BYD Electronic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BYD Electronic Bundle

Navigate the complex external forces shaping BYD Electronic's trajectory with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements that are critical for strategic decision-making. Download the full version now to gain actionable intelligence and secure your competitive advantage.

Political factors

Governments globally are actively pushing for electric vehicle (EV) adoption and green tech through policies and subsidies, a clear boon for BYD Electronic. China, BYD's home turf, has been particularly aggressive, with substantial incentives fueling its EV market leadership. For instance, in 2023, China's NEV (New Energy Vehicle) sales surpassed 9.5 million units, a significant jump from previous years, directly benefiting companies like BYD.

These supportive measures, ranging from purchase tax exemptions to charging infrastructure development, create a fertile ground for both EV production and consumer uptake. This policy-driven environment not only lowers barriers to entry for consumers but also encourages BYD to scale its manufacturing capabilities, solidifying its competitive edge in a rapidly expanding market.

Geopolitical friction, especially between the United States and China, presents a considerable hurdle for BYD Electronic's international growth and its intricate supply network. The imposition of tariffs, such as those impacting electric vehicles and electronic parts, directly escalates export expenses and restricts entry into vital markets like the US and Europe.

For instance, US tariffs on Chinese goods have fluctuated, with specific rates on electronics and automotive components impacting import costs. BYD's strategic response involves building manufacturing plants in diverse international locations, a move aimed at navigating these trade complexities and ensuring a more resilient global presence.

Global emissions standards are becoming stricter, a trend that directly benefits BYD Electronic. For instance, the European Union's CO2 emission targets for new cars are set to decrease significantly, aiming for a 55% reduction by 2030 compared to 1990 levels, and a 100% reduction by 2035. This regulatory push strongly favors electric and hybrid vehicles, the very segment where BYD's intelligent automotive systems are crucial.

BYD must continually innovate to keep pace with these evolving regulations. The company's investment in research and development is key to ensuring its automotive intelligent systems meet and exceed these increasingly stringent environmental requirements. This proactive approach positions BYD to capitalize on the growing demand for cleaner transportation solutions.

Local Government Partnerships and Investment Climate

BYD Electronic's success is closely tied to its ability to collaborate with local governments. These partnerships are vital for securing land for new factories and for implementing large-scale projects like electric bus deployments. For instance, BYD's expansion into Europe, including a significant investment in a new battery plant in Hungary, highlights the importance of local government cooperation in establishing a strong manufacturing presence and gaining market acceptance.

Political stability is a cornerstone for BYD's investment strategies. Fluctuations in government policies or political unrest in key operational regions can directly affect the company's investment decisions and overall growth trajectory. BYD's ongoing commitment to localization efforts, such as the aforementioned Hungarian facility, underscores its strategy to mitigate risks associated with policy changes and to better align with regional market demands.

- BYD's European Expansion: BYD announced a significant investment of over €700 million for its first European passenger car factory in Szeged, Hungary, creating thousands of jobs and signaling a major step in localizing production.

- Government Support for EVs: Many governments worldwide are offering substantial subsidies and tax incentives for electric vehicle adoption, which directly benefits BYD's sales and market penetration. For example, China's NEV (New Energy Vehicle) sales reached 9.5 million units in 2023, a 36% increase year-on-year, driven by supportive policies.

- Trade Relations: The company's global operations are also influenced by international trade agreements and potential tariffs, which can impact the cost-effectiveness of its supply chain and final product pricing in different markets.

Intellectual Property Protection Policies

BYD Electronic's reliance on innovation makes the strength and enforcement of intellectual property (IP) protection policies a significant political consideration across its global operations. The company's substantial investment in R&D, evidenced by its thousands of patent filings annually, directly benefits from strong IP frameworks that prevent unauthorized replication of its advanced technologies. For instance, BYD's commitment to electric vehicle and battery technology development means that robust patent enforcement in key markets like China and Europe is crucial for maintaining its competitive advantage and recouping its innovation investments. Weak IP enforcement in any of its operating regions could expose BYD to significant risks, potentially leading to market share erosion as competitors leverage its proprietary advancements without incurring similar development costs.

The varying degrees of IP protection and enforcement across different countries present a complex political landscape for BYD Electronic. Regions with well-established and rigorously enforced IP laws offer a more secure environment for BYD's technological assets, encouraging continued investment in cutting-edge research. Conversely, markets with weaker legal protections and inconsistent enforcement pose a greater risk of IP theft or infringement. BYD's strategy likely involves prioritizing markets with stronger IP safeguards for its most sensitive innovations, while potentially adapting its product rollout or technology sharing strategies in regions where IP enforcement is less reliable. This approach is essential for safeguarding its long-term market position and profitability.

Intellectual property protection is particularly critical for BYD Electronic in the rapidly evolving fields of new energy vehicles and advanced battery technologies. The company has consistently been a leader in patent applications within these sectors, with reports indicating significant growth in its patent portfolio year-over-year. For example, in 2023, BYD's patent filings related to battery management systems and electric powertrain components saw a notable increase, underscoring the importance of safeguarding these innovations. The effectiveness of IP laws in regions where BYD manufactures and sells its products directly impacts its ability to prevent competitors from legally or illegally copying its patented technologies, thereby protecting its market share and profitability.

