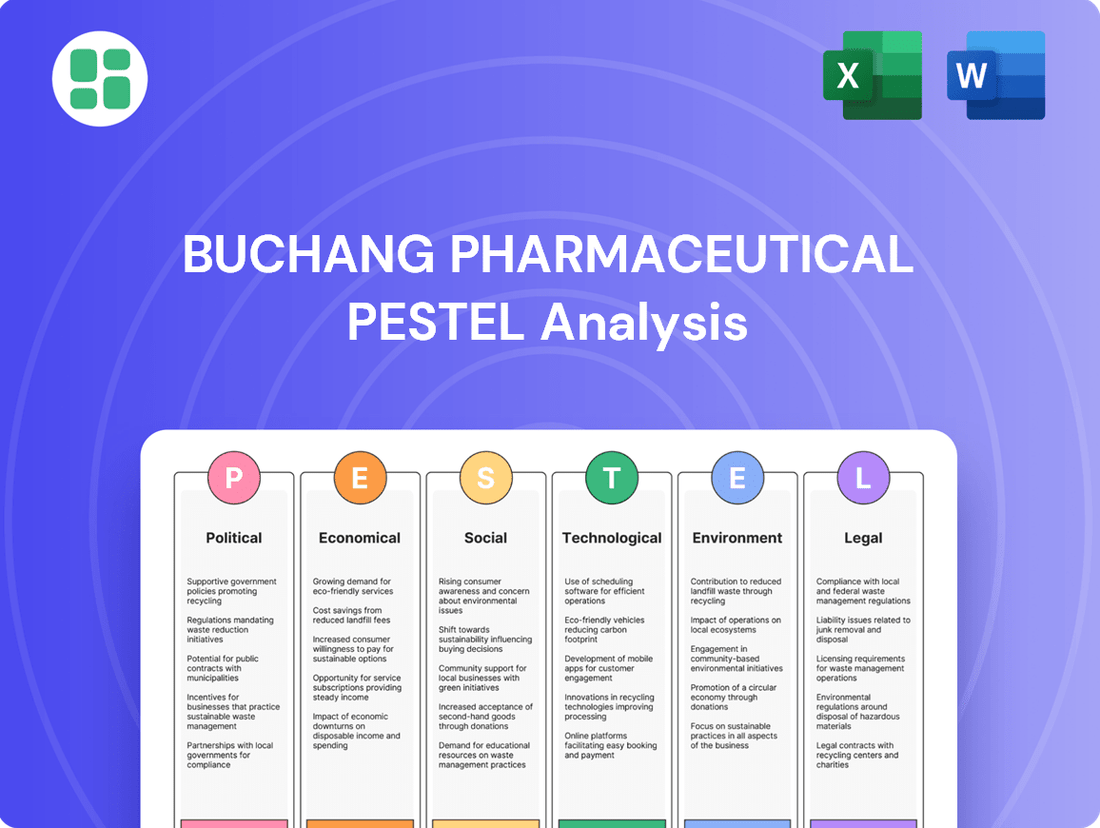

Buchang Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Buchang Pharmaceutical Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Buchang Pharmaceutical's trajectory. Our PESTLE analysis provides a clear roadmap of the external forces influencing this key player in the pharmaceutical industry. Equip yourself with this vital intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for actionable insights.

Political factors

The Chinese government's strategic focus on healthcare reform, particularly the promotion of Traditional Chinese Medicine (TCM), presents a significant tailwind for Buchang Pharmaceutical. Initiatives like the 'Healthy China 2030' plan actively encourage the integration of TCM into the national healthcare system, directly supporting Buchang's business model.

This governmental push translates into tangible benefits, including enhanced funding for TCM research and development, as well as expanded opportunities for clinical application. For instance, in 2024, the National Healthcare Security Administration continued to broaden the scope of TCM treatments covered by medical insurance, a move that bolsters demand for Buchang's products.

Updates to China's National Reimbursement Drug List (NRDL) are pivotal for pharmaceutical companies like Buchang. Inclusion on this list dramatically expands patient access, but it typically requires substantial price reductions. In late 2024, the NRDL saw the addition of 90 new drugs, including innovative Chinese medicines, with the changes taking effect from January 1, 2025.

This development presents Buchang with a dual-edged sword: the potential for significantly higher sales volumes due to broader accessibility versus the challenge of navigating intensified pricing pressures on its portfolio.

Recent amendments to China's patent law, effective January 20, 2024, introduce a pharmaceutical patent term compensation system. This system allows for up to five years of additional patent term for new drugs, significantly strengthening intellectual property protection for innovative pharmaceutical companies.

This enhancement directly benefits companies like Buchang Pharmaceutical, which focus on Traditional Chinese Medicine (TCM) innovation. By extending the market exclusivity period for their patented TCM products, Buchang can better recoup research and development investments and maintain a competitive edge.

