Bufab PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bufab Bundle

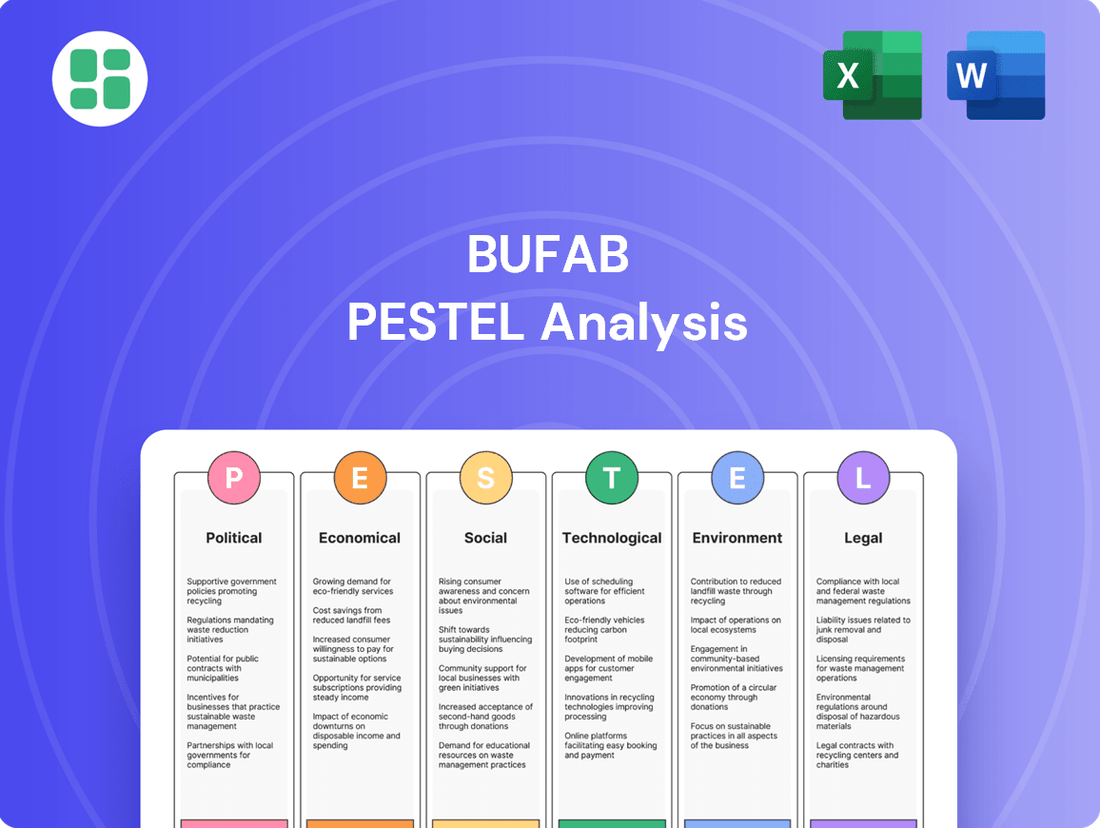

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors impacting Bufab's operations and future growth. This comprehensive PESTLE analysis provides the essential external intelligence you need to make informed strategic decisions. Download the full report now and gain a significant competitive advantage.

Political factors

Global trade policies, including tariffs and import/export regulations, directly impact Bufab's ability to source C-parts efficiently and cost-effectively. For instance, the US imposed tariffs on steel and aluminum in 2018, which, while not directly on C-parts, signaled a broader trend of protectionism that could affect raw material costs for Bufab's suppliers. Changes in these policies can lead to increased operational costs or necessitate adjustments to their supply chain network, as seen in the potential for retaliatory tariffs on manufactured goods.

Monitoring these developments is crucial for maintaining competitive pricing and stable supply. For example, the European Union's trade agreements, such as those with Canada or Japan, can offer preferential access and reduced duties for components, benefiting companies like Bufab that operate within or source from these regions. Conversely, trade disputes, like those between the US and China, can create significant market shifts, forcing companies to re-evaluate sourcing strategies to mitigate risk and cost increases.

Geopolitical stability is a critical concern for Bufab, as political regimes and international relations in its manufacturing and sourcing hubs directly impact supply chain reliability. For instance, ongoing tensions in Eastern Europe, which intensified in 2022 and continued through 2024, have demonstrated the tangible effects of political instability on global logistics, leading to increased shipping costs and lead times for many industries.

Bufab’s operational continuity hinges on its ability to navigate and mitigate risks stemming from diverse political landscapes. The company’s strategy of diversifying sourcing locations and logistics routes, a practice reinforced by the supply chain disruptions experienced globally in 2023 and early 2024, is crucial for maintaining consistent product flow and managing the potential impact of localized political unrest or conflicts.

Governments globally are increasingly prioritizing manufacturing, with initiatives like the US CHIPS and Science Act of 2022, allocating $52 billion to boost domestic semiconductor production, directly impacting supply chains for electronic components. This focus on reshoring and bolstering domestic capabilities creates new opportunities for C-part suppliers like Bufab, as companies look to strengthen their local manufacturing bases. Bufab must remain agile to capitalize on these shifts, potentially aligning its service offerings with regions experiencing significant government investment in industrial development.

