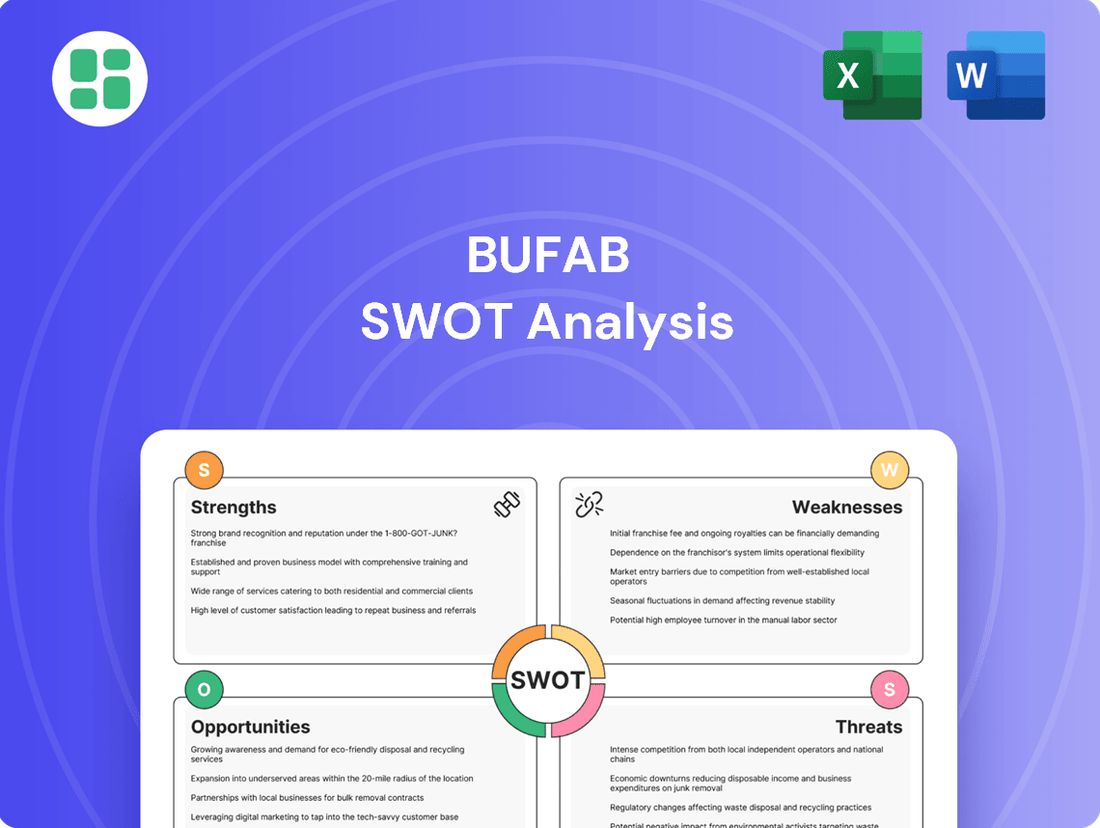

Bufab SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bufab Bundle

Bufab's strong global presence and extensive product portfolio are significant strengths, but understanding their potential weaknesses and the competitive landscape is crucial for strategic planning.

Our comprehensive SWOT analysis dives deep into these areas, revealing critical opportunities for growth and potential threats that could impact their market position.

Want the full story behind Bufab's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bufab's core strength lies in its profound global supply chain expertise, acting as a comprehensive partner for C-parts. This means they handle everything from sourcing to quality assurance and delivery, giving clients a significant advantage. Their extensive network, with over 50 companies operating in 29 countries as of early 2024, underscores their capacity to manage complex international logistics and provide a seamless experience for customers focused on their primary operations.

Bufab’s comprehensive service and product portfolio is a significant strength, positioning them as a full-service provider for C-parts rather than just a fastener supplier. This approach is designed to optimize customer supply chains, offering a more integrated and efficient solution.

They are actively enhancing their customer offering by introducing new logistics solutions and broadening their product range. This expansion directly addresses customer needs for streamlined operations and a wider selection of essential components, reinforcing Bufab's value proposition.

