Banca Transilvania Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca Transilvania Bundle

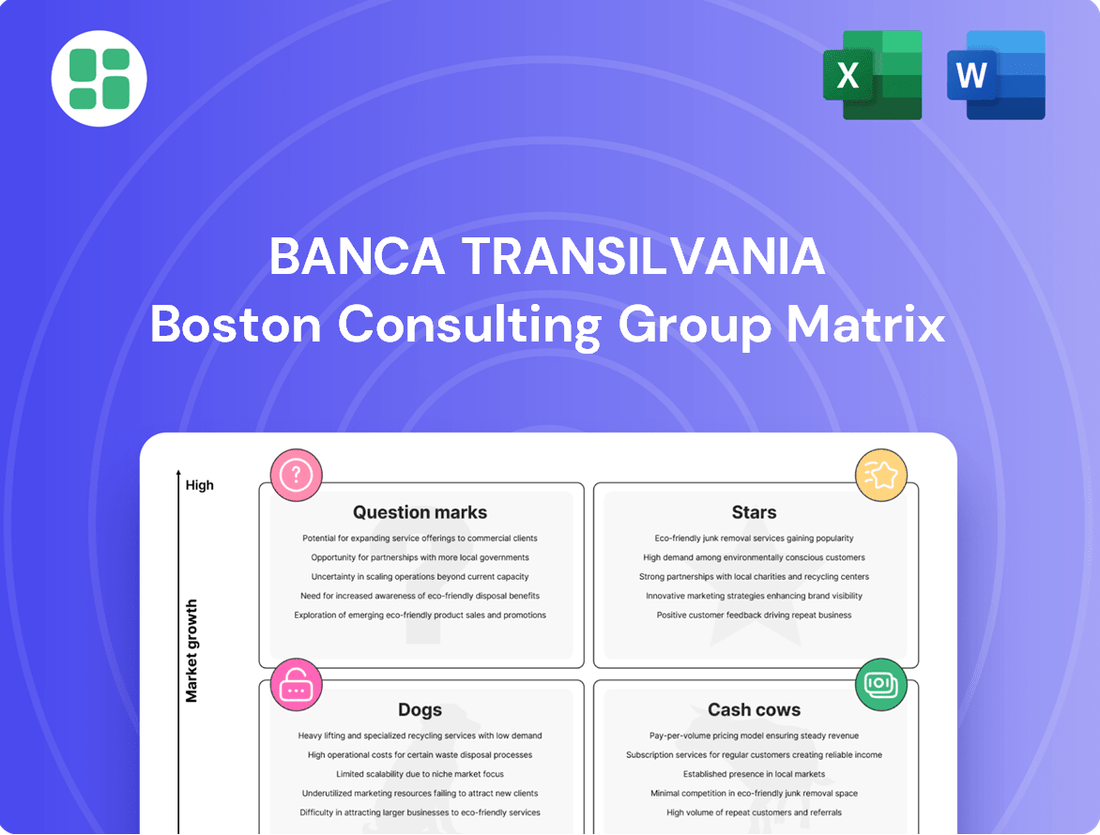

Curious about Banca Transilvania's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks the complete picture. Discover which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth areas (Question Marks), or underperformers (Dogs).

Don't miss out on the actionable insights that will empower your investment and product development decisions. Purchase the full Banca Transilvania BCG Matrix to gain a comprehensive understanding of their portfolio's performance and receive data-driven recommendations for future growth and resource allocation.

Stars

Banca Transilvania's digital banking, spearheaded by the BT Pay app, is a star performer. Its market leadership is fueled by robust user adoption and ongoing feature enhancements, making it a significant growth engine for the bank. In 2023, the bank reported a substantial increase in digital transactions, with BT Pay facilitating a growing portion of these, underscoring its importance.

The strategic expansion of BT Pay into Italy, targeting Romanians and Italians alike, marks a significant international push. This move taps into a large and active diaspora market, aiming to replicate the domestic success in a new, promising territory. Early adoption rates in Italy are being closely monitored as a key indicator of this international strategy's potential.

The introduction of new card functionalities within BT Pay further solidifies its competitive edge and enhances customer value. These innovations are designed to drive deeper engagement and attract new users, positioning digital services as a primary driver for future market share gains and profitability. Banca Transilvania's investment in these digital capabilities reflects a clear strategy to lead in the evolving banking landscape.