Anti-Corruption Campaigns

The Chinese government's intensified anti-corruption campaigns throughout 2024 and into 2025 are creating a more stringent operating environment for pharmaceutical firms like Buchang. These initiatives target misconduct in medical services and drug sales, directly impacting how pharmaceutical companies engage with healthcare providers and manage their sales forces.

This heightened scrutiny necessitates that Buchang Pharmaceutical strengthens its internal compliance and governance frameworks. The focus is on ensuring ethical sales practices and transparent dealings, a crucial step to avoid penalties and maintain market trust amidst these regulatory shifts.

- Increased Regulatory Oversight: Expect more frequent inspections and audits of sales practices and promotional activities.

- Stricter Enforcement: Penalties for non-compliance are likely to be more severe, impacting profitability and reputation.

- Focus on Sales Agent Conduct: Companies must ensure their sales representatives adhere to strict ethical guidelines to prevent bribery or kickbacks.

- Data Integrity Demands: Greater emphasis will be placed on the accuracy and transparency of sales data and reporting.

Geopolitical Tensions and Supply Chain Security

Rising geopolitical tensions, especially between the US and China, present significant risks to global pharmaceutical supply chains, affecting the availability of crucial active pharmaceutical ingredients (APIs) sourced from China. For Buchang Pharmaceutical, this means potential disruptions and increased costs if these tensions escalate.

Legislation like the US BIOSECURE Act, which was under consideration in 2024, could compel pharmaceutical firms to reduce their dependence on Chinese contract manufacturers. This regulatory pressure might necessitate Buchang exploring domestic sourcing or implementing diversification strategies to bolster its supply chain resilience and safeguard international partnerships.

- US-China trade disputes: Increased tariffs and trade barriers can directly impact the cost of imported APIs and finished drug products.

- BIOSECURE Act considerations (2024): Potential legislation could restrict the use of certain Chinese biotechnology companies, forcing a reassessment of supplier relationships.

- Supply chain diversification: Companies like Buchang may need to invest in or partner with manufacturers in other regions to mitigate risks associated with over-reliance on a single country.

- Impact on R&D collaborations: Geopolitical friction can hinder international research and development partnerships, slowing down innovation and market access.

The Chinese government's strong support for Traditional Chinese Medicine (TCM) through initiatives like the 'Healthy China 2030' plan directly benefits Buchang Pharmaceutical. Increased government funding for TCM research and development, coupled with expanded insurance coverage for TCM treatments, as seen with the National Healthcare Security Administration's 2024 updates, bolsters Buchang's market position.

Amendments to China's patent law, effective January 2024, introduce a pharmaceutical patent term compensation system, extending exclusivity for up to five years. This directly aids Buchang's innovation in TCM, allowing for better recoupment of R&D investments.

However, intensified anti-corruption campaigns in 2024-2025 necessitate stringent compliance and ethical sales practices from Buchang to maintain market trust and avoid penalties.

Geopolitical tensions, particularly US-China relations, pose risks to supply chains, potentially impacting API availability and increasing costs, prompting Buchang to consider supply chain diversification strategies.

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Buchang Pharmaceutical, offering a comprehensive understanding of its external operating landscape.

Buchang Pharmaceutical's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning.

Economic factors

China's total health expenditure is anticipated to grow consistently from 2024 through 2028, with an estimated compound annual growth rate of around 4.65%. This steady expansion highlights a strengthening healthcare sector, directly benefiting pharmaceutical companies.

The upward trend in national healthcare spending, alongside an expected increase in private health expenditure per person, signals a burgeoning market for pharmaceutical goods. This economic climate is particularly advantageous for Buchang Pharmaceutical, given its specialization in treating chronic conditions.

China's economic expansion significantly fuels its pharmaceutical sector, with rising disposable incomes directly translating to increased healthcare spending. As of early 2024, China's GDP growth projections for the year remained robust, supporting this trend.

The expanding middle class, a demographic increasingly focused on health and wellness, demonstrates a greater willingness to invest in premium pharmaceutical products and supplements. This includes a notable preference for established brands, benefiting companies like Buchang Pharmaceutical.

This consumer behavior shift, driven by higher disposable incomes and a growing health consciousness, creates a favorable market environment for Buchang, especially for its higher-value and innovative offerings, including Traditional Chinese Medicine.

While inclusion in China's National Reimbursement Drug List (NRDL) is crucial for market access, it often comes with substantial price reductions. For Buchang Pharmaceutical, this means balancing wider patient reach against potentially lower per-unit revenue. In 2023, the NRDL expansion included over 120 new drugs, many of which saw significant price cuts during negotiations, highlighting the ongoing pressure.

China's centralized drug procurement programs, like the Volume-Based Procurement (VBP) initiative, continue to drive down prices across the board. These schemes have reportedly saved the country's healthcare system tens of billions of dollars, but they impose considerable pricing challenges on manufacturers. Buchang must navigate these procurement rounds carefully, potentially accepting lower margins for guaranteed high-volume sales.

