Buchang Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Buchang Pharmaceutical Bundle

Buchang Pharmaceutical operates within a dynamic landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the pharmaceutical sector effectively.

The complete report reveals the real forces shaping Buchang Pharmaceutical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Buchang Pharmaceutical's reliance on unique Traditional Chinese Medicine (TCM) raw materials positions its suppliers with considerable bargaining power. Many of these essential herbs are cultivated in specific regions, and their availability can be influenced by environmental factors and limited production capacity. For instance, certain rare TCM ingredients, crucial for Buchang's formulations, may only be sourced from a handful of growers, amplifying supplier leverage.

The specialized nature and often seasonal harvesting of these TCM ingredients mean that suppliers can dictate terms, particularly when demand outstrips supply. This dependence creates vulnerability for Buchang, as price hikes or supply interruptions from these key suppliers can directly affect manufacturing expenses and production volumes. In 2023, the global TCM market saw continued growth, with demand for high-quality, traceable raw materials increasing, potentially further strengthening supplier positions.

While China has been actively promoting the expansion of TCM material cultivation areas, aiming to enhance supply chain stability and manage pricing, the inherent uniqueness of many raw materials still grants significant influence to their primary producers. This strategic move by China aims to mitigate some of the supplier power, but the scarcity of certain premium TCM ingredients remains a factor for companies like Buchang.

While certain specialized Traditional Chinese Medicine (TCM) ingredients might face supplier concentration, Buchang Pharmaceutical likely sources a significant portion of its common inputs, such as basic chemicals, packaging materials, and more generic raw materials, from a fragmented supplier base. This broad availability of alternatives for standard components significantly diminishes the individual bargaining power of any single supplier in these categories.

The pharmaceutical sector, particularly Traditional Chinese Medicine (TCM), mandates exceptionally high benchmarks for raw material quality, purity, and consistency. This is driven by strict regulatory mandates and critical efficacy considerations. Suppliers who can reliably meet these demanding specifications often wield greater bargaining power, as the risk associated with transitioning to unproven sources is substantial.

Buchang Pharmaceutical's reliance on dependable, top-tier inputs inherently bolsters the leverage of its established, compliant suppliers. In 2024, China continued its push to implement a comprehensive traceability system across the entire TCM supply chain, aiming to solidify quality assurance and further empower compliant suppliers.

Supplier's ability to forward integrate

The ability of suppliers to forward integrate, meaning they could potentially move into Buchang Pharmaceutical's business of manufacturing drugs, is a key factor in their bargaining power. While suppliers of crucial raw materials might possess strong cultivation or processing skills, the pharmaceutical industry demands significant capital, navigating a complex regulatory environment, and substantial investment in research and development. These barriers make it difficult for most raw material suppliers to realistically enter drug manufacturing.

This limited threat of forward integration by suppliers means they generally have less leverage over Buchang Pharmaceutical. For instance, in 2024, the global pharmaceutical contract manufacturing market, a related area, was valued at approximately USD 16.5 billion, highlighting the specialized nature and high entry costs involved.

- Limited Forward Integration Threat: Most raw material suppliers face substantial hurdles in entering pharmaceutical manufacturing due to high capital requirements and regulatory complexities.

- Reduced Supplier Leverage: This difficulty in forward integration curtails the bargaining power of suppliers against companies like Buchang Pharmaceutical.

- Industry Barriers: The pharmaceutical sector's stringent R&D and compliance demands create significant barriers to entry for potential upstream competitors.

Buchang's volume of purchases

Buchang Pharmaceutical, as a major player in the pharmaceutical industry, is expected to have significant purchasing power due to its large order volumes. This substantial demand grants Buchang considerable leverage in price and terms negotiations with its suppliers.

Suppliers, in turn, often find it vital to secure contracts with a company of Buchang's stature, which can diminish their own bargaining strength. This is particularly true for suppliers of common or non-specialized raw materials.

- High Purchase Volumes: Buchang's status as a leading pharmaceutical company implies it procures raw materials in substantial quantities.