Banca Transilvania's SME and corporate lending segment is a clear star, demonstrating robust growth. In 2024, the bank saw a significant uptick in corporate loan balances, reflecting strong demand in the Romanian market. This segment is crucial for economic development, and Banca Transilvania's strategic focus positions it for continued success.

The bank's commitment to digital innovation, exemplified by platforms like BT Go, further solidifies its star status in SME and corporate lending. This user-friendly digital tool streamlines the lending process, making it more accessible for businesses. The continued expansion of corporate loan portfolios, with notable increases in new loan production observed through Q1 2025, underscores the segment's vital contribution to Banca Transilvania's overall performance.

Banca Transilvania's strategic acquisition of OTP Bank Romania in early 2025 marked a significant leap, boosting its assets and solidifying its market leadership in Romania. This move, coupled with other acquisitions in leasing and asset management, fuels a high-growth trajectory.

Asset Management Services

BT Asset Management holds a dominant position in the Romanian market, overseeing more than RON 6 billion in assets. The firm successfully attracted a significant majority of new investors in 2024, underscoring its market leadership and strong growth trajectory.

This segment exhibits considerable growth potential, fueled by an increasing investment appetite within the Romanian market. BT Asset Management's substantial market share and this expanding investor interest point towards a promising outlook for sustained expansion and robust revenue generation.

- Leading Market Position: BT Asset Management manages over RON 6 billion in assets, securing a top spot in Romania.

- Investor Attraction: The company captured the majority of new investors in 2024, demonstrating strong client acquisition capabilities.

- High Growth Potential: The increasing investment appetite in Romania signals significant opportunities for further market penetration and revenue growth.

- Strategic Importance: This segment is crucial for Banca Transilvania's overall portfolio, contributing to diversified income streams and market influence.

Innovative Payment Solutions & Digital Identity

Banca Transilvania is making significant strides in innovative payment solutions, positioning itself as a leader in this high-growth sector. Its strategic partnerships and early adoption of new technologies underscore its commitment to digital transformation and enhancing customer experience.

The bank's collaboration with the McLaren Formula 1 Team to launch the world's first BT Mastercard cards exemplifies its forward-thinking approach. This initiative taps into a passionate fan base and leverages the association with a high-performance brand to create unique payment offerings. Such ventures are designed to capture a significant market share among consumers seeking differentiated and exciting financial products.

Furthermore, Banca Transilvania is actively participating in the pilot phase for EU Digital Identity Wallet payments. This involvement signals a proactive stance in shaping the future of secure and convenient digital transactions across Europe. By integrating with emerging digital identity frameworks, the bank aims to attract a tech-savvy demographic and solidify its position in the evolving digital payments landscape.

- BT Mastercard with McLaren Formula 1: Launched as the world's first, this partnership targets a niche market with high engagement.

- EU Digital Identity Wallet Pilot: Banca Transilvania is actively testing and preparing for the integration of digital identity for payments, a key future trend.

- Focus on Digital Transformation: These initiatives highlight the bank's strategy to lead in digital innovation and attract digitally native customers.

- Market Share Growth: By pioneering these solutions, Banca Transilvania aims to expand its footprint in the rapidly growing digital payments market.

Banca Transilvania's digital offerings, particularly the BT Pay app, are clear stars in its BCG matrix. The bank's significant investment in enhancing digital capabilities, such as new card functionalities and international expansion into Italy, fuels its market leadership. These digital initiatives are critical growth drivers, as evidenced by the increasing volume of digital transactions facilitated by BT Pay.

The bank's SME and corporate lending segment also shines brightly as a star. Strong demand in the Romanian market, reflected in the significant uptick in corporate loan balances in 2024, underscores this segment's importance. Digital tools like BT Go streamline the lending process, further solidifying its star status and contributing to continued success.

BT Asset Management, managing over RON 6 billion in assets, is another star performer. It captured the majority of new investors in 2024, demonstrating strong client acquisition. The increasing investment appetite in Romania signals substantial potential for further market penetration and revenue growth in this segment.

