Cadence Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

Cadence Bank operates within a dynamic financial landscape, facing pressures from rivals and the ever-present threat of new entrants. Understanding the intricate interplay of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Cadence Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers hold moderate to high bargaining power over Cadence Bank due to the critical nature of their specialized software and cybersecurity solutions. For instance, core banking systems and advanced data analytics platforms are essential for regulatory compliance and operational efficiency, making switching costs significant for financial institutions.

The banking technology sector saw substantial investment in 2024, with fintech funding reaching billions globally, highlighting the value and dependence on these providers. However, the growing adoption of cloud-native banking platforms and open APIs in 2024 is beginning to foster greater interoperability and reduce vendor lock-in, potentially tempering this power in the long term.

The banking sector, including institutions like Cadence Bank, grapples with securing and keeping talented individuals, especially in specialized fields such as cybersecurity, artificial intelligence, and digital innovation. This scarcity of proficient workers, particularly top-tier relationship managers in wealth management, directly boosts employees' leverage, translating into greater demands for improved salaries and benefits.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the median annual wage for financial managers was $131,850. This figure, while an average, underscores the competitive compensation landscape. Cadence Bank's strategic investment in employee perks, like programs designed to help pay off student loans, demonstrates a proactive approach to counteract this elevated bargaining power of its workforce.

Interbank lending markets are crucial for banks like Cadence Bank to manage their short-term liquidity needs. The cost of borrowing from other banks, or the interest rates charged on these loans, directly impacts Cadence Bank's profitability and operational flexibility. For instance, in periods of tight liquidity, such as during the regional banking stress in early 2023, interbank rates can surge, increasing funding costs for all participants.

Broader economic factors and monetary policy significantly influence these markets. When the Federal Reserve adjusts interest rates, it ripples through interbank lending, affecting the cost of funds for institutions. For example, a series of rate hikes by the Fed in 2022 and 2023 made interbank borrowing more expensive, putting pressure on banks that relied heavily on this funding source.

While Cadence Bank's focus on building stable customer deposits helps mitigate its dependence on interbank markets, major disruptions in overall market liquidity can still empower larger, more liquid institutions or central banks. In times of financial stress, the availability of funds in these markets can dry up, giving significant leverage to those entities that can still provide liquidity, potentially at less favorable terms for borrowers.

Data and Information Providers

Data and information providers wield considerable bargaining power over banks like Cadence. Access to accurate, timely financial data, market insights, and customer analytics is fundamental for a bank's strategic planning and risk mitigation efforts. Specialized providers often possess proprietary information that is crucial for competitive analysis, fraud prevention, and tailoring customer experiences.

The reliance on these specialized datasets is significant, as they are frequently indispensable for a bank's operations and strategic advantage. For instance, in 2024, the global market for financial data and analytics was projected to reach over $50 billion, highlighting the substantial value and demand for such information.

- Proprietary Information: Data providers often hold unique datasets that are not readily available elsewhere, giving them leverage.

- Essential for Operations: Banks depend on this data for critical functions like credit scoring, regulatory compliance, and market trend analysis.

- AI Integration: The growing adoption of AI in banking amplifies the need for high-quality, structured data, increasing the power of providers who can supply it.

- High Switching Costs: Integrating new data systems can be complex and costly, making banks hesitant to switch providers frequently.

Regulatory Bodies

Regulatory bodies like the Federal Reserve, OCC, and FDIC wield substantial influence over banks, acting as powerful gatekeepers. Their mandates shape the operational landscape, compliance burdens, and capital requirements, directly affecting a bank's profitability and strategic agility. For instance, increased capital adequacy ratios mandated by regulators can tie up more of a bank's resources, impacting their ability to lend or invest in growth initiatives.

The evolving regulatory focus on critical areas such as cybersecurity, artificial intelligence governance, anti-money laundering (AML) protocols, and operational resilience significantly elevates compliance costs. In 2024, the financial sector continued to see substantial investment in these areas. For example, the U.S. banking sector's spending on cybersecurity alone was projected to exceed $100 billion annually, reflecting the direct impact of regulatory pressure on operational expenditure.

- Increased Compliance Costs: Regulatory requirements necessitate significant investment in technology and personnel for compliance, directly impacting a bank's cost structure.

- Strategic Constraint: Strict regulations can limit a bank's flexibility in product development, market expansion, and risk-taking, thereby influencing strategic decision-making.

