Banca Transilvania PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca Transilvania Bundle

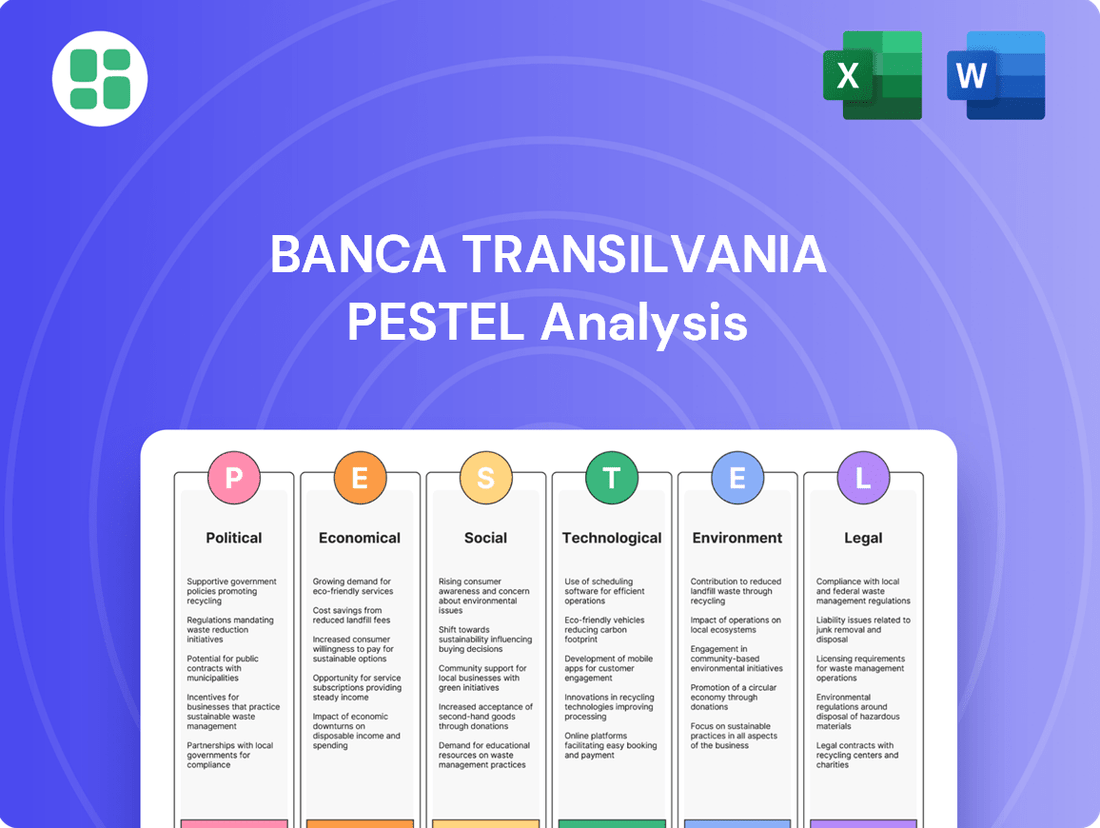

Navigate the dynamic landscape of Banca Transilvania with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping its strategic direction. Gain critical insights to inform your investment decisions and competitive strategies.

Unlock the full potential of your market understanding by diving deep into the external forces impacting Banca Transilvania. Our expertly researched PESTEL analysis provides actionable intelligence, crucial for identifying opportunities and mitigating risks. Download the complete report now to gain a definitive edge.

Political factors

The stability of the Romanian government and its policy direction are crucial for Banca Transilvania. A predictable policy environment, particularly concerning taxation and financial market regulation, fosters confidence and supports the bank's strategic planning. For instance, Romania's commitment to EU fiscal convergence, as seen in its 2024 budget discussions, indicates a move towards greater policy predictability.

The National Bank of Romania's (BNR) independence is paramount for Banca Transilvania and the broader financial sector. A robust, autonomous BNR fosters confidence in monetary policy and regulatory oversight, directly supporting a stable operating environment for banks.

For instance, in 2024, the BNR's continued commitment to maintaining inflation within its target range, as evidenced by its monetary policy decisions, provides a predictable economic backdrop. This autonomy is critical for ensuring financial stability, a key factor for the health of institutions like Banca Transilvania.

Any threat to the BNR's autonomy, such as political pressure on its decision-making, could introduce uncertainty and systemic risk, potentially impacting investor sentiment and market confidence in Romanian banks.