International Relations and Alliances

The strength and nature of international relations significantly influence Bufab's cross-border operations. Strong alliances, such as those within the European Union where Bufab has a substantial presence, generally facilitate smoother trade and investment, reducing tariffs and administrative burdens. For instance, in 2023, the EU's internal trade volume continued to be a critical driver for many of its member economies, indirectly benefiting companies like Bufab that operate within this integrated market.

Conversely, strained international relations can introduce considerable risk. Trade disputes or sanctions, like those impacting global supply chains in recent years, can lead to increased costs, delays, and the need to reconfigure sourcing and distribution networks. Bufab's ability to navigate these diplomatic landscapes is crucial for maintaining the efficiency of its global supply chain, especially considering its customer base spans numerous countries.

- EU Trade Facilitation: The EU's single market reduces trade barriers for Bufab, supporting its operations across member states.

- Geopolitical Risk Management: Bufab must monitor and adapt to geopolitical tensions that could disrupt its global supply chains and customer access.

- Global Sourcing Strategy: The company's international alliances and relationships directly impact its ability to source components efficiently and cost-effectively worldwide.

Political Stability in Sourcing Regions

Bufab's reliance on global sourcing means that the internal political stability of its supplier countries is paramount for maintaining a robust supply chain. Political instability can manifest as sudden regulatory shifts, disruptions due to labor disputes, or even the risk of asset seizure, all of which directly impact Bufab's ability to secure C-parts reliably.

To navigate these challenges, Bufab must actively conduct detailed political risk assessments for its primary sourcing hubs. For instance, as of early 2024, regions experiencing heightened geopolitical tensions, such as certain parts of Eastern Europe and the Middle East, present a higher degree of uncertainty compared to more established manufacturing centers in Western Europe or Southeast Asia.

- Geopolitical Risk Indicators: Monitoring indices like the World Bank's Worldwide Governance Indicators, which assess political stability and absence of violence, for key sourcing countries.

- Regulatory Environment Scans: Regularly reviewing changes in trade policies, labor laws, and environmental regulations in supplier nations.

- Supplier Diversification Strategy: Actively seeking and qualifying suppliers in politically stable regions to spread risk and ensure continuity. For example, Bufab's expansion into Vietnam in recent years offers a more stable sourcing alternative to some historically volatile regions.

Government policies on trade, such as tariffs and import/export regulations, directly influence Bufab's sourcing costs and supply chain efficiency. For example, the US's imposition of tariffs on steel in 2018, and ongoing trade negotiations in 2024, highlight the potential for increased raw material expenses and the need for strategic sourcing adjustments.

Geopolitical stability is crucial for Bufab's operational continuity, as political unrest in sourcing regions can disrupt logistics and increase lead times. The continued geopolitical tensions in Eastern Europe, impacting global shipping throughout 2023 and into 2024, underscore the importance of Bufab's diversified sourcing strategy to mitigate such risks.

Government initiatives promoting domestic manufacturing, like the US CHIPS Act of 2022, create opportunities for C-part suppliers by encouraging reshoring. Bufab must remain agile to align its services with regions receiving significant government investment in industrial development to capitalize on these shifts.

International relations significantly affect Bufab's cross-border operations; strong alliances, such as within the EU, ease trade, while disputes can increase costs and necessitate network reconfiguration. Bufab's global customer base means navigating these diplomatic landscapes is vital for supply chain efficiency.

What is included in the product

Bufab's PESTLE analysis offers a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's operational landscape and strategic decision-making.

The Bufab PESTLE Analysis offers a structured framework to proactively identify and mitigate external threats, thereby relieving the pain of unexpected market disruptions and enabling more confident strategic decision-making.

Economic factors

Global economic growth is a critical driver for Bufab. For 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a slight slowdown from 2023's 3.4%. This indicates a moderately healthy, albeit not booming, global economy.

The manufacturing sector, a key consumer of Bufab's C-parts, is expected to see varied performance. For instance, industrial production in the Eurozone experienced a modest contraction in early 2024, impacting demand for components. Conversely, the US manufacturing sector showed signs of stabilization and slight expansion by mid-2024, offering more positive signals for Bufab's sales in that region.

Bufab's revenue is intrinsically linked to the industrial cycles of its customer base. As of the first quarter of 2024, Bufab reported a 5% decrease in net sales compared to the previous year, largely attributed to a weaker demand environment in key European markets. This highlights the direct correlation between global economic health and Bufab's financial performance.

Rising inflation in 2024 and projected into 2025 directly impacts Bufab by increasing the cost of essential inputs like raw materials, energy, and logistics. This surge in expenses directly translates to higher cost of goods sold and overall operational expenditures, squeezing profit margins.

Elevated interest rates, a common response to inflation, pose a dual threat. For Bufab, it means increased borrowing costs for capital investments and operations. Simultaneously, it can dampen demand from customers who also face higher financing costs, potentially slowing down their own manufacturing and investment activities.

Bufab's profitability hinges on its ability to navigate these economic headwinds. Effective management of inflationary pressures through strategic price adjustments and rigorous cost control measures is paramount. Furthermore, optimizing financing strategies to mitigate the impact of higher interest rates will be crucial for sustained financial health.

Bufab, as a global player sourcing from regions like Asia, faces significant exposure to currency exchange rate fluctuations. These shifts directly impact the cost of its imported components and the translated value of its international sales. For instance, a stronger USD against the Swedish Krona (SEK) would increase Bufab's costs for goods sourced in USD-denominated markets.