Government incentives and regulations significantly shape BYD's operational landscape, particularly in the electric vehicle sector. Policies promoting EV adoption, such as subsidies and tax breaks, directly boost sales and encourage manufacturing expansion. For instance, China's continued support for new energy vehicles, with sales exceeding 9.5 million units in 2023, provides a strong domestic market advantage.

Conversely, geopolitical tensions and trade policies, including tariffs on goods between major economies like the US and China, create complexities for BYD's global supply chain and market access. The company's strategy to mitigate these risks involves establishing manufacturing bases in diverse international locations, such as its significant investment in a new battery plant in Hungary, aiming to navigate trade barriers and ensure supply chain resilience.

Stricter global emissions standards, like the European Union's targets for reduced CO2 emissions, create a favorable environment for BYD's electric and hybrid vehicle offerings, necessitating continuous innovation in its intelligent automotive systems to meet and exceed these environmental requirements.

Intellectual property (IP) protection is paramount for BYD's innovation-driven business model. Robust IP enforcement in key markets is crucial for safeguarding its technological advancements in areas like battery management systems and electric powertrains, as evidenced by BYD's consistent growth in patent filings related to these technologies.

| Political Factor | Impact on BYD Electronic | Supporting Data/Examples |

|---|---|---|

| Government Incentives for EVs | Boosts sales and market penetration | China's NEV sales reached 9.5 million units in 2023, a 36% year-on-year increase, driven by supportive policies. |

| Geopolitical Tensions & Tariffs | Increases export costs and restricts market access | US tariffs on Chinese goods impact import costs for electronics and automotive components. |

| Stricter Emissions Standards | Favors BYD's EV and hybrid offerings | EU aims for a 55% CO2 reduction by 2030, increasing demand for electric vehicles. |

| Intellectual Property (IP) Protection | Safeguards technological advancements and competitive edge | BYD's patent filings in battery management and electric powertrains saw a notable increase in 2023. |

What is included in the product

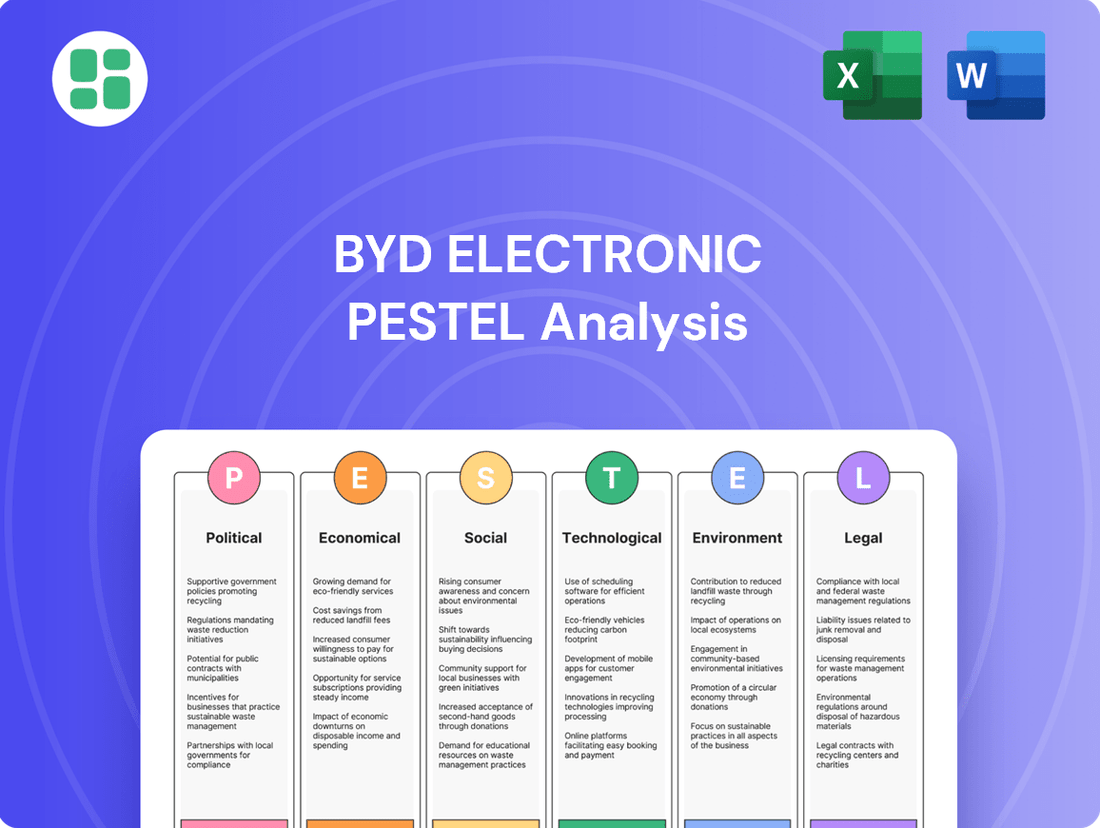

This BYD Electronic PESTLE analysis comprehensively examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic positioning.