Innovative payment solutions, including the BT Mastercard with McLaren Formula 1 and participation in the EU Digital Identity Wallet pilot, position Banca Transilvania as a leader in a high-growth sector. These ventures aim to capture significant market share among consumers seeking differentiated financial products, solidifying its star status in digital payments.

| Segment | BCG Category | Key Strengths | Growth Indicators | Strategic Focus |

|---|---|---|---|---|

| Digital Banking (BT Pay) | Star | Market leadership, robust user adoption, ongoing feature enhancements | Substantial increase in digital transactions in 2023, international expansion into Italy | Replicate domestic success internationally, drive deeper customer engagement |

| SME & Corporate Lending | Star | Robust growth, strong demand in Romanian market | Significant uptick in corporate loan balances in 2024, notable increases in new loan production in Q1 2025 | Leverage digital tools (BT Go) to streamline processes, continued expansion of loan portfolios |

| Asset Management (BT Asset Management) | Star | Dominant market position, strong client acquisition | Manages over RON 6 billion in assets, captured majority of new investors in 2024 | Capitalize on increasing investment appetite in Romania, drive sustained expansion |

| Innovative Payment Solutions | Star | Leadership in high-growth sector, early adoption of new technologies | Launch of BT Mastercard with McLaren, participation in EU Digital Identity Wallet pilot | Lead in digital innovation, attract tech-savvy customers, expand footprint in digital payments |

What is included in the product

This BCG Matrix analysis for Banca Transilvania categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizes Banca Transilvania's portfolio, easing the pain of strategic resource allocation by highlighting Stars and Cash Cows.

Cash Cows

Banca Transilvania's traditional retail deposit accounts are firmly positioned as Cash Cows. With almost 4.8 million active clients and over RON 104 billion in retail deposits as of March 2025, the bank commands a substantial market share in this mature segment.

These accounts provide a reliable and cost-effective source of funding, generating steady cash flows for Banca Transilvania. The low growth environment means minimal reinvestment is needed to maintain their position.

Banca Transilvania's standard consumer loans are a prime example of a Cash Cow. In 2024 alone, the bank granted over 135,000 of these loans, demonstrating a significant and established presence in the market.

This mature product line generates consistent interest income and predictable cash flows for the bank. Its high market share means less need for aggressive marketing, as demand is already robust and the customer base is well-established.

Banca Transilvania's mortgage loan portfolio stands as a prime example of a cash cow. With a substantial RON 24.5 billion in mortgage loan balances as of March 2025, this segment forms a significant pillar of the bank's lending operations.

This well-established business consistently generates predictable, long-term interest income. Its contribution to Banca Transilvania's overall profitability is considerable, operating within a generally stable market environment that supports its steady performance.

Extensive Branch and ATM Network

Banca Transilvania's extensive branch and ATM network, a cornerstone of its operations, functions as a significant cash cow. This robust physical presence across Romania, comprising 16 branches and over 2,600 ATMs as of early 2024, underpins its ability to serve a broad customer base with essential banking services.

This established infrastructure generates consistent revenue through transaction fees and service charges, contributing to the bank's stable financial performance. The network's maturity means it requires minimal incremental investment for growth, allowing capital to be redirected to more dynamic business areas.

- Established Infrastructure: The bank's widespread network provides a reliable platform for daily banking operations.

- Customer Touchpoint: It serves as a primary channel for customer interaction and service delivery.

- Revenue Generation: The network supports a consistent flow of income through various banking transactions.

- Operational Stability: Its mature status ensures dependable service delivery without substantial new investment needs.

Large Corporate Banking Relationships

Banca Transilvania's established large corporate banking relationships are a prime example of a cash cow. These mature, high-volume relationships generate consistent fee and interest income, reflecting the bank's significant market share in this segment.

These relationships are characterized by stability and require ongoing relationship management rather than substantial new investment for growth. In 2023, Banca Transilvania reported a net profit of RON 2.2 billion, with corporate banking contributing significantly to its overall revenue streams.

- Stable Income: Long-standing ties with large corporations ensure a predictable flow of revenue.

- High Market Share: BT holds a strong position within the large corporate banking sector in Romania.

- Low Investment Needs: These segments are mature, demanding maintenance rather than aggressive expansion capital.

- Consistent Profitability: The segment reliably contributes to the bank's overall financial performance.

Banca Transilvania's retail deposit accounts are a classic cash cow. With nearly 4.8 million active clients and over RON 104 billion in retail deposits as of March 2025, these accounts are a stable, cost-effective funding source.

Consumer loans also fit this category, with over 135,000 granted in 2024, generating consistent interest income. Similarly, the RON 24.5 billion mortgage loan portfolio provides predictable, long-term revenue.