Major currency movements can materially affect Bufab's bottom line and its ability to maintain competitive pricing against rivals. For example, if the Euro weakens significantly against the SEK, Bufab's sales in Eurozone countries would translate to fewer SEK, potentially squeezing profit margins if costs remain stable.

To counter these risks, Bufab likely employs hedging strategies, such as forward contracts, and aims to diversify its currency exposure across various markets. This proactive approach is crucial, especially when sourcing from low-cost countries where currency volatility can be more pronounced, impacting the overall cost-competitiveness of their supply chain.

Raw Material Price Volatility

The prices of essential metals like steel, aluminum, and brass, crucial for C-parts manufacturing, are highly volatile. These fluctuations are driven by global supply and demand shifts, directly impacting Bufab's procurement expenses. For instance, the LME three-month aluminum price saw significant swings throughout 2024, trading between $2,100 and $2,500 per metric ton, illustrating this inherent instability.

To navigate these price swings and safeguard margins, Bufab relies on robust strategies. These include meticulous inventory management to avoid holding excess stock during price downturns, forging long-term supplier agreements to lock in favorable rates, and employing strategic sourcing to diversify procurement channels. These measures are vital for maintaining cost predictability.

In situations where cost increases are unavoidable, Bufab may need to pass these on to its customers. This practice, however, requires careful consideration of market competitiveness and customer relationships. The ability to do so effectively is often dependent on the value proposition and unique selling points Bufab offers.

- Steel prices: Global steel prices, a key input for many C-parts, experienced an average increase of approximately 8% in the first half of 2024 compared to the same period in 2023, influenced by production cuts and demand recovery in major economies.

- Aluminum costs: The cost of aluminum, used in lighter-weight components, has been sensitive to energy prices and geopolitical events, with reports indicating a 5% year-on-year increase in average manufacturing costs for aluminum-based C-parts by Q2 2024.

- Supplier agreements: Bufab's focus on long-term supplier contracts aims to mitigate the impact of short-term price spikes, potentially securing a 3-5% cost advantage on contracted materials compared to spot market purchases.

- Inventory management: Efficient inventory practices can reduce carrying costs by up to 10% annually, a critical factor when raw material prices are unpredictable.

Supply Chain Disruption Costs

Economic shocks, like the COVID-19 pandemic and geopolitical events, have profoundly disrupted global supply chains, leading to soaring freight costs and extended lead times. For instance, the Drewry World Container Index saw a significant spike, reaching over $10,000 per 40-foot container in late 2021, a stark contrast to pre-pandemic levels. These disruptions directly impact Bufab's operational efficiency and its capacity to deliver timely solutions to clients.

Bufab's business model centers on supply chain optimization, yet it remains vulnerable to these external economic pressures. The increased costs associated with freight, longer transit times, and the necessity of holding larger buffer stocks directly affect profitability and service levels. For example, increased inventory holding costs can tie up working capital, impacting a company's financial flexibility.

Addressing these challenges requires continuous investment in supply chain resilience. This involves strategies such as:

- Diversifying supplier bases across different geographic regions to mitigate single-point-of-failure risks.

- Maintaining strategic buffer stocks of critical components to absorb unexpected demand surges or supply interruptions.

- Exploring and securing alternative transportation routes and modes to ensure flexibility in logistics.

- Leveraging technology for enhanced visibility and predictive analytics across the supply chain.

The global economic landscape in 2024 and projected into 2025 presents a mixed but generally stable outlook for Bufab. While the IMF projected global growth at 3.2% for 2024, a slight moderation from 2023, manufacturing sectors in key regions like the Eurozone faced contractions, impacting demand for C-parts. Conversely, the US manufacturing sector showed signs of stabilization, offering a more positive regional outlook. Bufab's Q1 2024 net sales reflected this, with a 5% decrease attributed to weaker European demand, underscoring the direct link between economic health and Bufab's performance.

Inflationary pressures and elevated interest rates in 2024 continue to pose significant challenges. Rising input costs for raw materials, energy, and logistics directly squeeze Bufab's profit margins. Higher interest rates increase borrowing costs and can dampen customer demand, creating a dual impact on operations and sales. Bufab's strategy must focus on cost control and strategic pricing to navigate these economic headwinds effectively.

Currency fluctuations remain a key economic factor for Bufab, impacting both procurement costs and international sales revenue. For instance, a stronger USD against the SEK would increase costs for USD-denominated sourced goods. Strategic hedging and currency diversification are critical to mitigate these risks and maintain competitive pricing. Volatile commodity prices, such as steel and aluminum, also directly affect Bufab's procurement expenses, necessitating robust inventory and supplier management.

