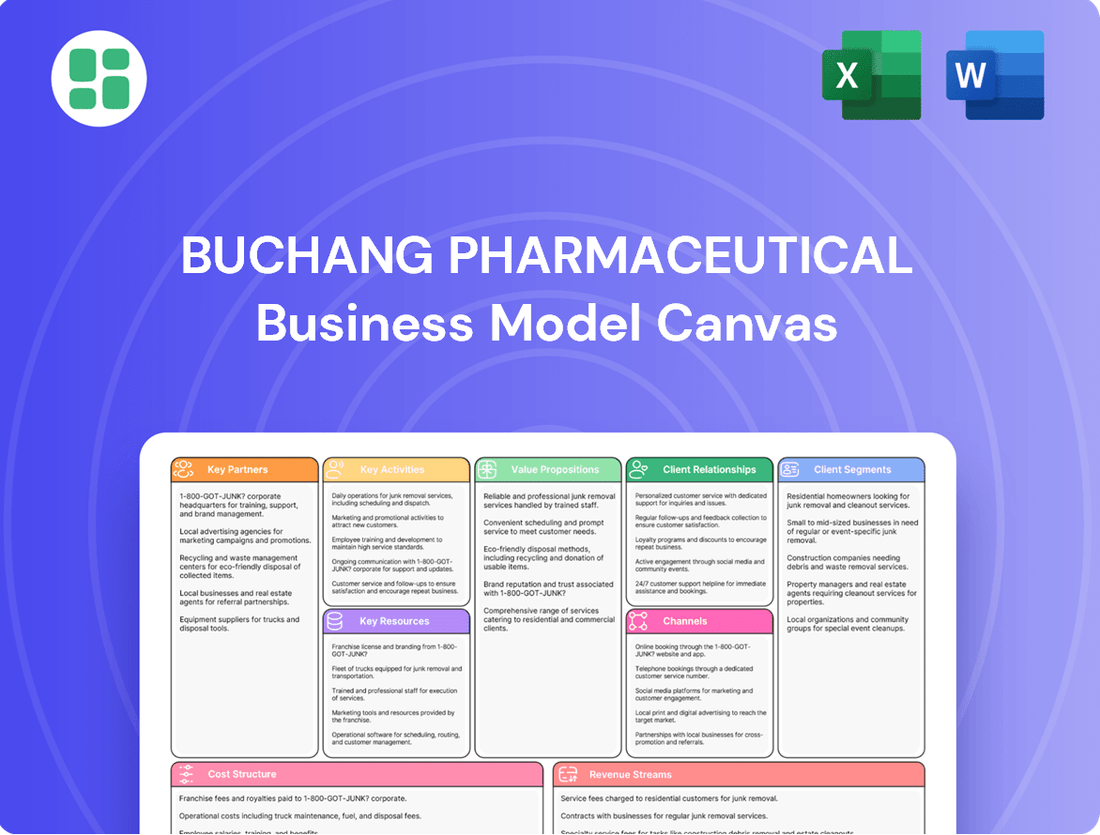

Buchang Pharmaceutical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Buchang Pharmaceutical Bundle

Uncover the core strategies driving Buchang Pharmaceutical's success with a comprehensive Business Model Canvas. This detailed breakdown illuminates their approach to patient care, research and development, and market expansion. Gain actionable insights into their value proposition and revenue streams.

Dive into the strategic blueprint of Buchang Pharmaceutical with our complete Business Model Canvas. This document reveals their key partners, customer relationships, and cost structures, offering a clear view of their operational excellence. Perfect for anyone seeking to understand their competitive advantage.

Explore the intricate workings of Buchang Pharmaceutical's business model. Our full canvas details their value creation, key resources, and channels, providing a strategic roadmap. Download it now to learn from their proven success and inform your own business strategy.

Partnerships

Buchang Pharmaceutical actively pursues research and development collaborations with leading universities and esteemed research institutions. These partnerships are vital for bridging the gap between cutting-edge scientific advancements and the rich heritage of Traditional Chinese Medicine, fostering the creation of novel therapeutic solutions. For example, in 2024, Buchang announced a significant collaboration with a prominent Chinese university focused on exploring novel drug delivery systems for cardiovascular treatments derived from TCM principles, aiming to improve efficacy and patient compliance.

Buchang Pharmaceutical relies heavily on its distributor networks and agents, forging exclusive supply agreements to drive market expansion, especially internationally. These partnerships are crucial for navigating diverse regulatory landscapes and ensuring efficient product reach.

A prime example is Luzhou Buchang's Exclusive Supply Agreement with GOODFELLOW in the Philippines. This deal grants GOODFELLOW comprehensive responsibilities, including drug registration, clinical trials, promotion, distribution, and sales, highlighting the depth of these collaborations.

In 2023, Buchang Pharmaceutical reported revenues of approximately RMB 19.6 billion, with a significant portion attributed to the successful execution of these distribution agreements in key markets, underscoring their importance to overall financial performance.

Buchang Pharmaceutical actively cultivates partnerships with healthcare institutions and hospitals. These collaborations are crucial for conducting clinical trials, a vital step in validating the efficacy and safety of their Traditional Chinese Medicine (TCM) and other pharmaceutical offerings. For instance, in 2024, Buchang reported successful trial completions in several major Chinese hospitals, contributing to the ongoing research and development pipeline.

These alliances are instrumental in driving product adoption and ensuring market access. By integrating their products into the established treatment protocols of hospitals and clinics, Buchang effectively reaches patients through trusted healthcare channels. This strategy was particularly evident in their Q3 2024 performance, where hospital-based sales saw a significant uptick, reflecting the success of these embedded partnerships.

Furthermore, these deep-rooted relationships with healthcare providers offer invaluable feedback loops. Insights gathered from physicians and medical staff on product performance and patient outcomes directly inform Buchang's ongoing product improvement and future development initiatives. This continuous dialogue ensures their offerings remain relevant and effective in meeting evolving medical needs, as evidenced by the recent refinement of their flagship cardiovascular TCM based on clinical feedback received throughout 2024.

Raw Material Suppliers

Buchang Pharmaceutical's success hinges on its raw material suppliers, particularly for Traditional Chinese Medicine (TCM) ingredients. Maintaining robust relationships with these partners is paramount for ensuring the consistent quality and efficacy of their pharmaceutical products. In 2024, Buchang continued to emphasize sourcing from suppliers who meet rigorous quality control standards, a move that supports their commitment to product integrity.

