Cadence Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

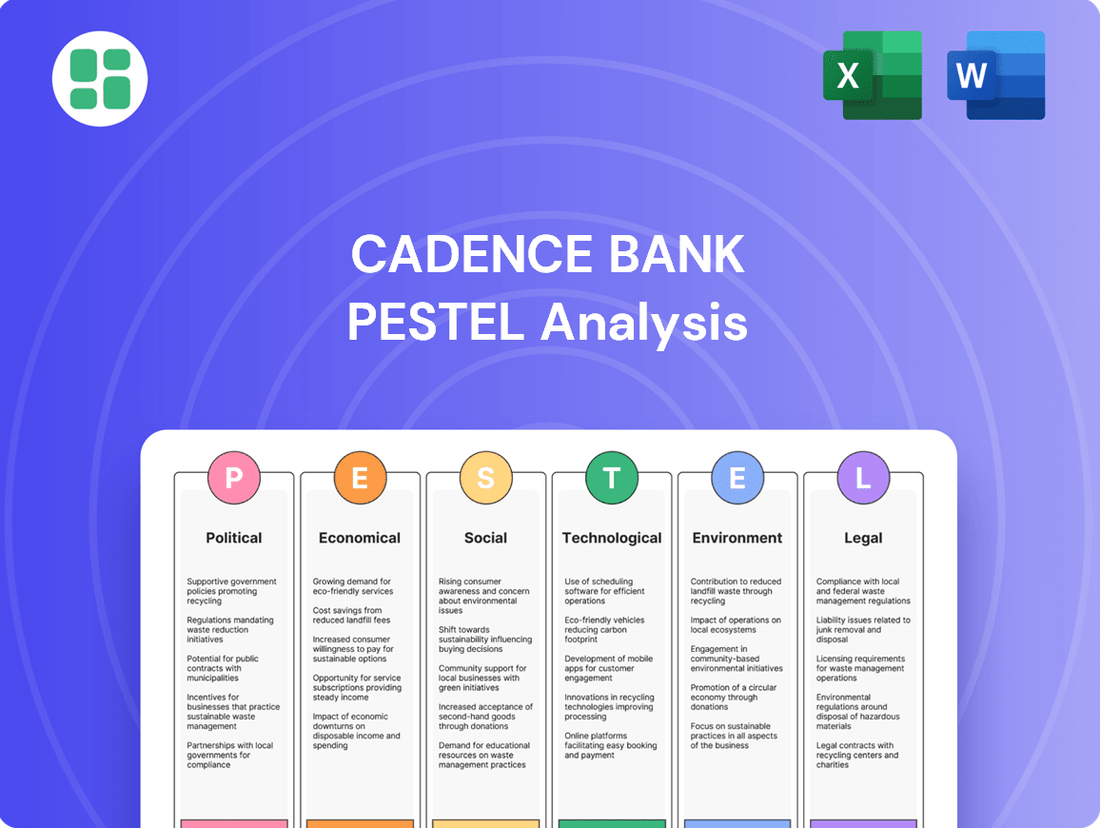

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cadence Bank's trajectory. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and make informed strategic decisions. Download the full version now to gain a crucial competitive advantage.

Political factors

Cadence Bank, like all financial institutions, navigates a complex web of government regulations and oversight. Federal bodies such as the Office of the Comptroller of the Currency (OCC) and the Federal Reserve, alongside state-level agencies, dictate operational parameters. For instance, the Dodd-Frank Act, enacted in 2010 and still influencing banking practices, imposed stricter capital requirements and enhanced consumer protection measures, directly impacting a bank's balance sheet and compliance costs.

Shifts in regulatory landscapes, whether through legislative action or evolving supervisory expectations, can significantly alter Cadence Bank's strategic direction and profitability. For example, changes to the Community Reinvestment Act (CRA) could influence lending priorities and community engagement strategies. As of early 2024, discussions around potential adjustments to capital adequacy ratios, particularly for mid-sized banks, highlight the ongoing dynamic nature of this regulatory environment.

The Federal Reserve's monetary policy, particularly its decisions on interest rates and quantitative easing, directly impacts Cadence Bank's profitability. Lower interest rates, while potentially squeezing net interest margins, can also stimulate borrowing, boosting loan origination volumes.

For regional banks like Cadence, a steeper yield curve, which is anticipated by many economists for 2025, could lead to improved net interest margins. Furthermore, a more stable or declining interest rate environment might also reduce the cost of deposits, offering another avenue for margin expansion.

Changes in corporate tax rates or specific banking taxes directly impact Cadence Bank's profitability and capital allocation strategies. For instance, the Tax Cuts and Jobs Act of 2017 significantly reduced the U.S. corporate tax rate from 35% to 21%, which positively affected many financial institutions, including Cadence Bank, by lowering their effective tax rate and increasing net income.