It provides actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities.

Provides a clear, concise summary of BYD Electronic's PESTLE factors, simplifying complex external influences to alleviate the pain of strategic uncertainty.

Offers a readily digestible overview of BYD Electronic's PESTLE landscape, acting as a pain point reliever by enabling swift understanding of market dynamics for agile decision-making.

Economic factors

Global economic downturns and persistent inflation can significantly erode consumer purchasing power, directly impacting demand for BYD Electronic's smart devices and new energy vehicles. For instance, rising inflation rates in major markets throughout 2024 and early 2025 are likely to make consumers more hesitant to invest in high-ticket items like EVs and advanced electronics.

The broader economic climate, including interest rate policies and employment figures, directly influences discretionary spending on premium electronics and sophisticated automotive intelligent systems. A slowdown in global GDP growth projected for late 2024, coupled with potential increases in unemployment in key regions, could dampen sales volumes for BYD Electronic.

In such an uncertain economic landscape, maintaining competitive pricing strategies is paramount for BYD Electronic to retain market share and ensure sustained profitability. The company will need to carefully balance cost management with pricing adjustments to remain attractive to consumers facing economic pressures.

BYD Electronic's deeply integrated supply chain, encompassing battery production, places it directly in the path of raw material price swings. Key components like lithium, cobalt, and nickel are subject to considerable volatility, which directly affects BYD's production costs and ultimately its profitability. For instance, lithium carbonate prices, a crucial element in EV batteries, saw significant fluctuations in 2023, with some benchmarks experiencing drops of over 50% from their 2022 peaks, showcasing the dynamic nature of these costs.

Currency exchange rates significantly affect BYD Electronic, a global player with substantial overseas sales. For instance, if BYD's home currency strengthens, its products become pricier for international buyers, potentially dampening export demand. Conversely, a weaker home currency increases the cost of imported components crucial for its manufacturing processes.

In the first half of 2024, BYD reported that foreign exchange gains and losses had a notable impact on its financial results. Effective management of these currency fluctuations through hedging strategies is therefore critical for maintaining financial stability and predictable earnings in its diverse international markets.

Competitive Pricing Pressure

BYD Electronic faces intense competitive pricing pressure in both the electric vehicle (EV) and smart device sectors, especially within the highly dynamic Chinese market. This environment necessitates aggressive pricing strategies to capture market share and drive sales volume, a tactic that can significantly impact profit margins and strain relationships with suppliers who may also be under pressure.

For instance, in the EV market, BYD's direct competitors, including domestic players like NIO and XPeng, along with international giants such as Tesla and Volkswagen, are constantly vying for consumer attention through competitive pricing. This is evident in BYD's own pricing strategies, where models like the BYD Seal often compete directly on price with comparable vehicles from other manufacturers. In the smart device arena, the proliferation of affordable, feature-rich smartphones and other electronics from brands like Xiaomi and Honor further intensifies this pressure.

The challenge for BYD Electronic lies in striking a delicate balance: maintaining competitive pricing to remain attractive to consumers while ensuring sustainable profitability. This requires meticulous cost management, efficient supply chain operations, and continuous innovation to offer superior value rather than simply competing on price alone. The ability to manage these competing demands will be crucial for BYD Electronic's long-term success and financial health.

- Intense Competition: BYD Electronic operates in highly competitive EV and smart device markets, particularly in China.

- Pricing Pressure Impact: Aggressive pricing strategies to boost sales can negatively affect profit margins and supplier relationships.

- Balancing Act: The company must carefully balance competitive pricing with the need for sustainable profitability.

- Market Dynamics: Competitors like Tesla, NIO, and Xiaomi exert significant pressure through their own pricing strategies.

Investment Trends in Renewable Energy

The global shift towards sustainability is a significant economic driver for BYD Electronic. Governments worldwide are channeling substantial funds into green initiatives, creating a fertile ground for companies like BYD that are deeply involved in renewable energy solutions. For instance, the International Energy Agency (IEA) reported that global investment in clean energy reached a record $2 trillion in 2023, a figure projected to climb further in 2024 and 2025.

This surge in investment directly benefits BYD's core businesses, particularly its energy storage systems and the intelligent systems powering electric vehicles. As countries aim to decarbonize their grids and transportation sectors, the demand for advanced battery technology and integrated vehicle electronics, areas where BYD excels, is expected to skyrocket. BYD's own financial reports often highlight the growing contribution of its new energy vehicles and energy storage segments to its overall revenue, underscoring the economic tailwinds.

- Record clean energy investments: Global investment in clean energy surpassed $2 trillion in 2023, with continued growth anticipated through 2025, according to the IEA.

- Electric mobility expansion: The global electric vehicle market is projected to grow significantly, with sales expected to reach over 15 million units in 2024, presenting a massive opportunity for BYD's automotive segment.

- Energy storage demand: The need for grid-scale energy storage solutions is escalating to support renewable energy integration, a key market for BYD's battery technologies.