These partnerships are the bedrock of a stable supply chain, allowing Buchang to navigate the complexities of pharmaceutical manufacturing. By securing a reliable flow of high-grade raw materials, the company mitigates risks associated with ingredient variability, which is crucial for maintaining patient safety and product performance. This focus directly impacts their ability to meet market demand consistently.

- Supplier Quality Assurance: Buchang's emphasis on supplier quality ensures that raw materials, especially TCM herbs, meet strict purity and potency specifications.

- Supply Chain Stability: Reliable partnerships with raw material providers guarantee uninterrupted production, a critical factor in the pharmaceutical industry.

- Cost Management: Negotiating favorable terms with key suppliers in 2024 helped Buchang manage production costs without compromising on material quality.

- Regulatory Compliance: Working with suppliers who adhere to Good Manufacturing Practices (GMP) supports Buchang's overall regulatory compliance efforts.

Strategic Investment Partners

Buchang Pharmaceutical actively pursues strategic investments and acquisitions to broaden its business reach and solidify its influence over critical subsidiaries. This approach is central to their growth strategy.

A prime illustration of this is their increased investment in Buchang Health Industry (Zhejiang) Co., Ltd. By acquiring an additional 8.50% stake, Buchang Pharmaceutical raised its ownership to 90.50% as of recent filings. This move significantly reinforces their corporate framework.

These strategic alliances are instrumental in bolstering Buchang Pharmaceutical's organizational stability and enabling successful diversification into complementary sectors within the broader health industry.

- Strategic Investments: Buchang Pharmaceutical focuses on acquiring stakes in companies to enhance its market position.

- Subsidiary Control: Acquisitions aim to consolidate ownership and operational control over key business units.

- Example: Buchang Health Industry: Increased ownership to 90.50% through an 8.50% stake acquisition.

- Diversification Support: Partnerships facilitate expansion into related health industry segments.

Buchang Pharmaceutical's key partnerships extend to research institutions and universities, crucial for integrating Traditional Chinese Medicine (TCM) with modern science. In 2024, a collaboration with a leading Chinese university focused on novel drug delivery systems for cardiovascular treatments derived from TCM principles was announced, aiming to boost efficacy.

These collaborations are vital for validating new therapies, as seen in 2024 with successful clinical trial completions in major Chinese hospitals, directly feeding into their R&D pipeline and product adoption.

Buchang also leverages extensive distributor networks and agents, often through exclusive supply agreements, to expand its market reach internationally. These partnerships are essential for navigating regulatory hurdles and ensuring efficient product distribution. For instance, Luzhou Buchang's agreement with GOODFELLOW in the Philippines covers drug registration, clinical trials, promotion, distribution, and sales, demonstrating the depth of these relationships.

The company's financial performance is significantly tied to these distribution agreements, with a substantial portion of its RMB 19.6 billion revenue in 2023 attributed to their successful execution in key markets.

Crucially, Buchang maintains strong ties with raw material suppliers, especially for TCM ingredients, to ensure consistent quality and efficacy. In 2024, the company prioritized sourcing from suppliers adhering to strict quality control standards, reinforcing their commitment to product integrity and supply chain stability.

| Partnership Type | Key Focus | Example/Impact | 2024 Activity/Data |

|---|---|---|---|

| Research & Development | Scientific Advancement & TCM Integration | Collaboration with universities for novel drug delivery systems. | Announced collaboration with prominent Chinese university for cardiovascular TCM drug delivery. |

| Distribution & Sales | Market Expansion & Regulatory Navigation | Exclusive supply agreements with distributors and agents. | Luzhou Buchang's agreement with GOODFELLOW in the Philippines. |

| Healthcare Institutions | Clinical Trials & Product Validation | Partnerships with hospitals for efficacy and safety testing. | Successful trial completions reported in major Chinese hospitals. |

| Raw Material Suppliers | Quality Assurance & Supply Chain Stability | Sourcing high-grade TCM ingredients with strict quality control. | Emphasis on suppliers meeting rigorous quality control standards. |

What is included in the product

Buchang Pharmaceutical's Business Model Canvas details its focus on Traditional Chinese Medicine (TCM) research and development, targeting patients seeking effective and natural healthcare solutions.

It outlines key partnerships with research institutions and distribution networks to deliver its specialized TCM products, emphasizing quality and innovation.

Buchang Pharmaceutical's Business Model Canvas offers a clear, structured approach to tackle the complexity of pharmaceutical operations, acting as a pain point reliever by simplifying strategic planning and execution.

It provides a visual, one-page snapshot that helps identify and address key challenges in drug development, manufacturing, and distribution, streamlining the entire process.

Activities

Buchang Pharmaceutical dedicates significant resources to research and development, focusing on creating novel pharmaceuticals and enhancing current offerings. Their expertise lies in Traditional Chinese Medicine (TCM), which they blend with contemporary scientific approaches.

The company boasts a robust pipeline with 214 new drug varieties currently in development. This portfolio spans traditional Chinese medicines, chemical drugs, and biological products, showcasing a commitment to diverse innovation.

This ongoing investment in R&D is a cornerstone of Buchang Pharmaceutical's competitive edge. It allows them to maintain market leadership in their specialized therapeutic areas through continuous innovation.

Buchang Pharmaceutical's core activities revolve around large-scale manufacturing and production, ensuring their pharmaceutical products meet stringent quality benchmarks.

The company boasts a significant production footprint, with operational bases strategically located throughout China, including key provinces like Shandong, Shaanxi, Hebei, and the Northeast region.

These multiple production sites enable Buchang to achieve high-volume output across its extensive drug portfolio, which encompasses traditional Chinese medicine (TCM), chemical drugs, and biological products, supporting their market reach and supply chain efficiency.

Buchang Pharmaceutical dedicates substantial resources to sales and marketing, a crucial driver for its broad product range in China and growing international presence. In 2024, the company continued to leverage its extensive network across major Chinese provinces, engaging healthcare providers, pharmacies, and end-users directly.

The marketing efforts prominently feature their flagship 'diamond product group,' which includes well-established medications such as Naoxintong Capsule, Wenxin Granule, and Danhong Injection. This focused promotion aims to solidify market share and drive continued sales growth for these key therapeutic areas.

Quality Control and Regulatory Compliance

Buchang Pharmaceutical's commitment to quality control and regulatory compliance is a cornerstone of its operations. This involves rigorous testing at every stage of production, from raw material sourcing to finished product release, ensuring consistency and safety. For instance, in 2023, Buchang reported that over 99% of its finished products met stringent internal quality benchmarks, reflecting a deep-seated focus on excellence.