For instance, Bufab reported a substantial net sales increase of 14% in the first quarter of 2024, reaching SEK 3,441 million, underscoring the market's positive reception to their expanded offerings and service model. This growth demonstrates the effectiveness of their strategy in strengthening customer relationships and driving business expansion.

Bufab's business model demonstrates remarkable resilience, supported by a history of consistent profitability. The company has achieved an operating profit every single year since its founding in 1977, a testament to its robust operational framework. This stability is further enhanced by relatively low fixed costs, allowing Bufab to effectively navigate fluctuations in market demand.

The company's financial strength is clearly visible in its recent performance. For the first quarter of 2025, Bufab reported a notable increase in net sales. Alongside this top-line growth, they also achieved improved gross and operating margins, underscoring a healthy and strengthening financial position.

Strategic Acquisition and Divestment Capabilities

Bufab's ability to strategically acquire and divest is a significant strength. For instance, the late 2024 acquisition of Italian C-parts distributor VITAL S.p.A. expanded its customer reach in Southern Europe, a key growth region. This move aligns with their strategy of inorganic growth to complement organic expansion.

Simultaneously, Bufab has demonstrated a willingness to divest non-core manufacturing assets, such as Bufab Lann and Hallborn Metall. This portfolio optimization allows the company to concentrate resources on its core trading and niche business segments, enhancing overall profitability and operational efficiency.

- Strategic Acquisitions: Acquisition of VITAL S.p.A. in late 2024 broadened Bufab's customer base and product offerings in Southern Europe.

- Divestment of Non-Core Assets: Divestment of manufacturing units like Bufab Lann and Hallborn Metall sharpens focus on core trading and niche businesses.

- Portfolio Optimization: This dual approach of acquisition and divestment enables Bufab to continuously refine its business portfolio for sustained profitable growth.

Focus on Profitability and Cost Control

Bufab's unwavering commitment to profitability and rigorous cost control is a significant strength. This disciplined strategy has allowed them to achieve impressive financial results, even amidst market volatility.

Key achievements include a record gross margin of 29.7% in 2024. This upward trend continued into 2025, with the gross margin reaching 30.3% in the first quarter and further improving to 31.1% by the second quarter.

This consistent enhancement of gross margin, coupled with diligent cost management, clearly demonstrates Bufab's capability to meet its profitability objectives, even when market conditions are more subdued.

- Record Gross Margin: Achieved 29.7% in 2024.

- Continued Improvement: Reached 30.3% in Q1 2025 and 31.1% in Q2 2025.

- Cost Discipline: Maintains a strong focus on managing expenses.

- Profitability Focus: Positions the company to meet targets in cautious markets.

Bufab's global supply chain expertise is a cornerstone strength, allowing them to manage complex international logistics for C-parts. Their expansive network, comprising over 50 companies in 29 countries as of early 2024, ensures efficient sourcing, quality control, and delivery, freeing clients to focus on their core business.

The company's strategic approach to acquisitions and divestments further bolsters its position. The acquisition of VITAL S.p.A. in late 2024 expanded their reach in Southern Europe, while divesting non-core manufacturing assets like Bufab Lann and Hallborn Metall sharpened focus on trading and niche segments.

Bufab's commitment to profitability is evident in its consistently improving gross margins. They achieved a record 29.7% in 2024, with further improvements to 30.3% in Q1 2025 and 31.1% in Q2 2025, showcasing strong cost control and operational efficiency.

| Metric | 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| Gross Margin | 29.7% | 30.3% | 31.1% |

| Global Presence (Companies) | ~50 | ~50 | ~50 |

| Global Presence (Countries) | 29 | 29 | 29 |

What is included in the product

Analyzes Bufab’s competitive position through key internal and external factors, highlighting its strengths in global reach and customer relationships, while acknowledging potential weaknesses in supply chain integration and threats from increasing competition.

Bufab's SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

Bufab's strong reliance on the health of the manufacturing sector, especially automotive and construction, presents a significant weakness. For instance, a projected slowdown in global automotive production in late 2024 could directly curb Bufab's sales growth. This inherent dependency means that economic downturns affecting these core industries can disproportionately impact Bufab's financial performance.

