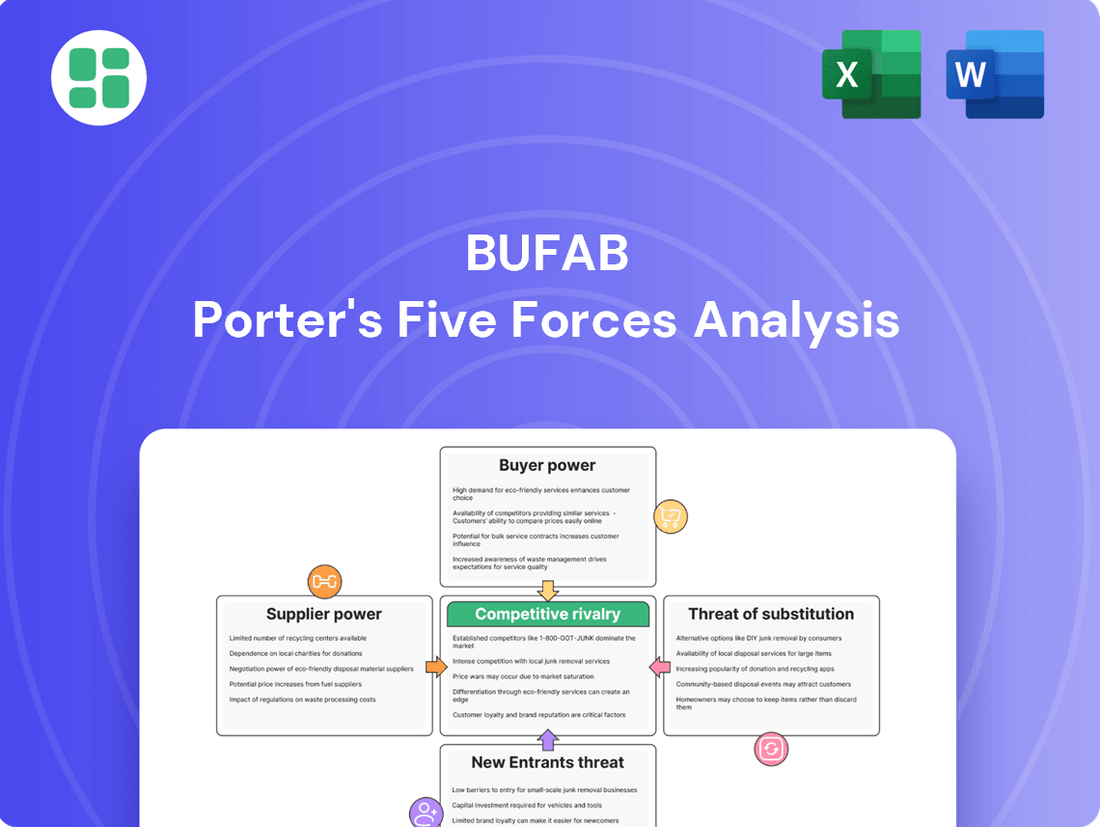

Bufab Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bufab Bundle

Bufab operates within a dynamic fastener industry, where understanding the competitive landscape is crucial for success. Our Porter's Five Forces analysis delves into the intense pressures that shape this market, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes.

The complete report reveals the real forces shaping Bufab’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bufab sources C-parts from a vast global network of thousands of suppliers. This extensive reach typically grants Bufab significant leverage, as there are often many alternative suppliers for standard components. This broad supplier base is crucial for mitigating the power of any single supplier and ensuring competitive pricing, with Bufab actively working to diversify its supplier relationships to maintain this advantage.

For highly specialized or custom-engineered C-parts, suppliers can wield significant bargaining power, especially when they possess unique capabilities or proprietary technology. This is particularly true when there are few alternative suppliers capable of meeting specific technical demands.

However, Bufab's strategic advantage lies in its in-house development and production capabilities for special parts. This reduces its reliance on external suppliers for critical components, thereby mitigating supplier power. For instance, Bufab's ability to design and manufacture bespoke fasteners allows them to control quality and ensure a consistent supply chain for unique customer requirements, a key differentiator in the C-parts market.