Anticipated tax policy shifts, such as potential adjustments to corporate tax rates or the introduction of new financial transaction taxes, could influence Cadence Bank's future earnings. A reduction in the corporate tax burden, if enacted, would likely improve the bank's bottom line, potentially freeing up capital for investments in digital transformation, cybersecurity, or expanding its loan portfolio, especially in key markets like Texas where it has a strong presence.

Political Stability and Geopolitical Tensions

Political stability within the Southern United States, particularly Texas, is a key driver for Cadence Bank's operational environment. In 2024, Texas continued to show robust economic growth, partly fueled by stable state governance and pro-business policies, which bolsters investor confidence. This stability directly impacts local economic conditions and the bank's ability to serve its client base effectively.

Broader geopolitical tensions, such as ongoing trade disputes or international conflicts, can create ripples throughout the financial sector. For instance, increased global uncertainty in late 2024 and early 2025 has led to higher market volatility, potentially affecting the performance of commercial clients' international operations and, consequently, their banking needs. This indirect impact necessitates careful risk management for institutions like Cadence Bank.

- Texas GDP Growth: Texas's GDP growth rate remained strong in 2024, outpacing the national average, indicating a stable and favorable business climate.

- Investor Confidence: Surveys of business leaders in the Southern US in early 2025 consistently reported high levels of confidence in the political stability of the region.

- Market Volatility Index (VIX): While fluctuating, the VIX saw periods of elevated readings in late 2024, reflecting broader geopolitical concerns impacting financial markets.

Government Support and Lending Programs

Government support, particularly through programs like Small Business Administration (SBA) loans, plays a crucial role in bolstering Cadence Bank's commercial lending. These initiatives directly fuel opportunities for the bank to expand its lending to small and mid-market businesses, thereby strengthening its market position.

Cadence Bank's commitment to this sector is evident. For instance, in 2023, the bank was recognized by the SBA for its significant lending volume, originating over $100 million in SBA 7(a) loans, a testament to its active participation in government-backed lending. This focus on small and middle-market businesses aligns with broader economic development policies, creating a favorable environment for the bank's growth.

The bank's strategic engagement with these programs is not just about volume; it's about fostering economic vitality. By actively participating in and being recognized for its excellence in small and mid-market banking, Cadence Bank leverages government support to drive its commercial portfolio forward, creating a win-win scenario for both the bank and the businesses it serves.

Political stability in key operating regions, particularly Texas, directly supports Cadence Bank's growth. Texas's GDP growth outpaced the national average in 2024, reflecting favorable pro-business policies. Investor confidence surveys in early 2025 indicated high regional political stability, bolstering the bank's operational outlook.

What is included in the product

This Cadence Bank PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on its operations, identifying key challenges and strategic advantages.

A concise Cadence Bank PESTLE analysis provides a clear roadmap to navigate external challenges, acting as a pain point reliever by offering actionable insights for strategic decision-making.

Economic factors

Interest rate movements are a critical economic factor for Cadence Bank, directly influencing its profitability through net interest income and the cost of its deposits. For instance, while rising rates can enhance income from loans, they simultaneously push up the bank's expenses for customer deposits.

The bank's net interest margin saw a positive trend, reaching 3.46% in the first quarter of 2025. This improvement was largely attributed to a decrease in the average cost of its interest-bearing deposits, showcasing the direct impact of rate management on core banking operations.

Inflation significantly impacts Cadence Bank by affecting customers' purchasing power and their willingness to take on new loans. For instance, if inflation remains elevated, consumers may reduce discretionary spending, which could dampen demand for personal loans and mortgages. Conversely, moderate inflation can sometimes encourage borrowing as individuals anticipate higher prices in the future.

Economic growth is a key driver for Cadence Bank's lending and asset management business. A robust economy typically means businesses are expanding and consumers are confident, leading to greater demand for commercial loans, real estate financing, and investment services. The U.S. economy is projected to carry momentum into 2025, although GDP growth is anticipated to slow down compared to previous periods.

For 2024, inflation in the U.S. has shown signs of moderation but remains a key concern for policymakers and businesses. The Federal Reserve's target for inflation is 2%. While specific forecasts for 2025 vary, many economists anticipate a continued cooling of price pressures, which could support economic expansion and create a more stable environment for banking operations.

Elevated unemployment rates directly threaten a bank's financial health. When more people are out of work, the likelihood of loan defaults rises significantly, directly impacting a bank's credit quality. This also means consumers have less disposable income, leading to reduced spending and lower revenue for retail banking operations.

The current economic climate, with total consumer debt reaching record highs, presents a substantial risk. As of early 2025, this trend suggests a heightened potential for increased credit delinquencies across the board. Regional banks, such as Cadence Bank, must maintain vigilant monitoring of these consumer debt levels to proactively manage potential impacts on their loan portfolios.