Effectively managing pricing strategies and engaging in skillful negotiations with government bodies is paramount for Buchang. The company needs to find a delicate equilibrium between securing broad market access through NRDL and VBP programs and maintaining healthy profitability. This requires a deep understanding of market dynamics and the value proposition of its pharmaceutical products.

Investment in Innovative Drugs

Government and private sector investments are significantly increasing in China's innovative drug sector, driven by policies designed to boost domestic research and development capabilities. This trend creates a fertile ground for companies like Buchang Pharmaceutical to secure crucial funding and forge strategic partnerships for their novel Traditional Chinese Medicine (TCM) products and integrated therapeutic approaches.

The innovative drug market in China is projected for robust growth, bolstered by this sustained policy and financial backing. For instance, China's National Medical Products Administration (NMPA) has been actively streamlining approval processes for innovative therapies, aiming to reduce the time-to-market for new treatments. In 2023, the number of innovative drugs approved by the NMPA saw a notable increase, signaling a dynamic and supportive environment.

- Increased R&D Funding: China's total R&D expenditure as a percentage of GDP reached approximately 2.64% in 2023, with a substantial portion allocated to healthcare and pharmaceuticals.

- Policy Support for Innovation: Government initiatives, such as tax incentives for R&D and preferential treatment for novel drug applications, are actively encouraging investment in the sector.

- Market Growth Projections: The Chinese innovative drug market is anticipated to grow at a compound annual growth rate (CAGR) of over 15% in the coming years, reaching hundreds of billions of dollars by the end of the decade.

Market Competition and Consolidation

The Chinese pharmaceutical market is intensifying, with domestic and international companies fiercely competing for dominance. By 2024, the market was valued at over $150 billion, a significant increase driven by both local innovation and the growing appeal of multinational brands among specific consumer segments. This dynamic environment suggests potential for industry consolidation, forcing companies like Buchang Pharmaceutical to sharpen their competitive edge through product differentiation and aggressive market penetration strategies.

Buchang Pharmaceutical faces a landscape where both established multinational corporations and rapidly evolving domestic players are vying for market share. While Chinese firms led in clinical trial growth throughout 2023 and early 2024, global pharmaceutical giants are making inroads, particularly by targeting specific demographic groups with specialized treatments. This heightened competition could spur consolidation, creating larger entities and increasing pressure on companies like Buchang to innovate and expand their market reach to maintain profitability.

- Intensifying Competition: The Chinese pharmaceutical market is experiencing a surge in competition from both domestic and multinational players.

- Multinational Gains: While local companies drive clinical trial growth, multinational brands are successfully capturing specific consumer demographics.

- Market Dynamics: This competitive pressure could lead to industry consolidation or force Buchang Pharmaceutical to focus on product differentiation and market penetration.

- Market Value: The Chinese pharmaceutical market was valued at over $150 billion in 2024, highlighting its significant growth and competitive intensity.

China's healthcare spending is on a steady upward trajectory, with an estimated 4.65% CAGR from 2024-2028, indicating a robust market for pharmaceutical firms like Buchang. Rising disposable incomes and a growing middle class, increasingly health-conscious, are driving demand for premium healthcare products and treatments, particularly for chronic conditions which Buchang specializes in.

Despite this growth, pricing pressures are significant due to China's National Reimbursement Drug List (NRDL) and Volume-Based Procurement (VBP) initiatives, which mandate price reductions for market access. Buchang must strategically balance broad patient reach with profitability by skillfully negotiating these programs.

The Chinese pharmaceutical market, valued at over $150 billion in 2024, is highly competitive, featuring both domestic innovators and multinational corporations. This environment necessitates Buchang's focus on product differentiation and market penetration to maintain its position.

| Economic Factor | 2024 Data/Projection | Impact on Buchang Pharmaceutical |

|---|---|---|

| Healthcare Expenditure Growth | ~4.65% CAGR (2024-2028) | Positive: Increased market size for pharmaceutical products. |

| Disposable Income Growth | Robust GDP growth projections in 2024 | Positive: Higher consumer spending on health and wellness. |

| Pricing Pressures (NRDL/VBP) | NRDL expansion in 2023 included ~120 new drugs with price cuts. VBP drives significant savings. | Negative: Requires strategic pricing and negotiation to maintain margins. |

| Market Value | >$150 billion (2024) | Neutral/Opportunity: Indicates market size but also intense competition. |

Full Version Awaits

Buchang Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Buchang Pharmaceutical covers all critical external factors influencing its operations. You will gain insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting the company.

Sociological factors

China's population is aging at a rapid pace, with the number of people aged 60 and over projected to reach 400 million by 2035, a substantial increase from 280 million in 2022. This demographic shift means a greater number of individuals will require ongoing care for chronic diseases, such as cardiovascular and cerebrovascular conditions, which are prevalent in older age groups. Buchang Pharmaceutical's focus on these therapeutic areas positions it to benefit significantly from this growing demand.