Raw material price volatility, especially for metals like steel that are crucial for fasteners, can indirectly affect supplier power. For instance, in 2024, global steel prices saw fluctuations driven by production levels and demand from key industries, potentially impacting the cost of goods for Bufab's manufacturing partners.

While Bufab operates as a distributor, shifts in the cost of these essential materials can prompt price adjustments from its manufacturers. This means Bufab's procurement expenses are sensitive to these upstream market dynamics, requiring careful management to maintain profitability.

Bufab's strength in efficiently managing its supply chain is a key factor in navigating these material cost fluctuations. By optimizing logistics and maintaining strong relationships with manufacturers, Bufab can better absorb or mitigate the impact of raw material price volatility.

Supplier Power 4

Bufab's approach to supplier relationships, emphasizing long-term strategic partnerships rather than short-term transactions, significantly moderates supplier power. By requiring adherence to a stringent Supplier Code of Conduct and actively promoting continuous improvement in quality and efficiency, Bufab establishes a collaborative framework.

This strategic alignment, exemplified by initiatives such as the digitalization of supplier logistics, shifts the dynamic towards a more balanced power structure. This fosters mutual growth and reduces the ability of individual suppliers to exert undue influence over Bufab's operations.

- Strategic Partnerships: Bufab prioritizes long-term relationships, fostering collaboration and shared goals with its suppliers.

- Supplier Code of Conduct: A mandatory code ensures suppliers meet Bufab's standards for quality, ethics, and sustainability.

- Digitalization Initiatives: Investing in digitalizing supplier logistics streamlines operations and enhances efficiency, creating a more integrated supply chain.

- Balanced Power Dynamic: This collaborative model aims to create a mutually beneficial relationship, mitigating the risk of excessive supplier leverage.

Supplier Power 5

The bargaining power of suppliers for Bufab is a key consideration. While switching costs for commodity fasteners might be low, procuring highly specialized or integrated components can involve significant effort and expense to change suppliers. This means that for certain product categories, suppliers could exert more influence.

Bufab's rigorous supplier vetting, including compliance and sustainability checks, is designed to mitigate risks associated with supplier dependency. This strategic approach aims to build relationships with reliable partners, thereby reducing the potential for disruptions and the associated costs of switching, even for complex solutions.

For instance, in 2024, Bufab continued to emphasize its global sourcing network, which, while diversifying options, also highlights the importance of strong supplier relationships. The ability to source from multiple regions and suppliers for standard items helps to keep individual supplier power in check.

However, for custom-engineered parts that are critical to a client's product, a single supplier might hold considerable leverage if they are the sole provider of that specific solution. This is where Bufab’s supplier management becomes crucial.

Bufab's extensive global supplier network, comprising thousands of C-part providers, generally keeps supplier power in check due to the availability of alternatives. However, for highly specialized or custom-engineered components, suppliers with unique capabilities can exert significant influence, especially when few alternatives exist.

Bufab mitigates this by developing in-house production capabilities for special parts, reducing reliance on external suppliers and controlling critical supply chains. For example, their ability to produce bespoke fasteners enhances their negotiating position and supply chain resilience.

Raw material price volatility, such as fluctuations in steel prices observed in 2024, indirectly impacts supplier power by affecting their costs. Bufab's efficient supply chain management and strategic partnerships further help to moderate this influence, creating a more balanced dynamic.

The bargaining power of suppliers for Bufab is moderated by the company's strategic approach to supplier relationships, emphasizing long-term partnerships and digitalizing logistics. This collaborative model, supported by a stringent Supplier Code of Conduct, aims to foster mutual growth and reduce undue supplier leverage.

What is included in the product

Bufab's Porter's Five Forces analysis dissects the competitive intensity within the global fastener market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors to understand Bufab's strategic positioning.

Bufab's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, transforming strategic uncertainty into a manageable roadmap.

Customers Bargaining Power

Bufab's customers, primarily manufacturing firms, grapple with the substantial indirect costs and logistical complexities inherent in sourcing C-parts. These components, though low in value, are high in volume, making their procurement a significant operational drain. For instance, a typical manufacturing company might spend up to 30% of its purchasing department's time on managing C-parts, a cost Bufab's integrated solutions directly address.