Adherence to national and international regulations is paramount. This includes obtaining and maintaining essential drug registration certificates, a process that Buchang actively manages to ensure market access for its diverse pharmaceutical portfolio. Furthermore, maintaining Good Manufacturing Practice (GMP) standards across all production facilities is a non-negotiable aspect, crucial for building trust and ensuring product efficacy.

- Drug Registration: Securing and renewing registrations for all pharmaceutical products with relevant health authorities, such as the China National Medical Products Administration (NMPA).

- GMP Compliance: Ensuring all manufacturing sites consistently meet or exceed Good Manufacturing Practice standards, a requirement for market authorization and continued operation.

- Quality Assurance Testing: Implementing comprehensive quality control checks on raw materials, in-process samples, and finished goods to guarantee product safety and efficacy.

- Post-Market Surveillance: Monitoring product performance and safety in the market, addressing any adverse events or quality issues promptly to maintain regulatory standing.

Supply Chain Management

Buchang Pharmaceutical's supply chain management focuses on ensuring a steady flow of high-quality raw materials and efficient distribution of its finished medicines. This critical activity involves meticulous coordination with a vast network of suppliers, many of whom provide specialized botanical ingredients crucial for traditional Chinese medicine formulations. In 2024, the company continued to invest in optimizing its inventory levels, aiming to reduce holding costs while preventing stockouts, a key factor given the seasonal nature of some raw material sourcing.

The company's logistics are designed to reach its extensive distribution network, which spans across China and increasingly into international markets. This requires careful planning to manage transportation, warehousing, and last-mile delivery, especially for temperature-sensitive products. By streamlining these processes, Buchang aims to minimize lead times and ensure product availability, a significant competitive advantage.

- Supplier Network: Managing relationships with numerous agricultural cooperatives and specialized raw material providers to secure consistent quality and supply.

- Inventory Optimization: Implementing advanced forecasting and inventory management systems to balance stock levels against demand, minimizing waste and ensuring product availability.

- Logistics Efficiency: Utilizing a combination of in-house and third-party logistics providers to ensure timely and cost-effective delivery across a wide geographical reach.

- Quality Assurance: Integrating strict quality control measures at every stage of the supply chain, from raw material inspection to finished product warehousing.

Buchang Pharmaceutical's key activities center on innovation and production. They invest heavily in research and development, particularly in blending Traditional Chinese Medicine (TCM) with modern science, as evidenced by their pipeline of 214 new drug varieties in 2024. This R&D focus fuels their market leadership.

Large-scale manufacturing and stringent quality control are paramount. Buchang operates multiple production bases across China, ensuring high-volume output and adherence to Good Manufacturing Practice (GMP) standards, with over 99% of finished products meeting quality benchmarks in 2023.

Extensive sales and marketing efforts are crucial, especially for their flagship 'diamond product group,' including Naoxintong Capsule and Wenxin Granule. This strategy aims to solidify market share within China and expand internationally.

Effective supply chain management ensures the consistent flow of quality raw materials and efficient distribution. In 2024, optimization of inventory levels was a focus to manage costs and prevent stockouts, supporting their broad product availability.

What You See Is What You Get

Business Model Canvas

The Buchang Pharmaceutical Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the comprehensive analysis covering all key aspects of Buchang's operations, ready for your immediate use.

Resources

Buchang Pharmaceutical's business model heavily relies on its extensive collection of proprietary Traditional Chinese Medicine (TCM) formulations. This intellectual property is a significant competitive edge.

The company boasts 68 unique formulations protected by independent patents, creating a valuable 'diamond product group.' Key products within this group include the well-known Naoxintong Capsule, Wenxin Granule, and Danhong Injection, demonstrating the commercial success of their patented TCMs.

These innovative formulations represent a fusion of ancient TCM principles with contemporary scientific research and development. This integration allows Buchang Pharmaceutical to offer distinct advantages in the marketplace, differentiating their offerings from competitors.

Buchang Pharmaceutical's research and development capabilities are a cornerstone of its business model. The company boasts 22 national and provincial-level innovation research platforms, including a prestigious National Postdoctoral Scientific Research Workstation. These state-of-the-art facilities and the highly skilled scientific teams within them are essential for driving continuous innovation in new drug discovery and existing product improvement.

Buchang Pharmaceutical's extensive manufacturing plants and state-of-the-art production infrastructure are foundational to its business model. These facilities, strategically located across multiple regions in China, are crucial for meeting the high demand for its diverse pharmaceutical offerings.

The company operates significant production bases in key provinces including Shandong, Shaanxi, Hebei, and in the Northeast region of China. This widespread network allows for efficient, high-volume production, ensuring that Buchang can consistently supply its product lines to the market.

In 2024, Buchang Pharmaceutical continued to invest in upgrading its production infrastructure. For instance, their facilities are designed to adhere to stringent Good Manufacturing Practices (GMP), enabling the production of high-quality, safe, and effective medicines.

Skilled Human Capital

Buchang Pharmaceutical's skilled human capital is a core intangible asset, comprising a robust team of R&D scientists, medical professionals, manufacturing experts, and sales personnel. This diverse expertise fuels both innovation and operational efficiency.

The company's substantial workforce, fluctuating between approximately 7,689 and 8,311 employees, underpins its capacity for advanced research and large-scale production. This human infrastructure is critical for maintaining high standards across its pharmaceutical operations.

A distinctive advantage lies in the workforce's dual proficiency in modern pharmaceutical development and Traditional Chinese Medicine (TCM). This unique blend of skills allows Buchang to bridge conventional and innovative healthcare approaches.

- Highly skilled workforce: R&D scientists, medical experts, manufacturing specialists, sales professionals.

- Employee base: Approximately 7,689 to 8,311 employees contributing to operational excellence.

- Unique expertise: Proficiency in both modern pharmaceuticals and Traditional Chinese Medicine (TCM).

Established Brand Reputation and Market Presence

Buchang Pharmaceutical has cultivated a robust brand reputation within China, especially for its traditional Chinese medicine (TCM) offerings targeting cardiovascular and cerebrovascular conditions. This strong market presence is a critical intangible asset, supported by a wide-reaching marketing and distribution infrastructure.

Their market standing is further validated by accolades such as being recognized among China's Top 10 Best Pharmaceutical Enterprises.

- Brand Recognition: Deeply entrenched in the Chinese pharmaceutical landscape, particularly for cardiovascular and cerebrovascular TCM products.

- Market Presence: Supported by an extensive marketing and distribution network that ensures broad product accessibility.