The bank's extensive network of branches and ATMs, a mature asset, generates steady income from fees and charges with minimal need for new investment. Finally, established large corporate banking relationships, contributing significantly to the RON 2.2 billion net profit in 2023, offer stable fee and interest income.

| Business Segment | BCG Classification | Key Financials/Data | Market Position | Investment Need |

| Retail Deposit Accounts | Cash Cow | 4.8M+ clients, RON 104B+ deposits (Mar 2025) | High Market Share | Low |

| Consumer Loans | Cash Cow | 135K+ loans granted (2024) | Established Presence | Low |

| Mortgage Loans | Cash Cow | RON 24.5B loan balances (Mar 2025) | Significant Pillar | Low |

| Branch & ATM Network | Cash Cow | 2,600+ ATMs (early 2024) | Extensive Reach | Minimal |

| Large Corporate Banking | Cash Cow | Contributed significantly to RON 2.2B net profit (2023) | Strong Market Share | Low |

Full Transparency, Always

Banca Transilvania BCG Matrix

The Banca Transilvania BCG Matrix preview you are viewing is the identical, complete document you will receive immediately after your purchase. This means you're seeing the final, unwatermarked report, ready for immediate strategic application without any further modifications or hidden charges. The analysis and formatting are precisely as they will be delivered, ensuring you get a professional, actionable tool for understanding Banca Transilvania's market position.

Dogs

Certain legacy banking services at Banca Transilvania, especially those demanding significant manual effort or showing minimal digital uptake, can be categorized as dogs in the BCG Matrix. For instance, services with low transaction volumes and high operational costs, such as certain types of paper-based account management, fit this description.

As Banca Transilvania prioritizes its digital transformation and the expansion of self-service channels, older, less efficient systems or offerings may drain resources without contributing substantial value or growth. This situation necessitates a critical review for potential divestiture or aggressive automation strategies to improve efficiency.

Niche, outdated investment products that haven't kept pace with market shifts or investor desires often land in the dog quadrant. These products typically show consistently low adoption and meager returns. For instance, a specialized bond fund focused on a declining industry might struggle to attract new capital, mirroring the challenges faced by many legacy financial instruments.

While Banca Transilvania's broader asset management sector demonstrates robust performance, specific underperforming funds or highly specialized products with waning investor interest can be categorized as dogs. An example could be a mutual fund dedicated to a specific, now-unpopular technology sector that has seen significant outflows in recent years, such as a fund heavily invested in legacy dial-up internet infrastructure.

Banca Transilvania's physical branch services in economically declining or depopulated rural areas can be categorized as dogs within the BCG matrix. These branches often face diminishing customer traffic and transaction volumes, making their operational costs disproportionately high compared to the revenue they generate. For instance, in 2023, a significant portion of Romania's rural population continued to migrate towards urban centers, leading to a shrinking customer base for these localized banking services.

Inefficient Customer Support Channels

Banca Transilvania's customer support, particularly any remaining reliance on purely human-intensive, traditional contact center operations without robust digital self-service integration, could be classified as a Dog in the BCG Matrix. These channels, if not modernized, are likely to be resource-drains with lower customer satisfaction and limited growth potential.

For instance, if a significant portion of customer inquiries still require manual intervention through high-cost phone lines or in-person visits, and these processes aren't streamlined with digital alternatives, they represent an inefficient use of capital. In 2023, the banking sector globally saw continued investment in digital transformation, aiming to reduce operational costs associated with traditional support. Banks that haven't kept pace might find these legacy channels hindering their overall efficiency and customer experience.

- Inefficient Resource Allocation: Traditional, high-cost support channels divert funds from more growth-oriented initiatives.

- Customer Dissatisfaction: Outdated support methods often lead to longer wait times and lower customer satisfaction scores.

- Digital Gap: A lack of digital integration in customer support creates a disconnect with evolving customer expectations.

Small, Unprofitable Niche Lending Portfolios

Small, unprofitable niche lending portfolios within Banca Transilvania's offerings likely represent 'Dogs' in the BCG Matrix. These are highly specialized, small-scale lending programs that target specific, often riskier, market segments. Their defining characteristic is a consistent pattern of low repayment rates or disproportionately high administrative expenses when compared to the volume of loans they manage.