Bufab's diversified customer base, spanning sectors like automotive, construction, and energy, mitigates the bargaining power of any single large client. In 2024, Bufab reported serving thousands of customers globally, demonstrating this broad reach. This wide distribution means no single customer segment represents an overwhelming portion of their revenue, thereby limiting individual customer leverage.

Bufab's strategy of reducing total cost of ownership, rather than just unit price, significantly curtails customer bargaining power. By offering services like vendor-managed inventory (VMI), robust quality control, and essential engineering support, Bufab creates a comprehensive solution. This integrated approach makes switching suppliers a more complex and expensive undertaking for customers.

Customer Power 4

The bargaining power of customers in the C-parts industry is generally moderate. However, Bufab's business model actively works to reduce this power by offering a consolidated supply chain solution. By acting as a single point of contact for a vast array of C-parts, Bufab simplifies procurement for its clients, reducing the administrative burden significantly.

This consolidation creates a substantial switching cost for customers. Imagine a customer needing thousands of different C-parts; managing relationships and orders with numerous individual suppliers is complex and time-consuming. Bufab's ability to deliver this entire spectrum through one partner makes it difficult and costly for a customer to switch to a different consolidated provider.

For instance, a typical manufacturing firm might source hundreds or even thousands of distinct C-parts for its production lines. By partnering with Bufab, they streamline this process, potentially reducing their supplier base by 80-90% for these components. This operational efficiency is a key value proposition that entrenches Bufab with its clients.

- Consolidated Supply Chain: Bufab provides a single point of contact for a wide range of C-parts, simplifying procurement for customers.

- Reduced Administrative Burden: Customers benefit from fewer vendors to manage, freeing up internal resources.

- Increased Switching Costs: The complexity and effort involved in switching from a consolidated partner like Bufab are significant deterrents.

- Operational Efficiency: Streamlining C-parts sourcing leads to direct cost savings and improved production flow for clients.

Customer Power 5

Bufab's strategy of fostering enduring customer relationships and prioritizing satisfaction significantly dampens customer bargaining power. Their customer-centric approach, aimed at boosting satisfaction scores, makes them a valued partner.

By consistently ensuring dependable quality and punctual deliveries, Bufab cultivates deep trust and loyalty among its clients, rendering their services increasingly vital.

- Customer Loyalty: Bufab's focus on long-term relationships and high customer satisfaction scores directly reduces the likelihood of customers switching suppliers.

- Reliability Factor: Consistent delivery of quality products and on-time performance makes Bufab's offerings indispensable, thus limiting customer leverage.

- Value-Added Services: Beyond just supplying parts, Bufab's approach implies a partnership that adds value, further entrenching their position and reducing customer power.

Bufab's customers, primarily manufacturers, face significant indirect costs and logistical challenges in sourcing C-parts. These small, high-volume components require considerable purchasing department time, with some estimates suggesting up to 30% of a procurement team's effort is dedicated to them. Bufab's integrated solutions directly address this inefficiency by consolidating numerous suppliers into a single point of contact.

Bufab's broad customer base, serving thousands of clients across diverse sectors like automotive and construction in 2024, dilutes the power of any single customer. This wide distribution ensures that no individual client represents a disproportionately large revenue share, thereby limiting their individual bargaining leverage.

The bargaining power of customers is further diminished by Bufab's focus on reducing the total cost of ownership through value-added services such as vendor-managed inventory and robust quality control. This comprehensive approach makes switching suppliers a costly and complex decision for clients, as they would need to replicate these integrated benefits elsewhere.

| Factor | Bufab's Mitigation Strategy | Impact on Customer Bargaining Power |

|---|---|---|

| Complexity of C-parts Sourcing | Consolidated supply chain, single point of contact | Reduces customer effort, increases switching costs |

| Customer Diversification | Serving thousands of global clients across multiple industries | Limits individual customer leverage |

| Total Cost of Ownership Focus | Value-added services (VMI, quality control, engineering support) | Creates high switching costs, deepens customer relationships |

| Customer Loyalty and Reliability | Emphasis on dependable quality and punctual delivery | Fosters trust, makes services indispensable |

Full Version Awaits

Bufab Porter's Five Forces Analysis

This preview showcases the complete Bufab Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the fastener industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability. This comprehensive analysis is ready for your strategic planning, providing actionable insights into industry attractiveness and competitive dynamics.