- Capital Adequacy Demands: Mandates on capital reserves reduce the capital available for other investments, effectively acting as a cost of doing business.

- Operational Resilience Requirements: Investments in business continuity and disaster recovery are driven by regulatory expectations, adding to operational expenses.

The bargaining power of suppliers for Cadence Bank is multifaceted, encompassing technology providers, data vendors, and even the labor market. While technology and data providers hold significant sway due to the critical nature of their specialized offerings and the high costs associated with switching, the influence of labor, particularly in specialized fields, also presents a considerable factor. Regulatory bodies, while not traditional suppliers, also exert immense power by dictating operational parameters and compliance costs.

In 2024, the financial technology sector continued to see robust investment, underscoring the dependence banks have on specialized software and platforms. For instance, global fintech funding remained in the billions, highlighting the value and leverage of these technology suppliers. This reliance means that changes in their pricing or service offerings can directly impact Cadence Bank's operational costs and efficiency.

The increasing integration of artificial intelligence in banking further amplifies the bargaining power of data providers. High-quality, structured data is essential for AI model training and deployment, making providers of such datasets indispensable. The global financial data and analytics market, projected to exceed $50 billion in 2024, illustrates the substantial economic importance and demand for these specialized information resources.

| Supplier Type | Bargaining Power Assessment | Key Factors | Impact on Cadence Bank |

|---|---|---|---|

| Technology Providers | Moderate to High | Criticality of core banking systems, high switching costs, specialized software | Increased operational costs, potential for vendor lock-in |

| Data & Information Providers | High | Proprietary datasets, essential for AI and analytics, high integration costs | Reliance on specific data for strategic advantage, potential for escalating data acquisition costs |

| Skilled Labor | High | Scarcity of talent in cybersecurity, AI, and digital roles, competitive wage demands | Higher personnel costs, challenges in talent acquisition and retention |

| Interbank Lenders | Variable (Market Dependent) | Liquidity conditions, Federal Reserve monetary policy, overall market stability | Fluctuations in funding costs, impact on profitability during tight liquidity periods |