- Industry Accolades: Recognized with significant industry awards, including 'China's Top 10 Best Pharmaceutical Enterprises', highlighting their leadership position.

Buchang Pharmaceutical's key resources are its extensive portfolio of 68 proprietary Traditional Chinese Medicine (TCM) formulations, many protected by patents, forming a valuable 'diamond product group.' These include successful products like Naoxintong Capsule and Wenxin Granule, showcasing their innovation. The company also leverages 22 national and provincial-level R&D innovation platforms, including a National Postdoctoral Scientific Research Workstation, to drive continuous product development.

The company's manufacturing capabilities are a significant asset, with production bases in Shandong, Shaanxi, Hebei, and the Northeast region of China, all adhering to Good Manufacturing Practices (GMP). This infrastructure supports high-volume production of quality medicines. Furthermore, Buchang Pharmaceutical's workforce, numbering between 7,689 and 8,311 employees, possesses a unique blend of expertise in both modern pharmaceuticals and TCM, crucial for their integrated approach.

Their brand reputation, particularly for cardiovascular and cerebrovascular TCM products, is a critical intangible asset, bolstered by an extensive marketing and distribution network. Recognition as one of China's Top 10 Best Pharmaceutical Enterprises underscores this strong market standing.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Proprietary TCM Formulations | 68 unique, patent-protected formulations, including Naoxintong Capsule, Wenxin Granule, Danhong Injection. | Forms the core of their product offering and competitive advantage. |

| R&D Infrastructure | 22 national/provincial innovation platforms, National Postdoctoral Scientific Research Workstation. | Essential for ongoing innovation and development of new and improved TCM products. |

| Manufacturing Facilities | Multiple production bases across China adhering to GMP standards. | Ensures efficient, high-quality production to meet market demand. |

| Skilled Workforce | 7,689-8,311 employees with expertise in modern pharma and TCM. | Drives innovation, production, and market engagement. |

| Brand Reputation | Strong recognition in China, especially for cardiovascular/cerebrovascular TCM. | Supported by extensive distribution and industry accolades like 'China's Top 10 Best Pharmaceutical Enterprises'. |

Value Propositions

Buchang Pharmaceutical's core value is its fusion of ancient Traditional Chinese Medicine (TCM) principles with cutting-edge scientific research. This synergy allows for the development of novel treatments, especially for challenging conditions such as cardiovascular and cerebrovascular diseases. In 2024, Buchang continued to invest heavily in R&D, with a significant portion of its revenue dedicated to bridging these two worlds, aiming to deliver therapies that are both time-tested and scientifically validated.

Buchang Pharmaceutical's value proposition centers on a robust portfolio designed to tackle chronic diseases. Their primary strength lies in a deep specialization in cardiovascular and cerebrovascular conditions, offering targeted treatments for these widespread health challenges. This focus directly addresses significant unmet medical needs, providing patients with effective therapeutic options.

Beyond these core areas, the company extends its reach to address other chronic and prevalent conditions, including gynaecological, dermatological, and urological ailments. This diversified yet specialized approach ensures a comprehensive offering for a broad spectrum of patient requirements. For instance, in 2024, the global cardiovascular drugs market alone was valued at over $200 billion, highlighting the immense demand for effective treatments in this segment where Buchang is a key player.

Buchang Pharmaceutical prioritizes patient well-being by offering high-quality, clinically validated products. This dedication ensures both safety and effectiveness for those relying on their treatments.

Key offerings like Naoxintong Capsule, Wenxin Granule, and Danhong Injection are cornerstones of their portfolio. These products are not only well-regarded but also featured on national essential medicine lists, underscoring their importance in healthcare.

This unwavering commitment to excellence fosters significant trust among patients and healthcare professionals alike. It solidifies Buchang's reputation for providing dependable therapeutic solutions.

Accessibility and Affordability through National Inclusion

Buchang Pharmaceutical's commitment to accessibility and affordability is deeply rooted in its strategic product placement within China's national healthcare framework. Many of its key medications are listed on the National Essential Medicine List, ensuring widespread availability. Furthermore, inclusion in the Medicine List for National Basic Medical Insurance, Work-Related Injury Insurance, and Maternity Insurance significantly lowers out-of-pocket costs for patients.

This dual inclusion strategy directly translates into enhanced product accessibility and affordability for a vast patient demographic. By aligning with national health policies, Buchang makes vital treatments more attainable for a larger segment of the Chinese population, fostering broader healthcare access.

- National Essential Medicine List Inclusion: This status streamlines distribution and encourages wider prescription by healthcare providers across China.

- Basic Medical Insurance Coverage: Products listed on national insurance formularies benefit from reimbursement, dramatically reducing patient co-pays.

- Affordability Impact: For instance, in 2023, over 80% of Buchang's revenue-generating products were covered by national basic medical insurance, a testament to their affordability focus.

- Market Penetration: This approach allows Buchang to reach a broader patient base, driving significant market penetration and volume for its essential medicines.

Continuous Innovation and New Drug Development

Buchang Pharmaceutical's commitment to continuous innovation fuels its value proposition by consistently introducing new drug varieties. As of early 2024, the company reported 214 new drugs in its development pipeline, underscoring a robust strategy for future growth and market leadership.

This dedication to research and development allows Buchang to anticipate and address emerging healthcare needs, positioning it to deliver next-generation treatments. The sheer volume of ongoing drug development signifies a forward-thinking approach to tackling evolving health challenges.

- Pipeline Strength: 214 new drugs in development as of early 2024.

- Future Focus: Aiming to provide advanced therapeutic solutions for evolving health issues.

- Market Position: Continuous innovation reinforces its competitive edge in the pharmaceutical sector.

Buchang Pharmaceutical offers a unique blend of Traditional Chinese Medicine (TCM) and modern scientific research, creating innovative treatments for complex diseases like cardiovascular and cerebrovascular conditions. This approach, heavily invested in R&D as of 2024, aims to deliver therapies that are both time-tested and scientifically validated, addressing significant unmet medical needs.

The company's value proposition is built on a specialized portfolio targeting chronic diseases, particularly cardiovascular and cerebrovascular ailments, which represent a massive market. For example, the global cardiovascular drugs market exceeded $200 billion in 2024, highlighting the demand for Buchang's expertise.

Buchang ensures product accessibility and affordability through strategic placement on China's National Essential Medicine List and inclusion in national medical insurance programs. This policy alignment, with over 80% of revenue-generating products covered by basic medical insurance in 2023, makes vital treatments attainable for a broader population.