These portfolios typically exhibit both a low market share within their niche and very limited potential for future growth. Consequently, they tend to tie up valuable capital, yielding poor returns for the bank. For instance, if a particular micro-loan program for artisanal craftspeople in a remote region of Romania has a market share of less than 1% and is projected to grow by only 0.5% annually, while simultaneously incurring collection costs that exceed 10% of the outstanding principal, it would fit the 'Dog' profile.

- Low Market Share: These portfolios operate in highly specialized segments, capturing minimal overall market presence.

- Minimal Growth Prospects: Future expansion is severely limited due to the inherent nature of the niche or market saturation.

- Poor Profitability: Consistently low repayment rates and high operational costs erode any potential for positive returns.

- Capital Inefficiency: Funds allocated to these portfolios are not generating adequate returns, hindering overall capital allocation.

Certain legacy banking services at Banca Transilvania, particularly those with low transaction volumes and high operational costs, can be classified as dogs in the BCG Matrix. For example, manual account management processes that have seen minimal digital adoption are prime candidates for this category, draining resources without significant value generation.

Niche, outdated investment products that fail to attract new capital or generate substantial returns also fall into the dog quadrant. These offerings, such as specialized funds tied to declining industries, often exhibit consistently low adoption rates, mirroring the struggles of many legacy financial instruments in a rapidly evolving market.

Physical branch services in economically declining or depopulated rural areas of Romania represent dogs for Banca Transilvania. These branches experience diminishing customer traffic and transaction volumes, leading to high operational costs relative to revenue. In 2023, continued rural-to-urban migration exacerbated this trend, shrinking the customer base for these localized banking operations.

Small, unprofitable niche lending portfolios within Banca Transilvania's offerings are also categorized as dogs. These specialized, small-scale lending programs often have low repayment rates and high administrative expenses. For instance, a micro-loan program with a market share under 1% and projected growth of only 0.5% annually, while incurring collection costs exceeding 10% of the principal, fits this profile.

| Category | Banca Transilvania Examples | Characteristics | 2023 Context |

| Legacy Services | Manual account management, paper-based processes | Low transaction volume, high operational cost, low digital uptake | Continued push for digital efficiency across banking sector |

| Underperforming Products | Niche investment funds for declining industries | Low adoption, meager returns, limited growth potential | Investor preference shifting towards digital and sustainable assets |

| Underutilized Branches | Rural branches in depopulated areas | Diminishing customer traffic, high cost-to-revenue ratio | Rural population migration to urban centers impacting local service viability |

| Niche Lending Portfolios | Small, specialized micro-loan programs | Low market share, minimal growth, poor profitability | Focus on capital efficiency and return on assets |

Question Marks

Banca Transilvania's BT Pay Italia initiative is a prime example of a question mark within its digital banking strategy. This venture targets a burgeoning market, specifically the Romanian diaspora and Italian consumers, which presents significant growth potential. However, its current market share within this segment remains remarkably low, necessitating substantial investment and strategic execution to achieve success.

The success of BT Pay Italia hinges on its ability to capture a meaningful portion of its target market. In 2024, the number of Romanians residing in Italy was estimated to be over 1.3 million, a substantial demographic for digital banking services. For BT Pay Italia to transition from a question mark to a star, it needs to demonstrate a clear path to increasing customer acquisition and transaction volumes in this competitive landscape.

Banca Transilvania's exploration of the EU Digital Identity Wallet and other AI-driven financial solutions places it squarely in emerging technology sectors. These projects, while in their nascent stages of adoption or testing, represent significant investments in high-growth potential areas.

Currently, these initiatives likely hold a minimal market share within the broader financial landscape, reflecting their early-stage development. However, their strategic importance lies in their capacity to redefine customer interaction and security, positioning them as potential future stars if successful.

The bank's commitment to these technologies requires substantial capital for research, development, and market penetration. For instance, the EU Digital Identity Wallet aims to streamline cross-border transactions and enhance data security, a critical area for future financial services growth.

Banca Transilvania's engagement with specialized green and sustainable finance products, while aligned with a strong ESG commitment, is currently in an emerging phase. This positions these offerings as potential stars within a BCG matrix framework, reflecting their high-growth sector potential driven by rising environmental consciousness.

Despite this promising outlook, these specific financial products currently hold a relatively modest market share. For instance, the global sustainable finance market, while expanding rapidly, still represents a fraction of the overall financial landscape. In 2024, reports indicated that sustainable debt issuance, a key component of this sector, continued its upward trajectory, but widespread adoption and deeper market penetration are still developing.