Economic factors significantly shape BYD Electronic's operational landscape, influencing everything from consumer spending to raw material costs. Persistent inflation throughout 2024 and into 2025 continues to challenge consumer purchasing power, particularly for higher-priced items like electric vehicles and advanced electronics, potentially slowing sales growth. Global economic slowdowns, as indicated by projected GDP growth figures for late 2024, further exacerbate this by impacting discretionary spending and overall market demand.

BYD Electronic's profitability is also directly tied to the volatility of raw material prices, such as lithium and cobalt, which are essential for battery production. For example, lithium carbonate prices experienced substantial fluctuations in 2023, highlighting the ongoing cost pressures faced by the company. Furthermore, currency exchange rates play a critical role, with foreign exchange gains and losses noted in BYD's first-half 2024 financial results, underscoring the need for robust hedging strategies.

| Economic Factor | Impact on BYD Electronic | Data Point/Trend (2024-2025) |

|---|---|---|

| Inflation | Reduces consumer purchasing power, impacting demand for high-ticket items. | Persistent inflation in major markets throughout 2024-2025. |

| Global GDP Growth | Dampens overall market demand and discretionary spending. | Projected slowdown in global GDP growth for late 2024. |

| Raw Material Prices | Affects production costs and profitability (e.g., lithium, cobalt). | Lithium carbonate prices saw over 50% drops from 2022 peaks in 2023. |

| Currency Exchange Rates | Impacts international sales revenue and import costs. | Notable impact on financial results reported in H1 2024. |

Same Document Delivered

BYD Electronic PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of BYD Electronic.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a detailed breakdown of BYD Electronic's PESTLE factors.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable PESTLE analysis for BYD Electronic.

Sociological factors

Growing environmental awareness is a significant tailwind for BYD Electronic. Consumers are actively seeking out sustainable and eco-friendly products, and this trend is particularly pronounced in the automotive sector. BYD's strong position in new energy vehicles (NEVs) directly benefits from this shift. For instance, BYD reported selling over 3 million NEVs in 2023, a substantial increase from previous years, demonstrating robust consumer adoption of their greener alternatives.

Societal trends are increasingly favoring shared mobility and public transit over private car ownership, a significant shift impacting BYD's market. For instance, in 2024, ride-sharing services saw continued growth, with major platforms reporting double-digit percentage increases in user engagement in key urban centers across Europe and Asia.

Rapid urbanization further amplifies this trend, as densely populated cities worldwide are actively promoting electric vehicles and efficient public transportation to combat air pollution and traffic congestion. Cities like Shenzhen, BYD's home base, have already achieved a 100% electrification of their public bus fleets, demonstrating a clear market demand for BYD's transit solutions.

These shifts create substantial opportunities for BYD to expand its portfolio beyond individual electric cars, focusing on integrated urban mobility solutions. The company's electric buses and autonomous shuttles are well-positioned to capitalize on this growing demand for sustainable and efficient urban transportation networks.

Consumer trust is paramount for BYD Electronic, particularly concerning the safety and quality of its electric vehicles (EVs). A strong reputation for reliability, coupled with innovative technology and excellent customer support, directly impacts consumer choices and fosters brand loyalty. For instance, BYD's commitment to battery safety, a key concern for EV buyers, has been a significant factor in its global expansion. In 2023, BYD reported a 62% increase in global sales, reaching over 3 million vehicles, underscoring the growing consumer confidence in their offerings.

Labor Market Trends and Workforce Development

The availability of skilled labor and effective talent retention are crucial sociological considerations for BYD Electronic. With a global workforce approaching one million employees, a significant portion of whom are engaged in research and development, maintaining a stable and innovative workforce is paramount. BYD's commitment to employee development and ensuring fair labor practices directly impacts its capacity for sustained innovation and operational efficiency.

BYD Electronic's substantial investment in its workforce, particularly in R&D personnel, underscores the importance of labor market trends. As of late 2023, the company's workforce exceeded 600,000 employees, with a substantial segment focused on technological advancement and product development. This focus necessitates continuous efforts in training and upskilling to meet the evolving demands of the electronics and automotive sectors.

- Skilled Labor Availability: BYD Electronic relies heavily on a deep pool of engineers and technical specialists, making access to qualified talent a key factor in its growth strategy.

- Talent Retention: The company's significant R&D investment means retaining experienced personnel is vital to protect intellectual property and maintain a competitive edge.

- Workforce Development: Ongoing training programs and career advancement opportunities are essential for fostering innovation and ensuring employee engagement across BYD's vast global operations.

Digital Lifestyle and Smart Device Integration

The pervasive shift towards a digital lifestyle directly fuels demand for BYD Electronic's diverse product portfolio, from smartphones to emerging intelligent devices. This trend is underscored by the growing expectation for seamless connectivity and advanced features across all consumer electronics. For instance, global smartphone shipments reached an estimated 1.2 billion units in 2024, reflecting this deep integration into daily routines.

Consumers increasingly seek devices that offer sophisticated AI capabilities and intuitive user interfaces, pushing manufacturers like BYD Electronic to innovate. This societal preference for smart, interconnected experiences is a key driver for BYD's strategic investments in areas like smart vehicle technology, where seamless integration is paramount.

