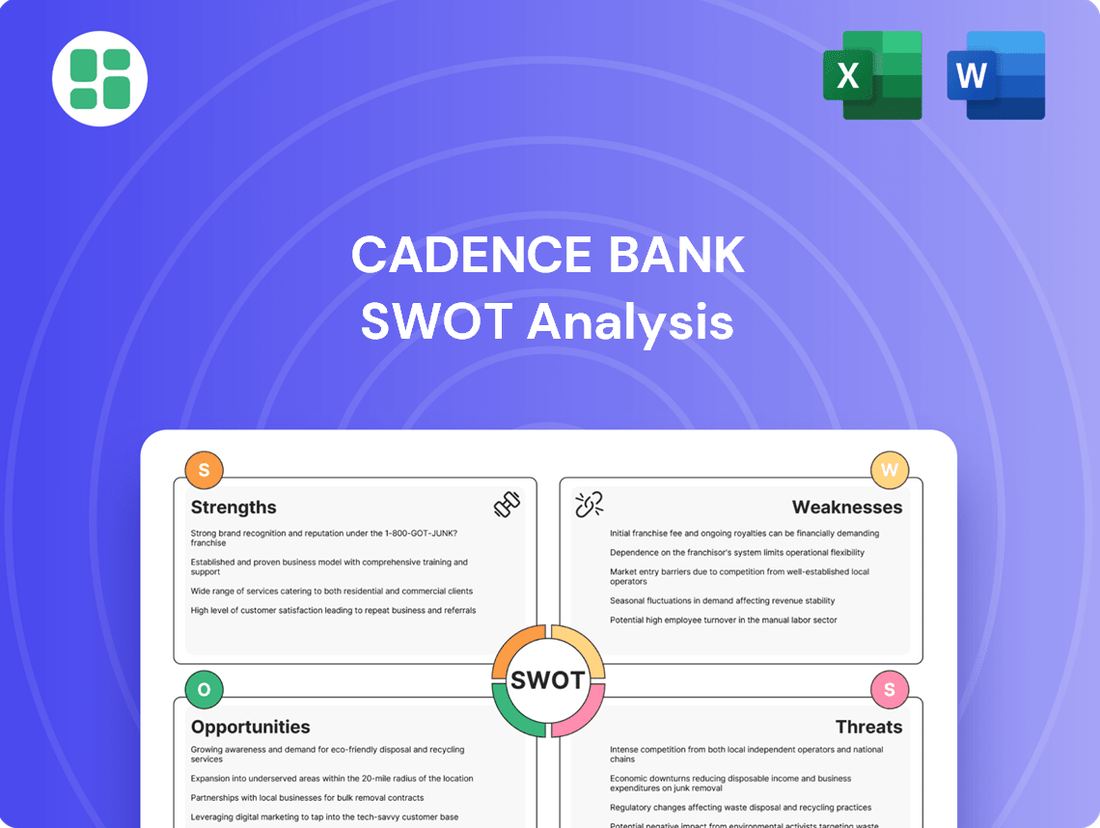

Cadence Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

Cadence Bank's strategic positioning is clear, but what are the hidden opportunities and potential threats that could impact its future? Our analysis delves into the core of their operations, revealing key competitive advantages and areas ripe for development.

Discover the complete picture behind Cadence Bank's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Cadence Bank boasts a comprehensive service offering, encompassing commercial banking, retail banking, and robust wealth management solutions. This broad spectrum of financial products allows the bank to cater to a diverse clientele, from individuals seeking personal banking services to large corporations requiring sophisticated treasury management.

Cadence Bank has shown impressive financial results, with earnings consistently growing and profitability metrics on the rise. This strength is underscored by its first quarter of 2025 performance, where the bank achieved a net income of $130.9 million for common shareholders.

The bank's return on average assets also saw an improvement, reaching 1.15% in Q1 2025. These figures highlight effective operational strategies and a solid financial foundation for Cadence Bank as it navigates the 2025 landscape.

Cadence Bank has demonstrated impressive strategic loan and deposit growth, a key strength. In the first quarter of 2025, the bank saw net organic loan growth of $309.9 million. This expansion was notably fueled by its mortgage, community banking, and private banking divisions.

This consistent increase in its loan portfolio, coupled with a solid base of stable core customer deposits, provides a strong foundation for Cadence Bank's ongoing expansion and financial resilience.

Improved Efficiency and Capital Position

Cadence Bank has demonstrated significant improvements in its operational efficiency, a key strength that underpins its financial stability. The bank's adjusted efficiency ratio reached an impressive 57.6% in the first quarter of 2025, reflecting successful cost management initiatives and streamlined operations.