Romania's ongoing commitment to anti-corruption measures, a key political factor, directly influences Banca Transilvania's operational environment. Increased transparency and stricter enforcement, as seen in the continued focus by bodies like the National Anticorruption Directorate (DNA), can reduce the risks of illicit activities within the financial sector. For instance, a 2023 report indicated a slight decrease in reported corruption cases compared to previous years, suggesting a positive trend.

These sustained anti-corruption reforms are crucial for boosting investor confidence in the Romanian market, which in turn benefits financial institutions like Banca Transilvania. A cleaner business landscape can attract more foreign direct investment and foster a more predictable and fair competitive environment, ultimately supporting the bank's growth and stability. The World Bank's 2024 Ease of Doing Business report, while not yet finalized, is expected to reflect continued improvements in governance indicators for Romania.

EU Integration and Geopolitical Landscape

Romania's ongoing EU integration significantly shapes Banca Transilvania's operating environment by aligning its regulatory framework with EU standards and opening access to a larger single market. This integration, particularly in the context of the 2024-2025 period, means the bank can leverage EU-wide financial directives and potentially tap into cross-border investment opportunities more readily.

However, the broader geopolitical landscape presents both opportunities and risks. While EU stability generally fosters investor confidence, regional tensions, particularly in Eastern Europe, can introduce economic volatility. For instance, shifts in global trade dynamics or increased defense spending in neighboring countries, observed throughout 2024, could indirectly impact capital flows and consumer spending in Romania, influencing the bank's loan portfolio performance.

- EU Harmonization: Banca Transilvania benefits from the transposition of EU banking directives, simplifying compliance and facilitating pan-European operations.

- Market Access: Integration grants access to the EU's capital markets, potentially lowering funding costs and expanding investment banking services.

- Geopolitical Sensitivity: Regional conflicts or political instability can lead to currency fluctuations and affect foreign direct investment into Romania, impacting overall economic growth and credit demand.

- Investor Sentiment: EU membership generally bolsters investor confidence in Romania, but geopolitical events can cause temporary dips in sentiment, affecting the bank's stock performance and market valuation.

Government Support for SMEs

Government support for small and medium-sized enterprises (SMEs) is a crucial political factor for Banca Transilvania. Initiatives like the Romanian government's "Start-Up Nation" program, which provides non-reimbursable funding for new businesses, directly stimulate economic activity and increase the demand for banking products. In 2023 alone, the Start-Up Nation program allocated over €500 million, directly benefiting many SMEs that are key clients for Banca Transilvania.

These government programs, including credit guarantee schemes and tax incentives, foster a more robust SME sector. This growth translates into a larger potential client base and a healthier loan portfolio for banks like Banca Transilvania, which has historically maintained a strong focus on supporting Romanian businesses.

For instance, the €1 billion "Invest in Romania" initiative, launched in 2024, aims to further bolster SME development through various financial instruments and regulatory easing. Such policies create a more favorable environment for lending and expand the opportunities for Banca Transilvania to offer its services.

- Government-backed SME financing programs directly boost the demand for loans and financial services offered by Banca Transilvania.

- Tax incentives and subsidies for SMEs encourage business expansion, leading to increased financial activity and potential for new banking relationships.

- Credit guarantee funds reduce the risk for banks, making them more willing to lend to SMEs, thus expanding Banca Transilvania's market reach.

- Regulatory reforms aimed at simplifying business operations for SMEs can indirectly benefit banks by fostering a more stable and predictable business environment.

Romania's political landscape significantly influences Banca Transilvania's operations through regulatory stability and governance. The government's commitment to EU fiscal convergence, as seen in its 2024 budget, provides a predictable framework. The National Bank of Romania's autonomy is crucial, with its 2024 inflation targeting efforts offering economic stability.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Banca Transilvania, offering a comprehensive understanding of its operating landscape.

It provides actionable insights into how these macro-environmental forces present both challenges and strategic opportunities for the bank's growth and stability.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights for Banca Transilvania's strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal influences impacting Banca Transilvania.

Economic factors

The National Bank of Romania's monetary policy, particularly its key interest rate, significantly shapes Banca Transilvania's profitability. As of early 2024, Romania's inflation remained a key concern, leading the National Bank of Romania to maintain a relatively high policy rate, which stood at 7.00% in February 2024. This environment directly impacts Banca Transilvania's net interest income.

While elevated rates can widen the spread between lending and deposit costs, potentially boosting net interest margins, they also increase the cost of borrowing for businesses and individuals. This could dampen loan demand and potentially lead to a rise in non-performing loans, impacting asset quality. For instance, if the policy rate increases further, a larger portion of the bank's loan portfolio could face repricing challenges.

