimal promotional investment. Its mature market position ensures a steady cash flow, effectively funding other CalAmp business units.

CalAmp's Core Telematics Cloud Platform (CTC) is a true cash cow. By 2024, it had processed an astounding one trillion data points, demonstrating its immense scale and critical function within CalAmp's ecosystem.

This robust platform generates consistent, recurring revenue through its subscription-based services, underpinning all of CalAmp's device-enabled software. Its extensive adoption points to a dominant market share in the essential telematics infrastructure space.

CalAmp's established telematics hardware for fleet tracking and monitoring is a key Cash Cow. This segment, with its extensive installed base, provides a steady and predictable revenue stream, crucial for the company's financial stability.

The market for this hardware might not be experiencing explosive growth, but CalAmp's impressive installed base of over 2.7 million subscribers across its various business units guarantees consistent demand. This sustained demand comes from replacements, upgrades, and essential maintenance, ensuring reliable cash flow generation.

These robust hardware devices are the bedrock of CalAmp's integrated telematics solutions, underpinning the value proposition for their fleet management customers. Their reliability and widespread adoption solidify their position as a mature, high-performing product line.

Basic Asset Tracking Solutions

CalAmp's basic asset tracking solutions, crucial for monitoring equipment and trailers, represent a stable revenue stream within their portfolio. This segment benefits from consistent demand as businesses prioritize theft prevention and efficient inventory management. In 2024, the market for telematics solutions, including asset tracking, continued its steady growth, with an estimated global market size of over $30 billion, underscoring the maturity and stability of this sector where CalAmp holds a significant position.

These offerings are considered Cash Cows because they operate in a well-established market where CalAmp has a strong foothold and established customer relationships. The focus for these solutions is on operational efficiency and maximizing profitability through existing infrastructure and customer loyalty, rather than aggressive expansion. This strategy ensures sustained revenue generation with relatively lower investment requirements.

- Consistent Revenue: Basic asset tracking provides a predictable and reliable income source for CalAmp.

- Mature Market: The demand for theft prevention and inventory management is stable and ongoing.

- Strong Market Presence: CalAmp leverages its established reputation and customer base in this segment.

- Efficiency Focus: Profitability is driven by maintaining efficient operations and customer retention.

Traditional Commercial Fleet Telematics Subscriptions

CalAmp's traditional commercial fleet telematics subscriptions are solid Cash Cows. These offerings, focused on essential GPS tracking and compliance, hold a significant market share due to their critical role in daily fleet management.

- Market Dominance: CalAmp maintains a high market share in the mature commercial fleet telematics sector.

- Stable Revenue: Recurring subscription fees from these essential services provide a predictable income stream.

- Profitability: A strong emphasis on customer retention and operational efficiency supports healthy profit margins.

- 2024 Data: While specific 2024 subscription revenue figures for this segment are proprietary, the telematics market continued its steady growth, with industry reports indicating an expansion driven by compliance needs and operational optimization.

CalAmp's Here Comes the Bus® app is a prime example of a Cash Cow, serving over 1.7 million parents in 2024 and demonstrating its dominant market share in student safety. Its consistent recurring revenue, requiring minimal promotional investment, effectively funds other CalAmp business units.

The Core Telematics Cloud Platform (CTC) is another significant Cash Cow, having processed one trillion data points by 2024. This robust, subscription-based platform generates consistent revenue and underpins all of CalAmp's device-enabled software, reflecting its extensive adoption and dominant market share.

CalAmp's established telematics hardware for fleet tracking and monitoring also functions as a Cash Cow. With an installed base exceeding 2.7 million subscribers across its units, this segment guarantees consistent demand for replacements and upgrades, ensuring reliable cash flow generation in a mature market.

| Product/Service | BCG Category | Key Metric (2024) | Revenue Driver | Market Position |

| Here Comes the Bus® App | Cash Cow | 1.7+ million parents served | Recurring subscription revenue | Market leader in student safety |

| Core Telematics Cloud Platform (CTC) | Cash Cow | 1 trillion+ data points processed | Subscription-based services | Dominant market share in telematics infrastructure |

| Fleet Tracking Hardware | Cash Cow | 2.7+ million subscribers | Hardware sales, upgrades, maintenance | Extensive installed base in a mature market |

Delivered as Shown

CalAmp BCG Matrix

The CalAmp BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the same comprehensive analysis, meticulously organized and ready for immediate strategic application, without any alterations or additional content.

Dogs

CalAmp's legacy Telematics Service Provider (TSP) solutions have faced headwinds, with the company noting softer demand in this segment during late 2023. This challenging environment contributed to a goodwill impairment charge, signaling potential low growth prospects and a need for strategic adjustment.

The TSP segment's performance suggests it may represent a "cash trap" within CalAmp's portfolio if not actively managed. The company has acknowledged these difficulties and is undertaking strategic shifts to navigate this market segment more effectively.