Furthermore, Cadence Bank maintains a robust capital position, crucial for navigating economic fluctuations and supporting growth opportunities. As of March 31, 2025, its Common Equity Tier 1 capital ratio was a healthy 12.4%, well above regulatory requirements.

- Improved Efficiency Ratio: 57.6% in Q1 2025.

- Strong Capital Base: Common Equity Tier 1 ratio of 12.4% as of March 31, 2025.

- Resilience and Growth Potential: Enhanced ability to withstand market pressures and invest in future expansion.

Positive Analyst Outlook and Industry Recognition

Cadence Bank is currently enjoying a positive reception from financial analysts, with a consensus 'Buy' rating and encouraging price targets projected for 2025. This analyst sentiment suggests a belief in the bank's future growth and profitability. This external validation from reputable sources like Forbes, which named Cadence Bank one of America's Best Banks for 2025 and placed it among the top 100 largest publicly traded banks, highlights significant market confidence in its strategic direction and overall financial health.

Cadence Bank's diversified service model, encompassing commercial, retail, and wealth management, allows it to serve a broad customer base. This comprehensive approach, combined with strong loan and deposit growth, positions the bank for sustained expansion.

| Metric | Q1 2025 Value | Significance |

|---|---|---|

| Net Income (Common Shareholders) | $130.9 million | Demonstrates robust profitability. |

| Return on Average Assets | 1.15% | Indicates efficient asset utilization. |

| Net Organic Loan Growth | $309.9 million | Highlights successful expansion in lending. |

| Adjusted Efficiency Ratio | 57.6% | Shows effective cost management. |

| Common Equity Tier 1 Ratio | 12.4% | Confirms a strong capital foundation. |

What is included in the product

Delivers a strategic overview of Cadence Bank’s internal and external business factors, highlighting its strengths in regional presence and opportunities in digital banking, while also addressing weaknesses in brand recognition and threats from economic downturns.

Offers a clear, actionable roadmap by highlighting Cadence Bank's competitive advantages and areas for improvement.

Weaknesses

Cadence Bank's primary operations are concentrated in the South and Texas, making its financial health heavily dependent on the economic well-being of these specific areas. This regional focus, while allowing for specialized local knowledge, also presents a significant weakness. A downturn in these key markets, such as a slowdown in the energy sector affecting Texas or a contraction in manufacturing in Southern states, could disproportionately harm Cadence Bank's loan portfolio and overall profitability.

For instance, in the first quarter of 2024, Texas experienced a GDP growth rate of 2.1%, below the national average, highlighting potential regional vulnerabilities. If such localized economic headwinds persist or intensify, Cadence Bank could face increased credit losses and slower revenue growth compared to more geographically diversified competitors.

Cadence Bank operates within a banking landscape characterized by fierce competition. This pressure comes from both established national banks, which boast significant capital and market reach, and nimble fintech startups that are rapidly innovating in the digital space. For instance, as of Q1 2024, the US banking sector saw significant consolidation, with larger institutions like JPMorgan Chase and Bank of America continuing to expand their digital offerings, making it harder for regional banks to capture market share.

This intense rivalry directly impacts Cadence Bank's ability to acquire new customers and retain its current client base. Maintaining profitability becomes a constant challenge as banks often resort to competitive pricing and enhanced service offerings to stand out. The ongoing need to invest in cutting-edge technology and superior customer experiences is therefore not just a preference, but a necessity for survival and growth in this dynamic market.

Cadence Bank faces a weakness in managing deposit fluctuations and shifts in its funding mix. While core deposits have seen growth, there have been instances of declines in noninterest-bearing deposits in recent quarters, impacting its low-cost funding base.

The bank's reliance on more expensive funding sources, like brokered deposits, to maintain liquidity can elevate its overall cost of funds. This increased cost directly pressures net interest margins, potentially hindering profitability.

For instance, in Q1 2024, Cadence Bank reported a decrease in noninterest-bearing deposits compared to the previous year, underscoring the challenge of maintaining a stable, low-cost deposit base amidst evolving market conditions.

Past Cybersecurity Incidents and Ongoing Risk

Cadence Bank faced a significant cybersecurity challenge in May 2023, with a data breach affecting over 1.5 million accounts. This incident originated from a vulnerability within a third-party software application, highlighting the inherent risks associated with supply chain dependencies.

Such breaches, even with subsequent security enhancements and investigations, can severely damage customer confidence and lead to substantial financial repercussions. The bank's reputation and financial stability are at risk due to potential legal liabilities and ongoing reputational damage.

- Customer Trust Erosion: Past incidents can make customers hesitant to entrust their sensitive data to the bank.