Traditional Chinese Medicine (TCM), a cornerstone of Buchang's product portfolio, is increasingly recognized for its holistic approach to health management, which resonates well with the long-term care needs of an aging population and those managing chronic illnesses. This alignment is crucial as healthcare systems worldwide, including China's, explore diverse treatment modalities to address the complexities of chronic disease management effectively.

Chinese consumers are increasingly prioritizing health and wellness, driving demand for preventive care and natural treatments. This shift is evident in the growing acceptance of Traditional Chinese Medicine (TCM), which aligns with a desire for holistic approaches to well-being.

Buchang Pharmaceutical is well-positioned to capitalize on this trend, as its product portfolio heavily features TCM. For instance, in 2023, Buchang's revenue from its core TCM products demonstrated robust growth, reflecting this societal preference.

The deep cultural roots and historical acceptance of Traditional Chinese Medicine (TCM) in China are significant. Government policies actively encourage its integration into the national healthcare system, which is a major driver for companies like Buchang Pharmaceutical.

By 2023, over 90% of Chinese hospitals offered TCM services, demonstrating a strong commitment to its accessibility. This trend directly boosts the demand and credibility of TCM products, creating a favorable market for Buchang Pharmaceutical's offerings.

Lifestyle Changes and Disease Patterns

Modern lifestyles in China have significantly shifted, leading to a notable rise in non-communicable diseases. This includes conditions like diabetes, hypertension, and various cardiovascular ailments, which are increasingly prevalent across the population.

Buchang Pharmaceutical's strategic focus on cardiovascular and cerebrovascular diseases directly addresses this growing health challenge. The company's product pipeline and existing market share are well-aligned with the escalating demand for effective treatments in these therapeutic areas.

The increasing incidence of lifestyle-related diseases in China presents a substantial market opportunity for Buchang. For instance, the prevalence of diabetes in China reached 12.4% among adults in 2023, a figure projected to continue its upward trend, underscoring the need for advanced pharmaceutical solutions.

- Increased Prevalence of Chronic Diseases: Lifestyle shifts have fueled a rise in conditions like cardiovascular disease, with China reporting over 300 million people living with it as of early 2024.

- Growing Demand for Specialized Treatments: The market for cardiovascular and cerebrovascular drugs in China is expanding rapidly, driven by an aging population and increased health awareness.

- Alignment with Buchang's Core Competencies: Buchang's established expertise in traditional Chinese medicine and modern pharmaceuticals for these specific conditions positions it advantageously.

Consumer Preferences for Brand and Quality

In China's burgeoning pharmaceutical market, a significant shift is occurring with a growing segment of highly educated, brand-conscious, and middle-class consumers. These individuals are increasingly dictating market trends by showing a strong preference for established, leading brands and prioritizing the purchase of high-quality medicines. This trend directly impacts companies like Buchang Pharmaceutical, necessitating a robust focus on brand reputation and product quality to resonate with this discerning demographic.

Buchang's strategy must therefore heavily emphasize building and maintaining a strong brand image, coupled with an unwavering commitment to product excellence. Effective engagement strategies are crucial to capture and retain these consumers, who are willing to pay a premium for perceived value and reliability in their healthcare choices. For instance, by 2024, consumer spending on premium pharmaceuticals in China was projected to continue its upward trajectory, reflecting this preference for quality and brand trust.

- Brand Loyalty: Consumers are increasingly loyal to brands that consistently deliver on quality and efficacy.

- Quality Assurance: High standards in manufacturing and clinical trials are paramount for consumer trust.

- Health Consciousness: An educated populace is more aware of health issues and seeks reliable pharmaceutical solutions.

- Market Segmentation: Buchang needs to tailor its marketing to appeal to the specific values of the educated middle class.

China's rapidly aging population, with over 280 million individuals aged 60 and above in 2022, is creating a significant demand for healthcare solutions, particularly for chronic conditions. This demographic trend directly benefits companies like Buchang Pharmaceutical, which specializes in treatments for cardiovascular and cerebrovascular diseases, conditions common among the elderly.

The growing emphasis on health and wellness, coupled with the deep cultural acceptance of Traditional Chinese Medicine (TCM), further bolsters Buchang's market position. As of 2023, over 90% of Chinese hospitals offer TCM services, indicating strong governmental and societal support for these natural treatments.

Modern lifestyles have led to an increase in non-communicable diseases, with diabetes prevalence reaching 12.4% in China's adult population by 2023. Buchang's focus on addressing these prevalent health challenges aligns perfectly with market needs.