Banca Transilvania must therefore strategically manage its balance sheet, adjusting its lending and deposit-taking strategies to navigate these interest rate dynamics. This includes optimizing pricing for new loans and deposits and managing the maturity profiles of its assets and liabilities to mitigate interest rate risk.

Inflation rates significantly influence purchasing power, and for Banca Transilvania, this means the real value of customer deposits and the bank's assets can diminish. For instance, if inflation in Romania hovers around 5-7% as seen in late 2023 and early 2024, the purchasing power of savings decreases, potentially leading customers to seek higher-yield investments or spend more readily. This erosion of real value can also increase the risk of loan defaults as borrowers' incomes may not keep pace with rising costs.

Managing the balance sheet effectively during inflationary periods is crucial for Banca Transilvania. This involves adjusting interest rates on loans and deposits, optimizing investment portfolios, and refining risk assessment models to account for potential economic downturns. For example, if the European Central Bank maintains a hawkish stance on interest rates to combat inflation, Banca Transilvania would likely follow suit, impacting its lending margins and the cost of funding.

While high inflation presents challenges, a stable and predictable inflation rate, ideally within the National Bank of Romania's target range of around 2-3%, fosters sustained economic activity. This stability allows for more accurate financial planning for both the bank and its customers, encouraging investment and lending, which are vital for Banca Transilvania's growth and profitability.

Romania's GDP growth is a significant driver for Banca Transilvania. For instance, the Romanian economy expanded by 2.1% in 2023, a solid performance that fuels demand for credit and banking services. A healthy economic environment generally means more businesses are investing and expanding, and consumers are more confident, leading to increased lending opportunities for the bank.

The resilience of the Romanian economy, particularly in navigating global economic uncertainties, is crucial. Despite inflationary pressures and geopolitical shifts in 2024, Romania has shown an ability to adapt. This resilience translates to a more stable operating environment for Banca Transilvania, reducing the likelihood of significant downturns that could negatively impact loan portfolios and profitability.

Unemployment Levels and Consumer Confidence

Low unemployment rates are a significant positive for Banca Transilvania. In Romania, the unemployment rate stood at a historically low 5.5% in Q1 2024, according to Eurostat. This healthy labor market translates to higher disposable incomes for consumers, boosting their confidence and their willingness to take out loans for purchases and investments. Consequently, this environment fuels demand for Banca Transilvania's core financial products and services, while also mitigating the risk of loan defaults.

Conversely, a downturn in the labor market, marked by rising unemployment, would present challenges. Increased job losses can lead to a surge in loan defaults, straining the bank's asset quality. Furthermore, economic uncertainty typically dampens consumer spending and investment appetite, reducing the overall demand for credit and other banking services. This highlights the direct correlation between employment figures and Banca Transilvania's operational performance and profitability.

- Romania's unemployment rate was 5.5% in Q1 2024.

- Low unemployment supports higher consumer spending and loan demand.

- A strong labor market reduces credit risk for Banca Transilvania.

- High unemployment can lead to increased defaults and reduced service demand.

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) is a significant driver for Romania's economic expansion, directly influencing sectors where Banca Transilvania operates. Higher FDI inflows translate into more capital for businesses, fostering growth and increasing demand for banking services, from corporate lending to project finance. This creates a fertile ground for Banca Transilvania to support both new ventures and existing companies looking to scale up.

Romania attracted approximately €10.1 billion in FDI in 2023, marking a substantial increase from previous years. This influx of foreign capital signifies growing international trust in the Romanian economic landscape. Such confidence often leads to a rise in the number of multinational corporations and larger domestic enterprises seeking sophisticated financial solutions, directly benefiting banks like Banca Transilvania that can cater to these evolving needs.

- FDI Growth: Romania's FDI surged to €10.1 billion in 2023.

- Sectoral Impact: FDI fuels growth across key Romanian industries, creating financing opportunities.

- International Confidence: Increased FDI signals a positive outlook for the Romanian economy.

- Banking Opportunities: Higher FDI correlates with greater demand for corporate banking and expansion financing.

Romania's economic growth is a key indicator for Banca Transilvania's performance. The country's GDP expanded by 2.1% in 2023, signaling a robust environment for increased lending and banking services. This growth is supported by a low unemployment rate, which stood at 5.5% in Q1 2024, boosting consumer confidence and demand for credit.

Foreign Direct Investment (FDI) is also a significant economic driver, with Romania attracting €10.1 billion in 2023. This influx of capital stimulates business expansion and creates greater demand for corporate banking and financing solutions, directly benefiting Banca Transilvania.