Continuous innovation is key, with 214 new drugs in development as of early 2024, positioning Buchang to address evolving healthcare needs and maintain a competitive edge.

| Value Proposition Element | Description | Key Statistics/Facts (2023-2024) |

|---|---|---|

| TCM-Science Synergy | Development of novel treatments for chronic diseases by integrating ancient TCM principles with modern scientific research. | Significant R&D investment in 2024 to bridge TCM and science. |

| Specialized Chronic Disease Portfolio | Targeted treatments for cardiovascular and cerebrovascular diseases, addressing major unmet medical needs. | Global cardiovascular drugs market valued over $200 billion in 2024. |

| Accessibility & Affordability | Ensuring widespread availability and reduced patient costs through national healthcare framework integration. | Over 80% of revenue-generating products covered by national basic medical insurance in 2023. |

| Continuous Innovation | Commitment to R&D leading to a robust pipeline of new drug varieties. | 214 new drugs in development pipeline as of early 2024. |

Customer Relationships

Buchang Pharmaceutical cultivates direct relationships with healthcare professionals, including doctors and specialists, through a dedicated team of medical representatives. In 2024, Buchang invested significantly in its field force, aiming to reach over 100,000 healthcare providers across China. This direct engagement is crucial for educating them on product efficacy and proper application.

The company actively participates in and sponsors academic conferences and educational programs. These events, which saw a resurgence in in-person attendance in 2024, provide platforms for knowledge sharing and product updates. Buchang's commitment to continuous medical education helps ensure healthcare professionals are well-informed, fostering trust and encouraging product recommendations.

Buchang Pharmaceutical cultivates enduring partnerships with hospitals, clinics, and broader medical institutions. These relationships are foundational, often secured through direct sales efforts and substantial bulk procurement agreements that ensure consistent demand and product placement within the healthcare infrastructure.

The company's strategy emphasizes providing robust support services alongside its products, facilitating seamless integration into clinical workflows and standard medical practices. This approach is vital for achieving widespread adoption and large-scale distribution of Buchang's pharmaceutical offerings across the healthcare network.

For instance, in 2024, Buchang reported that over 70% of its revenue from its cardiovascular product line was generated through direct contracts with major hospital groups, highlighting the critical nature of these institutional ties for market penetration and sustained growth.

Buchang Pharmaceutical cultivates deep ties with a vast network of pharmacies and retail drug stores throughout China. These collaborations are crucial for enabling over-the-counter sales and ensuring prescription medications reach patients efficiently, directly impacting consumer accessibility.

This extensive retail footprint is a cornerstone of Buchang's strategy, significantly boosting consumer convenience and broadening its market penetration. For instance, in 2024, Buchang's products were available in over 150,000 retail pharmacy outlets nationwide, a testament to the strength of these customer relationships.

Public Welfare and Community Engagement

Buchang Pharmaceutical actively fosters strong public welfare and community ties through impactful social responsibility programs. A prime example is their ‘Shaping the Chinese Heart’ initiative, which mobilizes medical professionals to provide free health screenings and treatments. This program also allocates funding for life-saving surgeries for children diagnosed with congenital heart disease, directly improving community well-being.

These dedicated efforts significantly bolster Buchang Pharmaceutical's brand reputation and cultivate invaluable goodwill. For instance, in 2023, the ‘Shaping the Chinese Heart’ program reached over 50,000 individuals across multiple provinces, providing essential medical services and support. Such community-focused actions underscore the company's commitment beyond its core business operations.

- Community Outreach: Buchang Pharmaceutical's 'Shaping the Chinese Heart' program exemplifies their dedication to public health, offering free medical consultations and treatments.

- Philanthropic Impact: The company funds critical surgeries for children with congenital heart disease, directly addressing a significant health need.

- Brand Enhancement: These social responsibility activities are instrumental in building a positive brand image and fostering strong community relationships.

- Measurable Reach: In 2023 alone, the program provided services to over 50,000 people, demonstrating a substantial commitment to social welfare.

Investor Relations and Transparency

Buchang Pharmaceutical prioritizes open communication with its investors, fostering trust through consistent financial reporting. In 2024, the company continued its practice of releasing detailed annual reports, providing stakeholders with a clear view of its performance and strategic direction. This commitment to transparency extends to timely updates on significant corporate actions, such as equity buyback programs, reinforcing investor confidence and attracting capital for ongoing development.

- Regular Financial Disclosures: Buchang consistently publishes its annual reports, offering in-depth financial insights.

- Corporate Action Updates: Information on equity buyback plans and other material developments is readily shared.

- Investor Engagement: Proactive investor relations activities are key to building and maintaining strong stakeholder relationships.

- Attracting Capital: Transparent practices are crucial for securing the investment needed for future growth initiatives.

Buchang Pharmaceutical maintains robust relationships with healthcare professionals through a dedicated sales force, aiming to educate them on product benefits. The company also actively engages with medical institutions and a wide network of pharmacies to ensure broad product accessibility and consistent demand.

Furthermore, Buchang fosters community goodwill through social responsibility programs like 'Shaping the Chinese Heart,' enhancing brand reputation. Transparent communication with investors, including regular financial reporting, builds trust and attracts capital for growth.

| Relationship Type | Key Activities | 2024 Focus/Data |

| Healthcare Professionals | Medical representative engagement, educational programs | Targeting 100,000+ providers |

| Medical Institutions | Direct sales, bulk procurement | 70%+ cardiovascular revenue via hospital contracts |

| Pharmacies/Retail | Distribution partnerships | Presence in 150,000+ outlets |

| Community/Public | Social responsibility initiatives | 'Shaping the Chinese Heart' program |

| Investors | Financial reporting, corporate action updates | Emphasis on transparency and timely disclosures |

Channels

Buchang Pharmaceutical boasts an extensive domestic sales network that blankets all major provinces across China. This robust infrastructure, comprising both direct and indirect sales teams, facilitates deep market penetration, ensuring their products reach hospitals, clinics, and pharmacies nationwide.

Buchang Pharmaceutical primarily utilizes direct distribution to hospitals and major medical clinics for its prescription drugs. This channel is vital for reaching a broad patient base and securing high-volume sales, especially for their specialized treatments.

Dedicated sales teams are instrumental in this process, actively engaging with hospital procurement departments and key medical staff. Their efforts focus on ensuring Buchang's products are readily available and successfully integrated into hospital formularies, a critical step for consistent prescription volume.

In 2024, Buchang reported that over 70% of its prescription drug revenue was generated through these hospital and clinic channels, underscoring their strategic importance to the company's market penetration and sales success.