Supply chain disruptions, exacerbated by geopolitical events and economic shocks, continue to affect Bufab. Soaring freight costs and extended lead times impact operational efficiency and delivery times. Bufab's resilience strategies, including supplier diversification, buffer stocks, and alternative logistics, are crucial for mitigating these ongoing challenges and ensuring consistent service delivery to clients.

| Economic Factor | 2024 Projection/Trend | Impact on Bufab | Mitigation Strategy |

|---|---|---|---|

| Global Growth | IMF: 3.2% (2024) | Moderate demand, varied regional performance | Focus on resilient markets, diversified customer base |

| Inflation | Elevated, persistent | Increased input & operational costs, margin pressure | Cost control, strategic price adjustments, supplier negotiation |

| Interest Rates | High | Increased borrowing costs, potential demand dampening | Optimized financing, efficient working capital management |

| Currency Exchange Rates | Volatile (e.g., USD/SEK) | Impacts procurement costs and sales translation | Hedging strategies, currency diversification |

| Commodity Prices | Volatile (e.g., Steel, Aluminum) | Fluctuating raw material expenses | Long-term supplier agreements, strategic sourcing, inventory management |

| Supply Chain Disruptions | Ongoing (freight costs, lead times) | Operational inefficiencies, increased logistics costs | Supply chain resilience, diversified sourcing, buffer stocks |

Full Version Awaits

Bufab PESTLE Analysis

The preview shown here is the exact Bufab PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Bufab's operating environment.

The content and structure shown in the preview is the same Bufab PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

The availability of skilled labor is a cornerstone for Bufab's success, particularly in manufacturing, logistics, and supply chain management. In 2024, many developed economies are experiencing a shortage of manufacturing workers, with some reports indicating millions of open positions. This scarcity directly impacts Bufab's ability to fulfill orders efficiently and support its clients' production schedules.

Demographic trends, such as aging workforces in some regions and varying educational system outputs globally, significantly shape the available talent pool. For instance, in 2023, several European countries reported a declining working-age population, exacerbating labor shortages. Bufab must therefore implement robust strategies for attracting, retaining, and upskilling its workforce to bridge these gaps and ensure consistent operational capacity, while also carefully monitoring labor conditions in its global sourcing hubs.

Societal expectations are shifting, with a significant rise in customer demand for products and supply chains that are both environmentally and socially responsible. This trend is particularly evident in Bufab's manufacturing client base, which is increasingly prioritizing C-parts and services that meet stringent sustainability criteria, encompassing ethical sourcing and a minimized environmental footprint.

For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products from sustainable brands, highlighting the commercial imperative for companies like Bufab to integrate sustainability into their core offerings. Meeting these evolving demands is crucial for Bufab to bolster its market appeal and maintain a competitive edge.

Conversely, a failure to adapt to these growing sustainability expectations could lead to significant reputational damage and, consequently, a loss of valuable business as customers seek out more conscientious suppliers.

Societal concerns regarding labor practices, human rights, and environmental impact within global supply chains are increasingly influencing corporate behavior. For companies like Bufab, this translates into significant pressure to demonstrate ethical sourcing in their operations. For instance, in 2024, a significant percentage of consumers reported that they would pay more for products from companies with strong ethical sourcing policies, highlighting the market's responsiveness to these issues.

Customers and stakeholders now demand greater transparency and accountability concerning the origins and production conditions of components, including C-parts. This expectation means companies must actively communicate their efforts and provide verifiable data on their supply chains. A 2025 survey indicated that over 70% of B2B buyers consider a supplier's ethical sourcing practices a key decision-making factor.

Adhering to strict ethical sourcing guidelines and conducting thorough due diligence on suppliers is therefore crucial for Bufab to maintain trust and protect its brand reputation. This proactive approach is essential for mitigating risks associated with issues like conflict minerals or forced labor, which can lead to substantial financial and reputational damage.

Changing Consumer Behavior in Manufacturing

While Bufab directly supplies businesses, shifting consumer desires for manufactured goods significantly impact their market. For instance, the burgeoning demand for electric vehicles (EVs) is a prime example. The global EV market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, according to some market analyses. This growth necessitates a surge in demand for specialized fasteners and C-parts used in EV construction, influencing material choices and product specifications for Bufab's clients.

Similarly, the increasing adoption of smart home technology, a market expected to grow substantially in the coming years, drives demand for smaller, more intricate components. Consumers' preference for sustainable packaging also translates to manufacturers seeking eco-friendly materials and production methods, which can influence the types of C-parts required. Bufab's ability to adapt to these evolving end-consumer trends allows them to better anticipate and meet the future needs of their industrial customer base.

- EV Market Growth: Global EV market projected to exceed $1.5 trillion by 2030, driving demand for specialized fasteners.

- Smart Home Adoption: Increasing consumer interest in smart home devices fuels demand for intricate electronic components.

- Sustainability Focus: Consumer push for eco-friendly products influences manufacturers' material and C-part specifications.

Demographic Shifts in Labor Markets

Demographic shifts present a complex landscape for Bufab. For instance, many developed nations, including key European markets where Bufab operates, are experiencing aging populations. In 2024, the median age in the European Union was around 44.4 years. This trend can lead to labor shortages and increased labor costs as fewer younger individuals enter the workforce to replace retiring workers. Conversely, emerging economies often boast a youthful demographic, offering a larger potential labor pool but potentially requiring more investment in training and skill development.

These contrasting demographic trends directly influence labor availability and costs for Bufab and its supply chain. In regions with aging workforces, finding skilled labor for manufacturing roles may become more challenging, potentially driving up wages. For example, Germany, a significant market for industrial components, had a dependency ratio (the ratio of dependents to the working-age population) that was projected to increase significantly in the coming years. This necessitates strategies like automation and enhanced employee retention programs.