The National Bank of Romania's monetary policy, including its key interest rate of 7.00% in February 2024, directly impacts the bank's profitability. While higher rates can widen net interest margins, they also increase borrowing costs, potentially slowing loan demand and affecting asset quality.

| Economic Factor | 2023 Data | Q1 2024 Data | Impact on Banca Transilvania |

|---|---|---|---|

| GDP Growth | 2.1% | N/A | Increased demand for credit and banking services. |

| Unemployment Rate | N/A | 5.5% | Higher consumer spending, increased loan demand, lower credit risk. |

| FDI Inflows | €10.1 billion | N/A | Stimulates business expansion, increases demand for corporate banking. |

| Policy Interest Rate (NBR) | N/A (7.00% in Feb 2024) | N/A (7.00% in Feb 2024) | Affects net interest margins and borrowing costs. |

Same Document Delivered

Banca Transilvania PESTLE Analysis

The preview you see here is the exact Banca Transilvania PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a comprehensive PESTLE analysis of Banca Transilvania.

The content and structure shown in the preview is the same Banca Transilvania PESTLE Analysis document you’ll download after payment. It provides an in-depth look at the external factors influencing the bank.

Sociological factors

Romania's demographic landscape is undergoing significant changes, with an aging population and a pronounced trend of internal migration towards urban centers. By 2024, projections indicate a continued shift, impacting consumer behavior and financial needs.

Banca Transilvania needs to strategically adjust its offerings and physical presence. For instance, focusing on digital banking solutions for an aging demographic while expanding services in dynamic urban hubs with younger, economically active populations is crucial for sustained growth.

The level of financial literacy in Romania significantly influences how readily people adopt advanced financial products and embrace digital banking. As more Romanians become financially savvy, Banca Transilvania has a greater opportunity to offer complex investment options and cutting-edge digital services, which in turn can attract a wider customer base and boost product adoption.

For instance, according to a 2023 survey by the National Bank of Romania, while a majority of the population understands basic financial concepts, only about 40% feel confident managing their finances or making investment decisions. This highlights a clear pathway for Banca Transilvania to engage in educational initiatives. Furthermore, ongoing efforts to enhance financial inclusion are crucial for expanding the market for essential banking services, reaching underserved populations and fostering broader economic participation.

Consumer preferences are rapidly shifting, with a significant uptick in demand for personalized banking experiences and seamless digital convenience. For instance, in 2024, a significant portion of Romanian consumers expressed a desire for tailored financial advice and easy-to-use mobile banking platforms.

Building and retaining customer trust is absolutely critical for Banca Transilvania in this evolving landscape. Transparent communication and a consistent focus on meeting individual customer needs are key differentiators. In 2025, customer retention rates will heavily depend on a bank's ability to demonstrate reliability and ethical practices.

Digital Adoption and Lifestyle Changes

The growing reliance on digital tools and evolving consumer habits, which lean towards online engagement and mobile accessibility, significantly shape customer interactions with financial institutions. Banca Transilvania needs to consistently upgrade its digital banking interfaces, mobile applications, and online support to align with these shifting customer preferences and maintain its competitive edge.

Digital adoption is accelerating across Romania. For instance, by the end of 2023, over 80% of Romanian internet users were actively using mobile banking applications, a figure projected to climb higher in 2024 and 2025. This trend underscores the critical need for banks like Banca Transilvania to prioritize robust digital offerings.

- Digital Engagement: In 2024, a significant portion of Banca Transilvania's new account openings and daily transactions are expected to originate through digital channels.

- Mobile-First Strategy: The bank's investment in its mobile app, which saw a 25% increase in active users in 2023, reflects a commitment to meeting the demand for convenient, on-the-go banking.

- Customer Expectations: Consumers increasingly expect seamless, personalized digital experiences, pushing banks to innovate in areas like AI-powered customer service and intuitive online platforms.

Cultural Attitudes towards Debt and Savings

Cultural attitudes towards debt and savings in Romania present a complex landscape for Banca Transilvania. While there's a growing acceptance of credit for consumption and investment, a deep-seated cultural inclination towards saving remains prevalent, especially among older generations. This duality means that marketing efforts need to balance the promotion of accessible credit with the encouragement of prudent financial planning and long-term savings.

In 2024, Romanian households demonstrated a continued commitment to savings, with bank deposits growing robustly. For instance, total deposits in the Romanian banking system reached approximately RON 500 billion by the end of Q1 2024, indicating a strong savings culture. Banca Transilvania, as a leading player, can leverage this by offering competitive savings products and advisory services that resonate with this ingrained behavior.