- Negotiating Leverage: Large purchase volumes translate into significant power for Buchang when negotiating prices and contract terms with suppliers.

- Supplier Dependence: For many suppliers, obtaining large contracts from Buchang is critical for their business stability, thereby reducing their bargaining power.

- Impact on Non-Specialized Inputs: The bargaining power dynamic is amplified for suppliers providing non-specialized or easily substitutable inputs.

Buchang Pharmaceutical's significant purchasing volume grants it considerable leverage over suppliers, especially for non-specialized inputs. This scale allows the company to negotiate favorable pricing and terms, reducing individual supplier bargaining power. The critical nature of securing large contracts with a firm of Buchang's size often makes suppliers more amenable to the company's demands.

| Factor | Impact on Supplier Bargaining Power | Buchang's Position |

| Purchase Volume | High | Buchang's large orders reduce supplier leverage. |

| Supplier Dependence | Low | Suppliers often rely on Buchang's contracts, weakening their negotiating stance. |

| Input Specialization | Varies | Power is higher for unique TCM ingredients, lower for common materials. |

What is included in the product

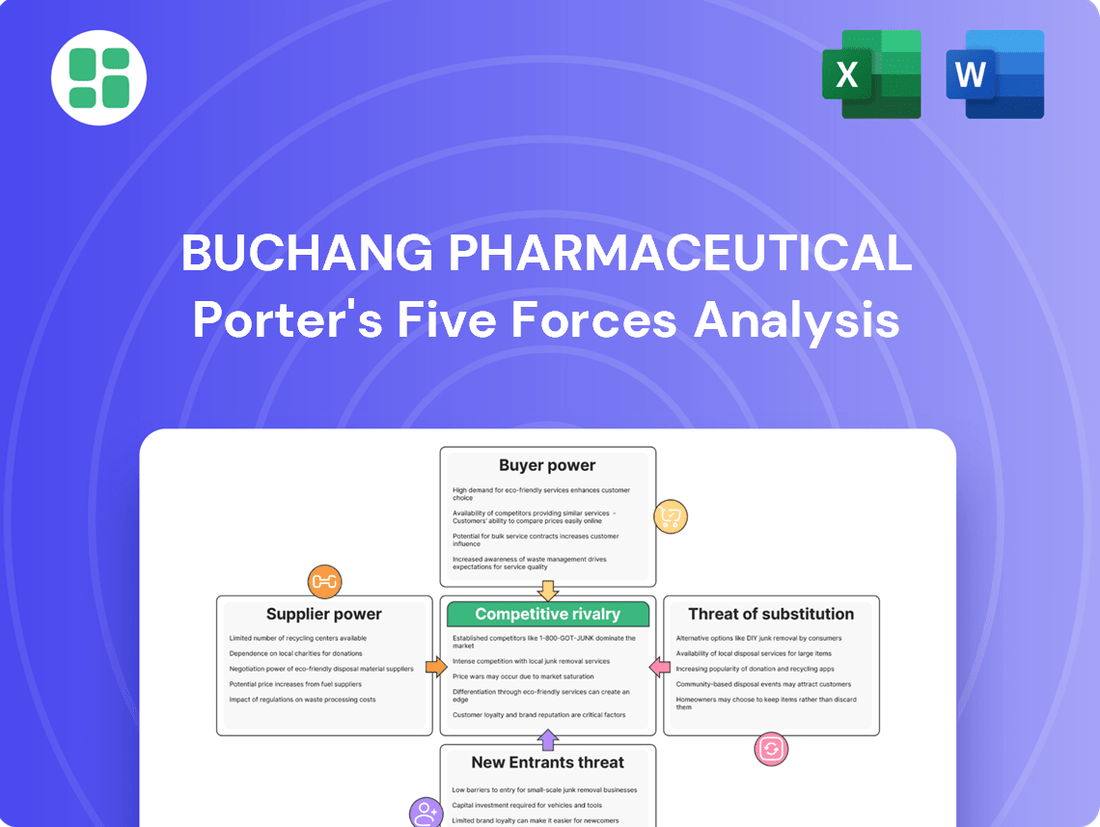

This analysis dissects the competitive forces impacting Buchang Pharmaceutical, revealing the intensity of rivalry, buyer and supplier power, new entrant threats, and the impact of substitutes on its market position.