Bufab must adapt its recruitment and talent management strategies to address these global demographic variations. In areas with labor scarcity due to aging populations, exploring automation solutions for repetitive tasks becomes crucial. Simultaneously, in regions with a burgeoning youth population, investing in vocational training and apprenticeship programs can ensure a pipeline of skilled workers for both Bufab's direct operations and its supplier network. Global talent mobility also plays a role, as companies may need to facilitate the movement of skilled workers across borders to meet specific needs.

- Aging Workforce Impact: Developed markets like those in Europe face increasing median ages (e.g., EU median age around 44.4 in 2024), potentially leading to labor shortages and higher labor costs for Bufab.

- Youthful Workforce Opportunity: Emerging economies offer a larger, younger labor pool, presenting opportunities but requiring investment in skill development and training for Bufab's supply chain.

- Strategic Adaptation: Bufab needs to consider automation in regions with labor scarcity and adapt recruitment to leverage younger demographics in other markets.

- Global Talent Mobility: The differing demographic trends necessitate a strategic approach to global talent mobility to fill skill gaps effectively.

Societal expectations regarding ethical business practices and supply chain transparency are increasingly influencing Bufab's operational landscape. Consumers and business partners alike are demanding greater accountability for human rights and environmental impact throughout the value chain, with a 2025 survey revealing that over 70% of B2B buyers consider a supplier's ethical sourcing a key decision factor.

This heightened awareness translates into direct pressure on companies like Bufab to demonstrate robust due diligence and ethical sourcing policies. Failure to meet these evolving standards risks reputational damage and potential loss of business, as clients actively seek more conscientious suppliers.

Furthermore, shifting end-consumer preferences, such as the surge in demand for electric vehicles (EVs)—a market valued at approximately $380 billion in 2023 and projected to grow significantly—directly impact the types of components manufacturers require, influencing Bufab's product specifications and material sourcing strategies.

Technological factors

The logistics sector is rapidly integrating automation and robotics, with the global warehouse automation market projected to reach $35.2 billion by 2028, growing at a CAGR of 13.2% from 2023. This trend directly impacts Bufab by offering opportunities to boost efficiency and precision in C-parts handling and distribution.

Technologies such as automated guided vehicles (AGVs) and automated storage and retrieval systems (AS/RS) are becoming standard for optimizing warehouse operations. These advancements can significantly reduce labor costs, accelerate delivery times, and minimize errors within the supply chain, aligning perfectly with Bufab's core offering of streamlined logistics.

Advanced data analytics and artificial intelligence (AI) are transforming supply chains, and Bufab is positioned to benefit significantly. These technologies allow for sophisticated demand forecasting, helping Bufab anticipate customer needs more accurately. For instance, AI-driven predictive maintenance can minimize downtime in manufacturing, ensuring consistent production. In 2024, companies adopting AI in their supply chains reported an average reduction in inventory holding costs by 15%.

AI's capabilities extend to analyzing supplier performance, identifying potential risks, and optimizing logistics. By leveraging AI for route optimization, Bufab can reduce transportation costs and delivery times. This technological integration enables more informed decision-making, leading to shorter lead times and better inventory control. Studies in late 2024 indicate that businesses utilizing AI for supply chain visibility experienced a 10% improvement in on-time delivery rates.

The manufacturing sector is seeing rapid advancements, with techniques like additive manufacturing, or 3D printing, and breakthroughs in material science reshaping production. These innovations could impact the demand for traditional C-parts, or component parts, that Bufab specializes in. For instance, while standard fasteners will likely remain critical, new methods could allow for highly customized or integrated components, potentially changing the market for certain specialized fasteners.

Bufab must keep a close watch on these evolving technologies to grasp their long-term effects on its product range and services. The global 3D printing market, for example, was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating a growing influence of additive manufacturing. This evolution might not only challenge existing product lines but also open doors for new service opportunities, such as offering specialized 3D-printed components or advanced material sourcing.

Digital Platforms for Procurement

The rise of digital platforms for procurement, including e-procurement systems and blockchain technology, is fundamentally reshaping how companies like Bufab manage their supply chains. These digital tools are becoming essential for increasing transparency and efficiency in supplier and customer interactions. For instance, by 2024, it's estimated that global e-procurement software market will reach approximately $15 billion, highlighting the significant adoption of these technologies.

These advancements directly impact Bufab's operations by streamlining critical processes such as order placement, invoicing, and real-time tracking of goods. The administrative burden associated with traditional procurement methods is significantly reduced, allowing for greater focus on strategic supplier relationships and customer service. Integrating with these digital solutions can offer Bufab more seamless and transparent supply chain management.

Leveraging these digital platforms allows Bufab to enhance collaboration and data exchange across its entire value chain. This improved flow of information can lead to better forecasting, reduced lead times, and increased responsiveness to market demands. For example, studies in 2024 indicate that companies utilizing advanced e-procurement solutions have seen an average reduction of 10-15% in procurement costs.

- Digitalization of Procurement: Increasing adoption of e-procurement platforms and blockchain for supply chain transparency.

- Efficiency Gains: Streamlined ordering, invoicing, and tracking processes leading to reduced administrative overhead.

- Enhanced Collaboration: Improved data exchange and communication across the entire value chain.

- Market Trends: Global e-procurement market projected to exceed $15 billion by 2024, with significant cost savings reported by users.