- Digital Lifestyle Growth: The percentage of the global population with internet access is projected to exceed 70% by 2025, highlighting the expanding digital consumer base.

- Smart Device Penetration: By the end of 2024, the number of connected IoT devices worldwide was estimated to be over 29 billion, showcasing the widespread adoption of smart technology.

- Consumer Expectations: Surveys in late 2024 indicated that over 60% of consumers prioritize AI-driven features and seamless integration when purchasing new electronic devices.

- BYD's Alignment: BYD Electronic's focus on developing smart connectivity solutions for its electric vehicles and consumer electronics directly addresses these evolving societal demands.

Societal shifts towards sustainability and electric mobility are a strong tailwind for BYD Electronic. Consumers are increasingly prioritizing eco-friendly options, a trend BYD capitalizes on with its extensive range of new energy vehicles (NEVs). The company's commitment to battery technology and safety has fostered significant consumer trust, reflected in its substantial global sales growth. For instance, BYD's NEV sales surpassed 3 million units in 2023, a testament to growing consumer confidence in their greener alternatives.

The increasing adoption of shared mobility and public transit over private ownership presents a key opportunity for BYD. As urban centers worldwide focus on reducing congestion and pollution, demand for BYD's electric buses and integrated transit solutions is on the rise. Cities like Shenzhen, BYD's home base, have already achieved 100% electrification of their public bus fleets, showcasing a clear market for these sustainable transportation networks.

BYD Electronic's success is also tied to its substantial workforce, with over 600,000 employees as of late 2023, many focused on R&D. The company's investment in talent development and retention is crucial for maintaining its innovative edge and operational efficiency in the competitive electronics and automotive sectors.

The pervasive digital lifestyle trend directly benefits BYD's diverse product offerings, from smartphones to smart devices. Growing consumer expectations for seamless connectivity and AI-driven features are driving demand for BYD's smart vehicle technology and consumer electronics. By the end of 2024, the number of connected IoT devices globally was estimated to exceed 29 billion, indicating the widespread adoption of smart technology.

Technological factors

BYD Electronic's commitment to research and development is a cornerstone of its strategy, with significant investments fueling innovation across its product lines. The company consistently allocates substantial resources to its R&D efforts, recognizing that continuous improvement is vital to staying ahead in the fast-paced electronics and automotive sectors. This dedication ensures BYD Electronic remains at the forefront of technological advancements.

In 2023, BYD reported a remarkable 112.7% year-on-year increase in its R&D expenditure, reaching 30.27 billion RMB. This substantial investment underscores their focus on developing core technologies, particularly in areas like battery technology, intelligent vehicle systems, and advanced semiconductor manufacturing. Such a strong financial commitment translates directly into a pipeline of cutting-edge products and solutions designed to meet evolving market demands.

The company's extensive R&D infrastructure, boasting a large team of dedicated scientists and engineers, is instrumental in translating these investments into tangible innovations. Their work spans critical domains such as next-generation battery chemistries, autonomous driving algorithms, and the development of novel materials that enhance product performance and sustainability. This relentless pursuit of innovation is what allows BYD Electronic to consistently introduce groundbreaking technologies to the market.

BYD Electronic's prowess in battery manufacturing, particularly its pioneering work with advanced chemistries and the exploration of solid-state batteries, represents a significant technological edge. These innovations are crucial for improving electric vehicle (EV) performance, offering higher energy density and quicker charging capabilities, which directly translates to more appealing consumer products.

This in-house technological development not only solidifies BYD's position as an industry leader but also significantly de-risks its supply chain by reducing dependence on external battery providers. For instance, BYD's Blade Battery technology, introduced in 2020, has been a key differentiator, boasting enhanced safety and longevity, and BYD continues to invest heavily in R&D for next-generation battery solutions, aiming to maintain its competitive advantage in the rapidly evolving EV market.

BYD Electronic is significantly advancing its product offerings through the integration of artificial intelligence (AI) and smart connectivity. This technological push is evident in their development of AI-powered driver assistance systems and sophisticated smart cockpits, aiming to create a more intuitive and safer user experience. BYD's commitment is underscored by substantial investments in AI and large language models, positioning them to be a leader in automotive intelligence.

Vertical Integration and Manufacturing Technology

BYD Electronic's commitment to vertical integration, from its own semiconductor production to final assembly, is a significant technological advantage. This approach allows them to maintain stringent quality control and optimize production efficiency. For instance, BYD's in-house chip manufacturing capabilities, particularly for power semiconductors, helped them navigate the global chip shortage experienced through 2023 and into 2024, ensuring consistent supply for their electric vehicle and electronics divisions.

This deep integration into manufacturing technology enables BYD to respond swiftly to market demands and technological shifts. Their advanced battery production facilities, utilizing technologies like the Blade Battery, showcase their manufacturing prowess. In 2024, BYD continued to invest heavily in R&D and manufacturing upgrades, aiming to further enhance automation and yield rates across their production lines, contributing to their competitive pricing strategy.

- Semiconductor Independence: BYD's in-house chip production, particularly for power management ICs, reduces reliance on external suppliers, a critical factor during global supply chain disruptions in 2023-2024.