Instantly understand competitive pressures on Buchang Pharmaceutical with a clear, one-sheet Porter's Five Forces analysis, simplifying complex market dynamics for effective pain point relief.

Customers Bargaining Power

Buchang Pharmaceutical's diverse customer base, spanning hospitals, pharmacies, and end consumers, significantly dilutes individual customer bargaining power. This broad reach means no single customer segment holds substantial leverage, as the company's revenue streams are diversified across multiple channels. For instance, in 2024, Buchang reported that its sales to institutional buyers like hospitals and pharmacies constituted a significant portion, but the growing direct-to-consumer market also provides a counterbalance.

Customers in the healthcare sector, especially major buyers like hospitals and public health systems, exhibit significant price sensitivity. This is largely driven by strict budget limitations and government initiatives focused on cost containment for pharmaceuticals. For Buchang Pharmaceutical, this translates to potential pricing pressure, particularly on their traditional Chinese medicine (TCM) products that are considered generic or lack significant differentiation.

The dynamics of price sensitivity are further amplified by policy frameworks such as China's National Reimbursement Drug List (NRDL). Updates to this list frequently necessitate price reductions or concessions from pharmaceutical companies to ensure their products are covered, directly impacting customer purchasing choices and Buchang's revenue streams.

For many conditions Buchang Pharmaceutical addresses, customers have a range of alternative treatments available. These include conventional Western medicines, other Traditional Chinese Medicine (TCM) brands, and even non-medicinal approaches. This variety of options directly strengthens the bargaining power of customers.

When substitutes are readily available, customers can easily switch to a different product if they find Buchang's offerings to be priced too high or lacking in perceived effectiveness. For instance, in 2024, the global pharmaceutical market saw continued growth in generic drug availability, a trend that pressures branded and established players like Buchang to remain competitive on price and demonstrate clear product differentiation and value proposition to retain market share.

Customer knowledge and brand loyalty

While individual patients might develop loyalty to certain Traditional Chinese Medicine (TCM) products due to perceived effectiveness or physician endorsements, the bargaining power of customers is significantly influenced by knowledge and alternative options. In 2024, the increasing availability of comparative clinical data and the influence of healthcare professionals and large procurement entities mean that purchasing decisions are often driven by efficacy and cost-effectiveness rather than solely brand loyalty. This informed approach empowers these key customers to negotiate better terms or switch to alternatives if Buchang Pharmaceutical's offerings are not competitive.

Healthcare professionals and institutional buyers, such as hospitals and government health programs, possess a deep understanding of the TCM market landscape. They are adept at evaluating the clinical outcomes and cost-effectiveness of various treatments. This knowledge base allows them to exert considerable pressure on suppliers like Buchang Pharmaceutical, demanding competitive pricing and demonstrable value. For instance, a hospital network in China might leverage its purchasing volume to secure discounts on widely used TCM ingredients, impacting Buchang's pricing power.

- Informed Decision-Making: Key customers, particularly healthcare providers and large purchasing organizations, base their choices on clinical evidence and economic viability, not just brand recognition.

- Increased Negotiation Leverage: This informed perspective grants these customers greater bargaining power, enabling them to push for better pricing and terms.

- Brand Reputation as a Mitigator: Buchang Pharmaceutical's strong brand reputation for consistent efficacy can help to counteract some of this customer bargaining power by fostering trust and reducing perceived risk.

Influence of medical professionals and prescribing patterns

Patients, the ultimate consumers of Buchang Pharmaceutical's products, often have limited direct influence. Their purchasing decisions are heavily shaped by the recommendations of medical professionals like doctors and pharmacists, who act as crucial intermediaries. These healthcare providers, in turn, base their prescriptions on factors such as clinical efficacy, patient outcomes, and established treatment guidelines, indirectly channeling demand and influencing the market for Buchang's offerings.