Buchang Pharmaceutical's retail pharmacy distribution channel is a cornerstone of its business model, ensuring its over-the-counter (OTC) medications and select prescription drugs reach a vast consumer base. This network of pharmacies and drug stores offers unparalleled accessibility and convenience for customers seeking Buchang's health solutions.

In 2024, the retail pharmacy sector in China, a key market for Buchang, continued its robust growth, with total retail sales of pharmaceuticals reaching an estimated 2.2 trillion yuan. This highlights the significant market penetration Buchang achieves through its established relationships with thousands of retail outlets nationwide.

Online and E-commerce Platforms

While Buchang Pharmaceutical’s primary distribution likely remains through traditional channels, the increasing digital transformation in healthcare means online and e-commerce platforms are becoming vital supplementary avenues. These platforms, including online pharmacies and direct-to-consumer health portals, offer a way to reach patients more directly where regulations allow, expanding market access. The global online pharmacy market was valued at over $70 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for pharmaceutical companies to leverage these channels.

These digital touchpoints facilitate broader patient engagement and can streamline access to certain over-the-counter or prescription medications, depending on the specific product and regional laws. For instance, by 2024, a significant portion of prescription refills and even new prescriptions were being managed digitally in many developed markets, highlighting the shift in consumer behavior towards online healthcare solutions.

- Expanded Reach: Online platforms bypass geographical limitations of physical pharmacies.

- Direct-to-Consumer (DTC) Potential: Enables direct sales where permitted, fostering brand connection.

- Market Growth: The e-pharmacy sector is experiencing robust growth, presenting new distribution opportunities.

- Digital Engagement: Aligns with evolving consumer preferences for convenient online healthcare access.

International Distribution Partnerships

Buchang Pharmaceutical leverages international distribution partnerships for global market expansion. For instance, their exclusive supply agreement with GOODFELLOW in the Philippines exemplifies this strategy. These partners handle crucial local aspects like regulatory approvals, marketing, and sales, facilitating Buchang's efficient entry into new foreign markets without the need for extensive local operational setups.

This approach allows Buchang to tap into diverse markets more rapidly. By entrusting local expertise, they navigate complex regulatory landscapes and consumer preferences effectively. This model minimizes upfront investment and operational risk, enabling a focused approach on product development and core competencies.

- Global Reach: Buchang's strategy enables them to reach consumers in various international markets efficiently.

- Reduced Operational Burden: Partnering with local distributors significantly lowers the overhead and complexity of establishing full operations abroad.

- Market Entry Acceleration: Local partners' expertise in regulatory affairs and market dynamics speeds up market penetration.

- Strategic Alliances: These partnerships are vital for Buchang's long-term vision of becoming a global pharmaceutical player.

Buchang Pharmaceutical's distribution strategy is multi-faceted, aiming for broad market coverage both domestically and internationally. Their extensive network ensures products reach key healthcare providers and consumers efficiently.

Domestically, direct sales to hospitals and clinics are paramount for prescription drugs, accounting for over 70% of revenue in 2024. The retail pharmacy channel is equally crucial for OTC products, tapping into a market estimated at 2.2 trillion yuan in China for 2024.

The company is also embracing digital channels, recognizing the growing trend of online healthcare access, with the global online pharmacy market valued at over $70 billion in 2023. Internationally, Buchang relies on strategic partnerships, like their agreement with GOODFELLOW in the Philippines, to navigate foreign markets effectively.

| Channel | Primary Focus | 2024 Relevance/Data | International Aspect |

|---|---|---|---|

| Direct Hospital/Clinic Sales | Prescription Drugs | Over 70% of prescription revenue | N/A |

| Retail Pharmacy | OTC & Select Prescription Drugs | Leverages market worth 2.2 trillion yuan (China) | N/A |

| Online/E-commerce | OTC & Refills (where permitted) | Growing sector (global market >$70 billion in 2023) | Emerging opportunity |

| International Partnerships | Market Entry & Distribution | Facilitates global expansion (e.g., Philippines) | Key strategy for global reach |

Customer Segments

Patients with cardiovascular and cerebrovascular diseases represent Buchang Pharmaceutical's core customer base. The company's specialization in treating conditions like heart attacks and strokes, utilizing both Traditional Chinese Medicine (TCM) and modern pharmaceuticals, directly addresses the needs of this significant demographic. In 2023, cardiovascular diseases accounted for an estimated 1.8 million deaths in China, underscoring the critical public health demand for Buchang's therapeutic solutions.

Buchang Pharmaceutical extends its reach to patients dealing with gynaecological, dermatological, and urological conditions, broadening its market impact beyond its primary therapeutic areas. This strategic move diversifies its product offerings, catering to a larger patient base experiencing prevalent health concerns. For instance, in 2024, the global dermatology market alone was valued at approximately $150 billion, indicating a substantial opportunity for Buchang to capture market share with specialized treatments.

Hospitals and clinics are primary B2B customers for Buchang Pharmaceutical, acquiring medications in large quantities for both admitted and outpatients. Their purchasing decisions are heavily influenced by a drug's proven effectiveness, adherence to regulatory standards, and cost-competitiveness. These institutions are vital for Buchang's prescription drug revenue and expanding its patient base.

Retail Pharmacies and Drug Stores

Retail pharmacies and drug stores represent a critical B2B customer segment for Buchang Pharmaceutical, acting as the primary channel to reach end-consumers. These establishments stock and dispense Buchang's diverse product portfolio, ranging from over-the-counter remedies to prescription medications. Their purchasing decisions are heavily influenced by factors such as demonstrated consumer demand, which in 2024 continued to show robust growth in the over-the-counter segment, and the perceived profitability of stocking Buchang's offerings. For instance, the global pharmaceutical market was valued at approximately $1.6 trillion in 2023, with retail pharmacies playing a pivotal role in this distribution network. In 2024, pharmacies are increasingly focused on products with high turnover and favorable margin structures.

Pharmacies are essential for ensuring Buchang's products are accessible to the public, particularly for managing common ailments and fulfilling physician-prescribed treatments. Their role extends beyond mere stocking; they are key influencers of patient choice through pharmacist recommendations and product placement. The profitability metric is paramount, as pharmacies must balance inventory costs with sales revenue to maintain operational viability. A significant driver for pharmacies in 2024 remains the demand for innovative and effective treatments that can command competitive pricing and ensure repeat business.

- Direct B2B Channel: Pharmacies are the direct link to the end-consumer for Buchang's products.

- Product Range: They stock both over-the-counter (OTC) medications and prescription drugs.