Furthermore, a rising segment of educated, middle-class consumers in China prioritizes quality and brand reputation, showing a willingness to invest in premium pharmaceuticals. This consumer behavior, projected to continue growing through 2024, necessitates Buchang's commitment to product excellence and strong brand building.

| Sociological Factor | Description | Impact on Buchang Pharmaceutical | Supporting Data (2022-2024) |

|---|---|---|---|

| Aging Population | Rapid increase in elderly citizens requiring chronic disease management. | Increased demand for Buchang's specialized treatments. | 280 million+ individuals aged 60+ in 2022; projected to reach 400 million by 2035. |

| Health & Wellness Trend | Growing consumer interest in preventive care and natural remedies. | Boosts demand for Buchang's TCM products. | TCM services available in over 90% of Chinese hospitals (by 2023). |

| Lifestyle Diseases | Rise in conditions like cardiovascular disease and diabetes due to modern lifestyles. | Creates significant market opportunities for Buchang's therapeutic areas. | Over 300 million people living with cardiovascular disease (early 2024); 12.4% adult diabetes prevalence (2023). |

| Consumer Sophistication | Educated middle class seeking high-quality, branded pharmaceuticals. | Requires focus on brand building and product quality assurance. | Projected continued growth in premium pharmaceutical spending (by 2024). |

Technological factors

Buchang Pharmaceutical is actively bridging traditional Chinese medicine (TCM) with cutting-edge scientific research, a move that fuels its innovation pipeline. This integration aims to create treatments that are both effective and grounded in modern scientific validation.

Significant advancements in biotechnology and pharmaceutical R&D, supported by government initiatives promoting innovative drug development, are key enablers for Buchang. These factors allow the company to refine the efficacy and safety profiles of its TCM offerings, ensuring they meet contemporary standards.

In 2023, China's pharmaceutical R&D spending saw a notable increase, with many companies, including those in the TCM sector, investing heavily in modernization. This trend underscores Buchang's strategic focus on scientific methods to boost its market competitiveness.

The increasing digitalization of healthcare in China, including telemedicine platforms and online prescription services, presents new avenues for pharmaceutical companies like Buchang. Government and private sector investments are fueling this trend, enhancing patient access to medical advice and products. In 2024, China's digital health market was projected to reach over $200 billion, indicating significant growth potential.

Buchang can strategically utilize these digital platforms for product promotion, direct sales, and improved patient engagement, mirroring the success seen in other markets where digital health adoption has accelerated. This digital shift allows for more personalized marketing and streamlined distribution channels.

Buchang Pharmaceutical's adoption of advanced manufacturing technologies like automation and smart manufacturing is crucial for boosting efficiency and quality. For instance, the global smart manufacturing market in pharmaceuticals was projected to reach $30.5 billion by 2025, indicating a significant trend towards digitalization and automation in the sector.

Investing in these modern processes allows Buchang to meet increasingly stringent quality standards, a vital aspect given the global regulatory landscape. By optimizing production output for its Traditional Chinese Medicine (TCM) products, the company can ensure consistent quality and scalability, a key competitive advantage.

AI and Data Analytics in Drug Discovery

The integration of artificial intelligence and data analytics is revolutionizing drug discovery. These advanced tools can significantly speed up the process of finding promising drug candidates and refining clinical trial designs. For instance, AI algorithms can analyze vast biological datasets to pinpoint potential therapeutic targets more efficiently than traditional methods.

Buchang Pharmaceutical can leverage these technological advancements to bolster its traditional Chinese medicine (TCM) research. By applying AI and data analytics to existing TCM knowledge and new research data, the company could accelerate the identification of novel compounds and optimize the development of more effective TCM-based therapies. This approach could lead to a more streamlined and data-driven R&D pipeline.

- AI in Drug Discovery: Studies suggest AI can reduce drug discovery timelines by up to 40% and cut costs by 25-50%.

- Data Analytics: Sophisticated analytics are crucial for sifting through complex genomic, proteomic, and clinical data to identify patterns and predict drug efficacy.

- Personalized Medicine: AI's ability to analyze individual patient data holds promise for tailoring treatments, a growing trend in the pharmaceutical sector.

- TCM Research: Applying AI to TCM could unlock new therapeutic insights from centuries of empirical knowledge, potentially leading to standardized and validated treatments.

Biotechnology and Gene Therapy Advancements

Breakthroughs in biotechnology, particularly in cell and gene therapy, are fundamentally altering the medical field. While Buchang Pharmaceutical's core business remains Traditional Chinese Medicine (TCM), these biotechnological advancements present significant opportunities. They can fuel new research directions and product development by providing deeper insights into disease mechanisms at a molecular level, paving the way for more precise therapeutic interventions.

China's strategic move to ease restrictions on foreign investment in cell and gene therapy within specific zones is a key indicator of the sector's growing importance. This policy shift, observed in 2024, signals a proactive approach to fostering innovation and attracting global expertise. For Buchang, this could translate into potential collaborations or access to cutting-edge technologies that complement its existing TCM research, particularly in areas like personalized medicine and advanced drug discovery.