CalAmp's older telematics hardware, lacking features like edge AI, is likely in the Dogs quadrant. These products, representing a shrinking portion of revenue, face commoditization and declining demand, as evidenced by the general market trend where newer, more intelligent devices are capturing market share.

These legacy devices may also see increased support costs relative to their diminishing market value, making them less attractive investments for revitalization. For instance, in 2024, the telematics market saw a significant push towards IoT devices with embedded intelligence, further marginalizing older, less capable hardware.

Standalone basic GPS tracking products, lacking advanced software or analytics, likely fall into the 'Dog' quadrant of the BCG matrix for CalAmp. In the competitive telematics landscape, these offerings face low growth and low market share due to ease of replication by rivals.

Such basic devices struggle to command premium pricing or attract customers seeking integrated solutions, potentially leading to reduced profit margins for CalAmp. For instance, while the global telematics market is projected to reach over $150 billion by 2027, the segment for purely hardware-based, unenhanced GPS trackers is likely experiencing stagnation or decline.

Divested LoJack U.S. Business

The divestiture of CalAmp's U.S. LoJack Stolen Vehicle Recovery business in 2021 positions it as a 'Dog' within the BCG Matrix. This strategic move, completed for $40 million, allowed CalAmp to streamline operations and concentrate on its more promising global SaaS ventures. The company's decision to exit this segment underscores its approach to managing underperforming or non-core assets, aiming to bolster overall financial health and strategic focus.

CalAmp's international LoJack operations, however, are showing signs of growth, suggesting a differentiated performance between geographic segments. This contrast highlights the importance of analyzing business units individually within a diversified portfolio. The U.S. divestiture aligns with CalAmp's broader strategy to enhance its recurring revenue streams and capitalize on evolving market opportunities in connected intelligence.

- Divestiture Value: The U.S. LoJack business was sold for $40 million.

- Strategic Rationale: To focus on global SaaS initiatives and improve financial performance.

- BCG Classification: Identified as a 'Dog' due to its non-core and potentially underperforming status in the U.S. market.

- International Performance: CalAmp's international LoJack operations continue to exhibit growth.

Inefficient or High-Cost Operational Processes

Inefficient or high-cost operational processes, while not a product itself, can be viewed as a significant drag on a company's performance, much like a Dog in the BCG matrix. These are areas that consume resources without generating proportional value or revenue. CalAmp has acknowledged this by implementing various cost-saving initiatives.

For instance, the company completed a headquarters relocation in 2023, a strategic move aimed at improving operational efficiency and reducing overhead. Such actions suggest that previous operational structures were indeed contributing to higher costs, impacting overall profitability. The goal is to transform these cost centers into more streamlined and cost-effective operations.

CalAmp's focus on operational streamlining is a direct response to the challenges posed by inefficient processes. These efforts are crucial for improving margins and freeing up capital for investment in more promising areas of the business. The company's commitment to these measures highlights their recognition of operational efficiency as a key driver of financial health.

- Headquarters Relocation: CalAmp relocated its headquarters in 2023, a move designed to optimize operational costs and enhance efficiency.

- Cost-Saving Measures: The company has actively pursued various initiatives to reduce operational expenses and improve profitability.

- Efficiency Focus: These actions underscore a strategic effort to address and mitigate the impact of inefficient or high-cost operational processes.

CalAmp's older telematics hardware, particularly basic GPS trackers without advanced features like edge AI, are categorized as Dogs. These products face low market growth and low market share due to ease of replication and commoditization. For example, the global telematics market is growing, but the segment for basic, unenhanced GPS trackers is likely stagnant or declining.

The divestiture of CalAmp's U.S. LoJack Stolen Vehicle Recovery business for $40 million in 2021 also placed it in the Dog quadrant. This move allowed the company to focus on its more promising global SaaS ventures, signaling a strategic decision to shed non-core or underperforming assets to improve overall financial health and strategic focus.

Inefficient operational processes, such as those that consume resources without generating proportional value, can also be viewed as Dogs. CalAmp's 2023 headquarters relocation was a strategic move aimed at improving operational efficiency and reducing overhead, indicating that previous structures were indeed contributing to higher costs.

| Business Unit | Market Growth | Market Share | BCG Quadrant | Notes |

| Legacy TSP Hardware (Basic GPS) | Low | Low | Dog | Faces commoditization and declining demand. |

| U.S. LoJack Stolen Vehicle Recovery | Low | Low | Dog | Divested in 2021 for $40 million to focus on SaaS. |

| Inefficient Operational Processes | N/A | N/A | Dog | Areas consuming resources without proportional value; addressed by cost-saving initiatives. |

Question Marks

The LMU-4350LB and LMU-4351LB gateways, launched in July 2025, are positioned as potential Stars in CalAmp's portfolio. Their edge-enabled programmability offers significant advantages for fleet optimization and custom application development, tapping into a high-growth, albeit competitive, market.