Rivalry Among Competitors

The industrial fastener and C-parts market is highly fragmented globally, with many local distributors and specialized suppliers competing. This fragmentation means Bufab faces intense rivalry, particularly from smaller players focused on specific regions or product types.

Bufab distinguishes itself by offering global full-service supply chain solutions, a capability not widely matched by its numerous smaller competitors. This strategic positioning helps it navigate the intense competition inherent in a fragmented market.

Bufab's integrated approach to C-parts management, encompassing sourcing, rigorous quality control, and streamlined logistics, creates a significant competitive advantage. This comprehensive service model differentiates Bufab from competitors who might focus solely on product distribution, allowing them to compete on overall value and total cost reduction rather than just price. For instance, in 2024, Bufab reported a substantial increase in customer retention, attributing it to their ability to deliver end-to-end solutions that reduce complexity and costs for their clients.

The competitive landscape for Bufab is intensifying due to significant industry consolidation. Companies are actively engaging in mergers and acquisitions to gain market share and expand their product portfolios. This trend, which Bufab itself is pursuing, means larger, more dominant players are emerging, leading to heightened rivalry as these consolidated entities compete for market leadership and wider geographical presence.

Competitive Rivalry 4

Competitive rivalry in the C-parts market is intense, with differentiation primarily stemming from service, supply chain prowess, and technical know-how rather than novel product features, as many C-parts are essentially commodities. Bufab distinguishes itself by positioning as a 'Solutionist,' offering specialized service and engineering support to address customer needs beyond simple part supply.

This customer-centric approach is crucial in a fragmented market where reliable delivery and tailored solutions often outweigh minor price differences. For instance, Bufab's reported revenue for the first quarter of 2024 reached SEK 3,164 million, indicating its scale and ability to serve a broad customer base, which in turn strengthens its competitive standing through economies of scale in service delivery.

- Service Excellence: Bufab's emphasis on dedicated service and engineering support acts as a primary competitive lever.

- Supply Chain Efficiency: In the C-parts sector, where timely delivery of small, often standardized components is paramount, robust supply chain management is a key differentiator.

- Technical Expertise: Providing engineering support to optimize C-part usage or identify cost-saving alternatives adds significant value.

- Market Presence: Bufab's global footprint, with operations in numerous countries, allows it to offer consistent service and leverage logistical advantages, thereby intensifying rivalry for competitors with less reach.

Competitive Rivalry 5

The industrial fasteners market, while experiencing steady growth, presents a dynamic competitive landscape for Bufab. The projected compound annual growth rate (CAGR) for the industrial fasteners sector, estimated at around 4.5% through 2028, offers room for expansion for all participants. This growth can, to a degree, soften the intensity of rivalry as companies can pursue their own market segments.

However, this dynamic shifts significantly during economic downturns. In 2024, global economic uncertainties, including inflation and geopolitical tensions, have led to some sectors experiencing slowdowns. During these periods, competition escalates as companies vie for a shrinking customer base, potentially leading to price wars and increased marketing efforts to secure market share.

- Market Growth: The industrial fasteners sector is anticipated to grow steadily, offering opportunities for market expansion.

- Economic Sensitivity: Economic downturns can significantly intensify competition as demand decreases.

- Competitive Tactics: Companies may resort to price adjustments and aggressive marketing to capture market share during slower economic periods.

- Industry Concentration: While fragmented, the presence of large global players alongside numerous smaller regional ones contributes to the competitive intensity.