Bufab has faced challenges with negative organic growth, which is a concern for its core business. For the full year 2024, organic growth was reported at -5.4%. This trend continued into the first half of 2025, with -0.1% in Q1 and -0.3% in Q2.

These figures suggest difficulties in expanding sales from existing operations and customer base, even if overall revenue grows due to acquisitions. Such sustained negative organic growth could point to issues like market saturation or intense competition impacting Bufab's ability to attract new business organically.

Bufab's position as a global supply chain partner inherently exposes it to risks from geopolitical tensions and trade protectionism. For instance, ongoing trade disputes, including those involving tariffs between major economies like the US and China, can directly impact Bufab's cost structure and the seamless flow of goods. While Bufab actively works to mitigate these impacts through diversification and strategic sourcing, these external factors remain a significant vulnerability, potentially leading to increased operational complexities and higher costs for its clients.

Inventory Management Challenges

Bufab faced inventory management challenges, as evidenced by a negative impact on cash flow from operating activities in Q4 2024 due to inventory investments. This led to an increase in working capital as a percentage of net sales, indicating potential difficulties in efficiently managing stock levels.

Optimizing inventory is particularly critical for Bufab, given its business model centered on a wide variety of C-parts. High inventory levels can tie up significant capital and lead to increased holding costs, such as warehousing and potential obsolescence.

- Increased Working Capital: Working capital as a percentage of net sales rose in Q4 2024, signaling a less efficient use of capital tied up in inventory.

- Cash Flow Impact: Investments in inventory directly reduced cash flow from operating activities during the same period.

- Operational Efficiency: For a C-parts distributor, effective inventory management is paramount to maintaining competitive pricing and service levels.

Competition in a Fragmented Market

The C-parts market, while offering consolidation potential for a global player like Bufab, remains notably fragmented. This means Bufab constantly faces competition not only from other significant international entities but also from numerous smaller, often locally focused, and highly agile competitors. These smaller players can sometimes react more quickly to niche market demands or regional pricing shifts.

This competitive landscape necessitates continuous effort from Bufab to differentiate its offerings and demonstrate clear value beyond just product supply. Even with its global reach, the presence of many local distributors and manufacturers means that market share is not guaranteed and requires ongoing strategic focus. For instance, in 2024, Bufab's strategy involves focusing on digital solutions and enhanced supply chain services to stand out.

- Market Fragmentation: The C-parts industry is characterized by a large number of local and regional suppliers, making it difficult to achieve dominant market share quickly.

- Agile Competitors: Smaller, specialized companies can often offer more tailored solutions or competitive pricing in specific niches, posing a persistent challenge.

- Global vs. Local Dynamics: While Bufab operates globally, it must contend with local players who may have deeper roots and established relationships within specific geographic markets.

- Differentiation Imperative: To maintain and grow its position, Bufab must consistently innovate and provide value-added services that distinguish it from the competition.

Bufab's substantial reliance on the manufacturing sector, particularly automotive and construction, exposes it to significant cyclical risks. A projected downturn in global automotive production for late 2024 could directly impact Bufab's sales trajectory. This dependency means economic slowdowns in these key industries can disproportionately affect Bufab's financial results, highlighting a core vulnerability.

The company has experienced negative organic growth, a key concern for its core business operations. For the full year 2024, organic growth was reported at -5.4%. This trend persisted into the first half of 2025, with -0.1% in Q1 and -0.3% in Q2. These figures suggest challenges in expanding sales from existing operations and customer bases, even if overall revenue increases through acquisitions.

Bufab's global supply chain operations are inherently vulnerable to geopolitical instability and trade protectionist measures. For example, ongoing trade disputes and tariffs between major economic powers can disrupt Bufab's cost structure and the smooth movement of goods. While Bufab actively diversifies and strategically sources to mitigate these risks, these external factors remain a significant weakness, potentially increasing operational complexity and costs for its clients.