The prescribing patterns of doctors are a significant determinant of Buchang's sales volume. For instance, in 2024, the global pharmaceutical market saw continued emphasis on evidence-based medicine, meaning prescriptions are increasingly tied to proven clinical results. This reliance on objective data empowers medical professionals, as their choices can steer patient choice towards or away from specific drugs, thereby impacting Buchang's market position.

- Influence of Medical Professionals: Doctors and pharmacists act as gatekeepers, their recommendations heavily influencing patient drug consumption.

- Prescribing Patterns: These patterns, driven by clinical guidelines and efficacy data, indirectly shape demand for Buchang's products.

- Indirect Customer Bargaining Power: The decisions of medical professionals effectively translate into bargaining power for the end-user by dictating product choice.

- Impact of Compliance: China's finalized anti-corruption compliance guidelines in 2025 are expected to further professionalize drug promotion, potentially reinforcing the influence of evidence-based prescribing.

Buchang Pharmaceutical faces moderate customer bargaining power, primarily from large institutional buyers like hospitals and government health systems. These entities, driven by budget constraints and a focus on cost-effectiveness, can negotiate pricing, especially for high-volume or less differentiated products. For example, in 2024, China's ongoing healthcare reforms aimed at reducing drug costs put pressure on pharmaceutical companies to offer competitive pricing.

The availability of numerous substitutes, including Western medicine and other TCM brands, further empowers customers. If Buchang's products are perceived as too expensive or less effective, buyers can readily switch. The increasing transparency and availability of comparative clinical data in 2024 also equip customers with more knowledge to make informed choices and negotiate better terms.

While individual patients may exhibit loyalty, their purchasing decisions are largely mediated by healthcare professionals. Doctors and pharmacists, influenced by clinical efficacy and cost, act as key decision-makers, indirectly channeling customer bargaining power through their prescribing habits. China's finalized anti-corruption compliance guidelines in 2025 are expected to further professionalize drug promotion, potentially strengthening the influence of evidence-based prescribing.

| Factor | Impact on Buchang | Evidence/Data (2024) |

|---|---|---|

| Customer Concentration | Low (Diverse customer base) | Sales diversified across hospitals, pharmacies, and direct consumers. |

| Price Sensitivity | Moderate to High (Institutional buyers) | Government initiatives for cost containment; NRDL price adjustments. |

| Availability of Substitutes | High | Growth in generic drugs globally; numerous TCM and Western medicine alternatives. |

| Switching Costs | Low to Moderate | Limited switching costs for many TCM products; physician influence can increase costs. |

| Information Availability | High | Increased access to comparative clinical data and market analysis. |

Preview the Actual Deliverable

Buchang Pharmaceutical Porter's Five Forces Analysis

This preview showcases the comprehensive Buchang Pharmaceutical Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering a deep dive into industry rivalry, buyer and supplier power, threats of new entrants and substitutes. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing valuable insights for strategic decision-making.

Rivalry Among Competitors

The Chinese pharmaceutical market is incredibly crowded, with a vast array of domestic and international companies competing fiercely. This fragmentation is particularly noticeable in the Traditional Chinese Medicine (TCM) segment, where numerous players are vying for dominance. For instance, as of early 2024, the Chinese pharmaceutical industry hosts over 6,000 registered pharmaceutical companies, many of which operate within the TCM space, making intense rivalry a defining characteristic.

Buchang Pharmaceutical's focus on patented Traditional Chinese Medicine (TCM) formulas, especially for cardiovascular and cerebrovascular conditions, provides a distinct product differentiation. This specialization allows them to carve out a niche in a market often characterized by more generalized offerings.

Despite these patented formulas, the broader TCM market presents challenges. Many TCM products share similar indications and can be replicated, intensifying rivalry. Competition often hinges on perceived efficacy, established brand reputation, and aggressive marketing strategies rather than solely on unique product formulations.