Despite their advanced capabilities, these gateways currently hold a nascent market share. CalAmp's strategy must involve substantial investment in marketing and sales to drive adoption and solidify their position against established players in the telematics sector.

CalAmp's strategic push to integrate advanced AI and machine learning across its telematics and asset intelligence offerings, moving beyond its current video safety applications, positions it as a significant Question Mark. The company processed over one trillion data points in 2024, highlighting its substantial data foundation.

While AI presents a high-growth opportunity, the actual market penetration and specific applications of these advanced AI capabilities beyond existing Vision products are still in their nascent stages. This necessitates considerable ongoing investment to realize their full potential.

CalAmp's Inventory Manager feature, launched in August 2024, is designed to simplify device onboarding and boost visibility for deployed IoT products. This new offering targets a key pain point in the expanding IoT sector, suggesting strong future growth potential.

While the feature addresses a critical operational need, its impact on CalAmp's market share is still developing. As of late 2024, its contribution to overall revenue and market penetration is nascent, reflecting its recent introduction.

Expansion into Untapped Vertical Markets

CalAmp's strategic focus on expanding into untapped vertical markets like agriculture, healthcare, and public transportation signifies a move towards potential high-growth areas for its telematics solutions. These sectors, while offering substantial opportunities, currently represent nascent markets for CalAmp, necessitating significant investment to build brand recognition and secure market share.

- Agriculture: Telematics can optimize farm operations, asset tracking, and yield monitoring, a market projected to grow significantly.

- Healthcare: Remote patient monitoring and asset management in healthcare present a burgeoning telematics application.

- Public Transportation: Enhancing fleet management, passenger safety, and route optimization in public transit offers another key expansion avenue.

New Connected Car Solutions for European Markets

New connected car solutions for European markets, while building on the established strength of LoJack International (a Star in the BCG Matrix), are currently positioned as Question Marks. These initiatives tap into the burgeoning demand for advanced automotive technology across Europe, a continent increasingly embracing digital integration in transportation.

Despite the overall growth trend in the connected car sector, with the European market projected to reach over €30 billion by 2025, these new offerings are in their early stages. They represent significant potential but require substantial investment to gain traction and market share in diverse national landscapes, many of which are still developing their connected infrastructure and consumer adoption rates.

- Market Growth: The European connected car market is experiencing robust growth, driven by increasing consumer demand for safety, infotainment, and efficiency features.

- Investment Needs: Significant capital is required to establish brand presence, develop localized solutions, and build out necessary infrastructure in these new European territories.

- Low Initial Share: New ventures in connected car solutions in emerging European markets typically start with a low market share, necessitating aggressive marketing and product development strategies.

- Strategic Focus: These initiatives represent a strategic pivot to capture future market leadership, acknowledging the high risk and high reward associated with pioneering new segments within the connected automotive ecosystem.

CalAmp's strategic push into advanced AI and machine learning across its telematics and asset intelligence offerings, beyond existing video safety products, positions these capabilities as Question Marks. While the company processed over one trillion data points in 2024, demonstrating a strong data foundation, the actual market penetration and specific applications of these advanced AI features are still in their early stages, requiring substantial ongoing investment to realize their full potential.

The recently launched Inventory Manager feature, introduced in August 2024, also falls into the Question Mark category. It aims to simplify device onboarding and enhance visibility for deployed IoT products, addressing a key pain point in the expanding IoT sector. However, as of late 2024, its contribution to CalAmp's overall revenue and market penetration remains nascent, reflecting its recent introduction and the need for further development and market acceptance.

CalAmp's expansion into new vertical markets like agriculture, healthcare, and public transportation represents another strategic area for Question Marks. These sectors offer substantial growth opportunities for telematics solutions, but they currently represent nascent markets for CalAmp, necessitating significant investment to build brand recognition and secure market share.

New connected car solutions being developed for European markets are also considered Question Marks. While they leverage the established strength of LoJack International, these initiatives are in their early stages and require substantial investment to gain traction in diverse national landscapes, despite the European connected car market's projected growth to over €30 billion by 2025.

| Category | Product/Initiative | Market Position | Growth Potential | Investment Needs |

|---|---|---|---|---|

| AI/ML Capabilities | Advanced AI & ML Integration | Nascent | High | Substantial Ongoing |

| IoT Solutions | Inventory Manager | Nascent | High | Significant |

| Vertical Expansion | Agriculture, Healthcare, Public Transport | Nascent | High | Significant |

| Automotive | New European Connected Car Solutions | Nascent | High | Substantial |

BCG Matrix Data Sources

Our CalAmp BCG Matrix leverages a blend of internal financial disclosures and external market research, including industry growth rates and competitor performance data, to accurately position each business unit.