Real Estate Market Trends

The real estate market's condition significantly impacts Cadence Bank's loan business. A robust housing market can boost mortgage originations, especially if interest rates decline. For instance, the Federal Reserve's actions on interest rates throughout 2024 and into 2025 will be a key driver for mortgage demand.

However, the commercial real estate (CRE) sector presents ongoing challenges, particularly for office properties. Many regional banks, including those with exposure to CRE, are navigating this landscape. Data from late 2024 indicates persistent vacancy rates in many urban office markets, a trend that could continue into 2025, affecting loan performance.

Key real estate market considerations for Cadence Bank include:

- Residential Market Strength: Fluctuations in home prices and mortgage rates directly influence the volume and profitability of residential lending.

- Commercial Real Estate Performance: The health of the CRE sector, especially office and retail spaces, impacts commercial loan portfolios and potential defaults.

- Interest Rate Sensitivity: Changes in interest rates affect both borrower demand for new loans and the value of existing real estate assets.

- Economic Growth Impact: Broader economic conditions, influencing job growth and business expansion, are critical for both residential and commercial real estate demand.

Mergers and Acquisitions Activity

The banking sector's mergers and acquisitions (M&A) landscape is dynamic, presenting both avenues for growth and heightened competition for Cadence Bank. As of early 2024, the trend of consolidation among regional banks continues, often fueled by a desire to achieve greater scale, enhance technological capabilities, or expand market reach.

Cadence Bank has actively participated in this trend, having recently finalized strategic mergers that bolster its operational footprint and service offerings. For instance, the completion of its merger with Community Bancorporation, Inc. in late 2023, brought approximately $1.1 billion in assets into Cadence Bank.

- Increased M&A activity: Regional banks are consolidating to gain scale and technological advantages.

- Competitive pressure: Consolidation can create larger, more formidable competitors for Cadence Bank.

- Strategic growth: Cadence Bank's own recent mergers demonstrate a proactive approach to leveraging M&A for expansion.

- Market consolidation: The ongoing M&A trend reshapes the competitive environment within the banking industry.

Economic factors significantly shape Cadence Bank's operating environment, with interest rate fluctuations and inflation directly impacting its net interest margin and customer behavior. The U.S. economy is expected to slow in 2025, with inflation moderating but remaining a point of focus, which could influence loan demand and credit quality.

Unemployment rates and overall consumer debt levels pose risks, as higher joblessness and debt can lead to increased loan defaults and reduced consumer spending. The real estate market, particularly commercial properties, also presents challenges due to persistent vacancy rates, impacting loan portfolios.

Cadence Bank's strategic mergers, such as the one with Community Bancorporation, Inc. in late 2023, highlight the ongoing consolidation within the banking sector. This trend increases competition but also offers opportunities for growth and enhanced capabilities.

| Economic Factor | Impact on Cadence Bank | Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Affects net interest income and deposit costs | Net interest margin reached 3.46% in Q1 2025 |

| Inflation | Influences consumer spending and loan demand | Moderating but remains a concern; Fed target is 2% |

| Economic Growth | Drives lending and asset management business | Projected slowdown in GDP growth for 2025 |

| Unemployment | Increases risk of loan defaults | Elevated rates threaten credit quality |

| Consumer Debt | Heightens potential for credit delinquencies | Total consumer debt at record highs in early 2025 |

| Real Estate Market (CRE) | Impacts commercial loan portfolios | Persistent office vacancy rates in late 2024 |

Preview Before You Purchase

Cadence Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cadence Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic planning. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

Cadence Bank's operating regions, primarily the South and Texas, are experiencing significant demographic shifts. For instance, Texas alone saw a population growth of 1.6% in the year ending July 1, 2023, adding over 473,000 residents, a substantial portion of which are younger demographics. This influx, coupled with an aging population in some established Southern markets, directly impacts the demand for various banking services. Younger, growing populations often drive demand for mortgages and consumer loans, while an aging demographic may increase the need for wealth management and retirement planning services.

Consumers increasingly favor digital banking, with mobile and online platforms becoming the go-to for transactions. This shift directly influences Cadence Bank's strategic decisions regarding technology investments and its physical branch footprint. For instance, a 2024 J.D. Power study indicated that customer satisfaction with digital banking channels is rising, with a significant portion of banking activities now conducted remotely.

Banks like Cadence are responding by prioritizing the development of seamless digital experiences and omnichannel strategies. This means ensuring customers can easily transition between mobile apps, online portals, and in-person interactions, all while receiving consistent service. The goal is to offer a superior customer journey that meets evolving expectations for convenience and accessibility.

The increasing emphasis on financial education is directly impacting the demand for sophisticated wealth management services. As more individuals grasp financial concepts, they are more likely to seek out expert guidance for growing and preserving their assets, presenting a significant opportunity for institutions like Cadence Bank.