What is included in the product

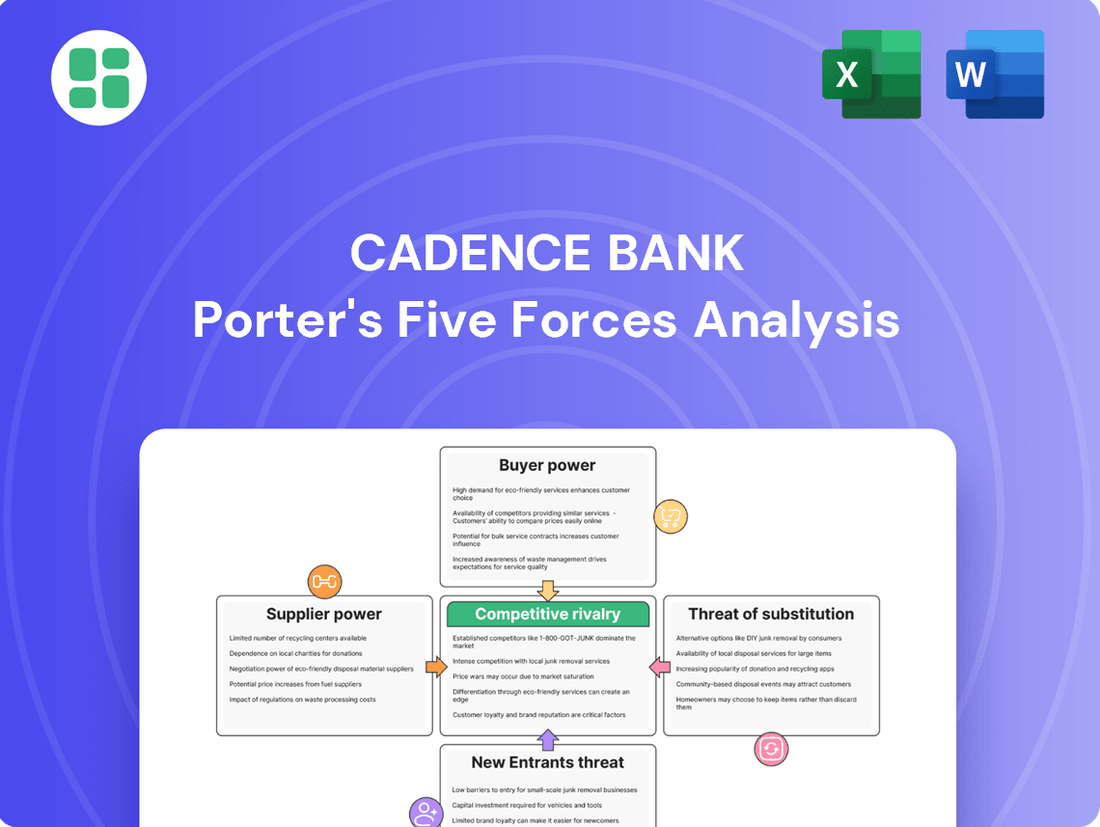

Cadence Bank's Porter's Five Forces analysis scrutinizes the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitutes on its banking operations.

Instantly understand strategic pressure with a powerful spider/radar chart, highlighting competitive intensity and potential threats for Cadence Bank.

Customers Bargaining Power

Individual retail customers today wield significant bargaining power. The ease with which they can switch banks, especially with the rise of digital platforms, means banks like Cadence need to offer compelling value. For instance, in 2024, the average consumer surveyed indicated they would consider switching banks for a better mobile app experience or lower fees, highlighting the low switching costs.

These customers, influenced by seamless digital experiences from tech giants, demand 24/7 personalized service from their banks. Cadence Bank, to combat this, is investing in its digital channels, aiming to provide intuitive mobile banking and data-driven product recommendations. This focus is crucial as customer expectations continue to align with best-in-class digital interactions.

Commercial and business clients, particularly those with large deposit accounts or intricate borrowing requirements, wield considerable influence. These clients often demand tailored offerings such as sophisticated treasury management, advantageous lending terms, and comprehensive financial packages. Cadence Bank actively pursues these relationships by providing specialized commercial banking services and support for small to medium-sized businesses, though it faces robust competition from a crowded financial landscape.

Wealth management clients, particularly high-net-worth individuals, wield considerable bargaining power. Their substantial assets and demand for bespoke investment, trust, and advisory services make them highly attractive to financial institutions. In 2024, the global wealth management market is projected to reach trillions, with these clients often having multiple options from independent asset managers to large banks, making loyalty contingent on performance and personalized service.

Access to Information and Alternatives

Customers today have unprecedented access to information, thanks to the digital revolution. This means they can easily research financial products, compare interest rates, and read reviews, putting them in a stronger position to negotiate or switch providers if they are not satisfied. For instance, a 2024 survey indicated that over 75% of banking consumers actively compare options online before making a decision.

The rise of fintech startups and neobanks has significantly expanded the choices available to consumers. These digital-first institutions often offer competitive pricing and user-friendly interfaces, directly challenging traditional banks like Cadence. This increased competition forces banks to innovate and improve their digital offerings to retain their customer base. In 2023, fintech adoption rates reached new highs, with a significant portion of consumers utilizing at least one fintech service.

- Increased Information Availability: Customers can readily access product details, fees, and competitor analyses online.

- Broader Range of Alternatives: Fintechs, online banks, and even non-traditional financial service providers offer diverse options.

- Digital Comparison Tools: Websites and apps allow for easy side-by-side comparisons of banking services.

- Customer Empowerment: This access shifts power towards the customer, demanding better value and service from financial institutions.

Price Sensitivity and Switching Costs

For basic banking services such as checking and savings accounts, customers often exhibit high price sensitivity. This means they are quite attuned to interest rates and fees, and the effort to switch banks for these products is generally minimal. For instance, in 2024, the average interest rate on savings accounts across major US banks hovered around 0.46%, with some online-only banks offering significantly higher yields, making it easier for customers to compare and move funds.

While Cadence Bank provides a broad range of financial solutions designed to foster customer loyalty, the increasing ease of digital account opening and fund transfers presents a constant challenge. Customers can now open new accounts and move their money with just a few clicks, especially if they find more attractive interest rates or superior digital services from competitors. This low friction environment amplifies the bargaining power of customers, as they can readily shift their banking relationships if better offers are available.

- Price Sensitivity: Customers are highly sensitive to interest rates on deposits and fees for basic banking services.

- Switching Costs: For standard accounts, the cost and effort to switch banks are low, enabling easy migration of funds.