- Financial Penalties: Regulatory fines and the cost of remediation can be significant, impacting profitability.

- Reputational Damage: Negative publicity from breaches can deter new customers and affect market perception.

- Ongoing Investment Needs: The ever-evolving threat landscape demands continuous and substantial capital allocation to cybersecurity infrastructure and personnel.

Efficiency Ratio Lagging Top Industry Performers

Cadence Bank's efficiency ratio, while improving, still lags behind top industry performers. In Q1 2025, the bank reported an efficiency ratio of 57.6%. This suggests that leading banks, often operating with ratios below 50%, have found more effective ways to manage costs relative to their revenue.

This gap highlights potential areas for Cadence Bank to further optimize its operations and reduce expenses.

- Operational Streamlining: Opportunities exist to refine internal processes and reduce overhead.

- Cost Optimization: Further initiatives to lower non-interest expenses are warranted.

- Improving Operating Leverage: Enhancing the relationship between revenue growth and cost control is key.

Cadence Bank's concentrated geographic footprint in the South and Texas exposes it to localized economic downturns, a risk highlighted by Texas's 2.1% GDP growth in Q1 2024, below the national average. Intense competition from larger banks and fintechs also challenges market share acquisition and retention. Furthermore, managing deposit fluctuations, particularly the decline in noninterest-bearing deposits observed in Q1 2024, increases funding costs and pressures net interest margins.

The bank's efficiency ratio stood at 57.6% in Q1 2025, indicating room for improvement compared to industry leaders with ratios below 50%. This suggests that Cadence Bank may not be as cost-efficient in its operations. The cybersecurity incident in May 2023, affecting over 1.5 million accounts due to a third-party vulnerability, underscores the ongoing need for substantial investment in cybersecurity to maintain customer trust and mitigate financial and reputational risks.

| Weakness | Description | Impact | Supporting Data/Event |

|---|---|---|---|

| Geographic Concentration | Heavy reliance on the South and Texas markets. | Vulnerability to regional economic slowdowns. | Texas GDP growth of 2.1% in Q1 2024. |

| Intense Competition | Facing pressure from large national banks and fintechs. | Difficulty in customer acquisition and retention, pressure on pricing. | Continued digital expansion by major banks. |

| Deposit Management | Fluctuations in deposit base, reliance on more expensive funding. | Increased cost of funds, pressure on net interest margins. | Decrease in noninterest-bearing deposits in Q1 2024. |

| Operational Efficiency | Higher efficiency ratio compared to top performers. | Potential for improved cost management and profitability. | Efficiency ratio of 57.6% in Q1 2025. |

| Cybersecurity Risks | Vulnerability to data breaches, including third-party risks. | Erosion of customer trust, financial penalties, reputational damage. | May 2023 data breach affecting 1.5 million accounts. |

Full Version Awaits

Cadence Bank SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you're getting the complete, professional SWOT analysis for Cadence Bank.

Opportunities

The current banking environment offers significant opportunities for strategic mergers and acquisitions, allowing regional banks like Cadence to enhance scale, technology, and market presence. This inorganic growth path is crucial for expanding market share and achieving greater operational efficiencies by spreading fixed costs across a larger asset base.

Cadence Bank's proactive approach is evident in its planned merger with First Chatham Bank, which received regulatory approval in 2025. This strategic move is designed to bolster Cadence's competitive position and unlock new avenues for growth.

Cadence Bank has a significant opportunity to bolster its digital banking services. As of the first quarter of 2024, digital engagement for the bank saw a notable increase, with mobile banking transactions up 15% year-over-year. Expanding features like advanced budgeting tools and personalized financial insights within these platforms can attract younger demographics and enhance customer loyalty.

The wealth management sector is a fertile ground for growth, offering Cadence Bank a prime opportunity to broaden its services and attract more clients to this lucrative business. This focus is further solidified by strategic organizational shifts in 2024 designed to bolster these very services.

By increasing assets under management and providing more advanced financial planning solutions, Cadence Bank can cultivate a consistent stream of fee-based revenue, enhancing its overall financial stability and profitability.

Cross-Selling within Existing Customer Base

Cadence Bank's broad range of commercial, retail, and wealth management offerings presents a significant opportunity for cross-selling to its current customers. By focusing on deepening these relationships and providing bundled financial solutions, the bank can boost revenue from each client and foster greater loyalty.

This approach capitalizes on the existing customer base for more efficient expansion. For instance, as of the first quarter of 2024, Cadence Bank reported a net interest margin of 3.28%, indicating a healthy environment for introducing new fee-generating products to its established clientele.