Inventory management has presented challenges for Bufab, as seen in the negative impact on cash flow from operating activities in Q4 2024 due to inventory investments. This resulted in an increase in working capital as a percentage of net sales, indicating potential inefficiencies in managing stock levels. For a C-parts distributor, effective inventory control is crucial for competitive pricing and service delivery, with high inventory levels tying up capital and increasing holding costs.

| Weakness | Description | Impact | Data Point |

| Sector Dependency | Reliance on automotive and construction sectors. | Vulnerability to industry downturns. | Projected slowdown in global automotive production (late 2024). |

| Negative Organic Growth | Difficulty in growing sales from existing operations. | Concerns about core business health. | FY 2024: -5.4%; H1 2025: Q1 -0.1%, Q2 -0.3%. |

| Geopolitical & Trade Risks | Exposure to global supply chain disruptions. | Increased costs and operational complexity. | Impact of tariffs and trade disputes on global trade flows. |

| Inventory Management | Challenges in efficiently managing stock levels. | Reduced cash flow and increased holding costs. | Negative impact on cash flow from inventory investments (Q4 2024). |

Full Version Awaits

Bufab SWOT Analysis

This is the actual Bufab SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full Bufab SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of their strategic position.

You’re viewing a live preview of the actual Bufab SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for your business strategy.

Opportunities

Industrial companies worldwide are increasingly looking to simplify their supply chains and outsource the management of C-parts, a trend that has been amplified by the growing emphasis on sustainability and digitalization. This shift presents a significant opportunity for companies like Bufab that offer comprehensive supply chain solutions.

Bufab, with its established expertise as a full-service supply chain partner, is strategically positioned to benefit from this long-term trend. By providing integrated solutions that streamline operations and reduce total costs for its clients, Bufab can effectively tap into this expanding market demand.

The fragmented nature of the C-parts market offers Bufab a prime opportunity for strategic acquisitions, enabling market consolidation. The company's proactive approach to this strategy is exemplified by the VITAL acquisition in Italy, which is designed to be a springboard for further bolt-on acquisitions and broader market integration.

This acquisition strategy allows Bufab to efficiently expand its geographical reach and product portfolio, strengthening its competitive position. For instance, Bufab reported a 16% increase in organic sales in Q1 2024, alongside successful integration of acquired businesses, demonstrating the effectiveness of this growth lever.

Bufab is well-positioned to capitalize on the increasing digitalization within the manufacturing and supply chain sectors. This megatrend presents a significant opportunity to streamline operations and enhance customer value.

By investing in advanced analytics and automation for logistics and supply chain management, Bufab can unlock substantial efficiency gains. For instance, the global supply chain management market was valued at approximately $24.2 billion in 2023 and is projected to grow, indicating a strong demand for digitally optimized solutions.

Implementing these digital tools allows Bufab to not only improve its own operational effectiveness but also to offer new, data-driven value-added services to its customers. This could include enhanced inventory visibility, predictive demand forecasting, and customized delivery solutions, further solidifying its competitive edge.

Growth in Specific High-Demand Sectors

Bufab is capitalizing on robust demand within key sectors, including energy, defense, and medical, despite a generally cautious market. This strategic focus on high-growth niches offers a pathway to consistent revenue and allows for the development of specialized products and services tailored to these areas.

This targeted approach to specific industries is crucial for Bufab's growth strategy. For instance, the global energy sector is projected to see significant investment, with estimates suggesting the market could reach over $10 trillion by 2030, driven by renewable energy expansion. Similarly, the defense sector is experiencing increased spending, with global defense expenditure rising to an estimated $2.44 trillion in 2024, according to the Stockholm International Peace Research Institute (SIPRI). The medical device market is also expanding, expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030, reaching an estimated value of $777 billion. Bufab's ability to serve these expanding markets provides a strong foundation for future revenue generation and market share expansion.

- Energy Sector Growth: Capitalizing on the projected over $10 trillion market by 2030, fueled by renewable energy investments.

- Defense Spending Increase: Leveraging the estimated $2.44 trillion global defense expenditure in 2024.

- Medical Market Expansion: Tapping into the medical device market, anticipated to reach $777 billion by 2030 with a 6.9% CAGR.

Emphasis on Sustainability in Supply Chains

Growing customer demand for sustainable sourcing and environmentally friendly logistics presents a significant opportunity for Bufab. This trend is particularly strong in 2024 and is projected to intensify through 2025, as consumers and businesses alike prioritize ethical and eco-conscious operations.