Data from the FINRA Investor Education Foundation's 2023 survey indicates that while financial literacy continues to be a concern, there's a noticeable uptick in individuals actively seeking financial advice. This trend suggests a growing market for personalized financial planning and investment management, areas where Cadence Bank can leverage its expertise.

Banks are increasingly recognizing the power of data analytics to offer tailored financial advice. By understanding customer behavior and financial goals, Cadence Bank can develop and promote wealth management solutions that resonate with specific client needs, fostering deeper relationships and driving revenue growth in this segment.

Public Trust and Brand Reputation

Public perception and trust are paramount for financial institutions like Cadence Bank, directly impacting its ability to attract and keep customers. A solid reputation built on reliability, robust security measures, and unwavering ethical conduct is non-negotiable, particularly within the fiercely competitive banking landscape.

In 2024, maintaining this trust is more critical than ever. For instance, a recent survey indicated that 68% of consumers consider a bank's reputation for security and trustworthiness as a primary factor when choosing where to bank. Cadence Bank's commitment to transparent communication and data protection directly addresses these concerns, aiming to solidify its standing.

- Customer Trust Metrics: Monitoring customer satisfaction scores and net promoter scores (NPS) provides ongoing insight into public perception.

- Brand Sentiment Analysis: Tracking social media mentions and news coverage helps gauge public sentiment towards Cadence Bank's actions and policies.

- Ethical Compliance: Demonstrating adherence to regulatory standards and ethical business practices reinforces a trustworthy image.

- Security Incident Response: Swift and transparent handling of any security breaches is vital for rebuilding and maintaining customer confidence.

Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility are rising, impacting how customers and employees perceive Cadence Bank. This growing emphasis on corporate citizenship means that banks demonstrating strong community outreach and financial support are viewed more favorably.

Cadence Bank's commitment to community engagement is a key factor in its social standing. For instance, in 2023, the bank reported investing over $14 million in community development initiatives and employee volunteer hours exceeding 30,000, directly addressing these evolving societal expectations.

- Community Investment: Cadence Bank's significant financial contributions to local non-profits and community projects bolster its social image.

- Employee Volunteerism: Encouraging employees to dedicate time to community service reinforces the bank's commitment beyond financial aid.

- Reputational Impact: Strong social responsibility efforts can translate into enhanced brand loyalty and a more positive public perception.

Societal shifts in financial behavior and expectations continue to shape the banking landscape. As digital adoption accelerates, a 2024 study by Deloitte found that 75% of consumers now prefer digital channels for routine banking tasks, influencing Cadence Bank's investment in user-friendly online platforms and mobile applications.

The growing emphasis on financial literacy is also a significant sociological factor. Data from the National Financial Educators Council in 2023 revealed that individuals with higher financial literacy are more likely to engage with wealth management services, creating an opportunity for Cadence Bank to expand its advisory offerings.

Public trust remains a cornerstone for financial institutions. A 2024 survey by PwC indicated that 70% of consumers prioritize a bank's reputation for security and ethical practices when making decisions, underscoring the importance of Cadence Bank's commitment to robust data protection and transparent operations.

Corporate social responsibility is increasingly influencing consumer choice. In 2023, a report by Cone Communications showed that 66% of consumers are willing to switch brands based on a company's social and environmental commitments, highlighting the positive impact of Cadence Bank's community engagement initiatives.

| Sociological Factor | Impact on Cadence Bank | Relevant Data (2023-2024) |

|---|---|---|

| Digital Banking Preference | Drives investment in online and mobile platforms. | 75% of consumers prefer digital channels for routine banking (Deloitte, 2024). |

| Financial Literacy Growth | Increases demand for wealth management services. | Higher financial literacy correlates with increased engagement in wealth management (NFEC, 2023). |

| Public Trust & Reputation | Requires strong security and ethical practices. | 70% of consumers prioritize security and ethics in bank choice (PwC, 2024). |

| Corporate Social Responsibility | Enhances brand loyalty and customer acquisition. | 66% of consumers switch brands based on social/environmental commitments (Cone Communications, 2023). |

Technological factors

Cadence Bank's commitment to digital transformation is crucial for staying ahead. In 2024, the banking sector saw continued investment in AI and machine learning to personalize customer interactions and streamline back-office operations. This focus on enhancing customer experience through robust online and mobile platforms, alongside seamless digital onboarding, directly addresses evolving consumer expectations for convenience and accessibility.

The drive for operational efficiency is another key technological factor. By implementing advanced analytics and automation, Cadence Bank can reduce costs and improve service delivery. For instance, many banks are leveraging robotic process automation (RPA) for tasks like data entry and account reconciliation, aiming for significant efficiency gains. This technological push ensures Cadence Bank remains competitive in a rapidly digitizing financial landscape, with a focus on integrated omnichannel experiences that bridge the gap between digital and physical touchpoints.