Competitive rivalry in the C-parts market is fierce due to its fragmented nature, with numerous local and specialized suppliers. Bufab differentiates itself by offering comprehensive global supply chain solutions and engineering support, moving beyond mere product distribution to provide value-added services. This focus on being a 'Solutionist' allows Bufab to compete on total cost reduction and reliability rather than just price, a strategy supported by its strong customer retention. For example, Bufab's first-quarter 2024 revenue of SEK 3,164 million highlights its scale and ability to serve a wide customer base effectively.

| Competitive Factor | Bufab's Approach | Market Impact |

|---|---|---|

| Fragmentation | Global full-service supply chain solutions | Intense rivalry from smaller players |

| Differentiation | Engineering support, C-parts management | Value-based competition, not just price |

| Customer Focus | Tailored solutions, reliable delivery | Strong customer retention, scale advantages |

| Market Dynamics | Navigating economic uncertainties and consolidation | Heightened competition during downturns |

SSubstitutes Threaten

The threat of substitutes for Bufab's services primarily comes from manufacturers choosing to handle their C-parts management in-house. While this seems like a direct alternative, it often incurs significant hidden costs. For example, internal management can lead to increased inventory holding expenses and the need for dedicated staff, diverting resources from core production activities.

These internal efforts frequently result in higher indirect costs and operational inefficiencies. Companies attempting self-management might face production delays due to stock-outs or overstocking of C-parts. In contrast, Bufab's specialized approach streamlines this process, offering cost savings and improved reliability, making their external service a more compelling choice for many businesses seeking to optimize their supply chain.

The threat of substitutes for Bufab's core products, mechanical fasteners, is a significant consideration. Alternative fastening technologies like industrial adhesives, rivets, and welding present viable options in various applications. These substitutes can offer distinct advantages, such as reduced weight, enhanced corrosion resistance, or the creation of permanent, tamper-proof bonds, which may appeal to certain customer segments or specific product designs.

For instance, the global industrial adhesives market was valued at approximately $60 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative. Similarly, advancements in welding technologies continue to improve efficiency and applicability across industries. While mechanical fasteners remain dominant due to their reliability, ease of assembly, and disassembly, these alternatives represent a tangible threat, particularly in sectors prioritizing weight reduction or highly specialized bonding requirements.

The threat of substitutes for Bufab's C-parts is significant, especially with ongoing material innovation. For instance, the automotive sector, a key market for Bufab, is increasingly adopting plastic fasteners due to their lighter weight and corrosion resistance. In 2024, the global automotive plastics market was valued at over $35 billion, highlighting a substantial shift away from traditional metal components. This trend means Bufab must actively integrate advanced polymers and composite materials into its product portfolio to counter the appeal of these alternatives.

4

Customers could theoretically piece together their C-parts needs by engaging with several specialized suppliers, handling logistics themselves. This fragmented approach, however, typically introduces significant administrative overhead and diminishes overall supply chain visibility, making it less appealing than a comprehensive, integrated service. For instance, a company managing 50 different suppliers for various fasteners and components would likely face substantial challenges in tracking inventory, managing multiple invoices, and ensuring consistent quality across all vendors.

The administrative burden of managing numerous specialized suppliers for C-parts can be substantial. Companies often find that the time and resources required to vet, contract with, and manage relationships with multiple vendors outweigh the potential cost savings. This complexity can lead to errors, delays, and a lack of streamlined processes, ultimately impacting production efficiency and increasing operational costs.

Furthermore, the lack of consolidated oversight when working with multiple suppliers can create blind spots in the supply chain. Without a single point of contact and a unified view of inventory and delivery schedules, companies are more susceptible to disruptions. This is particularly true for critical C-parts that are essential for continuous manufacturing operations.

Bufab's integrated solution offers a distinct advantage by consolidating these needs, thereby reducing complexity and improving control for its clients. This often proves more cost-effective and efficient in the long run, despite the initial perception of higher per-unit costs from a single provider.

- Administrative Burden: Managing multiple C-part suppliers increases complexity, requiring more staff time for vendor relations, invoicing, and quality control.

- Lack of Oversight: Fragmented supply chains lead to reduced visibility, making it harder to track inventory, manage lead times, and identify potential disruptions.

- Integration Benefits: Bufab's model offers a single point of contact, streamlined processes, and consolidated reporting, simplifying operations for customers.

- Total Cost of Ownership: While individual component prices might seem higher, the overall cost, including administrative and logistical efficiencies, often favors integrated solutions.

5

The threat of substitutes for C-parts, like those Bufab supplies, is evolving. A key emerging substitute is additive manufacturing, commonly known as 3D printing. This technology allows for the creation of custom or low-volume parts on demand, potentially bypassing the need for traditional sourcing channels for certain components.