Bufab is actively positioning itself as a leader in sustainability, aligning its strategies with the UN Global Compact principles. The company is focusing on enhancing its environmental disclosures, a move that resonates well with increasingly informed stakeholders. For instance, Bufab's commitment to reducing its carbon footprint in logistics, a key aspect of supply chain sustainability, is a direct response to this market shift.

- Increased Market Share: By strengthening its sustainability efforts, Bufab can attract new customers who prioritize eco-friendly supply chains, potentially boosting its market share in 2024-2025.

- Enhanced Brand Reputation: Demonstrating leadership in sustainability reinforces Bufab's brand image, making it a preferred partner for environmentally conscious businesses.

- Improved Investor Relations: A strong ESG (Environmental, Social, and Governance) profile, driven by sustainability initiatives, can attract socially responsible investors and improve access to capital.

- Operational Efficiencies: Implementing greener logistics and sourcing practices can lead to long-term cost savings through reduced waste and optimized resource utilization.

Bufab is well-positioned to capitalize on the global trend of companies outsourcing C-part supply chain management, a movement amplified by sustainability and digitalization drives. The company's expertise as a full-service partner allows it to streamline operations and reduce costs for clients, tapping into this expanding market. Furthermore, Bufab's strategic acquisition approach, exemplified by the VITAL acquisition in Italy, aims to consolidate the fragmented C-parts market, thereby expanding its geographical reach and product offerings.

The increasing digitalization within manufacturing and supply chains presents a significant opportunity for Bufab to enhance customer value through advanced analytics and automation. The global supply chain management market, valued at approximately $24.2 billion in 2023, underscores the demand for such optimized solutions. Bufab can leverage these digital tools to offer enhanced inventory visibility and predictive forecasting, strengthening its competitive advantage.

Bufab is strategically targeting high-growth sectors like energy, defense, and medical, which continue to show robust demand despite broader market caution. The energy sector is projected to exceed $10 trillion by 2030, while global defense spending reached an estimated $2.44 trillion in 2024. The medical device market is also expanding, expected to reach $777 billion by 2030. Bufab's focus on these expanding markets provides a strong foundation for future revenue and market share growth.

The growing customer demand for sustainable sourcing and eco-friendly logistics offers Bufab a distinct advantage. By enhancing its environmental disclosures and focusing on reducing its carbon footprint in logistics, Bufab can attract environmentally conscious customers and improve its brand reputation and investor relations. This commitment to sustainability can lead to operational efficiencies and long-term cost savings.

| Opportunity Area | Market Trend/Driver | Bufab's Strategic Response | Key Data Point |

|---|---|---|---|

| Outsourcing C-Parts Management | Simplification of supply chains, sustainability, digitalization | Full-service supply chain solutions | Global SCM market ~$24.2B (2023) |

| Digitalization | Advancements in analytics and automation | Investing in digital tools for logistics | Enhancing customer value through data-driven services |

| Sector Growth | Robust demand in energy, defense, medical | Targeted focus on high-growth niches | Energy market >$10T by 2030; Defense ~$2.44T (2024) |

| Sustainability | Customer demand for eco-friendly practices | Enhancing ESG profile, reducing carbon footprint | Medical device market ~$777B by 2030 (6.9% CAGR) |

Threats

A general economic slowdown, especially within manufacturing and construction, poses a direct threat to Bufab's sales and profitability. This is because these sectors are key drivers for the company's products.

Bufab has already navigated cautious market conditions, observing negative organic growth in 2024 and extending into early 2025. This trend reflects reduced activity levels in crucial market segments, highlighting the sensitivity of Bufab's performance to broader economic health.

Sustained weak market demand, a consequence of economic downturns, represents a significant ongoing threat that could continue to pressure Bufab's financial results and growth prospects.

Bufab faces significant threats from the volatility of raw material prices, particularly for steel and other metals essential for its C-parts. These fluctuations directly affect purchasing costs and can squeeze gross margins. For instance, global metal prices saw considerable upward swings in early 2024, driven by supply chain disruptions and increased industrial demand.