- Digitalization Impact: Online platforms and digital tools have further reduced the barriers to switching, increasing customer mobility.

- Competitive Landscape: The availability of higher rates or better services elsewhere empowers customers to demand more from their current bank.

The bargaining power of customers is amplified by the ease of information access and the proliferation of digital banking options. Consumers in 2024 are actively comparing rates and services online, with over 75% researching options before making decisions. This readily available data allows them to identify superior offers, such as the higher interest rates on savings accounts provided by some online banks compared to the average 0.46% offered by major US banks.

| Customer Segment | Key Bargaining Factors | Impact on Banks | 2024 Data/Trend |

|---|---|---|---|

| Retail Customers | Low switching costs, digital experience demands, price sensitivity (fees/rates) | Pressure on fees, need for superior digital platforms, competitive pricing | High consideration of switching for better mobile apps or lower fees; 75%+ compare options online. |

| Commercial Clients | Large deposits, complex borrowing needs, demand for tailored services (treasury management) | Need for specialized product offerings, competitive lending terms, relationship management | Focus on providing comprehensive financial packages and support for SMBs. |

| Wealth Management Clients | Substantial assets, demand for bespoke investment and advisory services | Requirement for high-performance, personalized service; loyalty contingent on results | Global wealth management market projected in trillions; clients have multiple options. |

What You See Is What You Get

Cadence Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Cadence Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the bank. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

Cadence Bank navigates a fiercely competitive regional banking arena. Rivalry comes from established national players, numerous other regional banks, and smaller community institutions. The landscape is further complicated by the rise of fintech firms, offering digital-first alternatives.

This broad spectrum of competitors, each with varying strengths and market focuses, intensifies rivalry across Cadence Bank's entire service offering. From everyday consumer banking to complex commercial lending and sophisticated wealth management, competition is a constant factor.

For instance, in 2024, the US banking sector continued to see consolidation, but also the persistent presence of over 4,000 FDIC-insured institutions, highlighting the sheer number of potential rivals. Fintech adoption also surged, with many digital banks reporting significant customer growth, directly impacting traditional banks like Cadence.

While Cadence Bank provides a broad range of financial services, many of its fundamental banking products are largely interchangeable, presenting a hurdle for distinctiveness. This commoditization means competition often hinges on factors beyond basic offerings.

Banks like Cadence Bank are actively differentiating themselves by focusing on exceptional customer service, developing cutting-edge digital banking tools, and offering niche lending products. Furthermore, tailored wealth management services are becoming a key differentiator in attracting and retaining clients.

Cadence Bank's strategic moves, including recent acquisitions and significant investments in technology, underscore its commitment to strengthening its competitive standing. For instance, in 2023, Cadence Bank reported a net interest margin of 3.32%, a key indicator of its lending profitability, and continued to invest in digital transformation initiatives to improve customer experience and operational efficiency.

The banking sector, especially at the regional level, is seeing steady growth. This moderate expansion often fuels a more intense competition among banks as they all aim to capture a bigger piece of the market. It’s a dynamic where every client and every loan matters more.

Looking ahead to 2025, we anticipate an uptick in both loan origination and merger and acquisition activity within the industry. However, this doesn't necessarily mean easier times; banks will still face significant pressure to attract and retain deposits, and securing profitable lending opportunities remains a challenge, particularly with deposit costs staying high.

High Exit Barriers

The banking industry, including institutions like Cadence Bank, faces significant competitive rivalry exacerbated by high exit barriers. These barriers are substantial, stemming from the vast fixed assets such as physical branches and extensive IT infrastructure, coupled with the need for highly specialized personnel and navigating intricate regulatory frameworks. For instance, in 2024, the cost of maintaining a national branch network for a bank can run into millions annually, making closure a complex and costly decision.

These high exit barriers mean that even banks experiencing financial difficulties are less likely to cease operations promptly. This persistence of less profitable entities within the market can prolong and intensify competitive pressures. As a result, the overall competitive landscape remains robust, with numerous players vying for market share, potentially impacting pricing and service offerings.

- Significant Fixed Assets: Banks invest heavily in physical infrastructure and technology, making divestment costly.

- Specialized Workforce: The need for skilled professionals in areas like compliance, risk management, and customer service creates a specialized labor market.

- Regulatory Obligations: Strict regulations govern bank closures, adding complexity and cost to exiting the market.