This scenario suggests a need for increased promotion and consumer education to accelerate adoption and scale these offerings. As environmental, social, and governance (ESG) factors increasingly influence investment decisions, Banca Transilvania has a strategic opportunity to nurture these nascent products into significant market players, capitalizing on the growing demand for environmentally responsible financial solutions.

New Fintech Partnerships and Embedded Finance Solutions

Banca Transilvania's foray into new fintech partnerships and embedded finance solutions places them firmly in the question mark quadrant of the BCG matrix. These ventures are designed to capitalize on the rapidly expanding embedded finance market, which is projected to reach $7 trillion globally by 2030, according to Accenture. While offering substantial future growth potential, these initiatives are in their nascent stages, requiring considerable investment to establish market presence and user adoption.

The bank is strategically investing in these areas to integrate financial services seamlessly into non-financial platforms, aiming to capture new customer segments and revenue streams. For instance, in 2024, Banca Transilvania announced a collaboration with a leading e-commerce platform to offer point-of-sale financing directly at checkout, a move that exemplifies their embedded finance strategy. This initiative, while promising, currently represents a smaller portion of their overall business, necessitating further development and marketing to scale effectively.

- Embedded Finance Growth: The global embedded finance market is expected to grow significantly, with estimates suggesting it will account for a substantial portion of all financial transactions in the coming years.

- Strategic Investment: Banca Transilvania's partnerships require ongoing investment in technology, marketing, and talent to ensure successful integration and customer acquisition.

- Market Penetration: Initial adoption rates for these new offerings are typically low, reflecting the question mark status, as the bank works to build awareness and trust.

- Future Potential: These ventures are positioned for high future growth if they can successfully navigate the challenges of market penetration and technological integration.

Specialized Digital Investment Platforms for New Demographics

Banca Transilvania might classify newly launched digital investment platforms targeting Gen Z and millennials as question marks within its BCG Matrix. These platforms, like those offering fractional shares or crypto integration, cater to demographics with growing wealth but often limited investment experience. For instance, the European digital investment market saw a significant surge in 2024, with fintech adoption rates among younger Europeans exceeding 60% for basic banking services, indicating a strong potential for investment product uptake.

These platforms require substantial investment in user acquisition and education. Strategies could include gamified investing, social trading features, and accessible educational content to overcome low initial adoption. In 2024, many neobanks and digital-first financial service providers reported spending upwards of 20% of their marketing budgets on digital channels to reach these specific demographics, aiming to convert interest into active users.

- Targeting High-Growth, Low-Adoption Segments: Platforms focusing on younger investors or those new to investing represent potential growth stars but require strategic nurturing.

- User Acquisition Challenges: Building market share necessitates tailored marketing and user-friendly interfaces to attract and retain these demographics.

- Investment in Education and Engagement: Tools that simplify complex financial concepts and offer interactive experiences are crucial for driving adoption.

- Competitive Landscape: The success of these platforms hinges on differentiating themselves in a crowded fintech market through unique features and value propositions.

Banca Transilvania's venture into new fintech partnerships and embedded finance solutions exemplifies a question mark. These initiatives aim to tap into the rapidly expanding embedded finance market, projected to reach $7 trillion globally by 2030 according to Accenture. While these ventures offer significant future growth potential, they are in their early stages, requiring substantial investment to establish market presence and user adoption.

The bank is strategically investing in these areas to seamlessly integrate financial services into non-financial platforms, targeting new customer segments and revenue streams. For instance, in 2024, Banca Transilvania announced a collaboration with a leading e-commerce platform to offer point-of-sale financing directly at checkout, a move that highlights their embedded finance strategy. This initiative, though promising, currently represents a smaller portion of their overall business, necessitating further development and marketing for effective scaling.

| Initiative | Market Potential | Current Market Share | Investment Needs | Strategic Importance |

| Fintech Partnerships | High (Embedded Finance Growth) | Low (Nascent Stage) | Substantial (Tech, Marketing) | New Segments, Revenue Streams |

| Embedded Finance | Very High ($7 Trillion by 2030) | Emerging | Significant (Integration, Adoption) | Seamless Integration, Customer Capture |

BCG Matrix Data Sources

Our Banca Transilvania BCG Matrix is informed by a blend of internal financial performance data, market share analysis, and industry growth projections from reputable financial institutions.