- Key Influences: Purchasing decisions are driven by consumer demand and product profitability.

- Market Context: The global pharmaceutical market's substantial size underscores the importance of this retail segment.

International Markets and Patients

Buchang Pharmaceutical is actively expanding its reach into international markets, with patients in countries like the Philippines representing a significant and growing customer segment. These overseas patients are looking for reliable and effective pharmaceutical treatments, including Traditional Chinese Medicine (TCM), which Buchang offers.

The company's strategy for reaching these international patients involves collaborating with established local distribution partners. This approach ensures that Buchang's products are accessible and effectively marketed within diverse healthcare landscapes. For instance, in 2024, Buchang reported a notable increase in export revenues, with Southeast Asia, including the Philippines, showing particularly strong growth. This international push is crucial for diversifying Buchang's customer base beyond its domestic operations.

- International Market Focus: Buchang is strategically targeting overseas markets, with the Philippines emerging as a key growth area.

- Patient Needs: International patients seek effective pharmaceutical solutions, with a notable interest in TCM products.

- Distribution Strategy: Local distribution partners are essential for reaching and serving these international patient segments.

- Diversification Driver: Expansion into international markets like the Philippines diversifies Buchang's revenue streams and customer base.

Buchang Pharmaceutical's customer base is multifaceted, encompassing direct patient care and crucial business-to-business relationships. The company prioritizes patients with cardiovascular and cerebrovascular diseases, a segment that saw significant mortality in China in 2023, highlighting a critical need for Buchang's treatments. Furthermore, Buchang caters to patients with gynaecological, dermatological, and urological conditions, tapping into a global dermatology market valued at approximately $150 billion in 2024.

Beyond individual patients, Buchang relies heavily on hospitals and clinics as key B2B customers, procuring medications for widespread use. Retail pharmacies and drug stores are equally vital, serving as the primary distribution channel for Buchang's diverse product portfolio, from over-the-counter items to prescription drugs. The global pharmaceutical market, valued around $1.6 trillion in 2023, underscores the significance of these retail partners in ensuring product accessibility and driving sales.

| Customer Segment | Primary Need | 2023/2024 Data Point | Buchang's Offering | Strategic Importance |

| Cardiovascular/Cerebrovascular Patients | Treatment for life-threatening conditions | 1.8 million deaths in China (2023) | TCM and modern pharmaceuticals | Core patient base, high demand |

| Gynaecological, Dermatological, Urological Patients | Treatment for prevalent health concerns | Global dermatology market ~$150 billion (2024) | Specialized treatments | Market diversification |

| Hospitals & Clinics | Bulk medication supply for patient care | N/A (B2B relationship) | Proven effective, regulatory-compliant drugs | Major revenue driver, patient reach |

| Retail Pharmacies & Drug Stores | Product stocking and end-consumer access | Global pharma market ~$1.6 trillion (2023) | Diverse product portfolio (OTC & Rx) | Essential distribution channel, consumer influence |

Cost Structure

Buchang Pharmaceutical's cost structure is heavily influenced by significant investments in research and development. This includes substantial spending on clinical trials, the intricate process of discovering new drugs, and refining existing formulations. In 2023 alone, the company reported R&D expenses of approximately 1.2 billion RMB, reflecting its commitment to innovation.

These R&D outlays cover a broad spectrum of expenses, from the salaries of highly skilled scientific personnel and the maintenance of advanced laboratory facilities to the considerable fees associated with regulatory submissions. With a robust pipeline featuring 214 new drugs currently under development, these costs are crucial for Buchang to maintain its competitive edge and introduce novel treatments to the market.

Buchang Pharmaceutical's manufacturing and production expenses are a significant component of its cost structure, encompassing everything from sourcing active pharmaceutical ingredients (APIs) and excipients to the salaries of its skilled production workforce. These costs are directly tied to maintaining and operating its numerous production facilities, ensuring they meet stringent quality and regulatory standards.

In 2024, the pharmaceutical industry, including companies like Buchang, faced ongoing pressures on raw material costs. For instance, global supply chain disruptions continued to impact the availability and pricing of key chemical intermediates and specialized ingredients. Furthermore, labor costs for specialized manufacturing roles, such as quality control technicians and process engineers, remained a considerable expense, reflecting the high skill requirements in pharmaceutical production.

Buchang Pharmaceutical's extensive domestic and international sales and marketing network represents a substantial cost. In 2024, these operational expenses likely included significant outlays for sales force compensation, encompassing salaries and performance-based commissions, as well as substantial investments in advertising and promotional activities to build brand awareness and drive product demand.

Furthermore, the logistics and warehousing required for efficient product distribution across diverse markets contribute to this cost structure. These expenditures are critical for ensuring market penetration and fostering product adoption, directly impacting Buchang's ability to compete and grow.

Administrative and General Overhead

Buchang Pharmaceutical's administrative and general overhead encompasses essential operational expenses that keep the company running smoothly. These include costs like executive compensation, salaries for administrative personnel, office space rent, and the upkeep of IT systems. Additionally, legal and compliance fees are a significant component, ensuring the company adheres to industry regulations.

Effective management of these overheads is crucial for Buchang Pharmaceutical's profitability. For instance, in 2024, many pharmaceutical companies focused on optimizing their administrative structures to reduce non-essential spending. This often involved leveraging technology for greater efficiency and streamlining processes. A lean administrative function directly translates to a healthier bottom line.

- Executive and administrative salaries: Covering leadership and support staff.

- Office rent and utilities: Costs associated with physical office spaces.

- IT infrastructure and maintenance: Expenses for technology systems and support.

- Legal and compliance fees: Costs for regulatory adherence and legal counsel.

Capital Expenditures and Investments

Capital expenditures for Buchang Pharmaceutical are significant, encompassing investments in new manufacturing plants and upgrading existing facilities to enhance production capacity and efficiency. These expenditures are crucial for maintaining a competitive edge and meeting growing market demand.

Acquisitions and strategic investments also form a key part of their capital expenditure strategy. For instance, Buchang Pharmaceutical's increased stake in Buchang Health Industry (Zhejiang) Co., Ltd. demonstrates a commitment to expanding its operational footprint and integrating its value chain. These moves are designed to foster long-term growth and market penetration.

- Investment in Production Facilities: Buchang Pharmaceutical allocates substantial capital towards building and modernizing its production sites to ensure adherence to stringent quality standards and to scale operations.

- Technology Acquisition: The company invests in acquiring advanced manufacturing technologies and equipment to improve product quality, reduce costs, and introduce innovative pharmaceutical products.