Cybersecurity Risks

Bufab's extensive reliance on digital platforms for its global supply chain, data management, and customer engagement makes cybersecurity a critical concern. Threats such as data breaches, ransomware, and operational technology disruptions pose significant risks to business continuity, reputation, and customer confidence. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this challenge.

Implementing and continuously updating robust cybersecurity measures is non-negotiable for Bufab. These investments are vital for safeguarding sensitive information, ensuring uninterrupted operations, and maintaining the integrity of its supply chain services. The company must proactively address evolving cyber threats to protect its digital assets and operational resilience.

- Cybersecurity Investment: Bufab must view cybersecurity as an ongoing operational necessity, not a one-time fix.

- Data Breach Impact: The potential financial and reputational damage from a significant data breach can be catastrophic, impacting customer trust and market position.

- Operational Technology Security: Protecting the systems that manage physical operations within the supply chain is as crucial as protecting data.

Technological advancements are fundamentally reshaping Bufab's operating environment, particularly in logistics and manufacturing. Automation, AI, and digitalization are key drivers, promising increased efficiency and new service models. For instance, the global warehouse automation market is expected to reach $35.2 billion by 2028, a clear indicator of this trend's impact on supply chain operations.

AI-driven analytics are enhancing demand forecasting and operational efficiency, with companies adopting AI in supply chains reporting a 15% reduction in inventory holding costs in 2024. Furthermore, the manufacturing sector's embrace of additive manufacturing, with the global 3D printing market valued at $15.1 billion in 2023, presents both challenges and opportunities for Bufab's C-parts offerings.

The digitalization of procurement, including e-procurement platforms, is streamlining transactions, with this market projected to exceed $15 billion by 2024. However, this increased reliance on digital systems elevates cybersecurity as a critical concern, especially with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025.

| Technology Area | Key Trend | Impact on Bufab | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Logistics Automation | Integration of AGVs and AS/RS | Increased efficiency, reduced costs, faster delivery | Warehouse automation market projected at $35.2B by 2028 (13.2% CAGR) |

| Artificial Intelligence | Demand forecasting, predictive maintenance | Improved inventory management, reduced downtime | 15% reduction in inventory costs for AI-adopting supply chains (2024) |

| Manufacturing | Additive Manufacturing (3D Printing) | Potential shift in demand for traditional C-parts, new service opportunities | Global 3D printing market valued at $15.1B in 2023 |

| Digital Procurement | E-procurement, Blockchain | Streamlined transactions, enhanced transparency, reduced admin overhead | E-procurement market projected to exceed $15B by 2024 |

| Cybersecurity | Data breaches, ransomware | Risk to operations, reputation, and customer trust | Global cost of cybercrime projected at $10.5T annually by 2025 |

Legal factors

Bufab's global operations necessitate strict adherence to a patchwork of international trade regulations. Navigating customs duties, import/export controls, and anti-dumping measures across its many operating countries is paramount, as missteps can result in substantial penalties and trade disruptions. For instance, in 2023, the World Trade Organization (WTO) reported that trade facilitation measures, including streamlined customs procedures, could boost global trade by up to 15%.

Failure to comply with these intricate legal frameworks can directly impact Bufab's supply chain efficiency and profitability. The company must actively monitor evolving trade policies, such as the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, to anticipate and manage potential impacts on its cross-border transactions.

Bufab's operations are legally bound to meet stringent national and international product safety and quality standards, such as ISO certifications and CE marking, particularly for fasteners and C-parts. Non-compliance can trigger costly product recalls, significant liability claims, and severe damage to Bufab's hard-earned reputation in the market.

In 2024, regulatory bodies worldwide continued to emphasize product traceability and material integrity. For instance, the European Union's General Product Safety Regulation (GPSR), which fully applies from December 2024, places a greater onus on manufacturers and distributors to ensure product safety throughout the supply chain, impacting how Bufab must document and verify its C-parts.

Bufab's commitment to rigorous quality control and sourcing practices ensures adherence to these evolving legal frameworks, covering critical aspects like material composition and performance specifications. This proactive approach is essential for maintaining market access and customer trust, especially as global regulatory scrutiny intensifies.

Bufab faces a complex web of environmental compliance laws impacting its manufacturing and product composition, such as REACH and RoHS directives concerning chemical substances in fasteners. These regulations, which differ significantly across countries and regions, necessitate rigorous adherence to manage waste and emissions effectively. For instance, in 2024, the EU continued to strengthen its chemical regulations, with ongoing discussions around potential restrictions on certain PFAS substances, which could affect materials used in some industrial fasteners.

Labor Laws and Regulations

Bufab's operations and its extensive supplier network are deeply impacted by a complex web of labor laws and regulations worldwide. Ensuring compliance with these statutes, which cover everything from minimum wage and working hours to health and safety standards and the specifics of employment contracts, is paramount. Failure to adhere can result in significant legal challenges, hefty fines, and severe reputational damage, particularly in an era where ethical sourcing and supply chain transparency are increasingly scrutinized by consumers and investors alike.

The company must actively monitor and enforce fair labor practices not only within its own facilities but also throughout its global supply chain. This necessitates a thorough understanding of local labor union regulations and collective bargaining agreements, as these can vary dramatically from one region to another. For instance, in 2024, many European countries are seeing increased union activity and demands for improved working conditions and wage increases, directly affecting manufacturing costs and operational stability for companies like Bufab.