In 2024, Buchang Pharmaceutical, like its peers, navigated this competitive landscape. While specific market share data for individual TCM brands is dynamic, the overall TCM market in China, a key region for Buchang, was projected to see continued growth, with companies leveraging brand trust and clinical evidence to gain an edge.

The pharmaceutical manufacturing sector is characterized by substantial exit barriers, largely stemming from the immense capital sunk into specialized production facilities, extensive research and development pipelines, and rigorous regulatory compliance frameworks. These factors make it incredibly difficult and costly for companies to simply shut down operations or divest assets.

Consequently, even when facing periods of reduced profitability, pharmaceutical manufacturers often remain in the market rather than exiting. This reluctance to leave can perpetuate overcapacity, as companies continue to operate existing plants, which in turn fuels more aggressive pricing strategies among competitors vying for market share.

For instance, the global pharmaceutical market, valued at approximately $1.5 trillion in 2024, demonstrates this dynamic; companies with significant investments in drug development and manufacturing infrastructure are hesitant to abandon these assets, even if current returns are modest, thereby intensifying the competitive landscape.

Industry growth rate and market saturation

While the broader Chinese healthcare sector shows robust expansion, specific niches, such as established Traditional Chinese Medicine (TCM) cardiovascular treatments, may face decelerated growth or market saturation. This dynamic can trigger intensified competition among existing players.

In such slower-expanding markets, companies often deploy aggressive tactics like price reductions, heightened promotional activities, and the introduction of new product variations to capture market share from competitors. This scenario directly impacts established companies like Buchang Pharmaceutical.

Despite these pressures in mature segments, the overall pharmaceutical market in China is anticipated to expand significantly. Projections indicate a compound annual growth rate (CAGR) of 7.8% for the Chinese pharmaceutical market between 2025 and 2030, underscoring the mixed growth landscape.

- Market Saturation in TCM Cardiovascular Drugs: Certain segments within the TCM cardiovascular drug market may be nearing saturation, leading to increased rivalry.

- Aggressive Competitive Tactics: Companies in slower-growth areas often resort to price wars, increased marketing, and product line extensions to gain an edge.

- Overall Market Growth: The Chinese pharmaceutical market is projected for substantial growth, with an estimated CAGR of 7.8% from 2025 to 2030.

- Impact on Established Players: Buchang Pharmaceutical, as an established player, faces intensified competitive pressures in these mature market segments.

Regulatory landscape and policy changes

The competitive rivalry within the pharmaceutical sector, particularly in China where Buchang Pharmaceutical operates, is heavily influenced by the regulatory landscape and ongoing policy changes. The Chinese government's commitment to healthcare reform, evident in initiatives like the volume-based procurement (VBP) program, directly impacts drug pricing and market access, intensifying competition. For instance, VBP has led to significant price reductions for many drugs, forcing companies to compete on cost and efficiency.

Policies that favor Traditional Chinese Medicine (TCM), a core area for Buchang, can provide a competitive edge. However, broader reforms aimed at encouraging generic drug adoption and centralizing procurement can increase pressure from larger, more diversified pharmaceutical companies. This dynamic was highlighted in 2024 as the National Healthcare Security Administration continued to expand VBP coverage to more drug categories, thereby increasing competitive intensity.

Companies like Buchang must remain agile, adapting their strategies to navigate these evolving regulations. The period of 2024-2025 has seen substantial shifts in China's pharmaceutical regulatory framework, including stricter requirements for drug approvals and enhanced post-market surveillance, which can favor well-resourced and compliant organizations. These changes necessitate continuous investment in R&D and regulatory affairs to maintain market position.

- Government healthcare policies: China's evolving policies, including drug procurement reforms and pricing controls, directly shape competitive intensity.

- Impact of VBP: Volume-based procurement programs have driven down drug prices, forcing companies to compete more aggressively on cost.

- TCM policy influence: Favorable policies for Traditional Chinese Medicine can benefit Buchang, but broader reforms may favor generics and larger players.