Conversely, the demand for credit, particularly for mortgages and consumer loans, has also seen an upward trend, fueled by economic growth and increased consumer confidence. Banca Transilvania's strategy can involve segmenting its customer base to address these differing attitudes, offering tailored credit solutions for those seeking to finance major purchases while simultaneously promoting wealth-building opportunities for savers.

- Savings Culture: Romanian households prioritize saving, with bank deposits showing consistent growth, reaching around RON 500 billion by early 2024.

- Credit Acceptance: There's an increasing willingness to use credit for major purchases and investments, reflecting evolving financial behaviors.

- Tailored Marketing: Banca Transilvania can effectively appeal to both savers and borrowers by offering distinct products and messaging for each segment.

Romania's demographic shifts, including an aging population and urban migration, necessitate strategic adjustments in banking services, with a growing demand for personalized digital experiences. Financial literacy is improving, yet a significant portion of the population still requires guidance, presenting an opportunity for educational initiatives and enhanced financial inclusion.

Consumer preferences are increasingly leaning towards digital convenience and tailored financial advice, making robust mobile banking and intuitive online platforms essential for customer retention and acquisition. Building trust through transparency and ethical practices will be paramount for Banca Transilvania in 2025.

The prevailing savings culture in Romania, evidenced by consistent growth in bank deposits reaching approximately RON 500 billion by early 2024, coexists with an increasing acceptance of credit for major purchases. Banca Transilvania can capitalize on this duality by offering segmented products and tailored marketing for both savers and borrowers.

| Sociological Factor | Impact on Banca Transilvania | 2024/2025 Data/Trend |

|---|---|---|

| Demographics | Need for digital services for aging population, expansion in urban centers. | Continued urban migration and aging population trends influencing service demand. |

| Financial Literacy | Opportunity for educational initiatives and complex product offerings. | 40% of Romanians feel confident managing finances (BNR 2023 survey). |

| Consumer Preferences | Demand for personalized digital experiences and mobile accessibility. | Over 80% of Romanian internet users actively used mobile banking apps by end of 2023. |

| Cultural Attitudes | Balancing promotion of credit with encouragement of savings. | Bank deposits grew robustly, reaching ~RON 500 billion by Q1 2024. |

Technological factors

Banca Transilvania's commitment to digital transformation is paramount in today's evolving financial landscape. The bank reported a significant increase in digital transactions, with over 70% of customer interactions occurring through digital channels by the end of 2024. This ongoing shift necessitates continuous investment in user-friendly online banking platforms and mobile applications to cater to customer demands for seamless and accessible banking.

The bank's strategic focus on digital onboarding and enhanced mobile banking features directly addresses the need for convenience and efficiency. By streamlining these processes, Banca Transilvania not only improves customer experience but also expands its operational reach, effectively transcending the limitations of traditional brick-and-mortar branches and solidifying its competitive edge in the Romanian market.

As banking services migrate further online, Banca Transilvania faces escalating cybersecurity threats and the critical need for robust data protection. The bank must prioritize continuous investment in advanced security technologies to counter sophisticated cyberattacks and safeguard sensitive customer data. Adherence to evolving data privacy regulations, like GDPR, is paramount for maintaining customer trust and avoiding significant penalties.

The burgeoning Fintech sector presents both a competitive challenge and a strategic avenue for Banca Transilvania. Companies like Revolut and Wise are reshaping customer expectations with seamless digital experiences, particularly in cross-border payments and digital banking. For instance, by the end of 2024, the global Fintech market is projected to reach over $33 billion, indicating the rapid expansion and influence of these disruptors.

Banca Transilvania must actively track these technological advancements. Integrating AI-powered customer service or leveraging blockchain for more efficient transaction processing could be key. Partnerships with promising Fintech startups, perhaps in areas like peer-to-peer lending or specialized investment platforms, offer a faster route to innovation and a way to expand service portfolios without building everything in-house.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming Banca Transilvania's operations. These technologies enhance customer service through personalization, improve fraud detection accuracy, and refine credit risk assessment. By leveraging AI, the bank can automate processes, leading to greater efficiency and cost savings.

The bank is actively integrating these advancements to make smarter, data-driven decisions. This allows for optimized resource allocation and the development of highly tailored financial products for its broad customer base.

- AI-powered chatbots are enhancing customer interaction, providing instant support and resolving queries efficiently.

- Advanced analytics are enabling more precise credit scoring, reducing default rates.

- Data-driven marketing campaigns are increasing product uptake by targeting specific customer needs.