- Minimum Wage Compliance: Bufab must ensure all its direct employees and those within its supply chain are paid at least the legally mandated minimum wage in their respective locations. For example, in the United States, the federal minimum wage is $7.25 per hour, but many states and cities have set much higher rates, with California's minimum wage reaching $16.00 per hour in 2024.

- Working Conditions and Safety: Adherence to occupational health and safety standards is critical. The International Labour Organization (ILO) reports that workplace accidents and diseases remain a significant global issue, with millions of fatalities occurring annually, underscoring the importance of robust safety protocols.

- Ethical Sourcing and Labor Practices: Bufab's commitment to ethical sourcing means actively verifying that suppliers do not engage in forced labor, child labor, or other exploitative practices. Regulations like the Uyghur Forced Labor Prevention Act in the US, enacted in 2022, place strict import restrictions based on labor practices, impacting global supply chains.

- Employment Contracts and Labor Relations: Ensuring clear and legally sound employment contracts is vital for both employer and employee. Understanding and respecting local labor union regulations, including the right to organize and bargain collectively, is also a key aspect of legal compliance and maintaining stable industrial relations.

Contractual Obligations and IP Rights

Bufab's extensive network of suppliers and customers necessitates robust legal frameworks for managing a multitude of contractual obligations. This requires diligent legal oversight to ensure compliance and proactively address potential disputes, thereby safeguarding Bufab's business interests and fostering stable relationships. For instance, in 2023, Bufab reported that its total order book value stood at SEK 5,988 million, underscoring the sheer volume of contractual commitments it manages.

Protecting intellectual property (IP) rights is paramount, especially concerning proprietary manufacturing processes and specialized C-part designs. Bufab must maintain strong legal mechanisms to shield its innovations and unique product offerings from infringement, a critical factor in maintaining its competitive edge in the component supply market. The company's commitment to innovation is reflected in its ongoing product development efforts, which rely heavily on the secure protection of its intellectual assets.

- Contractual Compliance: Ensuring adherence to terms across thousands of supplier and customer agreements, minimizing legal risks and fostering trust.

- Intellectual Property Protection: Safeguarding proprietary designs and manufacturing techniques to maintain competitive advantage and prevent unauthorized use.

- Dispute Resolution: Establishing clear legal channels for resolving any contractual disagreements efficiently and effectively.

- Regulatory Adherence: Staying abreast of and complying with all relevant national and international contract and IP laws.

Bufab's global operations are subject to a complex array of legal and regulatory requirements that significantly influence its business strategy and operational execution. Navigating international trade laws, product safety standards, environmental regulations, labor laws, and contractual obligations is critical for maintaining market access and mitigating risks.

In 2024, Bufab must remain vigilant regarding evolving trade policies, such as the EU's CBAM, and product safety regulations like the GPSR, which mandates enhanced traceability. Compliance with these frameworks, alongside stringent labor laws and intellectual property protection, is essential for operational stability and competitive advantage.

The company's financial performance is directly linked to its ability to adhere to these diverse legal mandates. For instance, Bufab's 2023 order book value of SEK 5,988 million highlights the extensive contractual landscape it manages, where compliance ensures smooth transactions and minimizes potential liabilities.

| Legal Factor | Impact on Bufab | 2024/2025 Relevance/Data |

| International Trade Regulations | Customs duties, import/export controls, trade disruptions | WTO's 2023 report indicated trade facilitation could boost global trade by up to 15%. |

| Product Safety & Quality Standards | Recalls, liability claims, reputational damage | EU's GPSR fully applies from December 2024, increasing manufacturer responsibility. |

| Environmental Compliance | Waste/emission management, chemical substance regulations | EU's ongoing discussions on PFAS restrictions in 2024 could affect materials. |

| Labor Laws & Ethical Sourcing | Legal challenges, fines, reputational damage | Increased union activity in Europe in 2024 impacts manufacturing costs and stability. |

| Contractual & IP Law | Dispute resolution, competitive edge, unauthorized use | Bufab's 2023 order book value of SEK 5,988 million underscores the volume of contracts managed. |

Environmental factors

Bufab's manufacturing clients are increasingly focused on their own environmental impact, pushing these expectations down their supply chains. This means Bufab faces growing demands for C-parts with reduced environmental footprints, eco-friendly packaging solutions, and a clear, traceable supply chain. For instance, in 2024, a significant percentage of automotive manufacturers surveyed by a leading industry group indicated they would prioritize suppliers with demonstrable sustainability credentials.

Meeting these customer-driven sustainability objectives is no longer optional; it's a critical factor for maintaining competitiveness and standing out in the market. This includes a rising need for Bufab to transparently report on its environmental performance metrics, such as carbon emissions and waste reduction efforts, to satisfy evolving client reporting requirements.

Bufab's global logistics network, essential for transporting C-parts, directly contributes to carbon emissions. In 2024, the logistics sector continued to be a major source of greenhouse gases, with road freight alone accounting for a significant portion of global CO2 emissions. This environmental factor necessitates proactive measures from Bufab.

Mounting regulatory pressure and ambitious corporate sustainability targets are compelling businesses, including Bufab, to actively reduce their carbon footprint from logistics operations. For instance, by 2025, many jurisdictions are expected to tighten emissions standards for commercial vehicles, impacting shipping costs and feasibility. Bufab's commitment to environmental stewardship means addressing these challenges head-on.