- Sustained Rivalry: These factors keep even struggling competitors in play, intensifying competition for all market participants.

Aggressiveness of Competitors

Competitors are aggressively adopting new technologies, with a significant focus on artificial intelligence (AI) and embedded finance solutions. This technological push aims to capture market share by offering more seamless and integrated financial services. For instance, by early 2024, many fintech companies and challenger banks had already integrated AI-powered chatbots for customer service, handling millions of inquiries daily, and were actively developing personalized financial advice tools.

Cadence Bank faces intense pressure to keep pace with these innovations. Rivals are not only investing heavily in digital channels but are also pursuing strategic acquisitions to broaden their technological capabilities and customer reach. In 2023 alone, the banking sector saw over $5 billion in fintech acquisitions, signaling a clear trend towards consolidation and technological enhancement to meet evolving customer expectations and improve operational efficiency.

- Technological Adoption: Competitors are rapidly integrating AI for personalized services and operational efficiency.

- Embedded Finance: The trend of embedding financial services into non-financial platforms is intensifying competition.

- Digital Channel Expansion: Banks are heavily investing in digital platforms to attract and retain customers.

- Strategic Acquisitions: Competitors are acquiring technology firms to accelerate innovation and market presence.

Competitive rivalry for Cadence Bank is substantial, driven by a diverse set of players including national banks, regional counterparts, community institutions, and increasingly, agile fintech companies. This intense competition is evident across all service lines, from basic banking to wealth management, as many core products are commoditized, forcing differentiation through service and technology.

The banking sector's inherent high exit barriers, including significant fixed assets and stringent regulations, mean that even less profitable competitors remain active, prolonging competitive pressures. For instance, in 2024, the cost of maintaining a national branch network can easily reach millions annually, making divestment a complex decision.

In 2024, the US banking sector continued to see consolidation, yet still comprised over 4,000 FDIC-insured institutions, underscoring the sheer volume of rivals. Furthermore, fintech adoption surged, with many digital banks reporting robust customer growth, directly impacting traditional institutions like Cadence.

Banks are actively differentiating through superior customer service, advanced digital tools, and specialized lending, with wealth management becoming a key differentiator. Cadence Bank's 2023 net interest margin of 3.32% reflects its focus on lending profitability amidst these competitive dynamics.

| Competitor Type | Key Differentiators | 2024 Trend Impact |

| National Banks | Brand recognition, extensive branch networks, broad product offerings | Continued market share consolidation, aggressive digital investment |

| Regional Banks | Local market knowledge, personalized service, community focus | Intensified competition for deposits and loans, focus on niche markets |

| Community Banks | Deep customer relationships, localized decision-making | Facing pressure from larger players and fintechs, often partner for technology |

| Fintech Firms | Digital-first experience, lower overhead, innovative solutions (AI, embedded finance) | Rapid customer acquisition, challenging traditional fee structures, driving digital transformation |

SSubstitutes Threaten

Fintech companies and digital payment platforms present a substantial threat of substitution for Cadence Bank. These nimble players, offering specialized services like peer-to-peer lending and digital wallets, are increasingly capturing market share. For instance, the global digital payments market was valued at over $7.7 trillion in 2023 and is projected to grow significantly, indicating a strong customer preference for these convenient and often lower-cost alternatives.

For commercial clients, the rise of non-bank lenders, private equity firms, and crowdfunding platforms presents a significant threat of substitutes. These alternatives offer businesses, especially small to medium-sized ones, flexible financing options that can bypass traditional banking channels, thereby reducing their dependence on institutions like Cadence Bank. For instance, the alternative lending market has seen substantial growth, with private credit funds alone managing over $1.7 trillion globally as of early 2024, indicating a robust and expanding competitive landscape.

Online brokerage firms and robo-advisors present a significant threat of substitutes for Cadence Bank's wealth management services. These platforms, like Schwab or Fidelity, often boast lower management fees and more user-friendly digital interfaces, attracting a growing segment of investors, particularly millennials and Gen Z. For instance, the robo-advisor market saw substantial growth, with assets under management reaching hundreds of billions of dollars globally by 2024, indicating a strong preference for these accessible alternatives.