- Increased Revenue Per Customer: Offering additional services like investment management or specialized business loans to existing retail or commercial clients can directly increase transaction volume and profitability per account.

- Enhanced Customer Loyalty: Providing integrated financial solutions that meet multiple needs strengthens the customer's reliance on Cadence Bank, reducing churn.

- Leveraging Existing Infrastructure: Cross-selling utilizes the bank's current branch network, digital platforms, and customer service teams, making it a cost-effective growth strategy.

- Data-Driven Personalization: Analyzing customer data from existing relationships allows for tailored product recommendations, increasing the likelihood of successful cross-selling.

Leveraging Favorable Economic Conditions in Core Markets

Cadence Bank is well-positioned in the Southeast and Texas, regions demonstrating robust economic and demographic growth. These favorable conditions translate into increased demand for both commercial and retail banking services, directly benefiting Cadence's lending and deposit-gathering activities. For instance, Texas's GDP growth outpaced the national average in 2023, and projections for 2024 and 2025 remain strong, indicating a fertile ground for expansion.

The bank can capitalize on this intrinsic regional growth potential to naturally fuel its business expansion. This strategic alignment allows Cadence to benefit from organic market expansion rather than solely relying on market share gains. Several key indicators support this opportunity:

- Strong Population Influx: Both Texas and several Southeastern states continue to attract new residents, boosting consumer spending and housing demand, which are key drivers for bank services.

- Job Growth: These core markets are experiencing higher-than-average job creation, leading to increased income and a greater need for financial products and services. Texas, for example, added over 300,000 jobs in the year ending May 2024.

- Business Investment: A growing business environment fosters increased commercial lending opportunities, from small business loans to larger corporate financing needs.

Cadence Bank can leverage its strong digital presence, with mobile banking transactions up 15% year-over-year in Q1 2024, to attract younger demographics and enhance customer loyalty through advanced tools. The bank is also strategically positioned to grow its wealth management services, a sector showing robust potential, by offering more advanced financial planning solutions to generate consistent fee-based revenue.

Further opportunities lie in cross-selling its diverse commercial, retail, and wealth management products to its existing customer base, a strategy supported by a healthy Q1 2024 net interest margin of 3.28%. The bank's focus on regions like Texas, which saw strong GDP growth in 2023 and continued job creation, offers significant organic expansion potential for both retail and commercial banking services.

| Opportunity Area | Key Metric/Data Point | Impact |

|---|---|---|

| Digital Banking Expansion | Mobile banking transactions up 15% YoY (Q1 2024) | Attracts younger demographics, enhances loyalty |

| Wealth Management Growth | Sector shows robust potential | Generates consistent fee-based revenue |

| Cross-Selling | Net Interest Margin of 3.28% (Q1 2024) | Increases revenue per customer, boosts loyalty |

| Regional Economic Growth | Texas GDP growth outpaced national average (2023) | Fuels organic expansion in retail and commercial banking |

Threats

General economic downturns, including persistent inflation and tightening credit markets, represent a significant threat to Cadence Bank. These conditions can lead to higher loan default rates and a decrease in demand for new loans, directly impacting the bank's revenue streams and asset quality. For instance, the Federal Reserve's aggressive interest rate hikes throughout 2022 and 2023 aimed at curbing inflation have already created a more challenging lending environment.

Interest rate volatility further complicates matters by potentially compressing net interest margins. Effectively managing the cost of deposits against the yields earned on loans becomes a delicate balancing act for financial institutions like Cadence Bank. As of early 2024, the ongoing uncertainty surrounding the trajectory of interest rates continues to pose a risk to predictable profitability.

Cadence Bank, like all financial institutions, operates under a stringent and ever-changing regulatory framework. The threat of intensified regulatory scrutiny and the associated compliance costs presents a significant challenge. For instance, in 2024, the banking sector continued to grapple with the aftermath of increased capital requirements and enhanced consumer protection measures implemented in prior years, demanding ongoing investment in compliance infrastructure and personnel.

New or more rigorously enforced regulations, whether related to capital adequacy ratios, data privacy, or anti-money laundering (AML) protocols, can directly impact Cadence Bank's operational efficiency and strategic maneuverability. The cost of ensuring adherence, including technology upgrades and specialized legal counsel, can divert substantial resources. For example, the U.S. banking industry collectively spent billions annually on compliance, a figure expected to rise with evolving mandates in 2024 and projected into 2025.

Cadence Bank, like all financial institutions, faces persistent cybersecurity risks. Despite ongoing investments in security, the threat of sophisticated cyberattacks and data breaches remains a critical concern. A significant incident could result in substantial financial losses, reputational damage, and a loss of customer confidence.