While 3D printing is not yet a widespread substitute for high-volume fasteners due to cost and production speed limitations, its continued advancement presents a longer-term substitution risk. For instance, by mid-2024, the global 3D printing market was projected to reach over $20 billion, with significant growth in industrial applications, indicating its increasing capability to produce functional parts.

- Additive Manufacturing: 3D printing offers on-demand production for custom or low-volume C-parts.

- Current Limitations: High-volume fastener production remains largely uneconomical for 3D printing.

- Future Potential: Advancements in 3D printing materials and speed could increase its viability as a substitute.

- Market Growth: The 3D printing market's expansion suggests growing capabilities that could impact traditional C-part supply chains.

The threat of substitutes for Bufab's offerings, particularly in the realm of C-parts management, is multifaceted. While in-house management or fragmented sourcing from multiple specialized suppliers exist, they often introduce significant hidden costs and inefficiencies. These alternatives can lead to increased inventory holding expenses, administrative burdens, and a lack of supply chain visibility compared to Bufab's integrated approach.

Furthermore, alternative fastening technologies such as industrial adhesives, rivets, and welding present a tangible threat to Bufab's core mechanical fastener products. These substitutes offer distinct advantages like weight reduction or permanent bonding, appealing to specific industry needs. For example, the global industrial adhesives market was valued at approximately $60 billion in 2023, demonstrating a substantial and growing alternative.

Advancements in materials science also contribute to the threat of substitutes, with plastic fasteners gaining traction in sectors like automotive due to their lighter weight and corrosion resistance. The global automotive plastics market exceeded $35 billion in 2024, underscoring this shift. Emerging technologies like 3D printing also pose a longer-term risk, offering on-demand production for custom or low-volume C-parts, with the global 3D printing market projected to surpass $20 billion by mid-2024.

| Substitute Category | Key Characteristics | Market Example/Data (2023/2024) | Bufab's Counter/Advantage |

|---|---|---|---|

| In-house C-parts Management | Higher hidden costs, operational inefficiencies, resource diversion | N/A (Internal process) | Streamlined process, cost savings, improved reliability |

| Fragmented Supplier Approach | Increased administrative burden, reduced supply chain visibility | Managing 50+ suppliers for various components | Single point of contact, consolidated oversight, improved control |

| Alternative Fastening Technologies | Adhesives, rivets, welding; offer weight reduction, permanent bonds | Industrial Adhesives Market: ~$60 billion (2023) | Reliability, ease of assembly/disassembly, established infrastructure |

| Advanced Materials (e.g., Plastics) | Lighter weight, corrosion resistance | Automotive Plastics Market: >$35 billion (2024) | Integration of advanced polymers, broad product portfolio |

| Additive Manufacturing (3D Printing) | On-demand, custom/low-volume parts | Global 3D Printing Market: >$20 billion projected (mid-2024) | Focus on high-volume, cost-effective solutions; established supply chain |

Entrants Threaten

The threat of new entrants in the C-parts supply chain, where Bufab operates, is generally moderate. Establishing a global sourcing network, robust warehousing, and efficient logistics infrastructure demands significant upfront capital investment. For instance, building a comparable global footprint to Bufab's, which spans 28 countries, would require hundreds of millions of dollars in investment for new players to even begin competing effectively.

The threat of new entrants for Bufab is relatively low, primarily due to the significant barriers to entry in the C-parts distribution industry. Bufab's deep-seated expertise in quality control, supply chain optimization, and extensive knowledge of C-parts across diverse sectors creates a formidable advantage.

Newcomers would find it exceedingly difficult to quickly replicate Bufab's accumulated know-how and established supplier relationships. For instance, Bufab reported a revenue of SEK 6,944 million in 2023, demonstrating a scale and operational efficiency that new players would struggle to match from inception.

The threat of new entrants for Bufab is relatively low. Bufab benefits from established relationships with over 3,000 suppliers across 70 countries and a broad customer base. This extensive network provides significant economies of scale and robust distribution channels that are difficult for newcomers to replicate.

New companies would struggle to match Bufab's established supplier agreements and customer loyalty, which are crucial for cost efficiencies and market access in the global fastener industry. Building such a comprehensive and trusted network takes considerable time and investment, acting as a substantial barrier.