The integration of biotechnological insights into TCM research could unlock novel treatment modalities. For instance, understanding the genetic basis of diseases targeted by TCM could lead to the development of more potent and scientifically validated formulations. This convergence of traditional and modern scientific approaches is crucial for Buchang's long-term growth and competitiveness in the evolving global pharmaceutical market.

Key implications for Buchang Pharmaceutical include:

- Exploring synergistic research: Investigating how gene therapy can enhance the efficacy or delivery of TCM compounds.

- Potential for new product lines: Developing bio-engineered TCM derivatives or combination therapies.

- Strategic partnerships: Leveraging increased foreign investment in China's biotech sector for collaborative R&D.

- Enhanced scientific validation: Using molecular biology tools to provide robust evidence for TCM's therapeutic benefits.

Technological advancements are reshaping Buchang Pharmaceutical's operations, from R&D to market access. The company is leveraging AI and big data to accelerate drug discovery, with AI potentially cutting discovery timelines by up to 40%. Digitalization in healthcare, including telemedicine, is opening new sales and engagement channels, with China's digital health market projected to exceed $200 billion in 2024. Furthermore, embracing smart manufacturing technologies is crucial for enhancing efficiency and meeting stringent quality standards, a trend supported by a global pharmaceutical smart manufacturing market valued at an estimated $30.5 billion by 2025.

Legal factors

China's pharmaceutical regulatory landscape is in constant flux, with significant reforms impacting drug reimbursement, approval timelines, and market entry strategies. New guidelines released in late 2024 and early 2025 are designed to streamline the registration process and improve patient access to innovative medicines, potentially affecting Buchang's product pipeline and commercialization efforts.

These regulatory shifts necessitate continuous adaptation for companies like Buchang, requiring diligent monitoring of evolving compliance requirements. For instance, the National Healthcare Security Administration's (NHSA) updated drug pricing and reimbursement policies, effective from January 2025, could influence the commercial viability of Buchang's products, especially those seeking inclusion in the national medical insurance catalog.

The National Medical Products Administration (NMPA) is actively streamlining drug approval and clinical trial processes. Pilot programs initiated in 2024-2025 are designed to significantly cut down review timelines, with innovative drug clinical trial approvals now achievable in as little as 21-30 days.

This accelerated regulatory environment presents a substantial opportunity for Buchang Pharmaceutical. By reducing the time it takes to get new Traditional Chinese Medicine (TCM) products through the approval pipeline, Buchang can more quickly introduce innovations to the market and gain a competitive edge.

New compliance guidelines for healthcare companies, aimed at preventing commercial bribery, were issued in January 2025. These reinforce China's ongoing anti-corruption efforts, specifically targeting high-risk activities within the pharmaceutical sector. Buchang Pharmaceutical, like its peers, faces increased accountability to ensure its sales representatives adhere strictly to these regulations.

These guidelines identify specific practices deemed high-risk, such as offering incentives or gifts to healthcare professionals. Pharmaceutical companies are now more directly responsible for their representatives' conduct, necessitating a proactive approach to compliance. Buchang must therefore strengthen its internal controls and compliance programs to effectively manage these legal and reputational risks.

Intellectual Property Enforcement

China's commitment to bolstering intellectual property (IP) enforcement, particularly with new patent term extension provisions introduced in January 2024, offers significant advantages for companies like Buchang Pharmaceutical. This enhanced legal framework provides greater protection for novel drug discoveries and traditional Chinese medicine (TCM) formulations, crucial for recouping substantial R&D expenditures. The strengthened IP rights are designed to deter rampant counterfeiting and unauthorized replication of Buchang's proprietary products, thereby safeguarding its market position and competitive edge.

The impact of these legal advancements is substantial. For instance, the average patent litigation resolution time in China decreased by approximately 15% in 2023 compared to the previous year, indicating more efficient enforcement. Furthermore, statistics from the China National Intellectual Property Administration show a 20% increase in patent infringement cases filed in 2023, reflecting both increased infringement activity and greater confidence in the legal system's ability to address it. This environment is particularly beneficial for Buchang's innovation pipeline, as it directly correlates with the protection of its investment in developing new TCM-based therapies.

- Enhanced Patent Protection: New provisions effective January 2024 offer extended patent terms for innovative drugs and TCM formulations.

- Deterrence of Counterfeiting: Stronger enforcement mechanisms discourage the unauthorized production and sale of Buchang's unique products.

- Safeguarding R&D Investments: Improved IP protection allows Buchang to better realize returns on its research and development efforts.

- Increased Legal Efficacy: A reduction in patent litigation resolution times and a rise in filed infringement cases signal a more responsive legal environment.

Product Quality and Safety Regulations

Product quality and safety remain paramount, with ongoing regulatory efforts to bolster these aspects. For instance, new re-registration requirements for domestically manufactured drugs are set to be implemented, alongside updated regulations concerning pharmaceutical excipients and packaging materials, both taking effect in 2025. Buchang Pharmaceutical must meticulously comply with these enhanced quality management standards to preserve its esteemed market reputation and foster continued consumer confidence in its Traditional Chinese Medicine (TCM) offerings.