- Adaptation imperative: Pharmaceutical companies must continuously adapt to regulatory shifts, as seen in China's significant pharmaceutical regulatory transformations during 2024-2025.

The competitive rivalry in Buchang Pharmaceutical's operating environment is intense due to a fragmented market with numerous domestic and international players, especially in the Traditional Chinese Medicine (TCM) segment. Many TCM products offer similar indications, forcing companies to compete on brand reputation and marketing rather than solely on unique formulations. This dynamic is exacerbated by high exit barriers in pharmaceutical manufacturing, leading companies to remain in the market even during periods of lower profitability, which can fuel aggressive pricing strategies.

| Factor | Description | Impact on Buchang |

|---|---|---|

| Market Fragmentation | Over 6,000 registered pharmaceutical companies in China, many in TCM. | Requires strong differentiation and marketing to stand out. |

| Product Similarity | Many TCM products have similar indications and are replicable. | Buchang's patented formulas offer some differentiation, but brand and perceived efficacy are key. |

| Exit Barriers | High capital investment in facilities and R&D discourages exit. | Perpetuates overcapacity and can lead to price wars. |

| Regulatory Environment | Government policies like VBP drive down prices and increase cost competition. | Buchang must adapt to pricing pressures and evolving compliance standards. |

SSubstitutes Threaten

Western medicine treatments, especially for conditions like cardiovascular and cerebrovascular diseases, present the most substantial substitute threat to Buchang Pharmaceutical's traditional Chinese medicine (TCM) offerings. Patients and healthcare providers frequently weigh the choice between TCM and Western pharmaceuticals, or opt for a blended approach, considering factors like perceived effectiveness, how quickly they work, and overall cost.

The ongoing progress in Western medical research and its broad societal acceptance create a persistent competitive alternative. For instance, in 2024, the global pharmaceutical market for cardiovascular drugs alone was projected to reach over $150 billion, indicating the significant scale and ongoing innovation within this sector, directly competing with TCM therapies for similar patient needs.

Beyond Western medicine, numerous other Traditional Chinese Medicine (TCM) brands and generic versions of popular TCM formulations present direct substitutes for Buchang Pharmaceutical's products. If a patient or physician is amenable to TCM, they face a broad spectrum of choices from various manufacturers, creating a highly competitive landscape. The perceived effectiveness, pricing strategies, and accessibility of these alternative TCM offerings can significantly influence the demand for Buchang's specific formulations, intensifying competition within the TCM market itself. For instance, the China Traditional Chinese Medicine market was valued at approximately $125 billion in 2023 and is projected for continued growth, underscoring the robust internal competitive environment Buchang navigates.

For numerous health conditions, particularly chronic ones like heart disease, lifestyle changes such as diet, exercise, and physiotherapy can serve as alternatives to medication. While these are often used alongside drugs, a stronger focus on preventive health or alternative treatments might lessen the need for pharmaceutical products, including those from Buchang, presenting a gradual but increasing threat.

Emerging alternative and complementary therapies

The growing popularity of alternative and complementary therapies, such as acupuncture and specialized dietary supplements, presents a subtle yet significant threat of substitution for Buchang Pharmaceutical. These options provide patients with diverse approaches to health management, potentially diverting demand from traditional Chinese medicine (TCM). For instance, the global dietary supplements market was projected to reach USD 230.7 billion in 2024, indicating a substantial alternative spend for consumers seeking wellness solutions.

Buchang Pharmaceutical needs to actively highlight the distinct advantages and proven effectiveness of its TCM offerings in comparison to this expanding landscape of health choices. The perceived efficacy and accessibility of these alternative therapies can influence patient decisions, making it crucial for Buchang to continually reinforce the scientific backing and therapeutic benefits of its products.

- Expanding Consumer Choice: The proliferation of alternative therapies broadens the options available to consumers seeking health and wellness solutions.

- Perceived Efficacy: Some consumers may view alternative therapies as equally or more effective for certain conditions than traditional TCM.

- Market Diversification: The growth of the dietary supplement market, valued at over USD 230 billion in 2024, signifies a significant alternative avenue for consumer health spending.