The escalating sophistication of cyber threats, such as ransomware and phishing attacks, presents a considerable risk to Cadence Bank. In 2023, the financial sector experienced a notable increase in cyber incidents, with reports indicating that the average cost of a data breach reached $4.45 million globally, a figure that underscores the financial and reputational stakes for institutions like Cadence.

Safeguarding sensitive customer financial data is absolutely critical for Cadence Bank, necessitating ongoing and substantial investments in cutting-edge threat detection systems and robust security protocols. The bank's commitment to cybersecurity is reflected in its technology spending, which is increasingly allocated to advanced encryption, multi-factor authentication, and continuous employee training to combat evolving digital dangers.

FinTech innovation is reshaping the banking landscape, presenting both competitive pressures and collaborative avenues for Cadence Bank. Emerging FinTech firms are rapidly introducing novel solutions in areas like digital payments, personal lending, and wealth management, forcing traditional institutions to adapt. For instance, the global FinTech market was projected to reach over $33 trillion by 2027, highlighting the significant disruption and potential for growth in this sector.

Regional banks, including Cadence, are increasingly recognizing the value of partnering with these agile FinTech companies. These collaborations allow banks to integrate cutting-edge technologies, enhance customer experiences, and expand their service offerings more efficiently than building everything in-house. This strategic approach enables them to offer innovative hybrid solutions that combine the trust and stability of a traditional bank with the speed and user-friendliness of FinTech platforms.

Artificial Intelligence (AI) and Automation

The banking sector, including institutions like Cadence Bank, is rapidly integrating artificial intelligence and automation to enhance operational efficiency and customer experience. AI powers advanced fraud detection systems and predictive analytics, allowing banks to better manage risk and forecast market trends. For instance, by 2025, the global AI in banking market is projected to reach significant figures, reflecting widespread adoption.

AI enables personalized financial advice and customer service, a key differentiator in today's competitive landscape. Cadence Bank can leverage AI to analyze vast amounts of customer data, identifying individual needs and offering tailored product recommendations or financial planning support. This data-driven approach improves customer engagement and loyalty.

Key areas of AI and automation impact in banking include:

- Enhanced Fraud Detection: AI algorithms can process transactions in real-time, identifying suspicious patterns with greater accuracy than traditional methods.

- Personalized Customer Experiences: AI-powered chatbots and virtual assistants provide instant support and personalized financial guidance.

- Streamlined Operations: Automation of routine tasks, such as data entry and loan processing, reduces costs and speeds up service delivery.

- Improved Risk Management: Predictive analytics help banks assess credit risk, market volatility, and operational vulnerabilities more effectively.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) present a transformative, albeit still developing, opportunity for the banking sector. While widespread adoption by regional banks like Cadence Bank may still be in its nascent stages, the potential impact on payments, securities settlement, and secure record-keeping is significant. For instance, in 2023, the global blockchain in banking market was valued at approximately $1.5 billion, with projections indicating substantial growth in the coming years, driven by increased efficiency and security. Keeping abreast of these advancements is vital for Cadence Bank's long-term strategic positioning, enabling them to explore future integration opportunities.

The implications of blockchain extend to areas such as faster cross-border payments and enhanced transparency in financial transactions. While Cadence Bank might not be leading the charge in large-scale blockchain implementations currently, the underlying principles of secure, decentralized record-keeping are being explored across the industry. For example, pilot programs for central bank digital currencies (CBDCs) are ongoing in various countries, hinting at a future where DLT could underpin core financial infrastructure. Monitoring these trends allows Cadence Bank to anticipate shifts in regulatory landscapes and customer expectations related to digital asset management and transaction processing.

Key areas where blockchain could influence banking operations include:

- Streamlined Payments: Enabling faster and cheaper domestic and international money transfers.

- Enhanced Security: Providing immutable and transparent transaction records, reducing fraud.

- Improved Record-Keeping: Offering a secure and efficient way to manage customer data and financial instruments.

- Potential for New Products: Opening avenues for digital asset custody and tokenized securities.

Cadence Bank's technological advancement hinges on embracing AI and automation for enhanced efficiency and customer engagement. The global AI in banking market is projected to see substantial growth, with estimates suggesting it could reach hundreds of billions of dollars by 2025, underscoring the widespread adoption of these technologies. This allows for personalized financial advice and improved risk management through predictive analytics.

Cybersecurity remains a paramount concern, with the financial sector facing increasingly sophisticated threats. In 2023, the average cost of a data breach globally was reported to be around $4.45 million, highlighting the critical need for robust security measures. Cadence Bank must continually invest in advanced encryption and threat detection systems to protect sensitive customer data.