To mitigate its environmental impact, Bufab is exploring and implementing strategies such as optimizing shipping routes, adopting more fuel-efficient transportation modes, and consolidating shipments. These efforts are crucial for minimizing its carbon footprint. Furthermore, optimizing energy consumption within warehouses is an integral part of this strategy, contributing to overall operational efficiency and sustainability reporting.

The extraction and processing of metals, the core of C-parts, carry substantial environmental burdens. This includes the depletion of finite resources, significant energy demands, and the potential for pollution. For instance, the mining sector is a major consumer of energy and water, and can lead to habitat destruction and water contamination if not managed responsibly.

Bufab must actively address the environmental footprint of its raw material supply chain. This means encouraging suppliers to adopt greener mining and manufacturing processes. A key strategy involves conducting thorough due diligence on supplier environmental policies and exploring the increased use of recycled materials, which can drastically reduce the need for virgin resource extraction.

Responsible sourcing is paramount to mitigating these environmental impacts. For example, initiatives promoting circular economy principles in metal production are gaining traction. In 2024, the global recycled metals market was valued at over $300 billion, highlighting the growing economic and environmental incentive for using recycled content in manufacturing.

Waste Management and Recycling Regulations

Bufab faces significant environmental considerations through its waste management and recycling obligations, impacting both its internal operations and its customer base. The company's activities, from packaging C-parts to the eventual end-of-life of these components, inherently generate waste streams that require careful management. Compliance with increasingly stringent waste regulations across its operating regions is paramount. For instance, in 2024, the European Union continued to push for higher recycling rates and extended producer responsibility schemes, which directly affect companies like Bufab that supply components used in a wide array of manufactured goods.

The company's strategy to address these environmental factors involves a multi-pronged approach focused on waste reduction and circularity. Bufab can actively optimize its packaging solutions to minimize material usage and enhance recyclability, thereby cutting down on the volume of waste generated. Furthermore, promoting circular economy principles for its C-parts, perhaps through take-back programs or designing for easier disassembly and material recovery, is a key area for development. In 2025, many industrial sectors are expected to see increased investment in supply chain circularity initiatives, driven by both regulatory pressure and growing consumer demand for sustainable products.

Collaboration with customers on recycling programs presents a significant opportunity for Bufab to demonstrate environmental stewardship and create shared value. By working together, Bufab and its clients can develop more effective systems for collecting and processing end-of-life components and packaging. This includes managing waste generated from manufacturing processes, ensuring that all waste streams are handled responsibly. The global push towards a circular economy is accelerating, with initiatives like the Ellen MacArthur Foundation's network highlighting the business case for redesigning products and systems to eliminate waste and pollution.

- Waste Generation: Bufab's operations and customer product lifecycles generate waste from packaging and end-of-life C-parts.

- Regulatory Compliance: Adherence to evolving waste management and recycling regulations globally is a critical operational requirement.

- Circular Economy Initiatives: Optimizing packaging, promoting product circularity, and customer recycling collaborations are key strategies.

- Manufacturing Waste: Responsible management of waste stemming from Bufab's own manufacturing processes is also included.

Climate Change Adaptation Strategies

The physical impacts of climate change, including more frequent extreme weather events, pose a significant threat to Bufab's global supply chain. These events can damage critical infrastructure, disrupt supplier operations, and impede transportation routes, leading to potential delays and increased costs. For instance, the World Meteorological Organization reported that in 2023, weather and climate extremes caused over $100 billion in damages globally.

To counter these risks, Bufab must implement robust climate adaptation strategies to bolster supply chain resilience. This involves diversifying sourcing locations to reduce reliance on any single region vulnerable to climate impacts. Building strategic buffer stocks of critical components can also mitigate the effects of short-term disruptions.

Furthermore, Bufab should consider investing in climate-resilient logistics infrastructure, such as warehouses designed to withstand flooding or transportation networks with alternative routes. Proactive adaptation measures are not just about mitigating immediate threats but are essential for ensuring long-term operational stability and competitiveness in an increasingly unpredictable climate.

Key adaptation strategies for Bufab include:

- Supply Chain Diversification: Reducing geographical concentration of suppliers to mitigate regional climate risks.

- Inventory Management: Maintaining strategic buffer stocks for key components to absorb short-term supply shocks.

- Infrastructure Investment: Prioritizing logistics and manufacturing sites with enhanced resilience to extreme weather events.

- Risk Assessment: Continuously evaluating climate-related vulnerabilities across the entire supply chain.

Bufab faces increasing customer pressure to demonstrate reduced environmental impact, necessitating eco-friendly packaging and traceable supply chains. In 2024, automotive clients specifically prioritized suppliers with proven sustainability credentials.

The company’s global logistics are a significant contributor to carbon emissions, a factor amplified by the logistics sector’s substantial role in greenhouse gas output, with road freight being a major component. By 2025, stricter emissions standards for commercial vehicles are anticipated, impacting shipping costs and logistics feasibility.

Bufab is actively working to minimize its environmental footprint by optimizing shipping routes, utilizing more fuel-efficient transport, and consolidating shipments, alongside improving energy efficiency in its warehouses.

PESTLE Analysis Data Sources

Our Bufab PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable economic databases, and leading industry research reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in accurate and current information.