- Banca Transilvania's investment in digital transformation, including AI, aims to solidify its market position and drive future growth.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for Banca Transilvania to innovate in areas like secure transaction processing and cross-border payments. As of early 2024, the global blockchain in banking market is projected to grow substantially, indicating a strong trend towards adoption. Banca Transilvania's strategic approach should involve actively researching and potentially piloting these technologies to gauge their impact on operational efficiency and security.

Exploring DLT could streamline processes such as supply chain finance, offering enhanced transparency and reduced settlement times. For instance, pilot programs in 2024 have demonstrated DLT's capability to reduce transaction costs by up to 30% in certain financial services.

- Enhanced Security: Blockchain's inherent cryptographic features can bolster the security of financial transactions.

- Improved Efficiency: DLT can automate and expedite processes like cross-border payments and trade finance.

- Increased Transparency: Shared ledgers offer a clearer audit trail for transactions, reducing disputes.

- New Revenue Streams: Exploring blockchain-based financial products could open up new market opportunities.

Technological advancements are fundamentally reshaping banking, and Banca Transilvania is actively embracing this shift. The bank’s digital transaction volume surged, with over 70% of customer interactions happening digitally by the end of 2024, highlighting a strong customer preference for online services. This necessitates ongoing investment in user-friendly platforms and mobile applications to meet evolving customer expectations for seamless banking experiences.

AI and data analytics are key drivers of efficiency and personalization for Banca Transilvania. These technologies improve customer service through tailored interactions, enhance fraud detection, and refine credit risk assessments. By automating processes, the bank anticipates greater operational efficiency and cost savings.

Blockchain and DLT offer significant potential for Banca Transilvania to innovate in secure transactions and cross-border payments. The global blockchain in banking market is experiencing substantial growth, suggesting a clear trend towards adoption. Exploring DLT could streamline processes like supply chain finance, offering improved transparency and faster settlement times, with pilot programs in 2024 showing potential cost reductions of up to 30%.

Legal factors

Banca Transilvania must rigorously comply with the National Bank of Romania's (BNR) extensive banking regulations and directives from the European Union. These rules are crucial for maintaining financial stability and cover areas like capital requirements, liquidity management, and risk control.

For instance, as of the first quarter of 2024, Banca Transilvania reported a robust Common Equity Tier 1 (CET1) ratio of 22.3%, significantly exceeding the BNR's minimum requirements, demonstrating strong capital adequacy amidst evolving regulatory landscapes.

Failure to adhere to these stringent standards, which also encompass corporate governance and operational resilience, could lead to substantial penalties and jeopardize the bank's operating licenses, underscoring the critical importance of ongoing compliance efforts.

Banca Transilvania operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, both domestically in Romania and across international jurisdictions. This necessitates a comprehensive approach to customer due diligence, including Know Your Customer (KYC) procedures, and the vigilant reporting of any suspicious financial activities to relevant authorities. Failure to adhere to these laws, which are increasingly being enforced with significant penalties, could result in substantial financial sanctions and severe damage to the bank's reputation.

In 2023, the European Union continued to strengthen its AML framework, with directives aimed at greater transparency and enforcement. For instance, the proposed 6th Anti-Money Laundering Directive (AMLD6) seeks to harmonize definitions and penalties across member states. Banca Transilvania's commitment to compliance in this area is crucial, as non-compliance can lead to hefty fines; in 2023, various European financial institutions faced penalties totaling hundreds of millions of euros for AML breaches, underscoring the financial and reputational risks involved.

Banca Transilvania's operations are heavily influenced by consumer protection laws and data privacy regulations, most notably the General Data Protection Regulation (GDPR). These legal frameworks dictate the bank's responsibilities in handling sensitive customer information, ensuring transparency, and safeguarding consumer rights throughout all financial interactions.

Compliance with these stringent rules is not just a legal obligation but a cornerstone of customer trust. For instance, in 2023, European banks faced significant scrutiny over data handling practices, with fines for GDPR violations reaching substantial amounts, underscoring the financial and reputational risks of non-compliance for institutions like Banca Transilvania.

Competition Law and Market Concentration

Banca Transilvania, as a dominant force in Romania's banking landscape, operates under stringent competition laws. These regulations are crucial for preventing market monopolization and fostering a fair environment for all participants. For instance, the Romanian Competition Council actively monitors market concentration, ensuring that no single entity gains undue power that could stifle innovation or harm consumers.

The bank's growth strategies, particularly any potential mergers or acquisitions, face rigorous review to ensure they do not lead to anti-competitive outcomes. This oversight is vital for maintaining a healthy financial ecosystem where smaller banks and new entrants can thrive.