- Advanced Battery Manufacturing: The company's proprietary Blade Battery technology, produced through highly automated and efficient manufacturing processes, underpins its leadership in the EV market.

- Cost Control and Quality Assurance: Vertical integration allows BYD to directly manage and improve production costs and maintain high-quality standards throughout the manufacturing process.

Autonomous Driving and Intelligent Systems Development

The evolution of autonomous driving and intelligent systems presents a dual-edged sword for BYD Electronic. Mastering these advanced technologies is crucial for BYD to stand out in both the consumer electronics and automotive markets, driving future product innovation and competitiveness.

BYD's commitment to integrating smart driving features across its entire vehicle range by 2025 underscores the strategic importance of this technological shift. This ambitious target requires substantial investment and expertise in areas like AI, sensor technology, and advanced software development.

- Opportunity: Enhanced vehicle safety, improved driving experience, and new revenue streams through advanced driver-assistance systems (ADAS) and fully autonomous capabilities.

- Challenge: High research and development costs, the need for specialized talent, and navigating complex regulatory environments for autonomous vehicle deployment.

- BYD's Goal: To equip its full product line with smart driving features by 2025, aiming for market leadership in intelligent vehicle technology.

BYD Electronic's technological prowess is a key driver of its success, particularly in battery technology and intelligent systems. Their significant R&D investments, exemplified by a 112.7% surge in expenditure in 2023 to 30.27 billion RMB, highlight a commitment to innovation in areas like advanced battery chemistries and AI integration for vehicles.

The company's vertical integration, including in-house semiconductor manufacturing, provides a crucial advantage, especially during global chip shortages experienced through 2023 and into 2024. This control over key components like power semiconductors ensures supply chain stability and quality assurance for their expanding electric vehicle and electronics portfolios.

BYD's focus on smart driving features and autonomous capabilities, with a goal to equip its entire product line by 2025, positions it to capitalize on the evolving automotive landscape. This technological ambition, however, comes with substantial R&D costs and the need for specialized talent to navigate the complexities of advanced vehicle systems.

| Technology Area | Key Innovation/Focus | Impact/Advantage | 2023 R&D Investment (RMB) |

|---|---|---|---|

| Battery Technology | Blade Battery, Advanced Chemistries, Solid-State Exploration | Enhanced EV performance, safety, and charging; supply chain de-risking | 30.27 Billion (Total BYD R&D) |

| Intelligent Systems | AI-powered ADAS, Smart Cockpits, Autonomous Driving | Improved user experience, vehicle safety, potential new revenue streams | Significant portion of total R&D |

| Semiconductor Manufacturing | In-house Power Semiconductors | Supply chain resilience during shortages (2023-2024), cost control, quality | Integral to vertical integration strategy |

Legal factors

BYD Electronic faces significant legal hurdles with evolving data privacy and cybersecurity regulations worldwide. The company must navigate frameworks like the EU's General Data Protection Regulation (GDPR) and China's Personal Information Protection Law (PIPL), which impose strict requirements on handling customer data. Failure to comply can result in substantial fines, impacting financial performance and brand reputation.

The increasing integration of smart technologies in BYD's electronic products, particularly in automotive intelligent systems, amplifies these legal obligations. Protecting sensitive user information is paramount, as breaches can erode consumer trust, a critical asset for any technology firm. The company's commitment to robust cybersecurity measures is not just a technical necessity but a legal imperative.

Data security risks extend throughout BYD's supply chain, demanding rigorous oversight and adherence to legal standards at every stage. For instance, in 2023, data breaches globally cost an average of $4.45 million, highlighting the financial and legal ramifications of inadequate security protocols that BYD must actively mitigate.

Protecting BYD Electronic's vast array of patents and intellectual property is paramount to safeguarding its market position. The company's commitment to innovation is reflected in its continuous global patent filings, with legal frameworks for IP enforcement being crucial to deterring infringement and fostering a level playing field. In 2023, BYD reported R&D expenses of 20.4 billion RMB, underscoring its investment in new technologies and the importance of IP protection.

BYD Electronic navigates a complex web of product safety and quality standards, crucial for its global smartphone, laptop, and automotive system operations. Meeting these diverse international regulations, such as those set by the EU's CE marking or the US's FCC certification, is paramount for market access and brand reputation.

Failure to comply can lead to costly product recalls, significant legal penalties, and damage to consumer trust. For instance, in 2024, the automotive sector saw increased scrutiny on battery safety, impacting electric vehicle manufacturers like BYD.

Consequently, BYD Electronic invests heavily in continuous product testing and certification processes to ensure its offerings meet or exceed these dynamic, often stringent, global benchmarks, a commitment vital for sustained market presence and risk management.

Labor Laws and Employment Regulations

BYD Electronic must navigate a complex web of labor laws across its global operations, encompassing fair wages, safe working conditions, and equitable employment practices. Compliance is paramount for maintaining a stable workforce and avoiding costly legal entanglements, reinforcing BYD's commitment to corporate social responsibility. For instance, as of late 2024, BYD Electronic reported employing over 600,000 individuals worldwide, highlighting the scale of its labor compliance obligations.