FinTech innovation presents both challenges and opportunities, with the global FinTech market expected to exceed $33 trillion by 2027. Partnerships with FinTech firms can enable Cadence Bank to offer innovative hybrid solutions, integrating cutting-edge technologies to improve customer experience and expand service offerings.

Blockchain technology, while still developing, offers potential for streamlined payments and enhanced security, with the global blockchain in banking market valued at approximately $1.5 billion in 2023. Monitoring these advancements is crucial for Cadence Bank's long-term strategic positioning.

| Technology Area | Key Developments (2024-2025 Focus) | Impact on Cadence Bank | Market Data/Projections |

|---|---|---|---|

| Artificial Intelligence & Automation | AI-powered chatbots, predictive analytics for risk, fraud detection | Improved customer service, operational efficiency, better risk management | Global AI in banking market to reach significant figures by 2025 |

| Cybersecurity | Advanced encryption, multi-factor authentication, threat intelligence | Protection of sensitive data, maintaining customer trust, regulatory compliance | Average cost of data breach in 2023: ~$4.45 million globally |

| FinTech Integration | Digital payments, personalized lending platforms, wealth management tools | Enhanced product offerings, competitive edge, improved customer experience | Global FinTech market projected to exceed $33 trillion by 2027 |

| Blockchain & DLT | Exploration of secure payments, record-keeping, digital asset management | Potential for faster transactions, increased transparency, future-proofing | Global blockchain in banking market valued at ~$1.5 billion in 2023 |

Legal factors

Cadence Bank operates within a stringent regulatory framework, adhering to capital adequacy requirements like Basel III, which mandate specific risk-weighted asset ratios. For instance, as of Q1 2024, the US banking sector's average Common Equity Tier 1 (CET1) ratio remained robust, providing a buffer against potential economic shocks.

The evolving regulatory landscape in 2024 and 2025 presents ongoing challenges. Updates to the Community Reinvestment Act (CRA) are prompting banks to reassess their lending and investment strategies in low- and moderate-income communities, with new data collection and reporting requirements expected to be phased in.

Furthermore, intensified focus on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) necessitates continuous investment in compliance technology and personnel. Regulatory bodies are increasingly emphasizing the effectiveness of a bank's suspicious activity reporting (SAR) processes and the robustness of their customer due diligence (CDD) measures.

Consumer protection laws significantly shape Cadence Bank's operations, particularly in retail lending. Regulations like the Equal Credit Opportunity Act and the Fair Housing Act ensure fair lending practices, while truth-in-lending rules mandate transparent disclosures. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively enforcing these regulations, with fines levied against institutions for violations impacting consumer rights.

The evolving landscape of consumer data control, exemplified by the CFPB's Section 1033 concerning open banking, presents both challenges and opportunities for Cadence Bank. This rule aims to empower consumers by giving them greater access to and control over their financial data, potentially leading to increased competition and innovation in financial services. As of early 2024, discussions and rulemakings around open banking are ongoing, with significant implications for how financial institutions manage and share customer information.

Cadence Bank must adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate comprehensive systems for identifying and thwarting illegal financial transactions, a critical aspect of banking operations.

The regulatory landscape is evolving, with proposed updates in 2025 expected to further enhance and modernize AML and Counter-Financing of Terrorism (CFT) programs for financial institutions. This means Cadence Bank will need to continually adapt its compliance strategies.

Data Privacy Regulations

Cadence Bank must navigate an increasingly complex landscape of data privacy regulations. The emergence of state-specific laws, alongside federal initiatives like the Consumer Financial Protection Bureau's (CFPB) proposed rule on 'Personal Financial Data Rights,' demands robust data protection protocols. For instance, in 2024, several states expanded their data privacy rights, requiring businesses to be more transparent about data collection and usage, impacting how Cadence Bank manages customer information.

Compliance is not merely a legal obligation but a cornerstone of customer trust and brand reputation. Failure to adhere to these evolving mandates can result in significant financial penalties and reputational damage. In 2023, for example, data privacy violations led to fines totaling hundreds of millions of dollars across the financial sector, underscoring the financial risks associated with non-compliance.

- Evolving Regulations: State-level privacy laws and federal proposals like the CFPB's 'Personal Financial Data Rights' rule are reshaping data handling requirements.

- Customer Trust: Strict adherence to data privacy is essential for maintaining customer confidence and loyalty in the banking sector.

- Financial Penalties: Non-compliance can lead to substantial fines, as seen in numerous data privacy violation cases in recent years.

- Operational Impact: Cadence Bank needs to invest in secure data infrastructure and training to meet these stringent data protection standards.

Litigation and Legal Risks

Cadence Bank, like many financial institutions, navigates a landscape rife with potential litigation. These risks can stem from a variety of operational areas, including disputes over loan agreements, customer complaints, and instances of non-compliance with regulatory mandates. For example, as of early 2024, the banking sector continues to see active litigation surrounding loan servicing and foreclosure practices.