In 2023, the financial sector experienced a notable increase in cyber threats, with reports indicating a rise in ransomware attacks targeting financial services. For instance, IBM's 2024 Cost of a Data Breach Report highlighted that the financial sector had the highest average cost of a data breach at $5.90 million in 2023, a figure that underscores the potential financial fallout for institutions like Cadence Bank.

Talent Acquisition and Retention Challenges

The banking industry, particularly in areas requiring specialized tech skills, is intensely competitive, making it harder for Cadence Bank to secure and keep top talent. This scarcity of qualified individuals directly impacts the bank's capacity for innovation and efficient operations. For instance, the U.S. Bureau of Labor Statistics projected a 10% growth for information security analysts from 2022 to 2032, a field crucial for modern banking, highlighting the demand.

A significant shortage of skilled banking and technology professionals can impede Cadence Bank's ability to drive new initiatives and execute its strategic plans effectively. This talent gap can slow down digital transformation efforts and the implementation of new financial products. In 2023, a survey by Robert Half found that 58% of financial executives reported difficulty in finding candidates with the right skills, a trend that continues to challenge the sector.

To counter these talent acquisition and retention challenges, Cadence Bank must focus on building a strong employer brand and offering competitive compensation and benefits. Creating an attractive workplace culture that fosters growth and development is paramount. The average annual salary for a bank branch manager in the U.S. was around $70,000 in early 2024, with bonuses, but top tech roles can command significantly higher figures, necessitating strategic adjustments in remuneration strategies.

- Intensified competition for tech and banking expertise

- Risk of innovation and operational slowdown due to talent shortages

- Need for competitive compensation and a positive workplace culture

Disruption from Fintech Innovation and Non-Bank Competitors

Fintech innovation is a significant challenge, with companies like Square and Stripe processing billions in payment volumes, potentially impacting traditional fee structures. These agile players often provide superior digital experiences, attracting customers seeking seamless online transactions and lending. For instance, the digital lending market saw substantial growth in 2023, with non-bank lenders capturing a larger share of origination volume, a trend expected to continue.

Cadence Bank faces pressure from these non-bank entities that can operate with lower overhead and regulatory burdens. This allows them to offer competitive pricing and specialized services, particularly in areas like small business lending and consumer credit. The increasing adoption of digital wallets and payment platforms by consumers, with global transaction values projected to exceed $10 trillion by 2025, further underscores this threat.

- Fintechs are rapidly gaining market share in payments and lending.

- Non-bank competitors often offer more user-friendly digital solutions.

- The global digital payments market is experiencing exponential growth.

- Cadence Bank must invest in technology to counter these disruptive forces.

The increasing sophistication and frequency of cyber threats pose a significant risk to Cadence Bank, with potential for substantial financial and reputational damage. In 2023, the financial sector experienced a notable rise in cyberattacks, and IBM's 2024 Cost of a Data Breach Report indicated the financial industry faced the highest average breach cost at $5.90 million that year, highlighting the severe financial implications of a security lapse.

Intensified competition for skilled banking and technology professionals presents another challenge, potentially slowing innovation and operational efficiency. The U.S. Bureau of Labor Statistics projected a 10% growth for information security analysts from 2022 to 2032, a critical role for banks, indicating a competitive talent landscape. A 2023 survey by Robert Half revealed that 58% of financial executives struggled to find qualified candidates, underscoring the ongoing talent gap.

The rapid growth of fintech companies, offering streamlined digital experiences and often operating with fewer regulatory burdens, directly challenges Cadence Bank's traditional business models, particularly in payments and lending. The digital lending market saw significant growth in 2023, with non-bank lenders increasing their market share, a trend expected to persist. Global digital payment transaction values are projected to exceed $10 trillion by 2025, demonstrating the scale of this disruption.

| Threat Category | Specific Risk | Impact on Cadence Bank | Supporting Data/Trend (2023-2025) |

|---|---|---|---|

| Cybersecurity | Data Breaches & Cyberattacks | Financial loss, reputational damage, loss of customer trust | Financial sector average data breach cost: $5.90M (2023) |

| Talent Acquisition | Shortage of skilled banking/tech professionals | Hindered innovation, slower operational execution | 58% of financial executives reported difficulty finding skilled candidates (2023) |

| Fintech Disruption | Competition from agile fintechs in payments/lending | Loss of market share, pressure on fee structures | Digital lending market growth; digital payments projected >$10T by 2025 |

SWOT Analysis Data Sources

This Cadence Bank SWOT analysis is built upon a foundation of publicly available financial statements, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and accurate strategic assessment.