Adherence to these regulations directly impacts operational continuity and brand reputation. By investing in employee development and implementing share ownership plans, BYD Electronic aims to foster a motivated and loyal workforce, mitigating risks associated with labor disputes and high turnover. This focus on employee well-being is a strategic imperative for a company of BYD's size and global reach.

- Global Workforce Management: BYD Electronic's workforce exceeding 600,000 employees necessitates stringent adherence to diverse international labor standards in 2024.

- Risk Mitigation: Compliance with fair wage and working condition laws prevents legal challenges and enhances BYD's social license to operate.

- Employee Engagement: Investments in employee development and share ownership plans are key strategies to ensure workforce stability and productivity.

Anti-Trust and Fair Competition Laws

BYD Electronic, as a major global player, navigates a complex web of anti-trust and fair competition regulations across its operating markets. These legal frameworks are designed to prevent monopolistic behavior, predatory pricing, and other unfair business tactics that could stifle innovation and harm consumers. For instance, in 2024, the European Union continued its scrutiny of large tech firms, with investigations into potential anti-competitive practices impacting market dynamics. Failure to adhere to these regulations can result in substantial financial penalties and significant damage to a company's reputation.

Compliance with these laws is not merely a legal obligation but a strategic imperative for BYD Electronic. The company must ensure its pricing strategies, supply chain agreements, and market conduct are transparent and do not create undue barriers to entry for competitors. This proactive approach helps maintain market access and fosters trust with regulators and customers alike. The ongoing enforcement actions by bodies like the US Federal Trade Commission in 2024 underscore the importance of robust compliance programs.

- Global Regulatory Landscape: BYD Electronic must comply with anti-trust legislation in key markets like the EU, US, and China, which vary in their specific enforcement priorities.

- Market Dominance Concerns: As BYD Electronic expands its market share in areas such as electric vehicles and consumer electronics, it faces increased scrutiny regarding potential monopolistic tendencies.

- Compliance Costs: Maintaining adherence to these evolving legal requirements necessitates ongoing investment in legal counsel, internal audits, and compliance training programs.

- Reputational Risk: A violation of anti-trust laws can lead to severe penalties, including significant fines and restrictions on business operations, impacting BYD Electronic's brand image.

BYD Electronic's global operations are subject to a complex array of trade regulations and tariffs, impacting its supply chain and market access. Navigating these varying international trade laws, including import/export controls and customs duties, is crucial for maintaining cost-effectiveness and timely product delivery. For example, in 2024, ongoing geopolitical shifts continued to influence trade policies, potentially affecting component sourcing and finished goods pricing for BYD.

The company must also adhere to sanctions and export restrictions imposed by various countries, which can limit its ability to conduct business in certain regions or with specific entities. Failure to comply with these trade laws can lead to severe penalties, including fines, seizure of goods, and reputational damage, underscoring the need for robust compliance frameworks.

BYD Electronic's commitment to environmental sustainability is increasingly shaped by evolving environmental laws and regulations worldwide. These include standards for emissions, waste management, and the use of hazardous materials in its electronic products and manufacturing processes. For instance, in 2024, the push for stricter battery recycling regulations in major markets like Europe presented new compliance challenges and opportunities for BYD's electric vehicle division.

Adherence to these environmental mandates is not only a legal requirement but also a critical factor in maintaining brand reputation and consumer trust, especially as sustainability becomes a key purchasing driver. The company's proactive investments in greener manufacturing technologies and circular economy principles are strategic responses to these growing legal and market pressures.

| Legal Factor | Description | Impact on BYD Electronic | 2024/2025 Data/Trend |

| Trade Regulations & Tariffs | Import/export controls, customs duties, and international trade agreements. | Affects supply chain costs, market access, and product pricing. | Geopolitical shifts in 2024 continue to influence trade policies and tariffs. |

| Environmental Laws | Emissions standards, waste management, hazardous material usage, product lifecycle regulations. | Requires investment in sustainable manufacturing and compliance with recycling mandates. | Increased focus on battery recycling regulations (e.g., EU) impacting EV sector in 2024. |

| Intellectual Property Rights | Patent protection, copyright, trademark enforcement globally. | Safeguards R&D investments and market competitiveness; infringement risks. | BYD's 2023 R&D spending of 20.4 billion RMB highlights IP importance. |

| Data Privacy & Cybersecurity | GDPR, PIPL, and other data protection laws; cybersecurity mandates. | Requires robust data handling protocols and security measures to avoid fines and reputational damage. | Global data breaches averaged $4.45 million in 2023, underscoring financial and legal risks. |

Environmental factors

BYD Electronic is actively pursuing ambitious carbon reduction targets, aiming for a 50% decrease in carbon intensity by 2030 and achieving carbon neutrality across its entire value chain by 2045. These commitments are directly in line with broader global climate change initiatives, fostering more sustainable operational practices.

The company's dedication to green production methods and investments in energy-saving projects are key drivers in meeting these environmental goals. For instance, BYD's manufacturing facilities increasingly incorporate renewable energy sources, reducing their reliance on fossil fuels.