The evolving regulatory environment presents significant legal uncertainties. Challenges to new rules, such as those proposed or implemented by the Consumer Financial Protection Bureau (CFPB) regarding small business data collection (like the 1071 rule) or updates to the Community Reinvestment Act (CRA), create a dynamic and often unpredictable legal terrain for banks like Cadence. The CFPB's final rule for Section 1071 of the Dodd-Frank Act, requiring financial institutions to collect and report data on small business and women- or minority-owned business loan applications, is expected to be phased in starting in late 2024, with compliance deadlines varying by asset size, potentially leading to legal challenges during its implementation.

- Loan Disputes: Ongoing litigation concerning loan origination, servicing, and collection practices remains a persistent risk for banks.

- Consumer Complaints: A rise in consumer protection lawsuits, often related to fees, disclosures, or account management, can impact financial institutions.

- Regulatory Challenges: Legal battles over new or existing regulations, such as those impacting fair lending or data privacy, create significant compliance burdens and potential liabilities.

- CFPB's 1071 Rule Impact: The implementation of new data collection requirements for small business lending could trigger legal scrutiny and disputes regarding compliance and data accuracy.

Cadence Bank operates under a complex web of legal and regulatory mandates that significantly influence its operations and strategic planning. Compliance with these evolving rules is paramount, directly impacting financial performance and customer relations.

The bank must navigate stringent consumer protection laws, including fair lending practices and transparent disclosure requirements, with regulatory bodies like the CFPB actively enforcing these standards. Additionally, the increasing focus on data privacy, driven by state-level laws and federal proposals, necessitates robust data protection measures and strategic adaptation to new consumer rights concerning financial data access.

Furthermore, the bank faces potential litigation stemming from loan disputes, consumer complaints, and regulatory non-compliance. The implementation of new regulations, such as the CFPB's Section 1071 rule for small business lending data, introduces further legal complexities and compliance challenges, requiring continuous adaptation of internal processes.

| Legal Factor | Description | Impact on Cadence Bank | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| Consumer Protection Laws | Ensuring fair lending, transparent disclosures, and preventing predatory practices. | Requires adherence to strict operational guidelines, potential for fines and reputational damage from violations. | CFPB enforcement actions continue, with a focus on fee transparency and fair debt collection practices. |

| Data Privacy Regulations | Managing and protecting customer financial data in line with evolving state and federal laws. | Demands investment in secure data infrastructure, updated privacy policies, and compliance training. | Several states have enacted new data privacy laws in 2024, increasing complexity for multi-state financial institutions. |

| AML/KYC Compliance | Implementing robust systems to prevent financial crime and illicit transactions. | Requires ongoing investment in technology and personnel to detect and report suspicious activities effectively. | Regulatory focus intensifies on the effectiveness of Suspicious Activity Reports (SARs) and Customer Due Diligence (CDD). |

| Litigation Risks | Potential legal challenges related to loan agreements, customer service, and regulatory adherence. | Can result in significant financial costs from settlements, judgments, and legal fees. | Litigation trends in 2024 show continued disputes over loan servicing and regulatory compliance interpretation. |

Environmental factors

Climate change presents significant risks to Cadence Bank's loan portfolio. Regions where Cadence Bank operates are increasingly susceptible to extreme weather, directly impacting real estate values and the agricultural sector, key areas for lending.

For instance, the Gulf Coast, a significant market for Cadence, faces heightened risks from hurricanes and rising sea levels, potentially devaluing properties and disrupting agricultural businesses that form the collateral for many loans.

Financial institutions like Cadence Bank must proactively integrate environmental risk assessment into their existing frameworks. This involves developing sophisticated models to quantify potential losses from climate-related events and adjusting underwriting standards accordingly.

By 2024, the financial sector is seeing increased regulatory pressure to disclose climate-related financial risks, with institutions expected to demonstrate robust adaptation strategies to maintain long-term stability and investor confidence.

Investor and public appetite for sustainable finance surged in 2024, with global sustainable debt issuance projected to reach over $1.5 trillion by year-end. This trend presents a significant opportunity for Cadence Bank to expand its offerings in green loans, ESG-focused investment funds, and impact investing solutions, catering to a growing segment of environmentally conscious clients.

By embedding sustainability criteria into its core lending and investment strategies, Cadence Bank can tap into this expanding market. For instance, aligning loan portfolios with climate risk assessments and offering investment products that prioritize companies with strong environmental, social, and governance (ESG) performance directly addresses this demand, potentially attracting new capital and enhancing brand reputation.