- Value Proposition Reinforcement: Buchang must consistently articulate the unique value and scientific validation of its TCM products to counter the appeal of substitutes.

Patient and physician perception of efficacy and safety

The perceived efficacy and safety of Buchang Pharmaceutical's Traditional Chinese Medicine (TCM) products compared to substitutes significantly influences their market position. If conventional Western medicine or alternative therapies are viewed as more effective, quicker to act, or possessing fewer adverse effects, both patients and physicians are likely to favor those options.

Buchang's commitment to ongoing research and rigorous clinical trials is paramount in bolstering the credibility and competitive advantage of its TCM offerings. This scientific validation is essential to counter the threat posed by substitute treatments, demonstrating that Buchang's products can stand on equal footing, or even surpass, conventional alternatives in terms of patient outcomes and safety.

- Perceived Efficacy: If patients and doctors believe Western drugs offer faster symptom relief or more potent treatment for specific conditions, they will gravitate towards those substitutes.

- Safety Profiles: A perception of fewer side effects or better long-term safety with non-TCM treatments can also steer choices away from Buchang's products.

- Clinical Evidence: Buchang's investment in clinical studies, such as those demonstrating comparable or superior outcomes to conventional treatments, directly combats the threat of substitutes. For example, studies on their cardiovascular TCM products aim to prove efficacy against established Western pharmaceuticals.

- Physician Education: Educating healthcare professionals about the scientific backing and safety data of Buchang's TCM is crucial to overcome any ingrained preference for Western medicine.

The threat of substitutes for Buchang Pharmaceutical is significant, primarily from Western medicine and other health-focused alternatives. Western treatments for conditions like cardiovascular disease, a key area for Buchang, represent a substantial alternative, with the global cardiovascular drug market projected to exceed $150 billion in 2024.

Beyond direct pharmaceutical competition, lifestyle changes such as diet and exercise offer non-medicinal substitutes for managing chronic conditions, potentially reducing reliance on any pharmaceutical intervention. Furthermore, the booming dietary supplement market, valued at over $230 billion in 2024, provides consumers with a wide array of wellness options that can divert spending from traditional TCM products.

Buchang must continually emphasize the scientific validation and unique benefits of its TCM products to differentiate them from these numerous substitutes. Demonstrating comparable or superior efficacy and safety through rigorous clinical trials is crucial for maintaining market share against both established Western pharmaceuticals and emerging health trends.

Entrants Threaten

The pharmaceutical industry in China, especially for new drug approvals and Traditional Chinese Medicine (TCM) products, faces significant regulatory challenges from the National Medical Products Administration (NMPA). These stringent and complex approval processes demand substantial time and financial resources from new entrants, effectively acting as a major barrier to entry.

This intricate regulatory landscape provides a protective moat for established companies like Buchang Pharmaceutical. While China saw a record number of new drug approvals in 2024, the path for newcomers remains arduous, requiring deep expertise and considerable investment to navigate successfully.

Developing and manufacturing innovative Traditional Chinese Medicine (TCM) products demands significant capital. Buchang Pharmaceutical, like others in the sector, invests heavily in research and development, rigorous clinical trials, and advanced manufacturing facilities. For instance, the cost of bringing a new drug to market can easily run into hundreds of millions of dollars.

New entrants face the daunting task of committing substantial financial resources, often without any guarantee of success or return on investment. This barrier makes it exceptionally challenging for smaller companies to enter the market and compete effectively with established players like Buchang. The sheer scale of investment required acts as a significant deterrent.

While these high capital requirements naturally limit new competition, it's worth noting that the Chinese government is actively encouraging innovation in drug development. This support aims to foster a more competitive landscape, but the fundamental need for large-scale investment remains a key hurdle for potential new entrants in the pharmaceutical industry.

Buchang Pharmaceutical, as a prominent player in Traditional Chinese Medicine (TCM), has cultivated robust brand loyalty and a widespread distribution infrastructure throughout China's healthcare system. This includes deep penetration into hospitals, pharmacies, and clinics, making it challenging for newcomers to replicate this level of trust and market access quickly.