- Market Share: As of Q1 2024, Banca Transilvania held approximately 20% of the total banking assets in Romania, underscoring its significant market presence.

- Regulatory Oversight: The Romanian Competition Council's investigations into market dominance and potential mergers are key legal factors influencing strategic decisions.

- Consumer Protection: Laws ensuring fair pricing and service availability are paramount, preventing any exploitative practices arising from market concentration.

Taxation Laws and Fiscal Policy

Changes in Romania's national taxation laws and fiscal policy directly affect Banca Transilvania's bottom line and operational expenses. For instance, the corporate income tax rate, currently at 16% as of the latest available data, influences net profit. Specific banking taxes or levies, if introduced or altered, would also impact the bank's cost structure and potentially its pricing strategies.

Banca Transilvania must remain vigilant regarding adjustments to Value Added Tax (VAT) regulations, which can affect transaction fees and the overall cost of services offered. The bank's financial planning and reporting processes need to be agile to ensure continuous compliance with Romania's dynamic fiscal environment.

- Corporate Income Tax: Romania's 16% corporate income tax rate is a key factor influencing Banca Transilvania's profitability.

- Banking Sector Taxation: The potential for specific taxes targeting the banking sector requires ongoing monitoring.

- VAT Regulations: Changes in VAT application to financial services can impact revenue and operational costs.

- Fiscal Policy Adaptability: Banca Transilvania's ability to adapt financial strategies to evolving fiscal policies is crucial for sustained compliance and performance.

Banca Transilvania is subject to Romania's evolving legal framework, encompassing banking regulations, consumer protection, and taxation. Compliance with directives from the National Bank of Romania and the European Union, particularly regarding capital adequacy and liquidity, remains paramount. For example, as of Q1 2024, the bank maintained a Common Equity Tier 1 ratio of 22.3%, well above regulatory minimums.

The bank must also navigate stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, including Know Your Customer (KYC) procedures, with significant penalties for non-compliance. In 2023, European financial institutions faced substantial fines for AML breaches, highlighting the financial and reputational risks. Furthermore, data privacy regulations like GDPR dictate how Banca Transilvania handles sensitive customer information, a critical aspect for maintaining trust.

Competition laws, enforced by bodies like the Romanian Competition Council, influence the bank's strategic decisions, especially concerning mergers and acquisitions, to prevent market monopolization. As of Q1 2024, Banca Transilvania held about 20% of Romania's banking assets, indicating substantial market presence and subject to oversight.

Romania's fiscal policies, including the 16% corporate income tax rate, directly impact Banca Transilvania's profitability and operational costs. Adaptability to changes in VAT regulations and potential sector-specific banking taxes is crucial for sustained compliance and performance.

| Legal Factor | Description | Relevance to Banca Transilvania | Data Point/Example |

|---|---|---|---|

| Banking Regulation | Compliance with BNR and EU directives on capital, liquidity, and risk. | Ensures financial stability and operational license. | CET1 ratio of 22.3% (Q1 2024) exceeds minimums. |

| AML/CTF Laws | Adherence to Anti-Money Laundering and Counter-Terrorist Financing regulations. | Prevents financial sanctions and reputational damage. | European AML fines in 2023 reached hundreds of millions of euros. |

| Data Privacy (GDPR) | Protection of sensitive customer data and transparency in handling. | Builds customer trust and avoids significant fines. | GDPR violations can lead to substantial financial penalties for banks. |

| Competition Law | Ensuring fair market practices and preventing monopolization. | Impacts M&A strategies and market positioning. | BT's ~20% market share (Q1 2024) is under regulatory scrutiny. |

| Taxation Laws | Compliance with corporate income tax, VAT, and potential banking levies. | Affects profitability and operational expenses. | Romania's corporate income tax rate is 16%. |

Environmental factors

Growing awareness of climate change is significantly shaping how investors and the public view banks. For Banca Transilvania, this means an increasing expectation to embed environmental, social, and governance (ESG) principles into its core business. This shift reflects a broader trend towards responsible finance, with investors actively seeking out institutions that align with sustainability goals.

Banca Transilvania is therefore under pressure to integrate ESG factors into its operations, lending practices, and investment decisions. This alignment with international sustainability targets and investor demand for responsible financial products is becoming a critical component of its long-term strategy and public image.

The growing global emphasis on sustainability is driving a surge in demand for green financing. This includes loans specifically for renewable energy installations and energy-efficient homes, creating a substantial market opening.

Banca Transilvania has a clear opportunity to innovate by developing and actively promoting these sustainable lending products. Such initiatives not only align with environmental protection goals but also serve to attract a new customer base and bolster the bank's reputation as a socially responsible entity.