- Strategic Stake Acquisitions: Increasing ownership in subsidiaries like Buchang Health Industry (Zhejiang) Co., Ltd. represents a capital investment aimed at consolidating market position and realizing synergies.

Buchang Pharmaceutical's cost structure is dominated by its substantial investment in research and development, aiming to maintain a competitive edge through innovation. Manufacturing and production expenses are also a major component, covering raw materials, skilled labor, and facility upkeep to meet regulatory standards.

Sales and marketing, alongside administrative overheads, represent significant operational costs crucial for market penetration and smooth functioning. Capital expenditures, including facility upgrades and strategic acquisitions, further shape the company's financial outlay.

| Cost Category | 2023 (Approx. RMB) | 2024 (Estimated Impact) |

| Research & Development | 1.2 billion | Continued high investment, driven by 214 drugs in pipeline. Raw material costs for R&D also a factor. |

| Manufacturing & Production | Significant | Pressure from rising raw material and specialized labor costs. |

| Sales & Marketing | Substantial | Ongoing investment in sales force and promotional activities, logistics costs. |

| Administrative & General Overhead | Essential Operational Costs | Focus on efficiency through technology and process streamlining. |

| Capital Expenditures | Significant | Investments in production facilities and strategic acquisitions like Buchang Health Industry. |

Revenue Streams

Buchang Pharmaceutical's core revenue generation stems from the sales of its cardiovascular and cerebrovascular drugs. Flagship products such as Naoxintong Capsule and Danhong Injection are key drivers, benefiting from consistent patient demand and significant market penetration.

Buchang Pharmaceutical also generates revenue through the sale of drugs targeting gynaecological, dermatological, and urological issues. These therapeutic areas, while not their primary focus, play a crucial role in diversifying the company's income streams and accessing broader patient populations. This strategy helps to mitigate risks associated with over-reliance on a single market segment.

In 2023, Buchang Pharmaceutical reported that its gynaecological and dermatological product lines, alongside other smaller segments, contributed to its overall sales performance, complementing the significant revenue from its cardiovascular offerings. This diversification strategy is key to their long-term growth, allowing them to capture market share in multiple healthcare areas.

Buchang Pharmaceutical's revenue extends beyond its primary focus areas through the sale of a wide array of Traditional Chinese Medicines (TCM) and chemical drugs. This diversified approach allows them to tap into various market segments and cater to a broader patient base.

The company actively develops and markets 214 distinct varieties of new drugs. This extensive pipeline includes 35 different TCM products and 175 chemical drug formulations, underscoring a commitment to innovation and a broad therapeutic reach.

International Market Sales

Buchang Pharmaceutical's international market sales are a crucial and expanding revenue stream. For instance, their collaboration in the Philippines exemplifies this global reach. This geographical diversification is key, lessening dependence on the Chinese domestic market and opening up access to new patient demographics and healthcare infrastructures.

This international expansion is not just about market share; it's about creating resilience. By tapping into diverse economies and healthcare needs, Buchang is building a more robust financial foundation. This strategy is particularly important in a dynamic global pharmaceutical landscape.

- Global Reach: Buchang's presence in markets like the Philippines diversifies revenue and reduces domestic market risk.

- New Opportunities: International sales tap into new patient populations and varying healthcare system demands.

- Revenue Growth: Sales from international operations contribute significantly to overall financial performance, reflecting successful market penetration strategies.

Licensing and Technology Transfer (Potential)

Buchang Pharmaceutical, with its strong emphasis on research and development, possesses a significant opportunity to generate revenue through licensing and technology transfer. This involves partnering with other pharmaceutical firms, allowing them to utilize Buchang's patented drug formulations or advanced manufacturing technologies.

These agreements typically involve upfront fees and ongoing royalties based on the sales of products developed using the licensed technology. For instance, in 2024, the global pharmaceutical licensing market was valued at over $100 billion, demonstrating the substantial financial potential in this area.

Such a strategy allows Buchang to monetize its intellectual property without the need for extensive capital investment in manufacturing or marketing for every new innovation. This can accelerate the availability of new treatments to patients while creating a consistent revenue stream for Buchang.

- Potential Revenue Source: Licensing patented formulations and technologies to other companies.

- Mechanism: Royalties and upfront fees from licensing agreements.

- Industry Trend: The global pharmaceutical licensing market exceeded $100 billion in 2024.

- Strategic Benefit: Monetizing intellectual property and expanding market reach.

Buchang Pharmaceutical's revenue is primarily driven by the sales of its cardiovascular and cerebrovascular drugs, with flagship products like Naoxintong Capsule and Danhong Injection showing strong market performance.

The company also diversifies its income through sales in gynaecological, dermatological, and urological therapeutic areas, broadening its patient reach and mitigating single-market reliance.

In 2023, Buchang's gynaecological and dermatological segments, alongside other smaller product lines, contributed to overall sales, complementing its core cardiovascular offerings.

Buchang Pharmaceutical's revenue streams are further bolstered by its extensive portfolio of 214 new drugs, encompassing 35 Traditional Chinese Medicine (TCM) products and 175 chemical drug formulations, reflecting a commitment to innovation and broad therapeutic coverage.

International sales, exemplified by its operations in the Philippines, represent a key and growing revenue source, enhancing financial resilience and accessing new demographics.

The company also has significant potential to generate revenue through licensing its patented drug formulations and advanced manufacturing technologies, a market valued at over $100 billion globally in 2024.

| Key Revenue Streams | Primary Products/Areas | 2023/2024 Data Points | Strategic Importance |

| Cardiovascular & Cerebrovascular Drugs | Naoxintong Capsule, Danhong Injection | Core revenue drivers, significant market penetration | Foundation of sales, consistent demand |

| Diversified Therapeutic Areas | Gynaecology, Dermatology, Urology | Contributed to overall sales in 2023 | Broader patient access, risk mitigation |

| Broad Drug Portfolio | 214 New Drugs (35 TCM, 175 Chemical) | Extensive pipeline for market reach | Innovation, catering to diverse needs |

| International Sales | Philippines operations | Expanding revenue, reducing domestic reliance | Global diversification, market resilience |

| Licensing & Technology Transfer | Patented formulations, manufacturing tech | Global licensing market >$100 billion (2024) | Monetizing IP, accelerated market access |

Business Model Canvas Data Sources

The Buchang Pharmaceutical Business Model Canvas is built using a combination of internal financial reports, extensive market research on the pharmaceutical industry, and strategic insights derived from competitor analysis. These data sources ensure each block of the canvas is informed by accurate and relevant information.