These evolving legal landscapes directly impact Buchang's operational framework. Adherence to these new standards, particularly concerning excipients and packaging, will likely necessitate investment in updated manufacturing processes and supply chain verification. Failure to comply could result in significant penalties and reputational damage, underscoring the critical need for proactive adaptation.

- New re-registration requirements for domestically manufactured drugs

- Updated regulations on pharmaceutical excipients and packaging materials effective 2025

- Emphasis on stringent quality management standards for TCM products

China's pharmaceutical regulatory environment is dynamic, with reforms in drug approval, pricing, and reimbursement significantly impacting market entry. New guidelines from late 2024 and early 2025 aim to expedite approvals and broaden patient access, directly influencing Buchang's product pipeline and commercial strategies, particularly concerning inclusion in the national medical insurance catalog by the NHSA.

The NMPA's accelerated drug approval process, with pilot programs in 2024-2025 reducing clinical trial approvals to as little as 21-30 days, offers Buchang a competitive advantage by speeding up the market introduction of its TCM innovations.

The legal framework around intellectual property protection has strengthened, with patent term extensions effective January 2024 providing greater security for Buchang's R&D investments and deterring counterfeiting. This is evidenced by a 15% decrease in patent litigation resolution times in 2023, signaling more efficient enforcement.

New compliance guidelines issued in January 2025 reinforce anti-corruption measures, holding companies like Buchang accountable for their representatives' conduct and necessitating robust internal controls to manage legal and reputational risks associated with interactions with healthcare professionals.

Updated regulations on product quality, including re-registration for domestic drugs and new standards for excipients and packaging effective in 2025, require Buchang to invest in manufacturing and supply chain verification to maintain its market reputation and consumer trust.

| Regulatory Area | Key Development/Policy | Effective Date | Impact on Buchang Pharmaceutical |

|---|---|---|---|

| Drug Approval & Reimbursement | Streamlined registration, expanded patient access | Late 2024/Early 2025 | Faster market entry for new products, potential impact on pricing via NHSA policies |

| Clinical Trial Approvals | Pilot programs reducing approval times | 2024-2025 | Accelerated time-to-market for innovative TCM therapies |

| Intellectual Property | Patent term extensions | January 2024 | Enhanced protection for R&D, reduced risk of counterfeiting; 15% faster litigation resolution in 2023 |

| Compliance & Anti-Corruption | New guidelines on commercial bribery | January 2025 | Increased accountability for sales practices, need for stronger internal controls |

| Product Quality & Safety | Updated excipient/packaging regulations, re-registration | 2025 | Investment in manufacturing upgrades, supply chain verification required |

Environmental factors

The pharmaceutical sector, including Buchang Pharmaceutical, faces growing scrutiny over its environmental impact. China's commitment to reducing its carbon footprint is driving stricter regulations on energy efficiency and waste management for manufacturers. For instance, China aims to peak carbon emissions before 2030, a target that directly influences industrial practices.

Buchang Pharmaceutical, as a key player in China's pharmaceutical manufacturing landscape, must integrate sustainable and green manufacturing processes. This includes optimizing energy consumption in its production facilities and implementing robust waste reduction and recycling programs. Failing to adapt to these evolving environmental standards poses a risk to its operational continuity and reputation.

Adherence to these new environmental mandates is not just a matter of corporate social responsibility but a critical factor for Buchang Pharmaceutical's long-term success. The company's ability to demonstrate compliance and embrace sustainable practices will be essential for maintaining market access and investor confidence amidst China's push for ecological civilization.

Buchang Pharmaceutical's supply chain, from sourcing traditional herbs to final distribution, faces growing environmental scrutiny. Companies like Buchang are increasingly expected to detail and mitigate their carbon footprint across all operations. For instance, the pharmaceutical industry globally is working towards reducing its environmental impact, with many companies setting targets for emissions reduction by 2030, a trend Buchang must align with.

Ethical sourcing of medicinal herbs and promoting sustainable cultivation are critical for Buchang's environmental responsibility. This includes ensuring that the harvesting of raw materials does not lead to biodiversity loss or soil degradation. As of 2024, there's a significant push for traceable and sustainable sourcing in the pharmaceutical sector, with consumers and regulators demanding greater transparency.

Climate change poses a significant threat to Buchang Pharmaceutical by impacting the availability and quality of natural medicinal herbs, the very foundation of Traditional Chinese Medicine (TCM). Fluctuations in temperature, rainfall, and increased extreme weather events can disrupt the delicate ecosystems where these herbs grow, potentially leading to reduced yields or even scarcity. For instance, studies in 2024 indicated that certain key TCM ingredients are experiencing an average yield decrease of 15% due to altered growing conditions.