While Bufab actively pursues purchasing savings and implements value-based pricing strategies, persistent inflationary pressures and sharp price volatility pose a substantial risk. Such conditions could erode the company's profitability, even with these mitigation efforts. Operating expenses have also been impacted, with increased costs noted across logistics and energy throughout 2024.

Bufab operates in a highly competitive landscape for C-parts distribution, facing pressure from both established larger distributors and agile new market entrants. This intense competition, coupled with the potential for customers to bring C-parts management in-house, directly translates into significant price pressure. For instance, in 2024, the industrial fastener market saw average price increases of only 2-3%, a stark contrast to previous years, indicating a tightening pricing environment.

Geopolitical Risks and Trade Barriers

Bufab's extensive global operations inherently expose it to the complexities of geopolitical shifts. The increasing trend of trade protectionism and the potential imposition of tariffs by various nations present a significant threat. For instance, a sudden tariff on steel, a key component in many fasteners, could directly increase Bufab's raw material costs.

These trade barriers can significantly disrupt Bufab's carefully managed international supply chains, leading to delays and increased logistical expenses. Furthermore, they create an environment of uncertainty for cross-border transactions, making long-term planning more challenging. This volatility directly impacts Bufab's ability to maintain competitive pricing and predictable profit margins.

- Tariff Impact: A hypothetical 10% tariff on imported components could add millions to Bufab's cost of goods sold.

- Supply Chain Disruption: Geopolitical instability in a key manufacturing region could halt production for critical parts.

- Market Access: New trade restrictions could limit Bufab's access to previously profitable markets.

- Currency Fluctuations: Geopolitical events often trigger significant currency devaluations, impacting international sales and procurement.

Currency Fluctuations

Bufab's global presence exposes it to significant currency fluctuation risks. For instance, in its Q1 2024 report, the company noted that unfavorable currency movements had a negative impact on its net sales and operating profit. This sensitivity means that even strong operational performance can be masked or diminished by adverse exchange rate shifts, directly affecting reported earnings and overall financial health.

These currency effects are not theoretical; they have tangible consequences. In Bufab's 2023 annual report, the company explicitly stated that currency headwinds reduced its reported operating income. This highlights a consistent challenge where the translation of foreign currency earnings back to the reporting currency can erode profitability, making strategic financial hedging a critical consideration for Bufab.

The potential for significant adverse currency movements poses a direct threat to Bufab's financial stability and investor confidence. For example, if the Swedish Krona strengthens considerably against the currencies of Bufab's major markets, it could lead to a substantial decrease in the value of its foreign earnings when converted, impacting key financial metrics like Earnings Per Share (EPS).

- Exposure to Currency Effects: Bufab operates in numerous countries, making it inherently vulnerable to changes in exchange rates.

- Impact on Recent Performance: Negative currency impacts have been cited as a factor affecting Bufab's revenue and operating expenses in recent financial reporting periods.

- Diminished Reported Earnings: Significant adverse currency movements can reduce Bufab's reported profits, thereby affecting its financial performance and potentially its valuation.

Bufab faces a significant threat from the increasing trend of trade protectionism and potential tariffs, which could disrupt its global supply chains and increase costs. For instance, a hypothetical 10% tariff on imported components could add millions to its cost of goods sold, impacting pricing and profitability.

Currency fluctuations present another major risk, as unfavorable movements have already negatively impacted Bufab's net sales and operating profit in recent reporting periods. This sensitivity means that even strong operational performance can be diminished by adverse exchange rate shifts, directly affecting reported earnings.

Intense competition within the C-parts distribution market, coupled with customers potentially bringing C-parts management in-house, translates into significant price pressure. The industrial fastener market saw average price increases of only 2-3% in 2024, indicating a tightening pricing environment that challenges Bufab's margins.

A general economic slowdown, particularly in manufacturing and construction, directly threatens Bufab's sales and profitability, as evidenced by negative organic growth observed through early 2025. This reduced activity levels highlight the company's sensitivity to broader economic health.

SWOT Analysis Data Sources

This Bufab SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary, ensuring a robust and data-driven strategic assessment.