The growing importance of Environmental, Social, and Governance (ESG) factors is pushing companies, including regional banks like Cadence Bank, towards more transparent reporting and strategic integration of sustainability. This trend is particularly evident as regulators increasingly mandate the disclosure of environmental impact, such as carbon footprints, and overall ESG performance. For instance, by the end of 2024, many financial institutions are expected to have robust systems in place to track and report their Scope 1, 2, and 3 emissions, a critical step in demonstrating commitment to environmental stewardship.

Operational Environmental Footprint

Cadence Bank is increasingly focusing on its own operational environmental footprint, recognizing that its energy consumption, waste management practices, and overall resource efficiency are under greater scrutiny. By actively working to reduce this footprint, the bank aims to bolster its public image and align with broader corporate sustainability objectives.

In 2023, for instance, many financial institutions reported on their Scope 1 and Scope 2 emissions. While specific Cadence Bank data for 2024 is still emerging, the industry trend shows a commitment to reducing energy use in branches and data centers. For example, many banks are investing in energy-efficient lighting and HVAC systems. Waste reduction programs, including increased recycling and reduced paper usage through digital transformation, are also key areas of focus.

- Energy Efficiency: Implementing LED lighting retrofits and optimizing HVAC systems across its branch network and corporate offices.

- Waste Reduction: Enhancing recycling programs and promoting digital document management to decrease paper consumption.

- Resource Management: Exploring opportunities for water conservation and sustainable procurement practices for office supplies and technology.

- Reporting Transparency: Increasing disclosure on environmental metrics to demonstrate progress and accountability to stakeholders.

Natural Disaster Preparedness

Cadence Bank, as a regional institution, faces significant environmental challenges, particularly concerning natural disaster preparedness. Operating across states like Texas, Louisiana, and Mississippi, the bank's infrastructure and customer base are exposed to risks such as hurricanes, floods, and severe storms. For instance, the Gulf Coast region, a key operational area for Cadence, consistently ranks high in hurricane activity. The 2024 Atlantic hurricane season is predicted to be above average, with NOAA forecasting 17-25 named storms, 8-13 hurricanes, and 4-7 major hurricanes, underscoring the ongoing threat.

Effective disaster preparedness is paramount for Cadence Bank's business continuity and financial stability. This involves robust plans for data backup and recovery, ensuring critical banking operations can resume quickly after an event. Protecting physical assets, including branches and data centers, through measures like floodproofing and reinforced construction is also vital. In 2023, the bank continued to invest in its disaster recovery capabilities, aiming to minimize downtime and maintain uninterrupted customer service during and after natural disasters.

The financial implications of natural disasters can be substantial, impacting loan portfolios through increased defaults and requiring significant capital for property repairs and business interruption. Cadence Bank's resilience strategy includes:

- Diversified Branch Network: Minimizing reliance on single geographic locations vulnerable to specific disaster types.

- Enhanced IT Infrastructure: Implementing cloud-based solutions and redundant data centers for improved accessibility and data security.

- Employee Training and Communication: Ensuring staff are prepared to respond effectively and communicate with customers during emergencies.

- Community Engagement: Participating in local disaster relief efforts and supporting community resilience initiatives.

Cadence Bank faces increasing pressure to disclose its environmental impact, with regulators in 2024 expecting robust tracking of emissions. The growing investor demand for sustainable finance, projected to exceed $1.5 trillion in global debt issuance by the end of 2024, offers opportunities for green lending and ESG-focused products.

The bank is also focusing on its own operational footprint, with initiatives in 2023 and 2024 targeting energy efficiency in branches and data centers, alongside waste reduction through digital transformation.

Environmental factors pose significant risks, particularly in the Gulf Coast region's susceptibility to hurricanes, impacting real estate and agricultural loan portfolios. Cadence Bank's disaster preparedness includes a diversified branch network and enhanced IT infrastructure to ensure business continuity.

| Environmental Factor | Impact on Cadence Bank | 2024 Projections/Trends |

|---|---|---|

| Climate Change & Extreme Weather | Risk to loan portfolio (real estate, agriculture) in vulnerable regions like the Gulf Coast. | NOAA forecast for 2024 Atlantic hurricane season: 17-25 named storms, 8-13 hurricanes, 4-7 major hurricanes. |

| Regulatory Pressure & Disclosure | Mandates for reporting environmental impact (e.g., carbon footprints) and ESG performance. | Expectation for financial institutions to have systems for tracking Scope 1, 2, and 3 emissions by year-end 2024. |

| Sustainable Finance Demand | Opportunity for green loans, ESG funds, and impact investing solutions. | Global sustainable debt issuance projected to exceed $1.5 trillion by end of 2024. |

| Operational Footprint | Scrutiny on energy consumption, waste management, and resource efficiency. | Industry trend towards energy-efficient retrofits (LED lighting, HVAC) and digital document management. |

PESTLE Analysis Data Sources

Our Cadence Bank PESTLE analysis is grounded in data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.