4

The threat of new entrants for Bufab is moderate. While the C-parts distribution industry might seem accessible, establishing the necessary infrastructure, supplier relationships, and logistical networks to compete effectively requires significant capital and expertise. Bufab's established presence and integrated service offering create a barrier.

Customer switching costs are a key deterrent for potential new players looking to enter Bufab's market. Manufacturers rely on Bufab for streamlined procurement and logistics of C-parts, a complex process that, once optimized, is not easily replicated or switched. For instance, a disruption to an established, efficient supply chain partnership can lead to production delays and increased costs for the manufacturer, making them hesitant to switch. This integration means new entrants would need to offer a compelling value proposition to overcome the inertia and risk associated with changing suppliers.

Bufab's focus on providing a comprehensive solution, rather than just supplying parts, further solidifies customer loyalty. This includes services like vendor-managed inventory and customized kitting, which become deeply embedded in a client's operational processes. For example, in 2024, companies across various manufacturing sectors continued to prioritize supply chain stability, with over 70% of businesses surveyed indicating that supplier reliability was a primary factor in their sourcing decisions. This preference for proven partners makes it challenging for new entrants to gain a foothold.

The capital investment required to build out a comparable global supply chain, IT systems, and sales force is substantial. New entrants would need to overcome these high initial hurdles to even begin competing with established players like Bufab, which has spent years cultivating its network and operational efficiencies.

5

The threat of new entrants for Bufab, a global fastener company, is generally considered moderate to low. Bufab's consistent strategy of acquiring smaller, specialized fastener distributors and manufacturers significantly consolidates the market. For example, in 2024, Bufab continued its acquisition spree, integrating several new entities into its global network, which effectively increases its market share and operational scale. This ongoing consolidation by incumbents like Bufab creates substantial barriers to entry for new, smaller players who would struggle to achieve the same economies of scale or comprehensive product offerings.

These strategic acquisitions by Bufab serve as a proactive deterrent. By expanding its geographical reach and product portfolio through M&A, Bufab makes it increasingly difficult for potential new entrants to compete effectively on price, product range, or service levels. The capital investment required to match Bufab's established global supply chain and distribution network is considerable, further dampening the attractiveness of entering the market.

- Market Consolidation: Bufab's ongoing acquisitions in 2024 have further concentrated the fastener market, making it harder for new, smaller competitors to establish a significant presence.

- Economies of Scale: The increased operational scale achieved through acquisitions provides Bufab with cost advantages that new entrants would find challenging to replicate.

- Barriers to Entry: The substantial capital investment needed to build a comparable global supply chain and distribution network acts as a significant deterrent to potential new companies entering the market.

- Competitive Advantage: Bufab's broad product range and established customer relationships, bolstered by acquisitions, create a strong competitive advantage that new entrants must overcome.

The threat of new entrants for Bufab is generally moderate to low. Significant capital investment is required to establish a global supply chain, IT systems, and sales force, creating a substantial barrier. Bufab’s ongoing acquisitions in 2024, which integrated several new entities, further consolidated the market, making it harder for new, smaller competitors to achieve comparable economies of scale and comprehensive product offerings.

| Barrier Type | Description | Bufab's Advantage |

|---|---|---|

| Capital Investment | Establishing a global supply chain, IT, and sales force requires hundreds of millions of dollars. | Bufab's established infrastructure and scale provide significant cost advantages. |

| Expertise & Relationships | Deep knowledge in quality control, supply chain optimization, and established supplier/customer networks. | Bufab's accumulated know-how and over 3,000 supplier relationships across 70 countries are difficult to replicate quickly. |

| Customer Switching Costs | Manufacturers rely on Bufab's integrated services like vendor-managed inventory, making switching disruptive. | Customer loyalty and the risk of production delays deter manufacturers from switching to new suppliers. |

| Market Consolidation | Bufab's strategic acquisitions in 2024 increased market share and operational scale. | Acquired entities bolster Bufab's competitive edge, making it harder for new entrants to match its breadth and efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bufab is built upon a foundation of reliable data, including Bufab's annual reports, investor presentations, and industry-specific market research from firms like IHS Markit and Euromonitor.