New entrants face significant hurdles in matching Buchang's established market presence and the deep-seated trust consumers place in its brands. Building comparable distribution networks and achieving widespread market penetration would necessitate substantial investment in marketing and a considerable timeframe, effectively creating a barrier to entry.

Access to specialized TCM knowledge and raw materials

The threat of new entrants into Buchang Pharmaceutical's traditional Chinese medicine (TCM) sector is significantly moderated by the specialized knowledge and raw material access required. Developing effective TCM products demands deep historical understanding, often proprietary formulations, and access to specific, high-quality traditional raw materials. Buchang has cultivated years of expertise and potentially secured exclusive supply chains for these unique ingredients, creating a substantial barrier.

Newcomers face considerable hurdles in replicating this specialized knowledge, R&D capabilities, and reliable sourcing for authentic TCM inputs. For instance, China's ongoing efforts to standardize TCM practices and ingredients, while aiming for broader quality control, could also inadvertently consolidate access to foundational knowledge and specific botanical resources, making it harder for new players to establish comparable foundations.

- Proprietary Formulations: Buchang's long history likely includes unique, time-tested TCM formulations that are difficult for new entrants to replicate or legally circumvent.

- Raw Material Sourcing: Securing consistent access to high-quality, authentic TCM raw materials, often from specific geographical regions or cultivated under particular conditions, presents a significant challenge for new companies.

- Expertise and R&D: The deep, accumulated knowledge of TCM principles, efficacy, and application, coupled with significant investment in TCM-focused research and development, is a resource that new entrants would struggle to match quickly.

- Regulatory Landscape: Evolving TCM regulations in China, while promoting standardization, may also favor established players with existing compliance infrastructure and established relationships within the supply chain.

Economies of scale for existing players

Existing pharmaceutical giants, including those with operations similar to Buchang Pharmaceutical, leverage significant economies of scale. This translates to lower per-unit costs in areas like bulk raw material purchasing and large-scale manufacturing, giving them a distinct price advantage. For instance, in 2024, major pharmaceutical manufacturers often reported operating margins that benefited from efficient supply chains built over years of high-volume production.

New entrants face a considerable hurdle in matching these established cost efficiencies. Without the same production volume, they cannot achieve the same per-unit cost savings. This makes it challenging for them to compete on price against incumbents who have already optimized their operations, a factor that significantly deters new companies from entering the market.

- Lower production costs due to bulk purchasing of raw materials.

- Efficient large-scale manufacturing processes reduce overhead per unit.

- Established R&D departments benefit from amortized development costs across a larger product portfolio.

- Significant market share allows for greater negotiation power with suppliers.

The threat of new entrants for Buchang Pharmaceutical is significantly low due to substantial barriers. High capital requirements for R&D, clinical trials, and advanced manufacturing, often running into hundreds of millions of dollars for new drugs, deter smaller players. China's stringent regulatory environment, managed by the NMPA, further complicates market entry, demanding extensive time and resources to navigate approval processes.

Established brand loyalty and extensive distribution networks, built over years by companies like Buchang, create another formidable barrier. Newcomers would need massive investments in marketing and time to achieve comparable market penetration and consumer trust. Furthermore, specialized knowledge in Traditional Chinese Medicine (TCM), proprietary formulations, and secured sourcing of high-quality raw materials are difficult for new entrants to replicate, solidifying Buchang's competitive position.

Economies of scale enjoyed by incumbents like Buchang, leading to lower per-unit costs through bulk purchasing and efficient manufacturing, also present a significant challenge. In 2024, major pharmaceutical firms often leveraged these advantages to maintain competitive pricing, making it difficult for new, smaller-scale operations to enter the market profitably.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Buchang Pharmaceutical leverages data from company annual reports, industry-specific market research from firms like IQVIA, and regulatory filings from China's National Medical Products Administration to provide a comprehensive view of the competitive landscape.