The degradation of soil quality and loss of biodiversity, exacerbated by climate shifts, further complicate the cultivation and harvesting of these vital raw materials. Buchang needs to proactively develop robust strategies for sustainable sourcing, perhaps by investing in controlled cultivation environments or partnering with regions less affected by climate volatility. Diversifying its raw material supply chain, exploring alternative or synthetic sources where feasible, will be crucial to mitigate the risks associated with climate-induced disruptions and ensure consistent production in 2025 and beyond.

Waste Management and Pollution Control

Environmental regulations concerning pharmaceutical waste and pollution are tightening globally. Buchang Pharmaceutical, like its peers, faces increased scrutiny and mandates for advanced waste treatment technologies and emission reduction. For instance, China, a key market for Buchang, has been progressively strengthening its environmental protection laws, with significant updates impacting industrial waste disposal and air quality standards throughout 2024 and into 2025. Failure to comply can result in substantial fines, operational disruptions, and reputational damage, making robust waste management a critical operational necessity.

Buchang's manufacturing sites must invest in and implement state-of-the-art pollution control measures. This includes sophisticated wastewater treatment systems capable of handling complex chemical compounds common in pharmaceutical production and air emission control technologies to reduce volatile organic compounds (VOCs) and particulate matter. Adherence to these standards is not just about avoiding penalties; it's about demonstrating corporate responsibility and maintaining a favorable public image, which is increasingly important for consumer trust and investor relations in the current climate.

- Stricter Enforcement: Environmental protection agencies are increasing inspections and penalties for non-compliance with waste disposal and pollution standards.

- Technological Investment: Buchang must allocate capital for advanced wastewater treatment and air emission control systems to meet evolving regulatory requirements.

- Reputational Risk: Ineffective waste management can lead to negative publicity, impacting brand perception and market share.

- Operational Costs: While compliance requires investment, efficient waste management can also lead to cost savings through resource recovery and reduced disposal fees in the long run.

Corporate Social Responsibility (CSR) and Public Perception

Public awareness and investor scrutiny of Environmental, Social, and Governance (ESG) factors are significantly shaping corporate expectations. Companies like Buchang Pharmaceutical are increasingly pressured to showcase robust corporate social responsibility (CSR) initiatives. This focus means that demonstrable commitment to sustainability and ethical practices is no longer optional but a key performance indicator.

Buchang's dedication to environmental stewardship and sustainable operations can directly bolster its brand reputation. This, in turn, attracts consumers who prioritize eco-friendly products and services. Furthermore, it appeals to a growing segment of responsible investors actively seeking to align their portfolios with companies demonstrating strong ESG credentials.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.8 trillion in 2024, indicating a strong investor preference for companies with high ESG scores.

- Consumer Preference: A 2024 survey found that over 70% of consumers consider a company's environmental impact when making purchasing decisions.

- Regulatory Trends: Emerging regulations in key markets are mandating greater transparency and reporting on CSR and environmental impact, making proactive engagement crucial for compliance and reputation management.

Environmental regulations in China are becoming more stringent, pushing companies like Buchang Pharmaceutical to adopt greener practices. This includes managing waste more effectively and reducing energy consumption, aligning with national goals to peak carbon emissions before 2030. Buchang's ability to integrate sustainable manufacturing processes will be key to its operational continuity and market standing.

Climate change poses a direct threat to Buchang's supply chain, particularly impacting the availability and quality of medicinal herbs. Studies in 2024 indicated a 15% average yield decrease for some key TCM ingredients due to altered growing conditions. Proactive strategies for sustainable sourcing and supply chain diversification are essential for Buchang to ensure consistent production through 2025.

The global trend towards increased ESG scrutiny means Buchang Pharmaceutical must demonstrate strong environmental stewardship. With sustainable investment assets reaching an estimated $37.8 trillion in 2024 and over 70% of consumers considering environmental impact, Buchang's commitment to sustainability directly influences its brand reputation and investor appeal.

| Environmental Factor | Impact on Buchang Pharmaceutical | Key Data/Trend (2024-2025) |

|---|---|---|

| Carbon Emission Reduction Targets | Requires investment in energy efficiency and cleaner production methods. | China aims to peak carbon emissions before 2030. |

| Climate Change Effects on Raw Materials | Potential disruption to supply and quality of medicinal herbs. | Estimated 15% yield decrease for key TCM ingredients due to altered growing conditions (2024 studies). |

| Waste Management & Pollution Control | Mandates advanced treatment technologies and emission reduction. | Increasingly stringent environmental protection laws in China impacting industrial waste disposal and air quality standards. |

| ESG Investor and Consumer Demand | Necessitates demonstrable commitment to sustainability and CSR. | Global sustainable investment assets estimated at $37.8 trillion (2024); 70%+ consumers consider environmental impact in purchasing decisions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Buchang Pharmaceutical is built on a robust foundation of data sourced from official Chinese government publications, reputable global health organizations, and leading pharmaceutical industry market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.