By the end of 2024, the European Investment Fund (EIF) reported a significant uptick in green bond issuances, with Romania showing increasing interest in sustainable projects. This trend is expected to continue into 2025, underscoring the market's readiness for banks like Banca Transilvania to lead in green finance.

Financial institutions, including Banca Transilvania, face increasing regulatory demands to report on their environmental footprint and climate-related financial exposures. This trend is evident across the European Union, with directives pushing for greater transparency in sustainability practices.

To comply and showcase its commitment, Banca Transilvania is likely to bolster its environmental reporting, potentially integrating frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD). As of early 2025, many European banks are enhancing their ESG disclosures, with a significant portion aiming for TCFD alignment by 2026.

Resource Scarcity and Operational Footprint

Concerns over the availability of key resources like energy and water directly influence Banca Transilvania's operational expenses and its broader sustainability initiatives. Rising energy prices, for instance, could increase the cost of maintaining its extensive branch network and data infrastructure.

Banca Transilvania is actively working to minimize its environmental impact. This includes optimizing energy usage across its physical locations and digital operations. For example, by promoting digital banking services and reducing paper-based transactions, the bank aims to achieve both cost efficiencies and greater environmental stewardship.

- Energy Consumption Reduction: Banca Transilvania has invested in energy-efficient technologies within its branches and data centers, aiming to lower its carbon footprint.

- Digital Transformation: The bank's push for paperless operations through its digital platforms directly addresses resource conservation.

- Operational Cost Impact: Fluctuations in energy prices, a key resource, can directly affect the bank's overheads, making efficiency crucial.

Reputational Risk from Environmental Incidents

Banca Transilvania faces significant reputational risk if its financing activities are linked to environmentally harmful projects or if the bank itself fails to manage its environmental footprint effectively. Negative press or public perception stemming from environmental missteps can directly impact customer loyalty and investor confidence. For instance, a major oil spill financed by the bank could lead to boycotts and divestment, as seen in past instances where financial institutions faced backlash for supporting fossil fuel projects.

The bank's commitment to sustainability is therefore a key factor in safeguarding its image. Proactive engagement in environmental stewardship, such as investing in green energy projects or reducing its operational carbon emissions, is vital. Transparency in reporting these efforts, including quantifiable data on its environmental performance, helps build trust. As of early 2024, many leading European banks have set ambitious targets for reducing financed emissions, with some aiming for net-zero portfolios by 2050. Banca Transilvania's progress against such benchmarks will be closely scrutinized.

- Reputational Impact: Negative environmental associations can lead to customer attrition and reduced investor appetite.

- Financing Scrutiny: Projects funded by Banca Transilvania will be increasingly assessed for their environmental impact.

- Sustainability Reporting: Clear communication of environmental initiatives and performance metrics is essential for maintaining public trust.

- Industry Benchmarks: Adherence to evolving environmental, social, and governance (ESG) standards and net-zero targets will be critical for competitive positioning.

Banca Transilvania, like all financial institutions, must navigate evolving environmental regulations and public expectations regarding sustainability. The increasing focus on climate change and resource scarcity directly impacts operational costs and strategic lending decisions.

The bank is responding by enhancing its environmental reporting and investing in energy-efficient operations, aiming to reduce its carbon footprint. This proactive approach is crucial for maintaining its reputation and attracting environmentally conscious investors and customers.

As of early 2025, the European Union continues to strengthen its environmental directives, pushing for greater transparency in climate-related financial disclosures. Banca Transilvania's commitment to aligning with these standards, such as the Task Force on Climate-related Financial Disclosures (TCFD), is paramount for its long-term viability and competitive standing.

| Environmental Factor | Impact on Banca Transilvania | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change Awareness | Increased demand for ESG-aligned products and services. | Growing investor preference for sustainable finance; 2024 saw a 15% rise in green bond issuances in the EU. |

| Resource Availability & Costs | Potential increase in operational expenses (energy, water). | Global energy prices remained volatile in late 2024, impacting operating costs for businesses. |

| Environmental Regulations | Stricter reporting requirements and compliance obligations. | EU directives pushing for enhanced climate risk disclosure; many banks targeting TCFD alignment by 2026. |

| Green Financing Opportunities | Market growth for renewable energy and sustainable projects. | Romania showing increased interest in sustainable projects, creating a market for green loans. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banca Transilvania is built on a robust foundation of data from official Romanian government publications, European Union economic and regulatory reports, and reputable financial news outlets. We also incorporate insights from leading market research firms and banking industry analyses to ensure comprehensive coverage.