Cryptocurrencies and Central Bank Digital Currencies (CBDCs)

The emergence of cryptocurrencies and the prospective launch of Central Bank Digital Currencies (CBDCs) pose a significant long-term threat to traditional banking models like Cadence Bank. These digital alternatives could potentially disintermediate established financial systems, impacting deposit growth and fee-based income.

While the adoption of cryptocurrencies for everyday transactions remains limited, their underlying blockchain technology offers a foundation for alternative payment rails. For instance, by the end of 2023, the global cryptocurrency market capitalization hovered around $1.6 trillion, indicating substantial investor interest and a growing ecosystem. The potential for CBDCs, as explored by numerous central banks including the U.S. Federal Reserve, could further accelerate this shift by providing a government-backed digital currency that might compete directly with commercial bank deposits and payment services.

- Cryptocurrency Market Cap: Approximately $1.6 trillion globally by the end of 2023.

- CBDC Exploration: Over 100 countries were exploring or piloting CBDCs as of early 2024.

- Potential Impact: Disintermediation of deposit bases and transaction revenue for traditional banks.

- Long-Term Threat: Represents an evolving alternative to traditional fiat currency and payment systems.

Internal Corporate Financing and Treasury Management

Larger commercial clients, especially those with robust balance sheets and predictable cash flows, increasingly leverage internal corporate financing and advanced treasury management systems. This trend directly impacts banks like Cadence by reducing their need for traditional lending and cash management services. For instance, a significant portion of corporate liquidity management is now handled in-house, bypassing external financial institutions for short-term funding and investment needs.

This internal capability acts as a potent substitute, particularly for established businesses that can efficiently manage their working capital and capital expenditures internally. Such clients might access capital markets directly or utilize sophisticated intercompany lending arrangements, diminishing their reliance on commercial loans or overdraft facilities from banks. The ability to self-fund or efficiently manage cash pools limits the demand for specific banking products.

The threat is amplified as more companies invest in treasury technology and expertise. By 2024, many large corporations have dedicated treasury departments that can optimize cash, manage foreign exchange exposure, and even issue commercial paper, effectively substituting services previously exclusive to banks. This strategic shift means Cadence Bank faces pressure on its fee-based income and interest margins for these client segments.

- Reduced Demand for Traditional Lending: Companies with strong internal cash generation may forgo commercial loans for operational needs.

- Rise of In-House Treasury Management: Sophisticated treasury functions can manage liquidity and investments, substituting bank services.

- Direct Access to Capital Markets: Well-capitalized firms can issue debt or equity, bypassing bank intermediation.

- Impact on Fee Income: Treasury services, like cash pooling and FX management, are increasingly handled internally, affecting bank revenue streams.

The threat of substitutes for Cadence Bank is significant, stemming from digital payment platforms, non-bank lenders, and alternative investment channels. Fintech companies offer specialized, often lower-cost services, capturing market share from traditional banking. For instance, the global digital payments market exceeded $7.7 trillion in 2023, highlighting customer preference for these alternatives.

Businesses, particularly SMEs, increasingly turn to non-bank lenders and private equity for flexible financing, bypassing traditional banks. The private credit market alone managed over $1.7 trillion globally by early 2024, showcasing the growth of these substitute options.

Wealth management services also face substitutes from online brokerages and robo-advisors, which offer lower fees and user-friendly interfaces. The robo-advisor market had hundreds of billions in assets under management globally by 2024, indicating a clear shift towards these accessible alternatives.

Entrants Threaten

Entering the banking sector demands immense capital. New entrants need significant funds for infrastructure, regulatory compliance, and attracting a customer base, effectively creating a high barrier to entry. For instance, in 2024, the average capital requirement for a new national bank charter in the US could easily run into tens of millions of dollars, with many requiring over $10 million just for initial operational setup and regulatory reserves.

The banking industry presents formidable barriers to entry due to stringent regulatory requirements. New players must navigate complex licensing processes, adhere to anti-money laundering (AML) regulations, and meet robust cybersecurity and data privacy standards. For instance, in 2024, the cost of regulatory compliance for financial institutions continued to rise, with many reporting significant investments in technology and personnel to meet evolving mandates from bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). This demanding landscape necessitates substantial legal and compliance expertise, making it exceptionally difficult for newcomers to establish a foothold and compete effectively with established institutions like Cadence Bank.