BYD Electronic faces significant environmental challenges in sourcing raw materials for its batteries, such as lithium and cobalt. The extraction of these minerals can lead to habitat destruction and water pollution. For instance, lithium mining, particularly in arid regions, can strain local water resources, a concern that intensified in 2024 as global demand for EVs surged.

Ensuring a sustainable and ethical supply chain is paramount for BYD, driven by stricter environmental regulations and increasing consumer preference for eco-friendly products. By 2025, many jurisdictions are expected to have enhanced reporting requirements for supply chain sustainability, pushing companies like BYD to demonstrate responsible sourcing.

BYD is actively addressing these concerns through robust battery life cycle management and the implementation of reuse systems. Their efforts in battery recycling and second-life applications, such as powering energy storage systems, aim to mitigate the environmental footprint of battery production and disposal, a strategy that gained further traction in 2024 with significant investments in recycling infrastructure.

BYD Electronic faces increasing pressure to effectively manage electronic waste (e-waste) and embrace circular economy principles. This includes robust battery recycling programs and a greater incorporation of recycled materials into its manufacturing processes. For instance, in 2023, the global e-waste generation reached an estimated 62 million metric tons, highlighting the scale of the challenge.

The company is actively working to enhance its sustainability profile through the development of innovative recycling technologies designed to significantly reduce environmental impact. BYD's commitment is further demonstrated by its substantial investments in advanced waste treatment facilities, ensuring strict adherence to evolving pollution control regulations.

Energy Consumption and Renewable Energy Adoption

BYD Electronic is actively pursuing ambitious environmental goals, focusing on reducing energy consumption within its manufacturing operations and significantly increasing its adoption of renewable energy sources. A cornerstone of this strategy is the company's commitment to achieving 100% renewable energy utilization across all its manufacturing facilities by the year 2030.

To support this objective, BYD Electronic is expanding its investments in solar energy projects designed to directly power its extensive operations. This proactive approach not only addresses environmental concerns but also aims to stabilize energy costs in the face of fluctuating global energy markets. In 2023, BYD reported a substantial increase in its renewable energy generation capacity, contributing to a greener operational footprint.

- 2030 Target: 100% renewable energy usage in manufacturing facilities.

- Key Initiative: Expansion of solar energy projects to power operations.

- 2023 Progress: Significant increase in renewable energy generation capacity reported.

Green Design and Product Life Cycle Management

BYD Electronic's focus on green design and product life cycle management is a significant environmental consideration. This means designing products that are built to last, easy to fix, and can be recycled at the end of their usable life. For instance, BYD's commitment to using more sustainable materials in its electronics, aiming to reduce the environmental footprint from sourcing to disposal, aligns with this strategy.

By integrating environmental factors from the initial design phase, BYD Electronic aims to minimize resource use and cut down on pollution across the entire product journey. This proactive approach is becoming increasingly important as consumers and regulators alike demand greater environmental responsibility from manufacturers. BYD's efforts in this area contribute to a more circular economy within the electronics sector.

Key aspects of BYD Electronic's green design and product life cycle management include:

- Designing for Durability: Creating products that have a longer lifespan, reducing the frequency of replacements and associated waste.

- Enhancing Repairability: Making it easier for consumers or repair services to fix devices, extending their useful life.

- Prioritizing Recyclability: Utilizing materials and design choices that facilitate efficient recycling processes at the end of a product's life, recovering valuable components and minimizing landfill impact.

BYD Electronic is committed to sustainability, targeting a 50% reduction in carbon intensity by 2030 and carbon neutrality by 2045, aligning with global climate efforts. The company is investing heavily in green production and renewable energy, aiming for 100% renewable energy use in its manufacturing facilities by 2030, evidenced by significant increases in solar energy generation capacity in 2023.

Challenges remain in sourcing raw materials like lithium and cobalt, with extraction impacting water resources, a concern amplified in 2024 due to surging EV demand. BYD is addressing this through robust battery life cycle management and recycling initiatives, including investments in recycling infrastructure in 2024 to mitigate environmental footprints.

The company is also tackling e-waste, a growing global issue with 62 million metric tons generated in 2023, by enhancing recycling programs and incorporating recycled materials. BYD's focus on green design, including durability and repairability, further supports circular economy principles, aiming to minimize resource use and pollution throughout product lifecycles.

| Environmental Goal | Target Year | Key Initiatives | 2023/2024 Data/Progress |

|---|---|---|---|

| Carbon Intensity Reduction | 2030 | Sustainable operational practices | Aiming for 50% decrease |

| Carbon Neutrality | 2045 | Value chain-wide initiatives | Achieve neutrality |

| Renewable Energy Usage | 2030 | Solar energy projects, waste treatment facilities | Significant increase in renewable generation capacity (2023) |

| E-waste Management | Ongoing | Battery recycling, circular economy principles | Global e-waste reached 62 million metric tons (2023) |

PESTLE Analysis Data Sources

Our BYD PESTLE analysis is meticulously crafted using data from official government publications, reputable industry research firms, and global economic databases. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting BYD's operations.