Established financial institutions like Cadence Bank often possess significant brand loyalty, a valuable asset that new entrants struggle to replicate. In 2024, for instance, consumer surveys consistently show a preference for well-known banks, with trust being a primary driver in choosing financial services. This ingrained trust, built over decades, creates a substantial barrier to entry for newcomers aiming to capture market share.

Economies of Scale and Distribution Networks

Existing financial institutions often leverage significant economies of scale, particularly in technology infrastructure and operational efficiency. This allows them to spread costs across a large customer base, leading to more competitive pricing on services like loans and deposits. For instance, major banks can invest heavily in advanced digital platforms and cybersecurity, which are prohibitively expensive for smaller, newer players to match initially.

Cadence Bank's established presence, boasting approximately 400 banking centers as of early 2024, creates a substantial barrier to entry. This extensive physical footprint, coupled with its growing digital offerings, provides a wide distribution network that new entrants would struggle to replicate without massive capital investment and considerable time. Building a comparable branch network and achieving brand recognition in these markets represents a significant hurdle.

- Economies of Scale: Large banks can achieve lower per-unit costs in technology, marketing, and compliance due to their size.

- Distribution Network: Cadence Bank's ~400 banking centers offer a tangible advantage in customer reach and service accessibility.

- Digital Capabilities: Investment in digital banking tools further enhances Cadence's competitive reach, requiring substantial upfront costs for new entrants.

- Capital Requirements: Replicating Cadence's scale and service breadth demands significant capital, deterring many potential new competitors.

Technological Innovation and Integration Costs

While fintech startups can innovate rapidly, new entrants still face significant costs and complexities in developing robust, secure, and scalable technology platforms that can compete with established banks' comprehensive systems. For instance, the average cost for a bank to upgrade its core banking system can range from tens of millions to over a hundred million dollars, a substantial barrier for new players.

Integrating new technologies while ensuring regulatory compliance and data security is a substantial challenge. The U.S. banking sector alone saw cybersecurity spending reach an estimated $30 billion in 2023, a figure that new entrants must also account for to build trust and maintain operational integrity.

- High Development and Integration Costs: Building secure, compliant, and scalable banking technology platforms requires substantial upfront investment, often in the tens of millions of dollars for core system upgrades alone.

- Regulatory Hurdles: New entrants must navigate complex financial regulations, including those related to data privacy (like GDPR or CCPA) and anti-money laundering (AML), adding significant compliance costs and time to market.

- Cybersecurity Investment: To protect customer data and maintain operational stability, new financial institutions must allocate significant resources to cybersecurity, with industry-wide spending estimated in the tens of billions annually.

The threat of new entrants for Cadence Bank remains relatively low, primarily due to the substantial capital required to establish a presence in the banking sector. In 2024, the initial capital outlay for a new national bank charter in the US could easily exceed $10 million, covering infrastructure, regulatory reserves, and customer acquisition. This high financial barrier, coupled with the extensive regulatory compliance demands, including adherence to AML and robust cybersecurity standards, makes it extremely challenging for newcomers to compete with established players like Cadence Bank.

Furthermore, Cadence Bank benefits from significant brand loyalty and established economies of scale. As of early 2024, Cadence operated approximately 400 banking centers, providing a vast distribution network that new entrants would struggle to replicate without immense investment. The ongoing need for substantial investments in technology, estimated at tens of millions for core system upgrades, and significant cybersecurity spending, which reached an estimated $30 billion across the U.S. banking sector in 2023, further solidifies the position of incumbents.

| Barrier to Entry | Description | Estimated Cost/Impact (2024 Data) |

| Capital Requirements | Funds needed for infrastructure, regulatory reserves, and initial operations. | Over $10 million for a new national bank charter. |

| Regulatory Compliance | Navigating licensing, AML, data privacy, and cybersecurity mandates. | Significant ongoing investment in technology and personnel; rising compliance costs. |

| Economies of Scale | Lower per-unit costs in technology, marketing, and operations for larger institutions. | Prohibitive for smaller players to match advanced digital platforms and cybersecurity. |

| Distribution Network | Physical branch presence and digital reach. | Cadence Bank's ~400 banking centers represent a substantial hurdle to replicate. |

| Technology Investment | Developing and integrating secure, scalable banking platforms. | Tens of millions to over $100 million for core banking system upgrades. |

Porter's Five Forces Analysis Data Sources

Our Cadence Bank Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Cadence Bank's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific research from financial institutions and market intelligence firms to capture the broader banking landscape.